The 5-hour long Spring Festival Gala (AKA Chunwan) is the most-watched Chinese TV program, with over 1.17 billion viewers and 30.07% viewership rate in 2019 according to CCTV. In comparison, the Super Bowl’s record-high viewership was only 114 million (in 2015).

Just like the Super Bowl, the Spring Festival Gala has become a competition for advertising sponsorship. The cost of ads also skyrocketed as companies discovered their marketing potential. Specifically, it has become a battlefield for big tech companies.

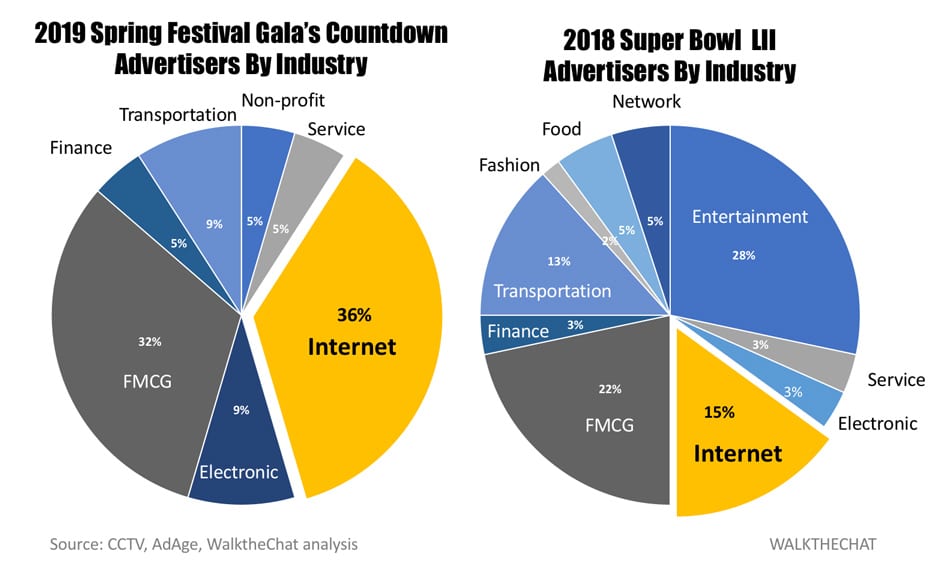

Advertiser industry comparison between the Spring Festival Gala and the Super Bowl?

I took the advertiser list recorded by iyiou.com for the Spring Festival Gala countdown (22 brands), and compared it with the advertiser list from the Super Bowl LII (60 brands), and categorized brands into industries:

Total of 9 internet companies advertised on Super Bowl LII, including Netflix, Amazon Prime, Groupon, Turbo Tax and etc. Tech companies only made up 15%. Entertainment and FMCG are the major sponsors.

The Chinese Spring Festival Gala sponsors are quite different: 36% of advertisers are technology companies. This year, the list includes Baidu, Pinduoduo, Kuaishou, Douyin, JD.COM, Alibaba, suning.com and ke.com.

Chinese tech companies usually embed branding information throughout the Gala. The host would invite the audience to participate in mobile campaigns in between shows. And tech companies are willing to pay a high price for that:

- Tencent spent 53 million RMB in 2015 for deep collaboration with the Gala. In exchange, the hosts asked the viewers to shake their phones to join the WeChat Red Envelope campaign

- In 2016, Alibaba spent 269 million RMB (39.9 M USD) in sponsorship in exchange for deep collaboration with the Gala to promote its Red Envelope campaign (collection of Fu Card), a tradition that carried forward ever since then

- Alibaba also spent over 300 million RMB (44.5M USD) each in 2017 and 2018 to be the main sponsor

- Baidu spent an undisclosed amount to become the main sponsor in 2019

Tech companies used not to be main sponsors for the Spring Festival Gala. FMCG companies such as white wine used to run the show. 2015 was the turning point: during the 10 minutes countdown, you could see ads from major tech companies including WeChat, vip.com, Didi, Kuaidi (later merged with Didi), ganji.com, and weidian.com.

For some companies, the return of the Spring Festival campaign goes well beyond their investment. During the 2015 campaign, over 200 million users bound their bank card with WeChat Payment in just 2 days over the Spring Festival. Alibaba spent over 8 years to achieve this result. Jack Ma called this campaign “a Pearl Harbor attack”.

2015 was also the year when the Chinese ads started to become very different from those on the Super Bowl. They became more interactive, the audience could engage with the campaign by shaking their phones, exchanging game cards with friends and sharing with friends.

Why do tech companies love to advertise on the Spring Festival Gala?

The success of the WeChat Payment campaign in 2015 was a wakeup call for big tech companies. Yet to really understand why we need to look into the audience demographics.

Compared with the audience in the US, Chinese customer groups can be extremely segmented. The Spring Festival Gala may be the only program that can reach users in lower-tier cities on a large scale. These are often first-time Internet users, thus harder to acquire via digital channels.

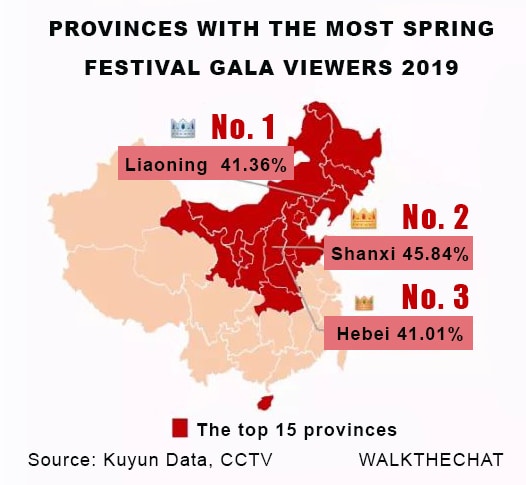

According to Kyun Data, the Spring Festival Gala is most popular among the northern provinces, such as Liaoning, Shanxi, and Hebei. These are relatively poorer provinces. The GDP per capita ranking of the 3 top provinces is N0. 14, No. 26, and No.17, among the 31 provinces (2017 data).

According to CNNIC, China’s Internet users reached 802 million by June 30th, 2018. Only 10.6% of users have an undergraduate degree, and 62.8% of users have middle school/ high school/ technical secondary school degree. Some data indicate that the penetration of the top tech companies (Baidu, Alibaba, Tencent, and Toutiao) is less than 20% in 3rd tier cities and below.

Given such segmented market, the Spring Festival Gala, as part of the Chinese culture, is the program to reach users in all regions, especially the ones in 3rd tier cities and below. These users are often a first-time smartphone owner (most would own a smartphone before owning a personal computer). They are new to the game, with fewer options, and away from the reach of the current user network, thus ideal potential users.

Thus the Spring Festival is a gold mine for tech companies to expand to lower-tier cities.

How expensive are the Spring Festival Gala ads?

According to wallstreet.cn, the total ads revenue in 2010 was 650 million RMB (96.4 million USD) in 2010. But with the competition from tech giants, the price of the Spring Festival Gala ads skyrocketed since 2015.

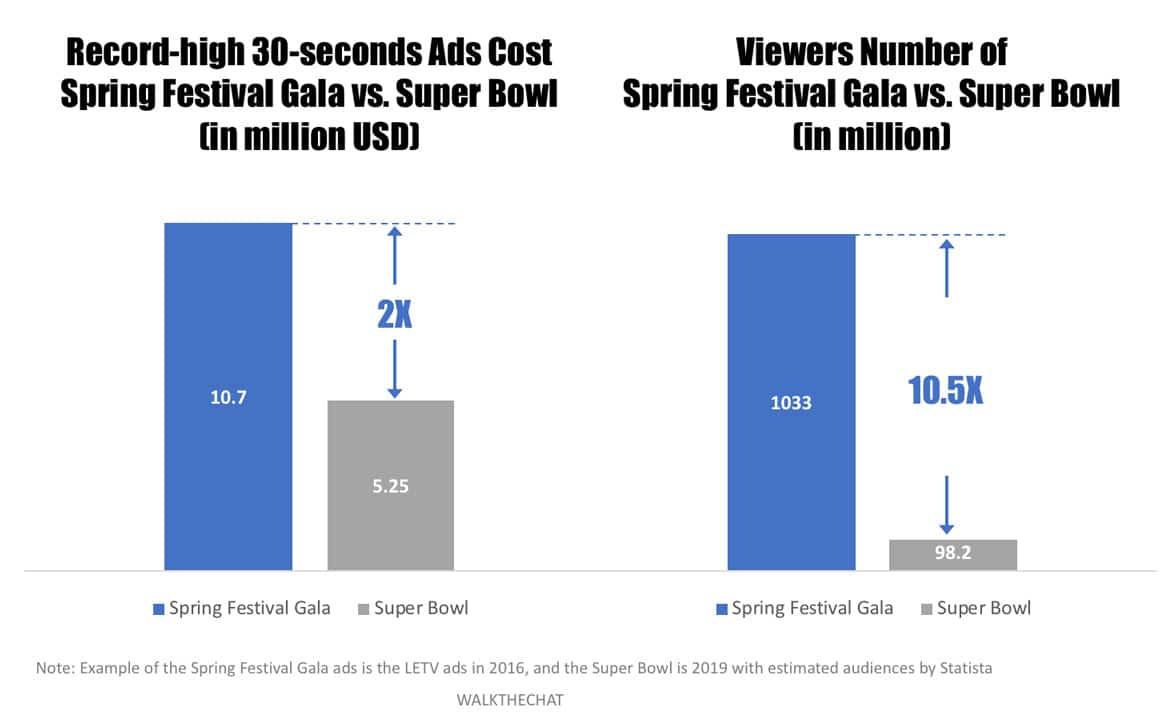

LETV spent 72.0 million RMB (10.7 M USD) for a 30 seconds ads during the Spring Festival Gala in 2016.

Taobao spent 300 million RMB (44.5M USD) in the Spring Festival Gala ads in 2018. It also gave away 600 million RMB (89.0M USD) worth of Red Envelope.

The average cost for 15 seconds of the Spring Festival Gala ads is 20 million RMB (3.0 million USD) according to iyiou.com. Most of the advertising price is undisclosed. From what we know, the record-high 30-second ads are from LETV, 72.0 million RMB (10.7M USD) in 2016. In comparison, the cost of the record-high 30-second Super Bowl ads is 5.25 million USD for the 2019 championship match-up.

Although the record-high Spring Festival Gala cost is 2 times more expensive than in the case of the Super Bowl, the cost is actually justified by the 10.5X amount of viewers. The potential impact of a successful campaign is much higher.

Who is buying the Spring Festival Gala ads?

The countdown of the Spring Festival Gala (AKA the “8 golden minutes”) records top viewership and top price. And in 2019, the Golden 8 became 9.6 minutes, including 1-minute non-profit ads. If the average cost per 15 seconds of ads was 20 million, companies spent 773 million RMB.

Total of 24 companies paid the Golden ticket price. Here is the list:

|

Company |

Industry |

Industry (category) |

Ads time (seconds) |

|

Pinduoduo |

Internet |

E-commerce |

77.5 |

|

Kuaishou |

Internet |

Video |

60 |

|

The Core Values of Chinese Socialism |

Non-profit |

Non-profit |

60 |

|

Gujing Distillery |

FMCG |

White Wine |

47.5 |

|

JUNLEBAO |

FMCG |

Dairy |

30 |

|

Douyin |

Internet |

Video |

30 |

|

Union Pay |

Finance |

Payment |

30 |

|

Audi |

Car |

Car |

30 |

|

Medi |

Electronic |

Home electronics |

25 |

|

China Post |

Service |

Logistic |

20 |

|

ke.com |

Internet |

Housing |

15 |

|

Yili |

FMCG |

Dairy |

15 |

|

Yunnan Baiyao Group |

FMCG |

Toothpaste |

15 |

|

JD.COM |

Internet |

E-commerce |

15 |

|

Suning.com |

Internet |

E-commerce |

15 |

|

Mengniu Dairy |

FMCG |

Dairy |

15 |

|

Baidu |

Internet |

Information |

15 |

|

Fenjiu |

FMCG |

White Wine |

15 |

|

Hair |

Electronic |

Home electronics |

15 |

|

Taobao |

Internet |

E-commerce |

15 |

|

Trumpchi |

Transportation |

Car |

15 |

|

Lulu |

FMCG |

Dairy |

5 |

Internet and FMCG are the top industries sponsoring in the Spring Festival Gala ads.

Compared with 2018, 17 new brands participated, and some are first-time Spring Festival Gala ads participants: Pinduoduo, Kuaishou, and Douyin. Only 7 brands from 2018 continued to sponsor this year, they are Gujin Distillery, Junlebao, Yili, JD.COM, Taobao, Medi, and Trumpchi.

Big tech companies such as Xiaomi and Meituan are no longer sponsoring the ads. Both companies went public during the year 2018.

Both Kuaishou and Douyin are short-video companies fighting for market share in lower-tier cities, making the Gala the perfect battleground.

The actual spending of each company goes well beyond ads. Kuaishou gave away 600 million RMB (89.0 M USD) worth of red envelope during the Spring Festival.

Users can invite friends to team up, take videos, invite new users, and join live streaming to receive the Red Envelopes. Newly registered users will receive at least a 10RMB cash incentive.

Kuaishou is also the first ever short-video platform that bought the live-streaming right of the Gala.

As for the ad campaigns, Pinduoduo, a 5-year old e-commerce company, bought 77.5 seconds of advertising during the Spring Festival Gala countdown. However other than these ads, Pinduoduo was not mentioned throughout the gala by the hosts.

Baidu and Douyin, on the other hand, are closely collaborating with the Gala programs. The host reminded the audience to collect red envelopes from Baidu App and Douyin.

The hosts gave instructions to audiences to participate in the Douyin campaign in 2019.

Does it work?

WeChat set a good example for a successful Spring Festival Gala campaign back in 2015. But did the campaigns work this year? Here are some of the result of the advertising campaign in 2019.

Kuaishou

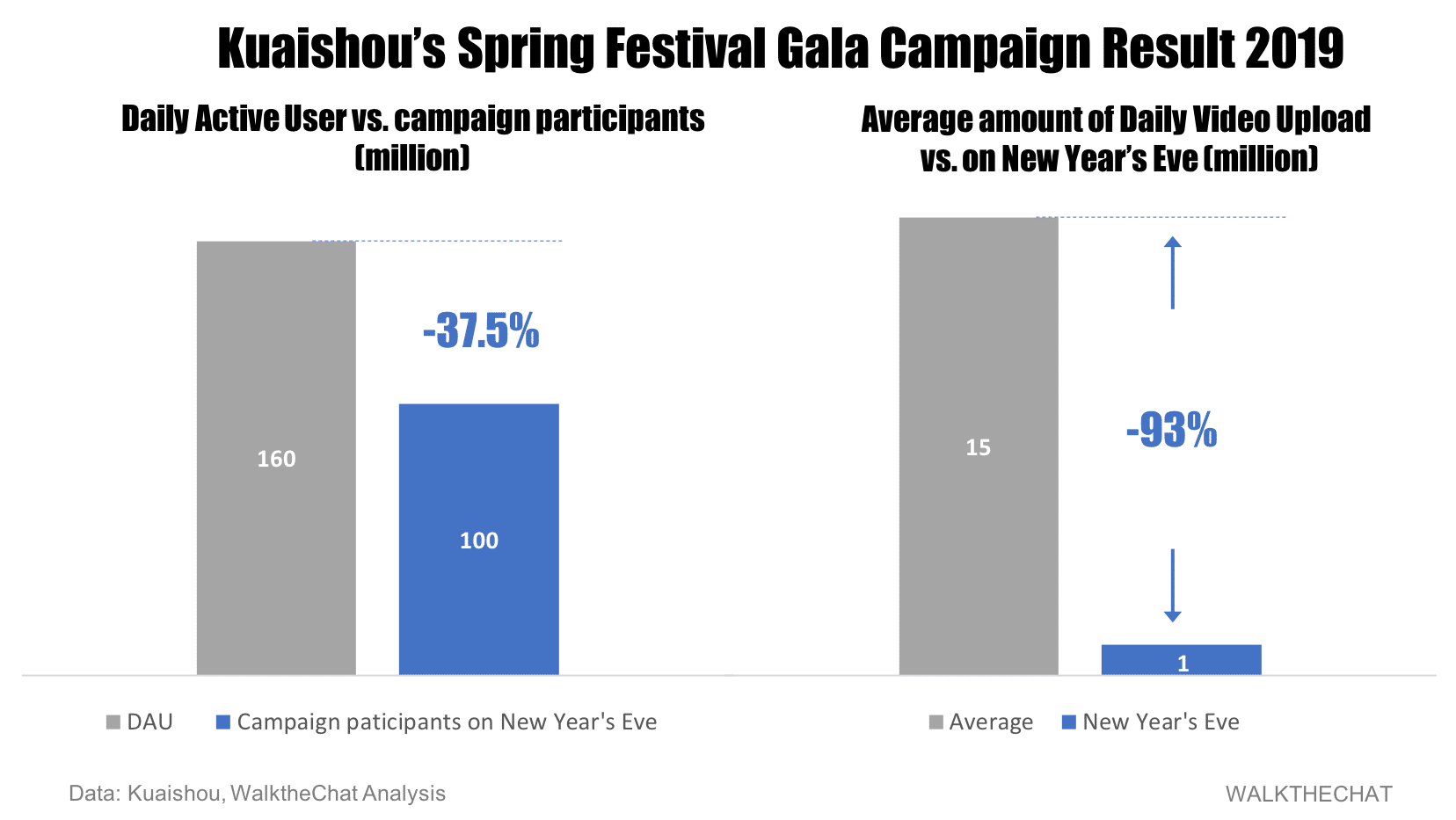

Despite the huge audience, the Spring Festival Gala ads don’t always work.

According to the official release of Kuaishou, during the New Year’s Eve, Kuaishou users uploaded over 1 million short videos and posted over 13 million video comments.

Nearly 100 million users participated in Kuaishou’s Red Envelope campaign. The top user made over 10,000 RMB, and over 10 million users opened the App at the same time.

Compared with Kuaishou’s user data on an average day, according to Kuaishou’s official release, the Daily Average User during December 2018 was 160 million, and Monthly active user was 300 million. Average daily video upload is 15 million. During 2018, 4.45 million users logged in to Kuaishou every single day.

Using the data above, only 62.5% of Kuaishou users participated in the Red Envelope campaign during the Spring Festival Gala. It doesn’t justify the high cost, given Kuaishou spent well over 80 million RMB on the 60-second gala ads (assuming cost per 15 seconds is 20 million RMB), and gave away 700 million red envelopes, not counting other advertising spendings around the new year.

The amount of new registered Kuaishou user was not released.

Baidu

Baidu is the biggest sponsor of the Spring Festival 2019. The amount of the sponsorship was not released, but given Alibaba (biggest sponsor then) paid over 300 million RMB in 2018, the price could only go up. On top of buying ads, Baidu also gave away 1 billion RMB in Red Envelopes from Jan 28 to Feb 4th, 2019.

Baidu claimed to give away 100 million RMB red envelope on Jan 28th, and 900 million RMB and 100k AI speakers during the New Year’s Eve.

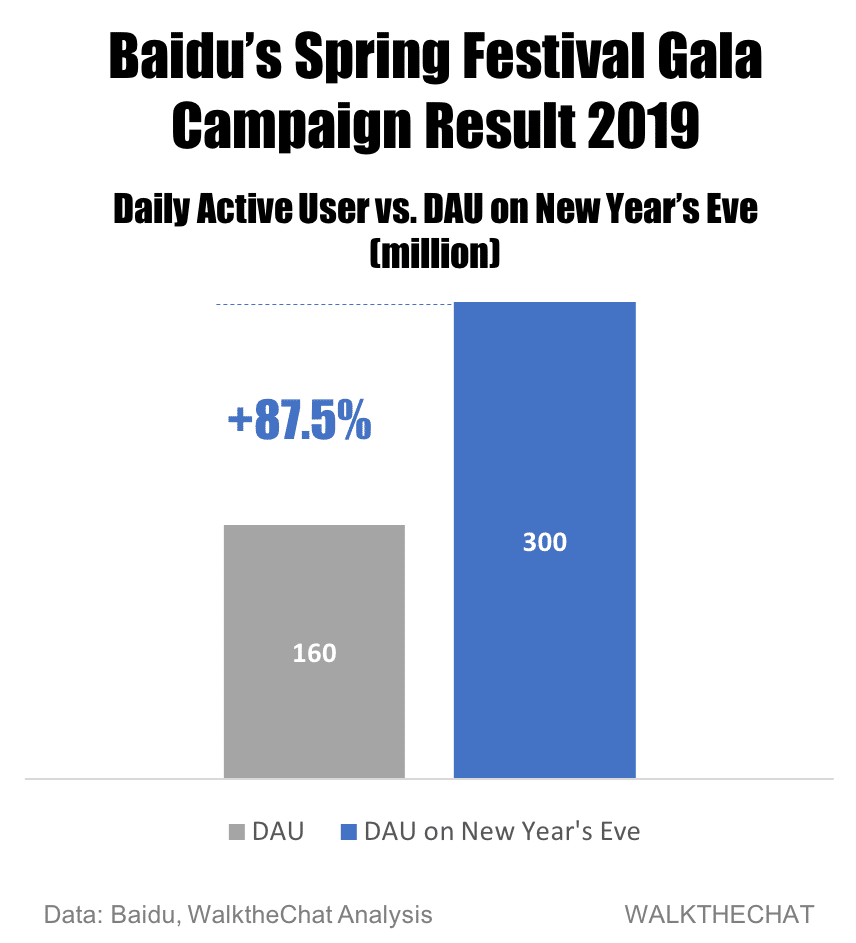

In exchange, the 20+ Apps in the Baidu ecosystem recorded a total of 20.8 billion engagements and 300 million Daily Active User on the New Year’s Eve.

Compared with Baidu’s average data, the 20 Apps from Baidu ecosystem have Monthly Active User of 990 million, and Daily Active User of 160 million.

Baidu’s daily active users increased by 87.5% on New Year’s Eve 2019.

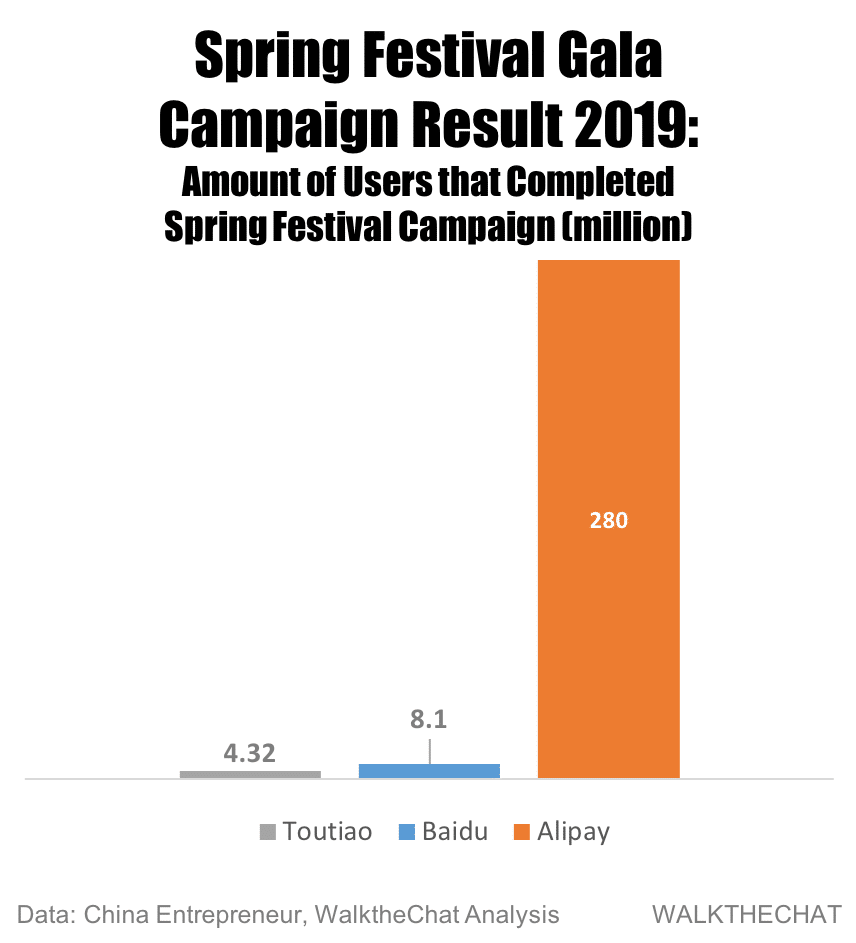

However, according to according to China Entrepreneur magazine, of the 300 million active users, only 8.1 million users were able to complete the campaign by collecting all the 10 Baidu Lucky Card collection (集好运卡). Comparing to other companies, 4.32 million users successfully collected the Toutiao Diamond Card (钻卡), and 280 million users successfully collected all of Alipay’s 5 FU Card(五福).

Even the Spring Festival Gala ads cannot save Baidu.

The low success rate may be due to the poor user experience.

- Baidu doesn’t have a mature payment product

Users have to enter their bank card information on Baidu in order to redeem the Red Envelope.

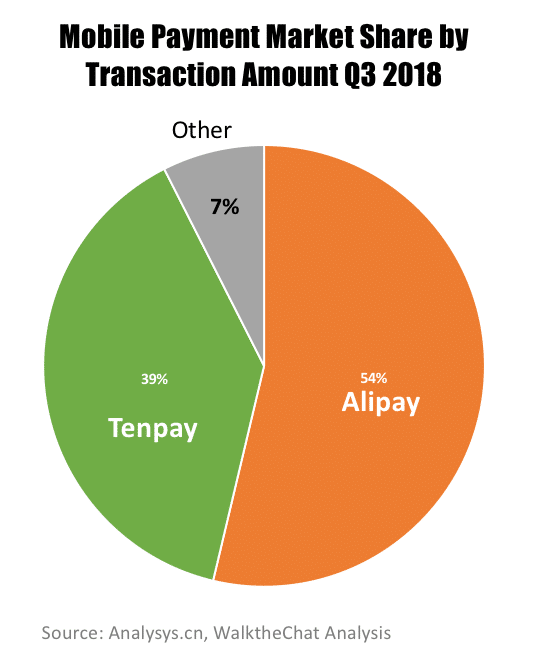

Yet, Mobile payment is already a natural market dominated by WeChat pay and Alipay. Users would hesitate to bind payment information with a search engine App, especially given Baidu’s poor reputation. According to Analysys.cn, WeChat Pay and Alipay together controlled 92.53% of the mobile payment market in Q3 2018.

2. The campaign relied heavily on Social sharing, but Baidu doesn’t have a social network.

Users had to interact with friends to collect all 10 Baidu Lucky Cards. But WeChat blocked the Baidu campaign sharing link on the launch day due to a violation of incentivized sharing rule. In order to keep the campaign going, Baidu created a Baidu code (度口令), a text code that acts as URL when users enter into the Baidu App. Users will not only have to switch back and forth between WeChat and Baidu to collect the 10 cards but also needs to copy and paste the Baidu code. The complexity of social sharing blocked the campaign from spreading.

3. Baidu diverted the traffic to other Apps in the Baidu ecosystem.

Last Baidu also involved other Apps from its ecosystem to join the campaign. Users can get more chance to collect Baidu Lucky Card by downloading Apps from the Baidy ecosystem: Kanduoduo 看多多, Haokan Video 好看视频, Baidu Tieba 百度贴吧, Baidu Read 百度阅读, Du Xiao Man 度小满 etc. As a result, during Chinese New Year, 7 out of the top-10 free Apps belonged to the Baidu ecosystem.

The user retention is however likely to be low as many users would delete the App after the campaign.

Baidu also failed to find brands who are willing to sponsor it’s Red Envelope campaign. According to China Entrepreneur, Baidu planned to sell 80 million ad spaces to 4 sponsors. Yet they ended up only getting 3 brands: FAW Group, JD.COM, and Duxiaoman (among which Duxiaoman is an AI company owned by Baidu).

Conclusion

The Spring Festival Gala ads are more expensive, have a larger scale and bring a larger impact than the Super Bowl ads. Internet companies are the biggest sponsors, and the ads often focus on driving user engagement and user acquisition from lower-tier cities.

While the potential of a successful campaign could change an industry (ie. the WeChat Pay campaign in 2015), without innovation, well-thought user path, and supporting ecosystems (social network and mobile payment), the ads could very much be a big-expensive-failure.

As the Chinese Internet space is changing faster than ever, what worked in the past does not guarantee future success. It remains to be seen whether WeChat phenomenal success during its 2015 campaign will ever be repeated.