Chinese “dama” (literally, big mamas) are budget-savvy shoppers most eager to snap up a good deal. They do most of the shopping for the family, and fortunately, they know just the place to score bargain-basement prices on everyday items, with discounts as deep as 90% off (look for overripe fruits that don’t last another day).

On one condition: whip up enough friends on WeChat to order the items together in bulk, directly from the manufacturer. After all, the deal is so good, it deserves a spot on everyone’s Moments (the equivalent of a Facebook user’s feed).

And the place to find these deals is Pinduoduo.

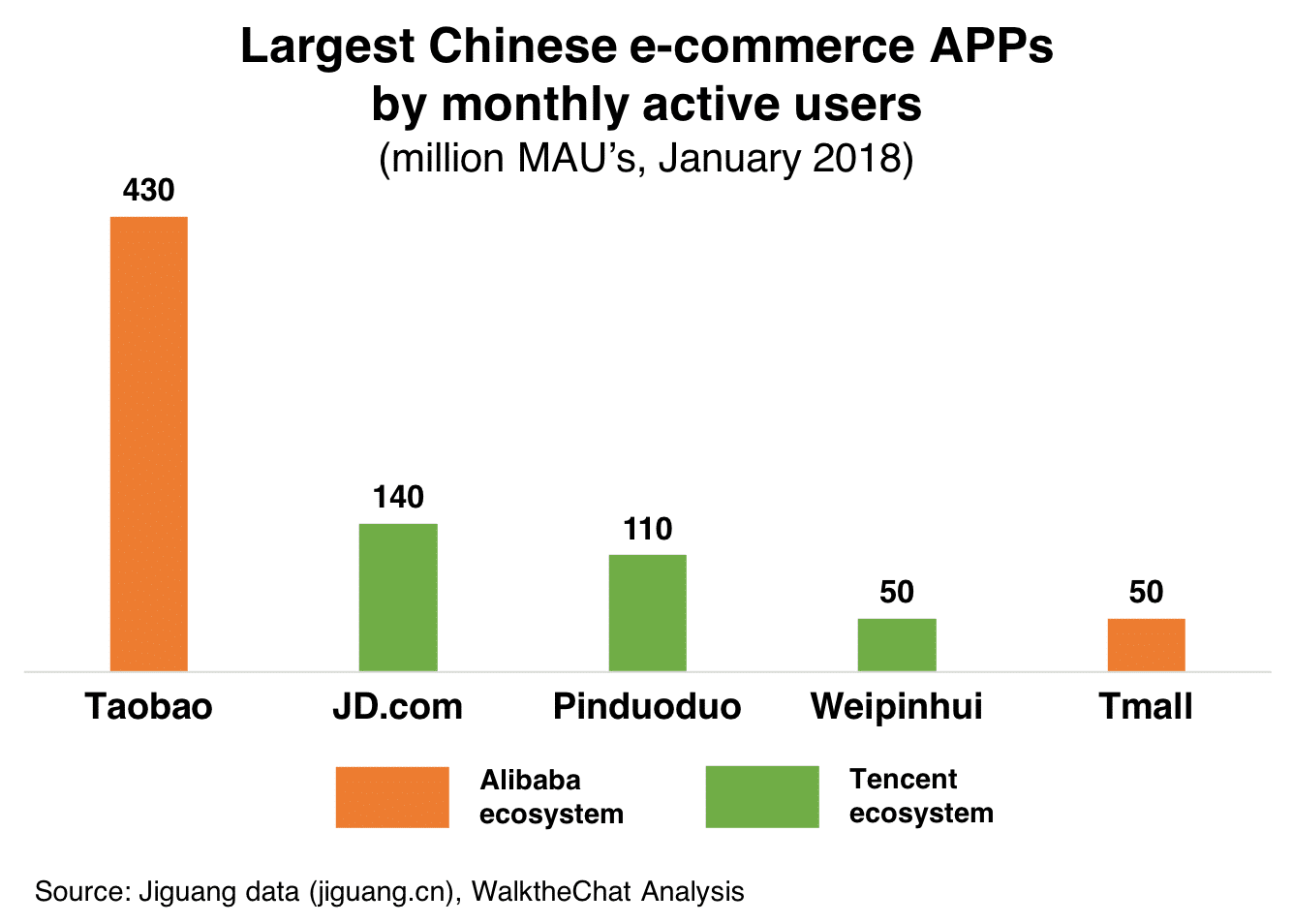

On the 9th of December 2017, Cheetah Mobile published a ranking of e-commerce Apps in China. Taobao was number #1. And right behind, the number #2, was Pinduoduo.

Pinduoduo is the leading Chinese App for social e-commerce, and the fastest growing App in the history of the Chinese Internet. Let’s take a close look at it.

Pinduoduo also went through their IPO in July raising $1.63 billion.

Here are some of the highlights:

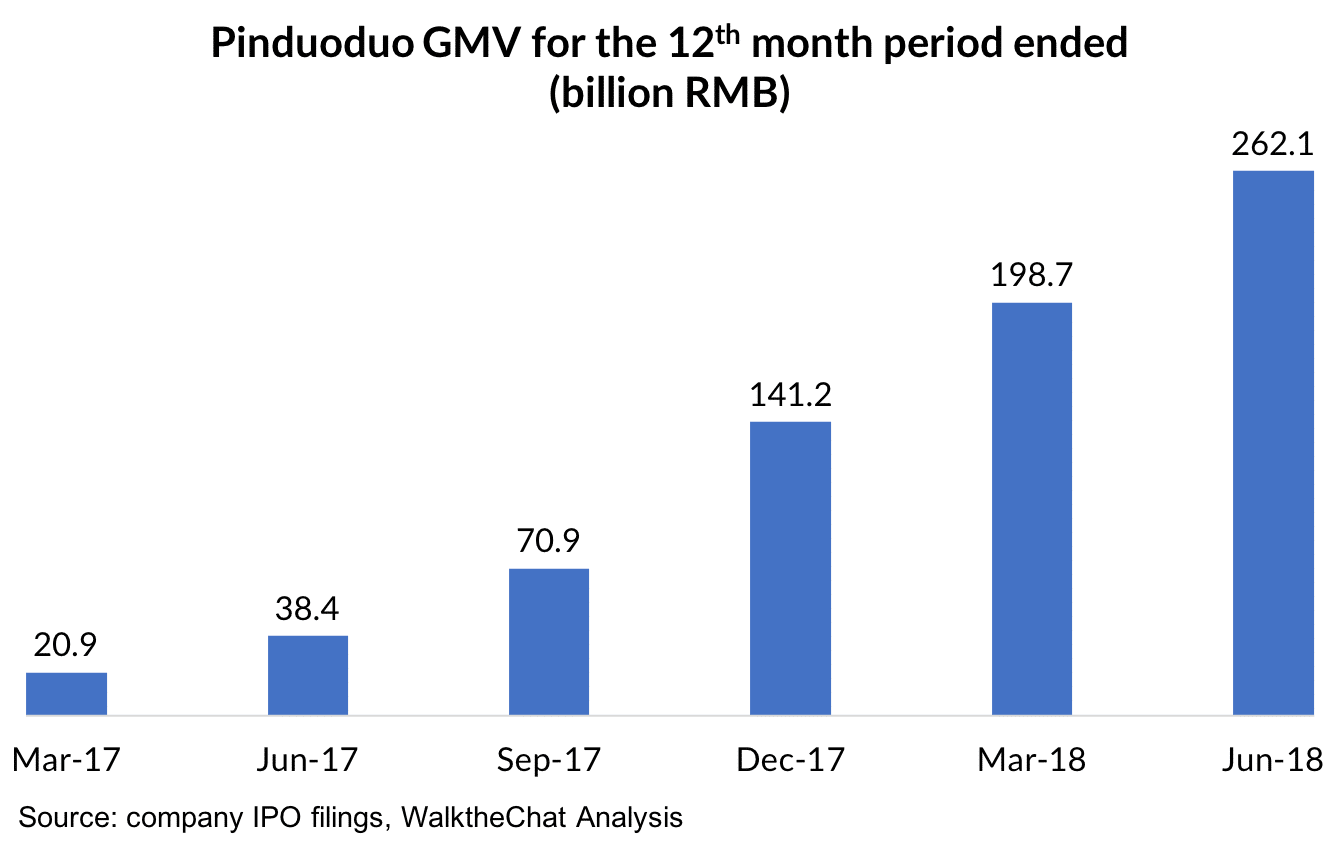

- Pinduoduo went above 100 billion RMB per year of merchandise sold on the platform 2 years after its launch… it took 10 years for JD.com to get there

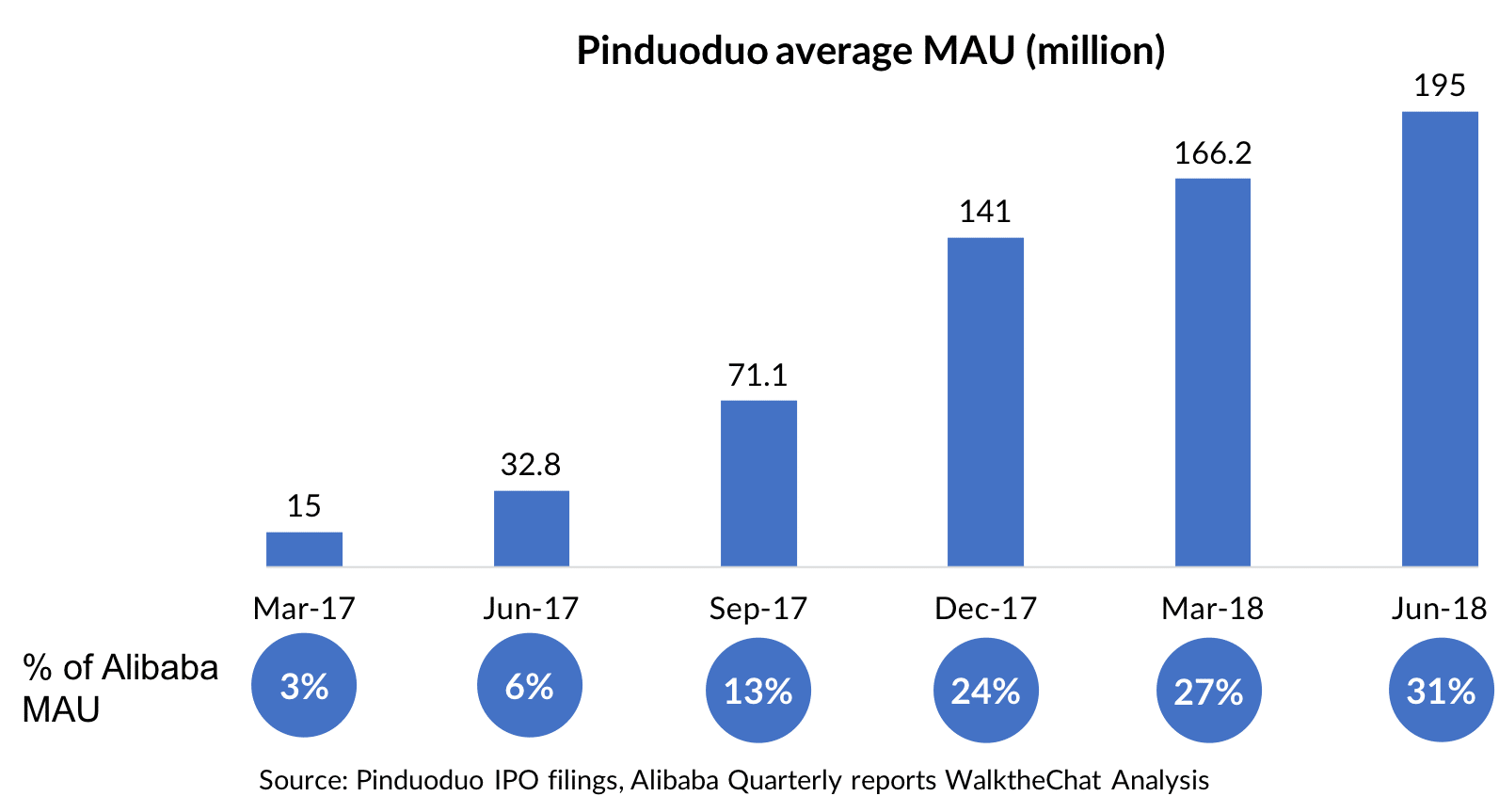

- Monthly Active Users (MAU’s) reached 195 million in June 2018: that’s 31% of Alibaba’s MAU’s

- Pinduoduo users are predominantly female, living in Tier 3+ cities

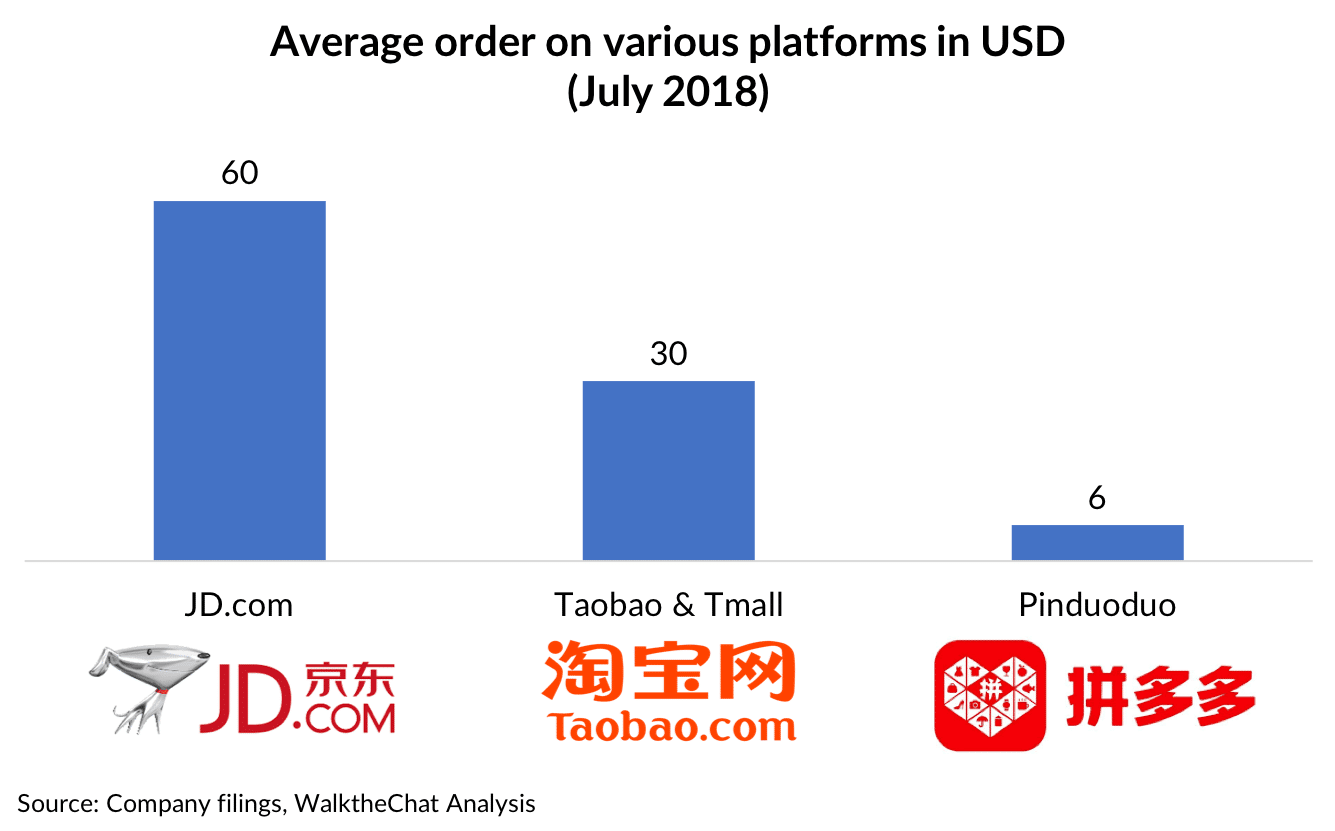

- The average order on Pinduoduo is 6 USD, against 30 USD on Taobao/Tmall and 60 USD on JD.com

How fast is Pinduoduo growing?

Pinduoduo has seen explosive growth since its launch in 2015, becoming one of the largest e-commerce Apps in China.

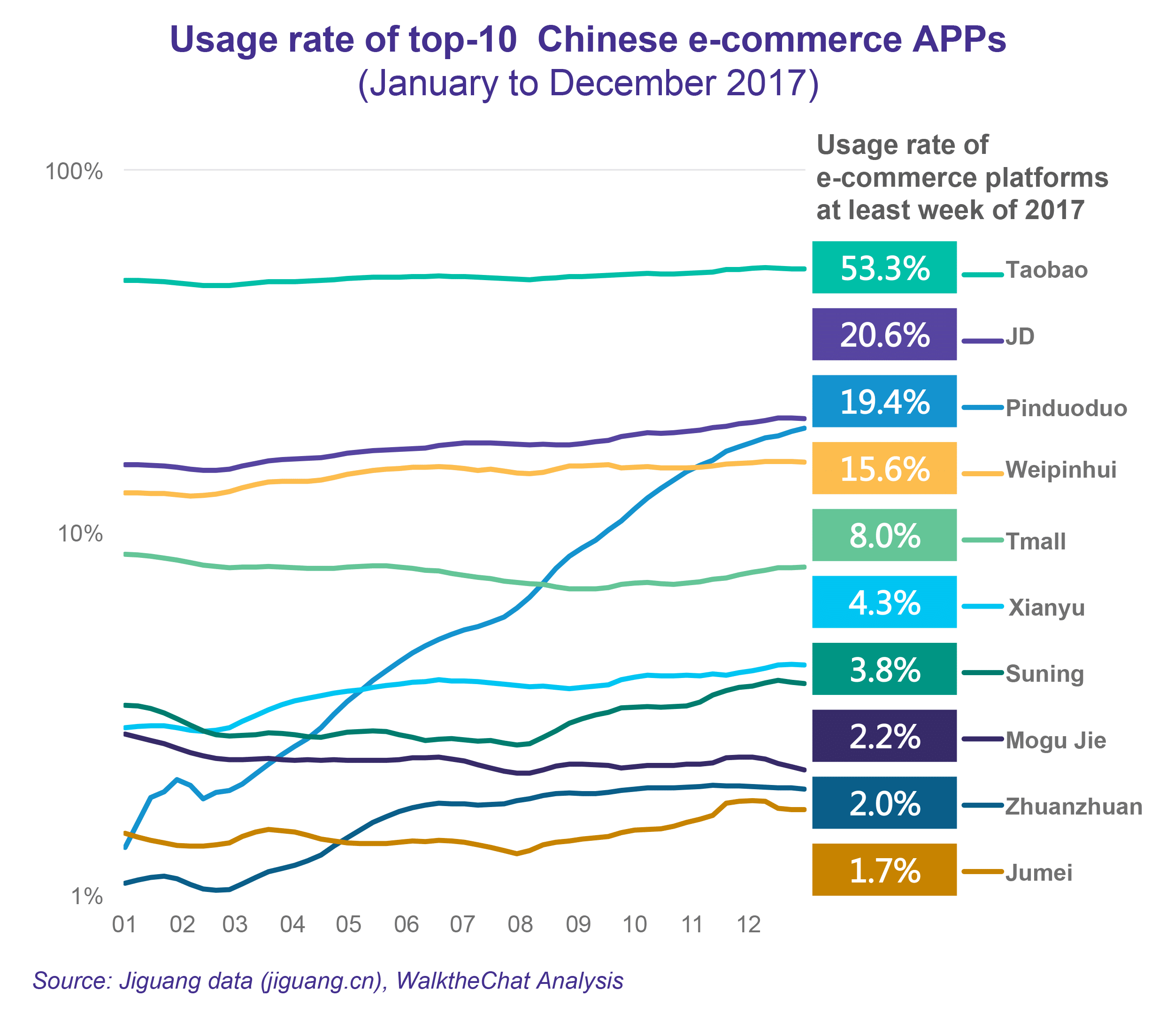

Can we say Pinduoduo out-Grouponed Groupon? The shop-with-friends app combines a group-buying strategy with cheap products and social media. It is now the fastest growing e-commerce platform with 13.85% YoY growth.

Gross Merchandise Volume (GMV) has been exploding on Pinduoduo reaching 262 billion RMB in June 2018, just before the IPO.

The usage rate of the platform among Chinese Internet users from under 2% to 19.4% over the course of 2018 (this leaves it right behind JD at 20.6%, but still far behind Taobao with 53.3% usage rate).

The number of users has also been steadily growing. In a bit more than a year, the platform went from 15 million users (3% of the Alibaba user base at the time) to 195 million users (representing 31% of monthly active users of the total Alibaba ecosystem)

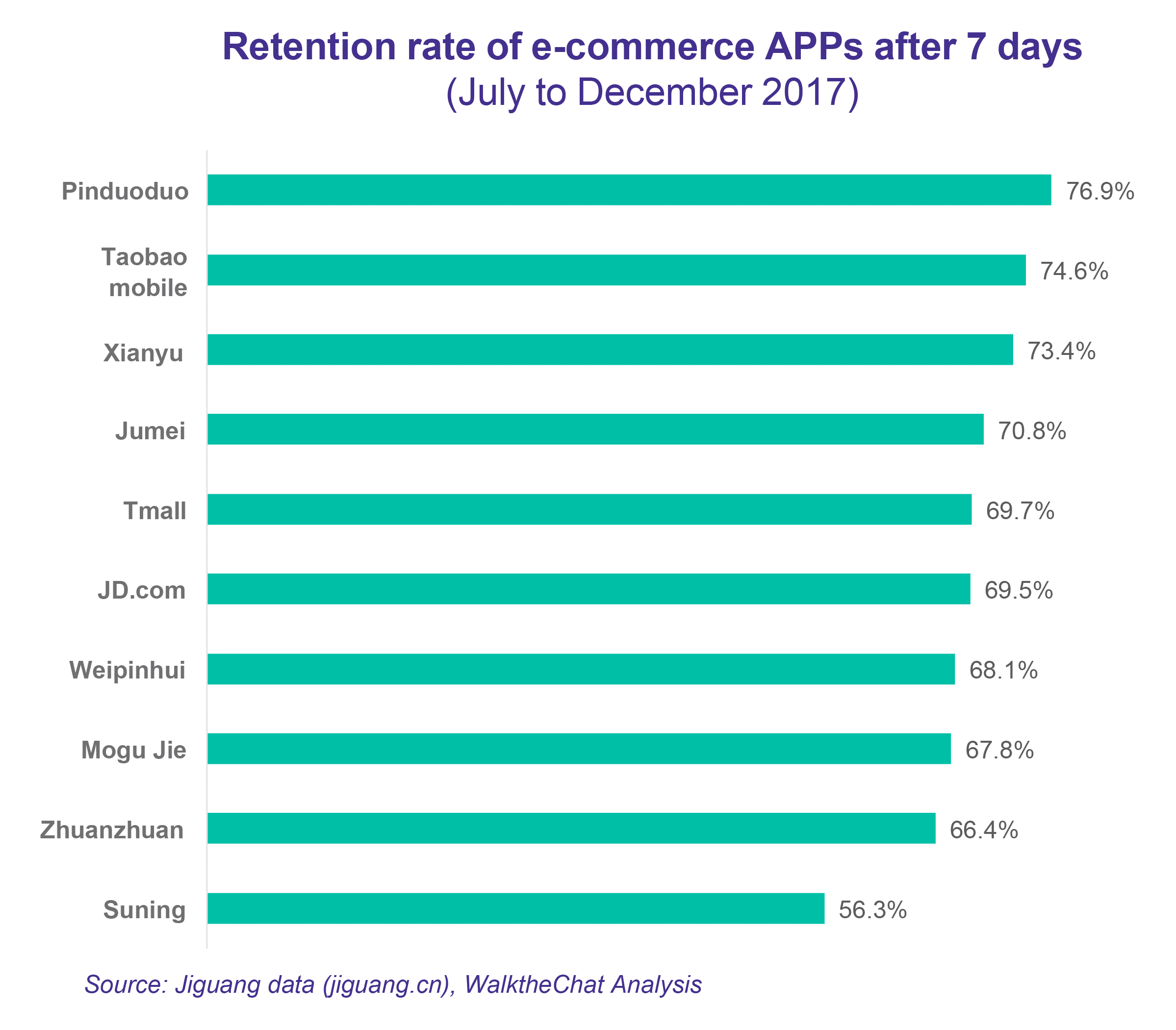

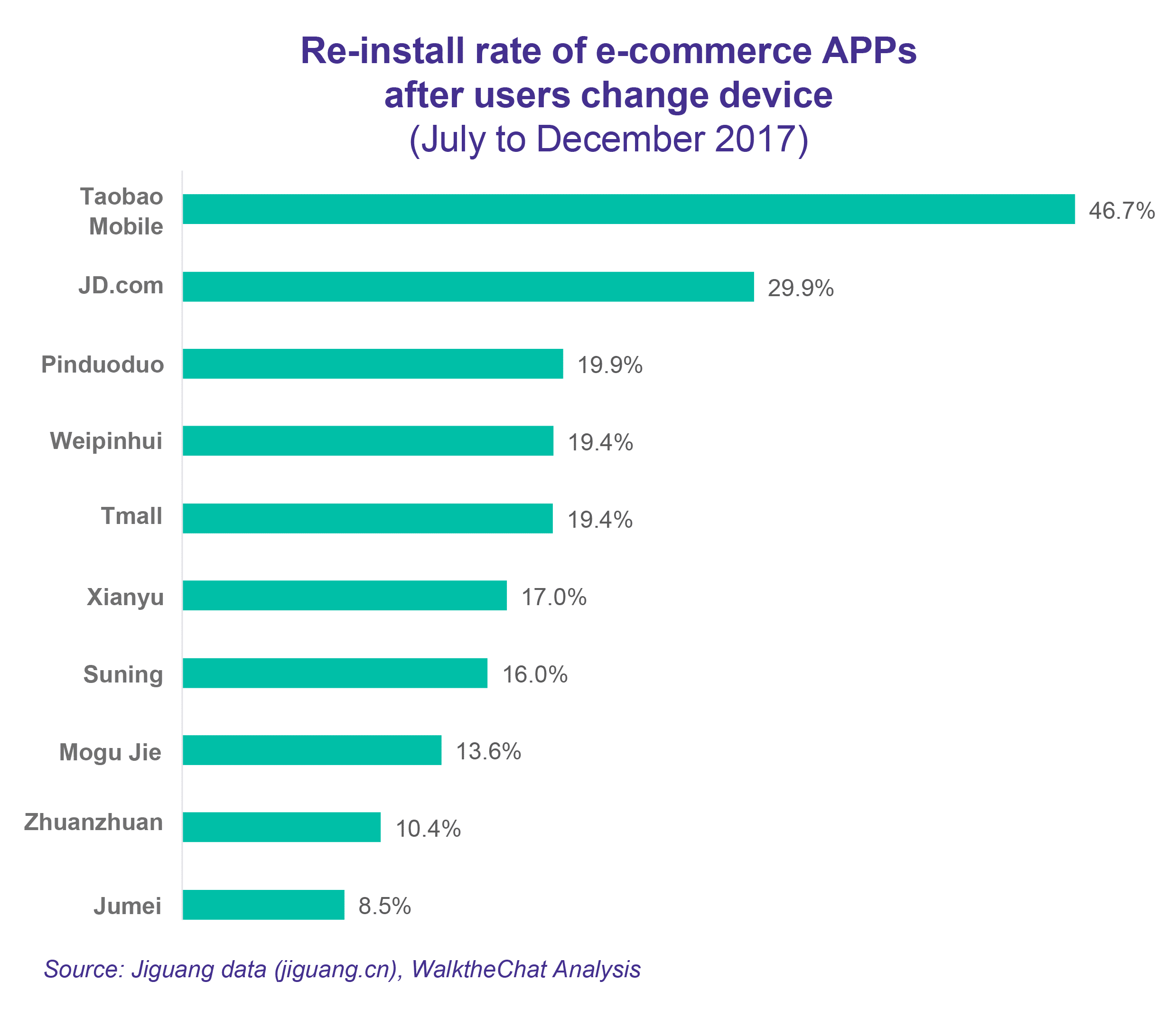

Pinduoduo also benefits from the best retention rate (7 days after APP install) from all Chinese e-commerce platforms.

Users changing phones are however more likely to install Taobao or JD than Pinduoduo.

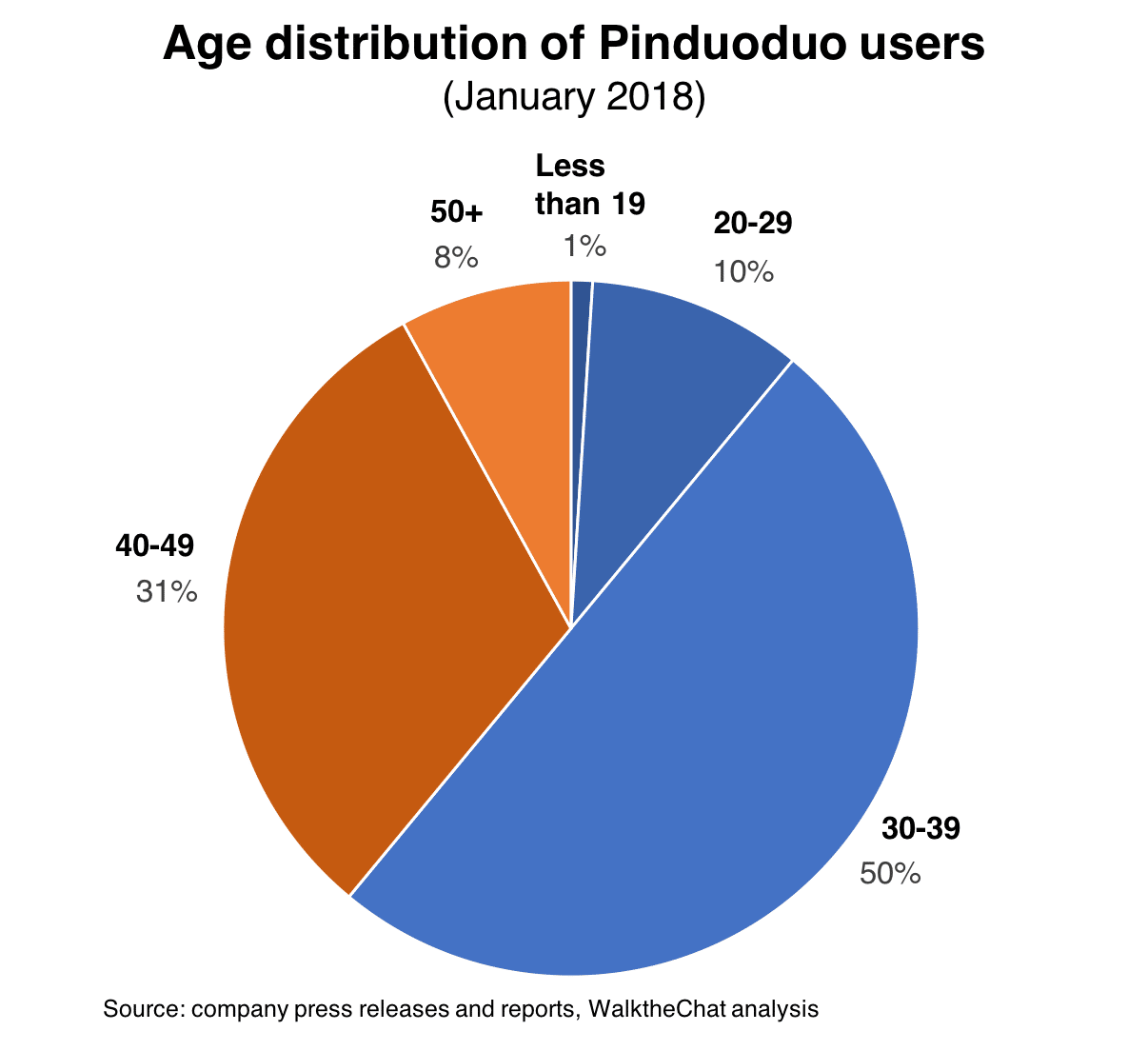

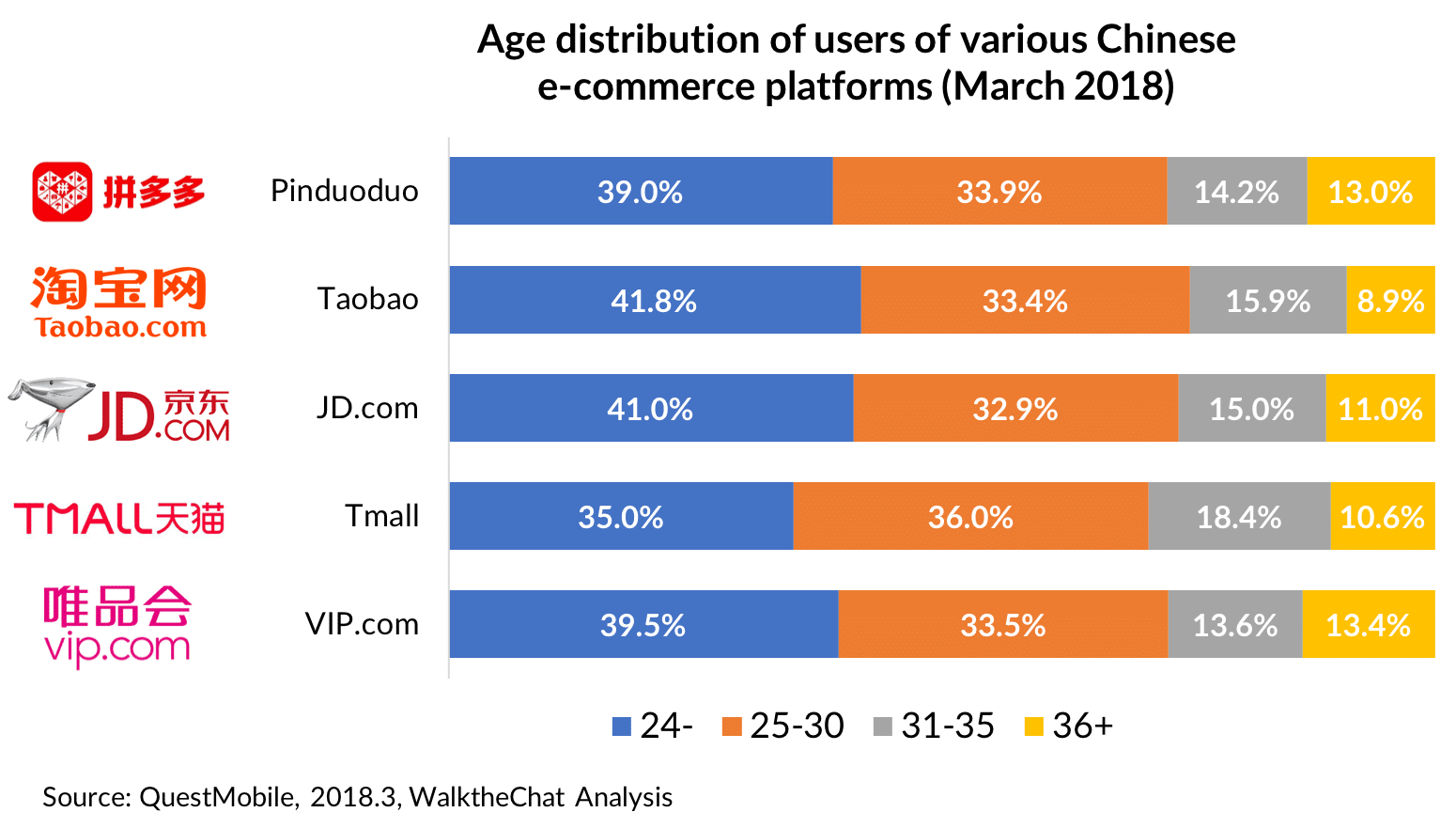

Pinduoduo caters to a very specific user demographic: they are predominantly female (70.1%) and living in 3rd tier cities or smaller (58.8%).

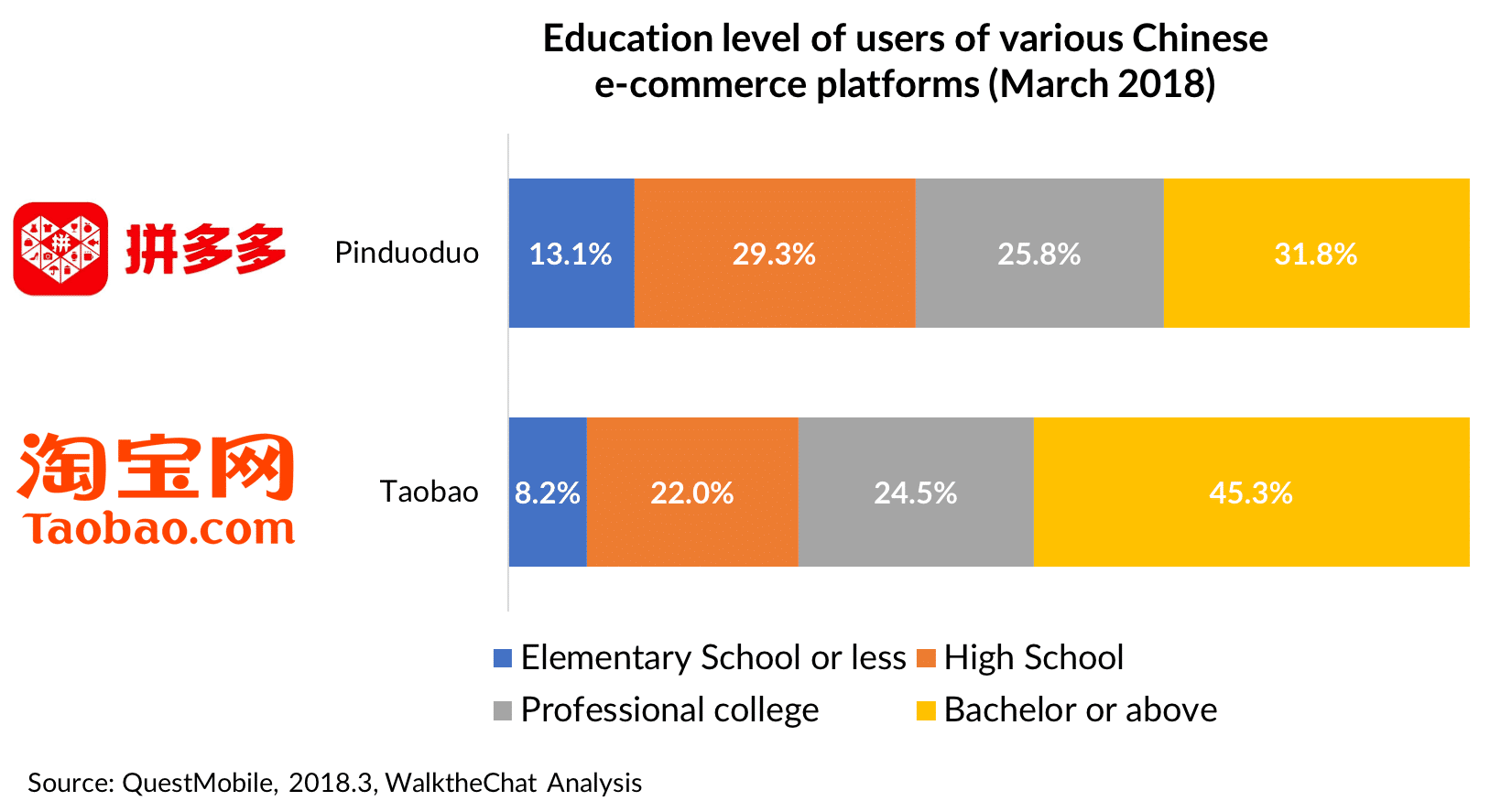

The users of Pinduoduo are also less educated than Taobao users: 42.4% of them don’t have any college degree, against 30.2% in the case of Taobao.

Reporting 114 million monthly active users in January 2018, Pinduoduo is behind only Taobao (425 million) and JD (145 million), boasting a 300 million-strong user base, with 65% of users coming from third-tier cities and beyond.

In fact, a large proportion of their users are female above 40 years old in smaller Chinese cities.

Purchasing behavior

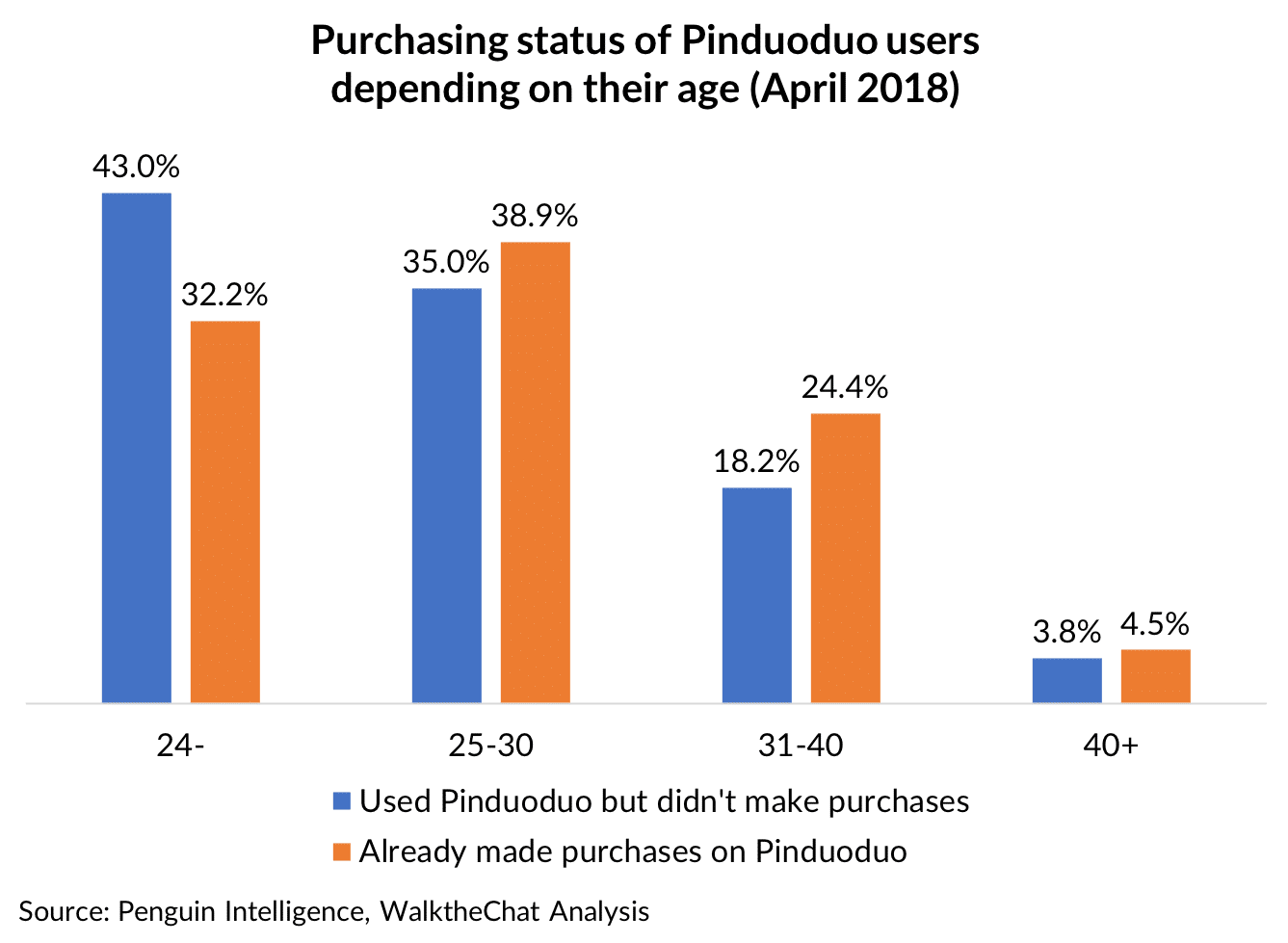

Among Monthly Active Users, the majority of users who made a purchase are between 25 and 40 years old (63.3%).

Young users below 24 years old are more likely to have used the platform but not made a purchase (they make up 43% of users who didn’t buy anything)

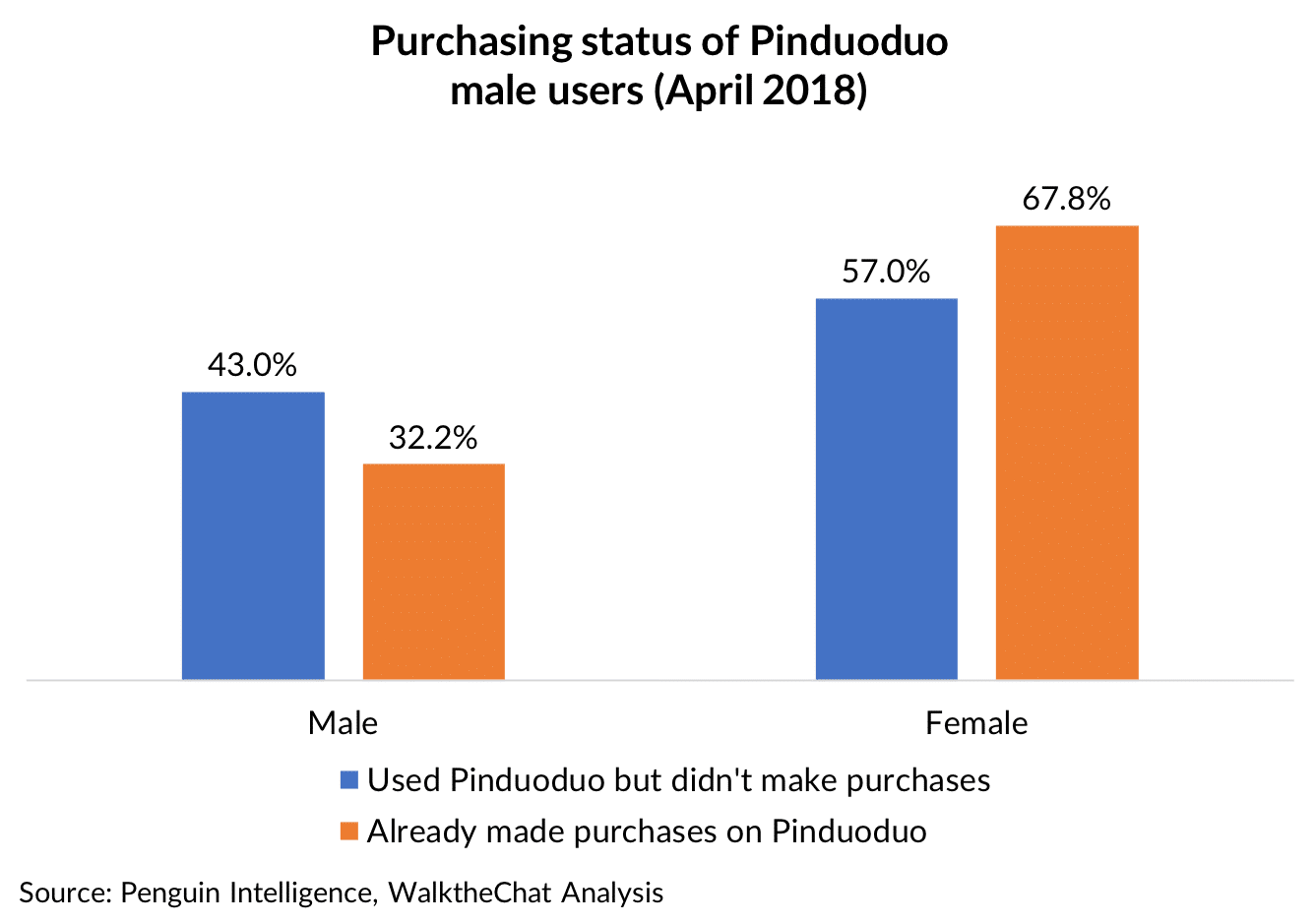

Female users are also more likely to be active buyers: they make up MAU’s 67.8% of users who made a purchase on Pinduoduo.

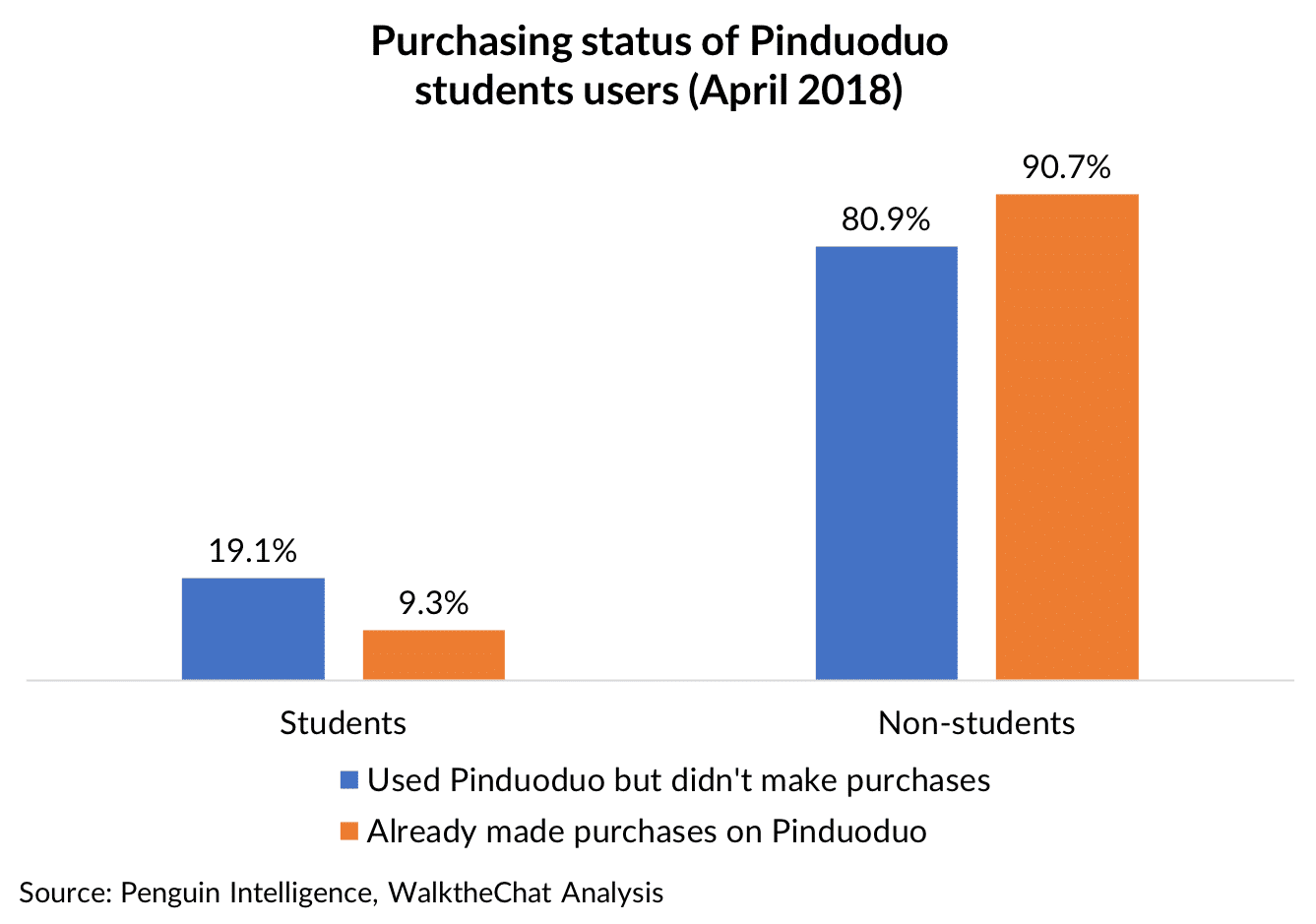

Students on the App are also more likely to use it without purchasing: they make up for 19.1% of non-purchasing users, but only 9.3% of active buyers.

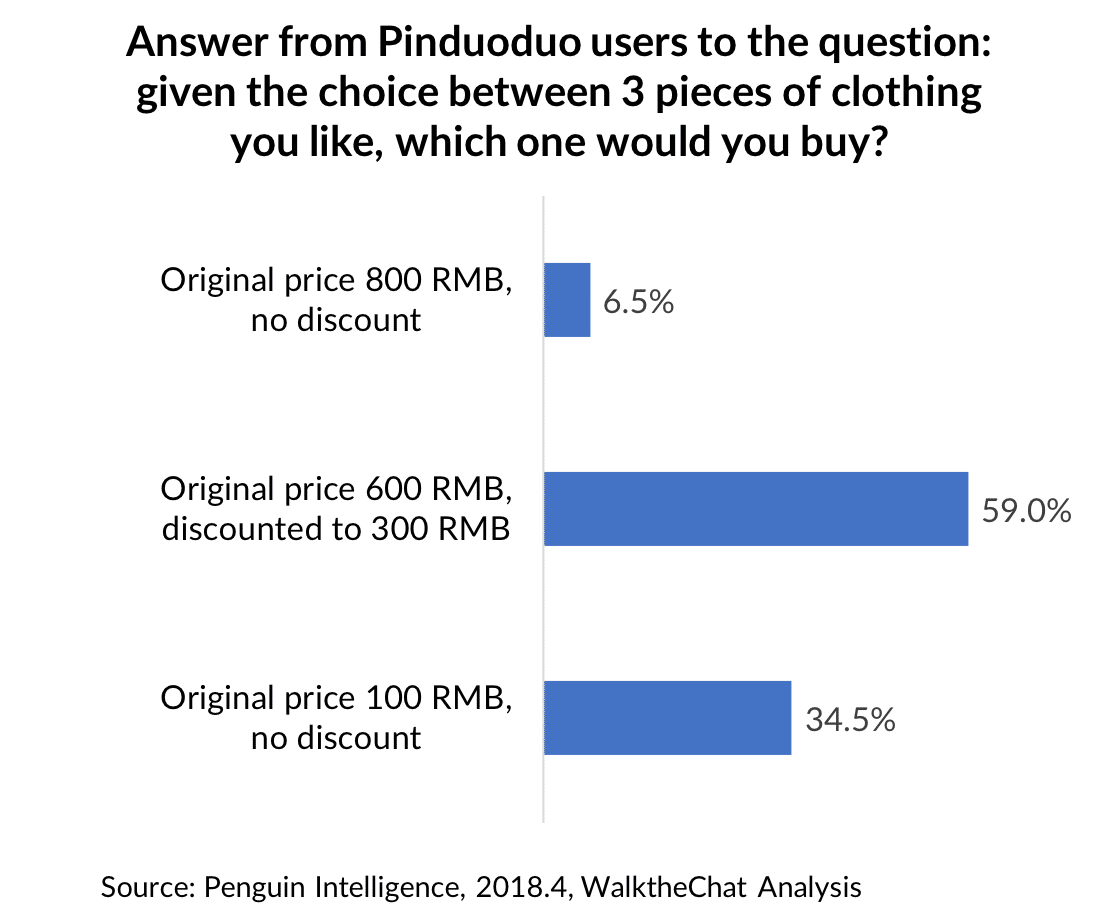

Overall, Pinduoduo users are looking for a bargain: they declare being more likely to buy an expensive product that is heavily discounted, rather than cheaper products without a discount.

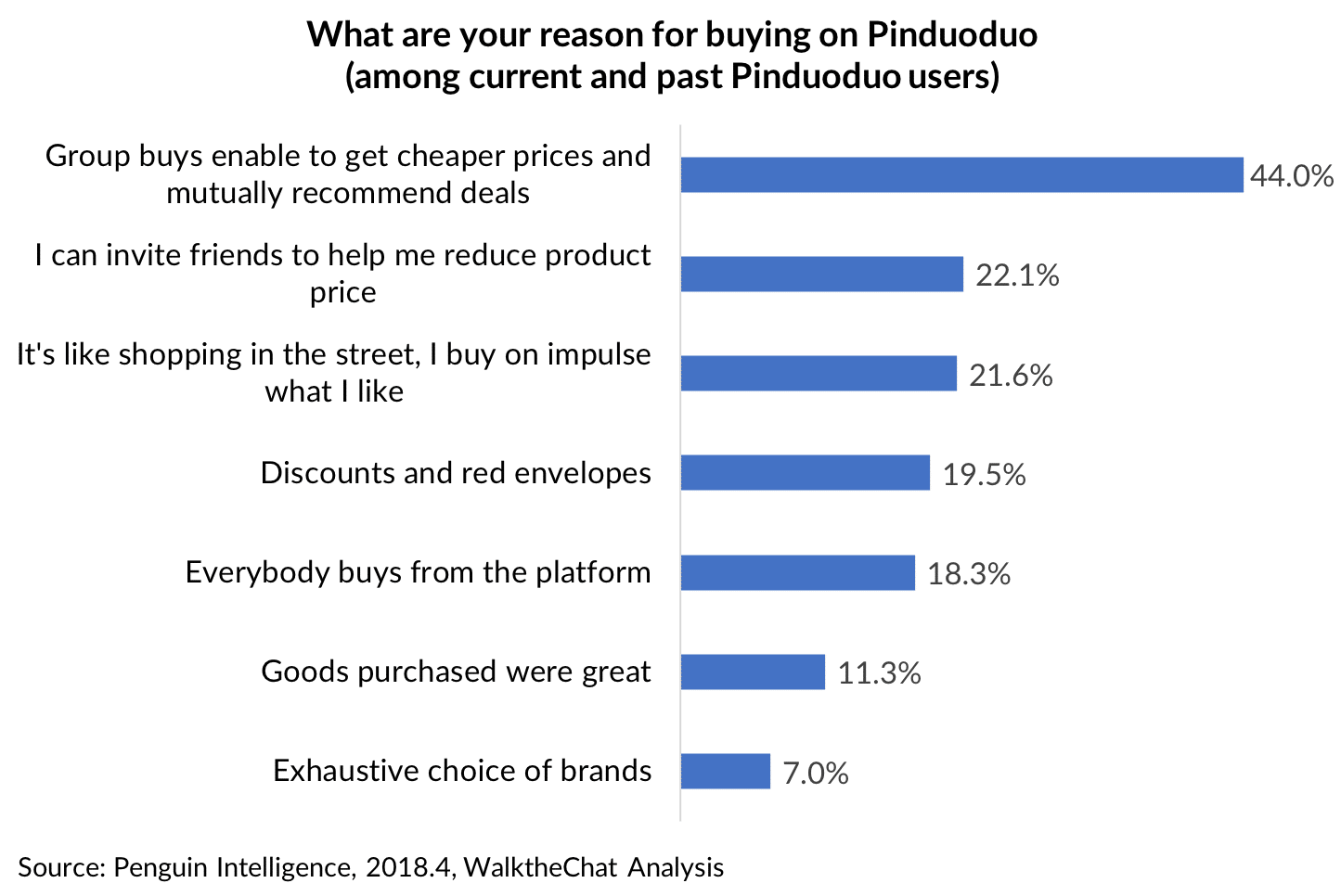

The group-buying feature of Pinduoduo is by far the most important incentives for people to use the App, both for price discounts and recommendations.

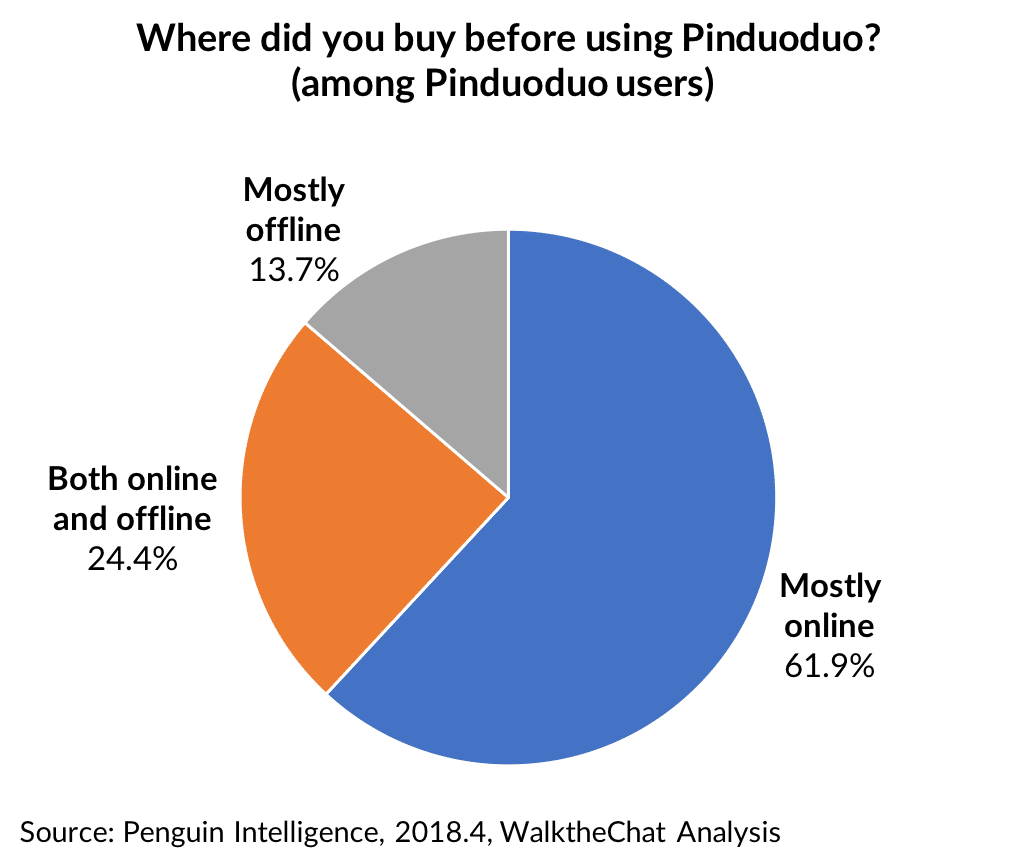

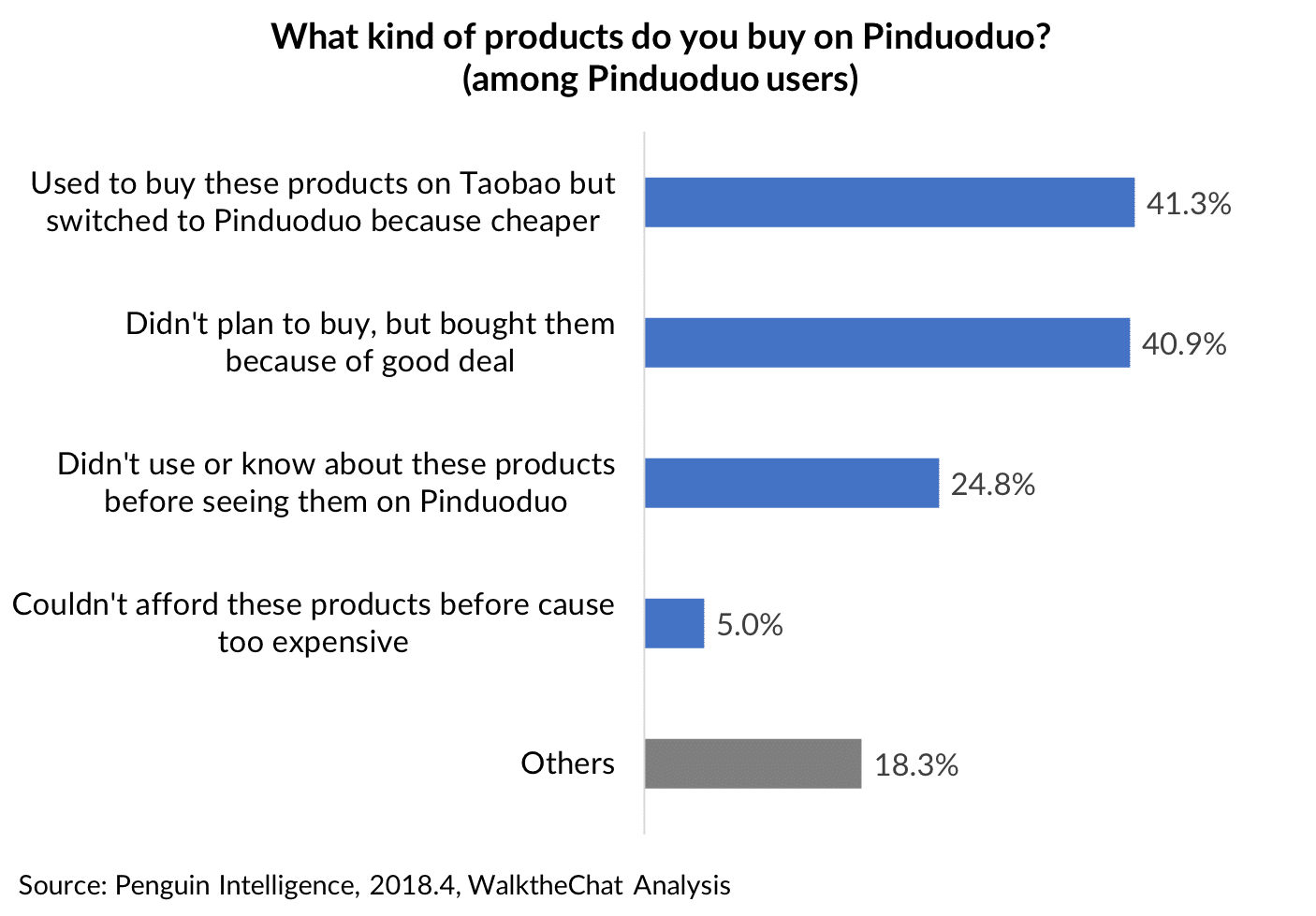

For the most part, users are buying products that they used to buy on Taobao (41.3%).

For the most part, users are buying products that they used to buy on Taobao (41.3%).

There is however also a significant percentage of users (40.9%) who are buying products on impulse that they didn’t plan to buy otherwise.

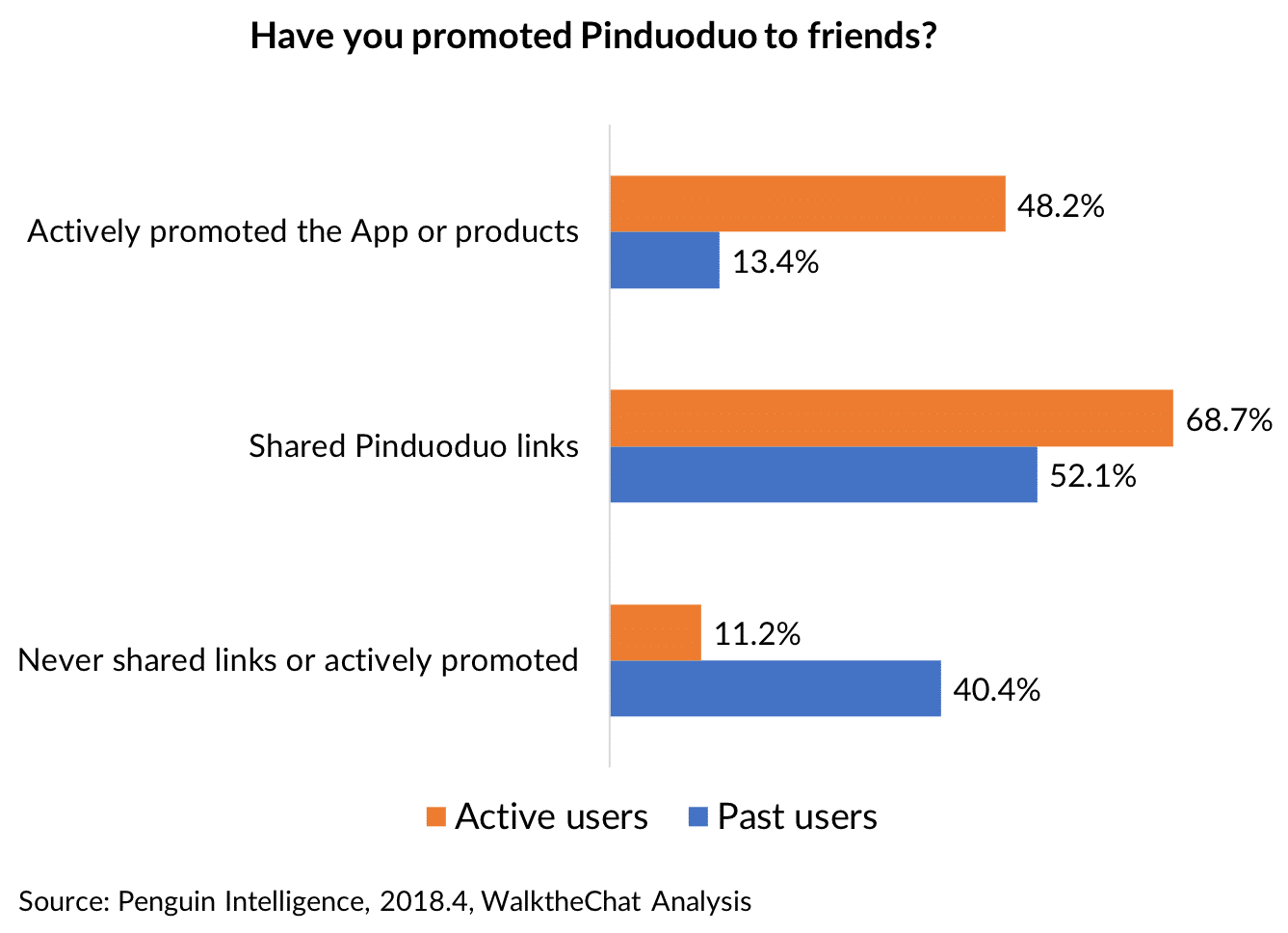

The power of Pinduoduo mostly comes from its social features: only 88.8% of active Pinduoduo users helped promote the platform in some way, either via sharing links or actively promoting products.

Average orders on Pinduoduo are, as one might expect, low: 10 times smaller than the average orders on JD.com.

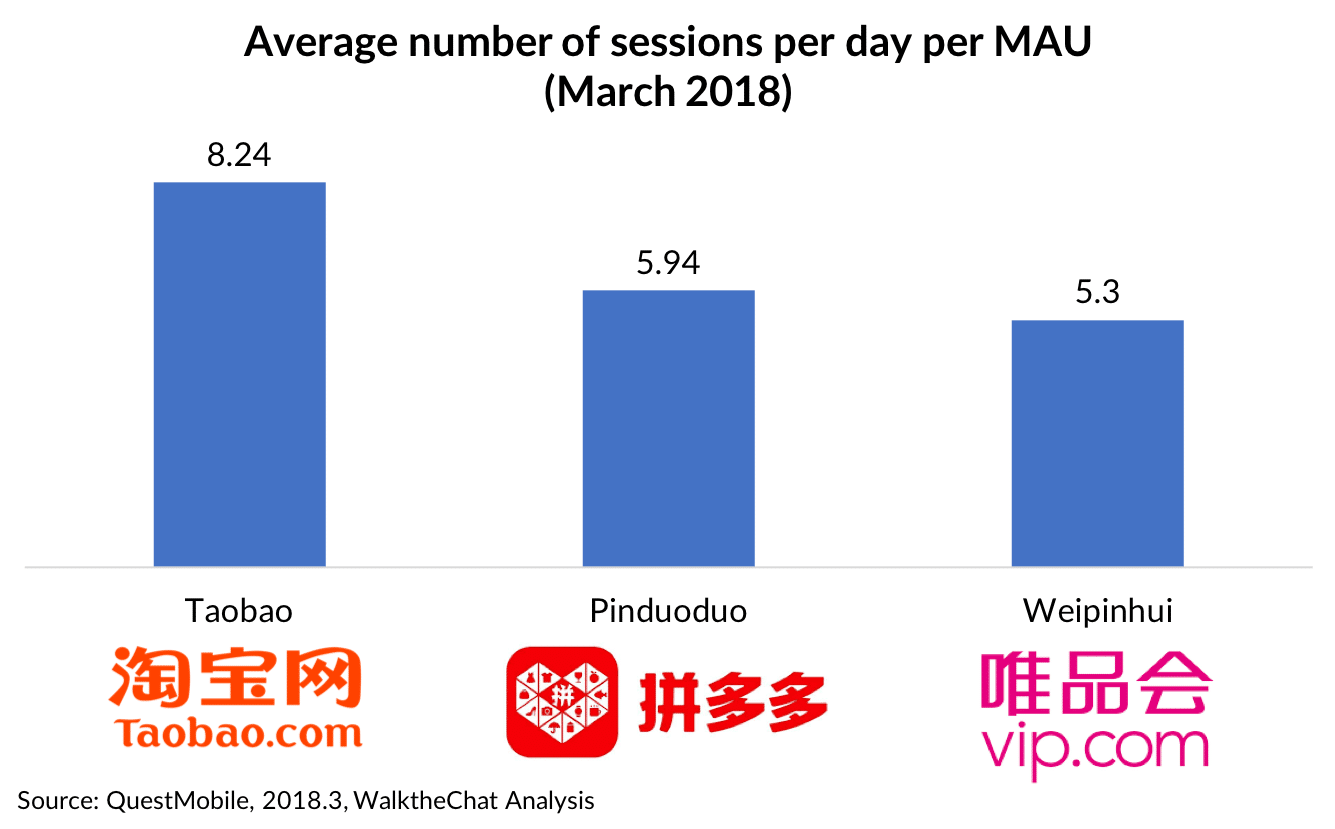

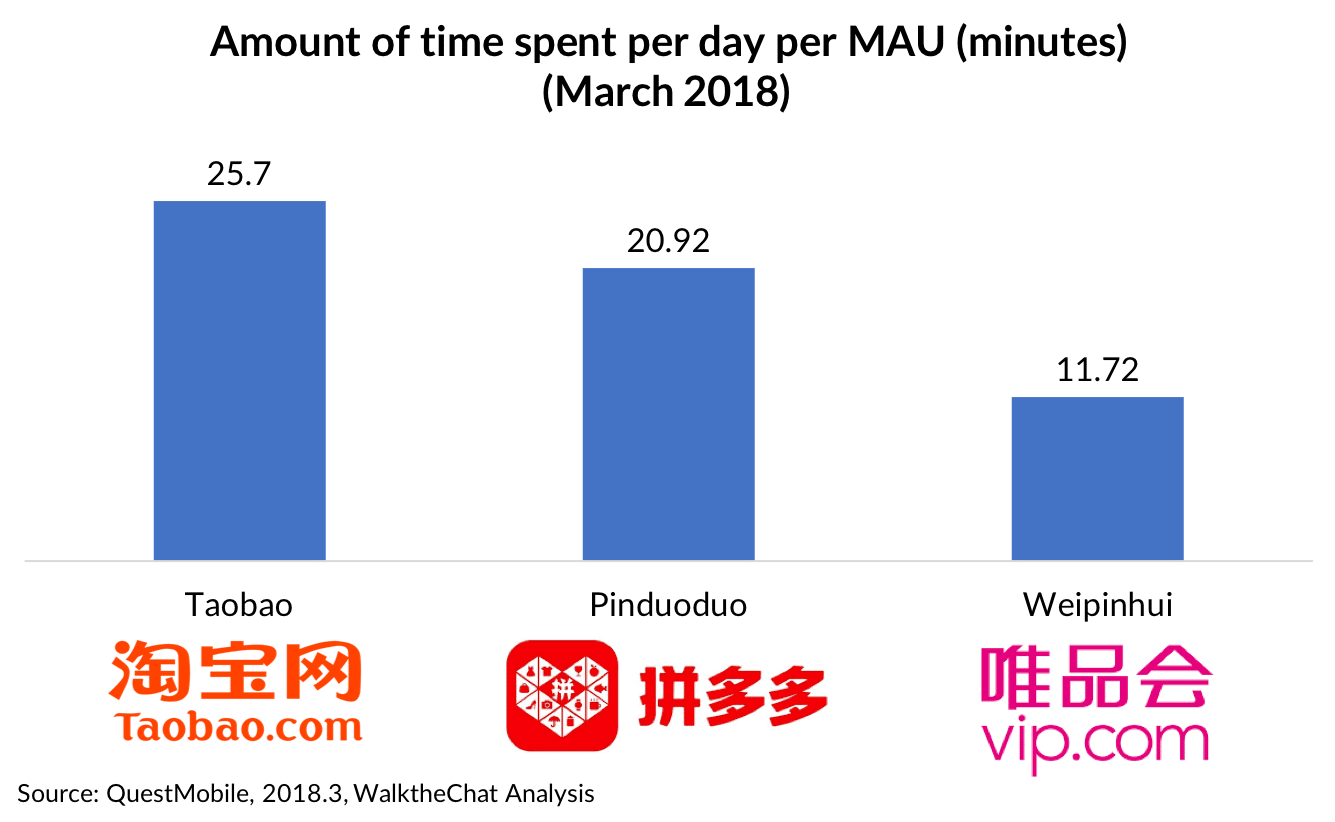

Users remain more active on Taobao than on Pinduoduo, both in terms of the number of sessions and time spent on the App.

Users remain more active on Taobao than on Pinduoduo, both in terms of the number of sessions and time spent on the App.

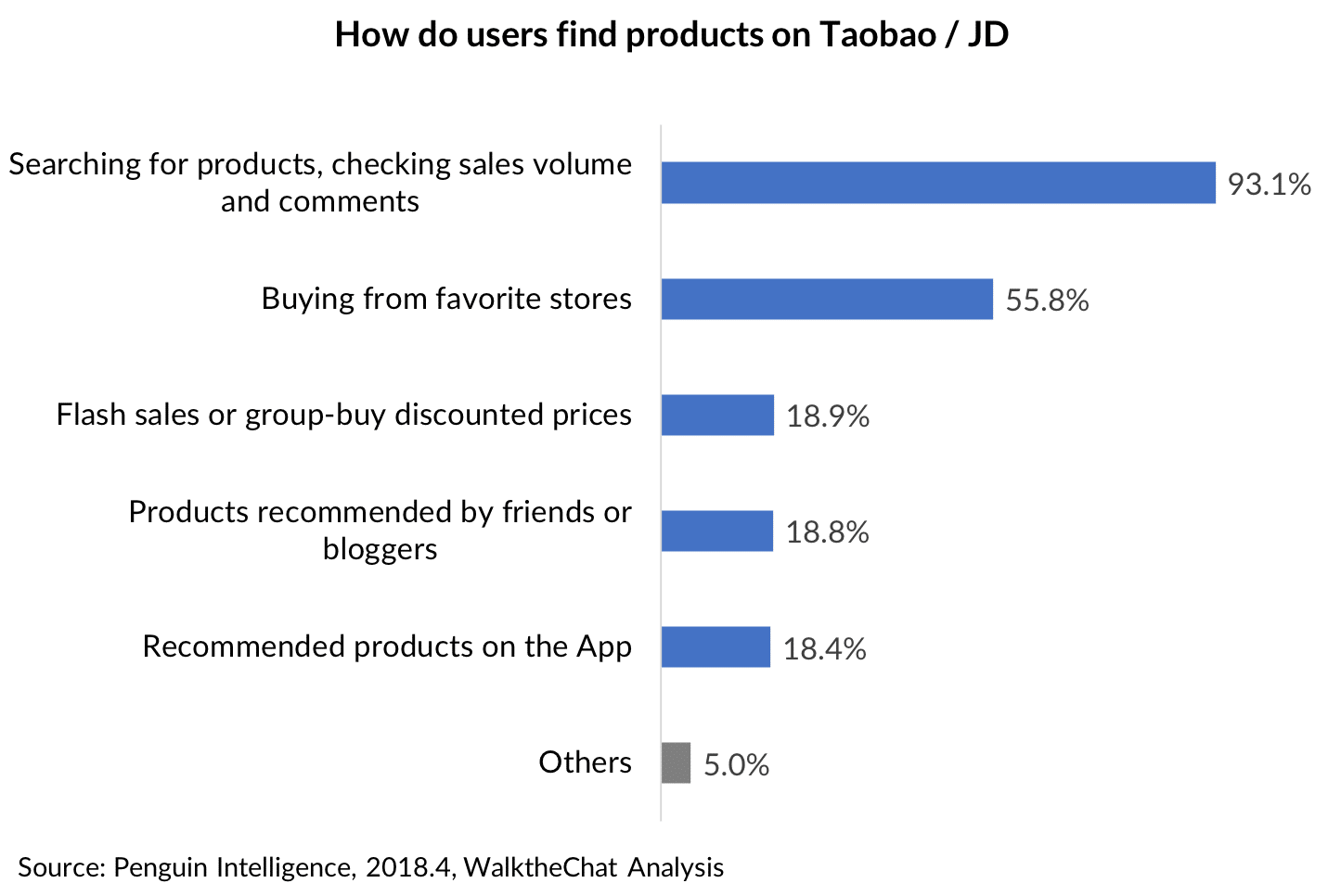

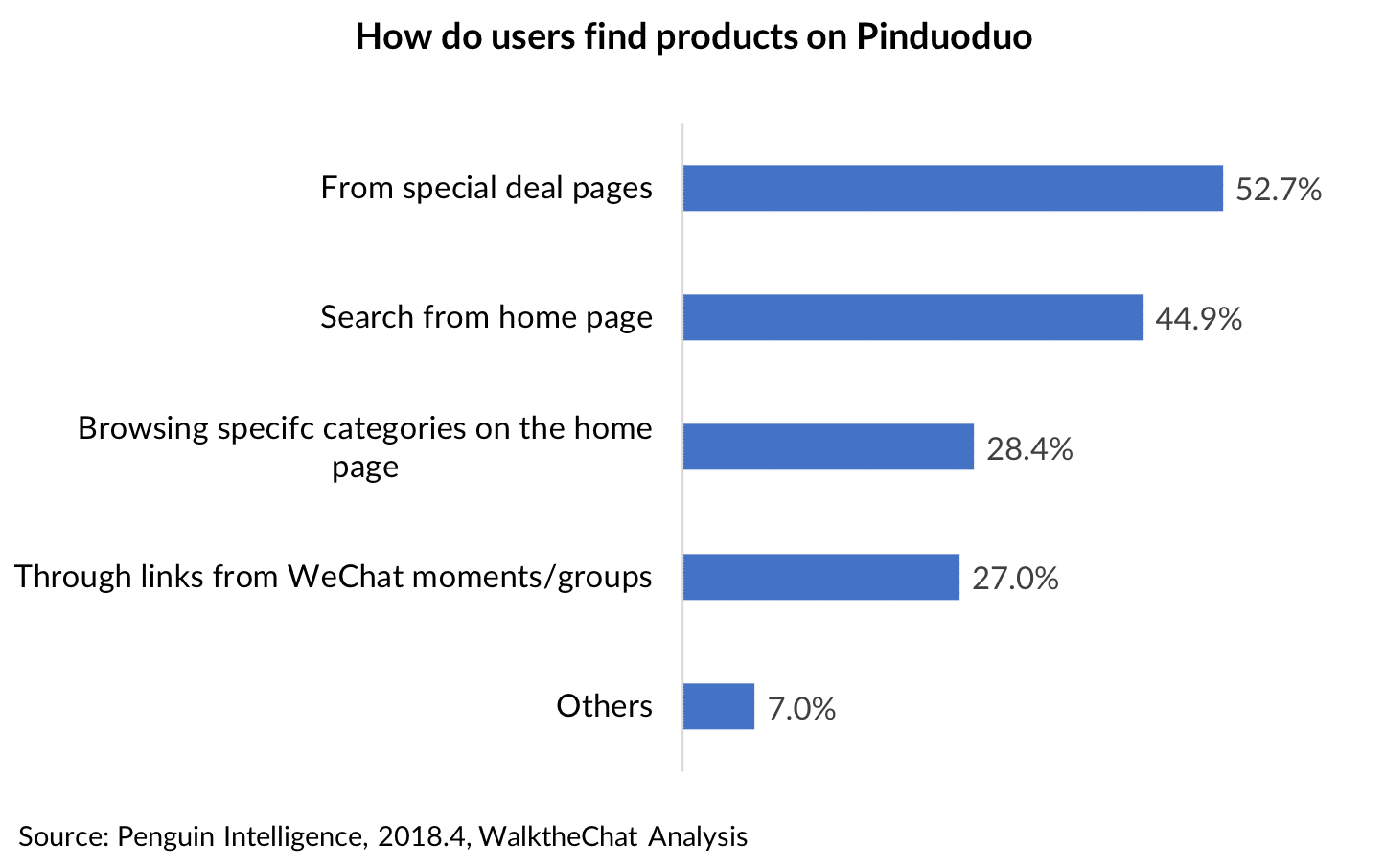

Taobao/JD and Pinduoduo have completely different user behaviors: 93.1% of Taobao/JD users find products through keyword search, while most of Pinduoduo users are looking at which special deals are available every day.

This is made possible by the AI behind Pinduoduo, which is pushing the right products to the right users based on product popularity and users purchase history.

Pinduoduo is also seen as a more meritocratic system for products: good products which get a lot of attention can find their way to the top of the rankings even if they are not coming from large brands/stores.

A de facto substitute for Taobao?

Chinese users have a lot of options to shop around. It is interesting to note that a subtle relationship exists between Pinduoduo and Taobao, Alibaba’s hugely popular marketplace.

Pinduoduo users are mostly displaced from Taobao and other platforms: they are for the most part (86.3%) users who are usually used to buying online.

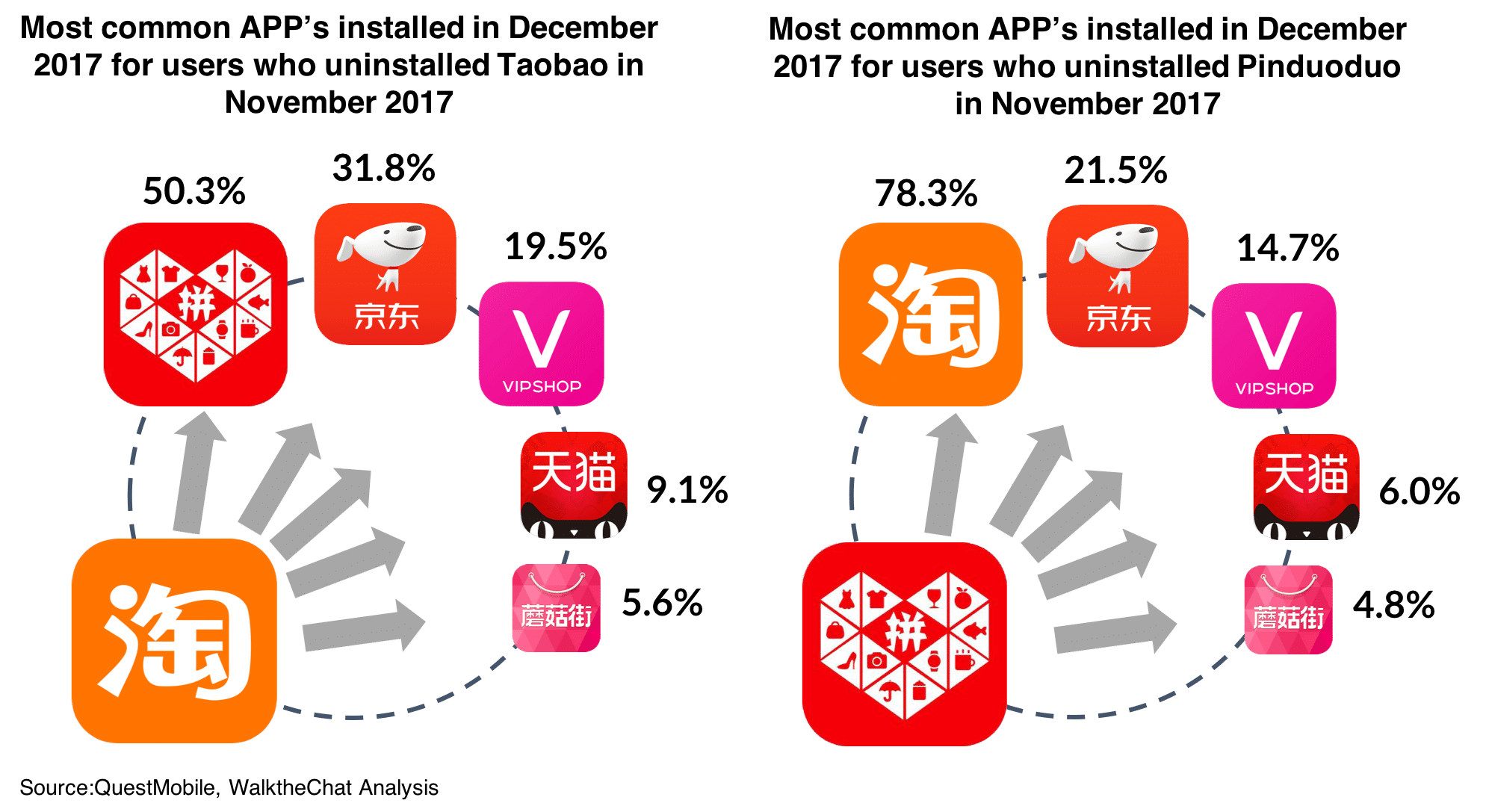

50% of the users that uninstalled the Taobao App installed Pinduoduo a month later. Pinduoduo is by far the most common substitute for Taobao.

On the other hand, 78% of the Pinduoduo uninstalls are followed by Taobao app downloads in the following month, according to QuestMobile’s data for November and December 2017. Taobao is still leading the fight.

Pursuing a significant but often overlooked market

The lure of Pinduoduo is not just the incredibly low prices, but the satisfaction of getting a good deal, scoring massive discounts. This hit home with the low-income crowd in China’s remoter towns and villages.

As e-commerce giants compete for affluent customers in urban centers in an era of consumption upgrading, Pinduoduo focused on sourcing fresh produce from local growers to build an initial user base in its early days. Prices are cheaper, as its C2B model sells in bulk and eliminates layers of distributors by connecting consumers with farmers directly.

The platform scaled up quickly and has since expanded the product range to include essentially all the household items you can think of, groceries, fashion, beauty, and electronics.

Pinduoduo claims that over the course of two years, about 1,000 factories that produce to sell on the platform.

Focusing on producing just a few SKUs in colossal quantities, these “Pin Factories” (拼工厂) are able to achieve and handle order volumes that have grown exponentially.

An impressive example is Chinese tissue manufacturers CoRou and ZhiHu (also known as Botare), whose factories have collectively completed more than 9,320,000 Pinduoduo orders. That is 261 million packets of tissue!

The sheer volume of each group order leaves sellers more room to cut prices, and the incredibly cheap prices attract even more customers, creating a positive e-commerce cycle.

Everyday items come at as low as 90% off.

Farmers feel relieved from the heartbreak of seeing their hard work go to waste as the fruits rot, as they ship fruits off in bulk to Pinduoduo shoppers, who typically get their produce at 60 to 80% off.

Seafood is another hugely popular category, which offers an average 30% to 80% saving.

| Fruit | Group Deal Price | Market Price | Discount |

| Oranges from Gongxi | 23.9 | 59.9 | 60% |

| Apples from Yantai | 28.8 | 66 | 57% |

| Pears from Xinjiang | 13.9 | 39.9 | 75% |

| Dragonfruit from Vietnam | 31.8 | 88 | 64% |

The group-deal app is quite sticky to its low-price user base, with an average of 50.7 sessions per week per user last year, according to Cheetah Data.

Pinduoduo is by far the largest APP in China focusing on providing discounts, with a 19.37% penetration rate, against 1.32% for its closest competitor.

As one might accurately assume, Pinduoduo is not known for quality. Last year alone, the platform took down 10 million problematic listings and set up an RMB 150 million fund to compensate users that reported such issues as shoddy goods, rotten fruits and difficulties in getting refunds.

Pinduoduo features

There are two words that come to mind when thinking of Pinduoduo: addictive and viral.

The App is doing everything to push you to share the App with your friends. And once you did, it does a great job at keeping them hooked. The App combines a bunch of tactics in order to achieve these results.

Group Buying

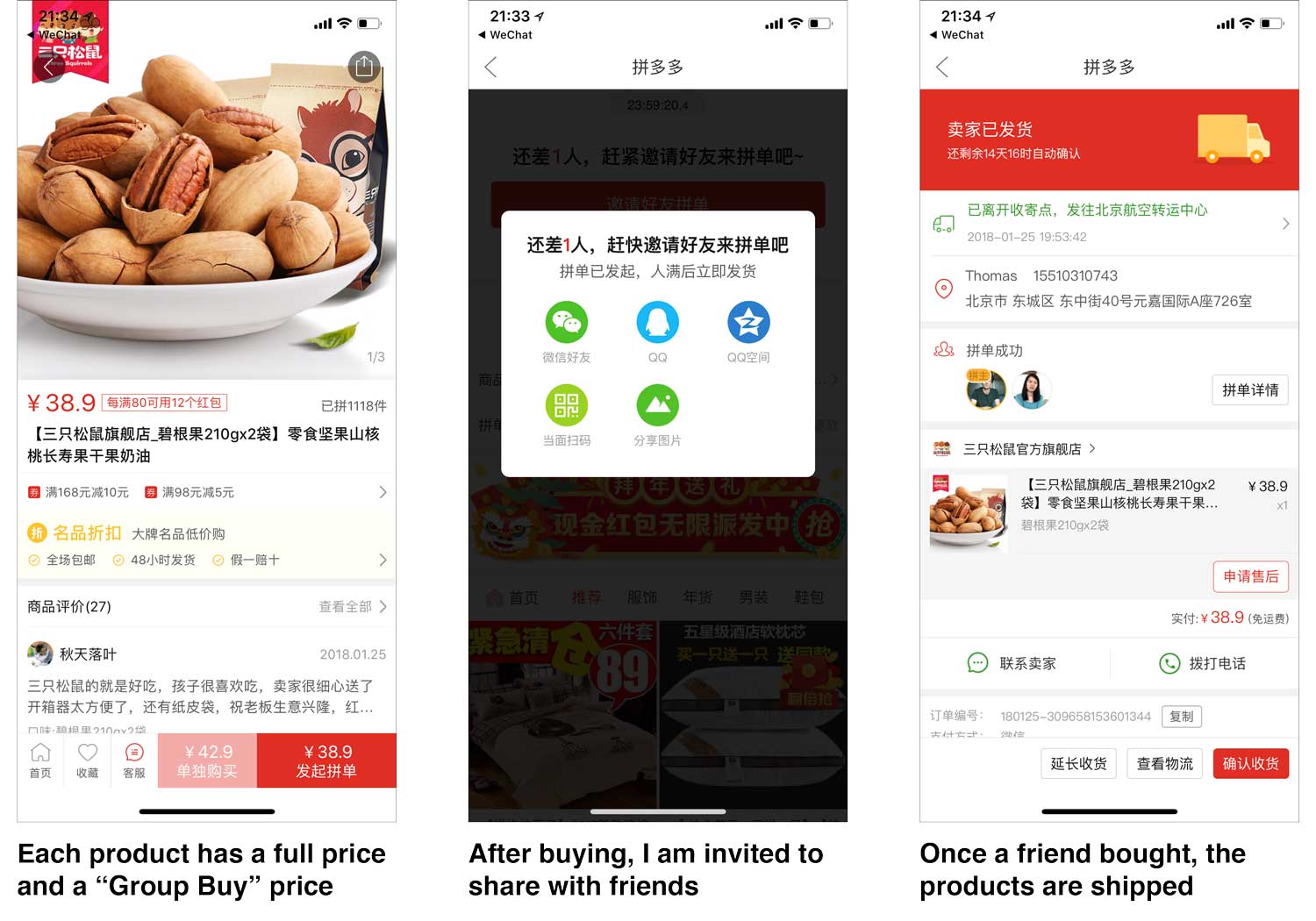

The core function of the App is Group Buying: each item has an official price and a group-buy discounted price. In order to get the discounted price, I can find another friend to join the group-buy deal, and we’ll both get the product shipped to our respective address.

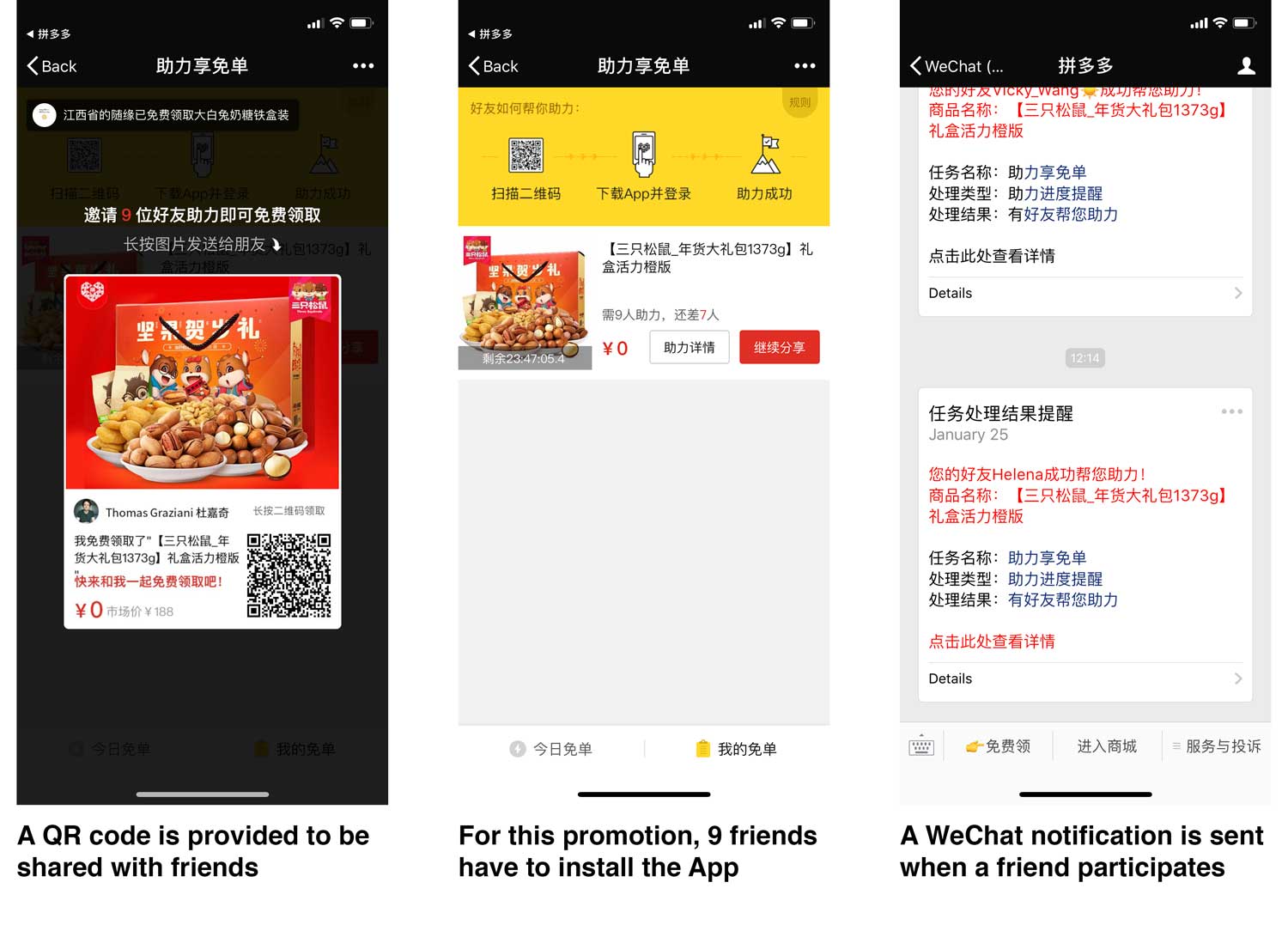

Free products

Cheap products are great. But what about free products? That’s just what Pinduoduo offers.

The App offers a range of products for free. You just have to get enough new users to follow the Pinduoduo Official Account, install the App and sign up via WeChat login.

1 App install will get you a small box of candy. 9 App installs will get you 1.3 kg of nuts from the food startup Three Squirrels (三只松鼠). That’s the one I went for.

Sure enough, my awesome WeChat friends helped out and installed the App, and on the next day…

This can sound like a crazy strategy, but it’s not. The package sells for 99 RMB full price, 79 RMB in group buying. But Three Squirrels makes a heavy margin on this, and most likely only charges Pinduoduo around 20-30 RMB to ship the free product.

That’s 3 RMB per high-quality App installs, linked with a WeChat social account. The promotion also leads one person to actually get a delivery, engage with products and share about the experience with friends. This is exactly the kind of strategy that propelled Pinduoduo on the top of the App stores.

Moreover, people might keep scanning the QR code after the free product has been claimed. In my case, 25 friends scanned the QR code trying to help me get the free product: that’s a cost of less than 1 RMB per follower for Pinduoduo!

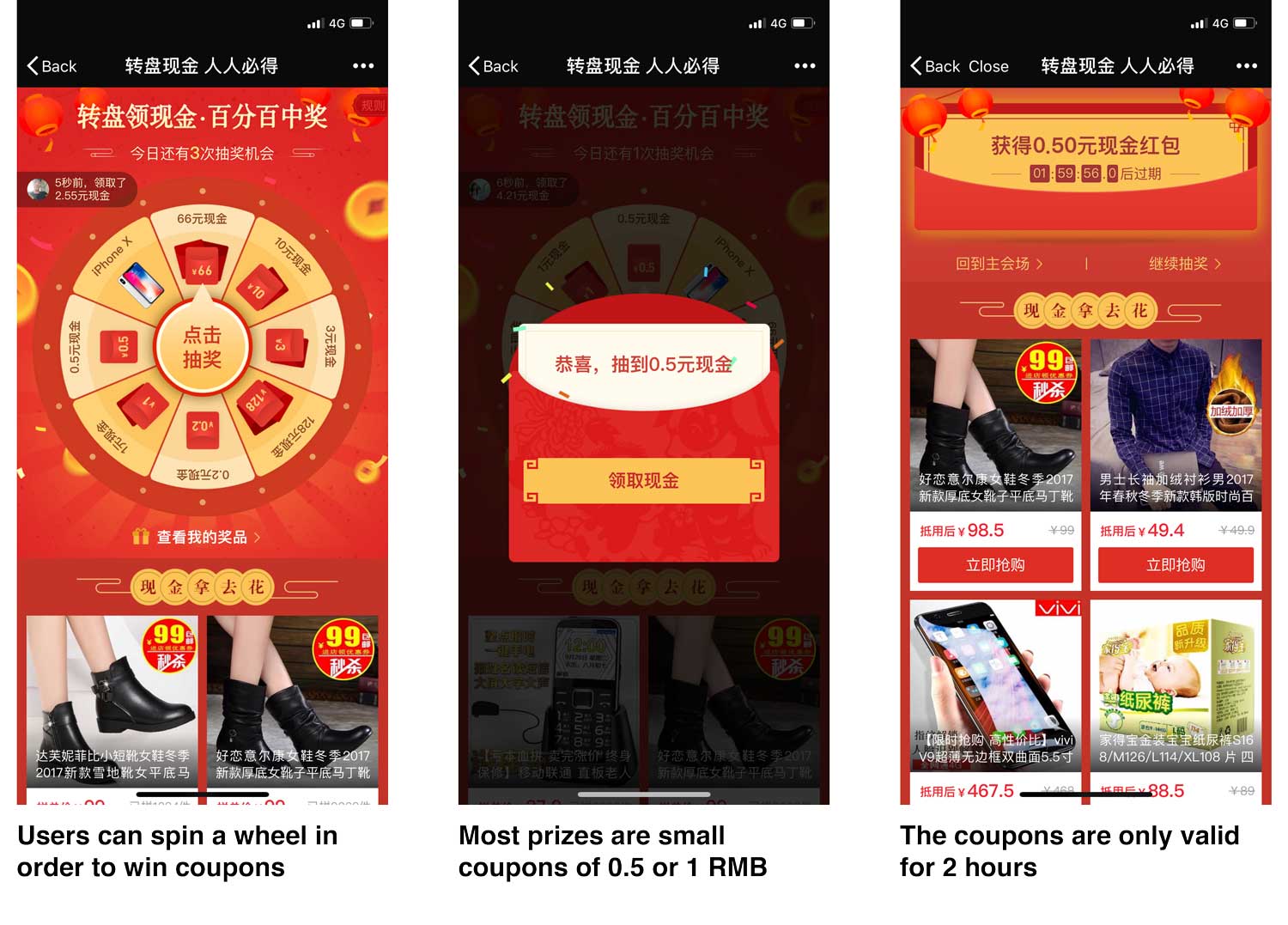

Short term coupons

Pinduoduo offers coupons. That’s nothing special in China.

However, Pinduoduo’s coupons have exceptionally short durations: usually only 2 hours.

The message is clear: you should not linger around or hesitate. Pinduoduo is a platform where you should buy things, and you should buy them now.

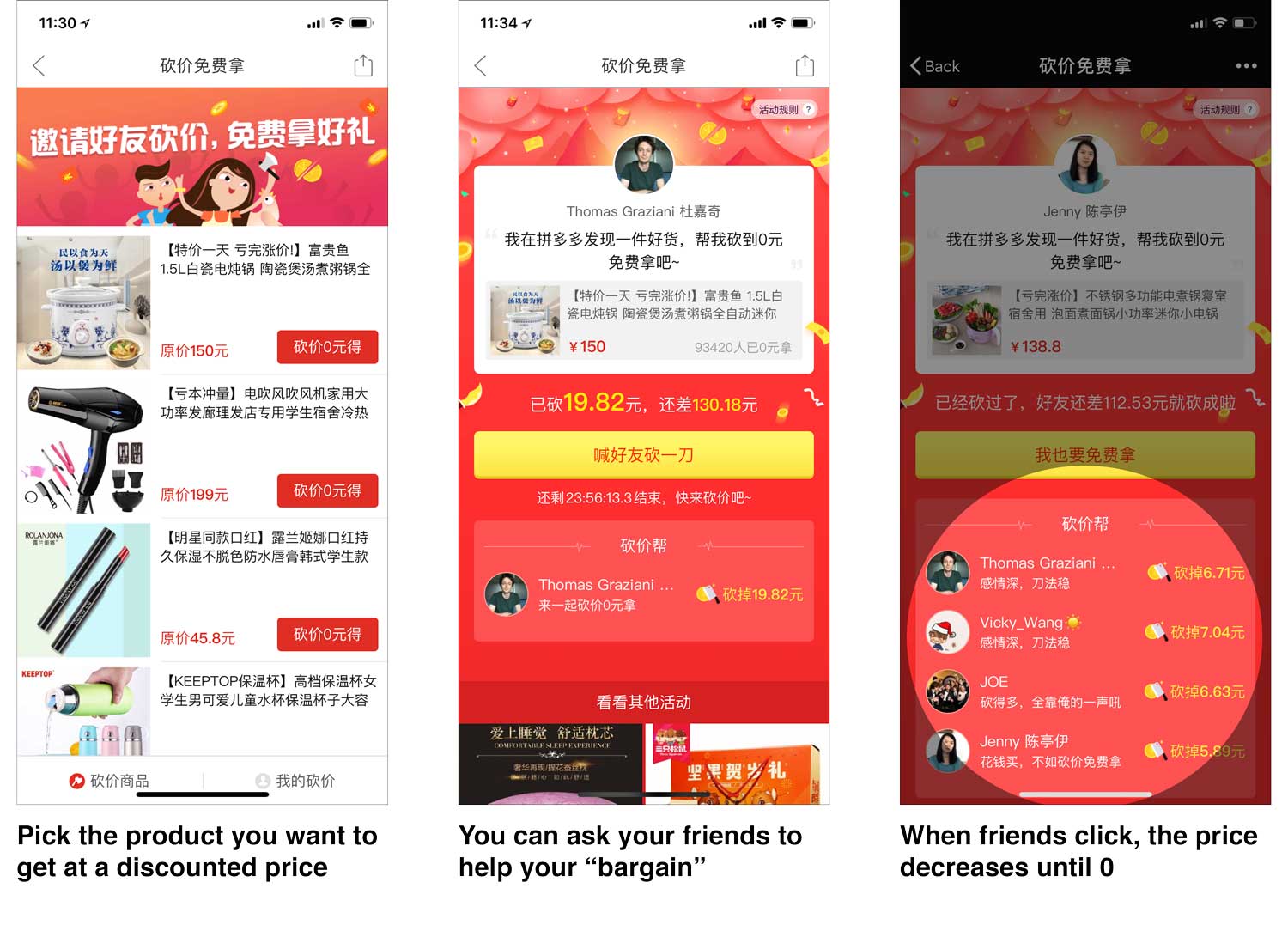

Ask friends to “bargain”

Another way Pinduoduo creates viral incentives is by asking friends to help “bargain” for a cheaper price.

You can share certain products with friends. Each time a friend volunteers to help you “bargain”, the price decreases a bit. Eventually, you can get the product for free.

This trick can also seem costly, but it can be worthwhile for the brand. In order to get a cooking pot worth 150 RMB (which in reality might only be worth 50RMB), you’ll have to have around 25 friends to log in to the WeChat shop.

And in doing so, you gave strong social proof supporting the brand, by letting your friends know you really care about getting this product.

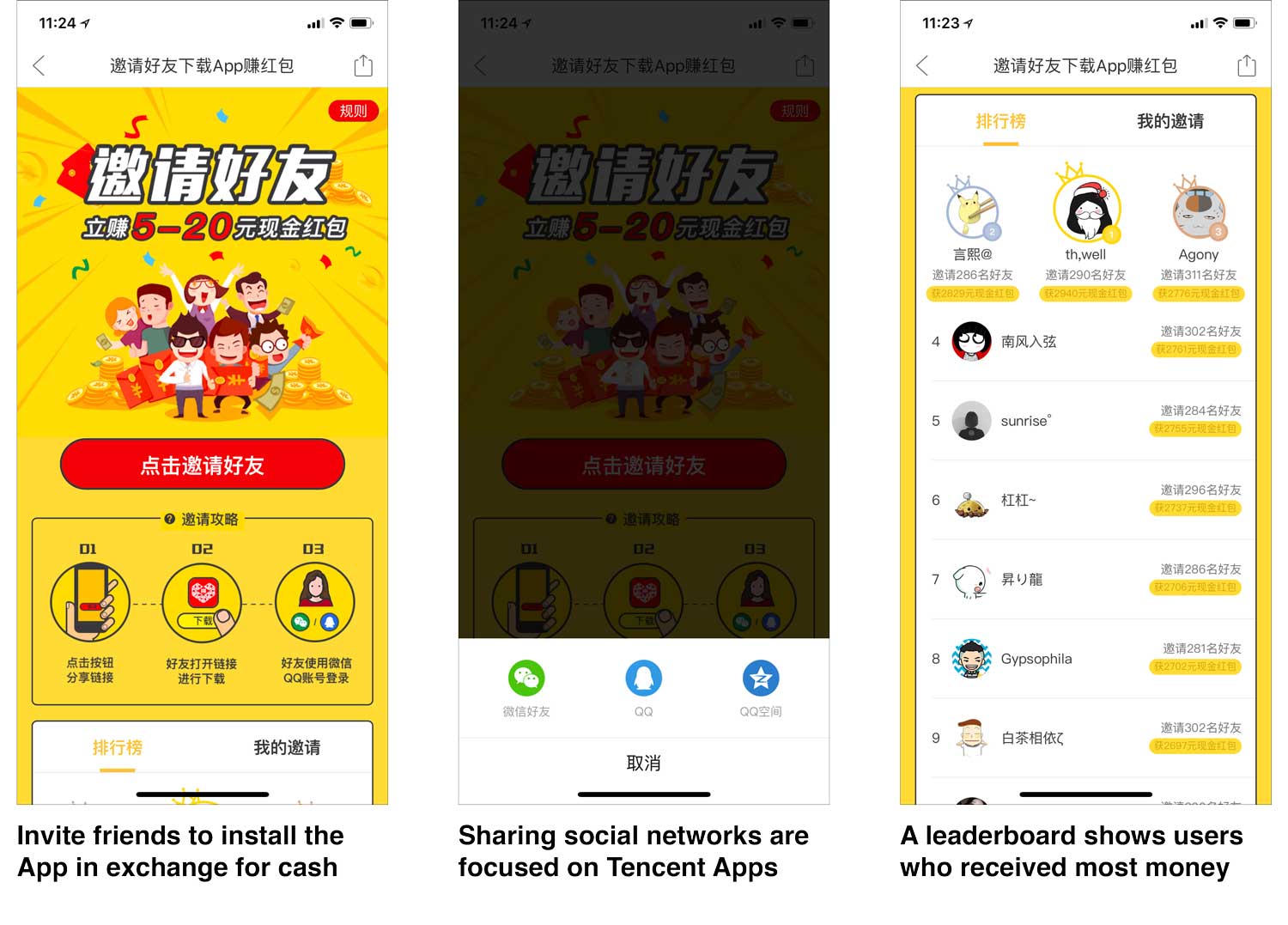

Red envelopes + Leaderboard

Using cash red envelopes to reward users for inviting friends is another old trick of viral marketing. Pinduoduo rewards users a cash red envelope between 5-20 RMB.

Here again, Pinduoduo takes it a step further. Not only do they reward users, but they also display a leaderboard of the users who made the most money out of inviting friends.

The top user made 2,940 RMB from sharing with 290 friends. Many of us have thousands of WeChat friends, and it’s easy to imagine earning similar amounts from sharing on our moments. Suddenly, the incentive that we picture in our mind is not a few RMB, but literally thousands.

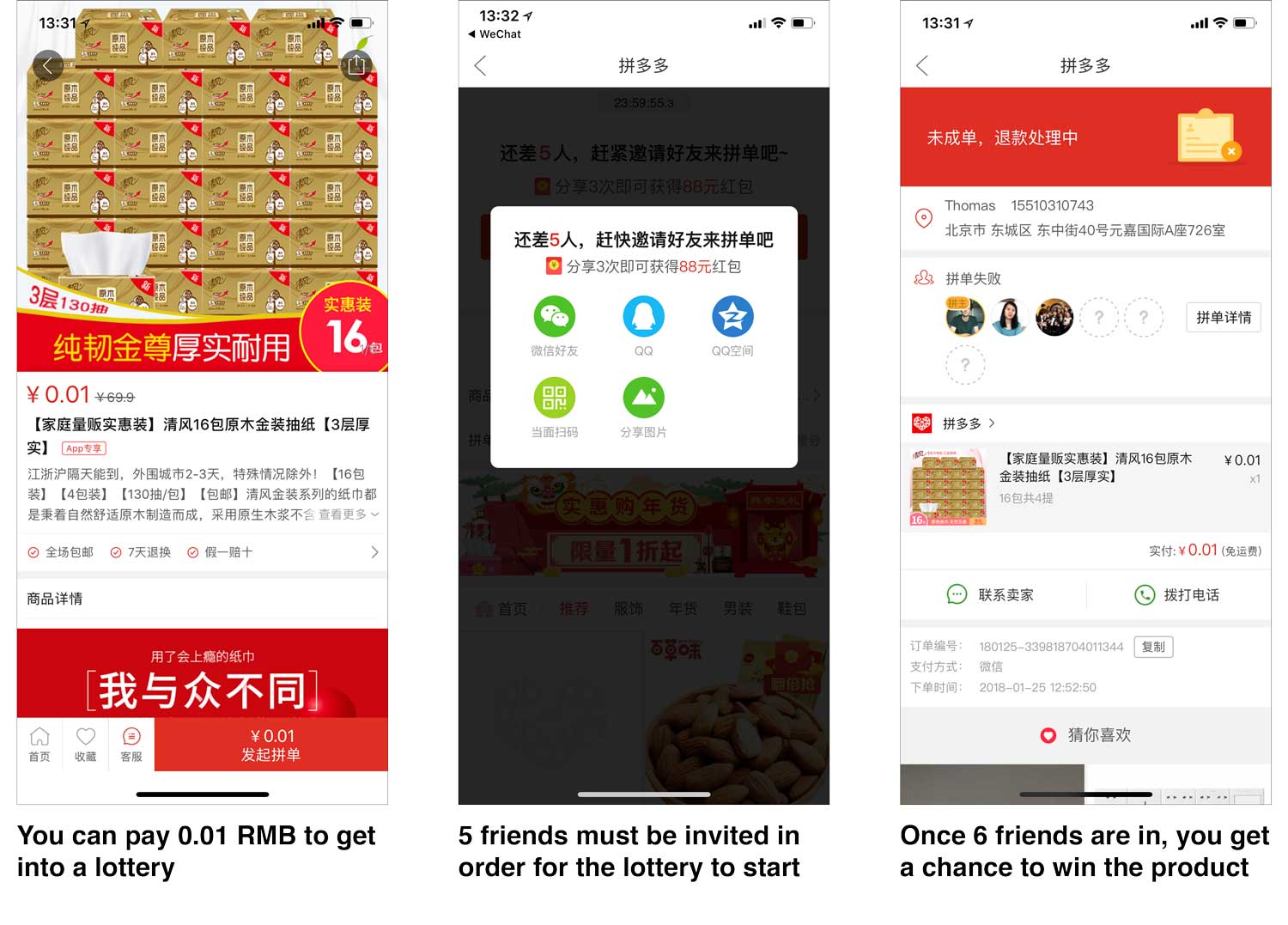

Lotteries

One more viral mechanism from Pinduoduo is the use of lotteries. Typically, users have to pay a small entry fee (0.01 RMB) to get into a lottery. For the lottery to be active, they must also invite enough friends to join it within a specific period of time.

If they get enough friends to join, users can then get a chance to win the product for only 0.01 RMB.

This is another marketing trick:

- It’s not clear how many users in total will join the lottery and what are the chances of winning

- The interface tricks the users into thinking this is just another group buy, so they would share the products with friends to reach the group buy number

- If you don’t win, Pinduoduo will refund the 0.01 RMB along with a coupon to buy more stuff on Pinduoduo

This is a great and cheap way for brands to do marketing without having to invest too much. Although users might only realize it’s a lottery trap after they invited 6 friends to join.

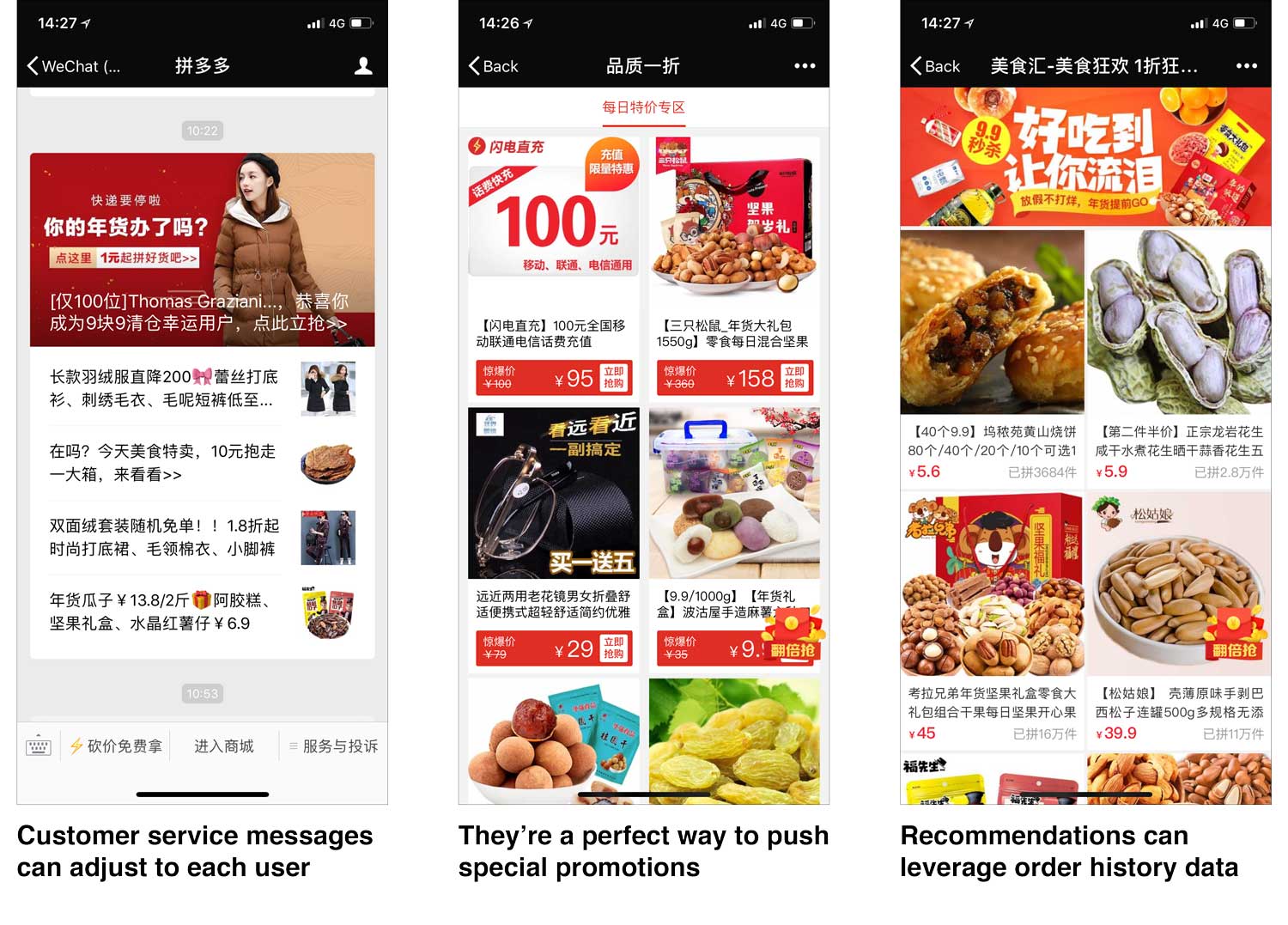

Customer service messages

Pinduoduo also makes great use of Customer Service Messages. These messages are customizable messages that can be sent 48 hours after the user followed the account or interacted with it.

Most of the accounts only use these messages for welcome message or customer service requests. But Pinduoduo does much more: they use these messages to continually recommend new products to the user.

Unlike the “Broadcast” messages that are limited (4 per months for service accounts), these messages are unlimited and can be customized for each user. They’re the perfect way to make recommendations based on order history.

We received on average 5 messages every 24 hours after subscribing – and these are very visible messages sent from a WeChat Service Account! Moreover, if users click a menu item on the WeChat Official Account (for instance to check order status) the 48 hours window is re-opened and Pinduoduo can keep messaging them.

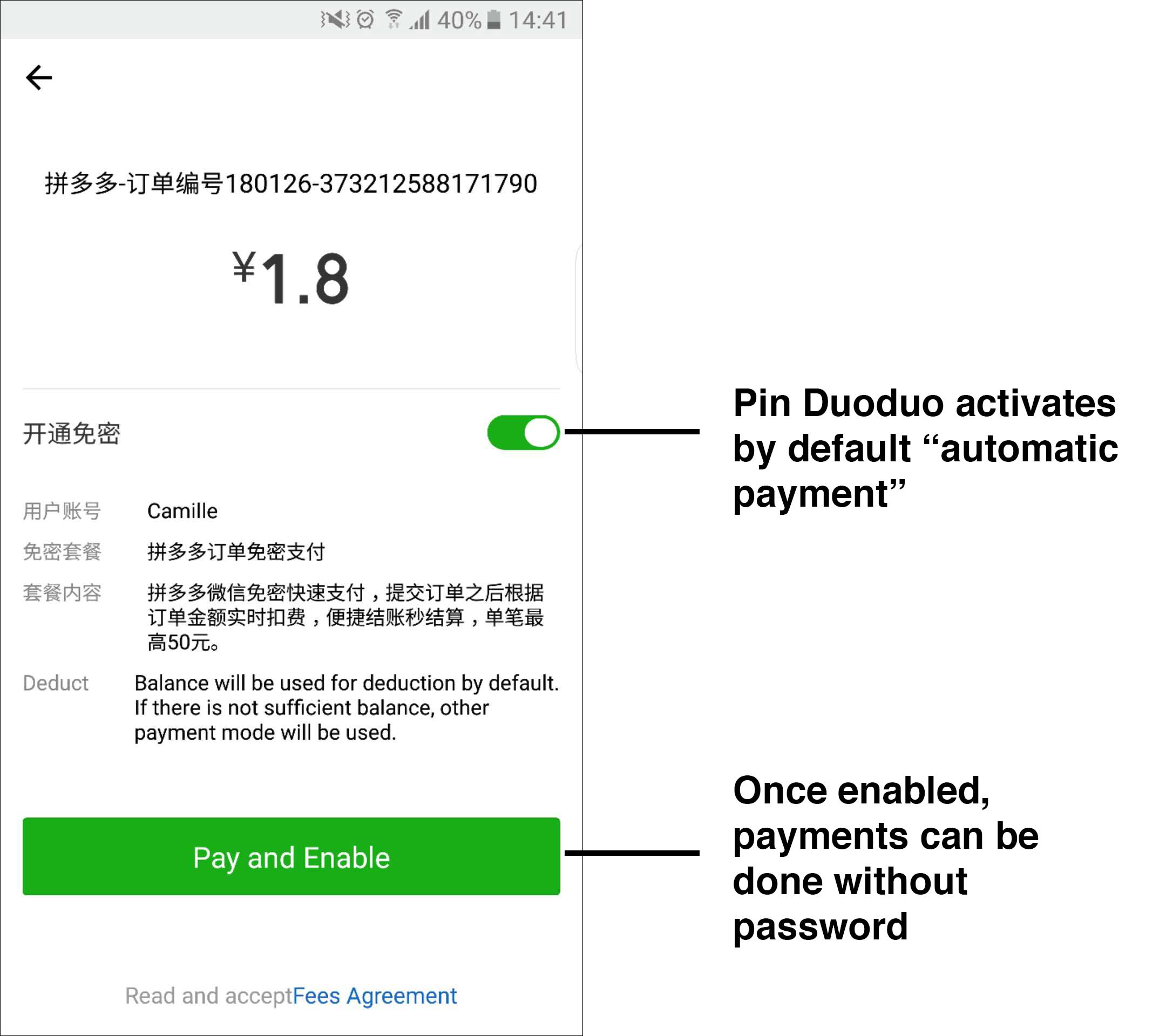

Automatic payment

The last trick we’d like to mention is the “automatic WeChat payments” that Pinduoduo is using. You might already be using this function if you’re using Didi Dache for ride hailing: once you finish a ride, it is automatically billed to your WeChat Payment account without the need for further validation.

That’s exactly what Pinduoduo does: the first time you pay, it enables “password-less payments” by default. After this first purchase, you won’t have to enter your password anymore and will be able to do one-click payments.

This is an amazing way to increase impulse purchases, which are the bread-and-butter of Pinduoduo.

A brief history of Pinduoduo

- January 2014: Pinduoduo was founded by Huang Zheng (黄峥), a former Google employee

- September 2015: Pinduoduo receives A round investment from an impressive list of investors, including the former Taobao CEO Sun Tongyu

- September 2016: B round of funding of 110 million USD, including Tencent and IDG as investors

- December 2017: Cheetah mobile ranks Pinduoduo as #2 e-commerce App

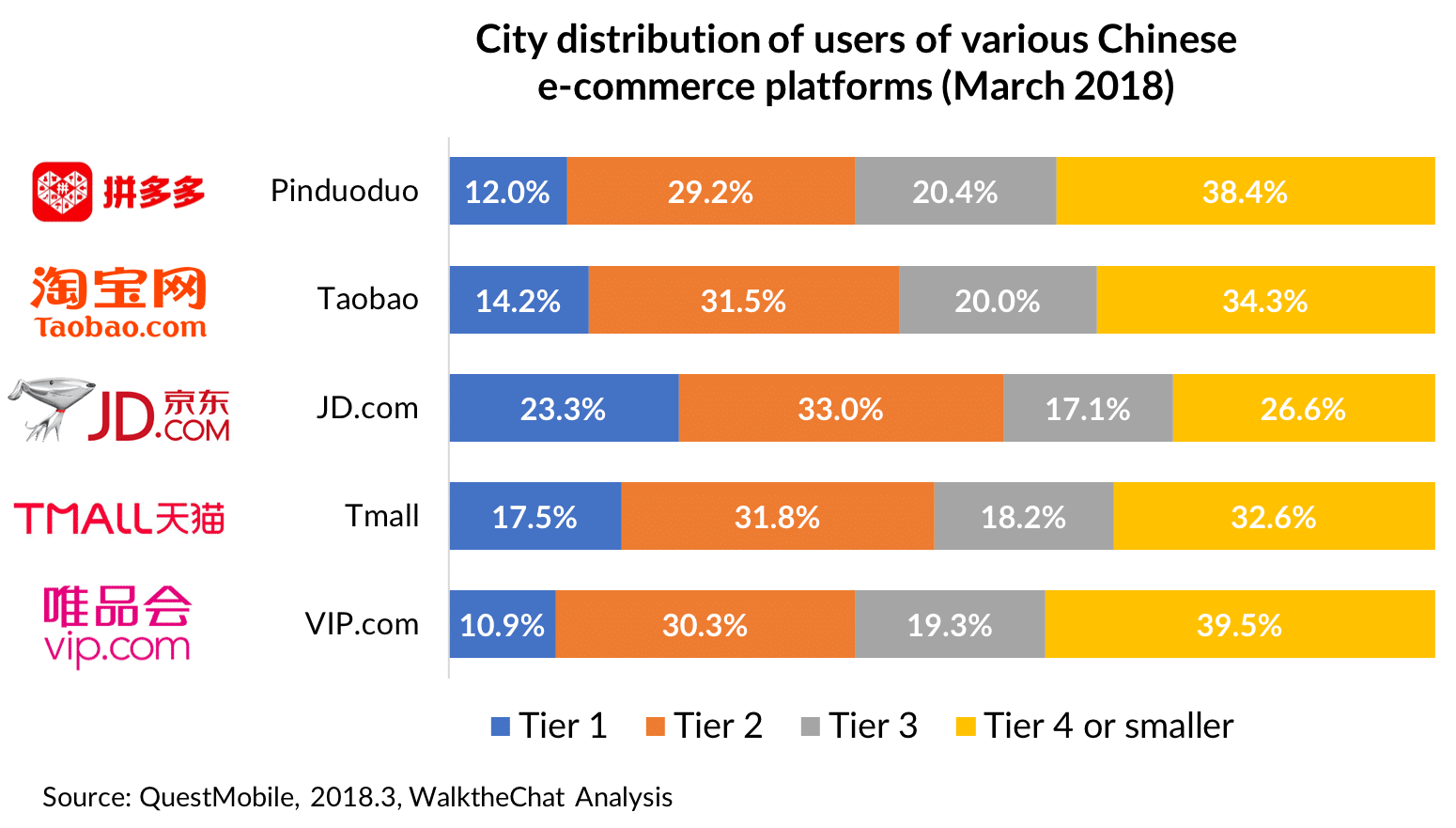

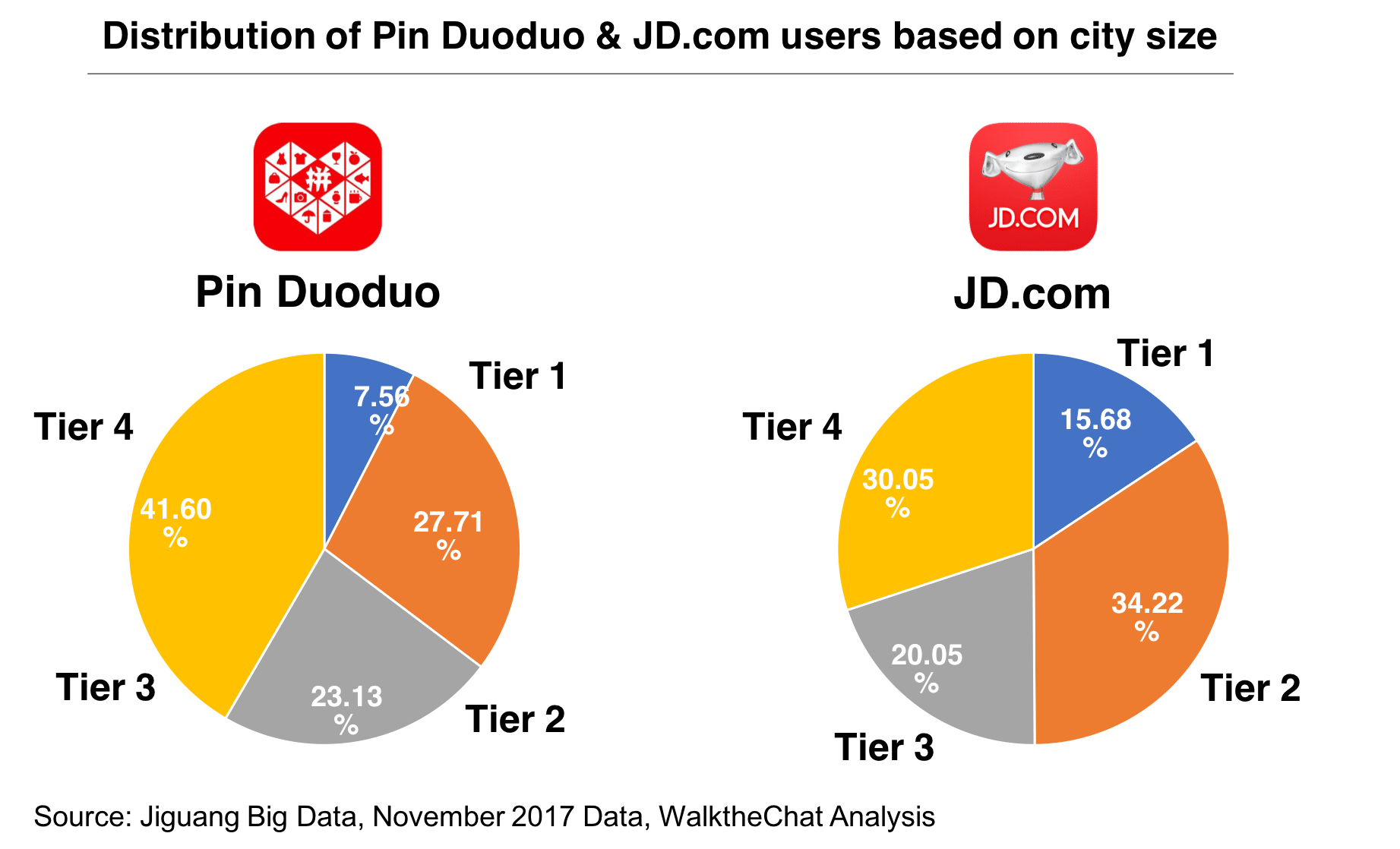

One might wonder what caused such an explosive growth. Besides all of the tricks we mentioned above, Pinduoduo has one specificity: it is doing exceptionally well in smaller cities (Tier 3 and smaller).

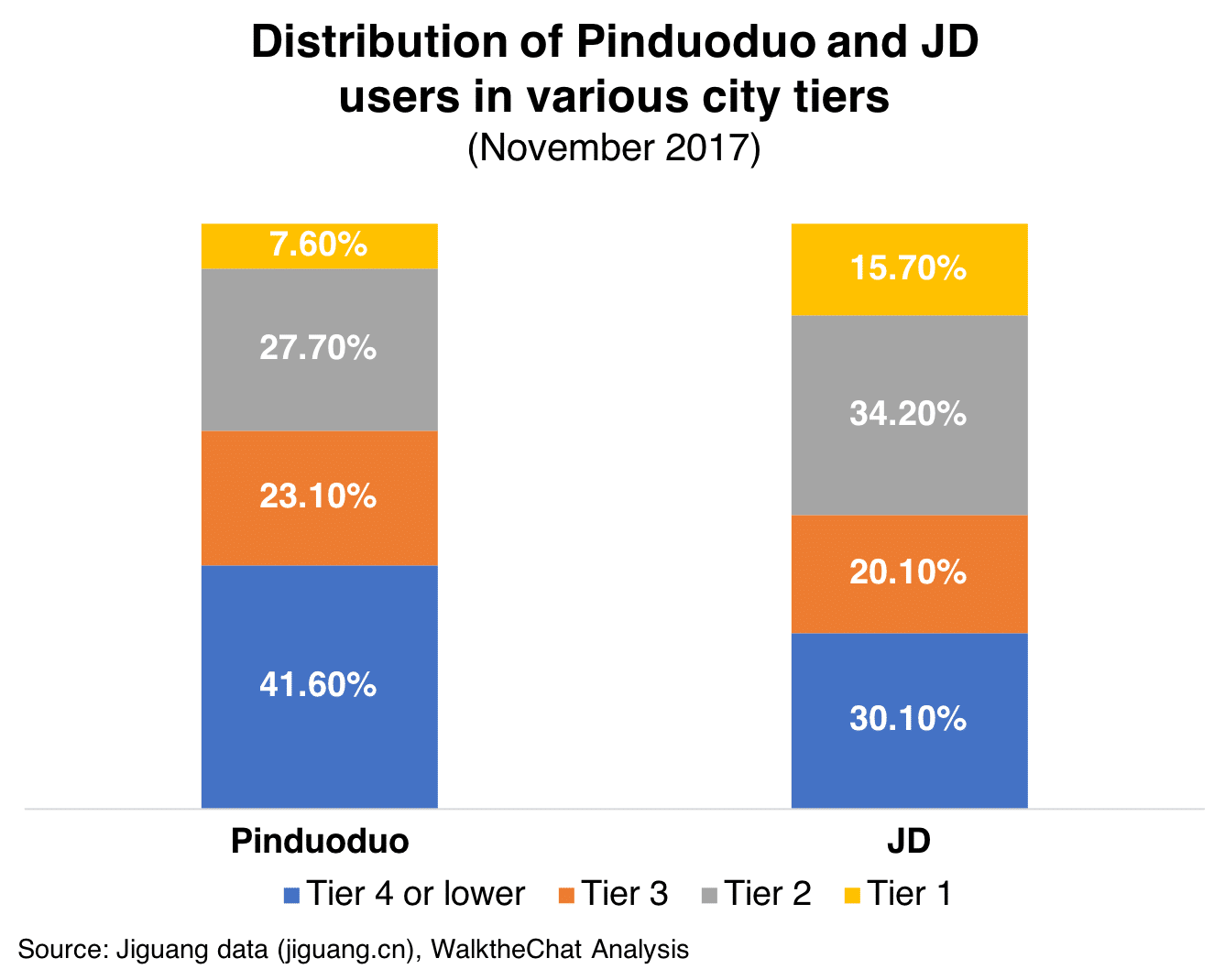

64.7% of Pinduoduo users come from Tier 3 cities or smaller, against only 50.1% of users for JD.com. And only 7.6% of Pinduoduo users come from Tier 1 cities.

Moreover, the majority of the Pinduoduo users are female above 40 years old in smaller Chinese cities. These users are extremely price-sensitive, but they make frequent purchase and they are often in control of purchasing for the whole family. These users might not have much experience with e-commerce purchase, but once they learn how (and bring all their friends into the platform) they can bring long term profits to the Pinduoduo: they have high purchasing power, and are continuously using the App.

Conclusion

E-commerce is hyper-competitive, especially so in China. It is important for new players to stand out with unique offerings that attract customers, and Pinduoduo is one such success case, crafting a convergence between social and commerce that discovers and capitalizes on a new source of users in lower-tiered cities.

As internet access in China’s rural areas continues to improve, it is likely the bargain-hunting app will sustain growth as its services reach remote areas. It is highly visible in a lower-end demographic area, carving out a niche for itself that thrives with a high-volume trade.

Pinduoduo has experienced a meteoric rise to the top of the Chinese e-commerce landscape over the last 2 years. At the core of its success was a strong emphasis on social commerce, viral marketing & retaining users.

Although this trajectory is very unique, a lot of brands and platforms can take cues from Pinduoduo’s success. By applying some of these tactics to your own business, you too can have more users with stronger levels of engagement.