When Pinduoduo went IPO in July 2018, there were concerns about whether the platform could maintain its meteoric growth. One year later, Pinduoduo has shown significant signs of strength and is expanding to new markets.

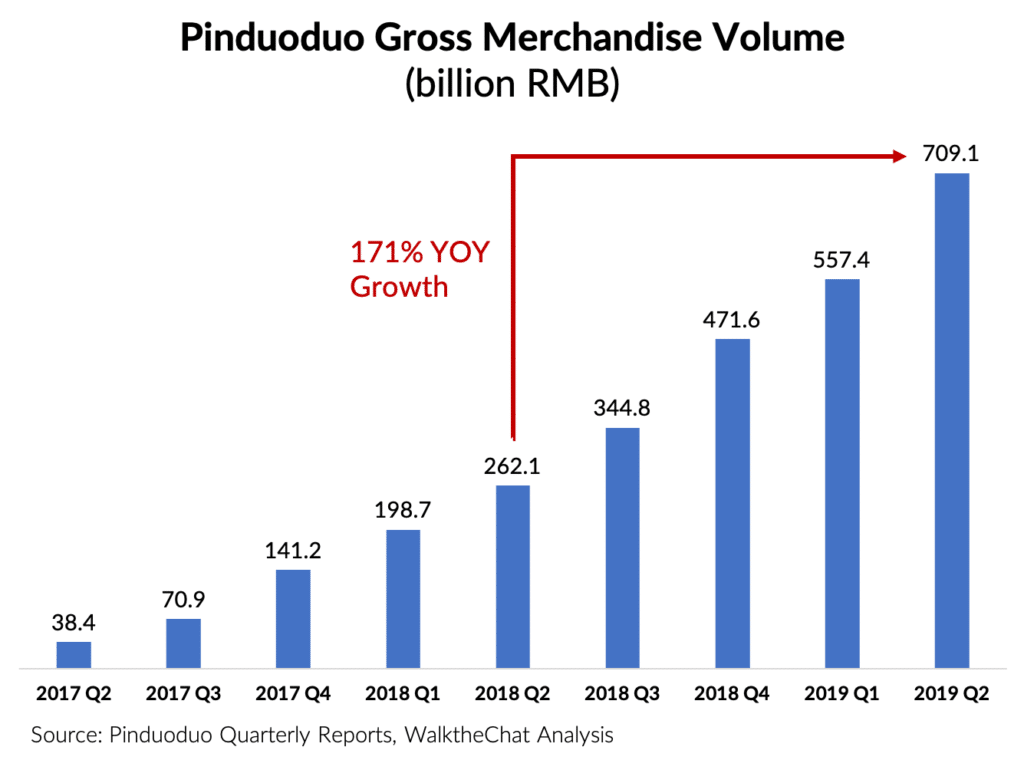

The explosive growth of GMV

The Gross Merchandise Volume (GMV) of Pinduoduo has been growing at an impressive 178% YOY rate.

It is remarkable to notice that Pinduoduo maintained its growth even after 11/11 2018. In fact, GMV grew by 27% between Q1 and Q2 2019, driven by the excellent performance of Pinduoduo during the 6.18 festival.

Huangzhen, Pinduoduo’s CEO, stated Pinduoduo got over 60 million orders per day during the June 18th shopping festival.

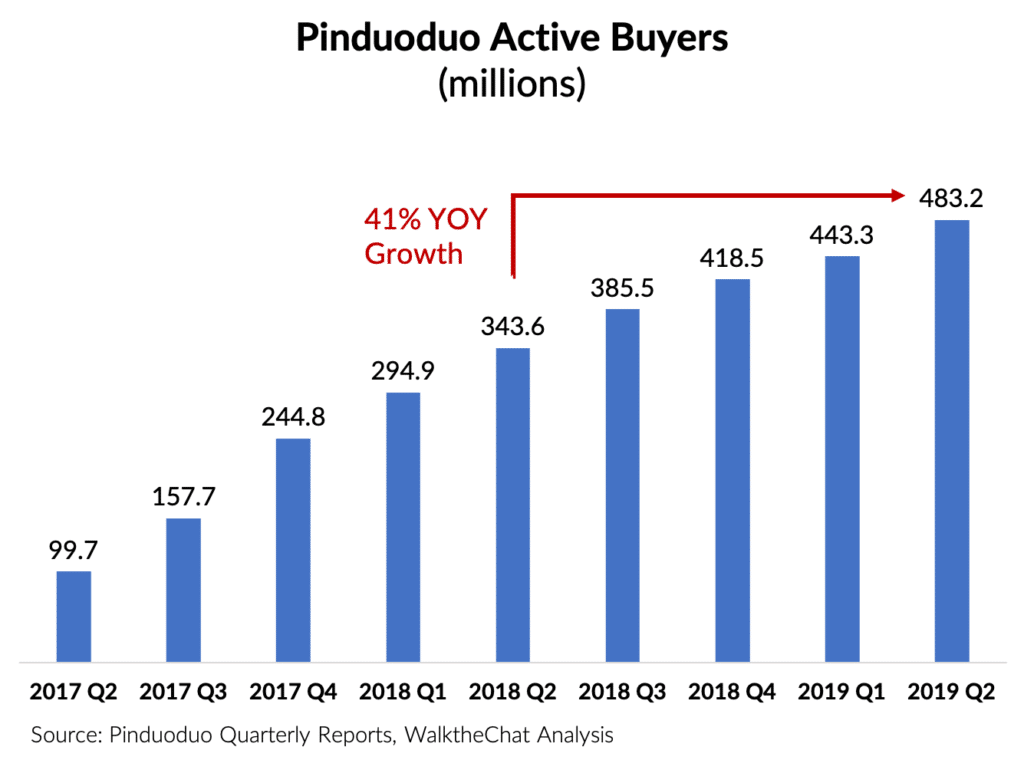

This growth was driven by two main factors. First, the number of active buyers increased by 41% YOY from 344 to 483 million.

As a comparison, JD only experienced a 3% YOY increase in MAU. Alibaba had an impressive 17% YOY annual active user increase, mostly attributed to new users from lower-tier cities. But Pinduoduo clearly stands out with 41% YOY Monthly Active Users growth.

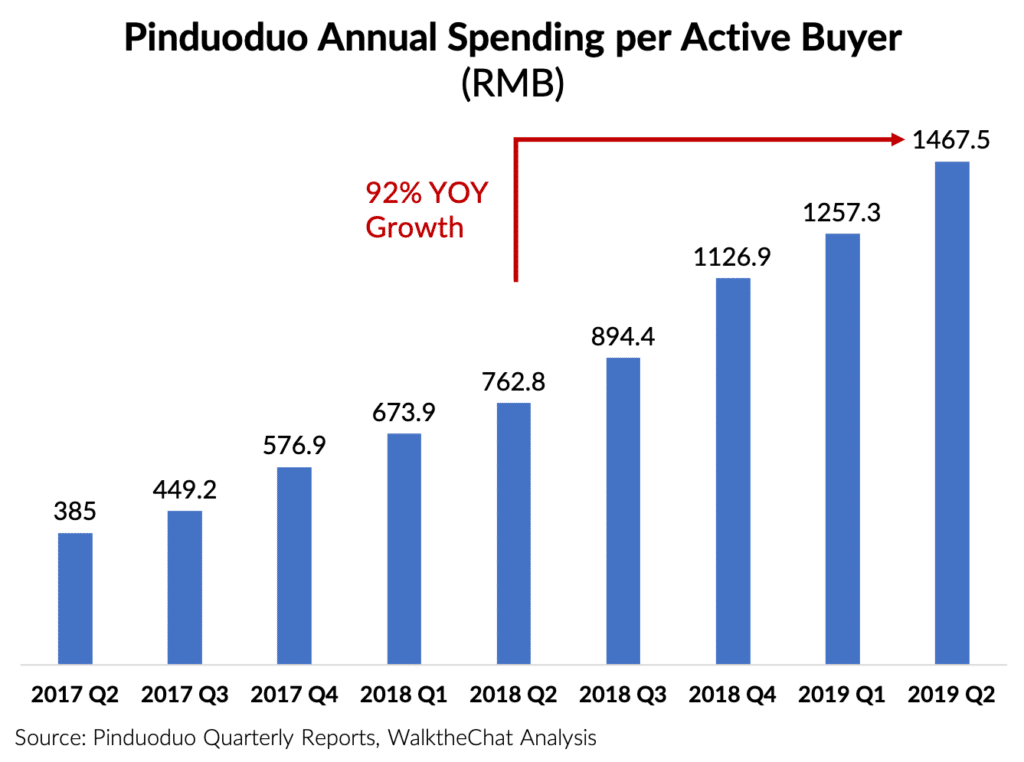

But more importantly, the yearly amount spent per customer on the Pinduoduo platform increased dramatically. It jumped from 763 to 1468 RMB / year, a 92% YOY increase.

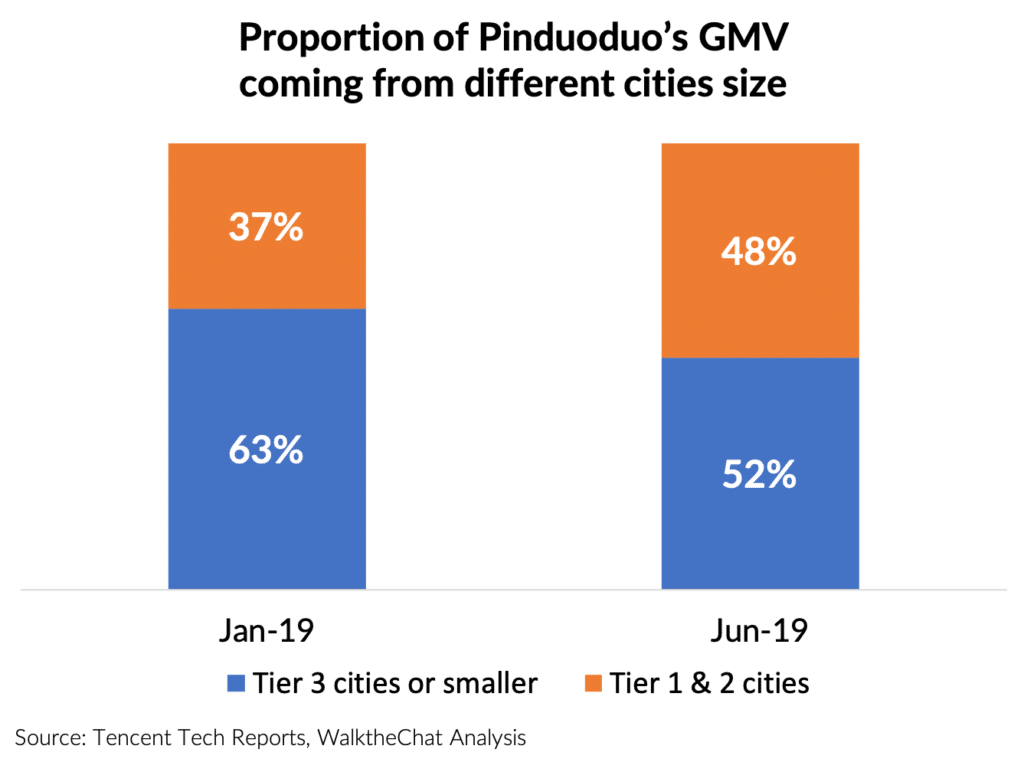

This dramatic shift in spending per customer shows that Pinduoduo’s target customers are changing. Most of the new users that Pinduoduo acquired over last year were located in Tier 1 or Tier 2 cities. These users have more purchasing power, leading to a higher revenue per user.

The GMV of Pinduoduo coming from Tier 1 and Tier 1 cities climbed from 37% to 48% of total GMV in just 6 months, between January to June 2019.

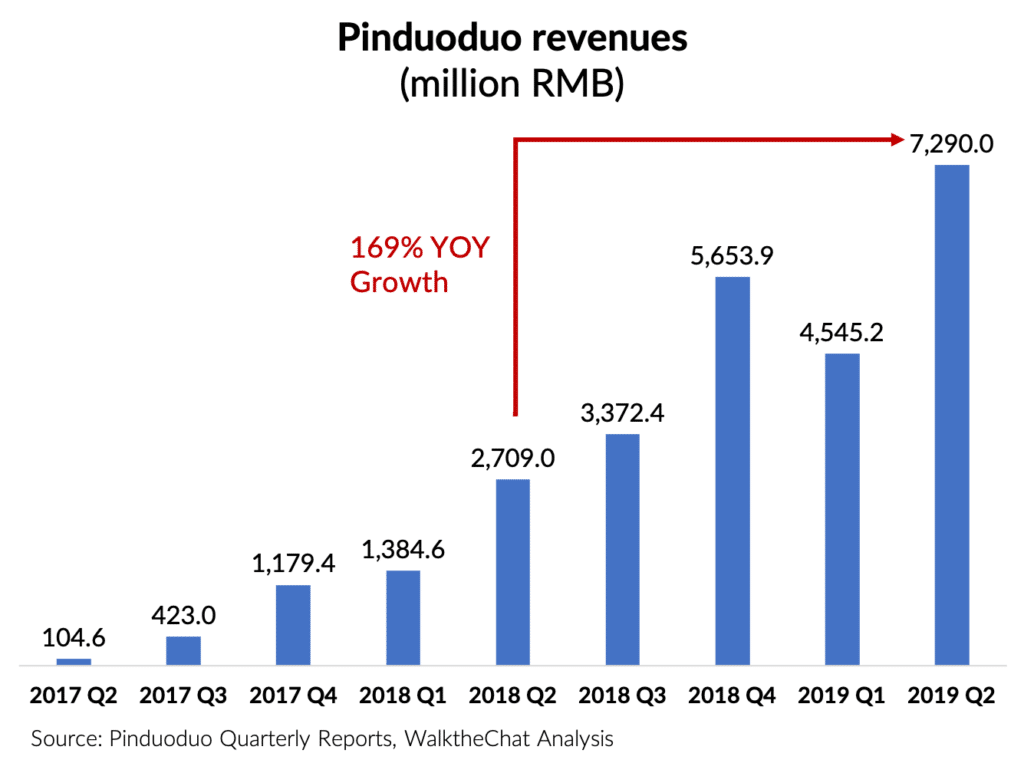

Solid revenues and monetization

On top of increasing its GMV, Pinduoduo also significantly increased its revenue. Pinduoduo mostly generates revenues from advertising, which explains the drop in revenue after 11/11 2018.

Revenues grew 169% YOY, jumping from 2.7 billion RMB to 7.3 billion RMB between Q2 2018 and Q2 2019

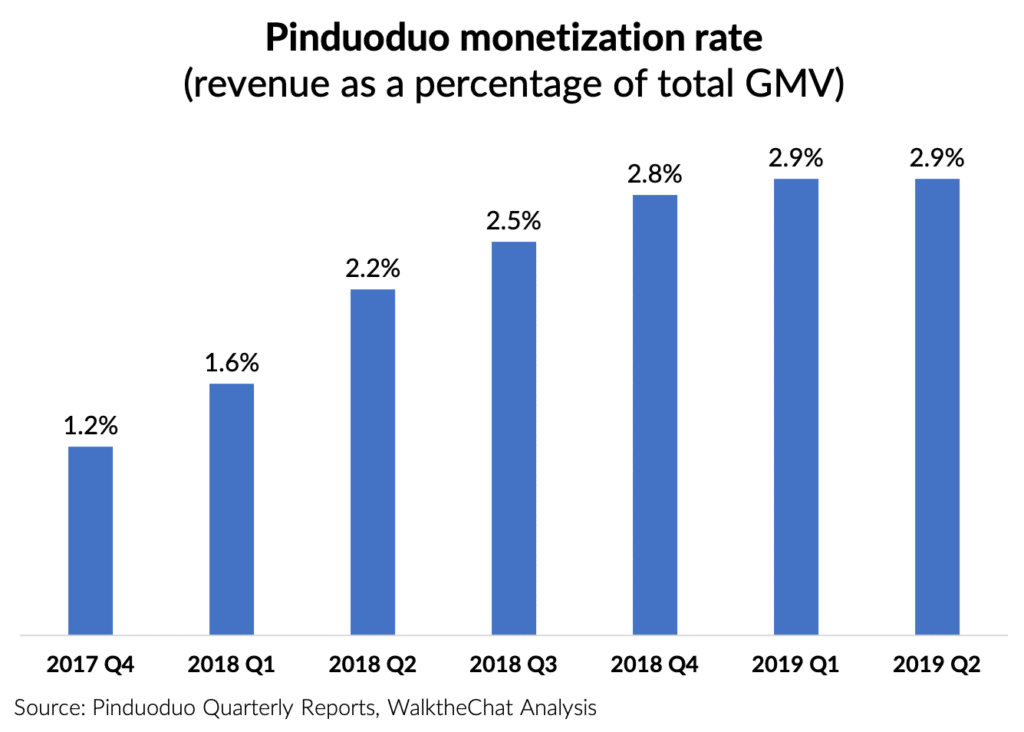

The increase in monetization rate (revenues as a percentage of total GMV) shows that the platform is becoming more and more attractive for advertisers. Brands are increasingly willing to invest in Pinduoduo advertising to get a share of its GMV.

Conclusion

Pinduoduo clearly outgrew its positioning as a platform for seniors looking for bargains in small cities. It is now moving upmarket, threatening to take shares from Taobao and even Tmall and JD.com.

Pinduoduo will, however, need time to catch-up with Alibaba. Pinduoduo’s revenues reached 7 billion RMB last quarter. But this figure is to be compared with nearly 100 billion RMB of revenues generated by Alibaba’s core commerce segment during the same period. And Alibaba is not resting on its laurels: the e-commerce leader’s revenues still grew 44% YOY.

The success of the social-commerce platform remains impressive. It managed to make a name for itself in an ecosystem so competitive that even Amazon recently decided to close shop. This is no small feat.