The second-biggest shopping festival in China, 618 mid-year sales (named after the date June 18th), happened just a couple weeks ago.

Here are 618 sales data from different platforms showing a clear growth trend and some surprising shift of power dynamic within the e-commerce space.

618 data comparison between major e-commerce platforms

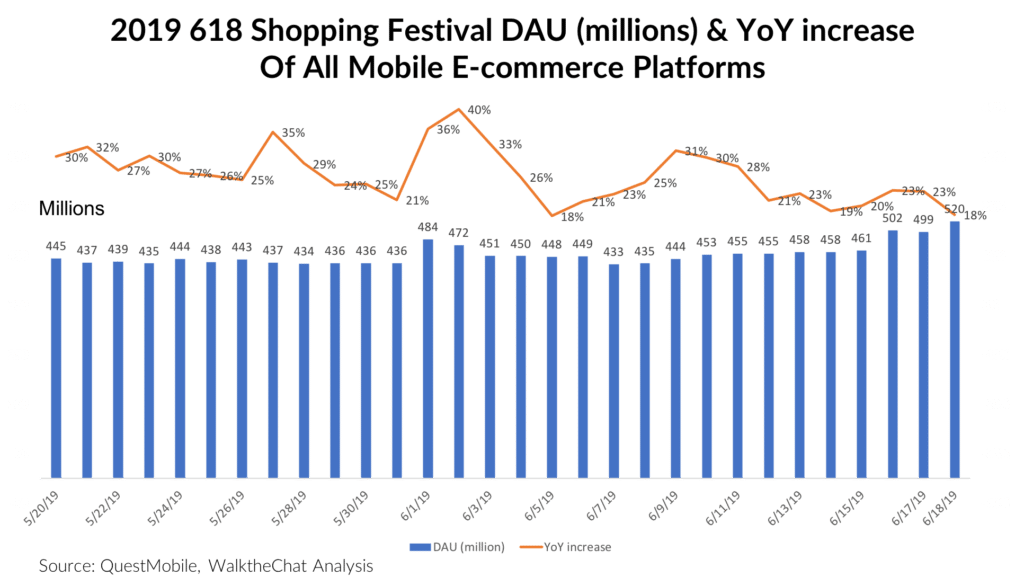

According to QuestMobile, the overall mobile e-commerce traffic during the 618 Shopping Festival increased by 26% on average.

It’s another record breaking 618 with 520 million monthly active users shopping on the day of June 18th. A 75 million YoY increase compared to 2018.

The 618 Sales did not just happen on June 18th. It’s a 18-day shopping holiday with a variety of promotional events. Compared with 2018, a lot of the traffic has shifted towards the beginning of the 18-days period, creating a 36%-40% YoY increase on the first 2 days.

Traffic during the actual July 18th actually only saw a 18% YoY increase.

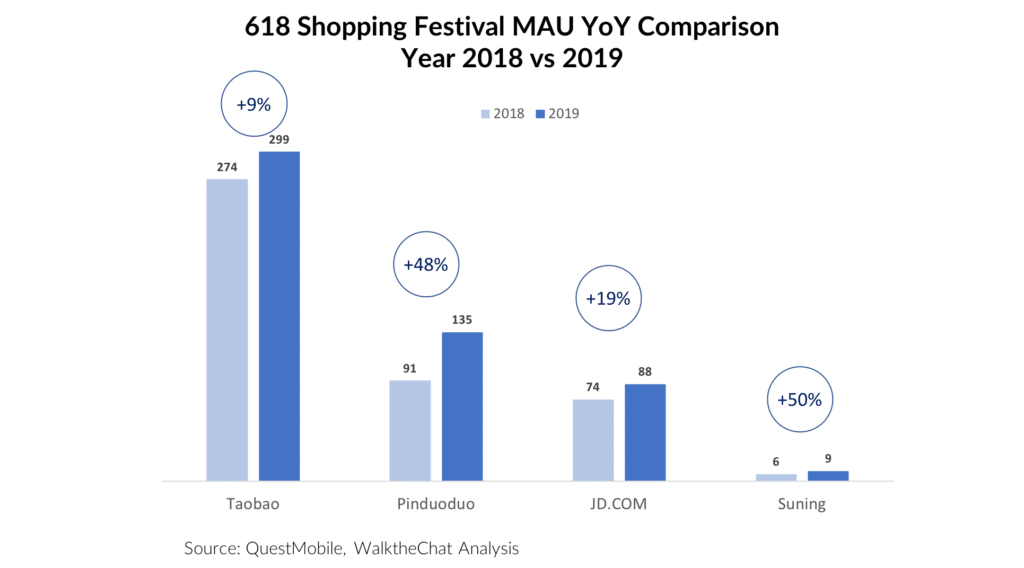

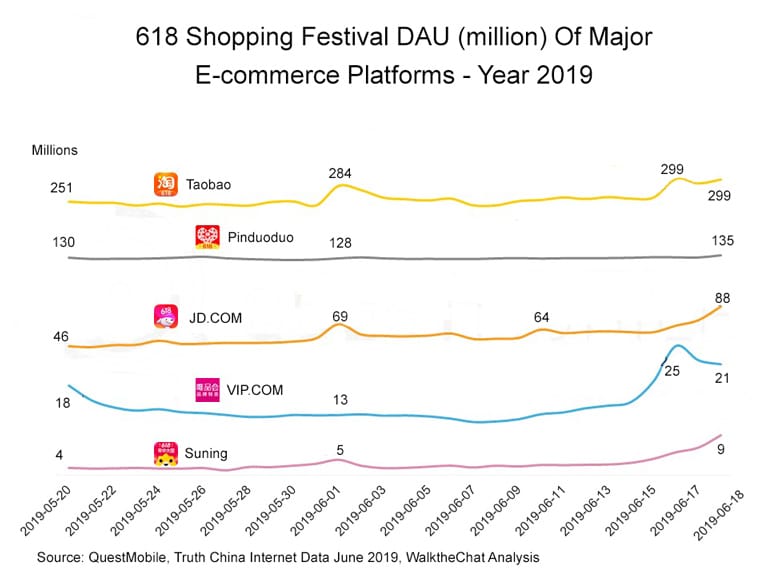

Taobao ranking No. 1 is not surprising. Its DAU on June 18th reached 299 million. But the growth rate clearly slowed down to 9.1% YOY.

This year Taobao chose to not release any overall GMV amount, thus hiding its slowing growth data.

But Pinduoduo completely stole the show by ranking No. 2 above JD.COM with 135 million DAU! It’s also the platform with the fastest growth, a 48% YoY growth.

To be fair, JD.COM also performed reasonably well: it recorded 88 million DAU, a 20% YoY growth.

All other platforms launched time limited campaigns that spiked the website visits during the 618 period. Promotions included flash-sales, social-focused coupons, games, live-streaming and more. Pinduoduo’s campaign lasted longer (from May 23 to June 20th) thus the traffic is relatively stable.

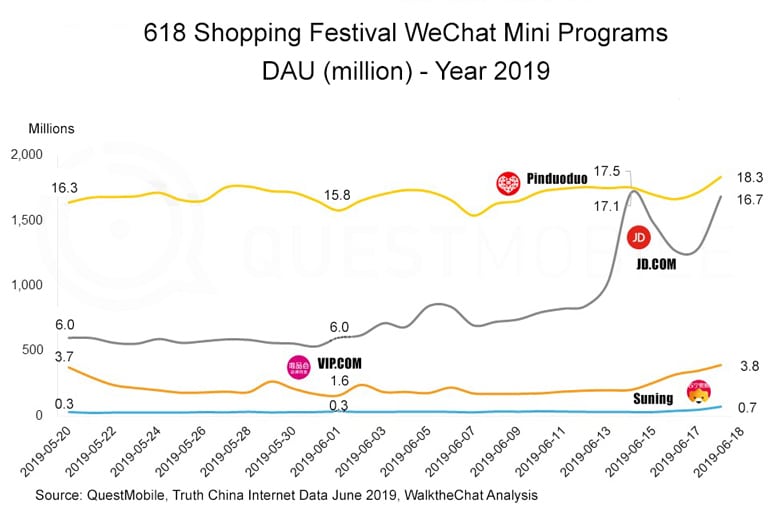

WeChat Mini Program played an important role in driving e-commerce traffic, especially for players in the Tencent ecosystem: Pinduoduo and JD.COM. The WeChat Mini Program traffic accounted for 13.5% of total traffic for Pinduoduo, and 19.0% for JD.com.

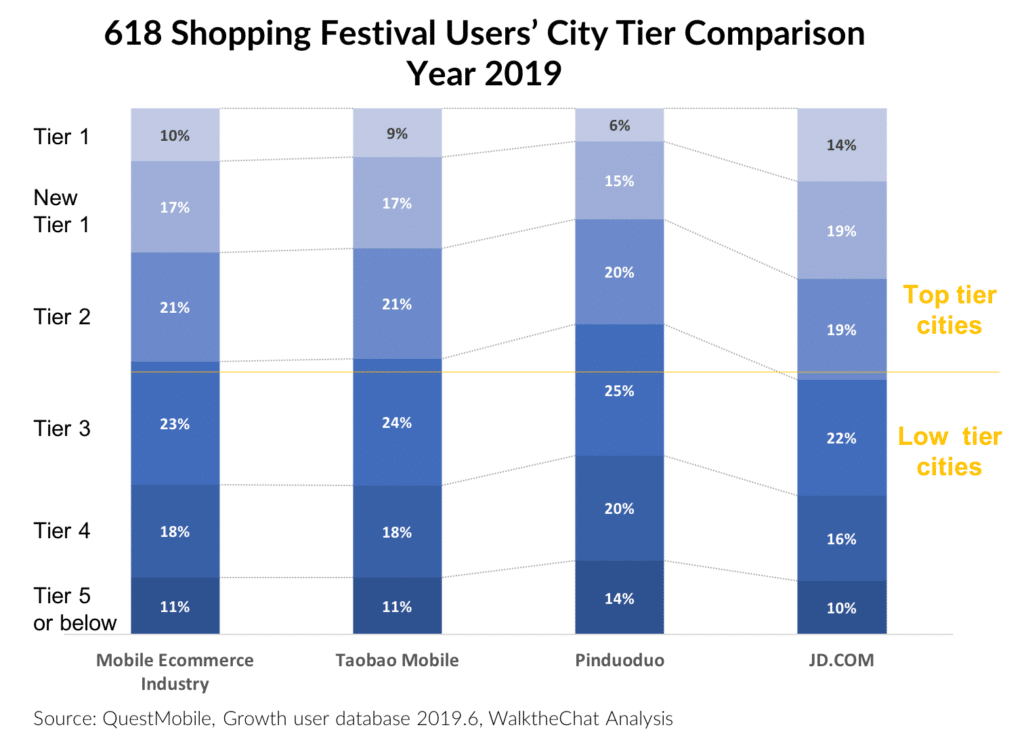

Most e-commerce platforms have a relatively balanced user base between the top 2 tier cities, and the lower tier cities. Pinduoduo is the only one with a strong focus on the low tier cities. Despite JD’s effort to launch a 500 million cash giveaway campaign targeting tier 4 and tier 5 cities, it is still the platform with most traffic from top tier cities.

We can expect outstanding performance from Pinduoduo on Single’s Day this year, since lower tier cities are the ones with the strongest growth potential.

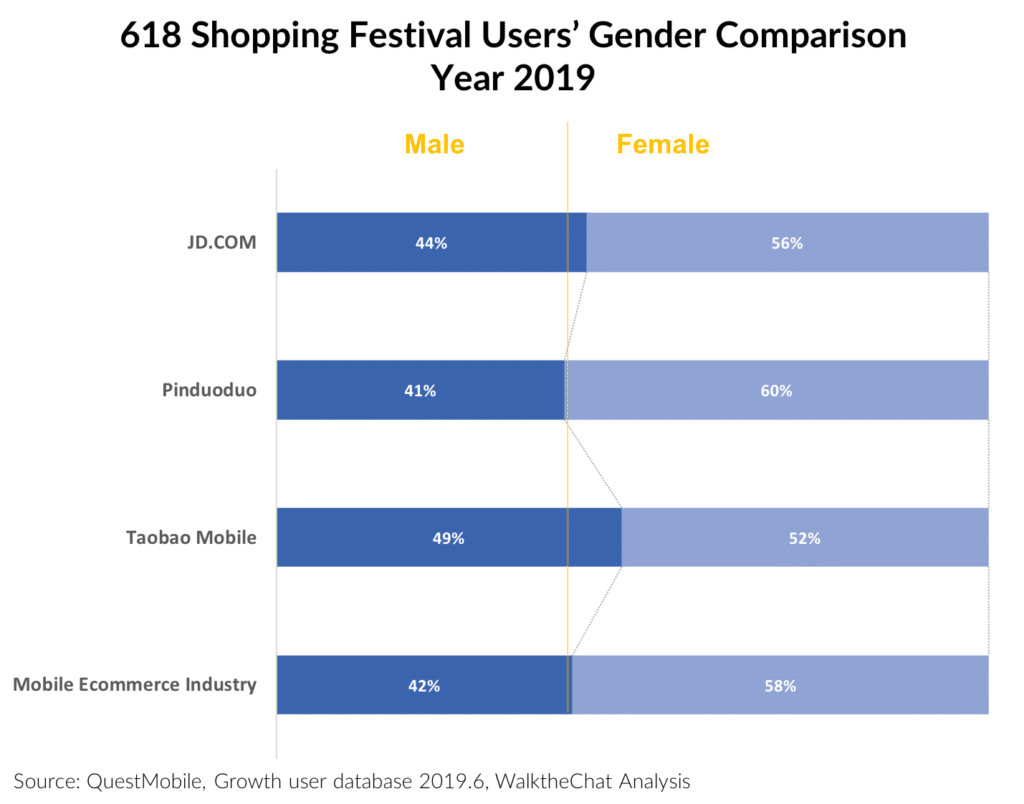

Pinduoduo stands out again in terms of gender demographics, with 60% female users. Taobao has the best balance in gender, 51% female and 49% male population. The main reason for this statistic is that Taobao has the highest penetration among all Apps.

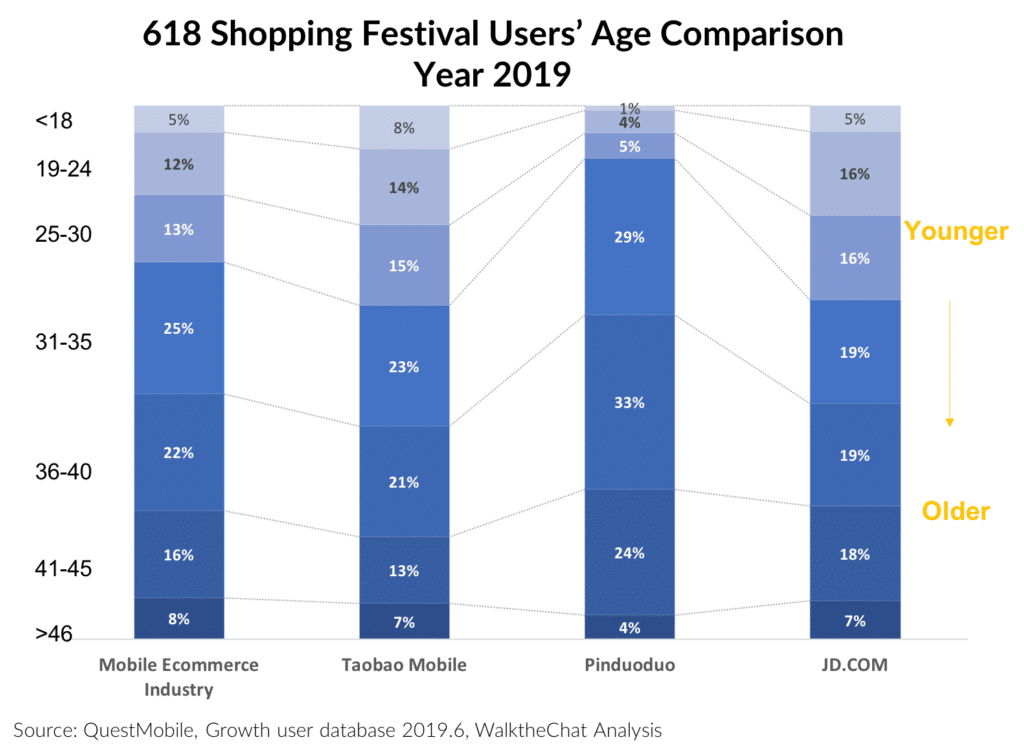

Pinduoduo’s users are exceptionally old compared to other platforms. Only 10% of Pinduoduo’s users are below 24. This matches with Pinduoduo’s overall strategy of targeting the older generations who has a lot more leisure time to participate in its time-consuming social campaigns.

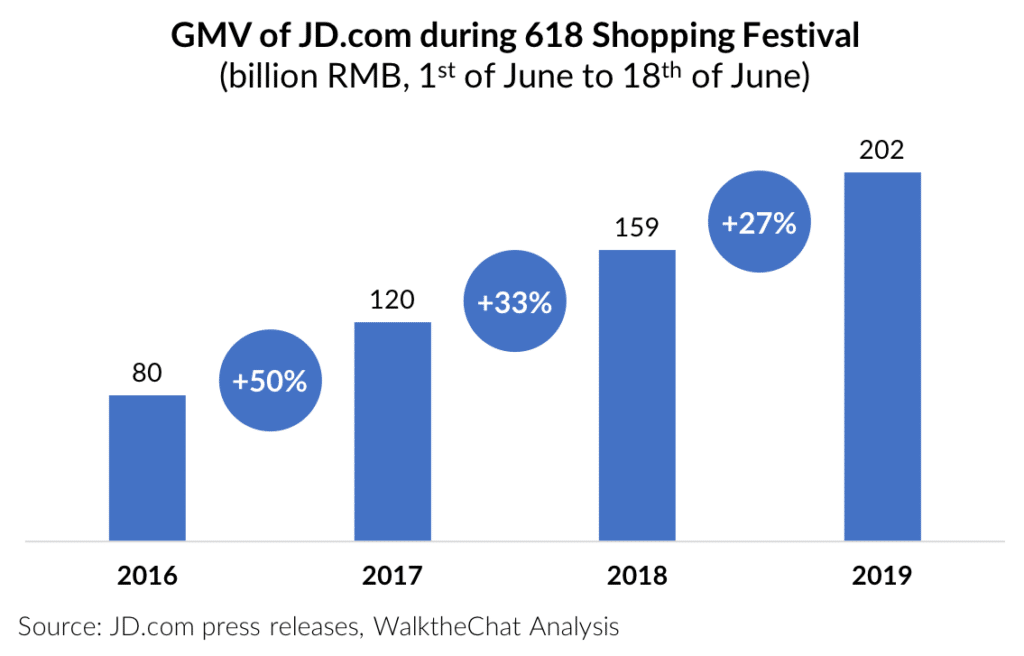

JD.com 618 results

The 618 festival was created by JD.com in an attempt to emulate the success of Tmall’s 11/11 festival. Therefore, JD tends to dominate the 618 festival with a growing GMV YOY.

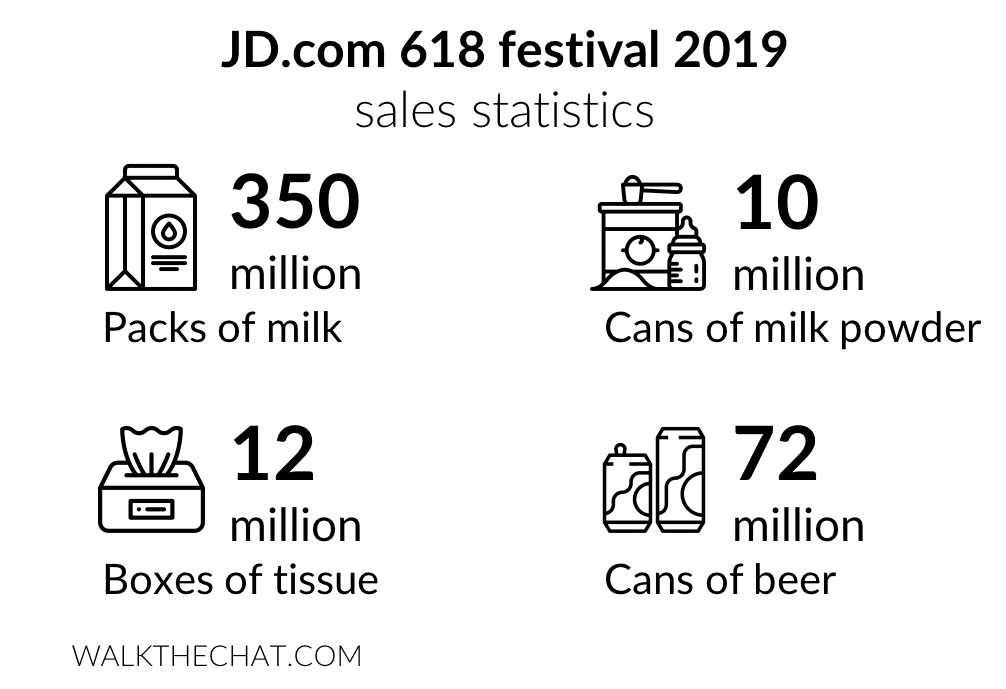

JD.com is boasting impressive results, especially for daily purchases which are most common on JD.com such as milk, milk powder, tissues or beer.

JD.com “Fresh products” platform (京东生鲜) experienced particularly strong growth during the festival, with a 90% YOY growth rate of GMV during the 618 days.

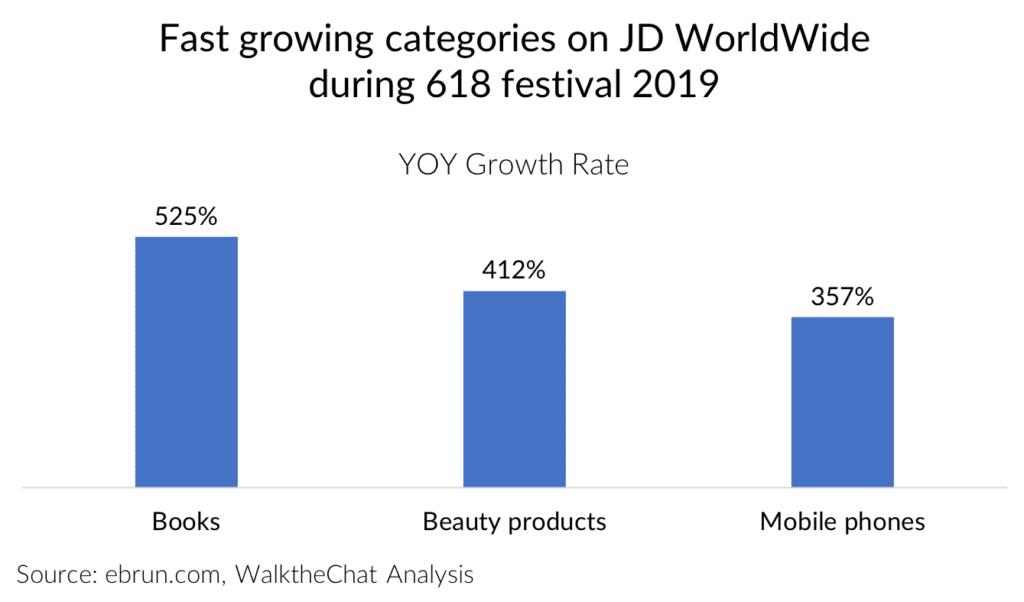

But one of the fastest segments was certainly cross-border, with cross-border sales of books, beauty products, and smartphones all exceeding a 300% YOY growth rate.

In order to achieve this impressive result, JD definitely invested a lot in the promotions. For example, most of the brands participated in a discount campaign of RMB 50 off for every RMB 400 cart amount. For specific categories such as the home & supply, JD even subsidized an additional 300 RMB coupon that can be applied on top of other discounts.

One major shift of JD’s 618 strategies was focusing on 4th and 5th tier cities. This has always been JD’s weakest audience group, and is traditionally the territory of Taobao and Pinduoduo.

This year JD tried to attract more followers by launching an RMB 500 million lucky draw campaign 城城分现金 across 367 cities. Users just needed to invite 5 friends to enter the lucky draw.

JD also continued to push its fashion and cosmetics categories by featuring the popular female celebrity group Rocket Girls 101 on its ads on subways, bus stops, elevators, and social networks.

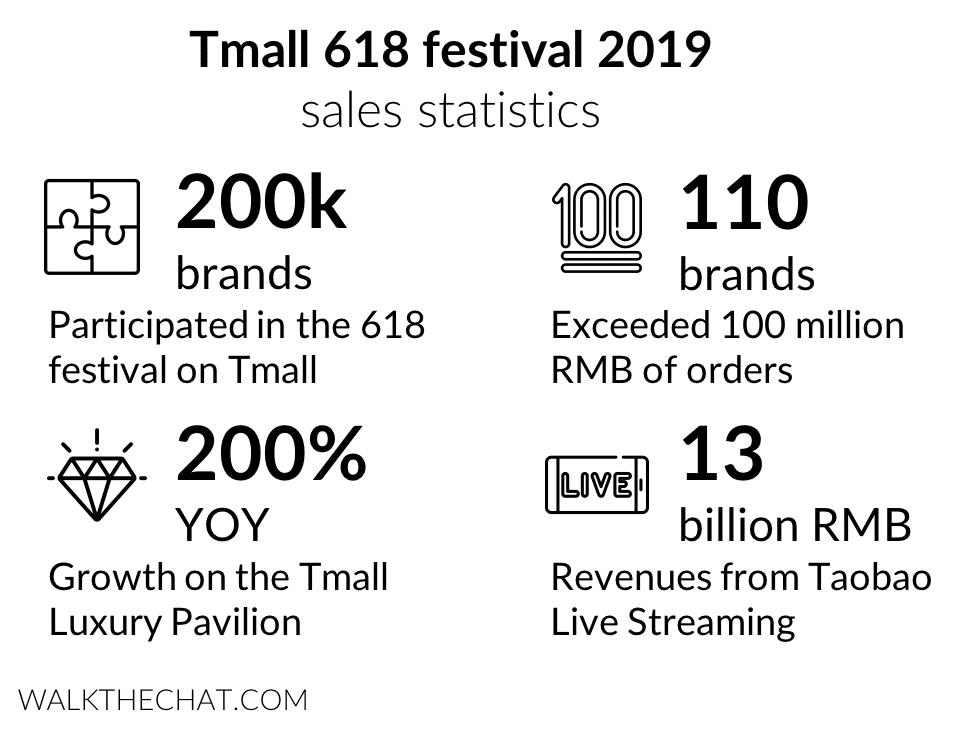

Tmall 618 results

Because JD.com is investing much more than Tmall into 618 promotion, Tmall is also much quieter about the exact GMV it collected during the festival.

Although Tmall discloses GMV of Single’s day in real time, the platform only shared growth rate of the 618 festival performance.

Here are the highlights:

- 200,000 brands took part into the festival

- More than 100 brands beat their last year’s Single’s Day sales volume

- More than 110 brands exceeded 100 million RMB of orders

- 589 beauty brands grew more than 100% YOY, among which 183 of them grew sales more than 1,000%

- GMV on Tmall Luxury Pavillon more than doubled YOY, mostly driven by growth in second and third tier cities (sales of Versace jumped 20 times YOY)

- Sales generated from consumers in third- and fourth-tiers cities on cross-border trade platform Tmall Global increased by 153% from a year before

- 13 billion RMB of GMV were generated via Taobao live-streaming

Pinduoduo 618 results

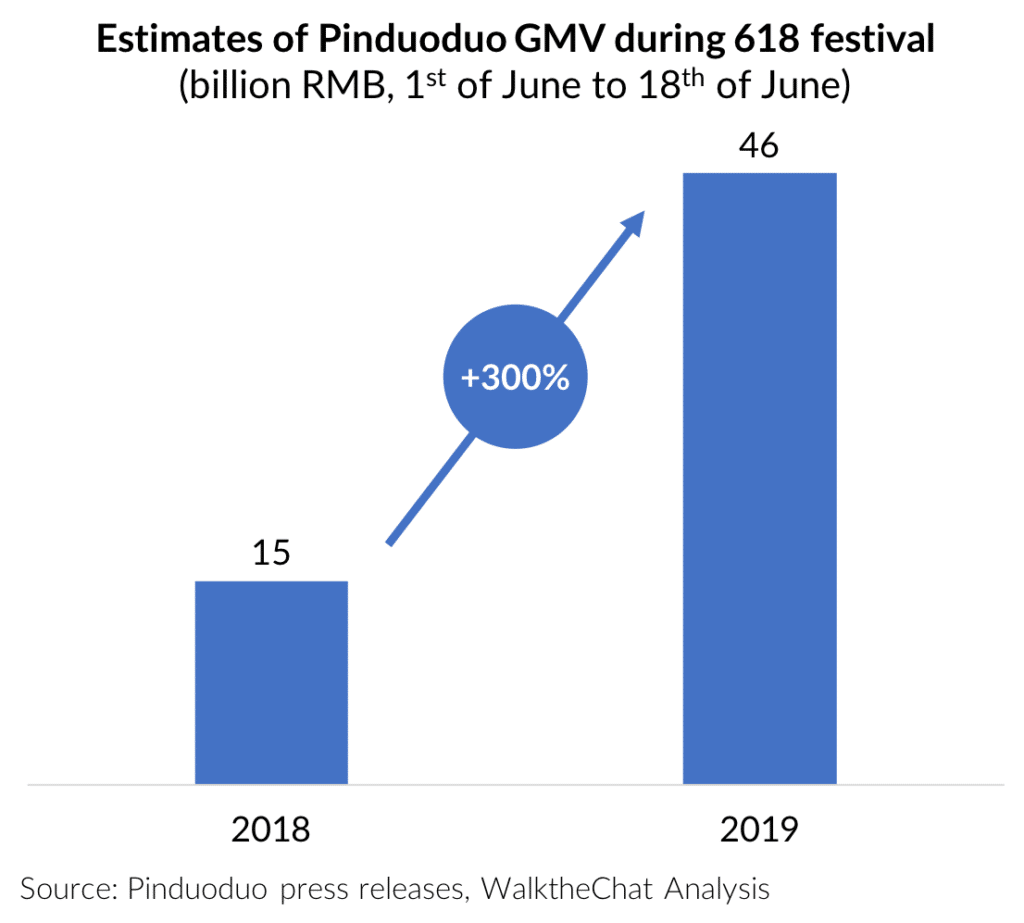

Pinduoduo was one of the newer entrants into 618 shopping festival. It performed remarkably well boasting 1.08 billion orders during the festival period.

Although Pinduoduo didn’t disclose GMV, we know that the average order on Pinduoduo platform was 42 RMB in 2018. This would suggest a total GMV of at least 46 billion RMB during 618 period (this is likely a conservative estimate, as consumers tend to buy in bulk during 618 shopping festival, especially on a platform like Pinduoduo focusing on daily usage products)

The other highlights of Pinduoduo during the 618 festival were the following:

- 70% of orders were coming from Tier 3 cities or smaller cities

- 12 million customers completed more than 5 orders

- After launch on June 1st, sales during the first hour were 10 times higher than during the same period last year

Pinduoduo is also the platform providing the biggest subsidy. Working together with brands, Pinduoduo announced RMB 10 Billion in cash subsidies to lower prices. The subsidy applies to a selected of 10k different products, with a specific focus on clothes, food, mother & baby products, home electronics, and phones. For example, with the subsidy, iPhone XR was discounted from RMB 7,400 to RMB 4399, and AirPod 2 was discounted from RMB 1,499 to RMB 1,059.

Other platforms

Many other platforms took part into the 618 shopping festival:

- Suning reported a 133% year-on-year increase of GMV

- Netease Kaola took only 101 minutes to exceed the sales from last year’s first sales day

- Platform Yangmatou (洋码头) claims 10 million RMB / hour of GMV during the 18th of June

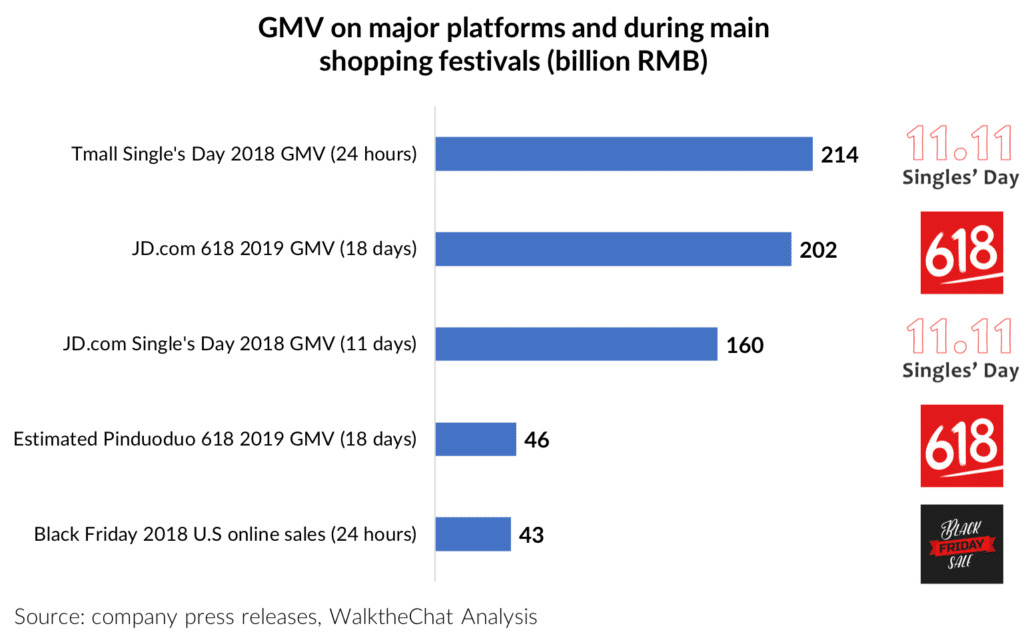

How do these results compare with Single’s Day?

Single’s day remains the benchmark for shopping festivals, both in China and abroad.

618 sales actually exceeded Single’s day sales for JD.com (although 618 promotions ran for 18 days, against only 11 days for Single’s Day)

Overall, sales on the largest Chinese platforms both for Single’s Day and 618 exceeded the total amount of sales in the U.S for Black Friday (6.22 billion USD according to an estimate by Adobe, which amounts to about 43 billion RMB)

“One out of two” scandal

Ever since 2011, when Alibaba registered the trade mark for Double Eleven, it planted the seed for what’s later known as “One out of two” movement. It refers to Tmalls effort to pressure brands to only promote on one platform (Tmall, instead of JD.COM) during shopping holiday Double Eleven.

In 2015, Tmall took it even further. It announced having signed an exclusive deal with the the Decathlon Group, Timberland, Lafuma and 20 other large brands to exclusively sell on Tmall, throughout the year.

JD.com tried to fight back with lawsuits, and news about Tmall pressuring brands to exclusively sell on their platform broke out. Although Tmall is now a lot more discreet about the “one out of two” rule, only carrying it out in a non-written format, the punishment for merchants who breaks the rule has actually becomes more severe.

If merchants choose to run larger promotion on platforms other than Tmall, they might face a variety of punishment including:

- Deletion from major promotion page

- Lowering SEO ranking

- Traffic limitation

- Lower data support

Starting from Jan 2019, the e-commerce law rule 35 states:

E-commerce platform operators shall not use the service agreement, trading rules and technology to unreasonably restrict, or unreasonably charge or impose unreasonable requests on the transactions and pricing strategy within or outside of the platform.

But the law clearly didn’t stops Tmall from enforcing its own rules. Galanz, one of the largest electronic brand, issued 7 official claims against Tmall for manipulating the search traffic during 618. Galanz has started close collaboration with Pinduoduo in May, and since been experiencing issues with their Tmall traffic.

Conclusion

Growth wise, Pinduoduo (48%) clearly stood out during the 618 promotion campaign, followed by JD (19%). JD’s heavy reliance on WeChat to bring traffic could snowball into a bigger risk, especially with a rapid changing social media space.

Tmall, however, could be facing the biggest challenger yet, Pinduoduo. Tmall’s slowing growth is alarming and Alibaba is doing everything it can to secure another impressive Double Eleven. For example, canceling the invitation-only rule for Tmall Global.

The days of Tmall domination are far behind. And given the impressive growth of Pinduoduo in 3rd tier and smaller cities, we would not be surprised to see the social commerce platform stand out even further during the upcoming Single’s Day.