June 20th marked the official conclusion of China’s 618 Mid-Year Sale in 2022. How was the result? According to Syntun 星图数据, during this year’s 618, the total online revenue reached 695.9 billion CNY (~103.9 billion USD), a 20.3% increase from last year.

The traditional eCommerce channel is slowing down, while the growth of live streaming eCommerce has exceeded expectations:

- Traditional eCommerce revenue grew around 1% and reached 582.6 billion CNY (~87 billion USD), including Tmall (Top 1), JD (Top 2), and Pinduoduo (Top 3).

- Livestreaming eCommerce revenue grew 124% and reached 114.5 billion CNY (~17 billion USD). The ranking is Douyin (Top 1), Kuaishou (Top 2), and Diantao (from Taobao, Top 3).

Due to continuous covid cases and regional lockdown in Q2, online and offline merchants have suffered from consumer shopping desire. However, we can observe new trends and opportunities hidden behind the changes.

In this article, we will summarize:

- JD.com 618 Mid-Year Sale result: transaction volume, growth rate, and uprising categories.

- Douyin 618 Mid-Year Sale result: highlights in sales-driven short videos and live streaming, consumer trends, and TOP 5 best-performing brands.

- Taobao/Tmall 618 Mid-Year Sale result: result, uprising categories, and consumer trends.

JD.com 618 Mid-Year Sale Result

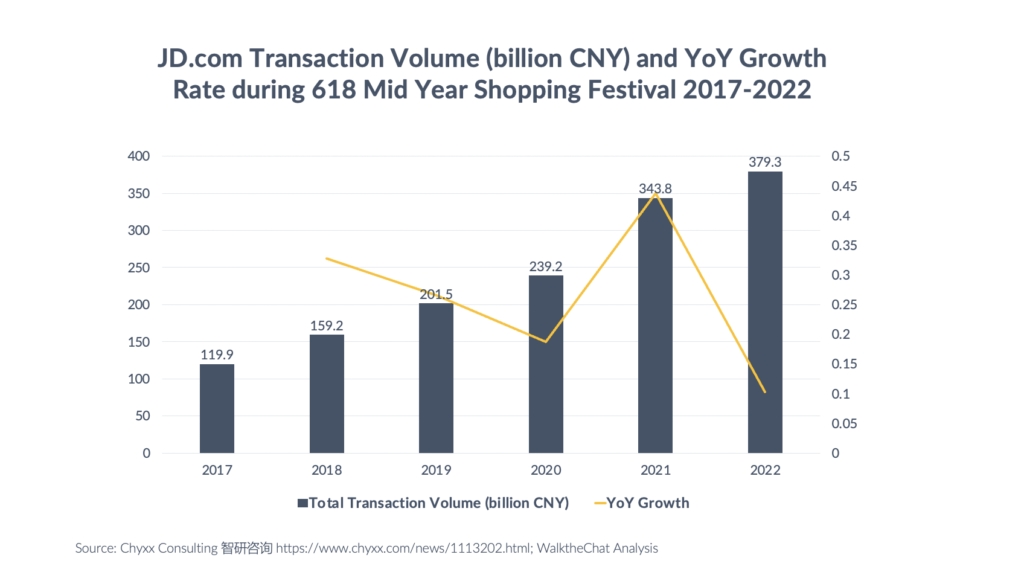

- As of 23:59 on June 18th, Beijing time, JD.com reported a total transaction volume of 379.3 billion CNY (~56.68 USD) for the 2022 JD618 Grand Promotion, which exceeds last year’s 343.8 billion CNY (~51.38 USD). (source: JD official website)

- Although JD.com achieved an increase of 10.32% in total transaction volume, the growth rate is lower than that of the same period last year (43.72%). (source: chyxx)

- Regarding category, home-workout equipment, smart home appliances, and quality household category have experienced positive YoY growth, with an increase of 232%, 123%, and 108% respectively. (source: CBNData)

- In 2021, JD.com experienced a revenge consumption trend that contributed to a YoY growth rate of 43.72. Unfortunately, this trend didn’t appear in 2022. Because of the sporadic covid situation, Chinese consumers tend to be more cautious and rational in their purchasing decision. (source: chyxx)

- During the Double 11 Single’s Day Shopping Festival 2021, JD.com reached a total transaction volume of 341.9 billion CNY. (source: Sohu) So JD.com’s performance was still more robust during the 618 Mid-Year Shopping Festival, which was initially JD’s Anniversary Festival.

We’ve prepared this chart showing JD’s evolvement in total transaction volume during the 618 Mid-Year Shopping Festival from 2017-2022:

Douyin eCommerce 618 Mid-Year Sale Result

Douyin eCommerce has been attracting merchants to open Douyin stores and pushing for in-app conversion. One of the main characteristics of Douyin eCommerce is to leverage Douyin KOL and Douyin Livestreaming.

- During the 618 Mid-Year Shopping Festival in 2022, brands and KOLs held 40.45 million hours of live streaming on Douyin. This is a 58.88% increase compared to Double 11 Single’s Day 2021 (25.46 million hours). (source: Douyin eCommerce official & iiMedia)

- More merchants and brands participated in 618 this year, with a 159% increase compared to last year. (source: Douyin eCommerce official)

- During 618, short videos with shopping carts (directly driving traffic to stores) have been viewed 115 billion times. Douyin has around 650 million monthly active users, so this means Douyin users have watched over 176 sales-driven short videos during this year’s 618 Shopping Festival.

- In terms of geographic location, consumers in Shanghai showed strong purchasing power, ranking them No.1 in total purchasing volume, followed by Beijing, Chongqing, Chengdu, and Guangzhou. (source: Douyin eCommerce official)

Shanghai went through a regional lockdown when online shopping and delivery were interrupted. So, consumers leveraged 618 to vent out the “delayed” shopping desire and store some daily necessities for the future.

- Regarding the buyer persona, Gen-Z has contributed the most to the growth of transactions on Douyin. Gen-Z buyers have spent 164% more compared to the same period last year. Millennials also purchased 117% more in order volume. (source: CBNData)

The TOP 5 best-performing brands in GMV (Gross Merchandising Volume) during Douyin 618 are:

- Xiaomi (consumer electronics)

- Maotai (Chinese liquor)

- Adidas

- YA-MAN (Japanese beauty instrument)

- Angeperle (Chinese pearl company)

The rest of the players in the TOP 10 ranking are all domestic brands. (source: CBNData)

Taobao/Tmall 618 Mid-Year Sale Result

Tmall announced that 618 Mid-Year Shopping Festival GMV (Gross Merchandising Volume) had achieved a “positive growth” without revealing too many details.

- During this year’s 618, over 260k brands and merchants participated in the grand event, a 4% increase from last year’s 250k. (source: CBNData)

- 300 brands have surpassed a transaction volume of over 10 million CNY (~1.49 million USD); 100 products have exceeded the same. We can observe that “hero product” still plays a crucial role in Taobao/Tmall eCommerce, as the best-selling “star” product can contribute a large percentage to the total revenue of a store or brand.

- In terms of geographic location, Shanghai consumers also ranked the highest in total transaction volume, achieving positive growth. Beijing ranked No.2.

- Regarding consumer trends, Gen-Z buyers grew by 30% compared to last year. Categories such as new healthcare, colored contact lenses, and home medical appliances are popular among Gen-Zs. Although still in their youth, Chinese Gen-Zs take good care of themselves, pursuing a prettier look and healthier lifestyle.

Looking for more data about Tmall? Check out this article:

Our observation

In post-covid China, Chinese consumers are more cautious and rational in purchasing decisions. Traditional eCommerce platforms face a severe challenge from live streaming eCommerce such as Douyin. With live streaming going on all year long, people are less excited at traditional major sales festivals because they can also enjoy discounts offered by live streamers.

Building a solid brand positioning to grow and sustainably thrive in China is more important than ever. Being on Chinese consumer’s top of mind in your niche vertical is the prerequisite for success.