Last week, China started its Mid Year e-commerce shopping festival known as 618 (June 18). It’s the second-largest e-commerce shopping day in China, second only to Single’s Day (November 11). Major eCommerce marketplaces like Tmall and JD.com have started the 618 pre-warm. So let’s take a quick look at brands’ performance up to now.

In this article, we will look at:

- What is the 618 Mid-Year Shopping Festival?

- When to start preparing for the 618 Mid-Year Shopping Festival?

- What are the promising categories for China judging from the pre-sale performance?

- How are the foreign and domestic brands performing this year during pre-sale?

What is the 618 Mid-Year Shopping Festival?

618 is one of the major shopping festivals in China. Chinese eCommerce platform JD.com first initiated it as Aniversary Day, offering a series of promotions and discounts. Then other eCommerce players such as Alibaba-run Taobao/Tmall, Pinduoduo, Suning also joined the battle.

Nowadays, Chinese social media like Douyin (the Chinese Tiktok), Red, WeChat, and Weibo are actively participating in 618 with social eCommerce, helping brands and merchants to drive awareness and sales. Offline retailers also see 618 as an important sales opportunity.

When to start preparing for the 618 Mid-Year Shopping Festival?

Same as the Double 11 Singles Day Shopping Festival, 618 Mid-Year Sales also consist of Pre-warm, Pre-sale, and Peak (the big days when the official events happen).

For significant shopping festivals like 618 or Double 11, the seeding preparation can date back to two months ago. Besides preparing enough stock in advance, brands also need to plan their marketing strategy ahead of the event.

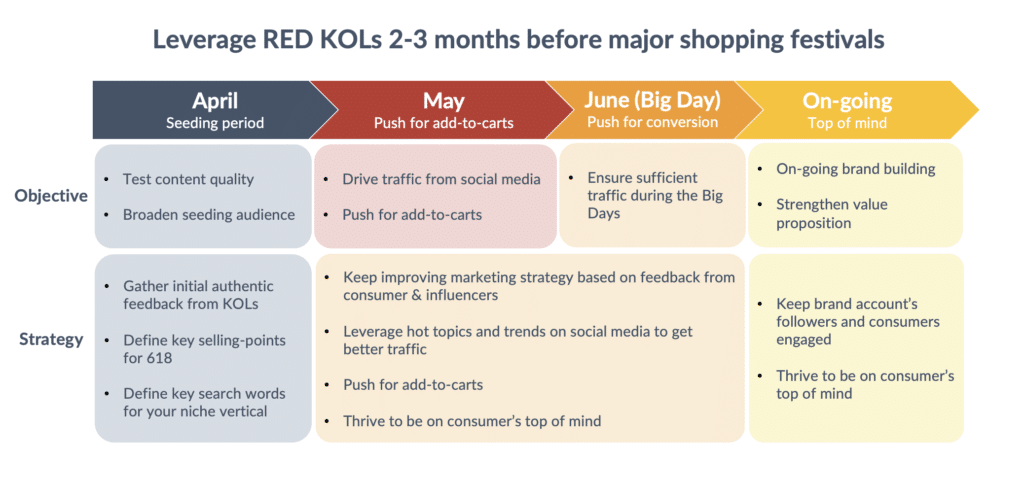

Take Red/Xiaohongshu as an example: April is an important month when brands start to invest in much more KOLs to test the content quality and broaden the seeding audience. In May, as the pre-sale period is approaching, brands need to focus more on KOLs with higher follower stickiness and conversion capacity. In the end, brands will see the seeding results in June – the big day.

Here is a timeline and strategy overview of leveraging Red starting from the pre-618 seeding period to drive awareness, traffic, and sales for the Big Day.

How are the brands performing this year?

This year, JD.com started pre-sale on May 23rd. Meanwhile, Taobao/Tmall began on May 26th.

During Pre-sale, consumers can already compare prices across different platforms, add to carts, and pre-order their desired products. The pre-sale period can help brands and merchants estimate the actual sales on the bid day. So we can have a rough estimation of the brand’s 618 performance according to their pre-sale performance.

Best performing categories for 618 Mid-Year Sale 2022 (Pre-sale)

In terms of GMV (Gross Merchading Value), categories with high AOV (Average Order Value), such as Consumer Electronics, Beauty, and skincare, continued to shine. Other verticals also showed strong potential, reaching an estimated GMV of 10 million RMB (~1.5 million USD) to 100 million RMB (~15 million USD). These promising categories are maternity & baby, food & health care, home decor & household items, and sports & outdoors items.

According to data from Digital Retail Data Provider Nint 任拓, during the first 4 hours of the pre-sale (May 26th, 20:00-24:00), some leading brands were already estimated to reach a GMV (Gross Merchandising Value) of over 100 million RMB (~15 million USD). These top-performing brands are beauty and skincare, home appliances, skincare and body care equipment, sports shoes, etc.

This trend shows that Chinese consumers are increasingly looking for self-satisfaction. Instead of buying to show off or for other social value, Chinese people value how their purchases can bring a positive and healthy impact and better quality of their personal life.

Poor performing categories for the 618 Mid-Year Sale 2022 (Pre-sale)

However, brands from the general fashion apparel category have been less lucky. According to the same source, menswear and underwear categories showed a decreasing trend compared to last year. The poor performance is also due to minor outbreaks of covid in a few Chinese cities everyone now and then, which reduced people’s needs for outings and thus for fashion items.

Best performing brands for 618 Mid-Year Sale 2022 (estimated)

According to Nint 任拓 and eBrun, here is a list of the top-performing brands by category during the first 4 hours of the pre-sale (May 26th, 20:00-24:00) on Tmall.

Beauty and skincare Top 10

Foreign brands still dominate the best performing ranking in the beauty and skincare categories. Only two Chinese brands managed to be on the list:

- Estée Lauder

- L’Oréal

- Lancôme

- Olay

- Proya (珀莱雅)

- La Mer

- Shiseido

- SkinCeuticals

- Helena Rubinstein

- WilNONA (薇诺娜)

Makeup and Perfume Top 10

The best-selling ranking for the makeup and perfume category has changed a lot this year. The estimated sales of make up forever and MAC in the first 4 hours are above 50 million RMB (~7.5 million USD), surpassing Saint Laurent to rank in Top 1 and Top 2.

COLOR KEY, Givenchy, and Maybelline were on the Top 10 last year, but this year they are replaced by NARS, make up for ever, and Lancome. Chinese beauty brand Florasis still holds the Top 10 position.

- Make up for ever

- MAC

- Saint Laurent

- 3CE

- Estée Lauder

- Armani

- Lancôme

- Blank Me

- Florasis (花西子)

Tmall 618 Women Fashion Top 5

Brands that used to be on the list, such as Uniqlo, have disappeared. This year, Chinese brands dominate the top-performing list for women’s apparel. Mo&Co. could be the only women’s fashion brand listed among Top 10 this year:

- Mo&Co.

- Ochirly (欧时力)

- Eifini (伊芙利)

- Jorya (卓雅)

- 独束

Tmall 618 Sportswear and Casualwear brand Top 10

Foreign brands still dominate the top-performing list for sportswear and casual wear. DESCENTE, a sports brand focusing on ski items, got popular leveraging the hot topics during the 2022 Winter Olympics held in Beijing.

- DESCENTE

- FILA

- Nike

- Adidas

- Under Armour

- Li Ning (李宁)

- Anta (安踏)

- Jordan

- Lululemon

- LORNA JANE

Tmall 618 Bags, luggages and leather goods Top 10

- Coach

- MK

- songmont

- TORY BURCH

- MCM

- Warmstudio (木良吉吉)

- bromen bags (不莱玫)

- Grotto (个乐)

- FURLA

- Peco

Tmall 618 Healthy food, diatery supplements Top 10

The ranking for health products and dietary supplements is dominated by foreign brands, except BY-Health, a well-established Chinese supplement brand.

- Swisse

- BY-Health 汤臣倍健

- Blackmores

- Movefree

- WHC

- life space

- Noromega

- Nestle

- Youthit

- Keylid 健力多 (by BY-Health Group)

Please note that these rankings are based on the estimated sales of Tmall brands during the statistical period (the total amount of “deposit + final payment” in the pre-sale period). Please understand that there may be some discrepancies with the actual sales. (Data source: Nint 任拓)

We will keep on eye on how the situation evolves during the 618 Mid Year Shopping Festival.

Read on here to learn more about our observations on the past 618 Mid Year Shipping Festivals:

- JD.com 618 Revenues Grow 33% Amid COVID-19 Pandemic

- 618 Sales Data 2019: Tmall growth slows down; Pinduoduo traffic up 48%