You might not have heard of Yunji, one of the latest giants of Chinese social commerce. Yet, it just went IPO on the Nasdaq, raising $121 million USD.

Who is this new booming social commerce company?

What kind of company is Yunji?

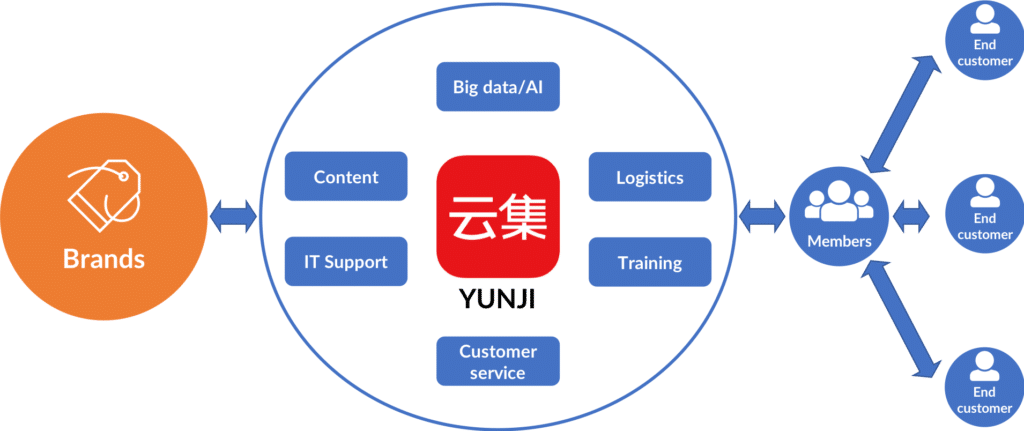

Like Pinduoduo, Yunji is a social commerce company relying mostly on WeChat sharing in order to generate sales. However, unlike Pinduoduo, Yunji uses a decentralized network of “members” who help sell products.

The process is the following:

- Members signup to be able to access the platform

- They can then access special discounts/offers along with the ability to open their own stores

- Members promote their products to other users (mostly via WeChat)

- If they manage to sell products or recruit new members, they receive a share of revenue (not directly through cash but through discounts for future purchases)

Members just have to handle the promotion of the products, while Yunji handles all logistics, IT integration and customer service.

Because of this model, Yunji has been under scrutiny from Chinese authorities because of suspicion of operating a pyramid scheme. In 2017, Yunji was actually fined for $1.4 million USD by a local government because of pyramid selling charges.

In order to avoid further charges, or even being blocked, Yunji doesn’t reward member with cash anymore. Instead, if members successfully promote Yunji’s products, they receive discounts for future purchases.

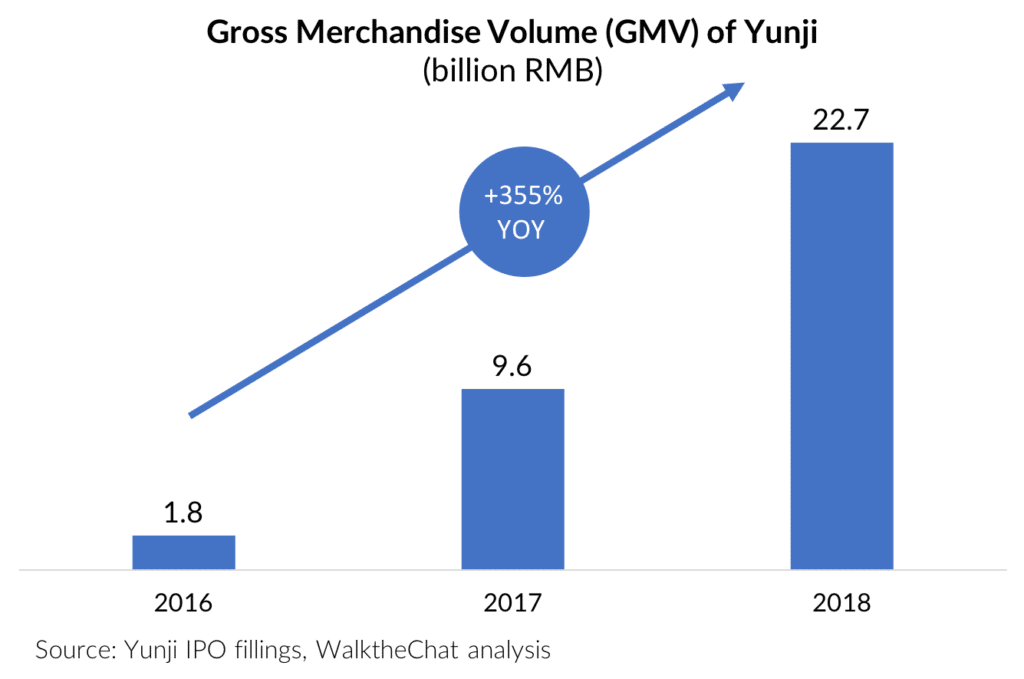

However, Yunji has one thing going for them: a lot of sales. Pyramid models usually rely mostly on members selling other memberships, with no real sales happening. But the Gross Merchandise Volume (GMV) of Yunji has been exploding over the last 3 years.

According to Yunji’s IPO filings, 66.4% of this GMV is however coming from members. It is unclear to which extent it is generated from genuine purchases or because users are required to purchase products in order to become members.

As of December 31, 2018, Yunji had accumulated 7.4 million members. The company had 6.1 million transacting members in 2018.

Yunji’s explosive growth

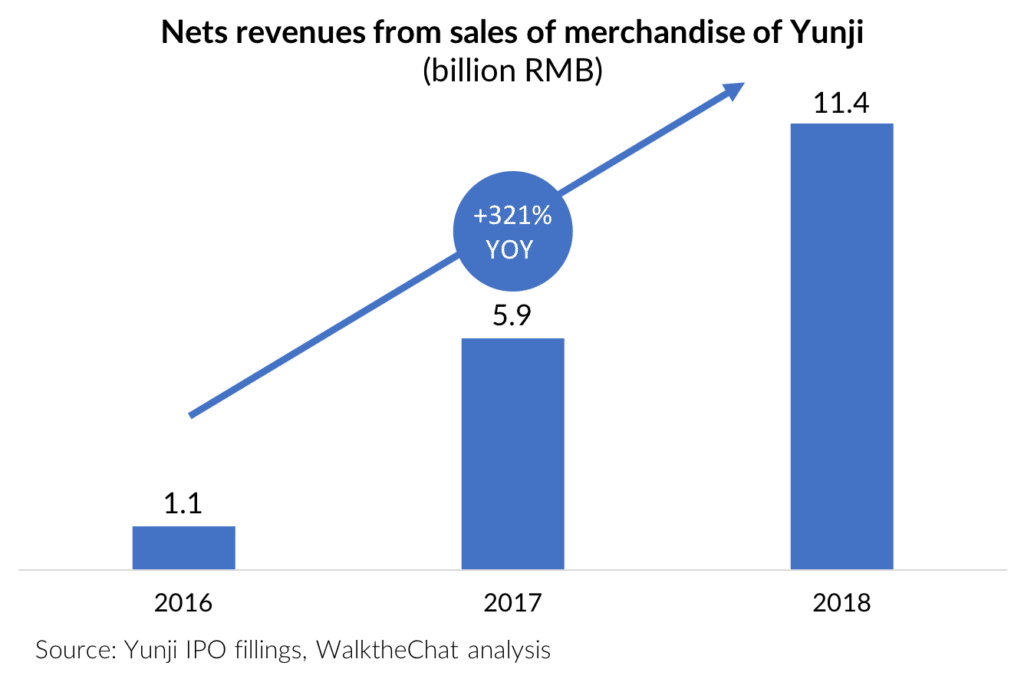

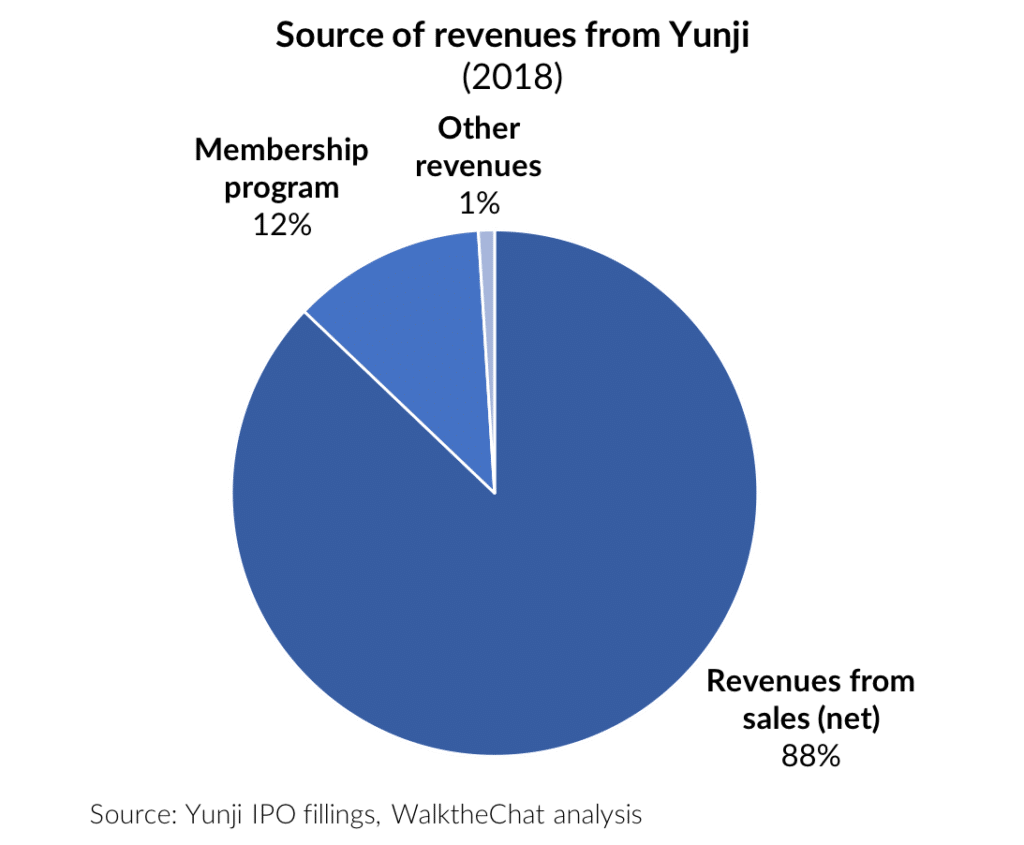

One thing is certain, Yunji has seen an explosive growth of its revenues. The main driver was the growth of revenues generated from sales (like JD.com, Yunji is a retailer and makes direct revenues from sales).

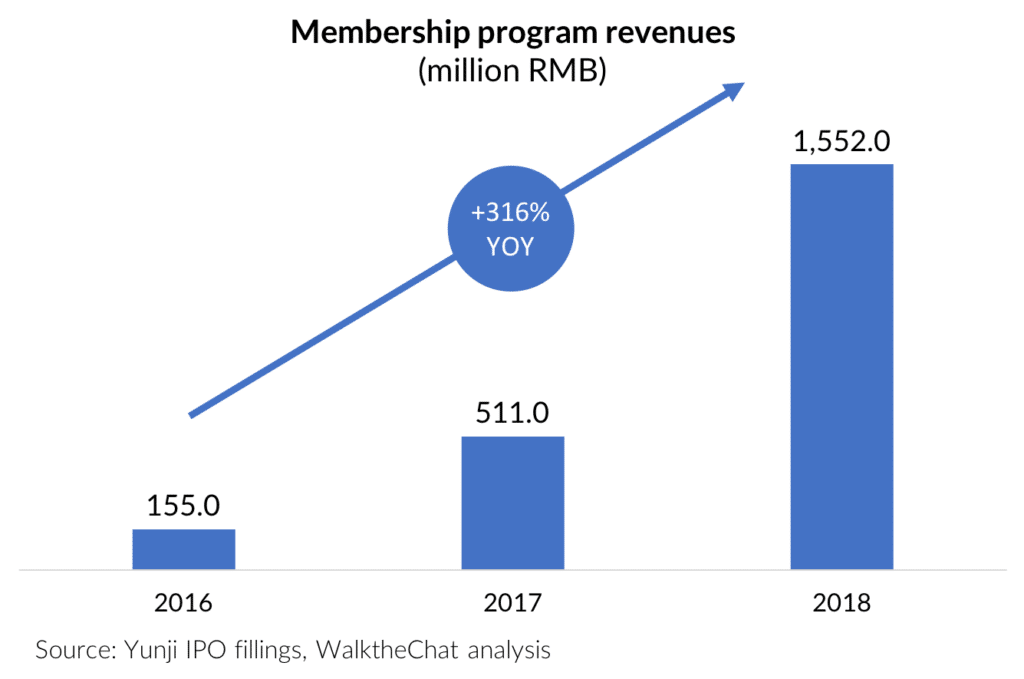

Another driver of Yunju’s revenues is the fees paid by members in order to access the platform and discounts.

Membership revenues are however only contributing to around 12% of total revenues, while most of the rest is coming from merchandise sales.

Yunji and Pinduoduo

It is hard to think of Yunji without thinking about the other massive social commerce company in China: Pinduoduo.

Pinduoduo launched the same year as Yunji (in 2015) and went IPO last year, ahead of Yunji.

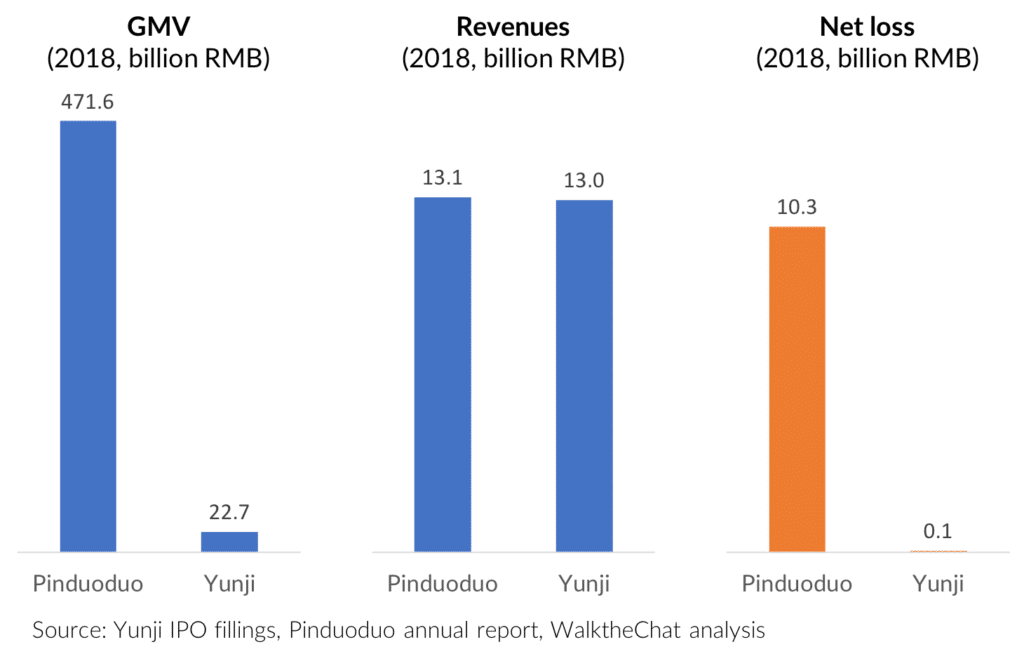

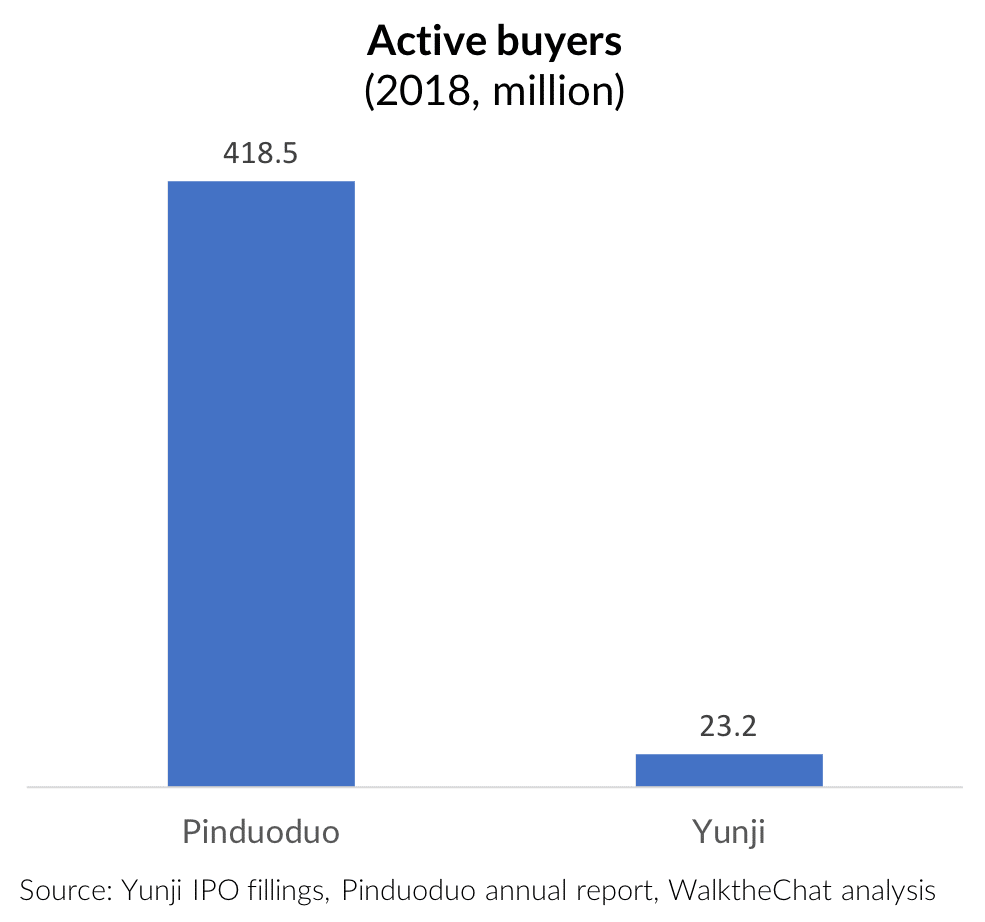

There are however some startling differences between the two companies. While Pinduoduo has a much larger GMV (more than 20 times the GMV of Yunji in 2018), it has similar revenues and is much farther from profitability (it recorded losses of 10 billion RMB in 2018, while Yunji was nearly profitable).

These figures can, however, be misleading. Because of Yunji’s positioning as a retailer, it writes down a lot of its GMV as revenue. In practice, the 11.3 billion RMB of revenues from Yunji also generated 10.7 billion RMB of cost of revenue (the price of the merchandise, inbound shipping charges, write-downs of inventory and member training costs) and 1.2 billion RMB of fulfillment expenses.

In reality, Yunji is therefore unprofitable in its direct sales model and cutting down its loss through membership services.

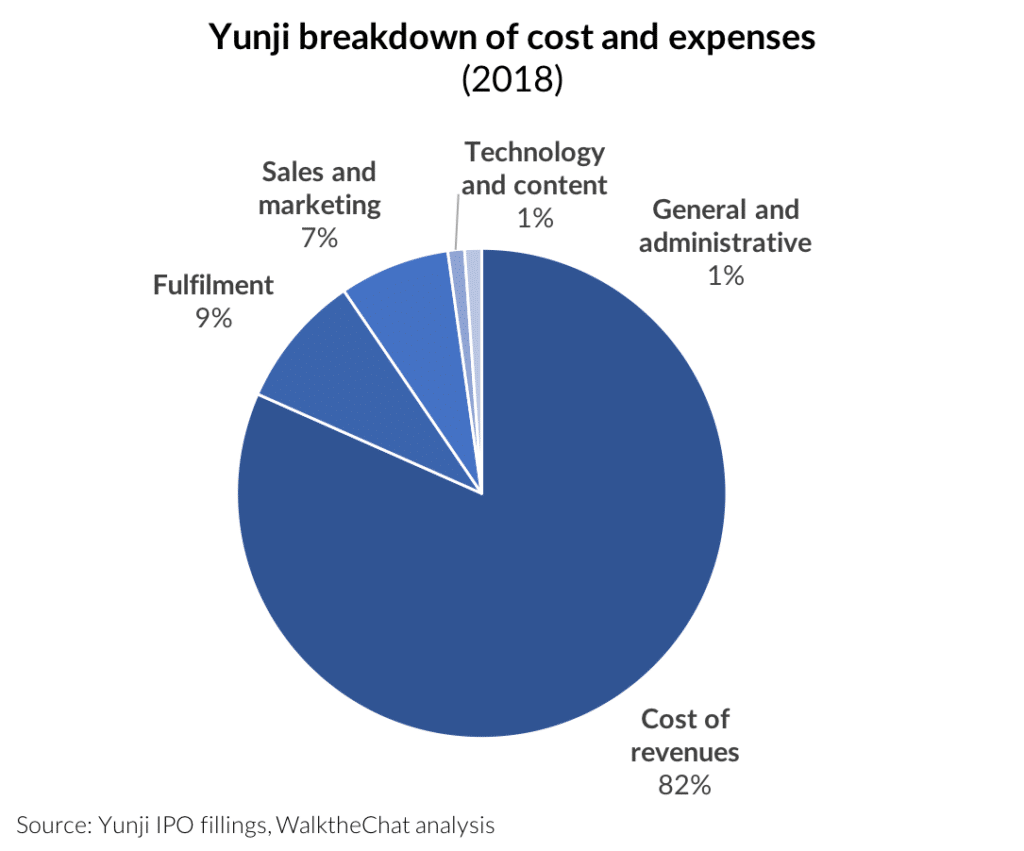

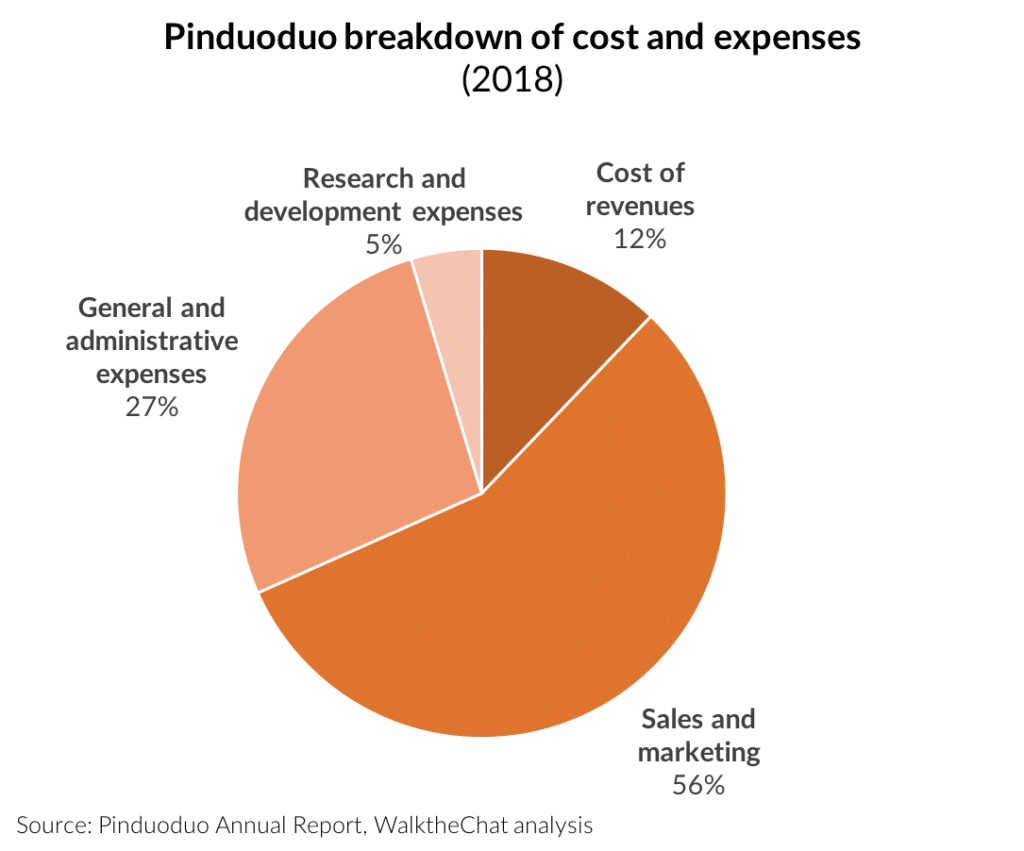

If we look at the details of the cost of expenses of both companies, it becomes obvious that Pinduoduo has been investing in its growth of GMV through user acquisition, while Yunji’s model was mostly focused on paying for its own fulfillment cost.

As a result, about 91% of Yunji’s costs are dedicated to paying for the cost of revenues and fulfillment.

In sharp contrast, Pinduoduo is mostly spending money on marketing in order to fuel its expansion and generates revenues from advertising from merchants on the platform.

It could be argued that Yunji’s decentralized model enables it to grow with lesser marketing expense. However, the difference in GMV makes it clear that Pinduoduo’s marketing investment brought significant results.

In terms of active buyers, Pinduoduo also stands out with about 20 times the number of active buyers of Yunji.

Other risks for Yunji

Beside the risks linked with its business model, Yunji is also exposed to risks linked with the regulatory environment in which it operates.

Because of the risk of being considered as a pyramid scheme, Yunji always lives with the risk of being shut down.

In their IPI filling documents, Yunji states:

“If our business model were found to be in violation of applicable laws and regulations, our business, financial condition and results of operations would be materially and adversely affected.”

Yunji IPO filling documents

And further…

“[T]here is no assurance that the competent governmental authorities in China that we communicate with will not change their views, or the other relevant government authorities will share the same view as our PRC legal counsel, or they will find our business model not in violation of any applicable regulations, given the uncertainties in the interpretation and application of existing PRC laws, regulations and policies relating to our current business model, including, but not limited to, regulations regulating pyramid selling. Moreover, new laws, regulations or policies may also be promulgated in the future, and there is no assurance that our current business model will be in full compliance with the new laws, regulations or policies.”

Yunji IPO filling documents

This existential risk is obviously a major threat which could bring a significant portion of Yunji’s business to a shutdown.

Conclusion

Yunji has been experiencing explosive growth of revenues and users, leading to its IPO last week.

There are however a lot of uncertainties in terms of the company’s growth model: how profitable can it be exactly? To which extent are the sales on the platform organic?

Moreover, the company is operating in a shaky regulatory context, where there is a real risk of being fined or getting a substantial part of their business shut down.