Secoo is China’s biggest luxury e-commerce platform. It also offers offline experience centers for shoppers.

Here are some highlights of Secoo:

- Secoo is listed on Nasdaq with $704.808 M market cap as of August 2018

- Secoo listed 300,000 SKUs, covering over 3,000 global and domestic brands

- Gross Merchandise Value reached RMB1,119.5 million (USD$178.5million) for Q1 2018

- 306,100 orders in Q1 2018

- Total net revenue reached RMB 802.5 million (US$127.9 million) in Q1 2018

- Net income increated by 10.2% YoY to RMB 25.9 million (US$4.1 million)

China Luxury E-commerce Market

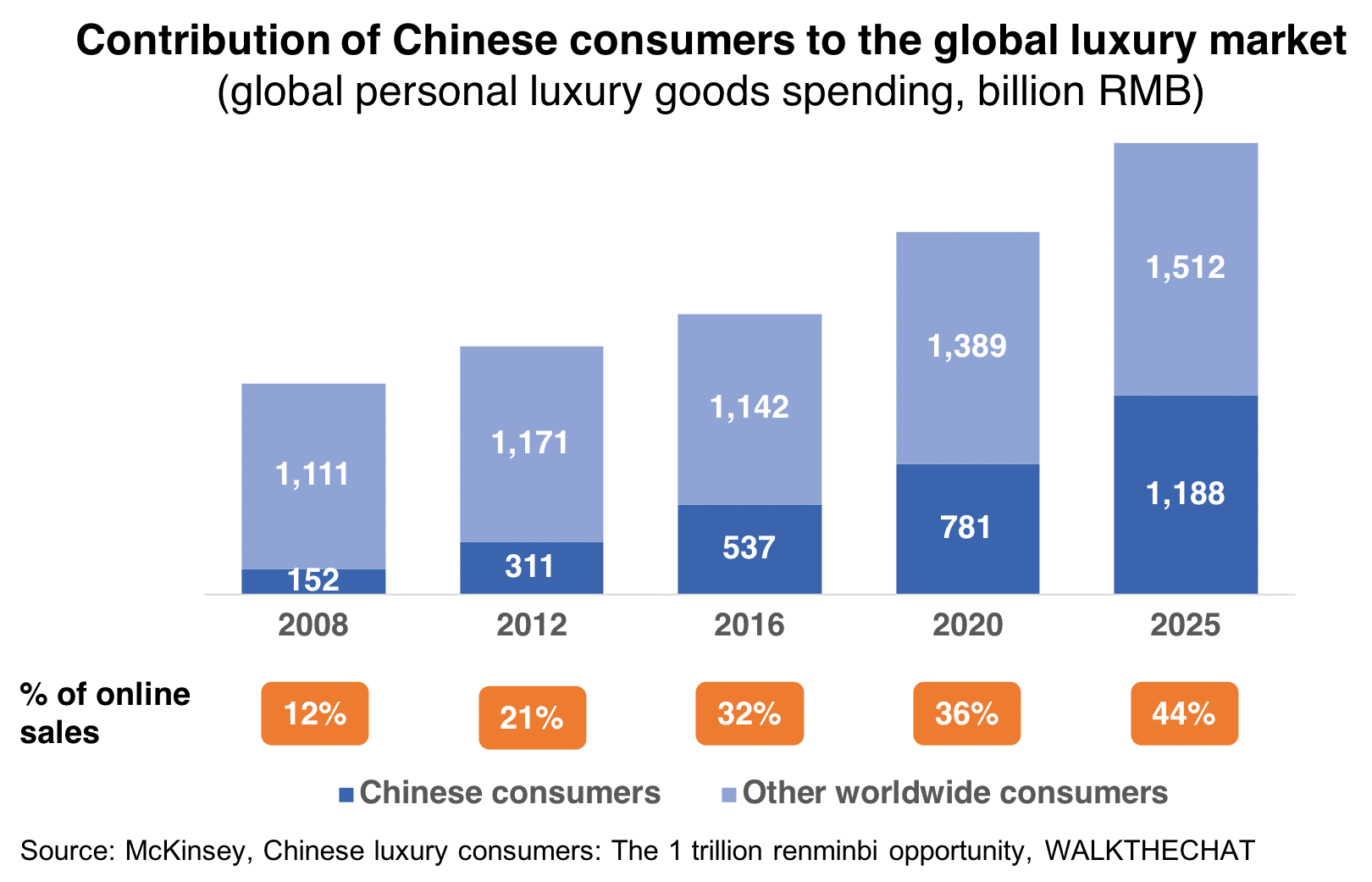

311 billion RMB. That is the sales of luxury goods in to Chinese customers in 2016, which accounted for 47% of the global market, meaning that Chinese consumers buy one almost one out of two luxury goods in the world.

And it isn’t the tuhao (China’s nouveau riche known for their ostentatious taste) this time. This burgeoning wave of consumer spending is largely driven by tens of millions of tech-savvy millennials who make up the country’s expanding middle class, given that the average age of Chinese luxury shoppers has dropped from 35 to 25, and 48% of them are under 30, as the World Luxury Association and a Secoo-published e-commerce white paper reported.

Moreover, the sales are of luxury items are moving online: 32% of online sales in 2016, with a forecasted increase to 44% by 2025.

Of course, luxury brands started to provide customized experiences in order to cater for this growing online demand.

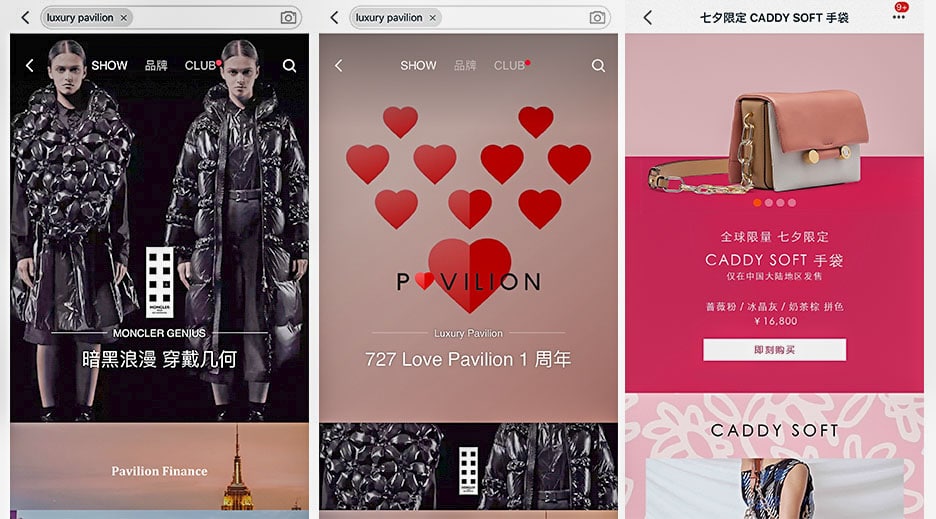

TMall’s Luxury Pavilion, launched in April 2017.

TMall’s Luxury Pavilion, launched in April 2017.

JD.com’s Top Life, launched in October 2017.

JD.com’s Top Life, launched in October 2017.

While China’s luxury market shows no sign of slowing down, e-commerce sites fight over who gets the biggest slice. The two biggest players in the field TMall and JD.com both launched their own luxury division in recent years to tap that demand. But it is Beijing-based Secoo that has been under the global spotlight since it started trading in the US last year.

Secoo Company Overview

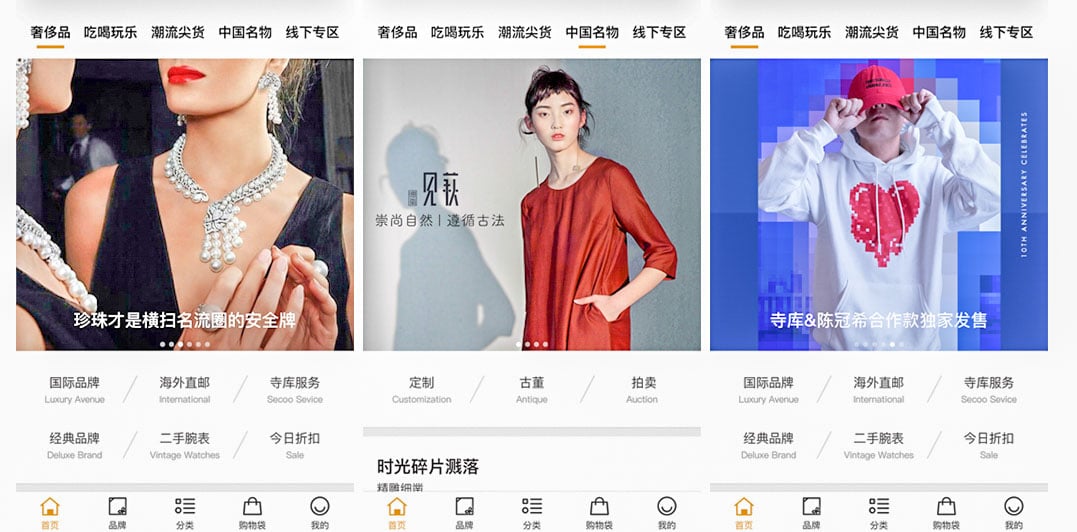

Having just marked its 10th anniversary, Secoo started out as an online consignment marketplace for (often used) luxury items, and has since expanded its offering to a range of lifestyle services.

Their typical customers value the finer things as much as they crave for choice and quality. They love a Fendi Baguette and delights in discovering original designs from indie brands, appreciates a fine bottle of wine and don’t skimp on healthcare, and are ready to hop on a plane for weekend getaways whenever they can.

Comparing Secoo with other luxury e-commerce platforms in China by monthly index

Source: Qianfan, WalktheChat Analysis

Source: Qianfan, WalktheChat Analysis

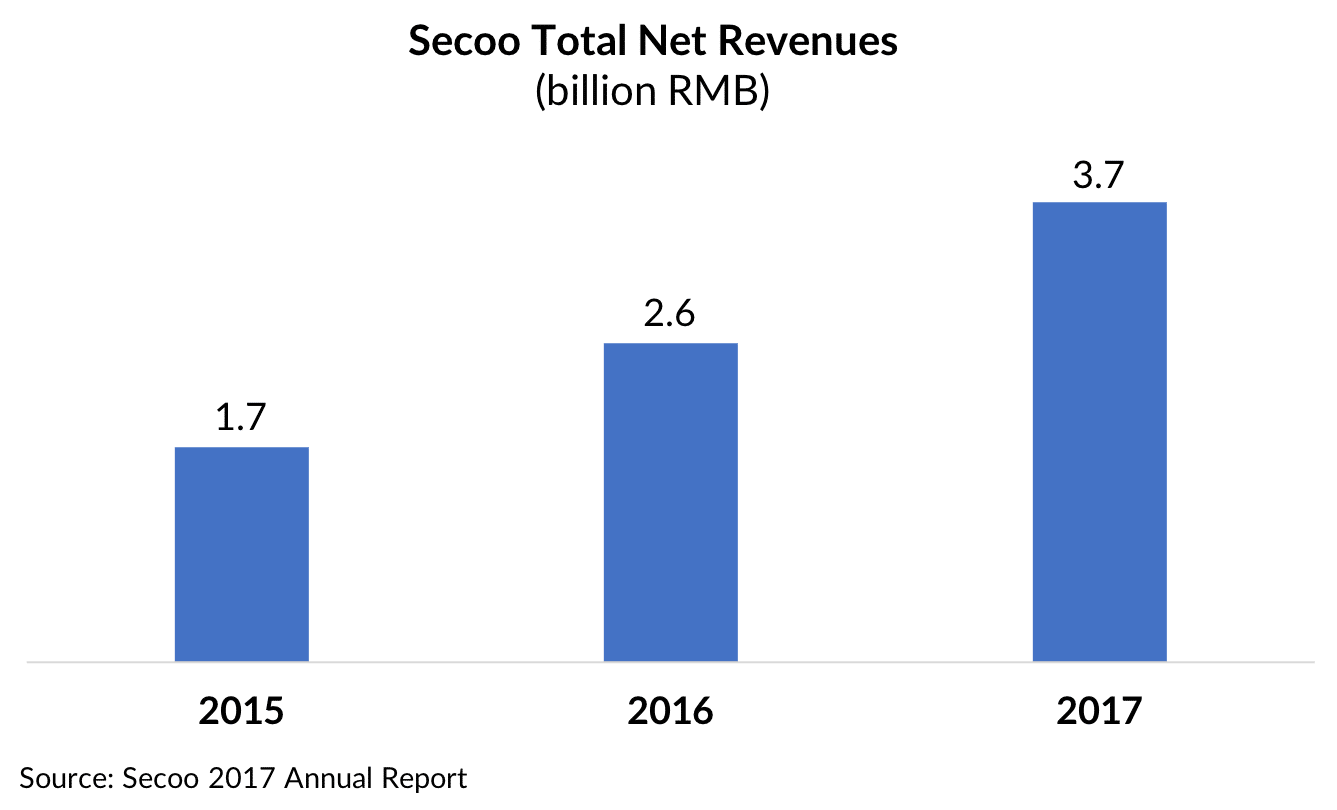

Secoo has been tapping the premium retail market since 2012 and built an empire with 301.8 million annual active users as of March. Their strategy of targeting second, third, and fourth-tier cities, whose growing middle class have the spending power but have limited access to luxury brands, has paid off. They reported a total net revenue of 575 million USD last year, up 44% from the year before.

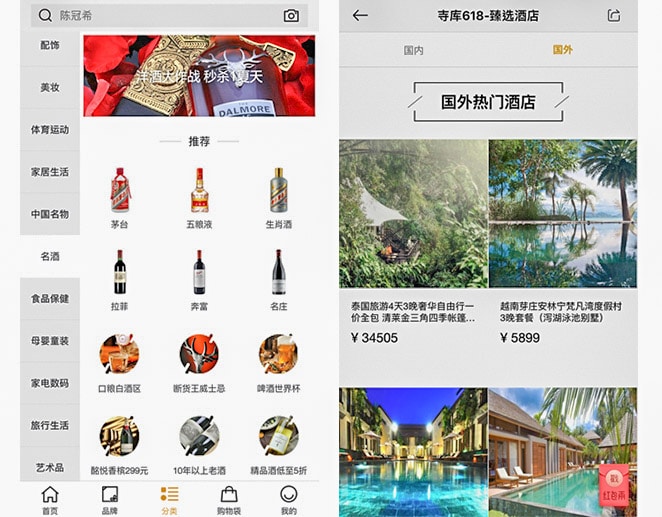

On their app and multiple offline stores known as experiential centers, Secoo currently offer more than 300,000 SKUs from some 3,000 global and domestic brands, with an average purchase per customer exceeding 3,500 RMB.

The main business: luxury, exclusive and customized

Secoo is still best known for luxury fashion, counting handbags and shoes among their best sellers. Many influential international labels have won a beachhead in China thanks to the exposure they received on the platform. More are following their footsteps this year, as Secoo actively seeks to expand and take control of its product mixes via direct distribution partnerships with brands and manufacturers.

L Catterton, LVMH’s private equity arm, announced their investment in and partnership with Secoo this year, meaning the luxury platform will benefit from special partnerships with a wide range of top-end brands under the LVMH umbrella.

In the same vein, you may have already noticed a surge in high-end made-in-Europe shoes on the platform, as the European Confederation of the Footwear Industry (CEC), which represents 87% of footwear production in Europe, signed on to be an exclusive partner back last year.

In response to Secoo’s own findings that under-30s shoppers are buying smaller indie brands in droves in pursuit of personalization, they are of course already cranking out customized products in limited quantities.

From Logo Tees to Daddy Caps, Edison Chen’s designs have taken over the app since they announced upcoming collaborations with former entertainer’s fashion brand Emotionally Unavailable. It also brought renewed attention to the platform’s designer channel, which is dedicated to domestic indie labels (currently featuring some 300) and limited edition products.

Apart from fashion, Secoo also partners with Malaysian department store chain Parkson to offer cosmetic and beauty products.

Research online, buy offline

Though consumers can find everything on their smartphones, the purchase of high-end goods more likely takes place in store. At least the luxury retailer believed so when they adopted an integrated online and offline business model, and began their journey into brick-and-mortar to complete its offline infrastructure.

Source: Discover JB

Source: Discover JB

Branded as lifestyle experience centers to showcase products and offer VIP services, Secoo has invested in a number of locations, including major first-tier cities in China, plus cross-border stores in Milan, New York, Tokyo and around the world.

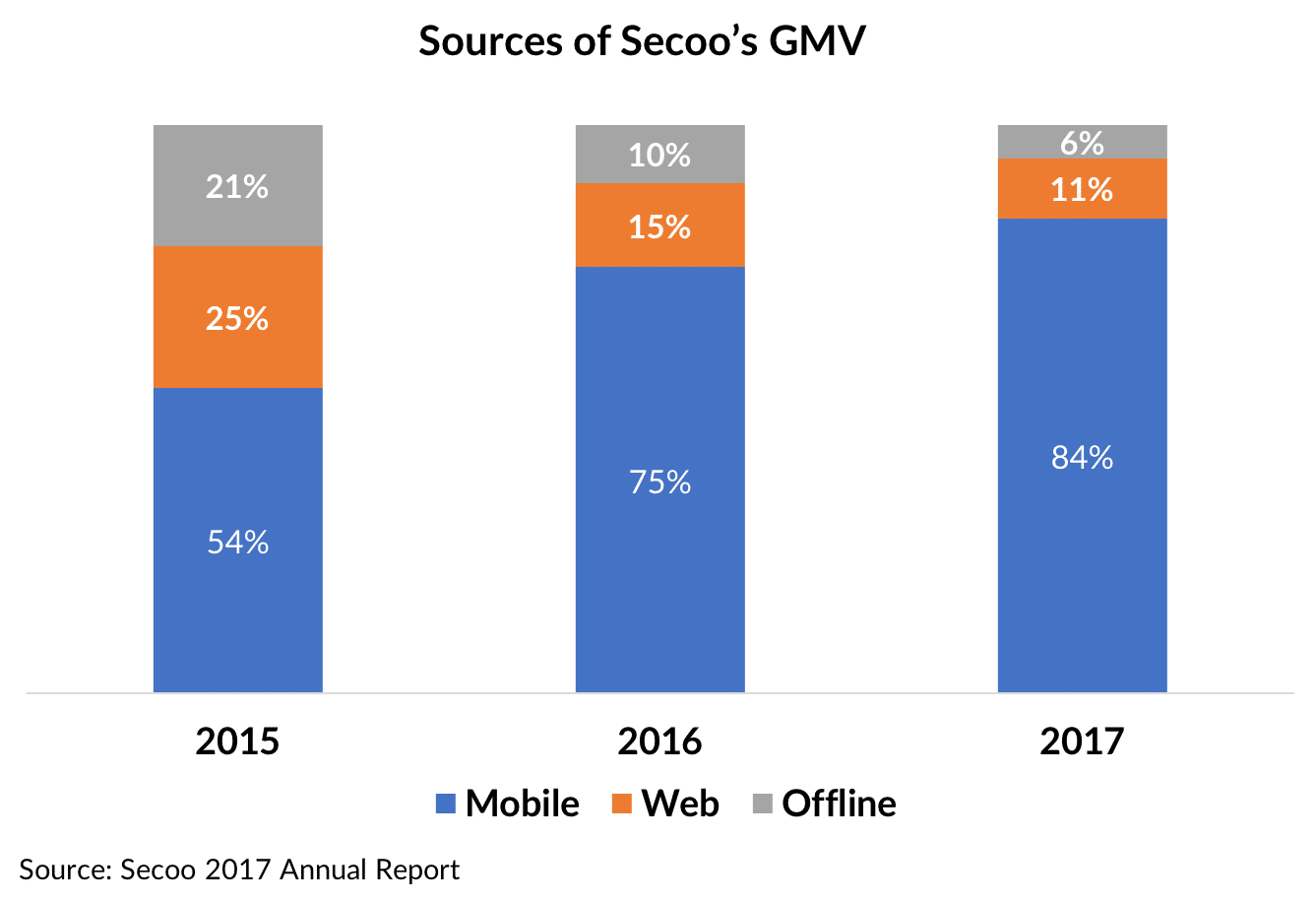

However, sales have been growing online while decreasing offline. Offline retail is a shrinking share of Secoo’s total GMV, going from 21% to 6% between 2015 and 2017.

In the meantime, the contribution of mobile Apps to sales has been booming, going from 54% to 84% of total GMV in 2 short years.

Keeping counterfeits out of the marketplace

Despite China’s reputation for counterfeiting, and while leading e-commerce sites like TMall and JD.com struggle to monitor fake goods, Secoo is commonly deemed a relatively reliable source of authentic luxury items. Apart from key partnerships that help with brand authority, they are the first e-commerce sites in China to adopt next-gen blockchain technology in tracking select top-priced items. It claims to ensure authentication as each product will have a unique identification at multiple checkpoints.

Your Armani suit, delivered today

Some luxury brands are not keen to jump on the e-commerce bandwagon given the logistics challenged involved. Fortunately for Secoo, they now have the full support of the largest nationwide logistics network built by JD.com with 515 warehouses across the country, as the former rival is now an investor.

Source: JD.com

Source: JD.com

When JD.com isn’t developing drones, automation and robotics, they are pairing China Railway with their Luxury Express that provides same-day delivery of big-ticket items (by suited, white-gloved couriers of course, because the typical kuaidi guy won’t cut it).

Perhaps luxury brands can do a lot more to wow Chinese consumers and capitalize on the trend that more and more of them are accustomed to shopping upscale items online. It seems only natural that these two e-commerce businesses come together to carve out an even bigger share of the market. The alliance will allow them to benefit from each other’s user base and consumer data. i.e. They may one day know you better than you know yourself.

Covering the good life

Luxury retail is only a part of Secoo’s ambitious plan to be a one-stop-shop for all things luxury. Their lifestyle business, set up in 2017, now covers travel, education and healthcare essentially by way of acquisition and partnership.

They take their core consumers’ particular fondness for travel seriously. Secoo bought a subsidiary of Caissa Travel who provides tourism services in more than 100 countries and regions. With that industry capacity, they began rolling out customized suites in hotels and premium routes, showcasing merchandise in boutique hotels.

On their rise to becoming China’s luxury destination, Secoo already had a blast on a mixology-themed night with their VIPs. Just this month, the platform featured China’s top bartenders, with creative drinks on taps and the brand’s luxury takeaway bottles at a pop-up bar in Shanghai. The event was also the launch of their own cocktail brand distributed via exclusive bar partnerships.

Source: The Beijinger

Source: The Beijinger

Conclusion

The way Secoo leaped to the top of the premium e-commerce league only proves the huge potential in China’s online luxury market. It is however still plagued by such issues as counterfeiting and logistical challenges.

Secoo has come a long way in only 10 short years, its impact on the entire luxury ecosystem in China has been quite significant. They have been on a fast-paced journey to build an infrastructure that allows a more integrated marketplace for all things luxury, bridging the online-to-offline experience gap and covering various lifestyle aspects with customized offerings.

This is no doubt a fascinating strategic development, and prospects are bright as other major e-commerce sites followed suit and broke into the luxury segment.