WeChat Social Commerce Report 2018 was released today by Youzan (the biggest WeChat shop platform in China) and Newrank (China’s largest social media data monitoring platform).

The report shows some surprising trends:

- The share of time spent on social media and Tencent-owned products is decreasing. Video content and Toutiao are stealing the show in 2018

- The most popular items purchased via WeChat are around 200 RMB

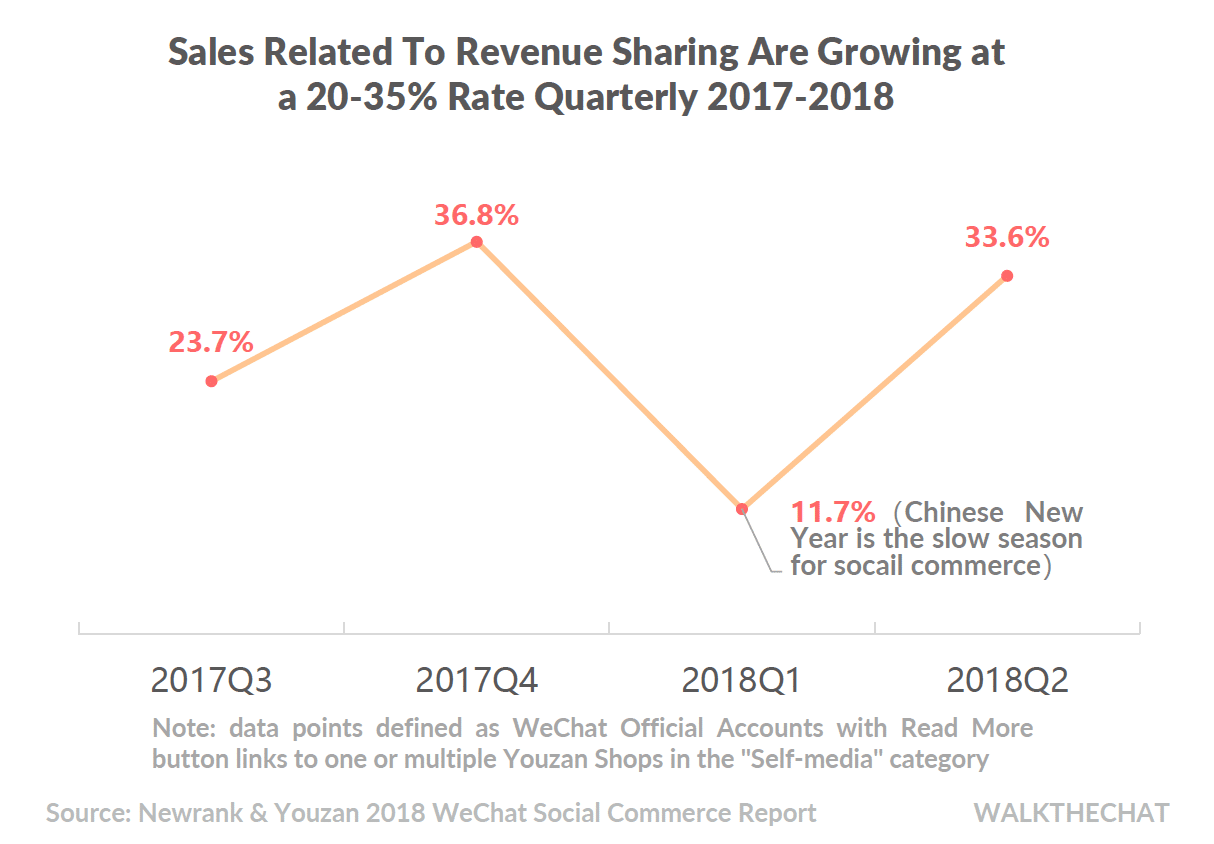

- Social commerce sales via revenue sharing are growing at a 33% quarterly rate.

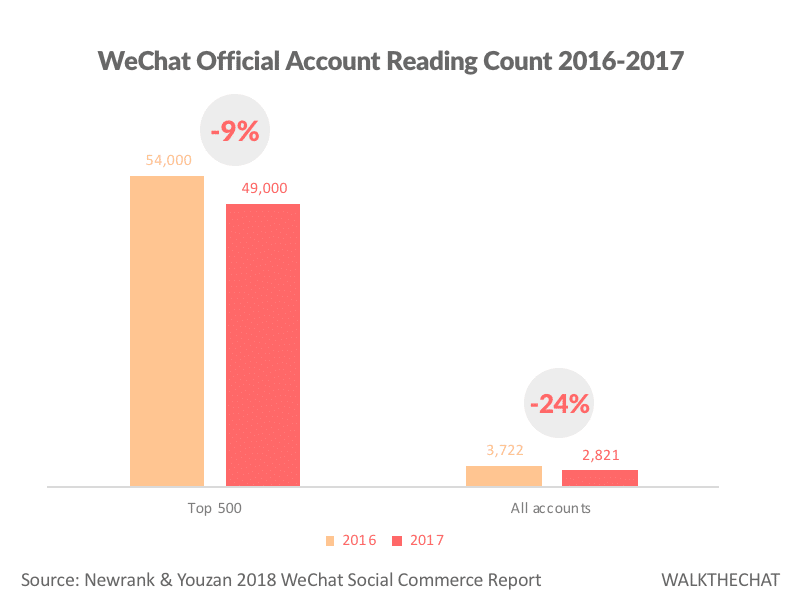

WeChat article’s average reading counts have decreased by 24% as competition continues to increase

The decrease in the reading rate is very clear. 24.2% for all WeChat Official Account samples, and 9.3% decrease for the top 500 accounts.

As more companies and individuals are registering WeChat Official Account, it is getting harder to get users’ attention. Even top-500 Official Accounts are seeing a decrease in reading rate.

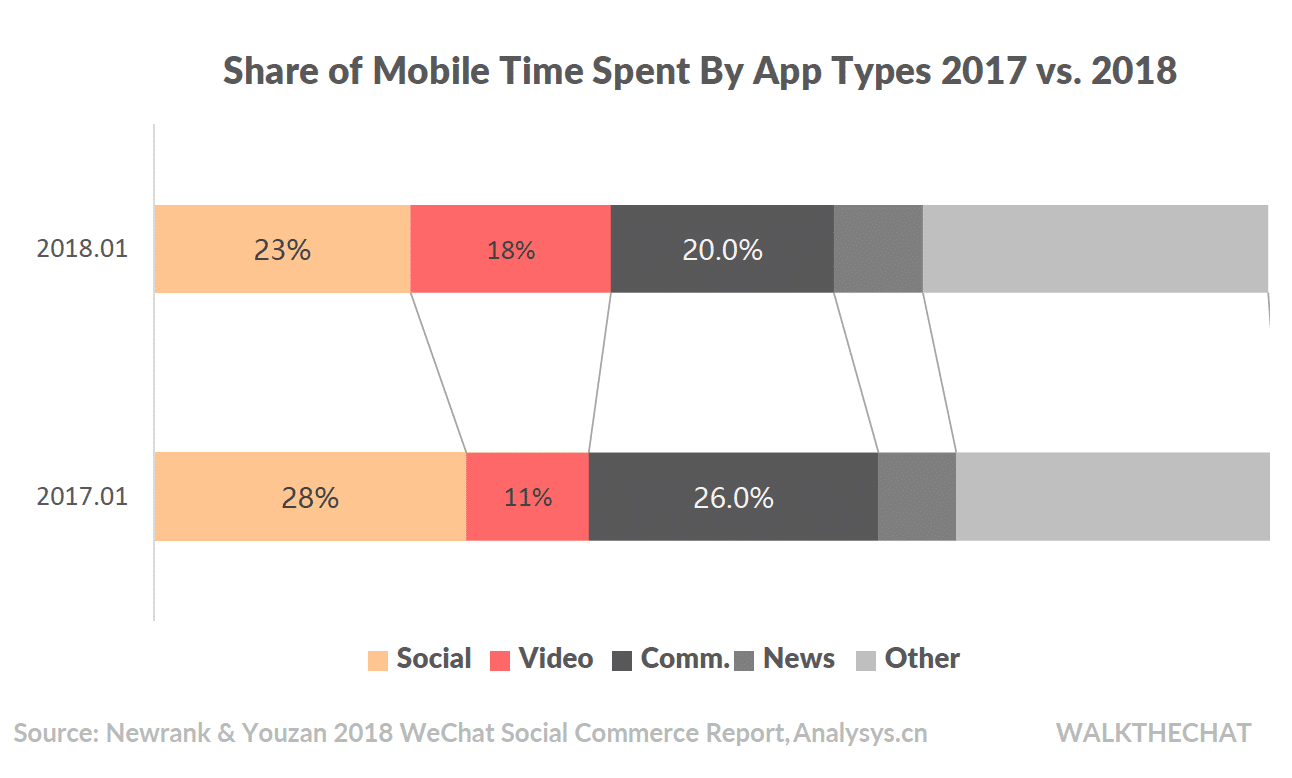

More engagement on video Apps caused the share of time spent on social apps is decreasing.

Time spent on social media has decreased from 28% to 23%. This is mostly due to the growth of video platforms.

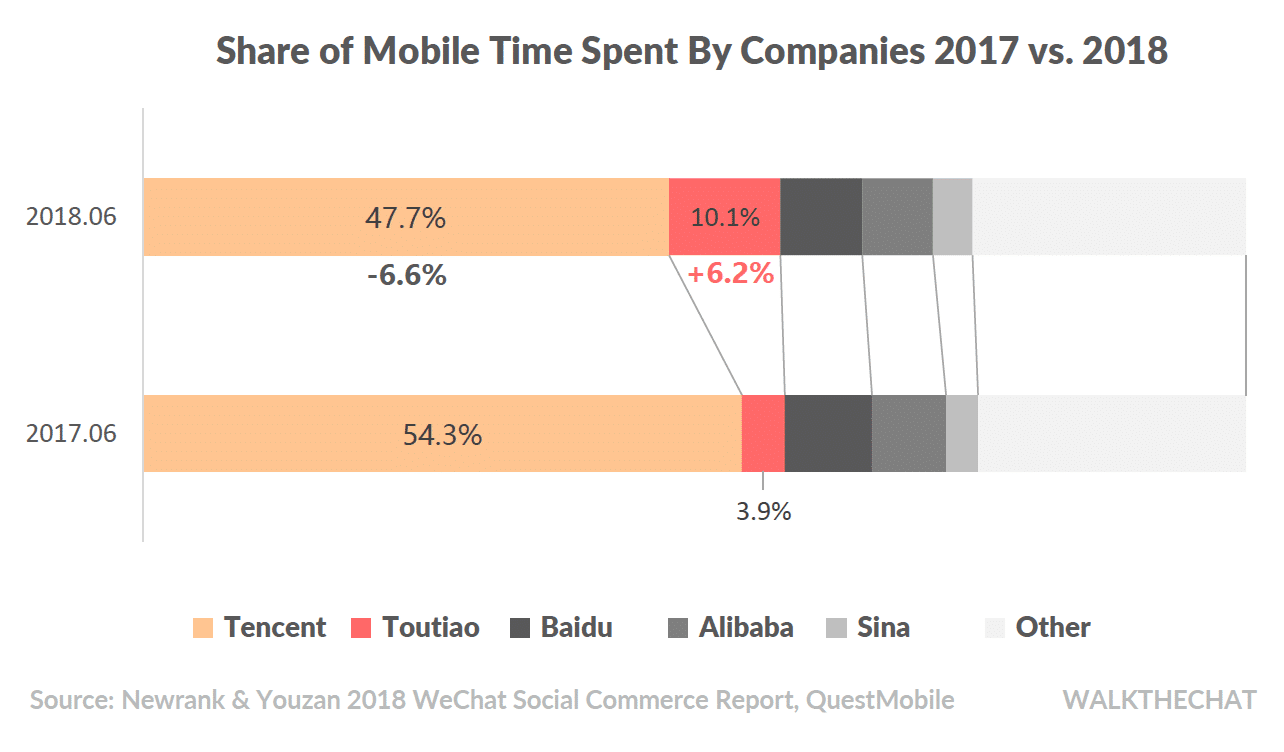

Breaking down into individual apps, the Toutiao ecosystem is taking over market share from the Tencent ecosystem. However, WeChat is still dominating most of the users’ mobile time.

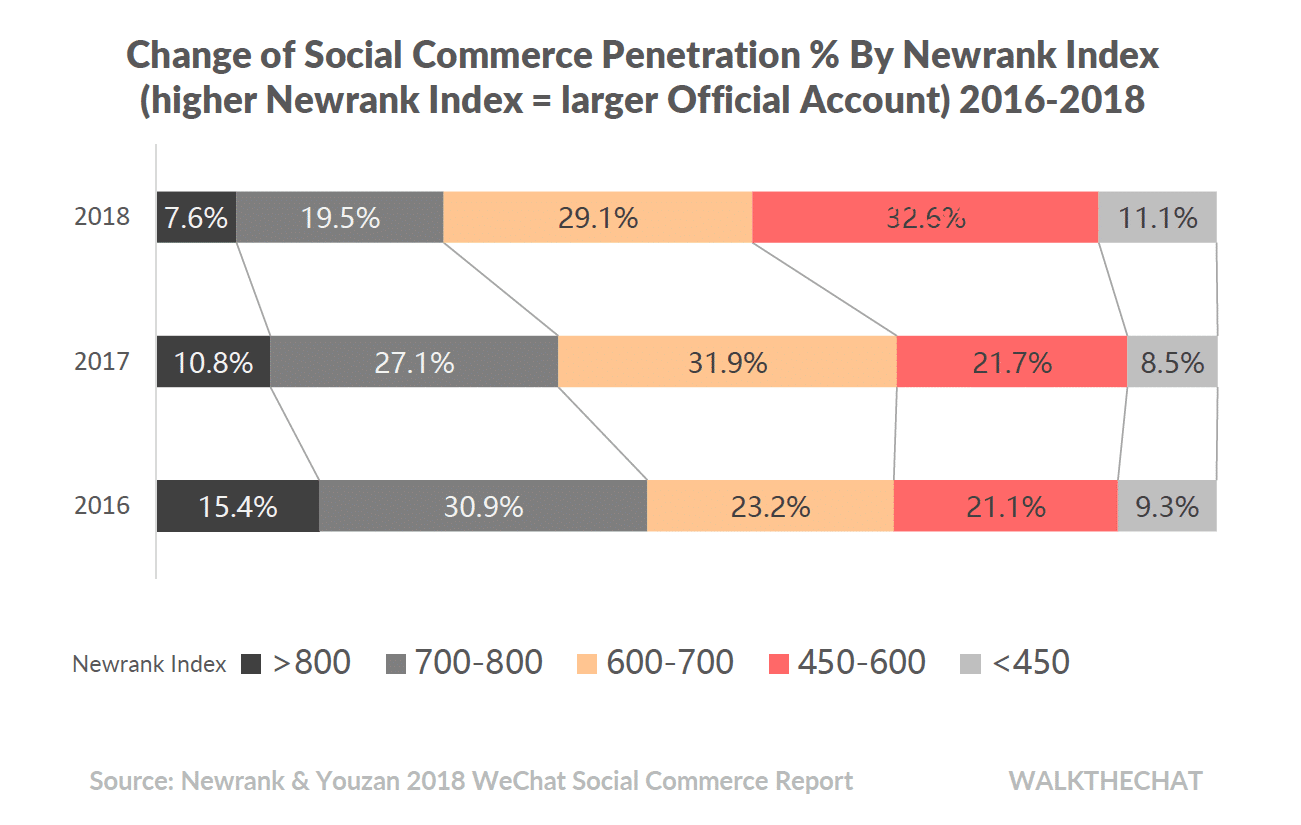

Around 10-30% of Official Account are linking to a WeChat shop via the Read More button at the end of their articles. It is getting more common for smaller Official Accounts to drive users to WeChat shops. There is a strong shift in social commerce across accounts of all sizes.

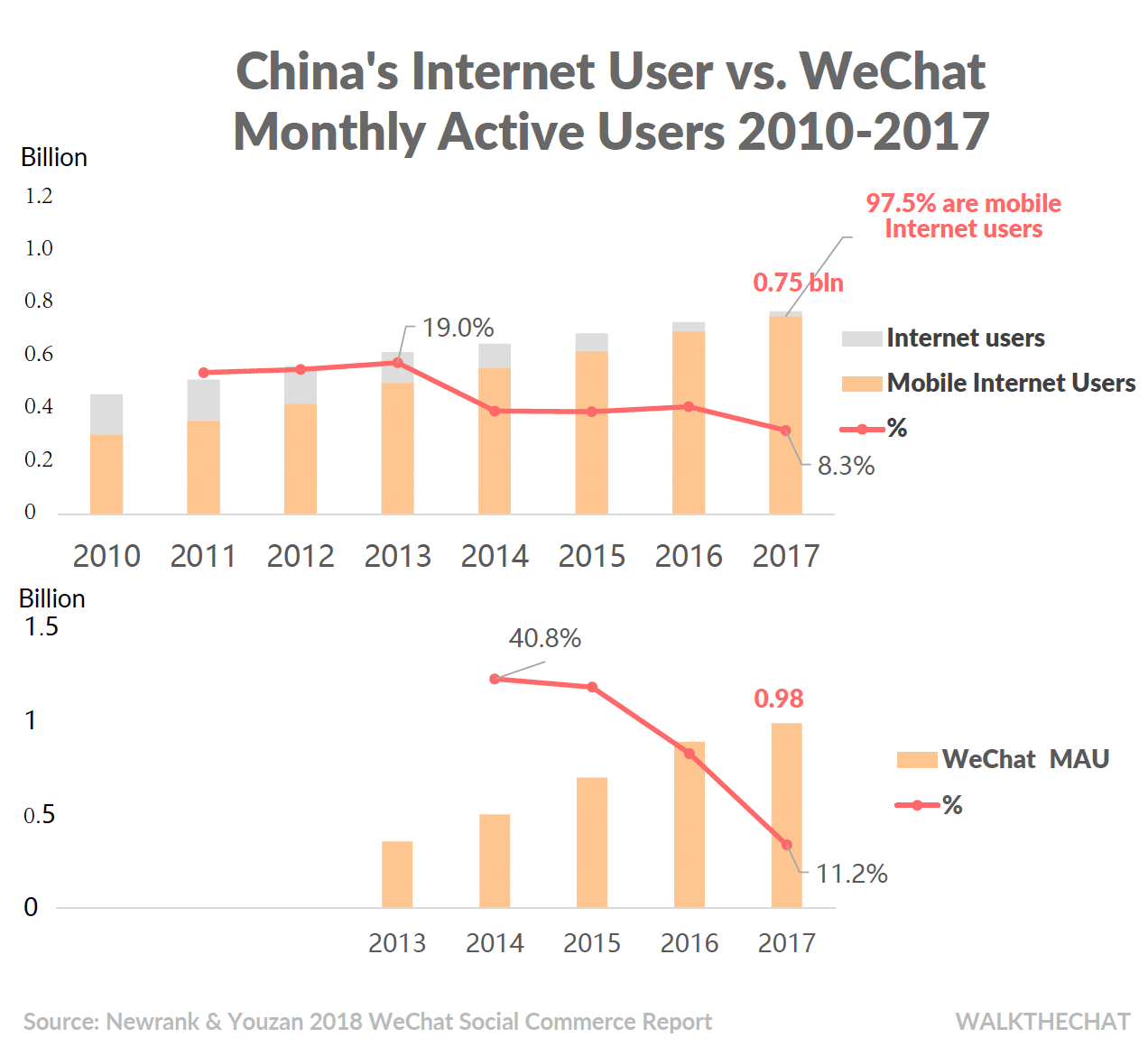

WeChat MAU growth is slowing down due to its reaching China’s Internet population ceiling

The growth of WeChat active users has continued to decrease since 2016 as it’s saturating the Chinese market.

WeChat has fully penetrated and surpassed the number of China’s internet user since 2015! It has continued to grow and by 2017, the number of WeChat MAU reached 980 million, 30% higher than the 751 million China’s internet users.

How can WeChat have more users than China Internet users?

- WeChat has a significant amount of users outside China (mostly within the Chinese diaspora)

- Many users registered for multiple accounts to separate work and personal contacts

- To a small extent, ghost account on click farms might impact the statistics

What’s worth noting is China is one of the most advanced mobile-first countries: 97.5% of China’s internet users are mobile internet users.

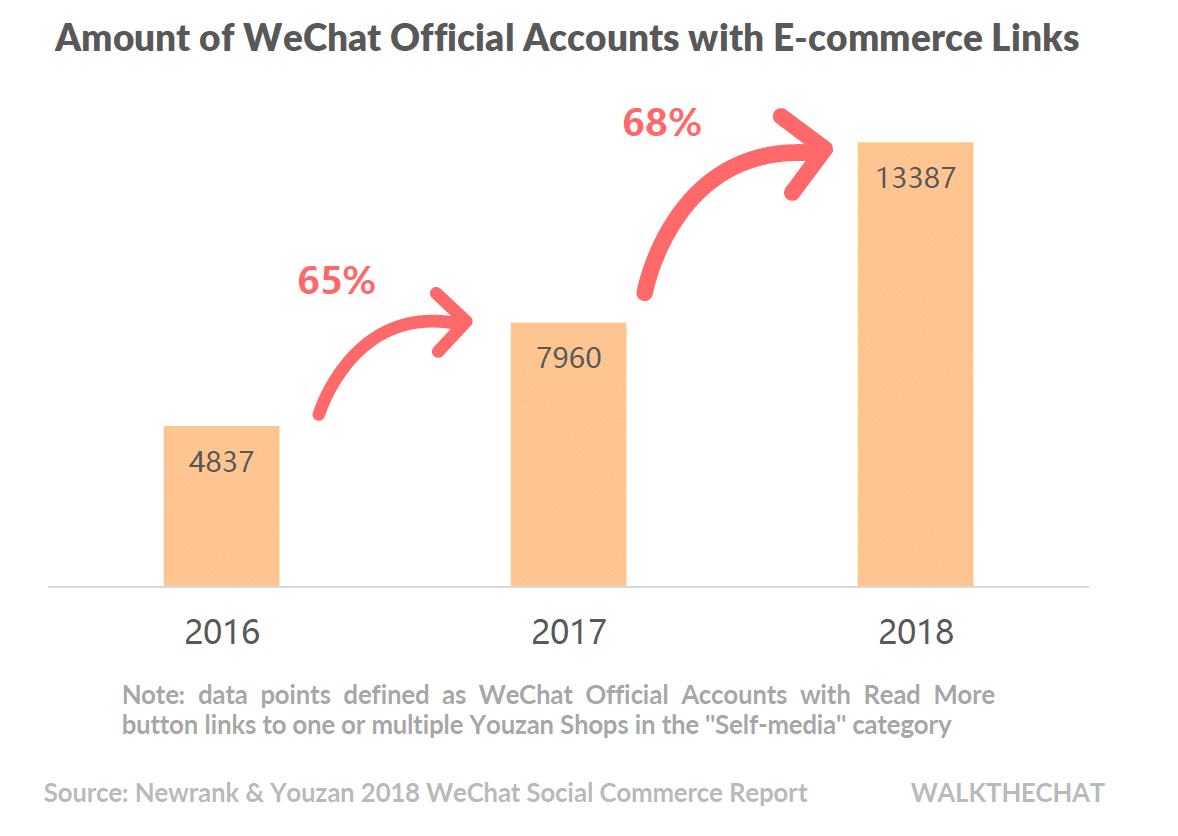

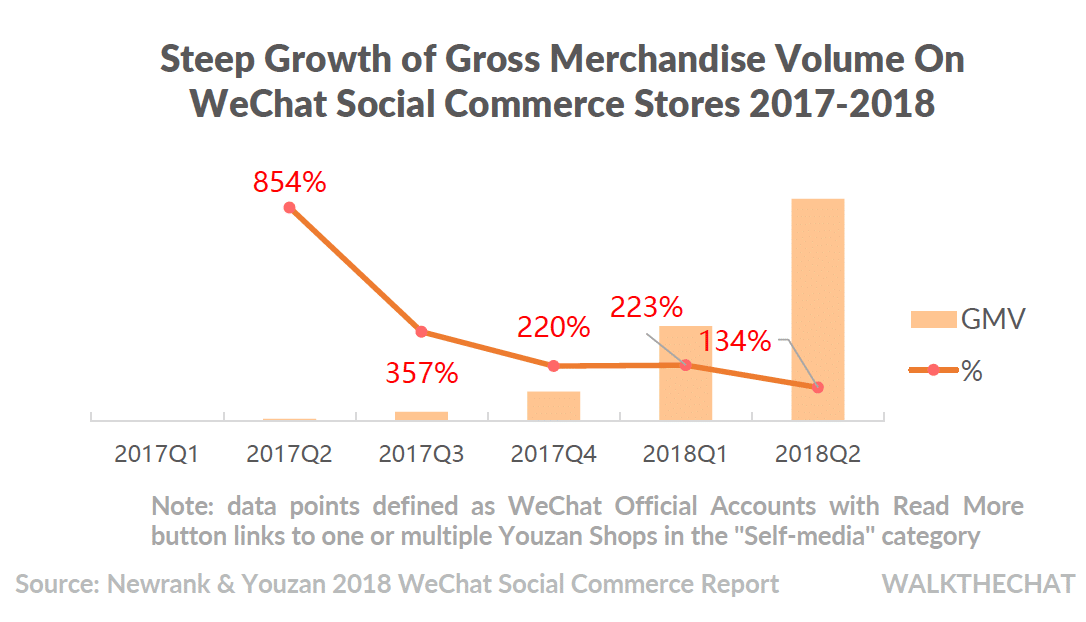

The number of WeChat social commerce store is growing at around 68% YOY

The number of self-media Official Account WeChat shop is growing at a 68% rate in the year 2018.

Transaction volume on WeChat shop is increasing at a surprising rate

In Q2 2018, the transaction volume on WeChat shop keeps growing at a 134% quarterly increase rate.

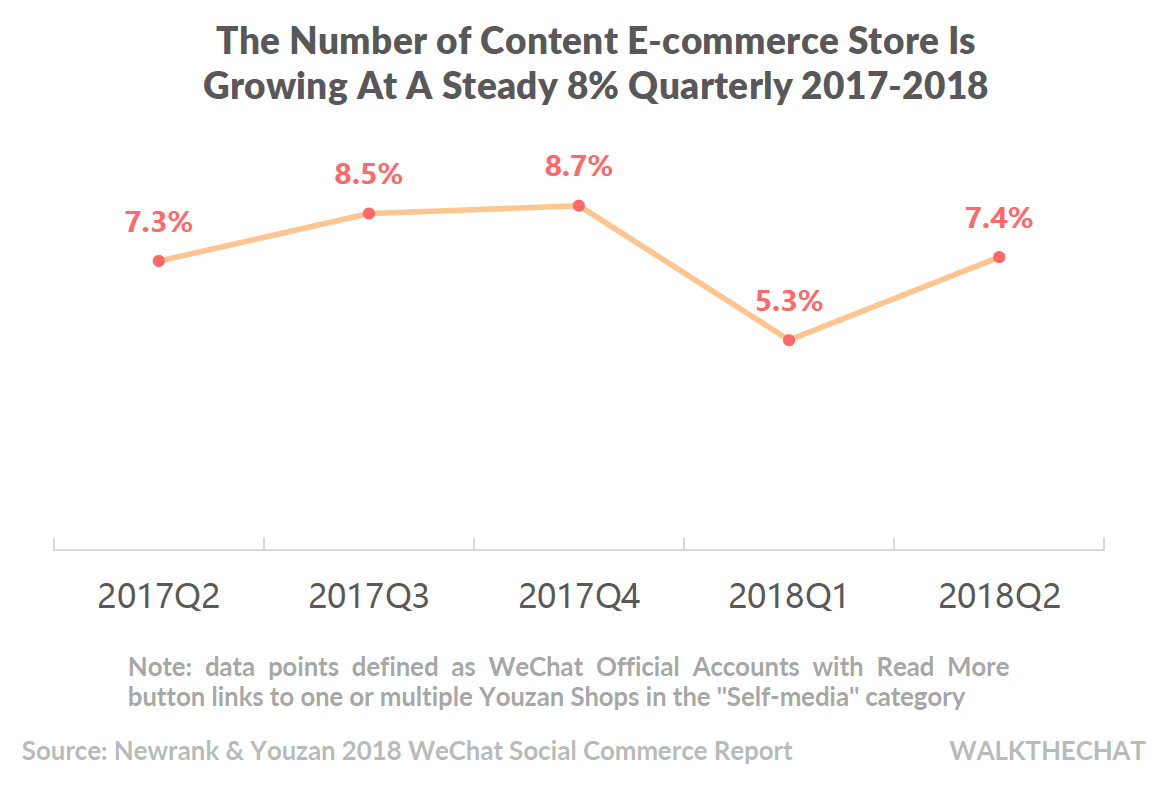

The number of content focused social commerce store continues to grow

Content focused social commerce store continues to grow at a 7% quarterly rate through the past year.

Content focused social commerce store continues to grow at a 7% quarterly rate through the past year.

Strong growth in revenue-sharing related sales. Revenue sharing is at the heart of the Daigou/KOL driven social commerce. The highest quality Official Account usually takes commission instead of a flat-rate advertising fee to maximums return.

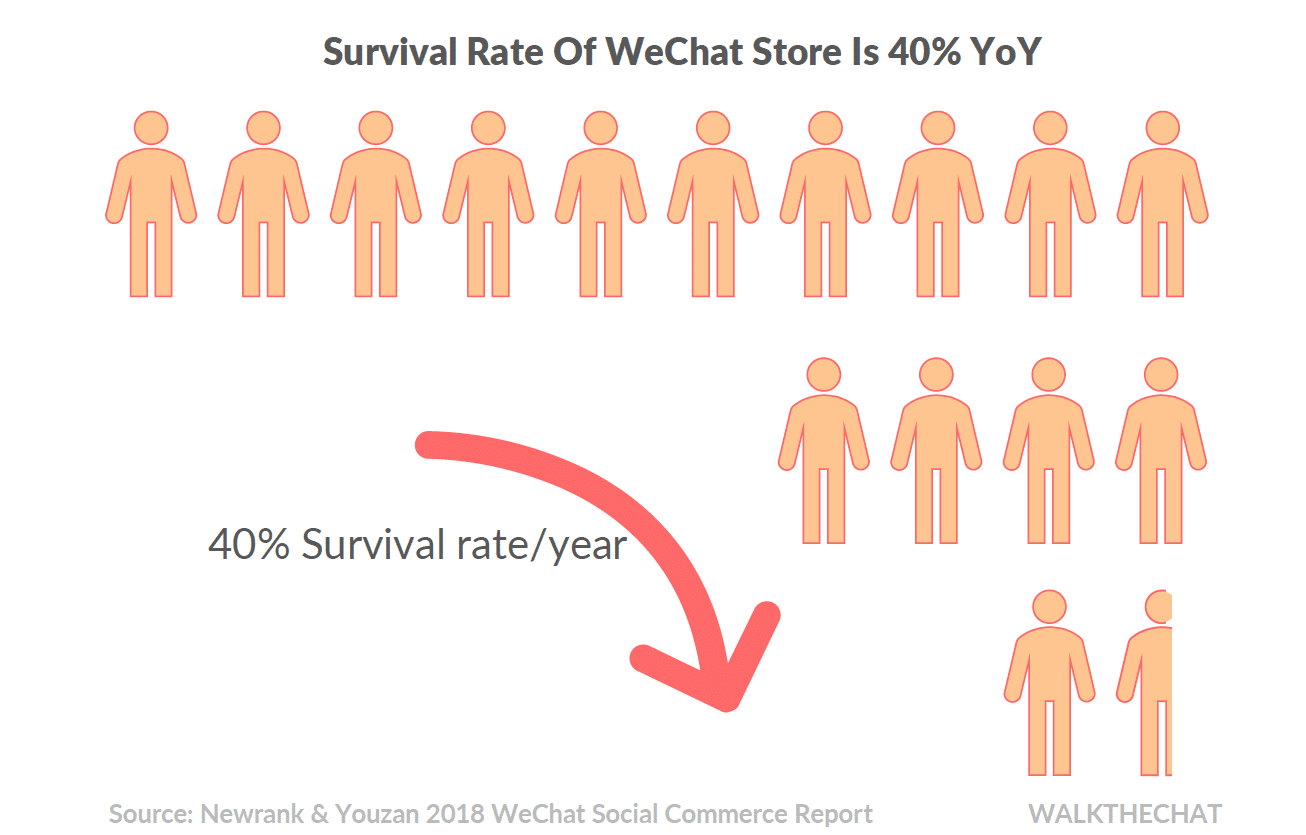

Only 2 out of 10 WeChat store could survive in the last 2 years

According to Newrank’s data, the yearly survival rate of WeChat store is 40%. This means only 1.6 out of 10 stores will survive after 2 years of operation. With the support of 3rd party tools to open WeChat stores (such as Youzan, Weidian, WalktheChat), the barrier of opening a store is low, but competition remains intense.

The market is also consolidating as large KOLs open their own WeChat store: Mr Bag 包先生, Xiaoxiaobao Mama 小小宝妈妈, Becky Li黎贝卡的异想世界, Shengyefachi 深夜发媸, Gogoboi, etc.

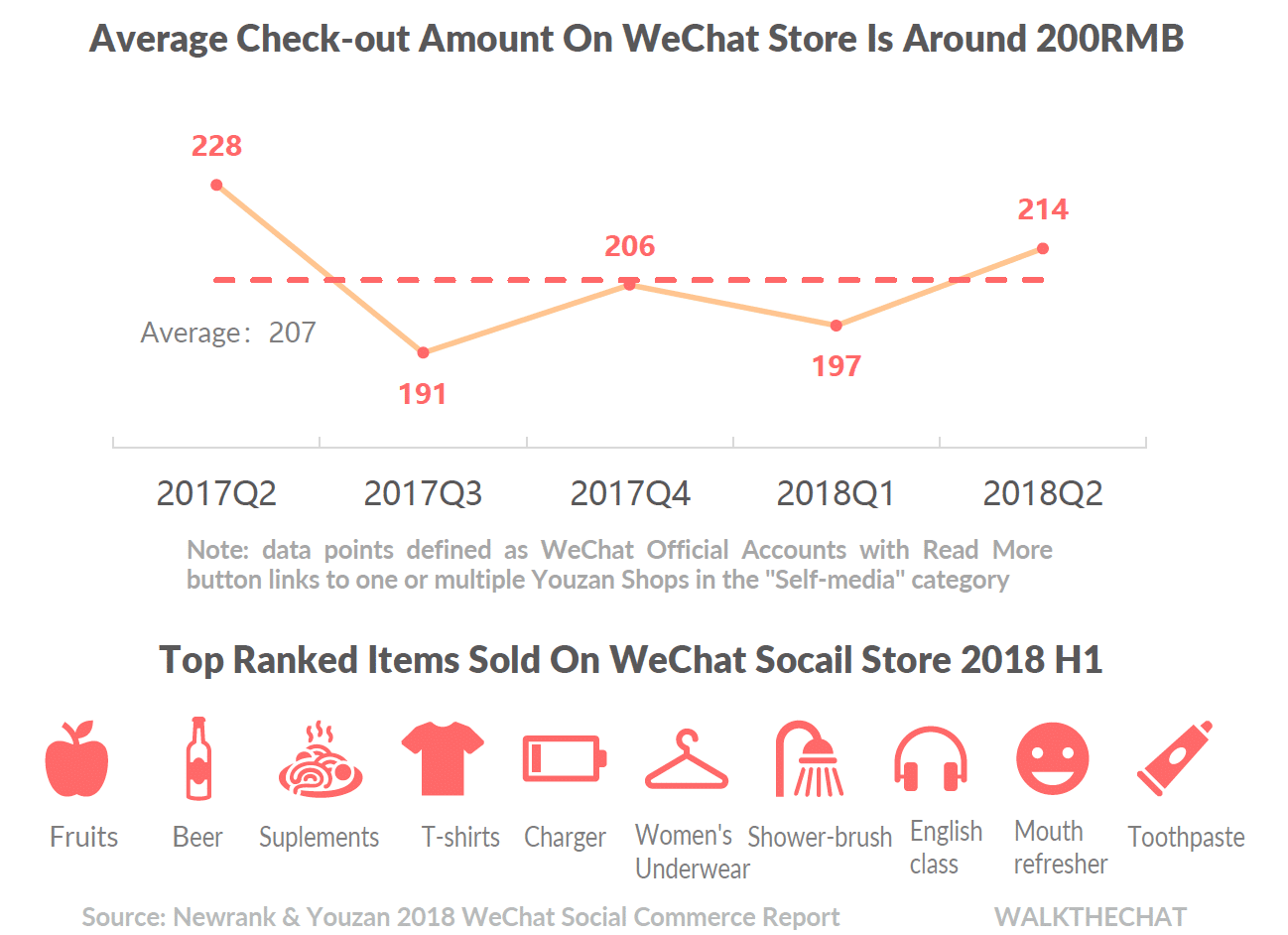

Average purchasing price on WeChat is around 200 RMB

Consumers continue to favor low price value items. As social commerce is becoming more common in all cities across China, users see WeChat as a channel for purchasing the most common day-to-day used items. Especially on social media, many of the purchases do not start with a strong intent. Instead, social commerce is often an impulse behavior driven by the emotional appeal of KOL’s content. Lower-price & daily-used items are the items with the highest conversion rate on social media.

The most commonly purchased items include fruits, beer, health supplement, T-shirt, charger, women’s underwear, shower brush, English class, mouth re-fresher, and toothpaste.

Smaller WeChat Official Accounts in lower-tier cities starts to drive their followers to WeChat shops

This causes the social commerce behavior to be more common across more accounts.

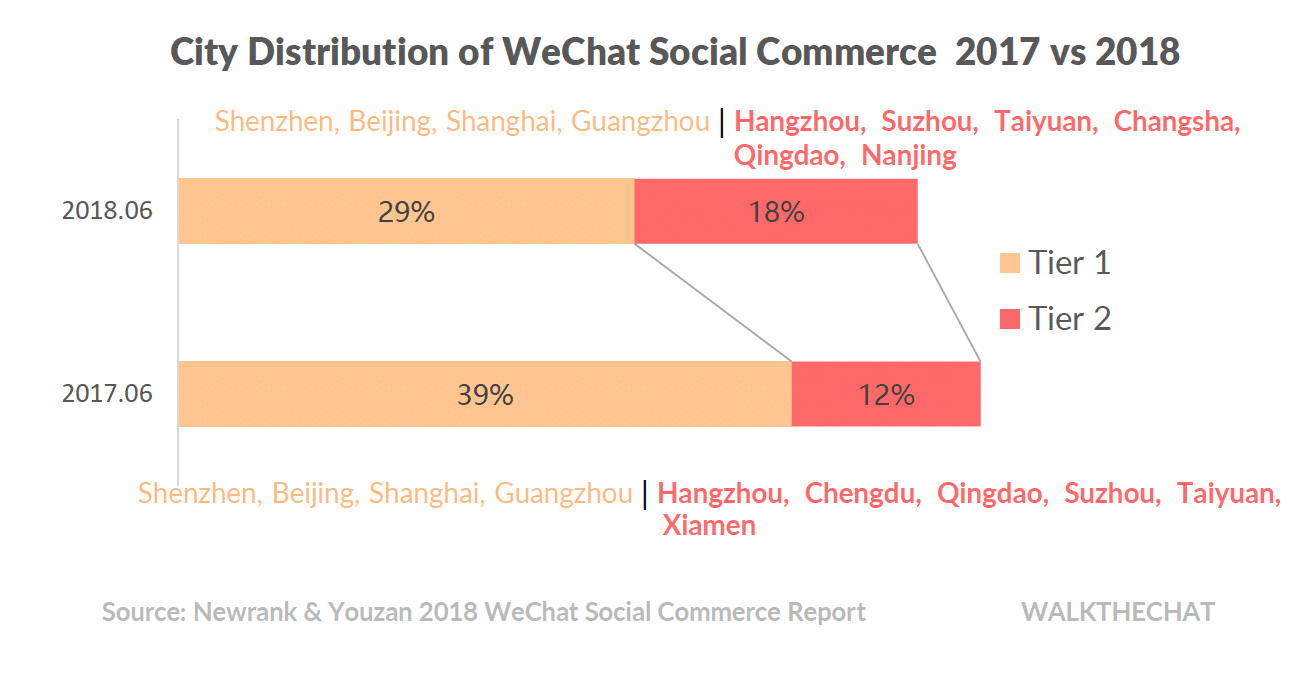

Social commerce is a phenomenon across China, not only in tier 1 cities

Social commerce used to be more centralized in tier 1 cities (39%) in 2017. In 2018, more second cities are joining the social commerce trend. Tier 1 cities have been diluted to 29% while tier 2 cities have increased to 18% of the total share.

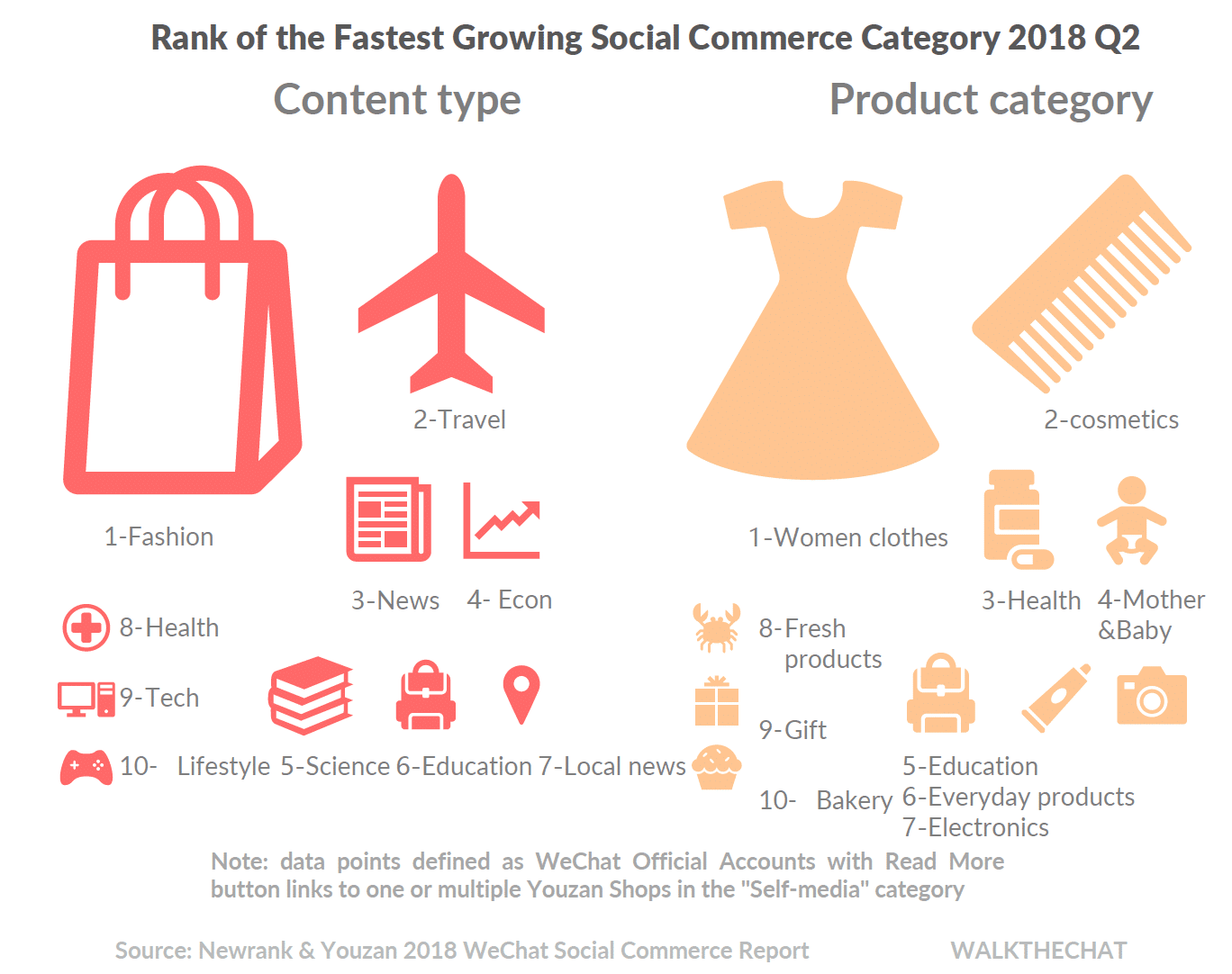

Fashion related content and women’s clothes are the categories that have the highest growth rate

Female-focused content and categories are the fastest growing type of product. Most of the biggest fashion KOLs are only focused on producing content for female users.

Conclusion

Social commerce is a nationwide phenomenon in China. The social commerce industry is becoming more dynamic as the market grows and more stakeholders are entering. As the market matures, running a profitable WeChat store is becoming more challenging than ever. Brands and entrepreneurs will need to master both content-market-fit and promotion techniques in order to stands out in such a competitive market.