App Today valued at 100 million RMB.

Restaurant Boss valued at 100 million RMB.

Yitiao raised B round of investment, valued at 600 millionRMB.

Car Professor valued at 600 millionRMB…

These sky rocketing figures are not the valuation of companies or APP’s, but the valuation of WeChat official accounts.

As user stickiness and the amount of content consumed on WeChat keeps growing, investors see growth opportunity in WeChat accounts. A new wave of investment fever for WeChat official account is rapidly taking place in China.

How do WeChat accounts make money?

Today, most WeChat accounts make money through native advertising. These accounts (KOLs) offer to mention or forward content from brands in exchange for a service fee. The cost of one piece of content starts from a few thousand RMB. But for the most popular WeChat accounts like Yitiao (一条) , one piece of native advertising message can cost 100 thousand RMB on average, and monthly revenue can add up to 30 million RMB.

More and more accounts are converting users to their own WeChat shops. By March 2015, on Weidian (one of the third party WeChat platforms) alone, users opened more than 29 million WeChat shops.

The third way of monetizing WeChat account is through O2O: attracting online users to purchase offline services. Tencent backed food delivery company Ele.me and taxi hailing app Didi Dache are some good examples.

How to value a WeChat official account?

The valuation of WeChat account depends on three major aspects:

1. Type of account

The higher the purchasing power of the followers, the higher is the valuation. A WeChat account focused high-end lifestyle activities like golf, luxury cars and fine dinning is likely to have higher valuation than an account focused on entertaining the high school students.

And a vertical industry account, meaning an account in a specific industry, is also more likely to get higher valuation than an account posting very general news. For example, an account about luxury watch sale can directly integrate the whole business cycle, from advertising, to e-commerce, to O2O conversion, within WeChat.

2. User base

The focus of this investment wave is on account with over 500 thousand followers.

3. View rate

View rate is the most consistent metric for all types of WeChat accounts. The common cut-off score of a high quality account is around 15% of view rate within 24 hours of article posting. This means that if a WeChat account has 100 million users, the view of the first article should be more than 15 million.

For accounts satifying the above three criteria, the valuation on a per user basis is between 30 to 80 RMB.

Case studies

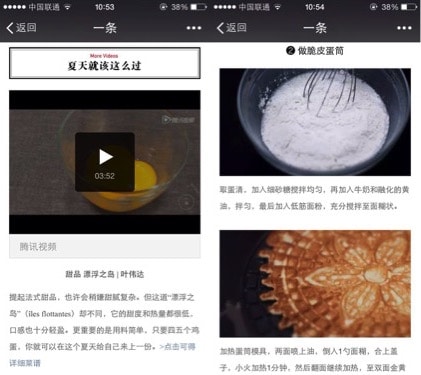

1. Yitiao (一条)

Valuation: 600 million RMB

Followers: 6 million followers

Valuation per follower: 100 RMB/follower

Funding round: B round

Monthly revenue from advertising: 30 million RMB, with every message of native advertising cost 100k RMB.

Content:

Every article of Yitiao is a well designed native advertising about a life-style product. Every message contains a videos to introduce the making of a product. For example, making of a brand of ice cream, antique furniture collector and her collections, an sculpture artist, and a custom made bike boutique.

WeChat account: yitiaotv

2. App Today 科技每日推送

Valuation: 100 million RMB

Followers: 1.4 million followers

Valuation per follower: 70 RMB/ follower

Funding round: 1st round of funding

Content: Focused on information related to Apple products, creating a second hand iphone product exchange community.

User can check the current price of an iphone product, and compare the price in different e-commerce stores, including JD.com, Taobao, Amazon Store, etc.

User can check the current price of an iphone product, and compare the price in different e-commerce stores, including JD.com, Taobao, Amazon Store, etc.

Users can also find the closest second hand iphone store, or the nearest store to fix their i devices based on current location.

WeChat id: apptoday

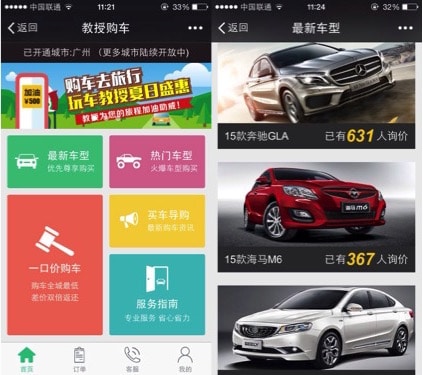

3. Car Professor 玩车教授

Valuation: 600 million RMB

Followers: 3 million followers

Valuation per follower: 200 RMB/follower

Funding round: A round

Content:

A car dealership platform for users to compare pricing, get information and make a purchase.

User can place quotation inquiry of specific model of cars directly on the WeChat account, directly contact with sale representative, and compare pricing with different dealerships in the nearest location. The complete user acquisition cycle happens within WeChat.

User can place quotation inquiry of specific model of cars directly on the WeChat account, directly contact with sale representative, and compare pricing with different dealerships in the nearest location. The complete user acquisition cycle happens within WeChat.

User can also read latest news about cars. This WeChat account even has a radio station for user to listen about car related news or maintenance tips while driving.

User can also read latest news about cars. This WeChat account even has a radio station for user to listen about car related news or maintenance tips while driving.

WeChat id: gzwcjs

4. Restaurant Boss Internal Reference (餐饮老板内参)

Valuation: 100 million

Followers: 220 thousands

Valuation per follower: 450RMB/follower

Funding round: pre-A round of 20 million RMB

Team number: 12 employees

Followers: 40% of restaurant owners; 30% of Food & Beverage entrepreneurs. Most user has high purchasing power, and is ready to make investment in restaurant industry.

Content:

This is a content focused account. 80% of original content. Among which 60-70% are original content produced by the team, and the rest are for native advertising.

Content including case studies of successful restaurant chain, last industry report and tips of how to run and manage a restaurant.

WeChat id: cylbnc

Valuation bubble?

The risk of investing in WeChat account is clear:

- Risk of WeChat being replaced by other social platforms, reminiscent of what happened to Weibo and Renren

- Users belongs to WeChat

Today, cost of acquisition of one WeChat follower ranges between 3-8 RMB, and more targeted users acquired from KOL campaigns can range from 10 to 50 RMB per followers. However, the valuation of these account ranges from 30 to 80 RMB per follower, and for some specific accounts can be up to more than 200 RMB per follower. Although cost per acquisition continues to raise over time, with more competition in even niche market, a clear gap exists between value per follower and cost of acquisition.

And when APP developers have themselves to deal with the constraints and rules imposed by Apple and the like, who is to say WeChat accounts are not a good investment?

Source:

The WeChat account with 100 million valuable and 30 million monthly revenue

Restaurant Boss valuation of 100 million is not because of the account itself

New wave of investment on WeChat account, several accounts valued more than 100million

The wave of WeChat account investment