According to a recently released Newrank.cn report, from the 1st of January to the 14th of December 2018, WeChat Mini-programs attracted 4.3 billion RMB of funding, as part of 130 different funding rounds.

This is 6 times more than the amount in 2017. Let’s have a closer look at this Mini-program investment boom.

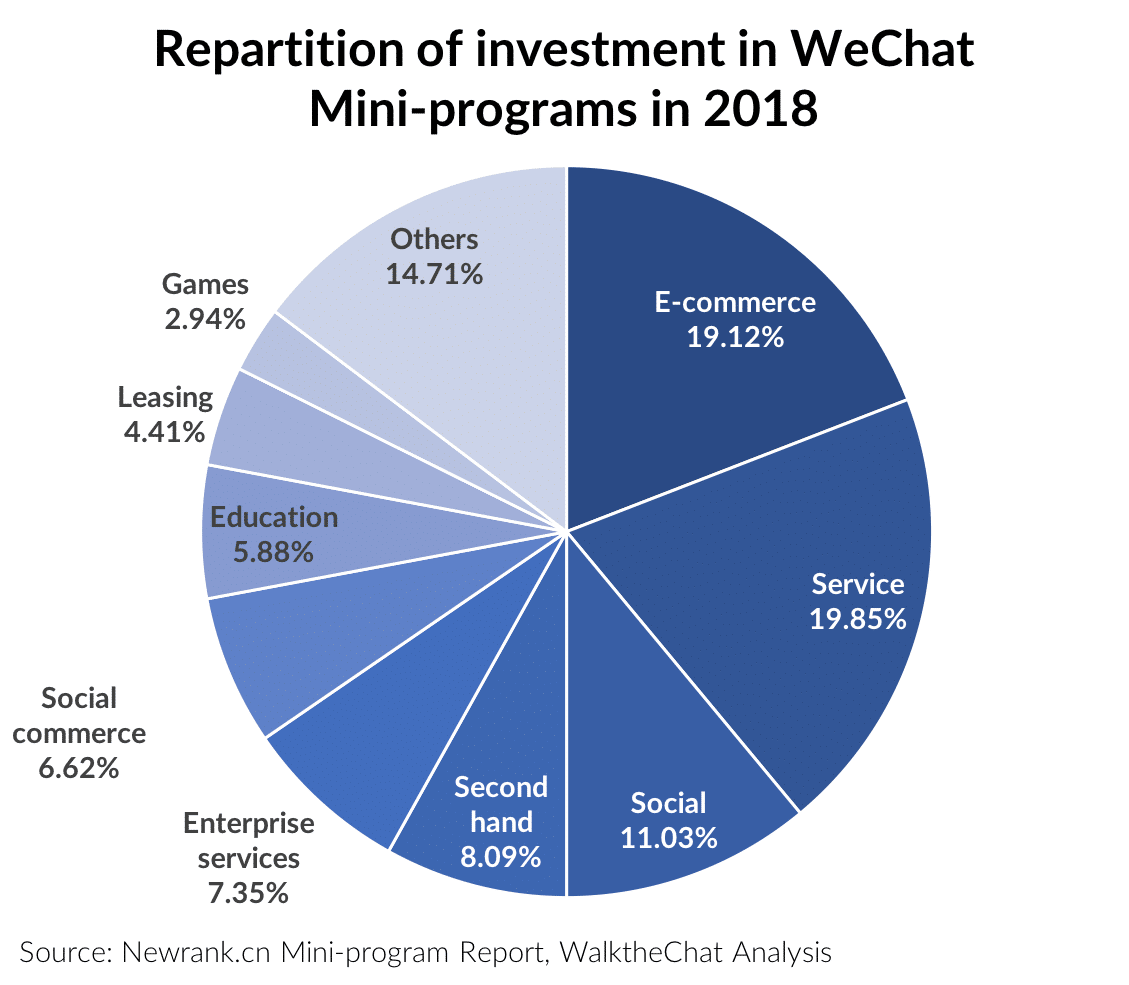

Investment focused on e-commerce and services

Most of the investment was focused on companies in the E-commerce and Service sectors.

WeChat Mini-programs have indeed been particularly popular in enabling companies and KOL’s to sell through their WeChat Official Accounts.

For instance, LOOK is a company providing KOL’s with a way to sell products via WeChat Mini-programs without having to take care of fulfilment (influencers can simply pick products from a catalogue, list them on their store, and get a cut from the sales). They raised 22 million USD in March 2018 in a funding round led by GGV Capital.

LOOK enables top KOL’s such as Gogoboi to sell a wide variety of products without having to worry about logistics.

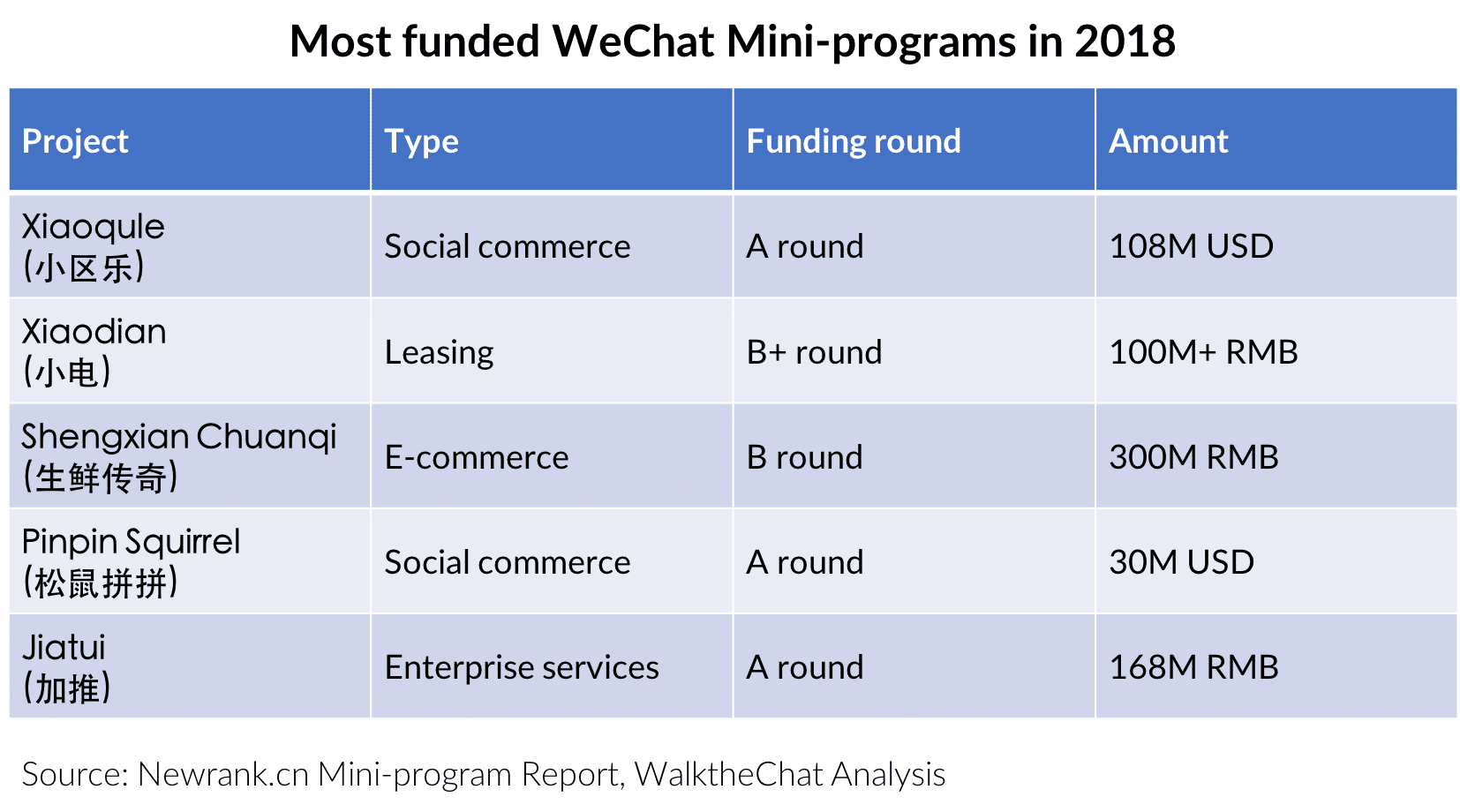

Out of the top-5 funded WeChat Mini-programs in 2018, 3 of them belong to the social commerce or e-commerce category.

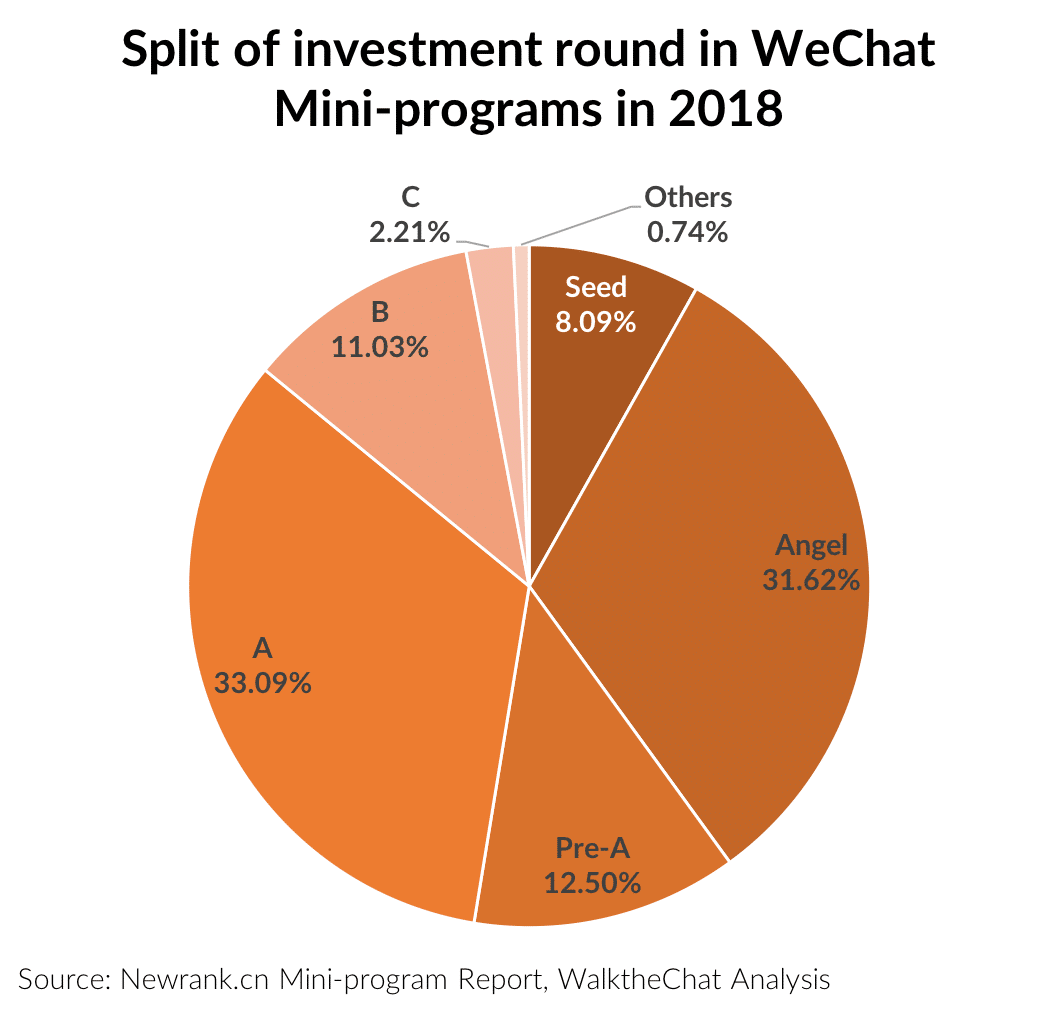

Large early-stage investments

Mini-programs are of course a new trend, and it makes sense that 85% of the investments made in WeChat Mini-programs are Round A or below.

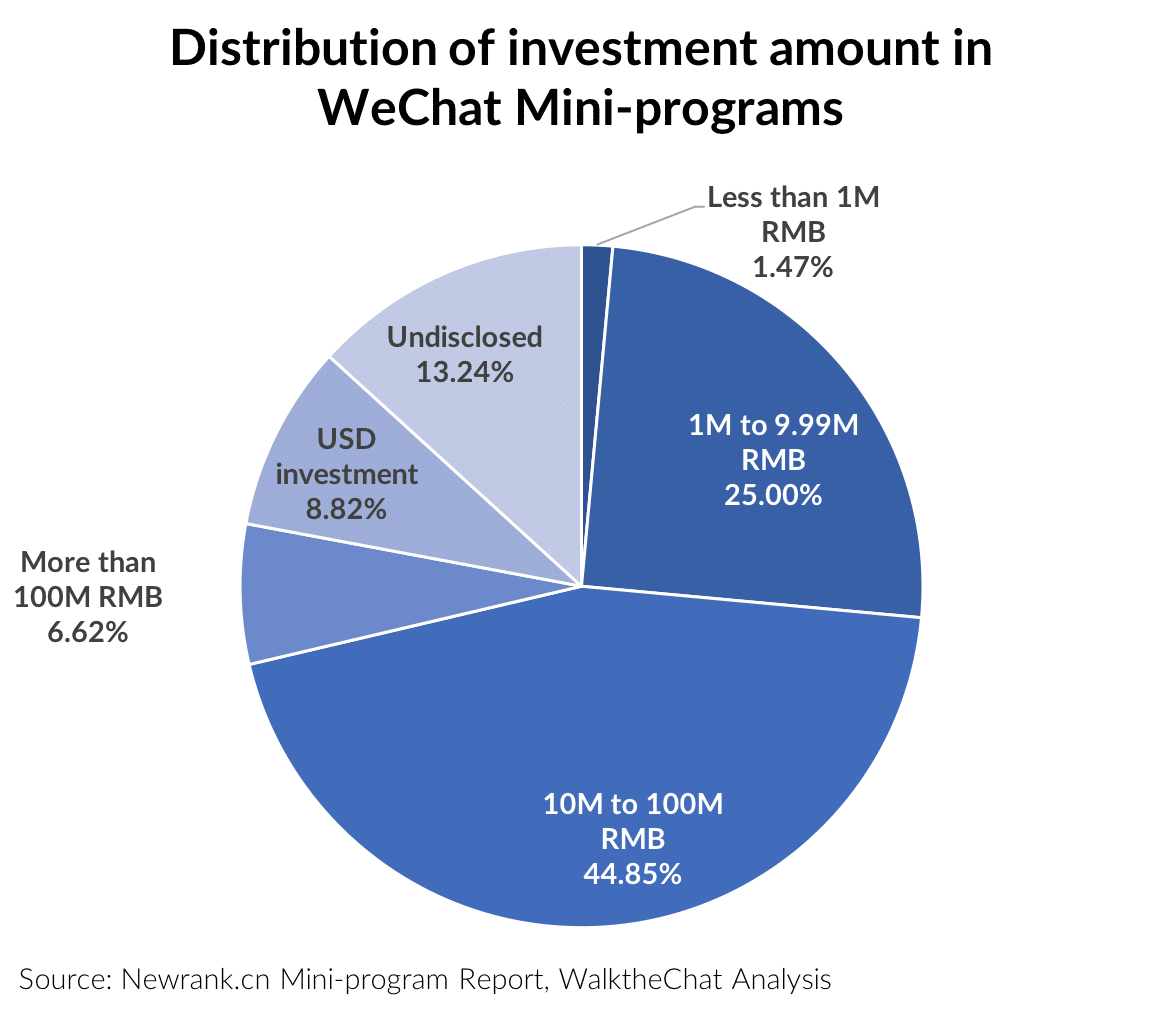

The funding amounts are however relatively large, for such early-stage rounds. This shows the eagerness of investors to heavily push the growth of promising Mini Programs. At least 50% of the funding rounds exceed 10M RMB.

Who invests in WeChat Mini-programs?

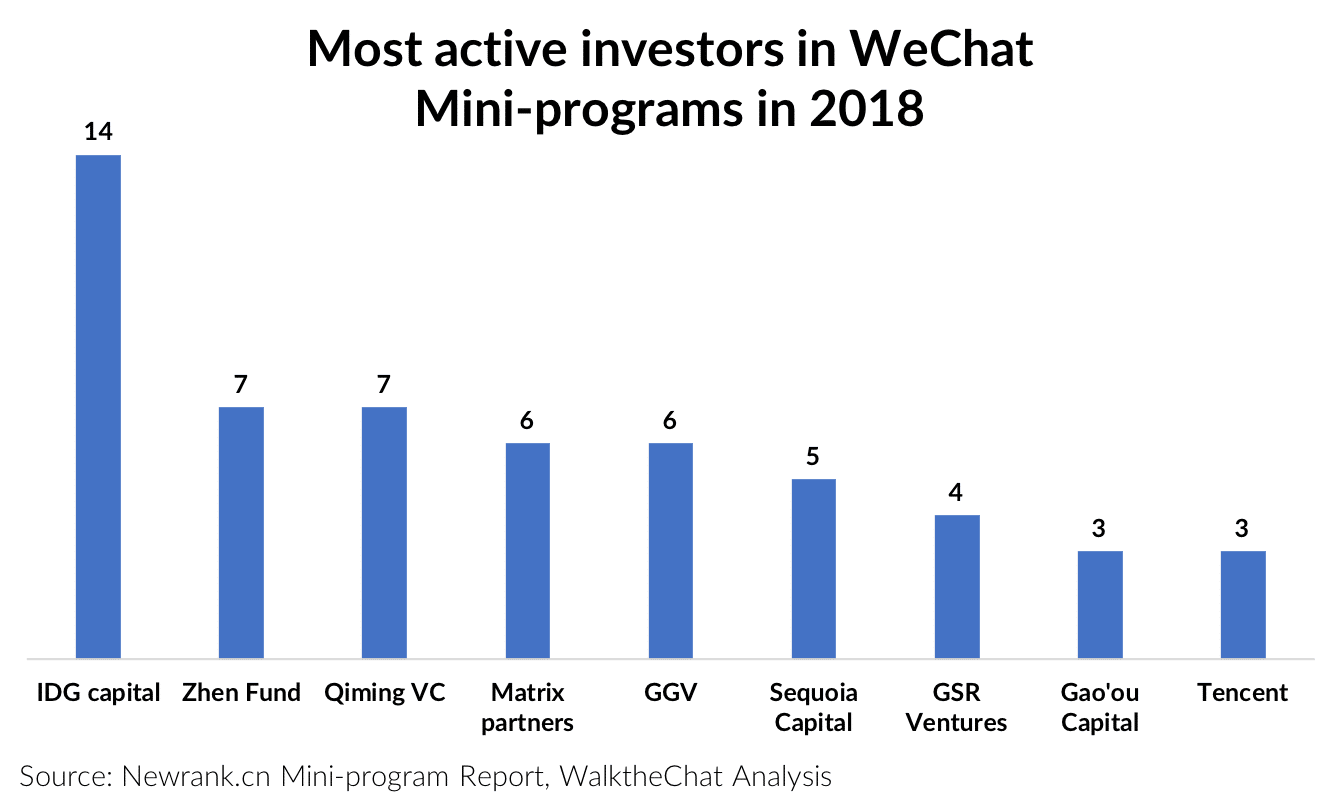

As WeChat Mini-programs tend to attract more investment in the E-commerce sector, the VC’s which are most active with Mini-programs are also the ones which have been most involved in the Chinese startup ecosystem.

This notably includes IDG Capital which invested in e-commerce platform Wish and Zhen Fund which was one of the early investors in Little Red Book.

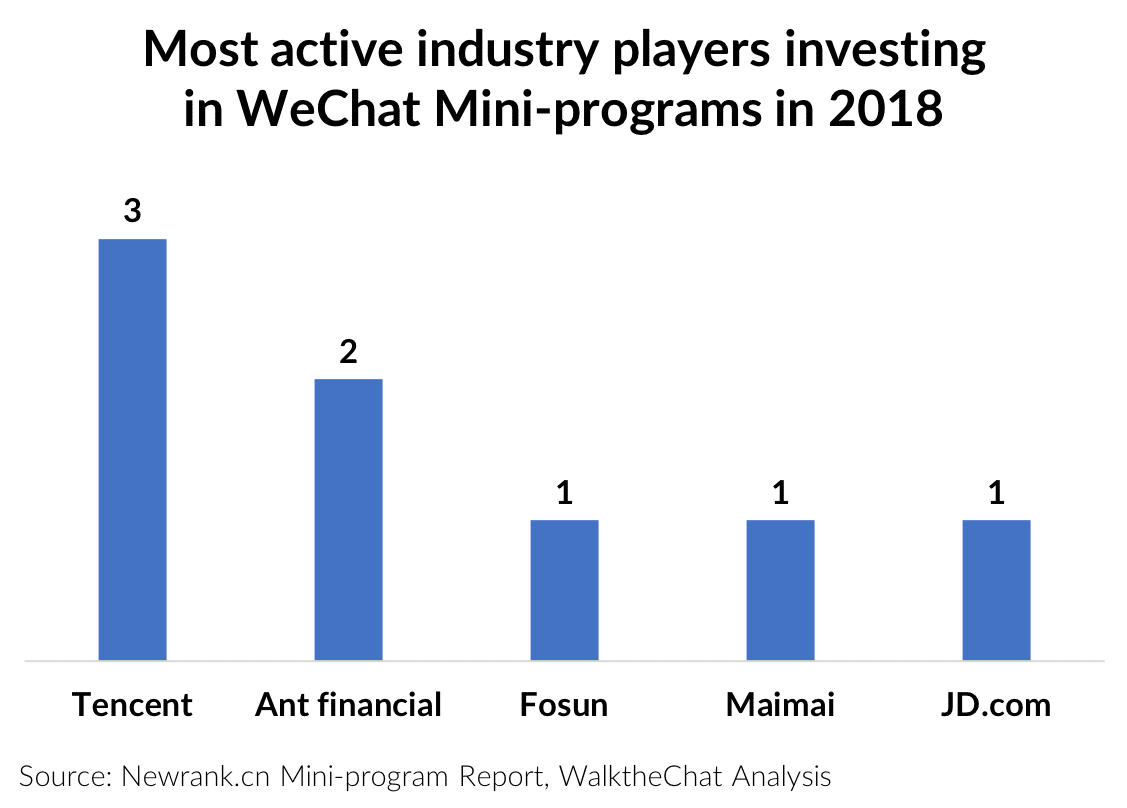

On the other hand, industry players have been more reluctant to invest in WeChat Mini-programs. Tencent is, of course, an exception, given its stakes in the ecosystem.

Conclusion

2018 saw a boom in the adoption of Mini-programs. This is true for end users, e-commerce players, influencers, but also for investors.

Mini-programs are becoming, just like traditional Apps, attractive investment products given their booming growth, strong O2O features and viral social capabilities.