WeChat Mini Program AR shopping experience

WeChat Mini Programs now enable brands to develop AR feature for the first time. As a pilot launch, WeChat collaborated with Armani to launch an AR lipsticks testing experience.

Users are able to personally try on different lipsticks simply by clicking on the various colors.

Users are also able to upload a picture to the Mini Program to test the colors. The Mini Program automatically detects the lip area and applies the selected color.

The Mini-program also has “viral” features, enabling users to easily generate a 2 by 2 test card for users to share with friends. Since lipsticks are one of the most popular gift categories, this picture uploading feature is especially useful.

However, Armani didn’t seem to experience a large increase of social mentions despite its killer AR feature launch. Most of the coverage for the new feature was carried by tech news outlets.

AR features definitely enable users to relate to the product and makes it easier to select the right color. But simply providing a state-of-art shopping experience is not enough in today’s social space. High-quality traffic generated by KOL marketing is still the key to a successful WeChat campaigns.

Tmall Global released open application channel

Tmall Global just launched a new application site aimed to attract more overseas brands. Today, Tmall Global has around 20,000 international brands. Its goal is to double the amount to 40,000 by 2022.

Application site: https://merchant.tmall.hk/

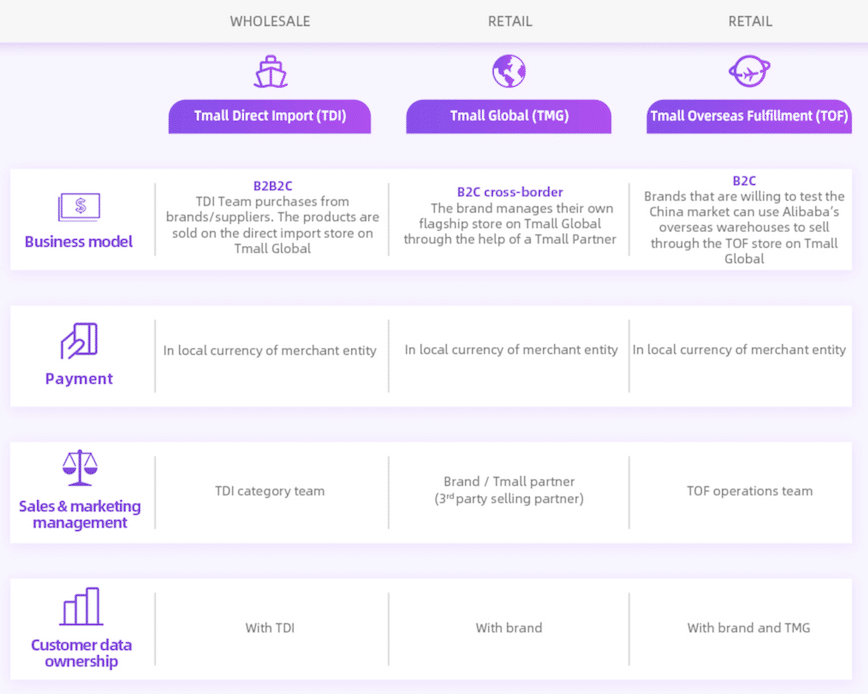

Brands can choose from 3 different models to start with Tmall Global:

- Tmall Overseas Fulfillment (TOF) – a retail model for brands with low China awareness

- Tmall Direct Import (TDI) – a wholesale model for top-selling lifestyle supermarket items (brands are required to invest in marketing)

- Tmall Global Flagship Store (TMG) – the most common method, brands will need to invest to hire a Tmall Partner (TP) to operate the store and marketing

1. Tmall Overseas Fulfillment (TOF)

This model is designed for brands with low China visibility. Brands just need to ship the product to Tmall’s overseas warehouse. The TOF team will operate the store and ship the product to end consumers. Since the inventory is stored in the brand’s home country, it’s easy to adjust the inventory if brands are not able to make a sale.

While it sounds like a good way to enter the Chinese market, without enough brand awareness, it’s unlikely traffic from Tmall will bring many if any sales conversions, unless the product is a commodity (fruits, vegetables, raw materials). A marketplace is not the right platform to build brand awareness.

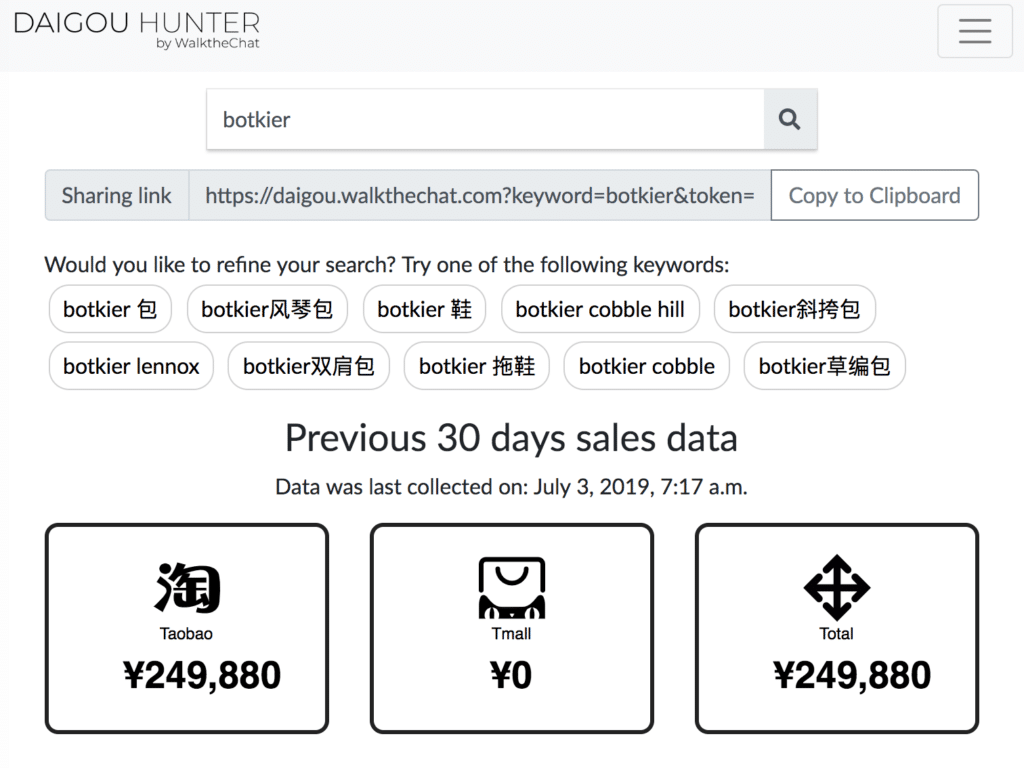

A good way to measure how high is your brand awareness is to check the sales amount of your product on Taobao (through “Daigou” unofficial resellers). Here is a search tool we built to detect brands Tmall/Taobao sales: https://daigou.walkthechat.com/

A monthly Daigou sales of RMB 100,000 or above is a good benchmark for entering Tmall.

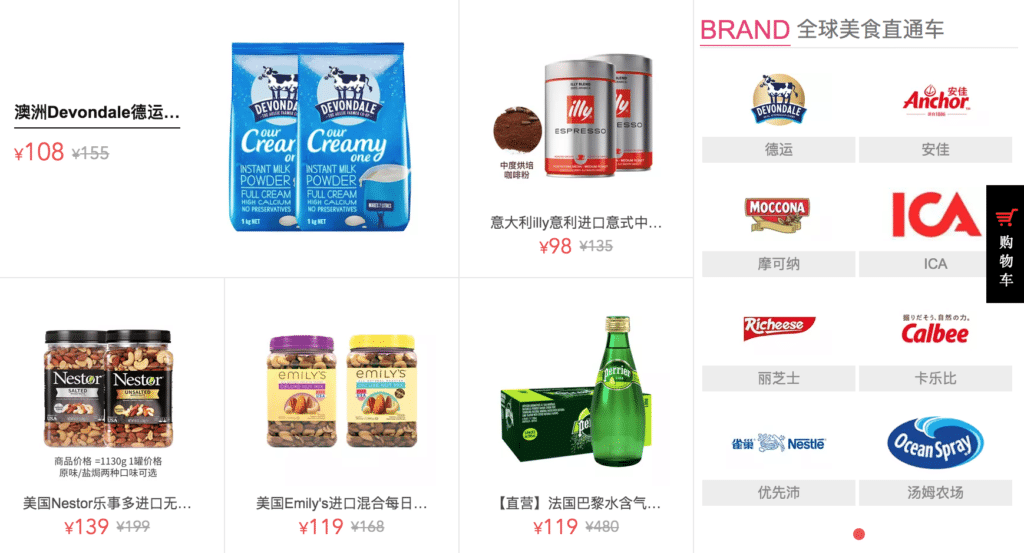

2. Tmall Direct Import (TDI)

A wholesales model for top-selling supermarket brands. Below are a few typical brands sold on Tmall Global Supermarket. These are well known for selling their hero products with discount.

3. Tmall Global Flagship Store (TMG)

For brands with enough brand awareness, and willingness to invest, they can apply for TMG and hire a TP (Tmall Partner) to help operate the store.

In this case, the brand still does not need to create a mainland China entity and can keep their inventory overseas.

This is a great model for products that cannot be imported into China via general trade. For example, health supplement products or cosmetics products without animal testing.

For other products that can be imported via general trade, they should first consider creating a Chinese company and import products via a domestic Tmall Flagship Store. This method would reduce shipping costs, and domestic Tmall Flagship Stores have much more traffic compared to Tmall Global.

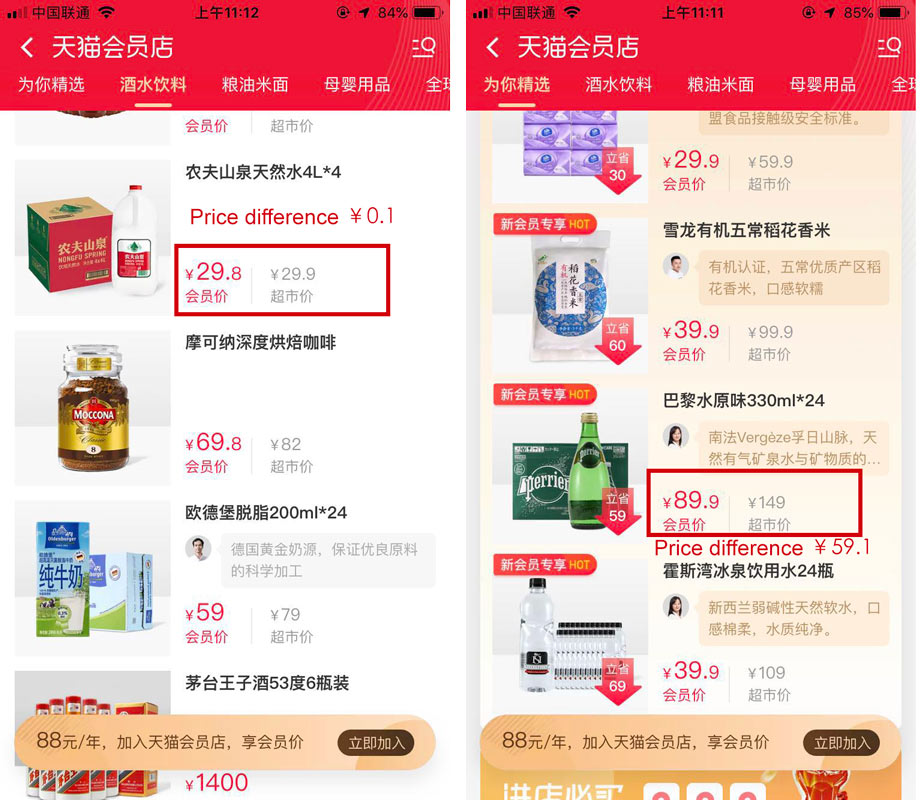

Tmall Membership Store

Tmall just launched an RM88/year membership store. Similar to the Costco model, by being a member, users are able to enjoy heavily discounted items.

According to Tmall search results, as of today, Tmall Membership Store has 3001 SKUs, and 27,157 orders per month. With a few exceptions, most of the products in the membership stores are premium products with high pricing strategy and more space for discount.

For example, 24 bottles of perrier are sold for RMB89.9 in the membership store, vs RMB149 on Tmall Supermarket. But for top-selling items such as Nongfu Spring water, the price difference is only RMB0.1.

It’s clear Tmall Membership program is targeting consumers in the top tier cities, who are used to the subscription/membership model.

JD also has a PLUS membership program charging RMB99/year. The program launched middle of 2018, and members could get discounts on over 5 million products.

For Costco, Membership revenue accounts of 90% of its income. Many players have tried this model in China but it never lasted.

But users are getting used to the membership concept using other platforms such as Ele.me, iQiyi, Tencent video. For e-commerce marketplace, investment in such features might very well pay-off on the long-run.

Short video platforms generate sales

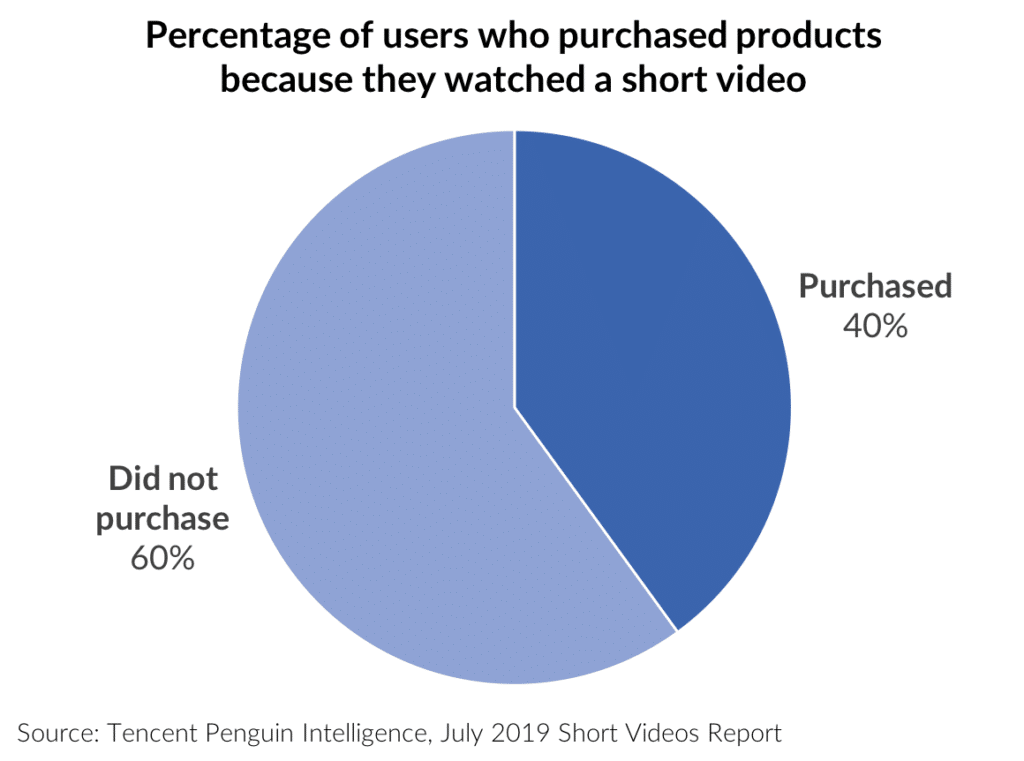

Research by Tencent Penguin Intelligence published in July 2019 shows that short video viewers are increasingly likely to use the platforms for product recommendation: 40% of users purchased a product because of a short video they watched.

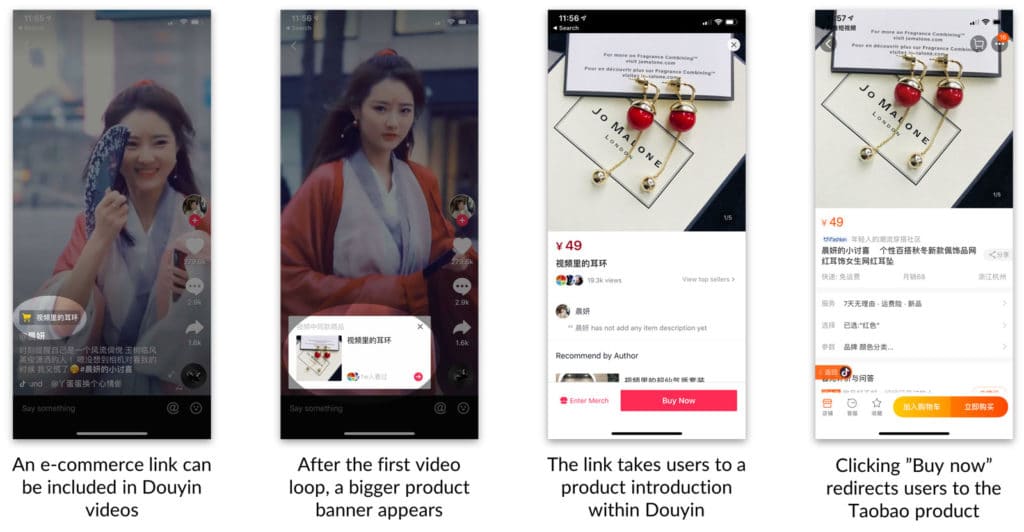

Short video platforms such as Douyin are especially likely to generate sales through a direct integration with Taobao.

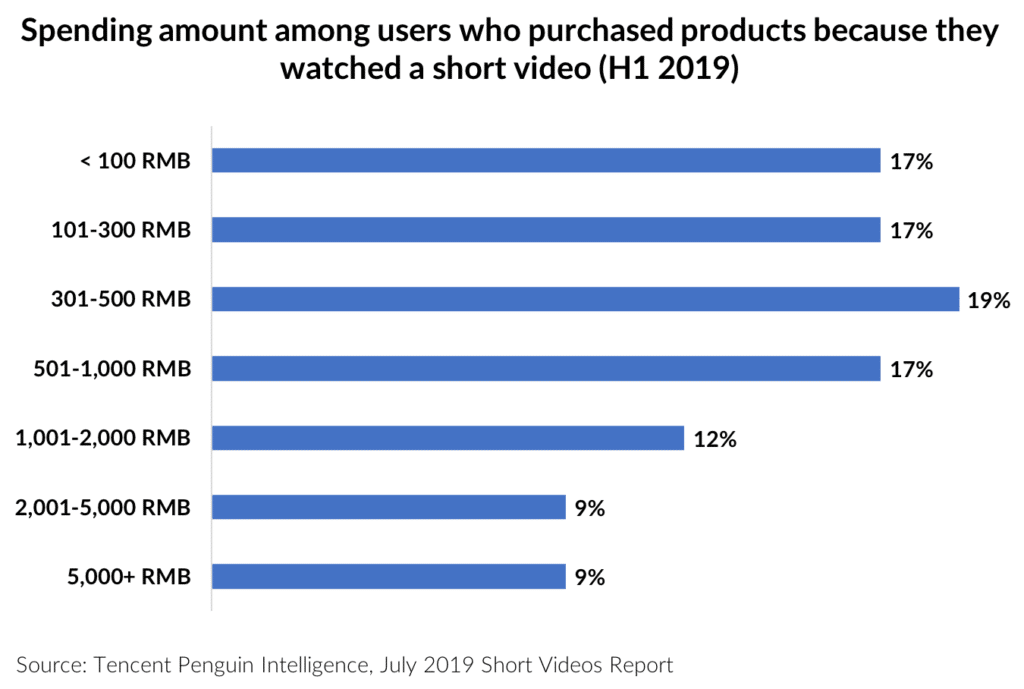

Sales on short video platforms are mostly focused on cheaper items: 53% of users spent less than 500 RMB on short video platforms during the first half of 2019. Only 9% of users spent more than 5,000 RMB over 6 months.

Because short video platforms have a large user base in lower tier cities, and because the short video format is a good fit for impulse purchases, most products sold on short video platforms are priced below 100 RMB.

Not all products are a good fit either: fashion products or cooking utensils which can easily be showcased within a few seconds of video are a better fit for short video promotion.