China’s 2025 Double 11 (Singles’ Day) shopping festival revealed significant shifts in platform strategies, consumer behavior, and technological integration. This report compiles key data and trends from the event.

1. Did people stop caring about Double 11?

This year’s consumers seemed to be incredibly rational, calmer, and even indifferent to Double 11’s promotions.

Double 11 has arrived, but it feels like there’s not much more happening at the delivery station than usual.

– Delivery worker from Shanxi Province

This year’s Double 11 was so quiet, it felt like it just passed by without much notice. Thinking back to Double 11 in previous years, it was truly a national shopping carnival. I even participated in frontline support… Actually, I most wanted to experience a day as a delivery courier, but never got the chance.

– Christine, JD BD manager

I used to work in HR at a fast fashion retailer, and during Double 11 everyone had to go support the e-commerce department. Later I left the job, and other colleagues also left for different retail companies. Every year during Double 11, I would see friends’ work updates about their performance in my social media feed. This year, there’s nothing.

I looked around and didn’t buy a single thing. – A comment on WeChat that got 667 likes

Some popular posts on Red Note include “The Truth Behind Merchants’ Collective Silence on Double 11”, “This Year’s Double 11 Is Somewhat Disappointing”, “This Year’s Double 11 Especially Shows the Economic Downturn”…

The empty delivery station, the absence of social media updates from retailers, JD’s internal reflection, and popular social posts all show an alternative reality that contradicts the past year’s Double 11 holiday vibe.

2. An Overall Increase In Monthly Active Users, As Consumer Priorities Shift Toward Health & Lifestyle Enhancement

While GMV reporting has been eliminated since 2022, following a significant hit from Covid-19 on the economy, this year’s data reporting seems even more moderate.

Tmall/Taobao

- Alibaba declined to disclose specific GMV figures

- Tmall recorded 80 brands surpassing RMB 100 million in first-hour sales on opening day, with 38,000 brands achieving over 100% year-on-year GMV growth

- Nearly 600 brands achieved transaction volumes exceeding 100 million yuan

- 34,091 brands saw year-on-year growth that doubled

- 18,048 brands had year-on-year growth exceeding 3 times

- 13,081 brands had year-on-year growth exceeding 5 times—all surpassing the same period last year.

- Brands including Apple, Haier, Midea, Markor Furniture, Xiaomi, FILA, Lao Pu Gold, Camel, Huawei, and Nike achieved transaction volumes exceeding 1 billion yuan.

JD.com

- JD.com reported that the number of customers making purchases increased by 40% year-on-year, and order volume increased by nearly 60%

- 95% of retail orders were fulfilled within 24 hours

- JD.com did not disclose specific GMV figures

Pinduoduo

- No specific GMV figures were officially disclosed by Pinduoduo

Douyin

- From October 9 to November 11, 67,000 brands on the platform achieved year-on-year sales that doubled, and over 100,000 merchants realized doubled sales through live-streaming.

- The number of individual products with sales exceeding 100 million yuan increased by 129% year-on-year, and the number of store live-streaming with sales exceeding 10 million yuan increased by 53% year-on-year.

- No specific total GMV figures were officially disclosed by Douyin

Xiaohongshu (Red Note)

- Xiaohongshu reported 77% traffic growth in the first 48 hours

- The number of orders placed on Xiaohongshu e-commerce increased by 77% year-on-year

- The number of merchants with tens of millions in turnover increased by 140% year-on-year

- No specific total GMV figures were officially disclosed by Xiaohongshu

Note: The definition of the Double 11 period changes every year. Tmall adds 3 more days, JD adds 6 days, and Douyin adds 22 days. Ironically, Pinduoduo, being the one platform not to release any sales stats, is the only platform that reduced the Double 11 period by 6 days.

| Platform | 2025 Dates | 2024 Dates | Duration Change (Days) |

|---|---|---|---|

| Taobao/Tmall | Oct 15 – Nov 14 | Oct 14 – Nov 11 | +3 |

| JD.com | Oct 9 – Nov 14 | Oct 14 – Nov 13 | +6 |

| Pinduoduo | Estimated: Oct 20 – Nov 11 | Started around Oct 14 | -6 |

| Douyin | Sep 16 – Nov 11 | Oct 8 – Nov 11 | +22 |

While we cannot do a direct side-by-side GMV comparison based on official data, we have the 3rd party data on the GMV.

According to data from Xingtu Data, this year’s “Double Eleven” generated total e-commerce sales across the entire network of 1.695 trillion yuan, representing a year-on-year growth of 14.2%. Among these:

- Instant retail (Meituan Flash Purchase, Taobao Flash Purchase, JD.com Instant Delivery, etc.) generated 67 billion yuan in Double Eleven sales, with year-on-year growth of 138.4%

- Comprehensive e-commerce platforms (Tmall, JD.com, Douyin, etc.) generated 1.6191 trillion yuan in Double Eleven sales, with year-on-year growth of 12.3%

However, note 2025 (October 7 – November 11) statistical period included 7 additional days compared to 2024 (October 14 – November 11). This is 24% more days counted towards stats, while sales only increased by 14.2%. It’s hard to tell if sales really increased or decreased from this macro data.

We can also see the impact via each platform’s active users.

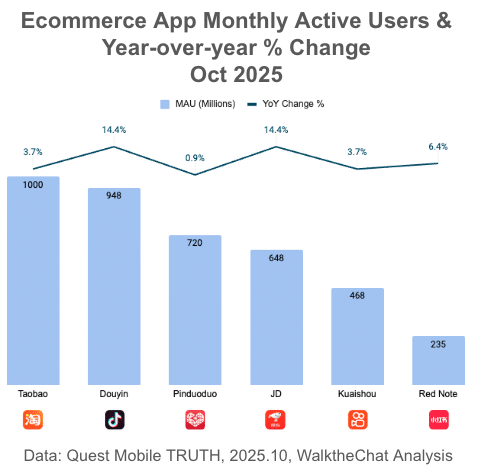

All the e-commerce platforms have more active users in 2025. Douyin and JD experienced the strongest user growth in October, with a 14.4% increase compared to October 2024. Each platform is having the promotion holiday earlier; Douyin’s 57-day Double 11 promotion started as early as September 11th.

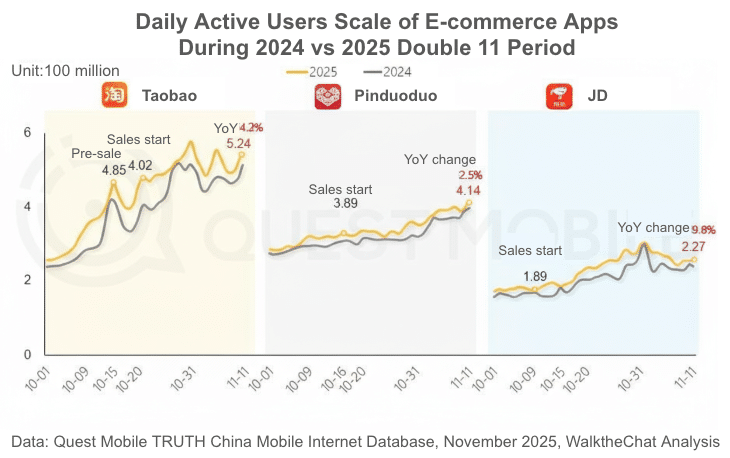

Looking more closely at daily active users, Taobao, Pinduoduo, and JD overall saw more traffic in 2025 than in 2024. JD especially has a solid 9.8% YoY increase this year. While Taobao saw a 4.2% increase in traffic.

According to the platform Jiuqian, Entertainment leads with exceptional growth of 1,177.73%, followed by Medical Products (47.50%) and Transportation (31.14%). Healthcare and wellness categories show strong momentum, while traditional categories like Baby & Infant and Skincare maintain steady growth. The data reflects shifting consumer priorities toward experiences, health, and lifestyle enhancement during the Double Eleven shopping festival.

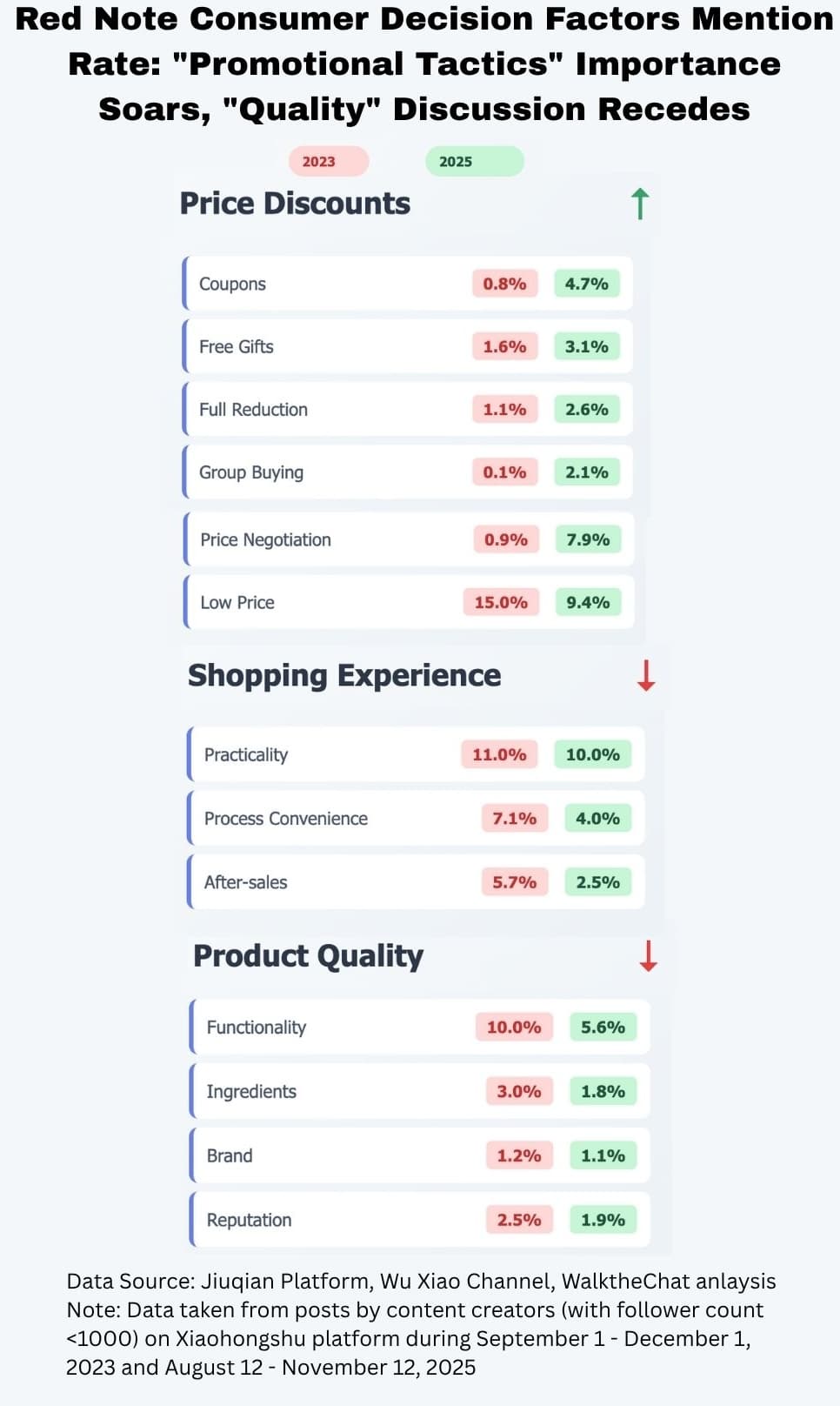

3. Consumers care more about discounts and less about quality

Social media discussion mention rate related to decision-making shows the shift from quality-focused purchasing decisions in 2023 to deal-seeking, promotion-driven behavior in 2025. Overall, discount discussions have increased, while discussions about the shopping experience and product quality are dropping.

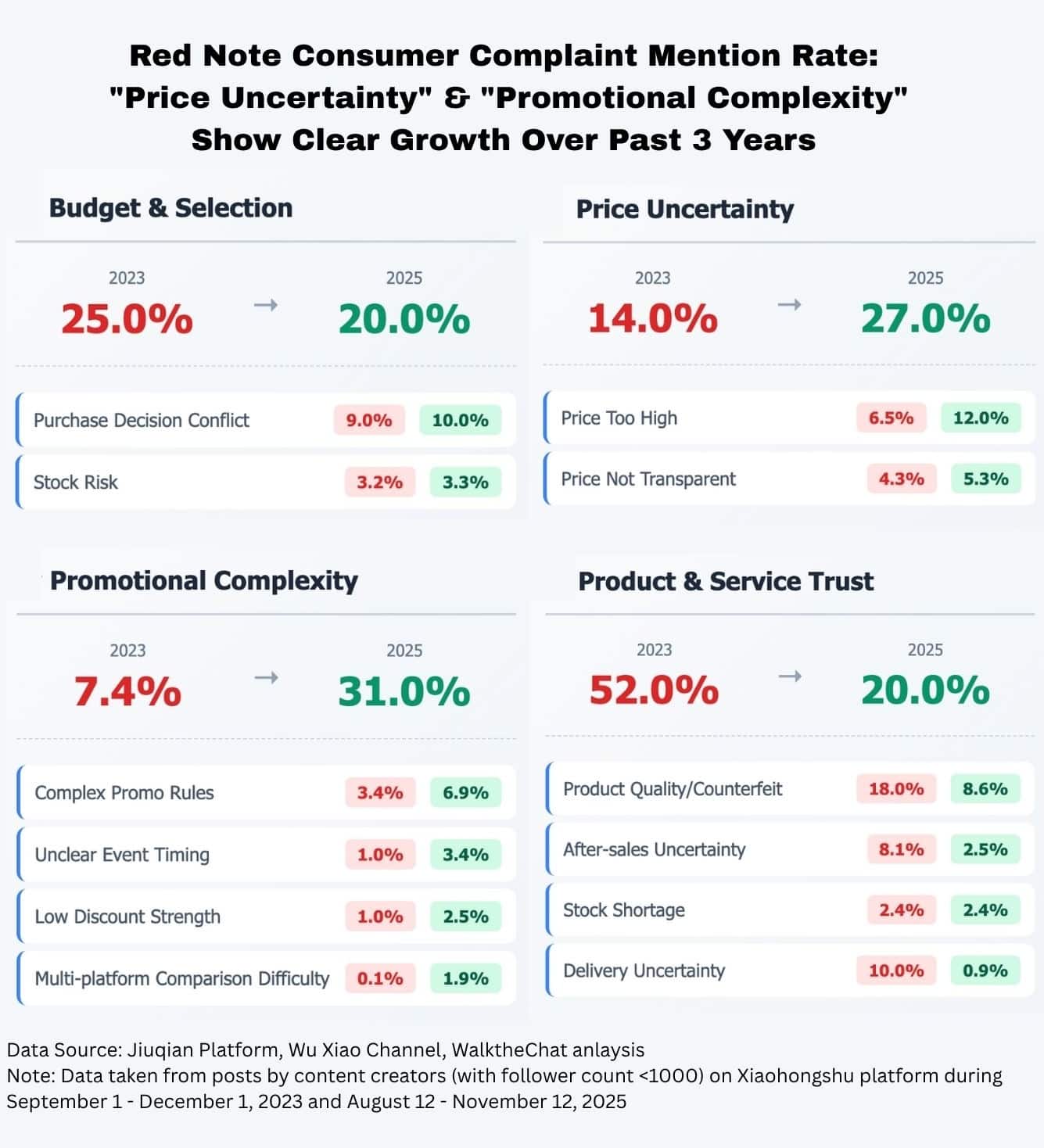

Even though platforms have implemented a simpler coupon structure, complaints about promotional complexity have still increased from 7% to 31%, remaining the biggest complaint. While fewer consumers are mentioning decision conflicts or complaining about product quality or service, the share of customers complaining about price uncertainty has increased from 14% to 27%, showing a lack of transparency and trust.

4. Simplified Promotional Rules

Taobao/Tmall: Introduced “official instant discounts” and 9-fold (10% off) consumer vouchers to eliminate complex bundle requirements; invested 5 billion yuan in 88VIP premium membership subsidies

JD.com: Ran a 37-day campaign with “Prices Torn in Half” slogan; reported +40% user growth and +60% order growth but did not disclose GMV

Pinduoduo: Continued “Daily True Low Prices” strategy with perceived reduced promotional intensity

Average discounts: Maintained at 83-85% across platforms (equivalent to 15-17% off), consistent with recent years according to CITIC Securities research

Consumer Response:

Simplified rules aimed to reduce the “calculation fatigue” from previous years when consumers stayed up late studying complex discount formulas and using Excel to calculate per-unit prices.

Conclusion: The New Normal Double 11’s Shifting to Rational Commerce

China’s Double 11 2025 while recorded increases in monthly active users, the event’s character has transformed from a frenzied consumer spectacle into a more subdued, value-driven shopping period. The data tells a story of maturation. Despite platforms’ efforts to simplify promotional rules, consumer complain shows trust and transparency that discount simplification alone cannot resolve.

Brands should adapt to this calmer, more discerning consumer mindset, embrace sustainable growth over spectacle, genuine value over manufactured urgency, and long-term customer relationships over short-term GMV gains.