It’s been a difficult year for Tencent with tough competition and increasing regulation around gaming. Let’s see how this impacted the company’s financial performance.

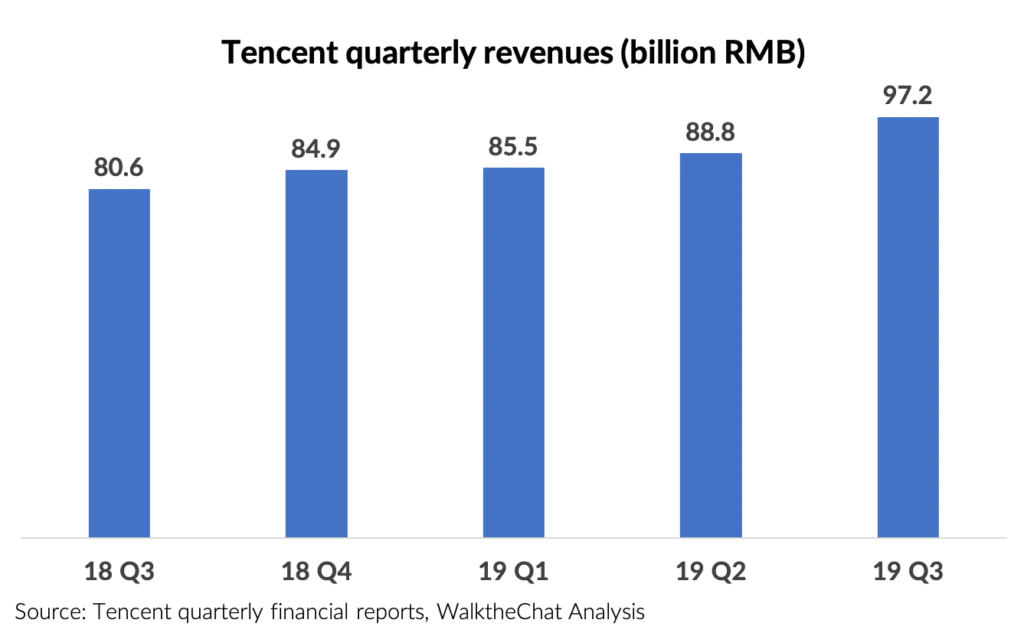

Revenues are still growing steadily

Revenues of Tencent have kept growing at a relatively steady pace, with a 21% YOY increase.

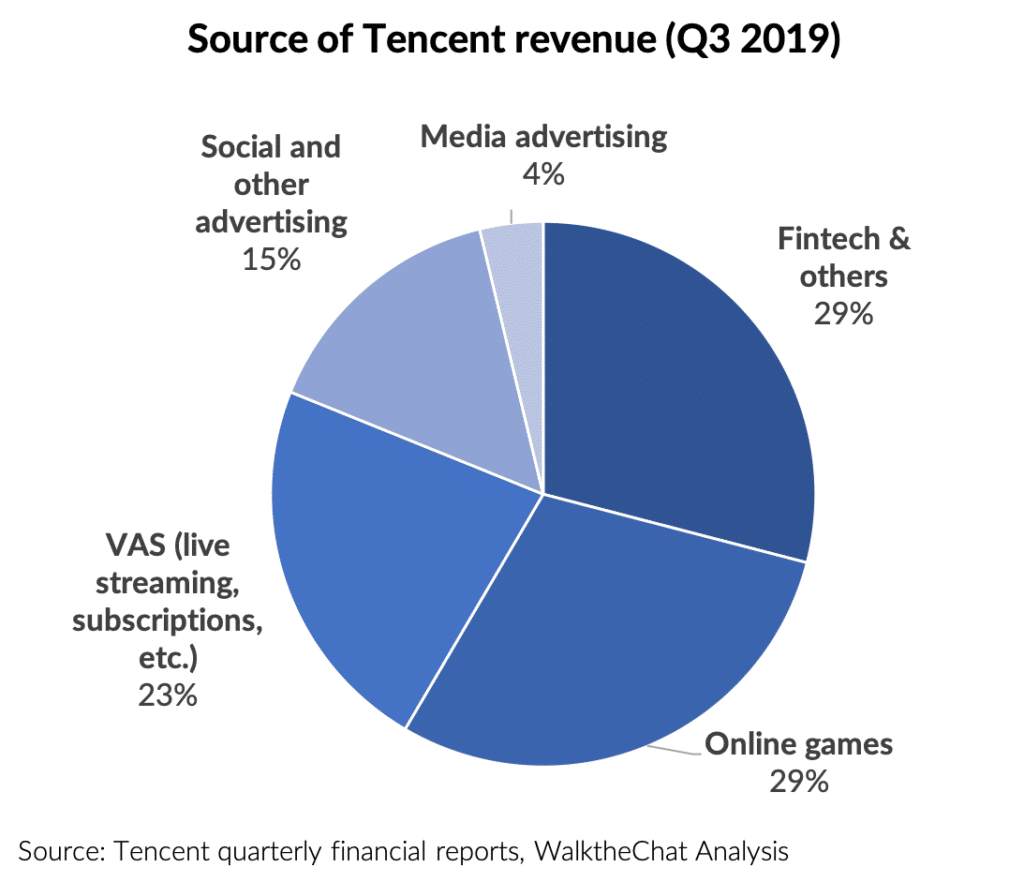

This growth has mostly been led by the expansion of the Fintech & Cloud computing sectors for Tencent. They now make up more than 29% of Tencent revenues.

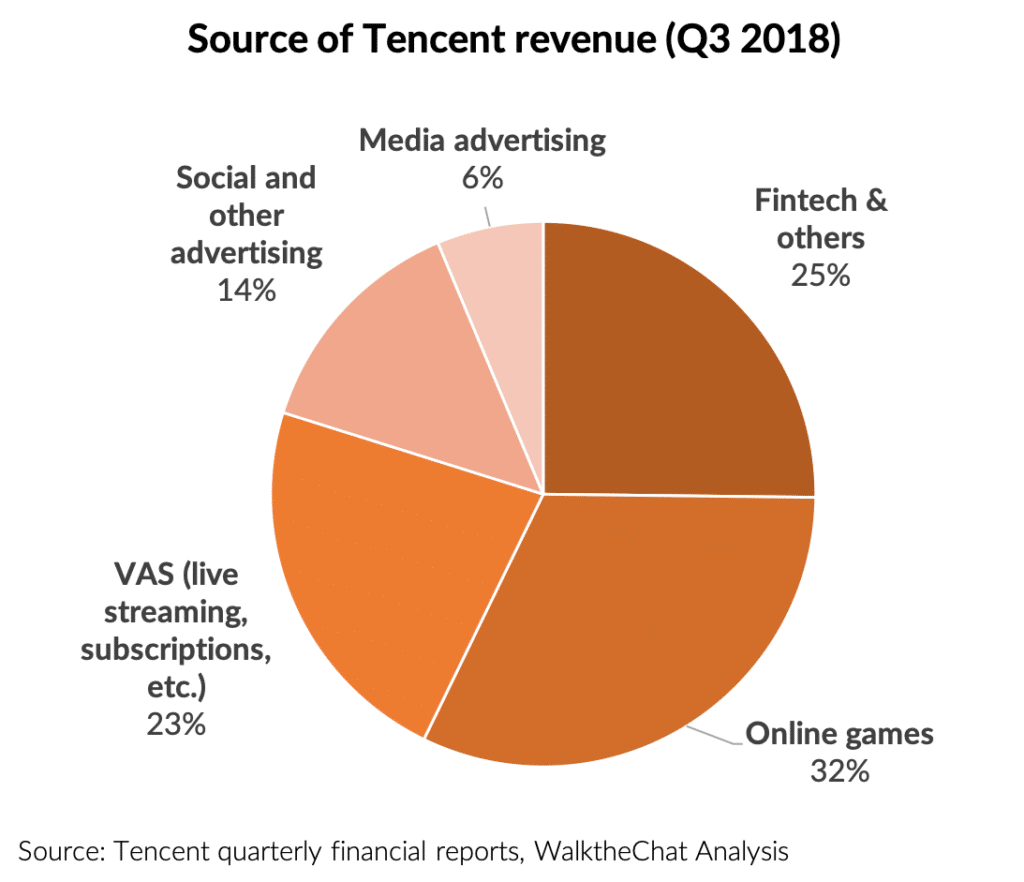

In Q3 2018, Fintech and cloud computing only made up 25% of Tencent revenue.

Programmatic social advertising (such as WeChat Moment advertising) has been growing from 14% to 15% of total revenue YOY, while media advertising (such as Tencent Video ads) went down.

This shift is due to the increase of inventory made available to advertising for WeChat Moment ads.

These figures illustrate the ongoing transformation of Tencent from a gaming-focused company into a (financial?) services company.

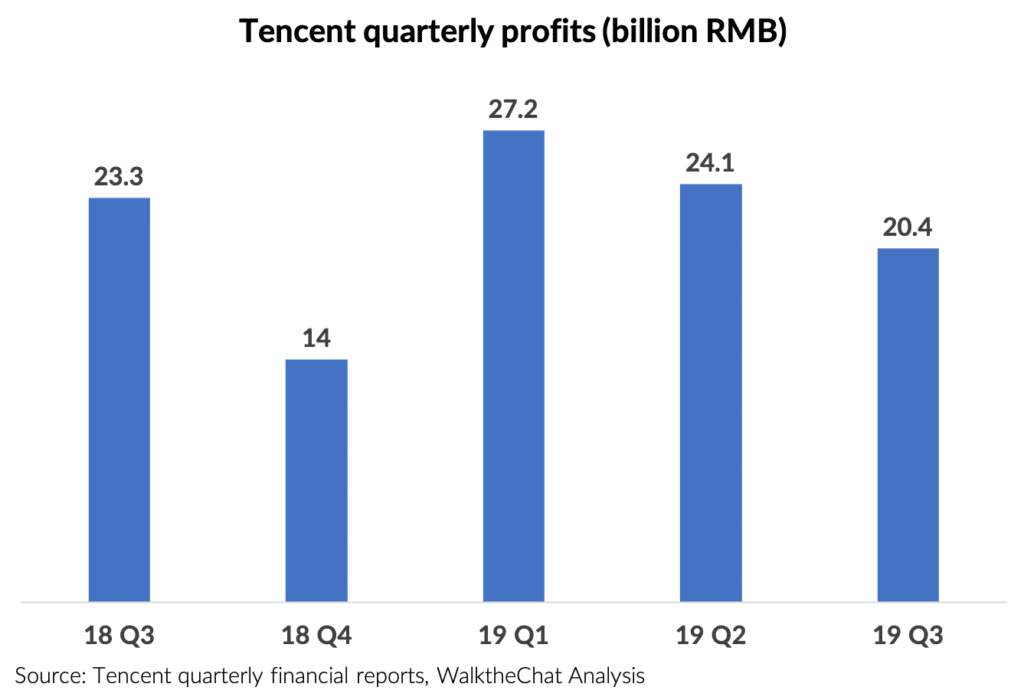

Drop in profits

Although revenue figures seem encouraging, the company also experienced a drop in profits of 13% YOY that disappointed even the most pessimistic analysts.

This underwhelming performance is in part due to the drop in advertising revenues as marketers are tightening their budgets. Another contributor was the increase in the cost of revenue (+21% YOY) and other administrative costs.

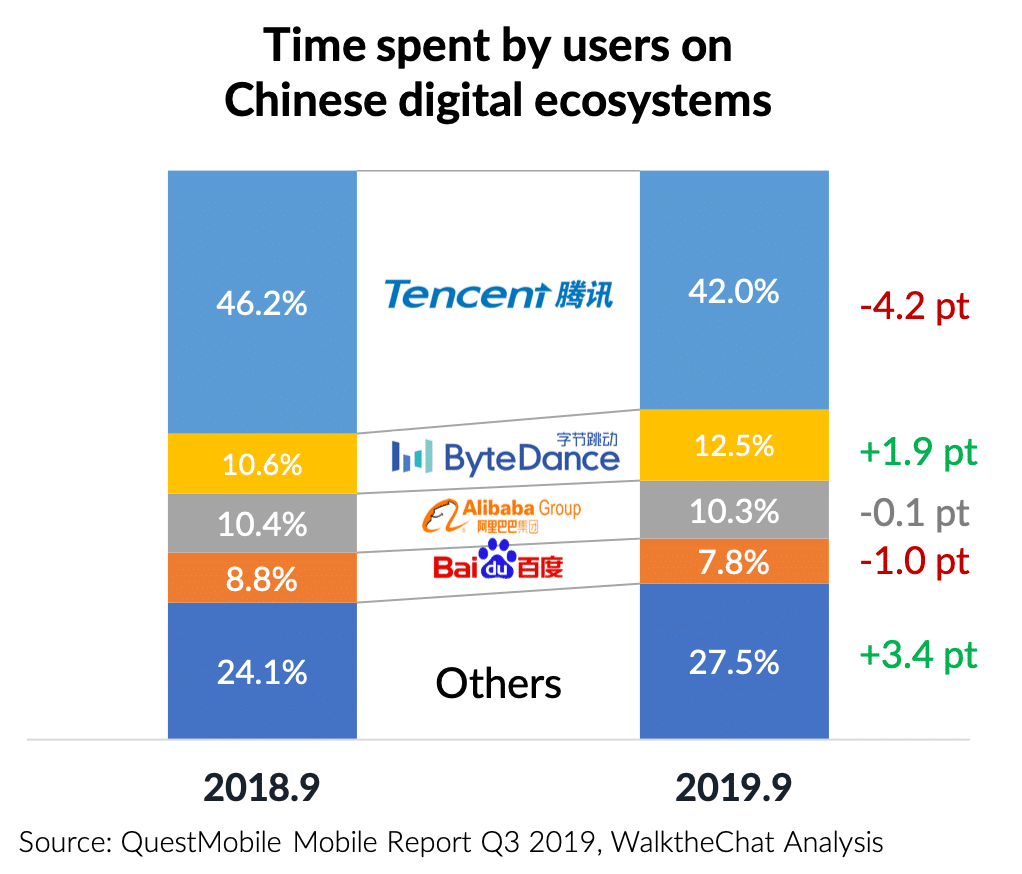

Advertising revenues also suffered from competition from ByteDance, which is taking more and more user time away from the Tencent ecosystem.

The financial results missed the estimates of investors, who were expecting a rebound from Tencent. The company had been impacted by increasing regulation from the Chinese government, which slowed down game approval and limited screen time in an effort to protect younger users.

There is however good news on the gaming front: the launch of the mobile version of Call of Duty was a tremendous success, gathering more than 100 million downloads in a month.

New game licenses are now being issued, but it will take time for Tencent to go through an accumulated backlog of about 7,000 games to publish, and to start monetizing these games in a significant way.

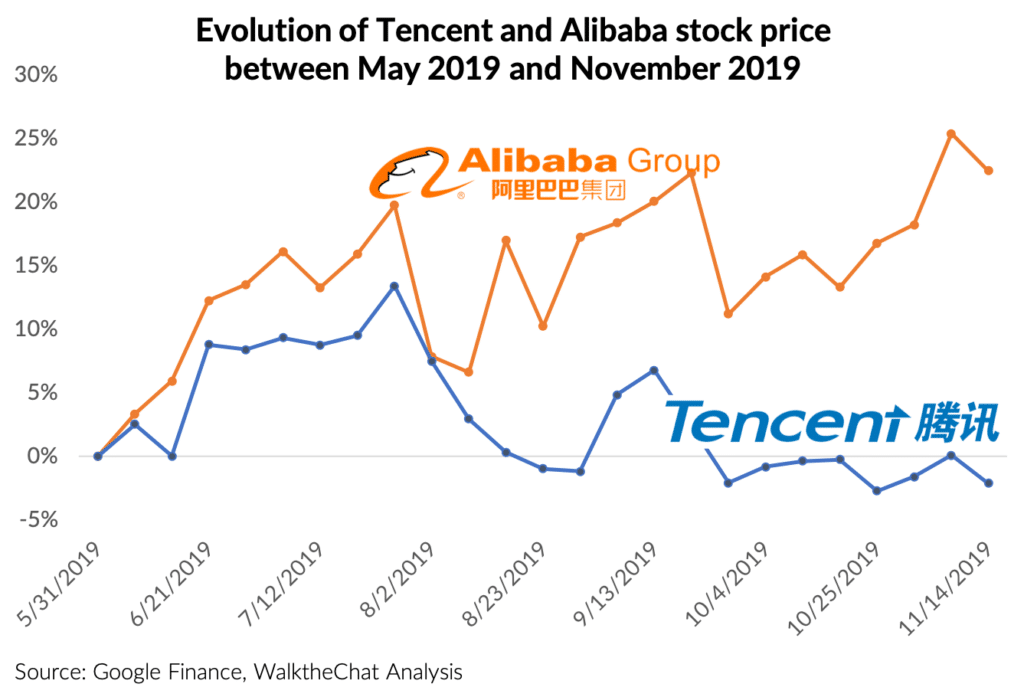

The decrease in profits impacted Tencent’s stock price, which clearly underperformed compared to its archrival Alibaba. Between the 31st of May and the 14th of November 2019, Tencent’s stock went down 2% while Alibaba’s stock price was up more than 22%.

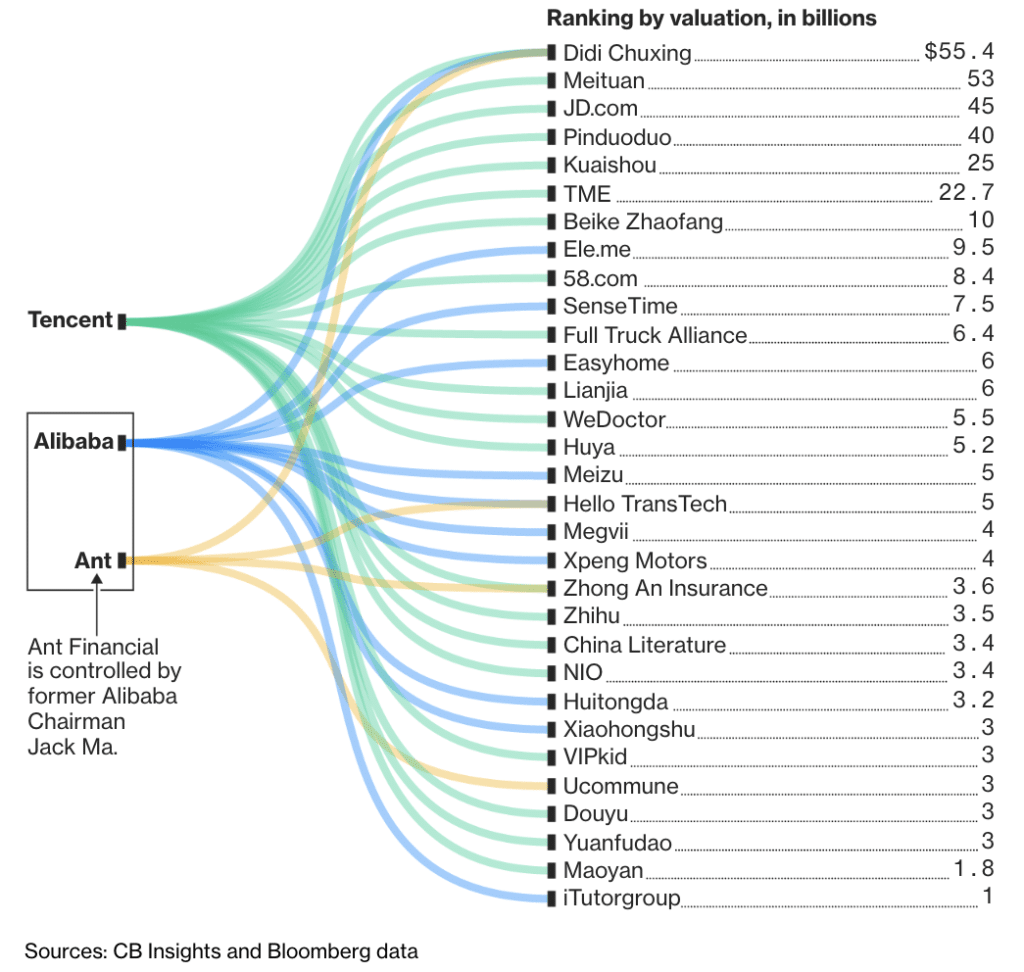

Decreasing gains from M&A activity

Tencent investments didn’t help its bottom line. Its portfolio companies in China are worth roughly $107 billion, according to Bloomberg, but Q3 2019 saw a 90% drop in one-time gains from these investments.

Tencent, however, stated that it would maintain its aggressive pace of investment over the coming months.

Monthly Active Users still growing

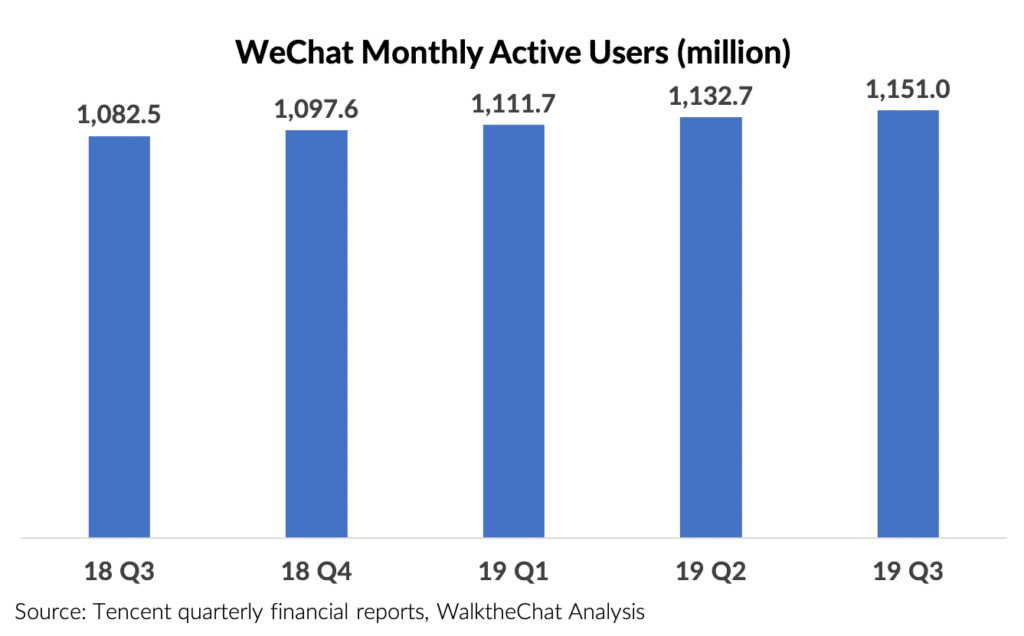

There is however a silver lining for Tencent: despite having almost saturated the social media market in China, its Monthly Active Users (MAUs) figures keep growing.

WeChat MAU’s grew to 1.151 billion, at a healthy 6.3% YOY growth rate.

Daily Active Users (DAUs) of WeChat Mini-programs reached 300 million as of the 31st of September 2019. This is booming growth given Tencent had reported 200 million mini-programs DAUs a bit more than one year prior, in August 2018.

QQ disclosed some more disappointing results. MAUs were down 8.9% YOY (to 731 million). Tencent had previously tried to spin QQ results more positively by breaking down mobile MAUs numbers, but these are also dropping at a fast rate (a 6.4% YOY decrease).

Conclusion

Tencent is showing healthy revenue growth, but a drop in profits. The company is going through a tough patch, caught between gaming regulation, increasing competition, and new services (such as financial services and cloud computing) which are yet to show their full potential.

There are however reasons to be hopeful: the tide is turning when it comes to game approval, and WeChat Payment and financial products are likely to keep bringing a growing share of Tencent revenues.