Tencent just released it’s Q4 2018 financial report and 2018 annual report. The report provides insights about the overall strategy of Tencent, and the future of WeChat and QQ.

Financial growth

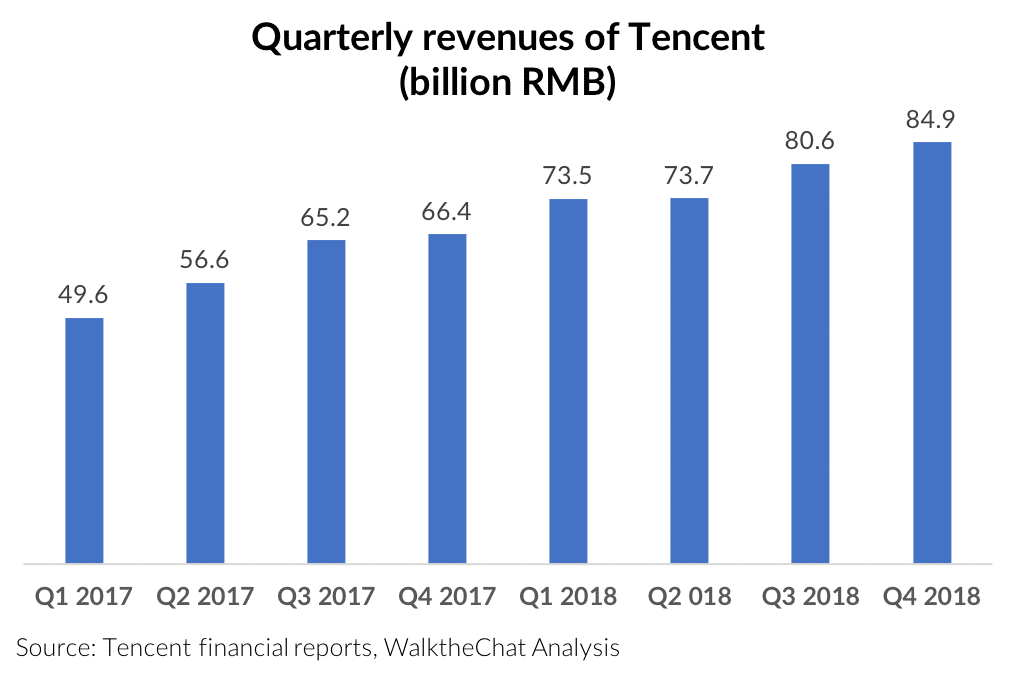

Tencent continued on a steady growth of revenue: revenues reached nearly 85 billion RMB, a healthy 28% YOY increase.

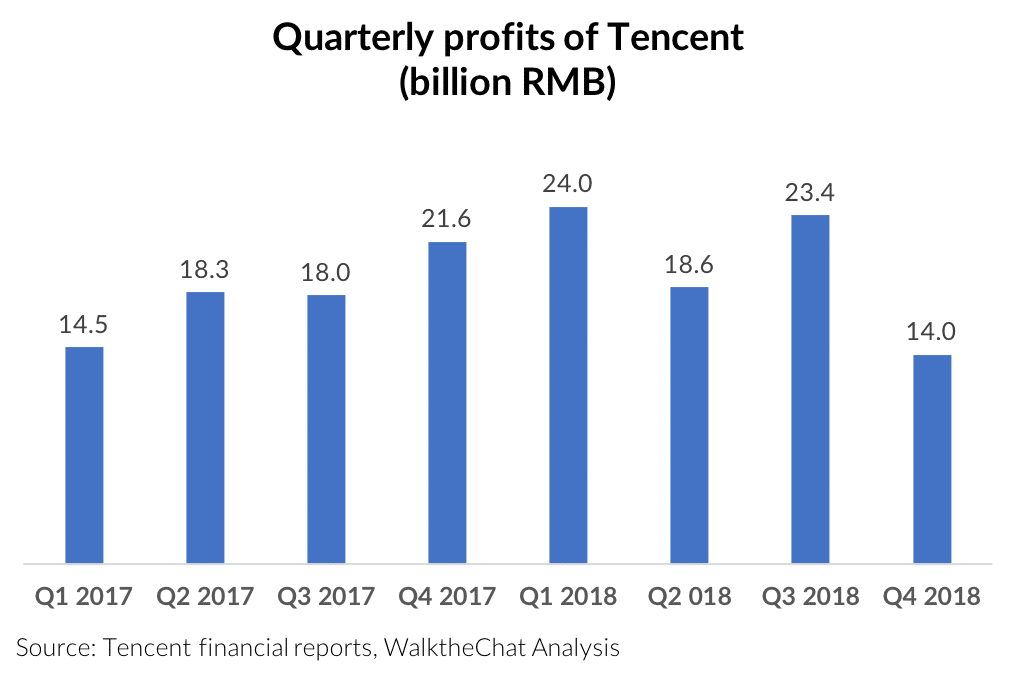

The company however delivered disappointing profits of 14 billion RMB (a 35% YOY decrease), below analysts 18.4 billion RMB forecasts.

This decrease was mostly due to M&A expenses during the year 2018 (which were quite significant, including leading a $5.4 Billion investment for 14% of Wanda Commercial Property, and a $317.6M investment in Bilibili)

Where did growth come from?

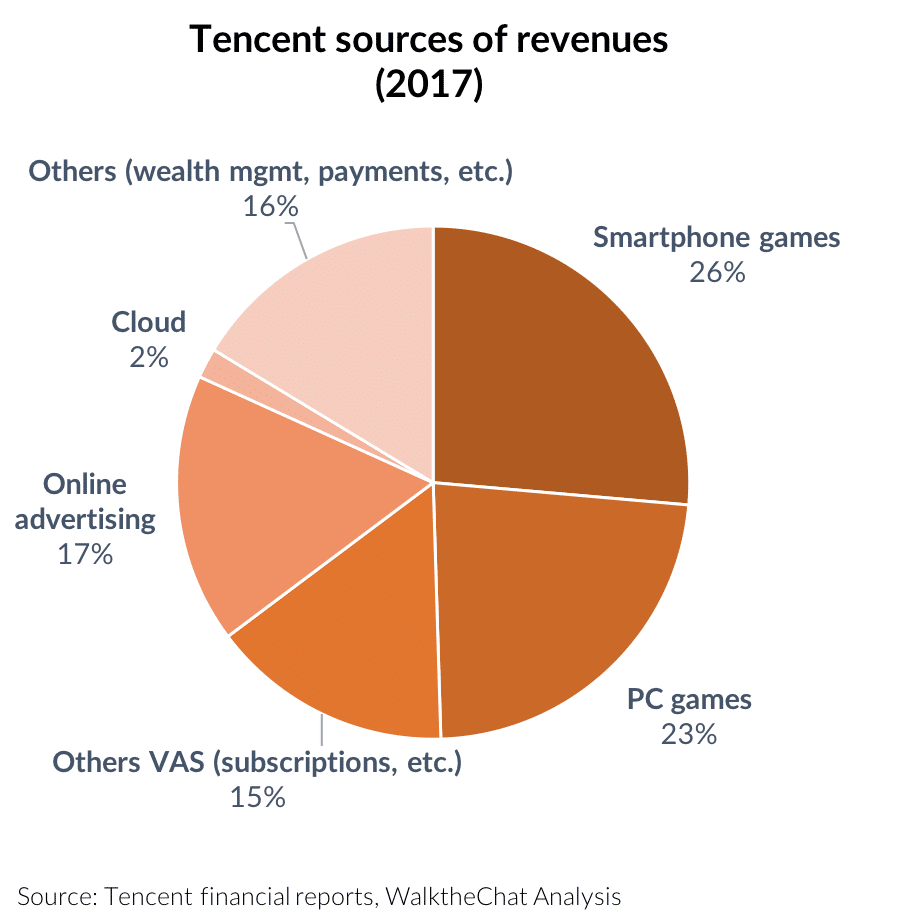

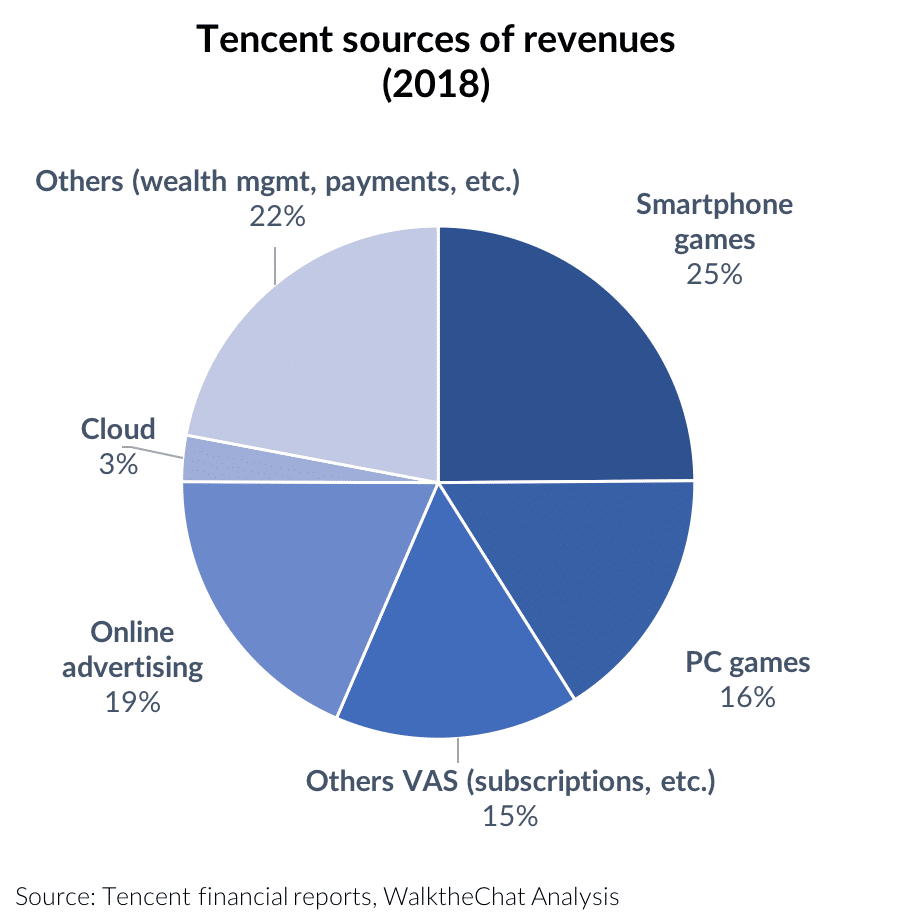

Tencent is currently experiencing a shift in its revenue sources.

Smartphone game revenues grew at a 24% YOY rate, while PC game revenues saw a decrease of 8%. This is in sharp contrast with the year 2017, were online games as a whole had experienced a 38% YOY growth rate.

This stagnation of gaming revenues was compensated by growth in other businesses, in particular, wealth management and payments, which grew from 16% to 22% of Tencent revenues between 2017 and 2018.

Tencent wealth management is catching up with Alibaba

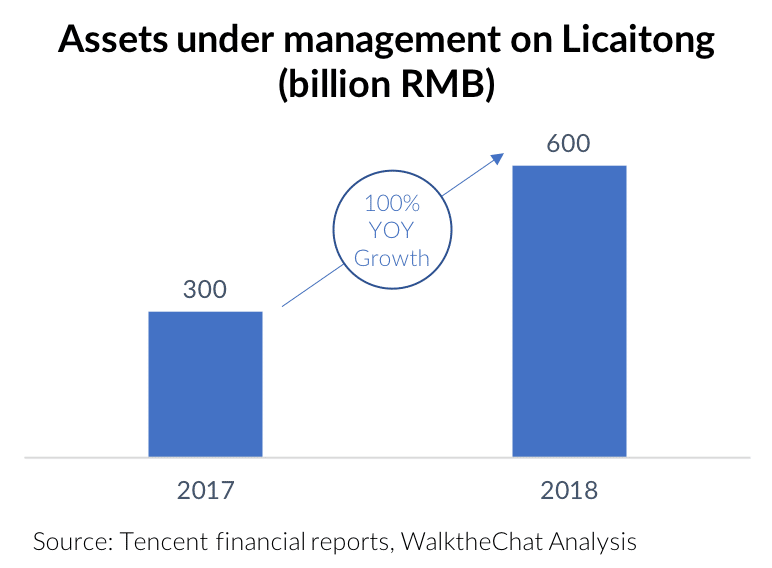

Assets under management in the Licaitong Tencent fund doubled between 2017 and 2018, from 300 to 600 billion RMB. The service reached 100 million users in 2018.

Tencent is in fact now catching up with Yu’E Bao, Alibaba’s fund. Regulators pushed Yu’E Bao to downsize in 2018 amid systemic risk, which brought its assets under management down to $168 billion USD (around 1.1 trillion RMB, now about twice the size of Licaitong).

Growth in online subscriptions

Tencent subscriptions were up by 19.1% year-on-year to 160.3 million subscriptions, mostly via Tencent Video and Tencent Music offerings. Tencent Video grew to 89 million subscribers, up 58% year-on-year.

Increase in advertising revenues

Online advertising business achieved RMB 58.1 billion revenues, a 44% YOY growth. The “Social and Others” category grew even faster at a 55% YOY growth.

This explosive growth was due to several contributing factors: an increase of inventory (about half of WeChat users started to see 2 ads per day) and an improvement in advertising quality.

In particular, WeChat introduced new advertising features which have long been popular on Facebook such as retargeting (ability to show ads to users who have been involved in past campaigns) and lookalike audiences (ability to submit a list of WeChat users / Phone numbers to WeChat and ask WeChat to look for similar profiles through its artificial intelligence algorithm).

Tencent also undergoes a major advertising restructuring during February 2019. This drastically decreased the number of authorized WeChat advertising agency, leaving only the largest company to control the market. Tencent also starts to offer a lower rebate rate to advertising agencies. This reduced the admin cost of supporting advertising agencies and will have a positive impact on the next financial quarter.

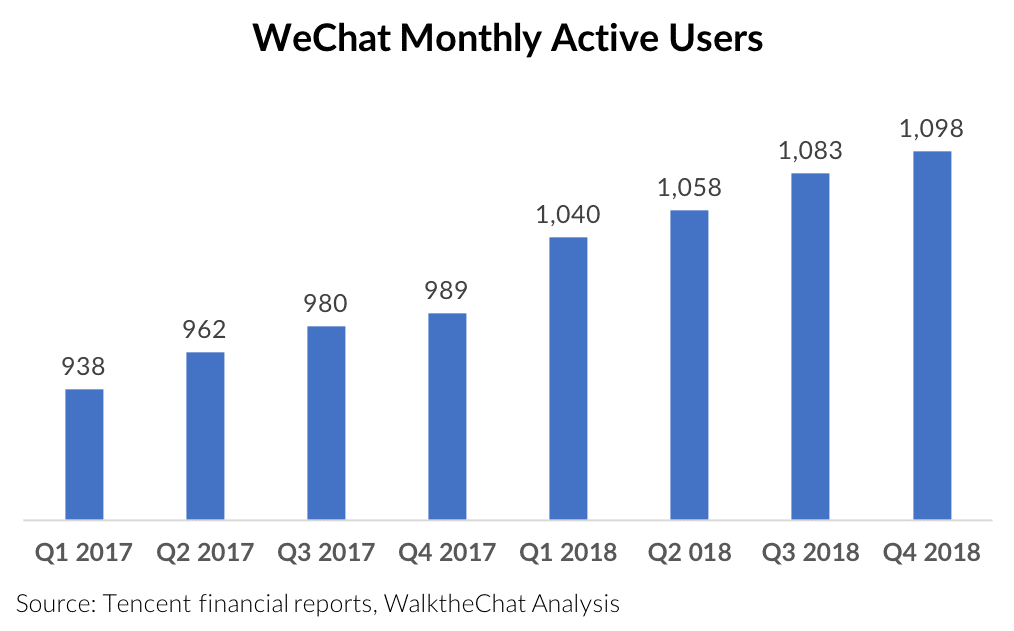

WeChat users growth

WeChat maintained a steady growth of its user base reaching 1,097 million users with a 11% YOY growth rate. The messaging App is, however, starting to saturate its market.

WeChat Mini-programs have of course been one of the success stories of Tencent in 2018. Daily

visits per user increased by 54% year-on-year. Visits to “long-tail” WeChat Mini-programs (smaller mini-programs with less traffic) accounted for 43% of the total daily visits, showing a healthy ecosystem with a large number of developers and 3rd party application.

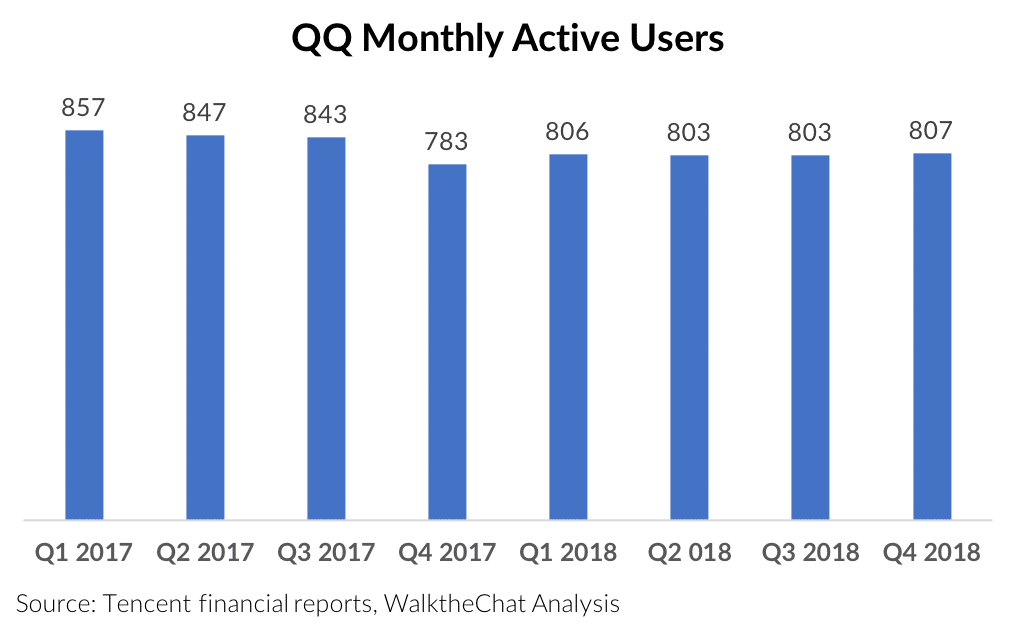

QQ making a come-back

Another highlight of the report was that QQ Monthly Active Users were finally back on an upward slot, with 807 million MAU’s.

The reason for this slight increase was the come-back of QQ among younger users. In fact, smart

device MAU for users aged 21 years or below increased by 13% year-on-year.

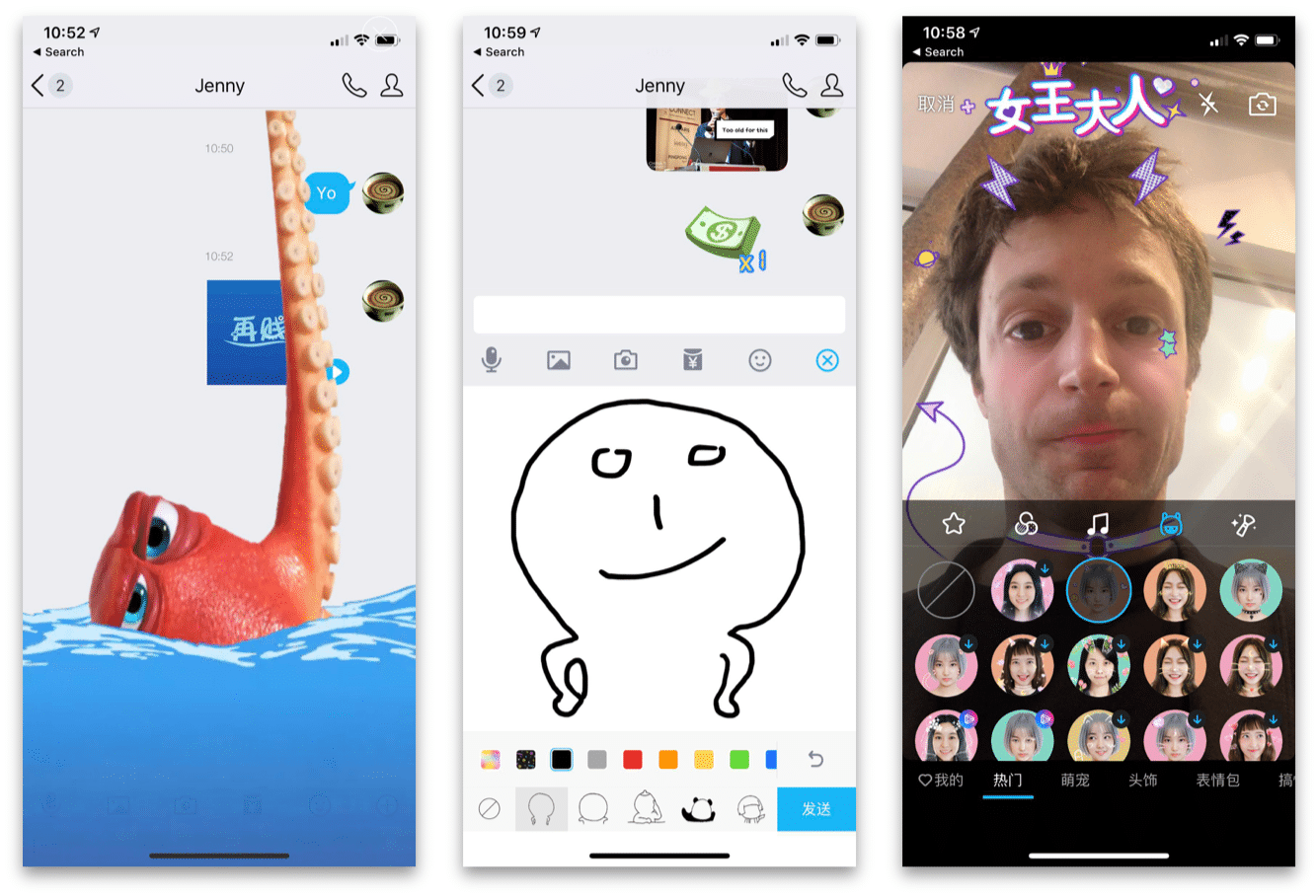

This growth was pushed by new features such as AI-driven filters, stickers and other playful features popular among younger users.

Conclusion

Tencent has been catching up with Alibaba on a growing number of market segments. After beating Alipay in terms of number of mobile payment transactions, it is now starting to take over the wealth management market.

Although Tencent is also being threatened by several players such as ByteDance and Alibaba, it is showing strong fundamentals. The steady growth of WeChat, the revival of QQ among young users and the boom of the WeChat Mini-program and payment ecosystems make up a strong basis for the company’s future growth.