Year over year, Alibaba has managed to beat its own record during the biggest shopping festival on the planet. There were real concerns about whether the company would pull it off once again.

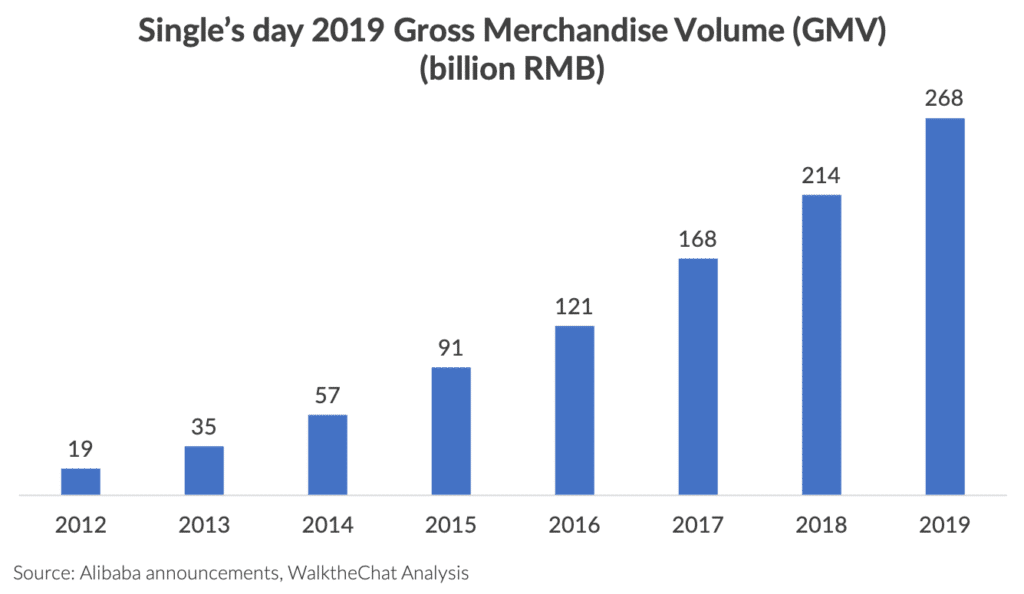

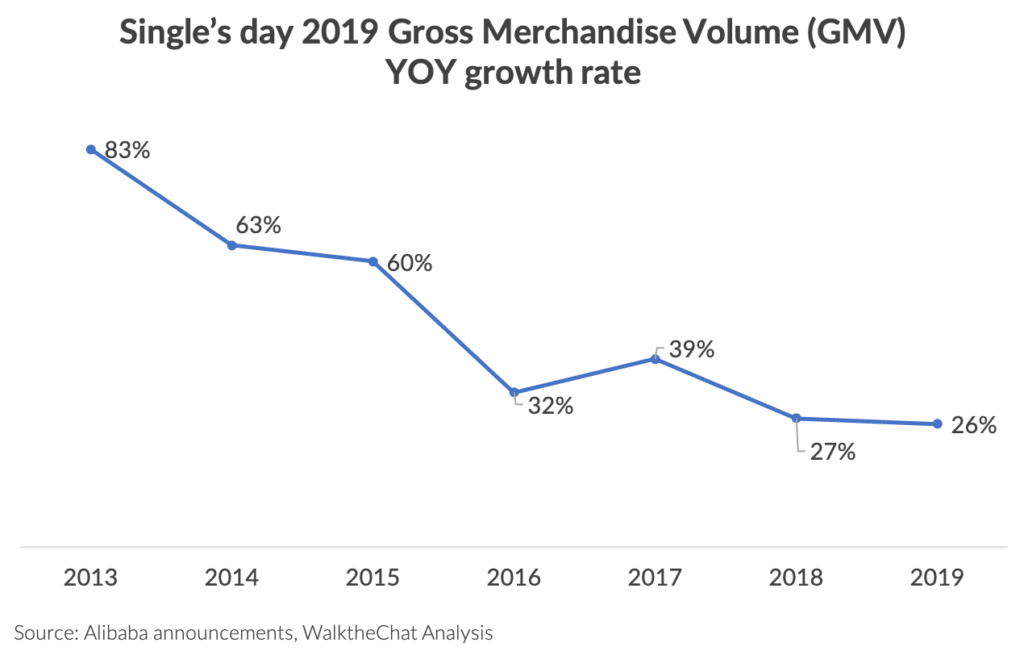

The answer is a resounding yes: gross merchandise volume (GMV) on Tmall reached 268 billion RMB (38 billion USD) within 24 hours, a 26% YOY growth.

The growth of Tmall Single’s Day GMV

Since the inception of the festival in 2009, Tmall’s GMV during Single’s Day has been growing exponentially.

The GMV has been growing at a steady 26% YOY rate. Although the growth is starting to decelerate, it is remarkable that Tmall managed to maintain pretty much the same growth rate as it did last year.

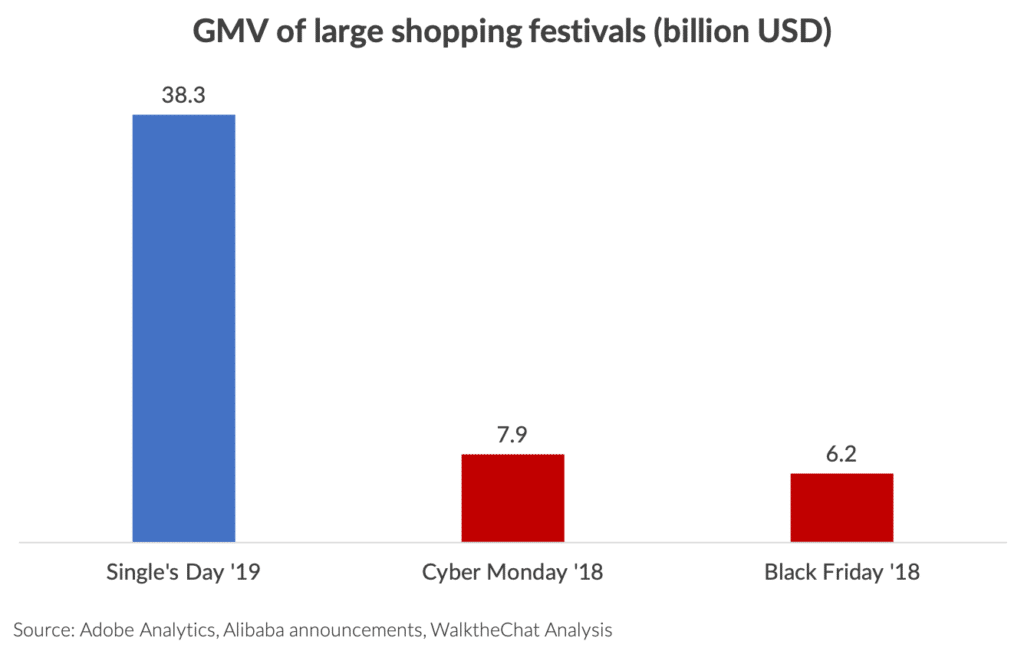

The Chinese festival also dwarves its U.S equivalents: the GMV of Single’s Day 2019 was almost 5 times bigger than Cyber Monday 2018 in the U.S, and more than 6 times larger than Black Friday 2018.

This Single’s Day also set a new technical record with a peak of 544,000 transactions/second. It was a huge technical feat for Alibaba to handle this traffic smoothly. The company did so solely relying on its own Alibaba cloud.

What made this Single’s Day different?

The rise of live-streaming

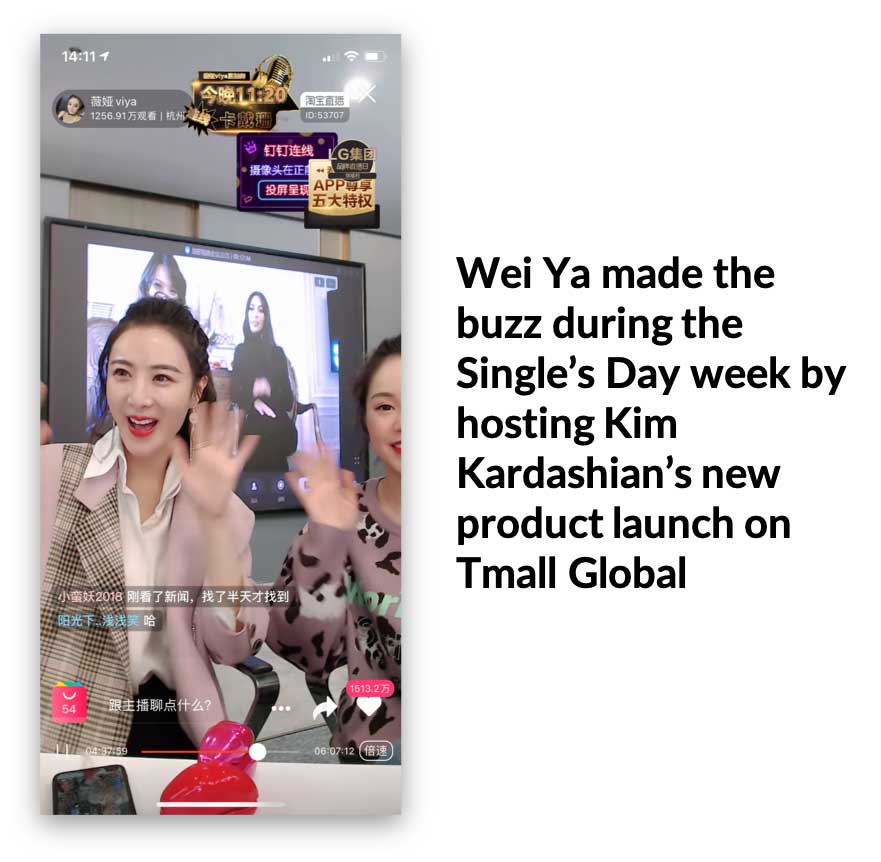

Live-streaming isn’t a new trend in China, but 2019 was the first year where it played such a big role in driving online sales.

More than 50% of merchants saw an increase in GMV caused by live-streaming. Transactions driven by live-streaming grew by 400% YOY.

A broadcast by one of the biggest anchors on Taobao Live, Wei Ya, reached 42 million viewers at 2am at night. Over 24 hours, Wei Ya drove the sales of 330 million RMB of merchandise.

Meanwhile, Li Jiaqi, the “lipstick king” of China, attracted more than 35 million viewers.

But Chinese hosts are not the only ones to drive large volumes. On the 7th of November, halfway through the Single’s Day promotion week, Wei Ya partnered with Kim Kardashian, the number one Western influencer, to promote Kim Kardashian’s latest fragrance product.

The product was sold via Tmall Global (the cross-border version of Tmall). The campaign was a success, attracting 13 million viewers and generating 15,000 product sales within 1 minute.

The Kim Kardashian campaign, although it stands out, is not an isolated phenomenon. It is part of the new “Purple influencer” (网紫) strategy of Tmall Global (it is a play on word on “Wang Hong” / 网红, a Chinese name to designate influencers – purple is the color of Tmall Global).

Tmall Global recruited a network of hundreds of Western influencers or foreign-based Chinese influencers on a variety of Chinese and Western social networks. They also started partnering with Western stars (such as Kim Kardashian) to encourage them to launch their brands on the Tmall Global platform.

New social platforms

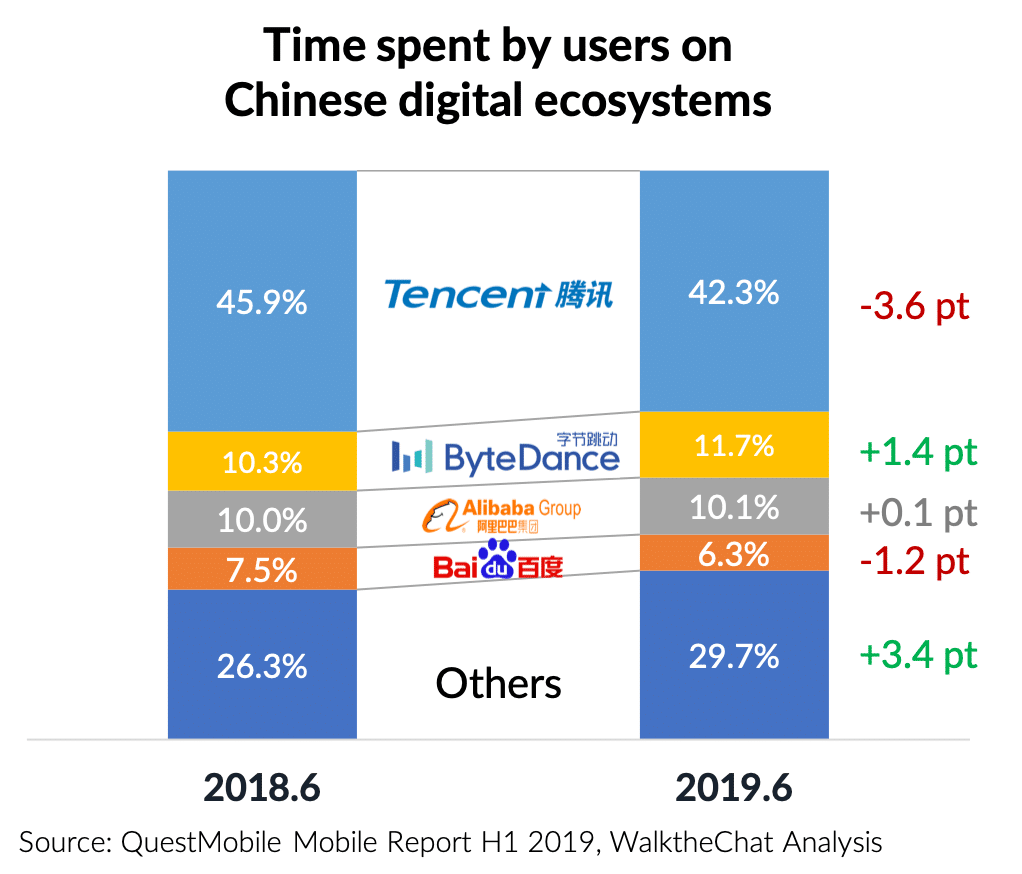

The social space in China is also very different in 2019 from what it was in 2018.

To a large extent, it is less dominated by Tencent and WeChat. ByteDance and its superstar App, Douyin, have been gaining traction.

This evolution is significant because WeChat and Tmall are blocking each other. In the meantime, Douyin (which stole a lot of traffic from WeChat) is well integrated with Tmall, helping to push the Single’s Day numbers.

It is certain that the shift of the content ecosystem toward Douyin was beneficial to Tmall’s Single’s Day promotion.

Beyond Tmall

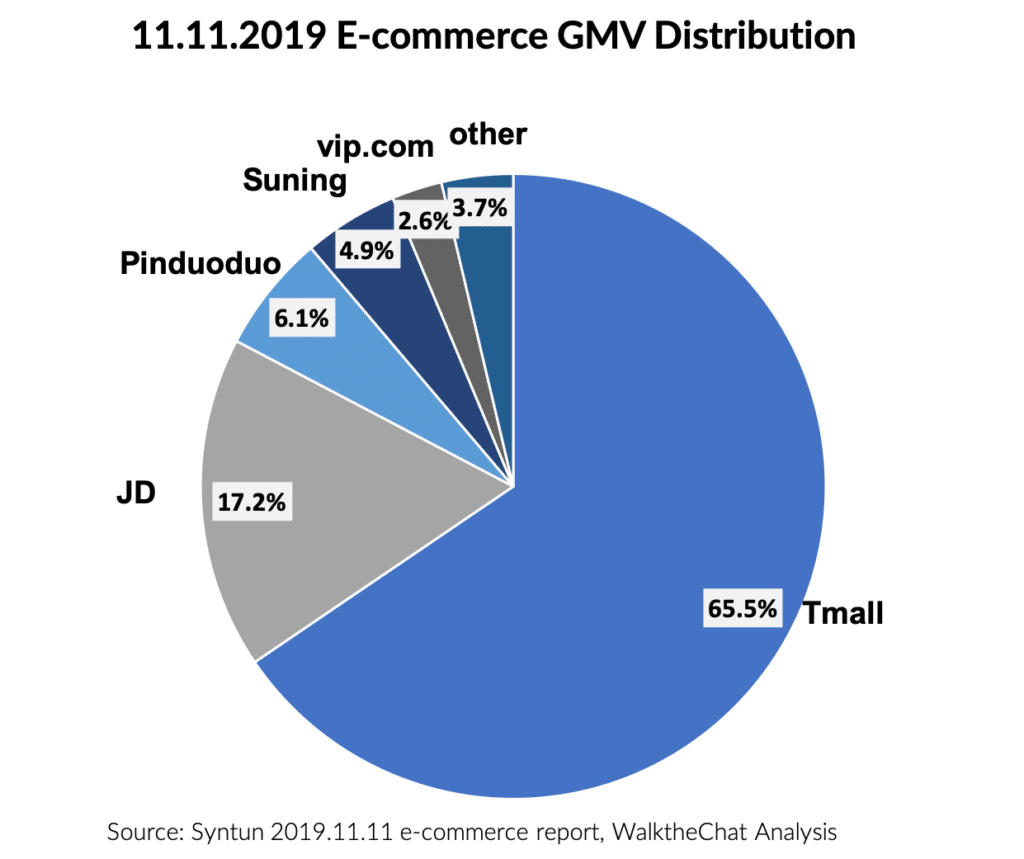

Tmall is, of course, the superstar of Single’s Day, but it’s not the only one benefiting from the sales festival.

According to Syntun Data, the overall gross merchandise volume sold during 11.11.2019 is RMB 410.1 billion ($586 billion USD). Tmall controls the majority of the market while Pinduoduo only managed to seize 6.1% of it.

Here are a few figures from some of Tmall’s competitors according to the official news release:

- JD.com generated 204.4 billion RMB of sales between November 1 to November 11 (a 28% YOY growth)

- Suning’s 1-hour order volume increased by 89% year-on-year and its overall GMV grew by 76% YOY

- Interestingly, Pinduoduo chose not to disclose data about Single’s Day this year. The company was most likely pessimistic about its ability to beat Alibaba on its own turf

Conclusion

Tmall scored another record-breaking year and showed there was still potential for growth for its Single’s Day event.

The growth was driven not only by discounts but also by a growing content ecosystem around e-commerce. Live-streaming and influencers were essential to push new products to potential buyers.

Although Tmall is not the only one to reap the benefits of Single’s Day, it remains well ahead of its competitors such as JD, Pinduoduo, and Suning. For the foreseeable future, Double 11 will remain Alibaba’s territory.