Frequent readers of our posts may have already learned how to set up your e-commerce presence in China and generate traffic to their WeChat store.

We’ll now deep-dive into a common problem of vendors selling to China: logistics and shipping to China.

- Can my product be shipped to China? Click here

- Cross-border trade and FOREX Click here

- Custom clearance Click here

- Direct shipping Click here

- New cross-border e-commerce regulation (January 2019) Click here

- Update April 8th, 2019: tax reduction Click here

Can my product be shipped to China?

The first question you might have is: is it legal to ship my product directly from oversea to China, via cross-border e-commerce?

Thankfully, the EU SME Center has put together a helpful list of products that are legal to export from EU to China. You can find the list here.

The list is very long, and includes, among other products:

- Fashion & Fashion accessories (footwear, watches, jewelry etc.)

- Furniture and kitchenware

- Coffee & various spices

- Various kinds of seafood

- Milk products and milk powder

If you have questions about this list and you are a SME from Europe, you can reach out directly to use (info@walkthechat.com) or to the EU SME Center through this link.

Cross-border trade and FOREX

Another common question is: who handles currency conversion when conducting cross-border trade with China?

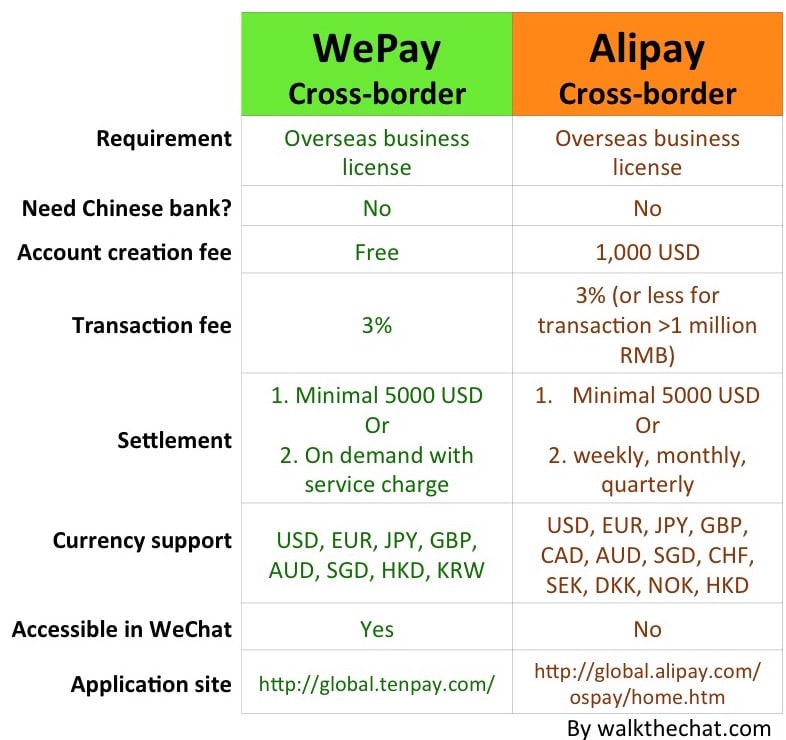

With the rise of Alipay and WeChat Payment, there are now two clear alternatives: Alipay cross-border and WeChat Payment cross-border.

With both of these services, upon transaction:

- Chinese user will pay in RMB

- Alibaba or Tencent will handle currency conversion with their partner bank (usually they will apply a charge around 2.5%)

- Payment amount will be sent to an oversea account

- A transfer will be made to the merchant’s account once the settlement amount is reached

Custom clearance

The custom clearance can be a complex process in China.

It involves the following steps:

- During the customs clearance procedure, the importer will have to complete the following formalities

- Customs registration

- Commodity inspection (inclusive of animal and plant inspection and quarantine)

- Customs declaration

- Documents submission

- Examination

- Payment of taxes and other fees

- Release

- Foreign exchange control

In order for the customs to be cleared, the vendor also have to provide the personal information of the buyers:

- Legal name

- Chinese ID number

Most companies will leverage the help of third party logistic providers in order to ship their products to China. The logistic provider will handle the custom clearance process and help to pay the appropriate taxes when shipping your products to China.

Here are a few examples of logistic providers:

- UFreight (http://www.ufreight.com)

- DTW (www.dtw.com.cn/en)

Direct shipping

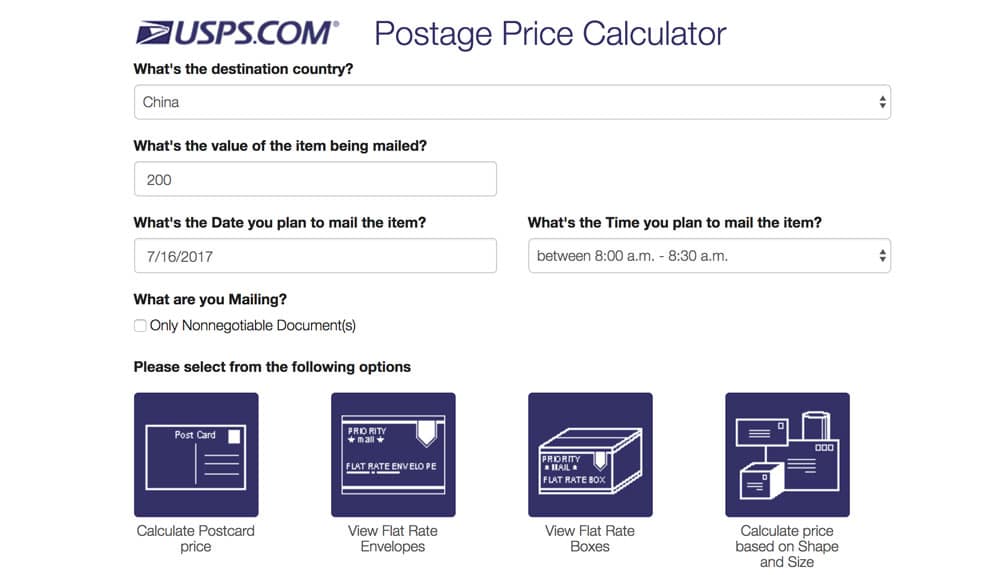

Another alternative is direct shipping from oversea to China. This is usually a slow and expensive option. Shipping a small box (weighing up to about 2 kilos) from the U.S to China will cost you around $32 with USPS. And the shipment are often neither trackable nor guaranteed.

USPS offers transparent pricing for shipping to China https://postcalc.usps.com/

In that case, there is also a higher probability that the items might get help up by the customs (around 5% probability). If that were to happen, your customer in China will have to go claim the item, and possibly pay some custom taxes to have it enter the country.

Most countries have manageable when shipping from their local post office to China, especially countries with large trade volumes with China such as New Zealand or Australia.

Overall, direct shipping is not a scalable option for companies wanting to do significant business with China. It is however a good option if you are conducting a small test and are looking for a simple way to ship a handful of items sold after your first promotion.

New cross-border e-commerce regulation (published November 2018 – apply from January 2019)

The Chinese Ministry of Finance announced in November a new set of regulation affecting cross-border purchases. The new rules will take effect on the 1st of January 2019.

What are these new regulations, and how will they affect you?

An increase of maximum amounts for cross-border transactions.

The main change of the new regulation is the increase of the cut-off amount for tax-free cross-border purchases:

- Single-transaction amount increased from 2,000 RMB ($291 USD) to 5,000 RMB ($727 USD)

- Yearly amount of cross-border purchases increased from 20,000 RMB ($2,909 USD) to 26,000 RMB ($3,782 USD)

Within these limits, customers won’t pay any import tariffs, and will have their import VAT and consumer tax collected at 70% of the statutory taxable amount.

In practice, this reform opens up the cross-border market for a lot of luxury retailers with products in the 2,000 to 5,000 RMB range. For industries such as high-end fashion and cosmetics which strongly appeal to Chinese cross-border buyers, this is a game-changing move.

New items added to the positive list

63 new items categories were added to the positive list for cross-border purchases. The new allowed categories notably include sparkling wine, beer, health care products, and fitness equipment.

The full list of allowed items (in Chinese) can be found here.

Additional geographical coverage

The cities included in this cross-border tax-rebate were expanded from 15 to 37 cities.

The full list of cities covered by the cross-border policy is: Beijing, Tianjin, Shanghai, Tangshan, Hohhot, Shenyang, Dalian, Changchun, Harbin, Nanjing, Suzhou, Wuxi, Hangzhou, Ningbo, Yiwu, Hefei, Fuzhou, Xiamen, Nanchang, Qingdao, Weihai, Zhengzhou, Wuhan, Changsha, Guangzhou, Shenzhen, Zhuhai, Dongguan, Nanning, Haikou, Chongqing, Chengdu, Guiyang, Kunming, Xi’an, Lanzhou, Pingtan

No country for Daigou

The reform also stresses out the fight against “Daigou”: people buying a product tax-free oversea and then re-selling it online or offline on the local market.

The new regulation insists strongly on the fact that cross-border purchases are final, and that then re-selling these products in China would be illegal.

The positive trend to expand imports

This new regulation is a part of the collective effort China is making to expand its import market and drive internal consumption.

Early in July, China identified 22 cities as the cross-border e-commerce pilot zones. In September China started to cut admin charges and expedite cargo clearance to incentives global trade. In November 1st, China implements a tariff cut on 1,585 imported goods.

In November, China also held the first China International Import Expo that attracts 2,800 brands from 130 counties to participate. President Xi Jinping called it “demonstration of China’s embracing of greater openness”.

Take-away from new cross-border e-commerce regulation

With an increase in tariff-free purchases cap, the number of categories in the positive list and a wider city coverage, this new regulation update is great news for all companies shipping to China.

The news is especially good for high-end fashion companies, or cruelty-free cosmetic companies wanting to sell to China cross-border, which will most benefit from the ability of customers to make larger orders.

Conclusion

If your products are legal to export in China, shipping can be a hassle but which is easy to overcome. Working with logistic partners operating from Hong Kong or free trade zones is the easiest way to handle your start in China in a transparent and efficient way. For the first test, direct shipping might be an option. But be ready to switch to a more scalable shipping strategy after things gain momentum.

Update April 8th, 2019: new Cross-border e-commerce regulation brings tax reduction.

Cross-border e-commerce (CBEC) industry is undergoing major policy changes. On the one hand, China is promoting the cross-border e-commerce channel and lowering tax rate; on the other hand, China is imposing a lot more regulations on the technical integration and data transparency.

There are the latest updates:

- For Cross-border e-commerce, the comprehensive tax rate was lowered from 11.2% to 9.1% for ordinary cosmetics, and from 25.53% to 23.05% for high-end cosmetics

- Starting from April 3rd, 2019, Postal tax rate dropped from 15% to 13% for food and medicine; and from 25% to 20% for textiles, leather garments, and electrical appliances

- Starting from April 1st, 2019, cross-border e-commerce platforms need to integrate with local customs to push 3 pieces of order information (payment, order, and shipping information)

- Daigous and companies are strictly prohibited from reselling products that were imported via the cross-border channel. Products should be sold directly to the end consumer via CBEC/CC channel

- Ensuring the legitimacy of each cross-border orders is a top priority. E-commerce platform shall no longer Sha Dan (刷单, making fake orders in order to create fake purchasing history)

Cross-border e-commerce tax rate update

Starting from April 1st, China’s VAT rate was updated as follows:

- Manufacturing sector (including imported goods): dropped from 16% to 13%

- Construction and transport: dropped from 10% to 9%

- Services: remained at 6%

This reduction of VAT tax will significantly impact the tax rate of CBEC:

- For most products (with 0% consumption tax), the CBEC integrated tax is lowered from 11.2% to 9.1%

- For high-end cosmetics, CBEC integrated tax rate is lowered from 25.53% to 23.05%

*High-end cosmetics refers to products with an after-tax wholesale import price above 10 RMB/ml(g) or 15 RMB/piece.

Here is a list of CBEC integrated tax rate for each product category (in Chinese).

The implication

The CBEC integrated tax rate applies to transactions that fall within the CBEC limitation.

Earlier on January 1st 2019, the transaction limit of CBEC was updated to 5,000 RMB per transaction and 26,000 RMB per person per year. This allows brands to sell higher priced items via CBEC.

Thus if the package is under 5,000 RMB, and it’s within 26,000 RMB limitation for the individual consumer, the company only needs to pay for the CBEC integrated tax rate (usually 9.1%).

If the single transaction is over 5,000 RMB, but within the personal annual limit of 26,000 RMB, the product is allowed to be imported via CBEC but is subject to full tax.

If beyond the annual limit, the transaction will be regulated as general trade.

Tightened regulation on CBEC

According to <Notice of the General Administration of Customs Year 2018 Letter No. 165>, starting from April 1st, an e-commerce platform need to synchronize with the customs’ system for the following information: order number, product name, transaction amount, currency type, customer information, product link, payment number, verifying department, time, and other information.

Here is the API for custom integration.

Impact of the tightened CBEC regulation

The key impact of the April 1st CBEC regulation update is that China has further legitimized this channel. Thus the government will focus on collecting taxes via this channel and cracking down on shady activities such as Daigou re-sellers, fake orders, and custom under-declaring activities.

This new regulation will also impact cross-border payment providers. The custom will demand the cross-border payment gateways to provide custom integrations to ensure transparency.

Direct purchase imports update

The CBEC channel is not the only way for brands to sell from overseas to China. Brands can also encourage “Direct purchase” whereby the product is shipped via postal channels without custom integration:

Pros: the product doesn’t have to be registered with the customs

Cons:

- Customer’s experience is uncertain since if the parcel is checked by the custom (usually between 5%-10% chance depending on the custom), the customer will need to pay for the tax

- Products will need to be stored outside of China, this means longer shipping time

Direct Purchase Import is often the easiest channel to start selling to China. Especially for new brands with an uncertain daily parcel amount and hero product (爆款) still undefined.

Effective from April 9, China will lower the Postal tax rate on imported goods, and promote the import trade and domestic consumption:

- Food and medicine: lowered from 15% to 13%

- Textiles, electrical appliances: 25% to 20%

This is encouraging news for brands that want to experiment with the Chinese market.

Direct purchase import is still a great opportunity for foreign companies to test the market via the WeChat/Weibo stores and Key Opinion Leader marketing. After achieving initial success, brands can then consider the lengthier process of setting up a Chinese company or engaging in the custom registration process.

Conclusion

As cross border e-commerce becomes a more recognized and prominent channel, it is also being regulated by the government. The tax rate deduction is an encouraging sign for brands who want to invest in the Chinese market.

However, the regulation is now more strict for cross-border e-commerce: brands will need to make sure to follow the rules, avoid shady methods such as Daigou, fake transactions (shua dan), and under-declaring products.

Consult WalktheChat to start testing the Chinese market via WeChat Cross-border Mini Program stores:

info@walkthechat.com