The largest Chinese marketplaces and platforms are already famous abroad: WeChat, Tmall, Red, JD.com, or Douyin don’t need further introduction.

But beyond these super-platforms, there exist a large number of niche channels that can help foreign brands sell to China.

Need help listing on one of these channels, or would you like to discover more channels to promote your brand? Feel free to reach out to info@walkthechat.com

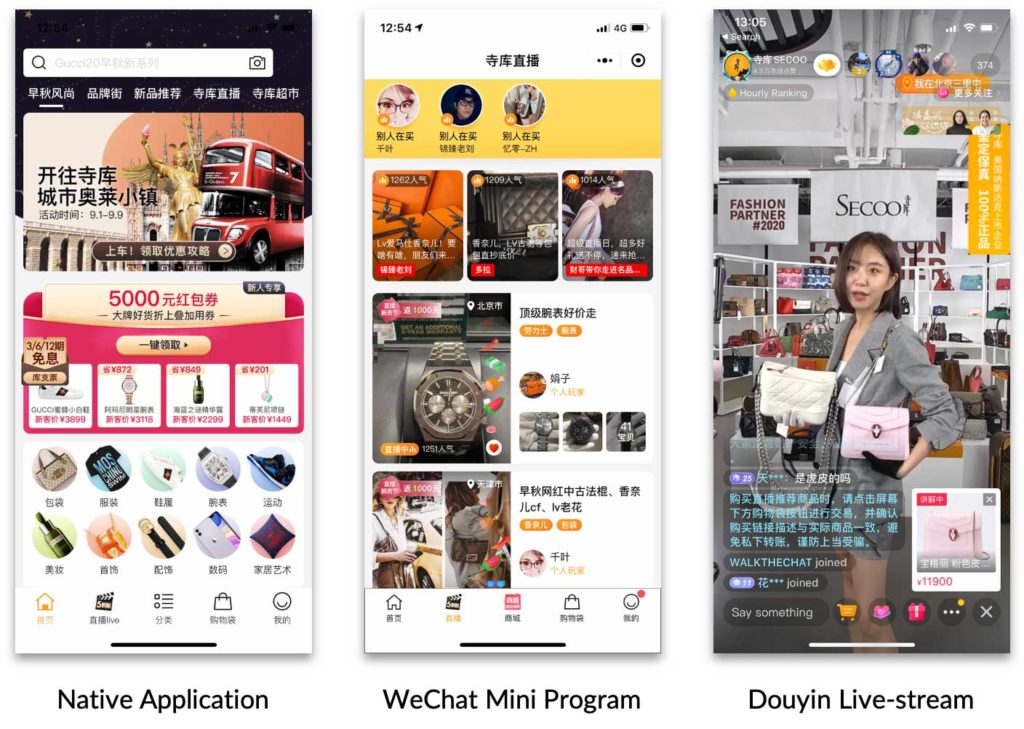

Secoo

- Focus: luxury items

- Active buyers: 600k (Q4 2019)

- Average order value: 3,600 RMB (Q4 2019)

- Channels: Native App, Mini-program, JD flagship, Douyin store

- Cost: no set-up fee, ~25% commission

Alright, Secoo is not that niche, but it is worth mentioning! With over 600,000 active customers during Q4 2019, it is the largest luxury-focused platform in China.

The platform operates a Native App, along with a WeChat Mini-programs and a very active Douyin Account.

Secoo is a massive platform, with 4.7 billion RMB (672 million US$) GMV generated during the fourth quarter of 2020. Moreover, the average order of 3,600 RMB (around 525 US$) will appeal to premium brands seeking to enter China.

Although the bulk of the offering is coming from major brands such as Prada or Gucci, niche brands are increasingly sought-after by customers. Segments such as jewelry or footwear are especially relevant, being less competitive than clothing and handbags.

Pros:

- Relatively large platform with 600,000 quarterly active customers

- The high average order of 3,600 RMB

- No set-up fees, flat 25% commission

- Very engaged user-base who’s actively looking to buy and discover new products and brands

Cons:

- Hard to list on, Secoo carefully selects brands

- Lots of competition inside the platform, especially against established brands

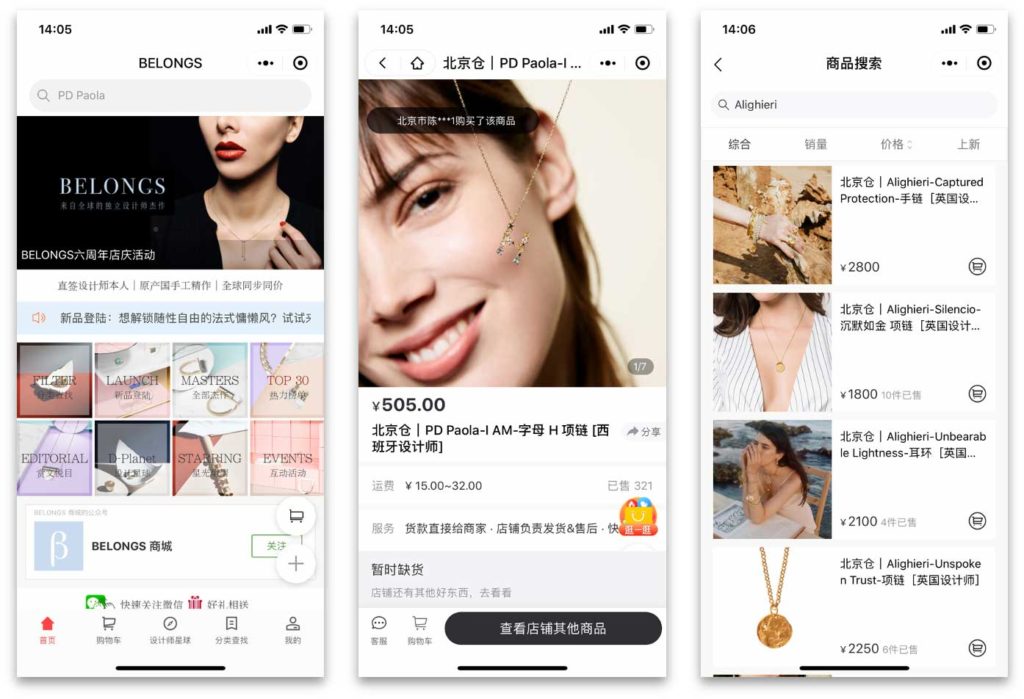

Belongs

- Focus: oversea jewelry

- Monthly users: 85,000 (Newrank.cn estimate)

- Commission: 40-50%

- Channels: WeChat Mini-program

Belongs is a WeChat Official Account and WeChat Mini-program focused on promoting foreign jewelry brands in China.

It has a very active following of jewelry enthusiasts, eager to discover oversea brands. Most of the listed brands are niche premium brands such as Alighieri or PDPAOLA.

Pros:

- Very active community of buyers

- Focus is on niche premium brands, avoiding mixing/competing with established brands

Cons:

- Small scale

- Only focused on the jewelry market

- High commission

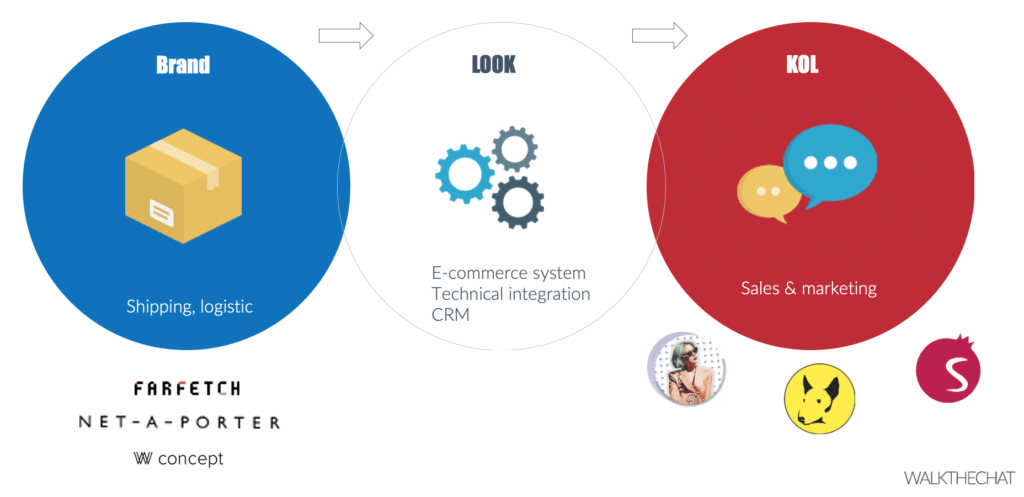

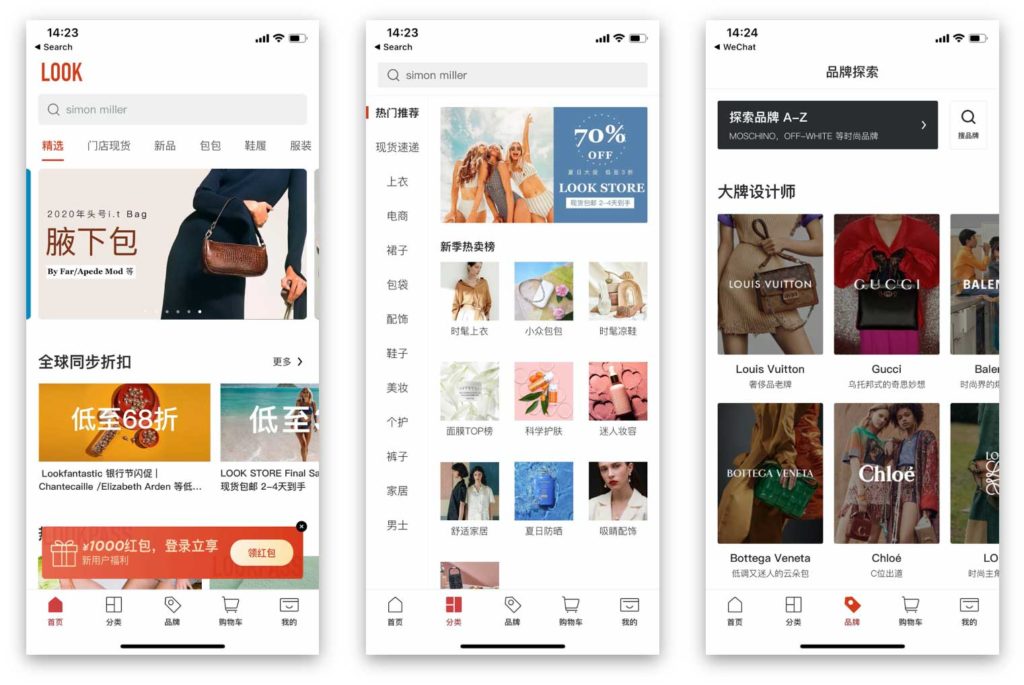

LOOK

- Focus: oversea premium brands

- Channels: Native App, WeChat Mini Program, KOL stores

- Cost: no set-up cost, 40% commission for online sales, 50% commission for offline sales

LOOK is a platform with a mission to bring oversea brands to mainland China.

To achieve this mission, LOOK went for an innovative strategy: they enable many influencers (including huge ones such as Gogoboi) to create their own mini-store and receive a commission from sales.

Influencers don’t need to handle any of the fulfillment and customer service: they help generate sales, earn a commission, and LOOK takes care of the rest.

Although, like Secoo, LOOK also lists famous brands such as Louis Vuitton or Gucci, they put more emphasis on premium niche brands, which are harder to come by in China.

One of the advantages of LOOK is its offline network. The company has built an extensive network of offline locations where users can discover, feel and buy some of the products listed on their online store.

This network is a perfect solution for oversea brands who want to set the first foothold in China’s offline retail market without spending upfront.

However, LOOK charges hefty fees for these services: commissions between 40% to 50% can be hard to sustain for oversea brands with a high cost of production.

Moreover, the company is heavily relying on KOLs using WeChat Mini-programs to promote products. As WeChat is experiencing increased competition from other Apps such as Douyin or Kuaishou, LOOK is also seeing a decrease in its traffic.

Pros:

- An extensive network of influencers

- Focus on premium niche brands

- Offline locations in tier 1 cities in China

Cons:

- Heavily reliant on WeChat

- High commission

- Relay on KOLs to select and promote the product

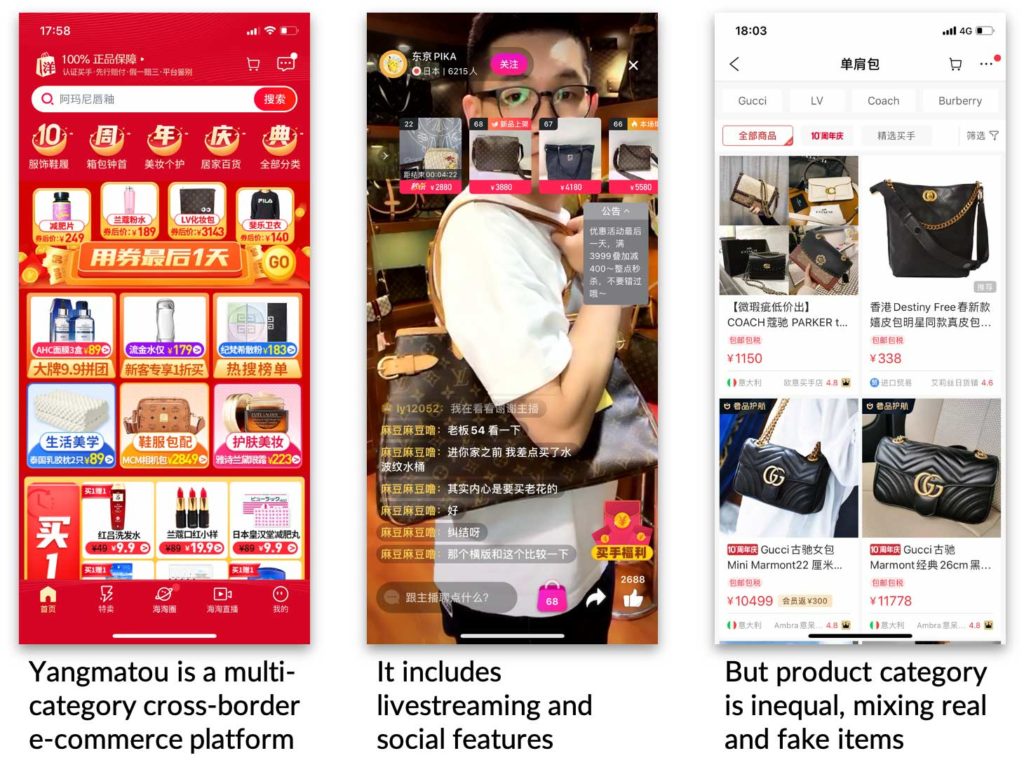

Yangmatou (洋码头)

- Focus: cross-border cosmetics and fashion

- Channels: Native App

Yangmatou is a cross-border platform helping brands big and small sell directly to China.

Although the platform doesn’t disclose yearly GMV, it already reached a significant scale. Yangmatou announced 1.2 billion RMB of GMV during the first hour of Black Friday 2019. 40% of users came from social channels. The platform also leveraged the live-streaming craze with a very vibrant live-streaming activity.

Yangmou has a heavy focus on luxury brands with discounted prices, along with a few niches brands selling on the platform.

The quality of products on Yangmatou is, however, inequal. 11,000 RMB Gucci bags are sold side-by-side with 300 RMB rip-offs.

Pros:

- Large GMV for a niche platform

- Open to brands big and small

Cons:

- Mix high-quality and low-quality products

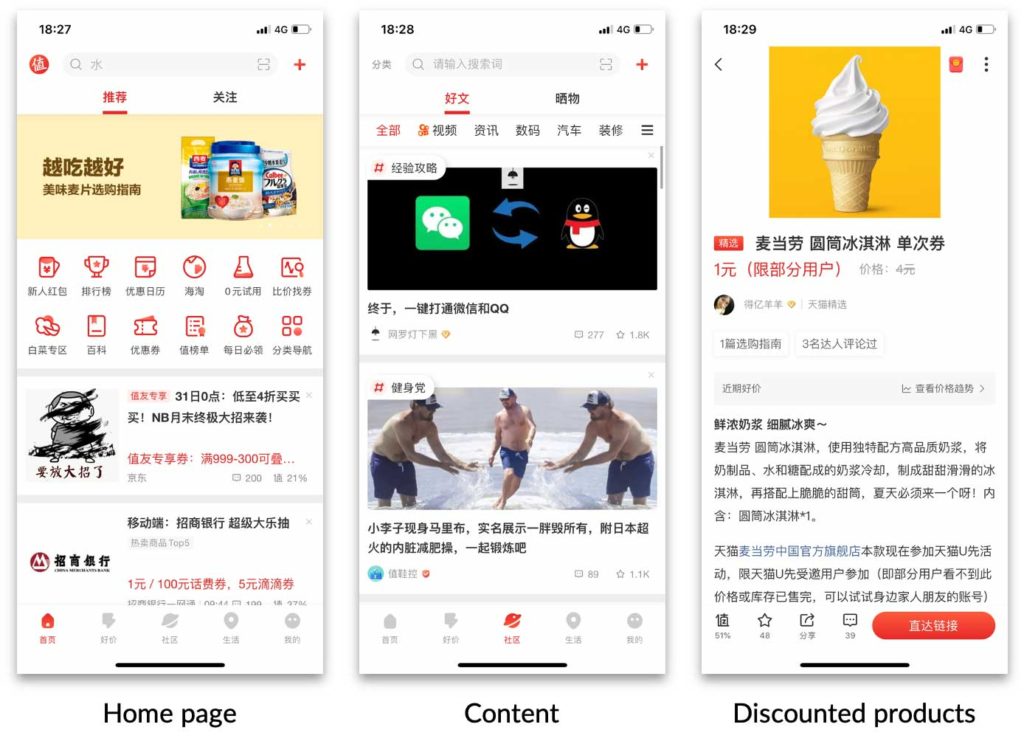

Shenmezhidemai (什么值得买)

Channels: Native App, affiliate network

GMV: 15.1 billion RMB (2019)

Monthly active users: 29 million (2019)

Shenmezhidemai (translates to: “What’s worth buying” in English) is a bit different from the previously introduced platforms. It is an affiliate system relying on an army of resellers to push products.

The platform also developed content features to keep its users engaged.

A lot of large brands promote on Shenmezhidemai, including UNIQLO and McDonalds (offering coupons for 1 RMB ice cream to drive traffic).

Shenmezhidemai can be quite advantageous for brands: the commission can be very low, between 0 to 20%, as long as the brand guarantees the lowest price on the market.

There are however two major downsides to Shenmezhidemai. First, the platform is only promoting very cheap items. It might be challenging for premium brands to attract the core users of the platform.

Another hurdle is that Shenmezhidemai requires brands to have a JD.com or Tmall store to be promoted. The App doesn’t have its own ordering system: it redirects traffic to third party marketplaces.

Therefore, only brands with existing presence in China can leverage the platform to push their sales further

Pros:

- High GMV showing great potential for results

- Strong network of affiliates

- Low commission

Cons:

- Mostly cheap items listed

- Requires a JD.com or Tmall store

Conclusion

Tmall and JD.com are dominating the Chinese e-commerce market, but they’re not alone.

By being present on multiple platforms, brands can increase both their sales and marketing reach.

Would you like to list your brand on more marketplaces in China? Reach out to info@walkthechat.com. We’re here to help.