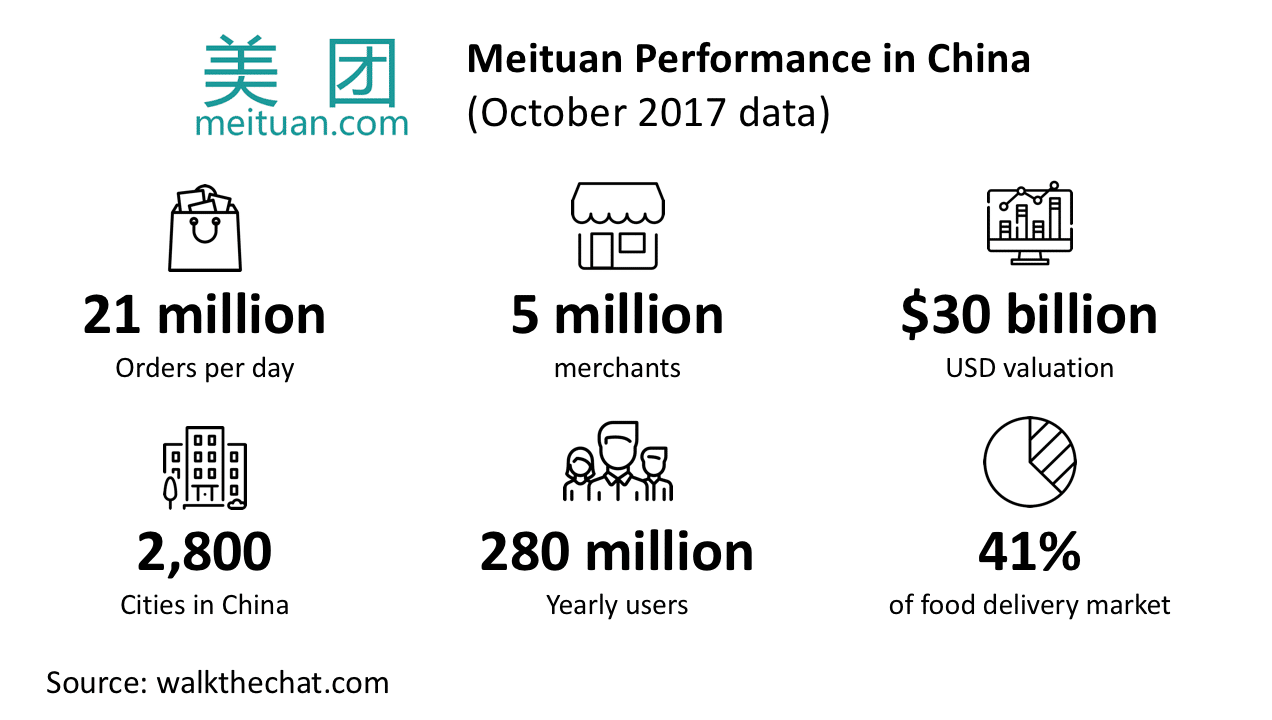

Meituan, a company focused on providing lifestyle O2O services, is planning on its IPO aiming to value at 60 billion to 80 billion USD. The company was valued at 30 billion USD during its last funding round in October 2017, ranking Meituan behind Xiaomi and above Airbnb.

Lately, Meituan made some bold moves:

- Going head to head against Didi on ride-hailing

- Acquiring Mobike for US$2.7 billion

Meituan, a lifestyle service provider

Meituan started out as a Groupon copycat providing group buying deals. In 2015, it merged with Dianping, the biggest restaurant review App, forming the biggest group buying company.

And it keeps expanding the scope of services to anything related to O2O. Meituan currently provides food delivery, ride-hailing, travel booking, movie reviews, restaurant reviews, and other various lifestyle services.

As such, Meituan is now competing with the largest players in China (Baidu Alibaba Tencent) for domination in several O2O markets.

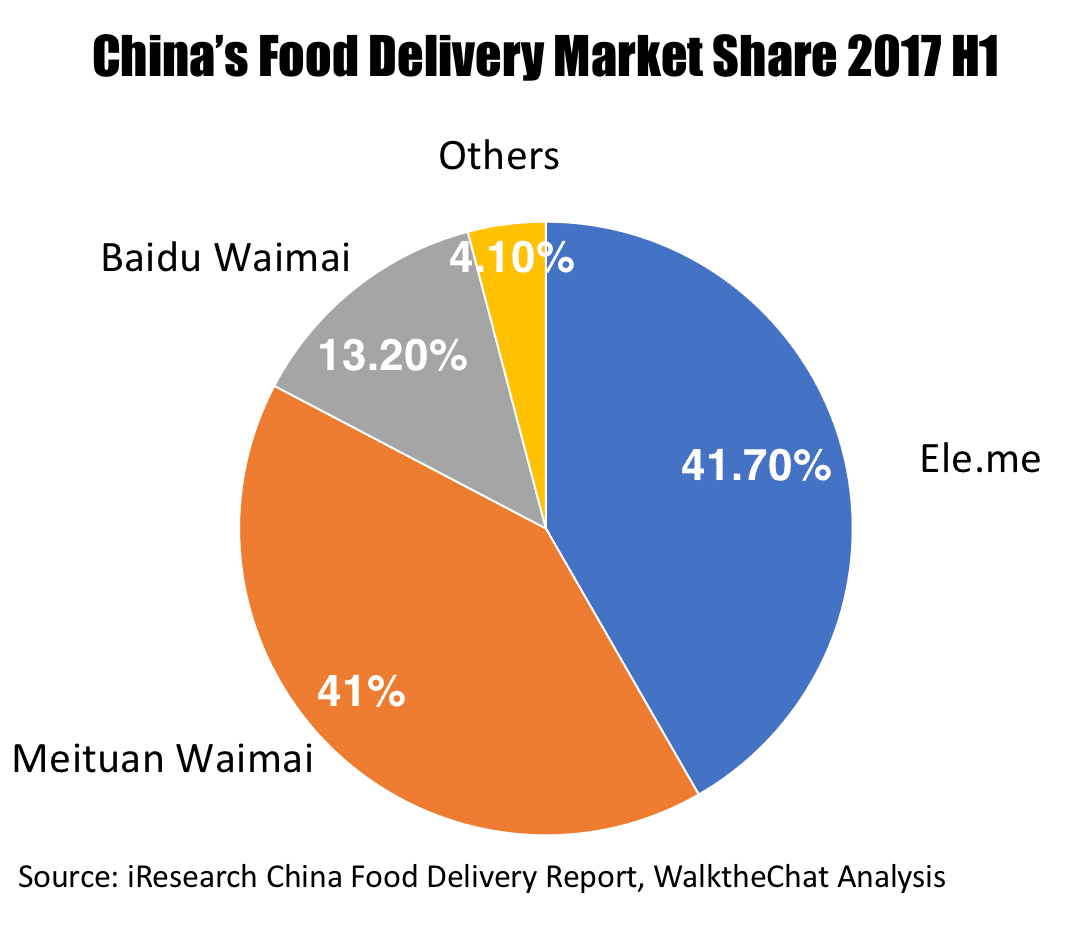

Meituan’s main service is food delivery. According to iResearch’s report, by the 1st half of 2017, Meituan was head to head with ele.me taking 41% of the Chinese food delivery market. According to Huxiu News, Meituan’s food delivery service account for 2/3 of the whole company’s valuation.

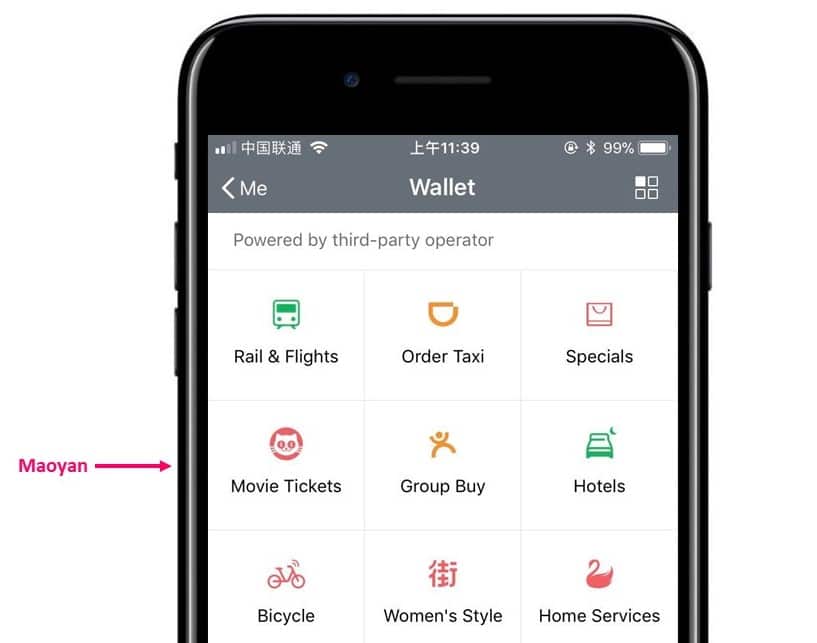

Besides food delivery, Meituan founded Maoyan, a movie ticketing App. Maoyan merged with its competitor Weiying in September 2017. Tencent became one of the major investors after the merger and gave Maoyan a seat in the WeChat Wallet. Bloomberg mentioned in Jan 2018 that Maoyan is planning its IPO in Hong Kong to raise around $1 billion.

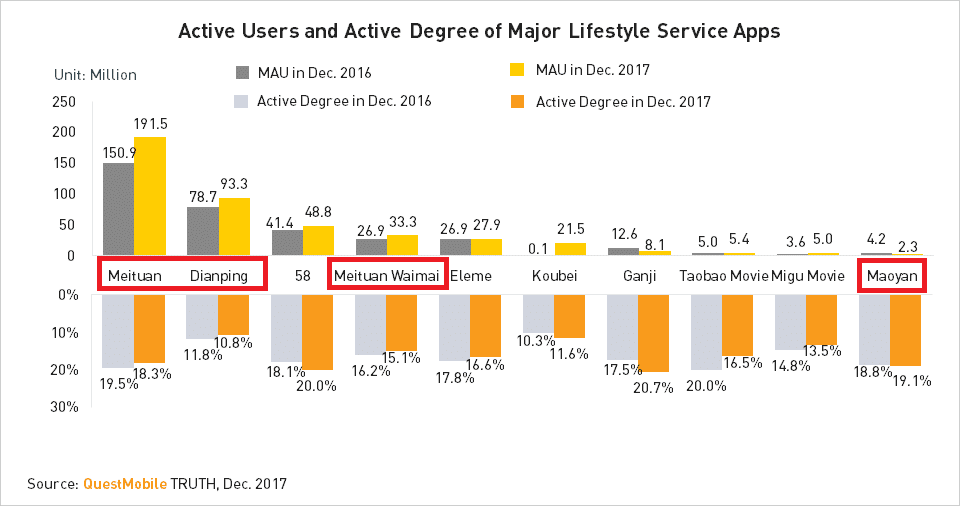

With the combination of Meituan, Dianping, Meituan Waimai, and Maoyan, the group had 280 million yearly users by October 2017 according to TechCrunch. Below highlighted are services belong to Meituan in comparison to other lifestyle Apps.

The ride-hailing war against Didi

Meituan had a very late start on the ride-hailing business. It started in Feb 2017 in Nanjing and claimed to gain 1/3 of Nanjing’s market share.

Meituan’s ride-hailing services were just launched in Shanghai this March, and it announced an impressive number of orders:

- Day 1: 150k orders

- Day 2: 250k orders

- Day 3: 300k orders

Meituan claimed that it overtook 30% of Shanghai’s ride-hailing market share.

Of course, as a latecomer, Meituan is fighting an expensive war. Meituan waived drivers’ service fee for the first 3 months, and keeps it at 8% going forward. If the driver clock in enough hours, Meituan will also make up any difference to make sure drivers are making at least 600 RMB per day. The company is also rewarding the drivers extra 200 RMB if they take enough orders. Meituan also gives out coupons to customers to deduct 14 RMB off of the first 3 orders.

According to Huxiu News’ calculation, Meituan is spending 40 RMB on every order completed. If this is true, it means Meituan has spent 28 million RMB on coupons and subsidies during its first 3 days of operation in Shanghai.

After winning the fight against Uber, Didi now owns 90% ride-hailing market share. Yet, the war is not over. Beside Meituan, other companies are still trying to fight back: Ctrip, Dida, Gaode, Shenzhou and Yidao.

The problem with Meituan

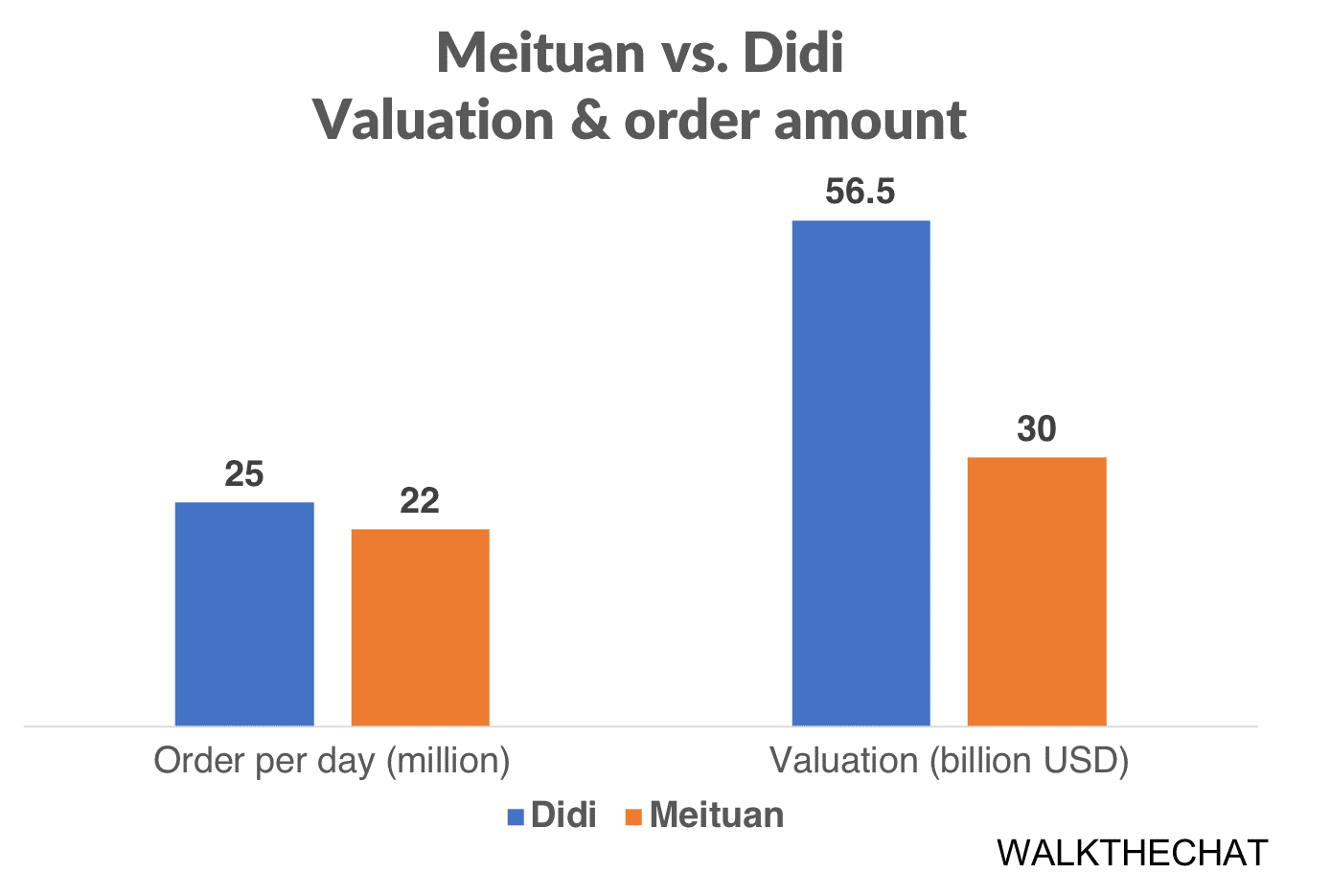

Didi receives on average around 25 million orders per day, only 3 million more than the food delivery orders made on Meituan. However Didi is valued over 56 billion USD, almost double the 30 billion USD valuation of Meituan.

Why such a discrepancy between number of orders and valuation? There is a simple reason for that: Didi won the ride hailing war, with 90% market share. Meituan on the other hand, is still fighting a tough and expensive battle against Alibaba for the food delivery market.

To a large extent, Meituan failed to go “0 to 1” in any of its market: it failed to create a monopoly position which would enable the company to generate long-term profits.

This drives the valuation down as investors are concerned that the company might, on the long run, be crushed by Baidu/Alibaba/Tencent companies in one of its key markets.

Meituan acquire Mobike, a step into bike sharing industry

Meituan bought Mobike this week for around US$2.7 billion. Bike-sharing is now a 227 million users market, and the number is expected to grow to 306 million by 2019 according to Liebao Quanqiu Zhiku. Mobike and Ofo together take more than 90% of the market share.

Despite the huge user base, the bike-sharing industry doesn’t look so pretty financially. According to TMTPOST, Mobike lost 681 million RMB in December 2017.

The Balance sheet of Mobike in December 2017 looked like so:

- Revenue 110 M

- – Cost of Sales 565 M

- – Management Expense 146 M

- – Depreciation 80 M

- = 681 M RMB net loss on December

Its competitor Ofo it not in a better state either. According to Tencent Tech news, Ofo had 600 M in cash left in the bank in January 2018, enough to operate for only one month; Ofo also owed 2.5 billion RMB to its vendors; it also spent 3 billion of the deposits users paid.

Ofo and Mobike tried but failed to merge earlier in 2018. It was a chance to end the price war and actually make some profit. Just like the way Didi was able to dominate 90% of the market and charge a higher commission to its drivers.

Now Mobike and Ofo are both backed up by strong investors. Mobike has Meituan, Dianping, and Tencent; Ofo has Alibaba.

Both Tencent and Alibaba are interested in the high-frequency spending behavior caused by bike-sharing, it could lead into a spending behavior of either WeChat Pay or Alipay, thus a possible higher transaction volume in the long run.

However, with the Mobike acquisition, Meituan steps into another market where it will have to wage an expensive war against rich tech giants. Without important synergies with its other businesses, it is unclear whether the move will prove beneficial on the long run.

Conclusion

Acquiring Mobike and going against Didi are expensive bets. As long as Tencent has Meituan’s back, and the company keeps growing, these moves might be able to help pump up the valuation for its IPO.

However, Meituan is competing against large players in all of its key markets. Although the main competitor is Alibaba, Meituan is sometimes going against its own investor, Tencent. Despite its impressive growth rate, Meituan is likely in for a tough ride.