Livestreaming started taking off in China back in 2016, that is almost a decade ago. While this realisation will make any China marketer feel ancient, does it mean Livestreaming is a thing of the past ? Certaintly not.

Let’s look at the China livestreaming trend in 2025, and understand the key tactics to leverage it for your brand.

Livestreaming gained momentum in 2024

Platforms such as Tmall and JD used to proudly publish booming growth numbers each year, after each major sales festival (Double Elven in November and 618 in June).

Since 2022, slugging sales have led these platforms to stop publishing precise numbers, we therefore do not know the exact Double Eleven and 618 figures for 2024. However, the published figures show us that Chinese e-commerce is bouncing back and that livestreaming is leading the growth.

618 Shopping Festival 2024

- Total GMV was 3 times higher than the same period in 2023.

- Livestreaming GMV was 5.4 times higher than 2023.

Double 11 Shopping Festival 2024 (First Week Performance)

- Merchants with sales exceeding 10 million RMB were 3.3 times more than 2023.

- Merchants with sales exceeding 5 million RMB were 4.5 times more than 2023.

- Merchants with sales exceeding 1 million RMB were 3.1 times more than 2023.

The picture is clear : Chinese e-commerce is bouncing back with 300% growth rate on average, while Livestreaming is leading the charge with a 500% growth rate.

Who are the top Livestreamers in China for 2025 ?

The choice of the right livestreamer very much depends on the brand doing promotion. Here are a few successful Livestreamers that will give you a sense of Average Order Values (AOV), positioning and pricing.

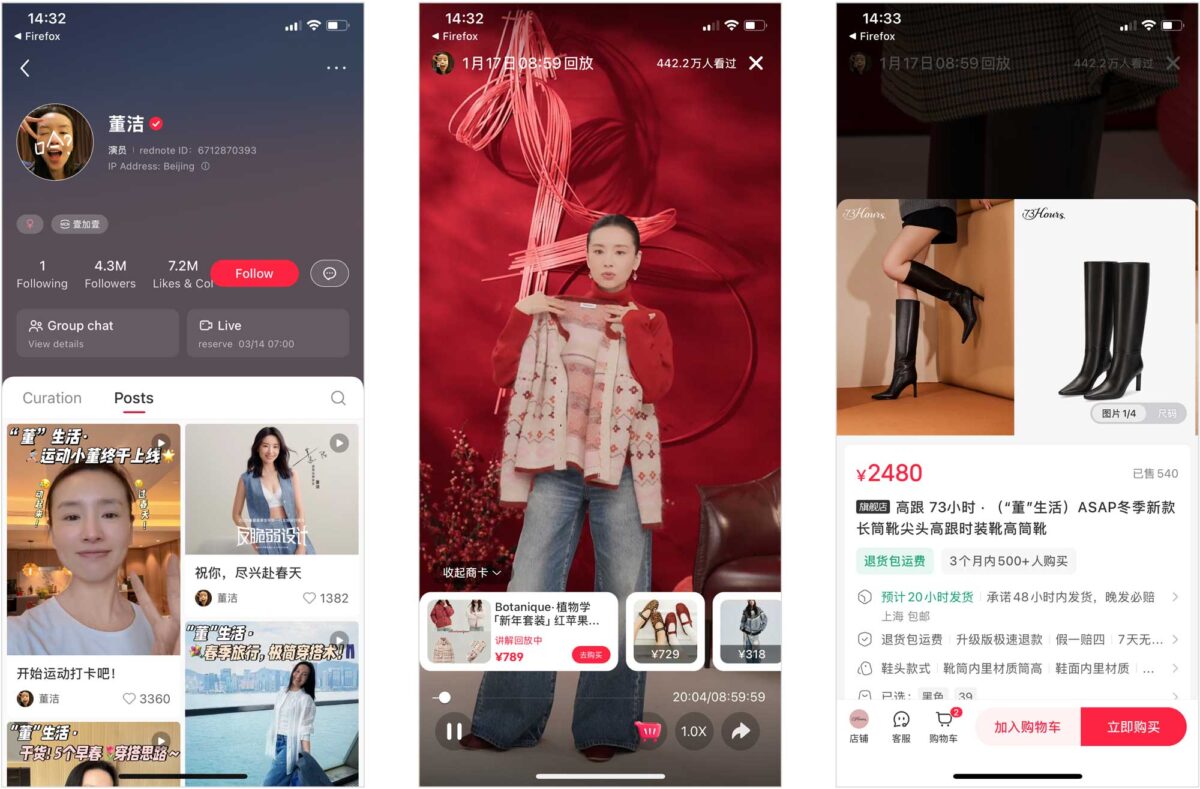

1. Dong Jie (Actress-Turned-Influencer)

Background:

Dong Jie is a former actress turned into a top-tier livestreaming influencer on Red (the Chinese version of Instagram). She is recognized as a benchmark for “Seeding-style” e-commerce livestreaming. In 2024, she achieved a GMV exceeding 1 billion RMB in a single month ($138 million USD)

Product Categories:

- High-ticket fashion (e.g., GANNI cardigan – 2,700 RMB, single livestream sales: 1M RMB)

- Designer footwear & accessories (e.g., A.Cloud crossbody bag – 1,899 RMB, single livestream sales: 610K RMB)

- Luxury jewelry (e.g., HEFANG floral necklace – 800 RMB, single livestream sales: 210K RMB)

Livestreaming Strategy:

- Trust-Building Approach: Encourages thoughtful purchasing with “Buy Only If You’re Sure” messaging, making consumers feel respected.

- Lifestyle-Based Storytelling: Demonstrates products within daily life settings, such as showcasing essential oil application techniques.

Performance Metrics:

- GMV surpassed 1 billion RMB in November 2024

- Average order value (AOV) of 400-800 RMB ($55 – $110)

- 65% repurchase rate

- Single-Session Record 50.54M ($7M USD) RMB GMV in January 2024

Collaboration Costs:

- Slot Fee: 40,000 RMB for two product links

- Commission: 20-30% (fashion & accessories category)

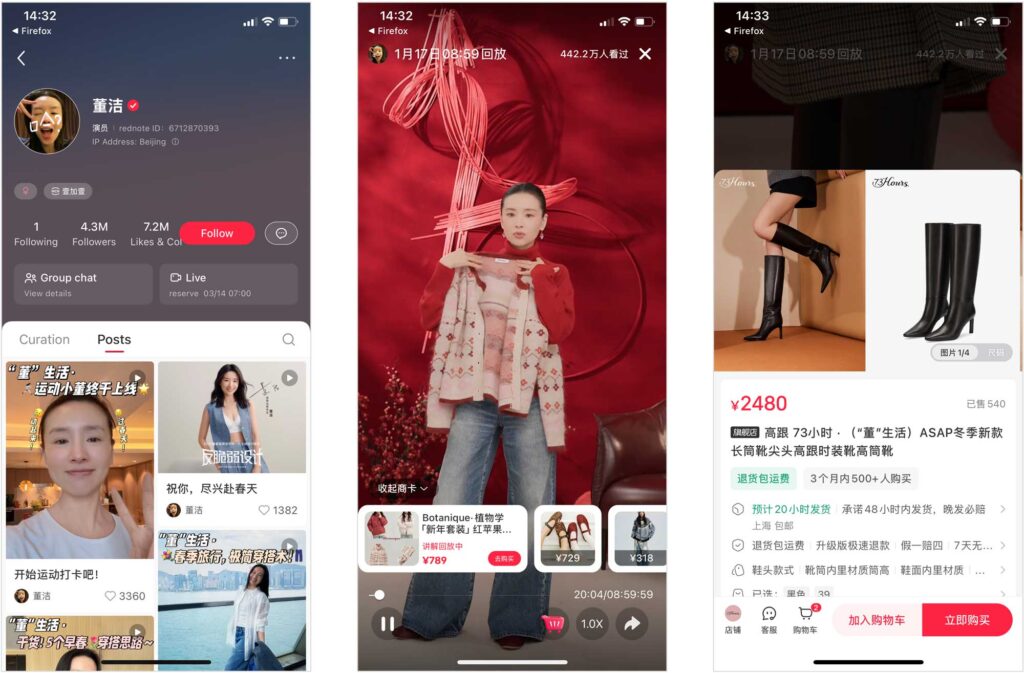

2. Zhang Xiaohui (Socialite & Brand Founder)

Background:

Hong Kong socialite and fashion writer, founder of personal brand “Rose Is a Rose,” Zhang Xiaohui achieved a sales revenue of 39M RMB (5.4$M USD) in January 2025.

Product Categories:

- High-end beauty & skincare (e.g., 7,000 RMB HairMax hair growth device)

- Niche international brands (e.g., MY.ORGANICS – single-session sales of 10.61M RMB, Augustinus Bader skincare)

Livestreaming Strategy:

- Aesthetic-Driven Content: Slow-paced, immersive storytelling integrating luxury and lifestyle.

- Private Domain Marketing: Leverages WeChat Official Accounts and Mini Programs to engage a high-net-worth audience, increasing repurchase rates to 30% above the industry average.

Performance Metrics:

- 2025 Brand Success: achieved 39M RMB in a single month, AOV exceeding 1,500 RMB.

- Single-Session Record: Double 11 (2023) GMV exceeded 100M RMB, with 41.6% of buyers from Tier-1 cities.

Collaboration Costs:

- Slot Fee: 20,000-40,000 RMB per product link

- Commission: 20-30% (beauty & home category

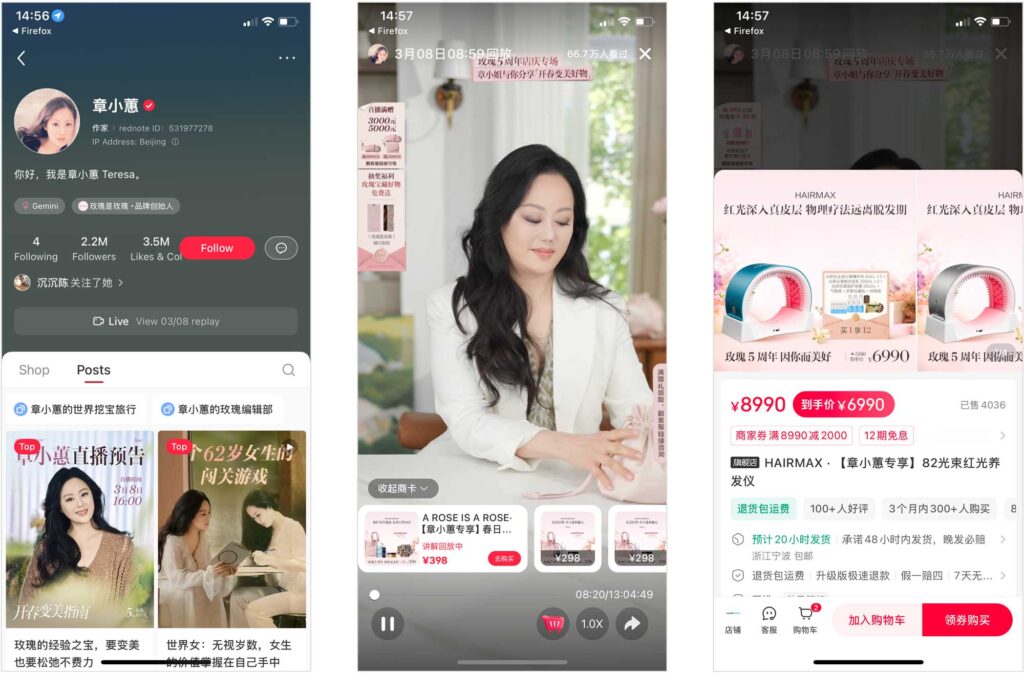

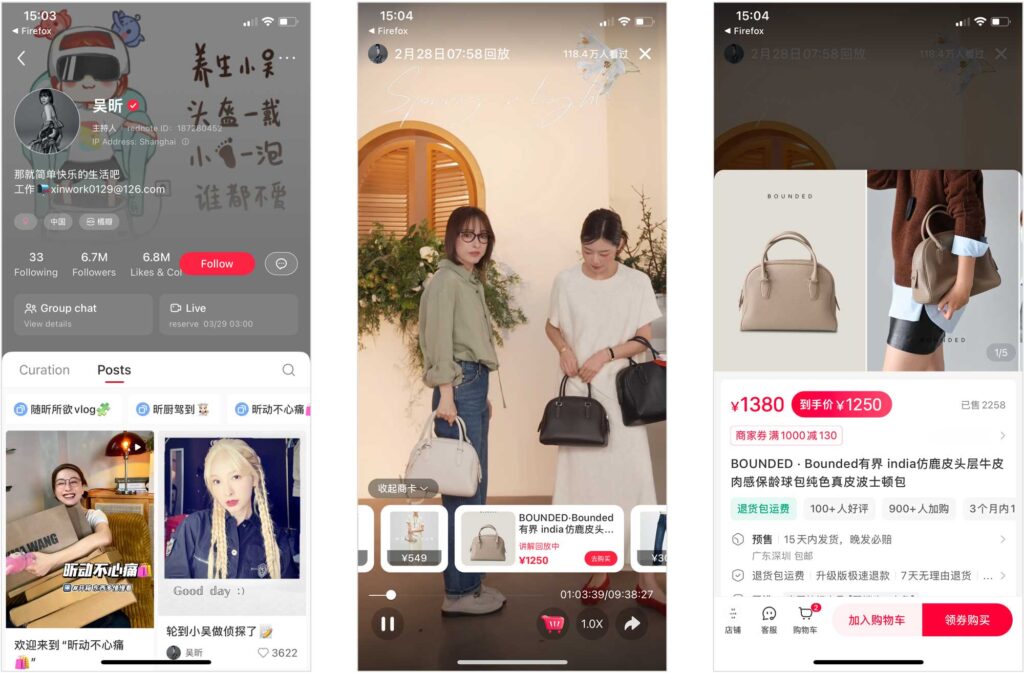

3. Wu Xin (Mass-Market Appeal & “Everywoman” Branding)

Background:

Former TV host turned livestreaming influencer, embraced the “relatable girl-next-door” image to connect with mainstream audiences. Monthly GMV exceeded 100M RMB in 2024.

Product Categories:

- Affordable luxury fashion (e.g., 200-1,000 RMB designer boots & vintage-inspired outfits)

- Everyday essentials (e.g., motion-sensor lamps, dishcloths with high repurchase rates)

Livestreaming Strategy:

- Highly Engaging & Down-to-Earth Approach: Uses humor and self-deprecation, such as kneeling to demonstrate a sensor lamp or joking about “frizzy slippers.”

- International Expansion: Adapted to TikTok’s global audience, spontaneously switching to English, leading to 2.18M views in one session.

Performance Metrics:

- Debut Success: First livestream exceeded 100M engagements (likes, comments, shares) and 35M RMB in GMV, with an AOV of 500-1,500 RMB.

- Sustained Growth: Consistently reaches 10M+ RMB in monthly GMV, with a fanbase primarily composed of young women from Tier-2 and Tier-3 cities.

Collaboration Costs:

- Slot Fee: 10,000-20,000 RMB per product link

- Commission: 20-30% (fashion & daily essentials category)

Which platform to use for Livestreaming ?

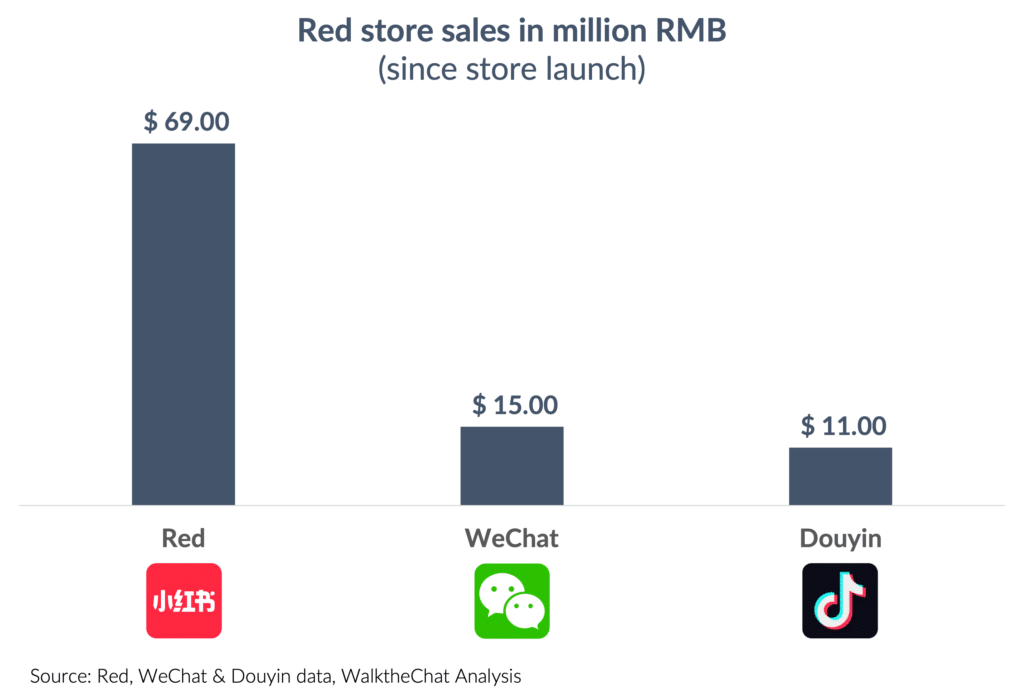

The choice of platform for Livestreaming depends very much on the pricing of your products. Red is by far the most premium platform among Chinese social networks, with an AOV of 500 RMB ($69) against 200 RMB ($28) for WeChat Channels.

Douyin (the Chinese version of Tik Tok) Livestreaming AOV is even lower: it dropped from around 110 RMB ($15) to only 80 RMB ($11)

As we saw in previous examples, Red sales can very much exceed this AOV figure, with orders above $350 / item.

3 steps to launching Livestreaming in China

Step 1: identifying the right KOL/KOC for Livestreaming

Your first focus will be to identify the right influencers for your brand :

- Duration: 0-3 months

- # of campaigns: 15 KOL/KOC / month

- Target GMV: less then 10k RMB / livestream

- Ads strategy: no ads

- In-store livestreaming: not active yet

Most brands stick to a selected product pool, often their signature/iconic items, for livestream promotions, typically offering a 20-30% discount compared to regular prices.

At the end of this process, you can identify the best performing streamers (>10k RMB / livestream) for long-term collaborations.

Step 2: repeat collaboration & ads spending

You will then attempt to expand the GMV / livestream by focusing on best-performing streamers and expand their presence through advertising

- Duration: 3-6 months

- # of campaigns: 30/40 mid-tier KOL / month

- Target GMV: 20k-40k RMB / livestream

- Ads strategy: repost and promote livestream highlight clips through commercial ads.

- In-store livestreaming: not active yet

By the end of this step, you should have established Livestreamers with whom you collaborate on a regular basis and who generate profitable campaigns for your brand

Step 3: expand to top livestreamers

The final step focuses on expanding to top livestreamers, while the brand starts its own in-house Livestreaming activity. In-house livestreaming is essential to having an “Always on” presence on social media, but it is also a costly investment, therefore better suited for most established brands.

- Duration: after 6 months

- # of campaigns: 30/40 mid-tier KOL / month + 1 of the top-20 livestreamers

- Target GMV: 20k-50k RMB / livestream for small streamers, 300k+ for top livestreamers

- Ads strategy: repost and promote livestream highlight clips through commercial ads.

- In-store livestreaming: in-store livestreams account for around 20% of total livestream sessions, with brand ambassadors frequently invited to co-host to drive sales

Which brands can do Livestreaming in China ?

Cosmetics, F&B and fashion are by far the most popular categories for Livestreaming in China.

For the vast majority of brands Livestreaming is possible without specific permissions. But special fields such medicine, finance, law, and education, need to have the proper certification to be allowed to stream.

In practice however, a lot of brands do operate without such licenses, and products such as hemorrhoid cream or adult toys can be found among Red or Douyin livestreams.

Conclusion

Livestreaming is booming again in China with a 500% growth rate in 2024. It is one of the fastest-growing channels in a Chinese e-commerce market that is bouncing back after challenging COVID years.

If you want to launch Livestreaming in China, a step-by-step approach is required: you need to identify the right platform and positioning for your brand, and progressively scale your way to bigger and bigger Livestreaming influencers.

And of course, if you have any questions, we are here to help.