The pandemic has caused damages to the world’s economy, but for internet companies, it’s an opportunity for growth and expansion. JD, Alibaba, and Pinduoduo, the 3 largest Chinese e-commerce companies, have released their financial earnings last week.

More active e-commerce users as a lasting impact of COVID-19

The pandemic has changed the users’ behavior by forcing most people to stay at home. This change is reflected in the latest earning results. Although users are resuming their daily commuting lifestyle, the June 2020 results show that the impact on their online shopping behavior is lasting.

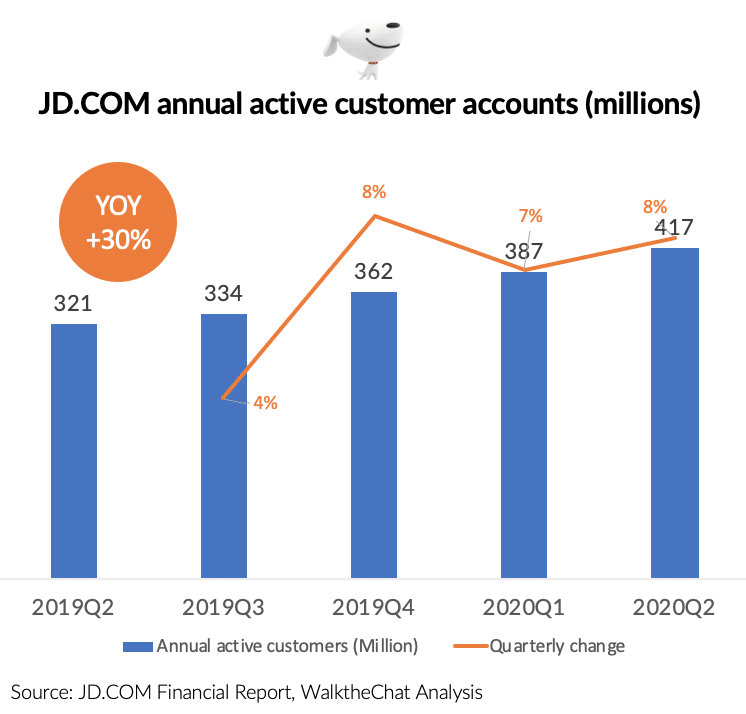

JD has a positive trend of increasing active customers throughout the year and was able to maintain a positive growth of around 8% in the last 3 quarters.

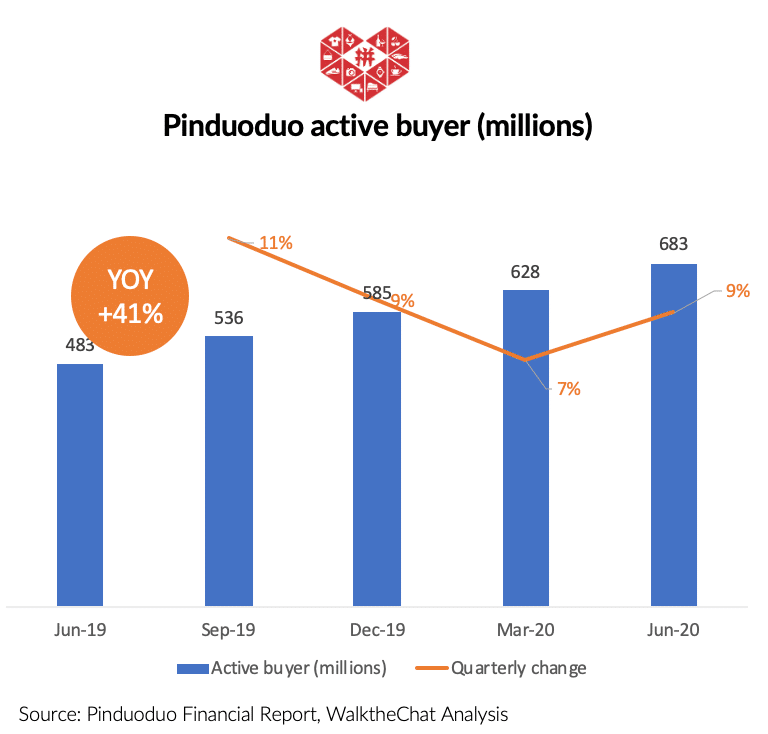

Pinduoduo’s growth slowed down compared to previous quarters. However, an overall YoY growth of 41% still makes it the fastest-growing major e-commerce platform.

Pinduduo’s accumulated 683 million active buyers by June 2020. With this rate of growth, the number of buyers could surpass Alibaba in merely 4 months!

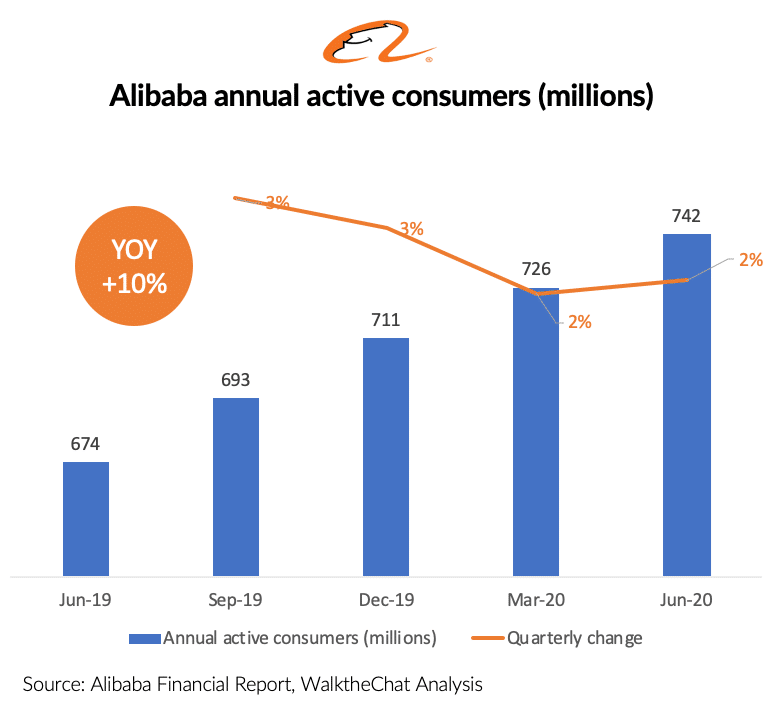

Alibaba, despite its strong market penetration, is still consistently growing at 2% QoQ, and 10% YoY.

Strong focus on lower-tier city users & high purchasing value customers

JD’s main focus is on less developed areas.

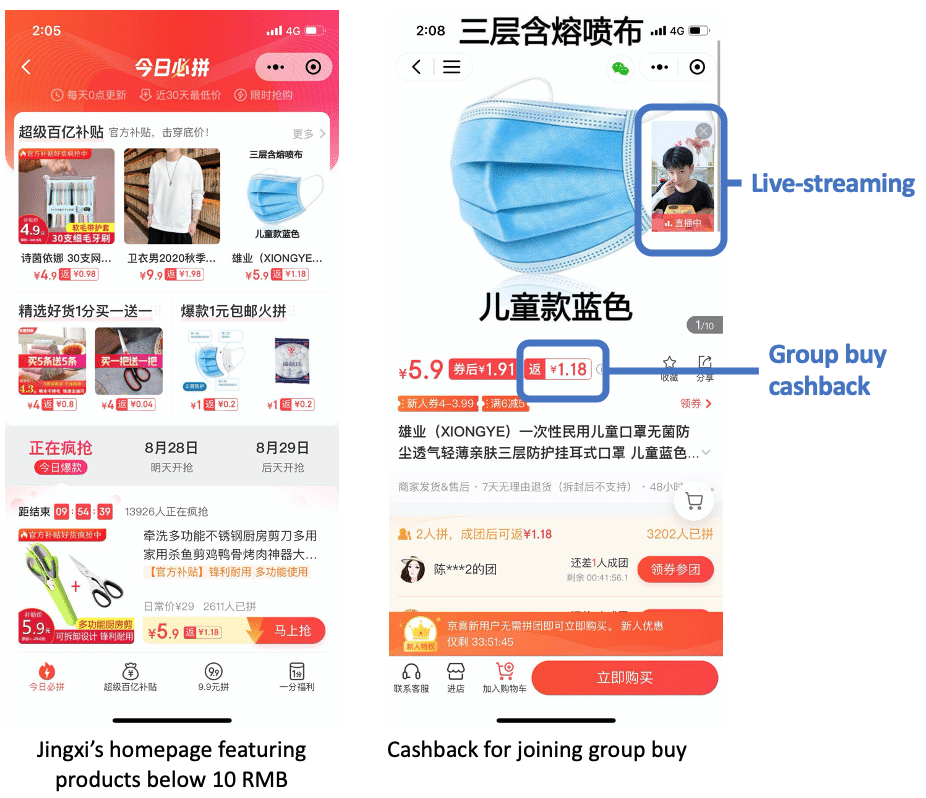

One of the top-performing JD sales channels is its Mini Program Jingxi京喜. Jinxi is an e-commerce Mini Program that focuses on low-priced items (between 1 RMB to 10 RMB) and using group buy cashback as incentives for buyer acquisition. This Mini Program focuses on lower-tier city users who often live in a close community, perfect for a group buy strategy to kick in.

These last quarters’ strong user growth is also due to the strategic partnership with WeChat. Since Single’s Day 2019, WeChat added direct access to JD’s Mini Program called Jingxi on the user’s Discovery tab bringing a surge of traffic. This is reflected in the 8% QoQ customer growth since 2019 Q4.

Jingxi had 7 million daily orders on June 18th this year. 60% of the orders came from tier 3 to tier 6 cities. As of August 2020, the Jingxi Mini program is still listed as the top 6th Mini Program on WeChat, according to aldzs.com.

Just like JD, Alibaba is focusing on user acquisition in lower-tier cities. One of the highlights of this season is the strong performance of the Taobao Deals App.

Taobao Deals (淘宝特价版) was launched in 2018, focusing on heavily discounted products. The target group is less developed areas, but the App hasn’t got much success until this year. Amid the COVID-19 pandemic, it has grown to 40 million MAUs this June. Starting in March 2020, the strategy of Taobao Deal is to moving away from branded products and instead encouraging 1688 merchants to provide products directly from factories. In March, Taobao deal was ranked the 7th most downloaded App on the Chinese Apple App Store.

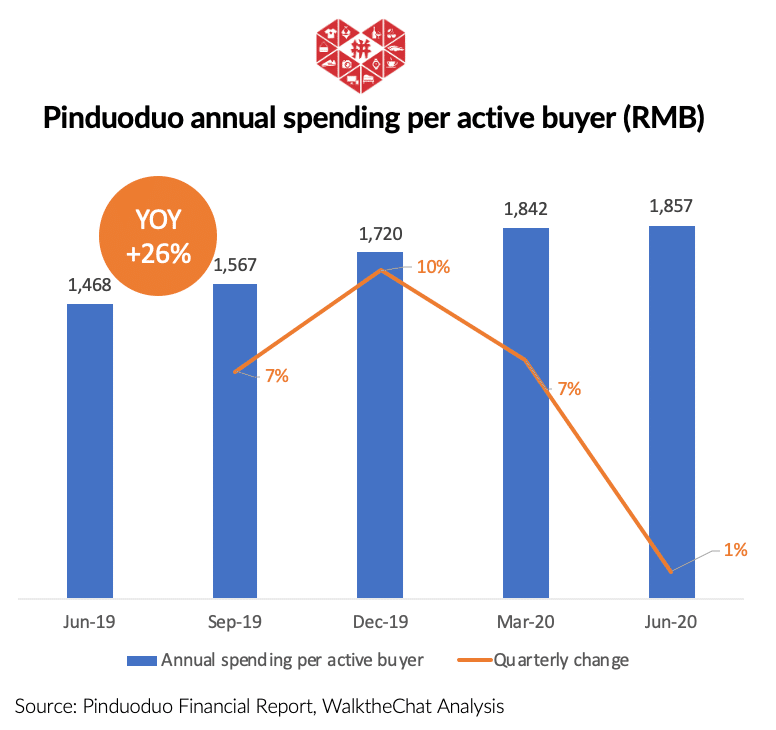

Pinduoduo on the other hand is aiming to raise the spending per buyer.

The average annual spending on Pinduoduo is 1,857 RMB. This is much lower than Alibaba.

According to Alibaba’s annual report ending in March 2020, it’s total GMV on China retail marketplaces is 6,589 billion RMB, divided among 726 million annual active consumers. The average consumer’s annual spending is 9,076 RMB, almost 5 times higher than Pinduoduo.

Pinduoduo launched a 10 billion RMB subsidy program since Q2 2019. The subsidized products are premium products such as iPhone, Dyson hair drier, and even Tesla. These subsidies encourage new customers to purchase high-value items.

GMV & Revenue

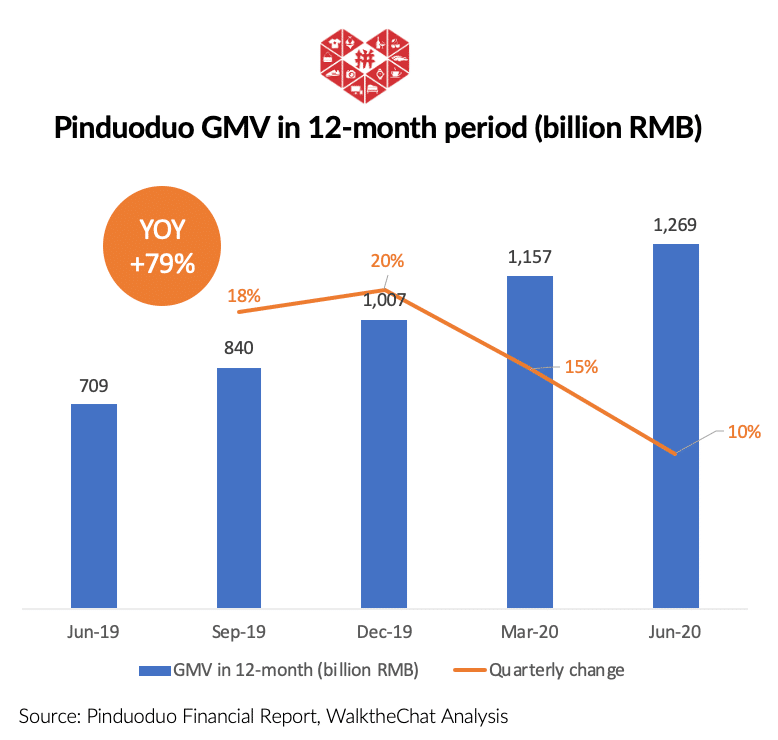

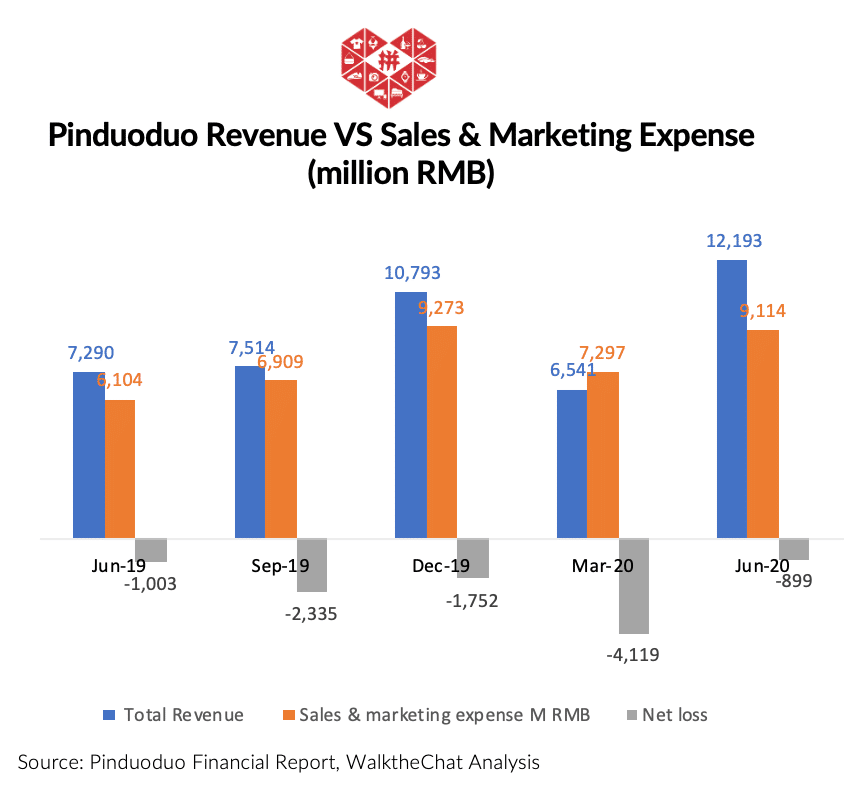

Pinduoduo’s GMV reached 1,269 billion RMB in the 12-month period ended in June 2020. GMV QoQ growth dropped to 10%.

The drop in GMV growth is unusual since June 18th is usually considered as the 2nd largest e-commerce sales season in China.

Pinduoduo chose to spend less on sales and marketing during this June 18th compared to Single’s Day last year. The high net loss from the March quarter could have constrained spending. Moving away from the 618 sales campaign also prevented a price battle against Tmall and JD.

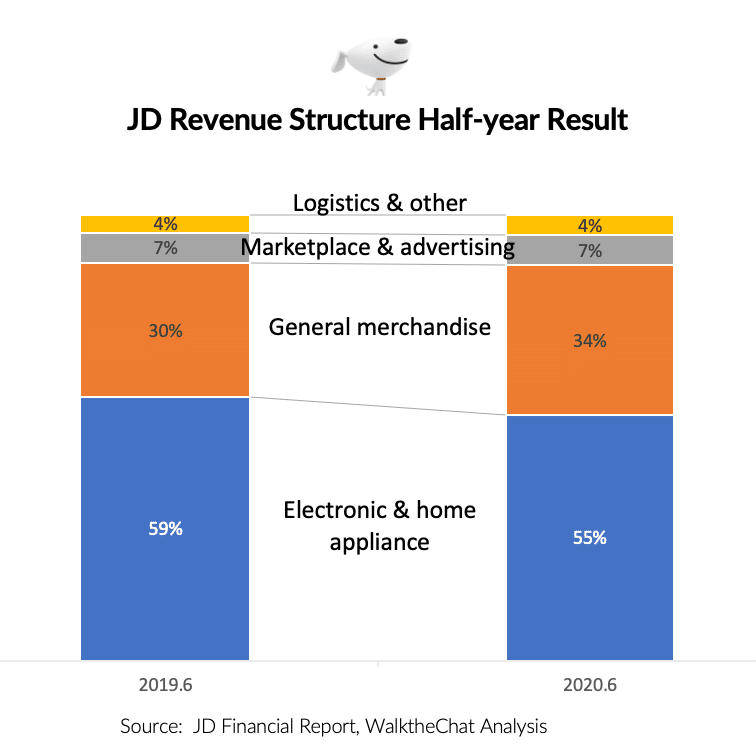

JD has been trying to diversify its revenue from electronic & home appliances to general merchandise. Revenue from general merchandise has increased from 30% in 2019 to 34% in 2020.

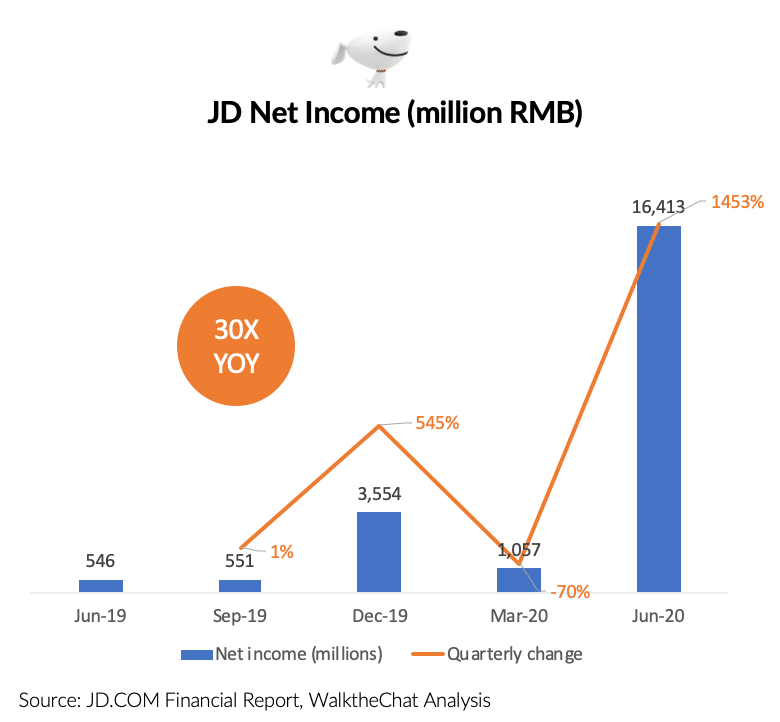

As a retailer business, JD’s net income has grown 30 times to 16 billion RMB compared to the same period last year. But these changes are not entirely due to business growth. The biggest impacting effect is “Other Income”, which increased from a negative RMB 1.0 billion to a positive RMB 7.9 billion, due to “ fair value change of investment securities”.

Strong focus on live streaming

Both JD and Alibaba put an emphasis on live-streaming sales.

Taobao’s Live GMV grew over 100% year-over-year. Today Taobao is still the top platform for e-commerce conversion from Kuaishou (Kwai) and Douyin. However, Douyin is starting to build its own e-commerce ecosystem, threatening to compete against Taobao Live.

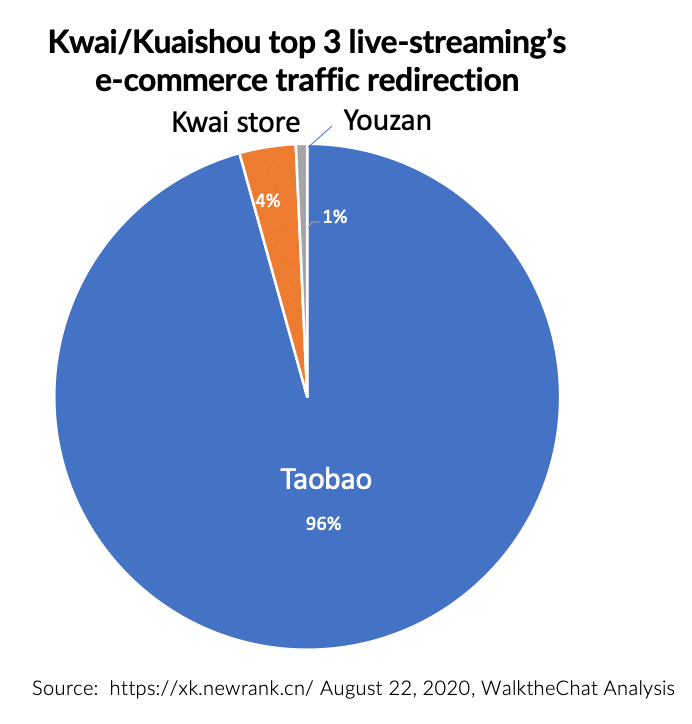

JD in response launched a strategic partnership with Kuaishou (Kwai). However, the actual impact is debatable. Taobao is no doubt still the top platform for Kwai’s live-streaming conversion. Of the top 3 live-streaming e-commerce destinations on Kuaishou, 96% of traffic goes to Taobao. None of the products sold links to JD.

For both JD and Alibaba, the reliance on short-video platforms to drive live-streaming sales traffic is a huge risk.

Douyin, the Chinese version of TikTok, just announced this week that it will stop allowing live-streaming products to link to 3rd party e-commerce platforms such as Taobao or JD. Douyin and Kwai are both shifting focus to support their internal e-commerce system. This will eventually take away a major source of social media traffic from e-commerce platforms.

Expansion of cross-border e-commerce

The rebound of the Chinese market has attracted lots of premium global brands to Chinese marketplaces.

Tmall Global GMV grew 40% year-over-year in June 2020. According to isfashion.com, over 200k new products got listed in Tmall Global from January to March 2020, and the new store opening rate has increased 327% YoY.

For example, Luxury group LVMH is collaborating with Tmall to launch new cosmetic brands via Sephora’s Tmall Global store in May. Tmall Global also plans to introduce over 800 overseas cosmetics brand in a year, by collaborating with L’Oréal, Estee Lauder, Johnson & Johnson, Shiseido, P&G, and Unilever.

JD is also actively onboarding global brands this quarter. Some of the newly onboarded merchants including Prada’s footwear brand Church’s, Christopher Kane, Tom Dixon, Sergio Rossi, SJYP, and Daikoku.

Conclusion

Despite of the COVID-19 Pandemic, the major Chinese e-commerce platforms managed to maintain a steady growth rate.

With a renewed focus on live-streaming and smaller cities, the crisis was actually an opportunity for these marketplaces to broaden their user base and move to new markets.

It is likely that these short-term strategic gains will turn into long-term profits for Taobao, JD and Pinduoduo.

In 2022, JD and Shopify formed a strategic collaboration to help overseas merchants sell via cross-border eCommerce more easily. Check out this article if you are interested: