Oreo Alipay game

Alipay is taking marketing campaigns to another level with its AR scan feature. Oreo partnered with Alipay to launch an AR game to let users play with the cookies. Users just need to take an Oreo cookie and scan it with Alipay’s AR tab.

You will be able to play a game to catch falling Oreos with a cup of milk.

After the campaign, users will be able to win a red envelope if they make a purchase in selective supermarkets and stores.

It’s a great campaign to let customers interact with the product while providing coupons to incentivize in-store purchases.

So far all the brands that launched Alipay AR campaigns were selling drinks. The list includes: Starbucks, Coca-cola, Weiquan, Vitasoy, and Tianwo. Users need to scan the packaging label to enter the campaigns.

Other interesting things you can find using Alipay AR scanner include:

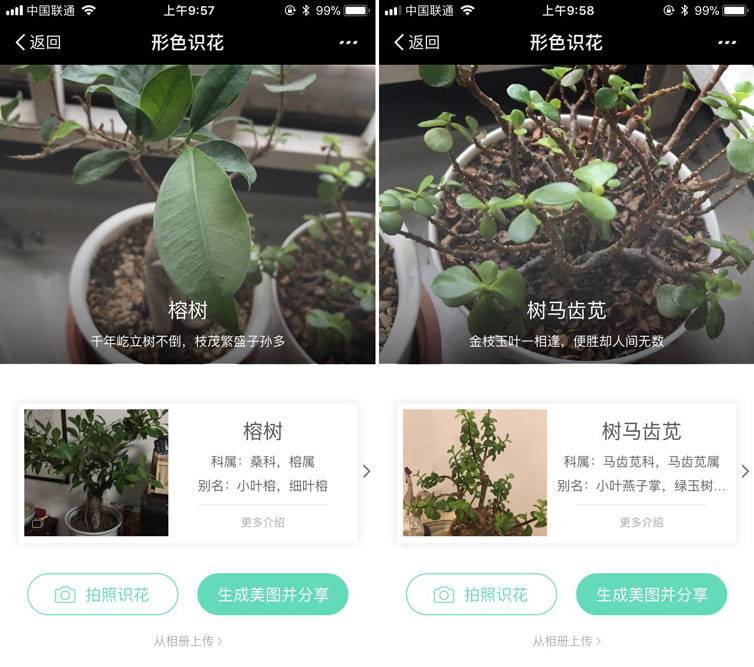

Recognize the plants and flowers around you. It could accurately recognize all the plants at my place.

Learn about the solar system, although this game doesn’t go beyond the display of a simple description of each planet.

Tencent invests in Douyu and Huya

On March 8th, Tencent invested a total of 1.09 billion USD into Douyu and Huya, 2 of biggest game live streaming companies.

Douyu, the No. 1 player in live streaming Apps, received 630 million USD investment solely from Tencent. This is the the 3rd time Tencent has invested in Douyu. Previously it led a 100 million USD series B founding round in March 2016; and a 236.5 million USD series C founding round in August 2016.

Douyu’s homepage directs users to 6 major live streaming games.

Huya, one of Douyu’s biggest competitor, got B round funding of 461.6 million USD investment from Tencent on the same day. This purchase was made at market price, after which Tencent Tencent now controls 50.1% of voting power. Huya has also announced it’s plan to file for IPO in the US by submitting a statement to the SEC.

This means the 2 competitors will now continue to fight for market share, but no matter which party wins, Tencent will be the one to benefit. Since Douyu and Huya are focused on game live streaming, both could drive traffic to games that are developed by Tencent. This will continue to push Tencent’s monopoly position in the gaming industry to an unreachable level for any other company in the world.

Through acquisition, Tencent is moving toward controlling the whole supply chain of China’s gaming industry:

- Game development: Tencent, Supercell

- App stores: Tencent App Store, WeGame

- Social logins: WeChat, QQ

- Game live streaming platform: Douyu, Huya

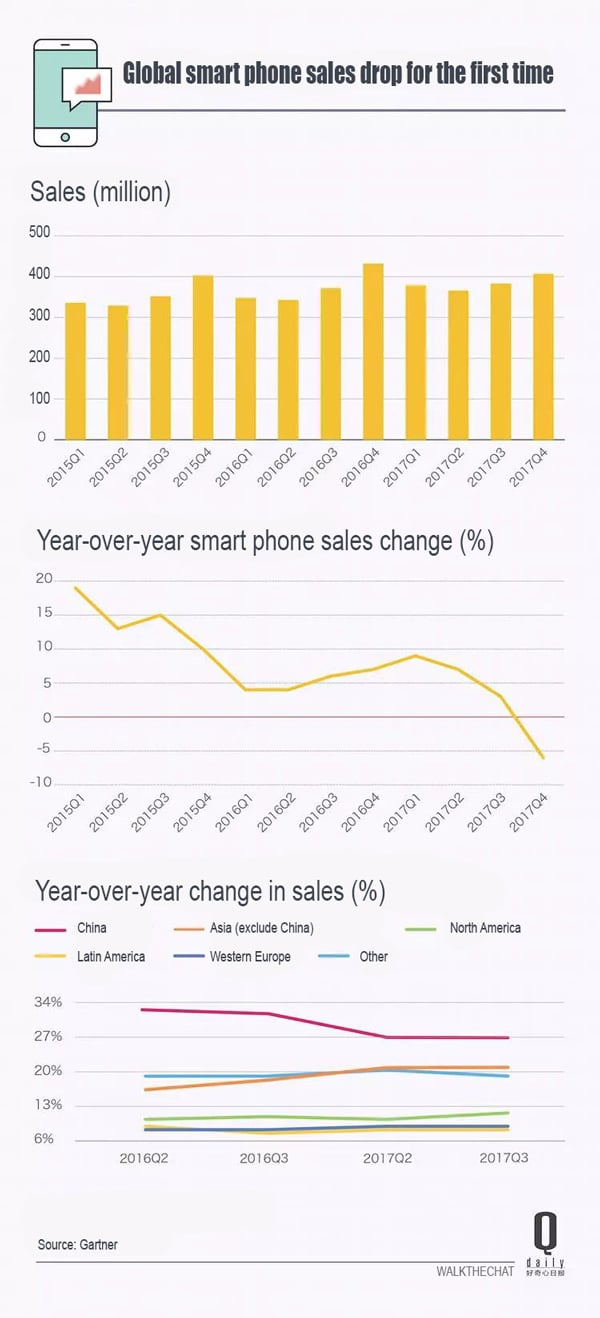

Smart Phone sales starts to decrease for the first time

1.472 billion smart phones were produced in year 2017, a 1 million decrease from year 2016. The 480 billion USD smart phone industry has been growing for the past decade, and it now shows the first signs of decrease.

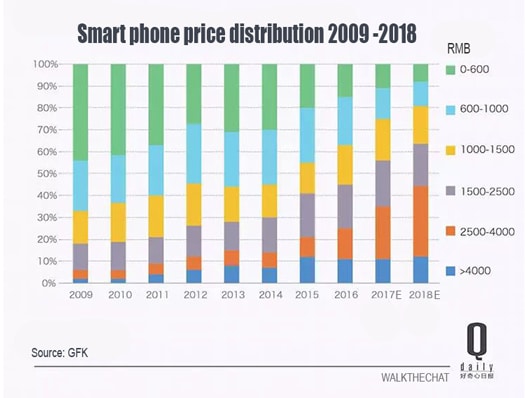

Most of the decrease is due to smartphone sales slowing down in China. Smart phone penetration is reaching its peak level in the Middle Kingdom. Most growth in the smartphone market will come from users switching to more expensive models.

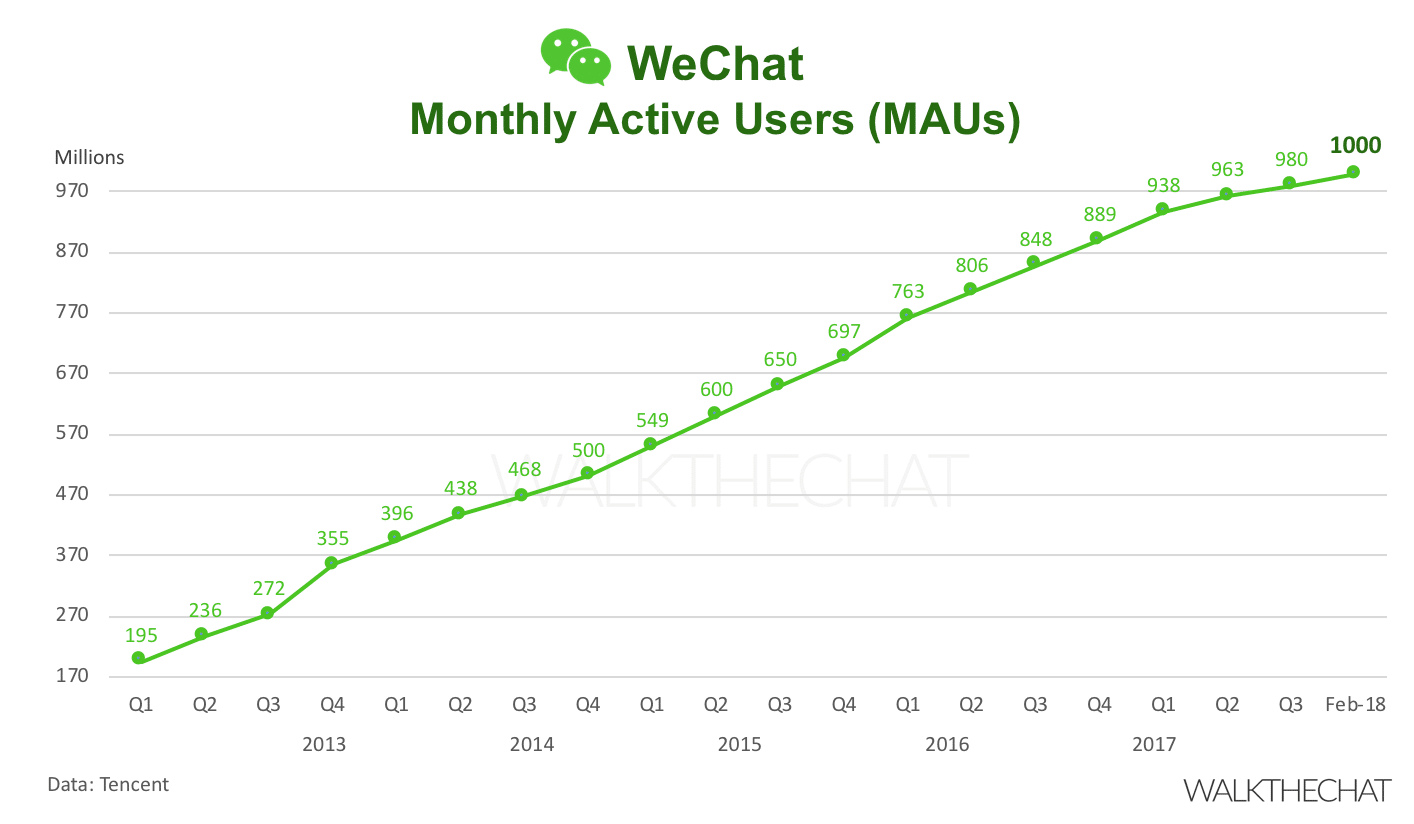

WeChat reached 1 billion user

During an interview at the China National People’s Congress, Pony Ma announced that WeChat has surpassed 1 billion Monthly Active Users during the Chinese New Year.

Commercialized International Women’s Day

While the rest of the world is discussing women’s right and equality in the work place, brands in China turns the International Women’s Day into the biggest sales of the year for women. E-commerce platforms such as JD.com, Taobao and Suning celebrate this day as “Queen’s Day”, “Butterfly Day” and “Goddesses’s Day”, deliberately avoidding to use the term “women”.

Female targeted advertising is very common in China. According to Reuters, women spend 74% more in 2017 than in 2015. And the size of “she economy”, women-focused market, will grow to 4,500 billion RMB by 2019.

1.4% of WeChat articles are deleted after publishing

Newrank took a survey of 10 million WeChat article samples between Feb 3rd and Feb 28th, and found that 1.4% are deleted within 3 days of publishing. Comparatively, a similar survey by Newrank in March 2017 indicated that 5% of articles were deleted.

Among the 143k deleted articles, 87.9% of articles are deleted by the account operator. The remaining 12.1% of articles are deleted by WeChat due to violation of WeChat terms of use. Incentivized sharing is among the top reasons for WeChat to delete an article.

The survey also shows larger WeChat accounts are more likely to delete articles after publishing. These accounts have large follower base that often leave comments to warn the account about any sensitive topics. Larger accounts are more likely to delete any sensitive topics to avoid the punishment from WeChat, which could lead to deletion of the account (as they have more to lose).

Brands operating in China should be fully aware of the terms of use of WeChat. Try to avoid incentivized sharing campaigns and avoid writing about sensitive topics.