iResearch released a report about the Chinese mobile payment market this month.

Highlights:

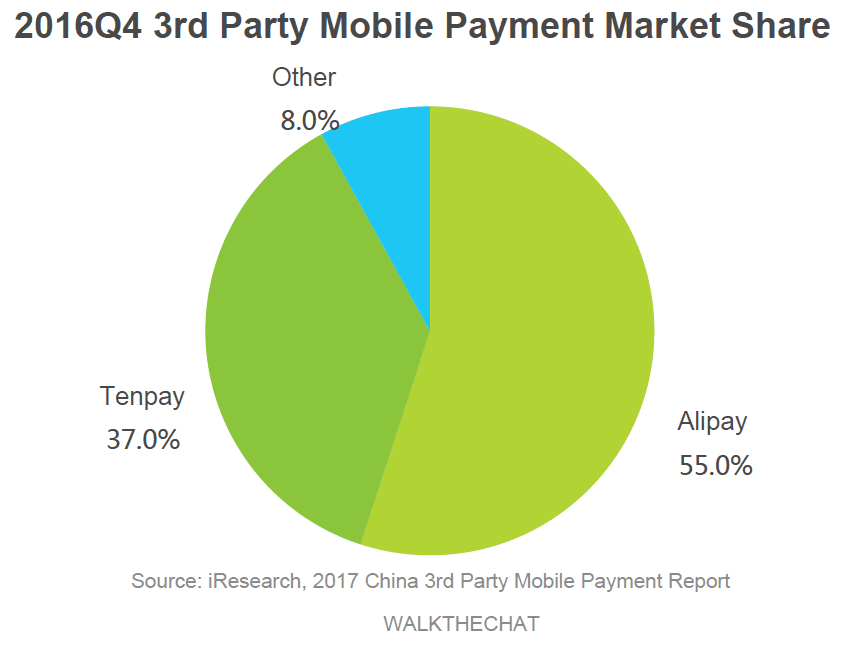

- Alipay and TenPay(WeChat Payment) together make up for 92% of the mobile payment market

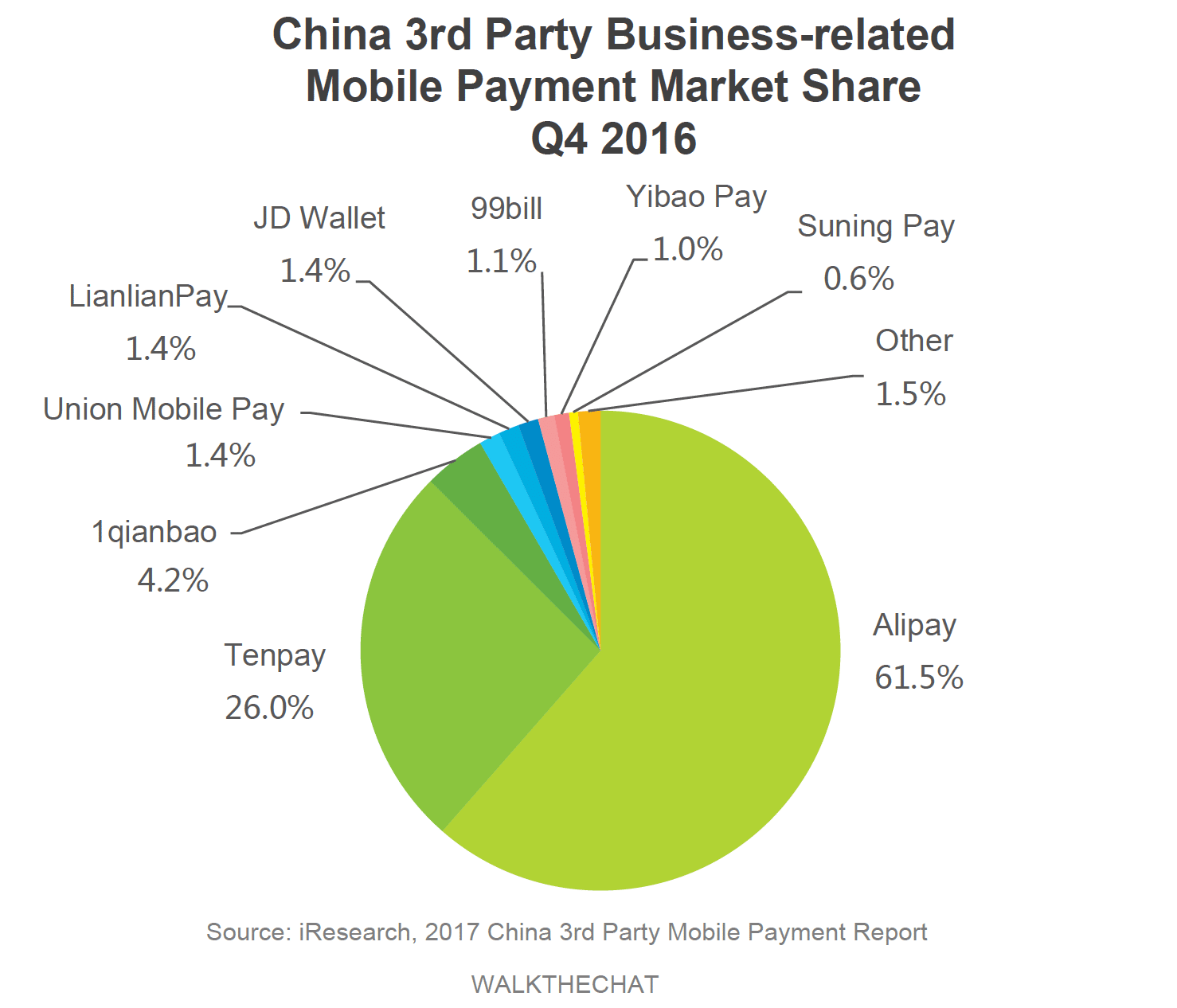

- Alipay makes up for the majority (61.5%) of business-related transactions

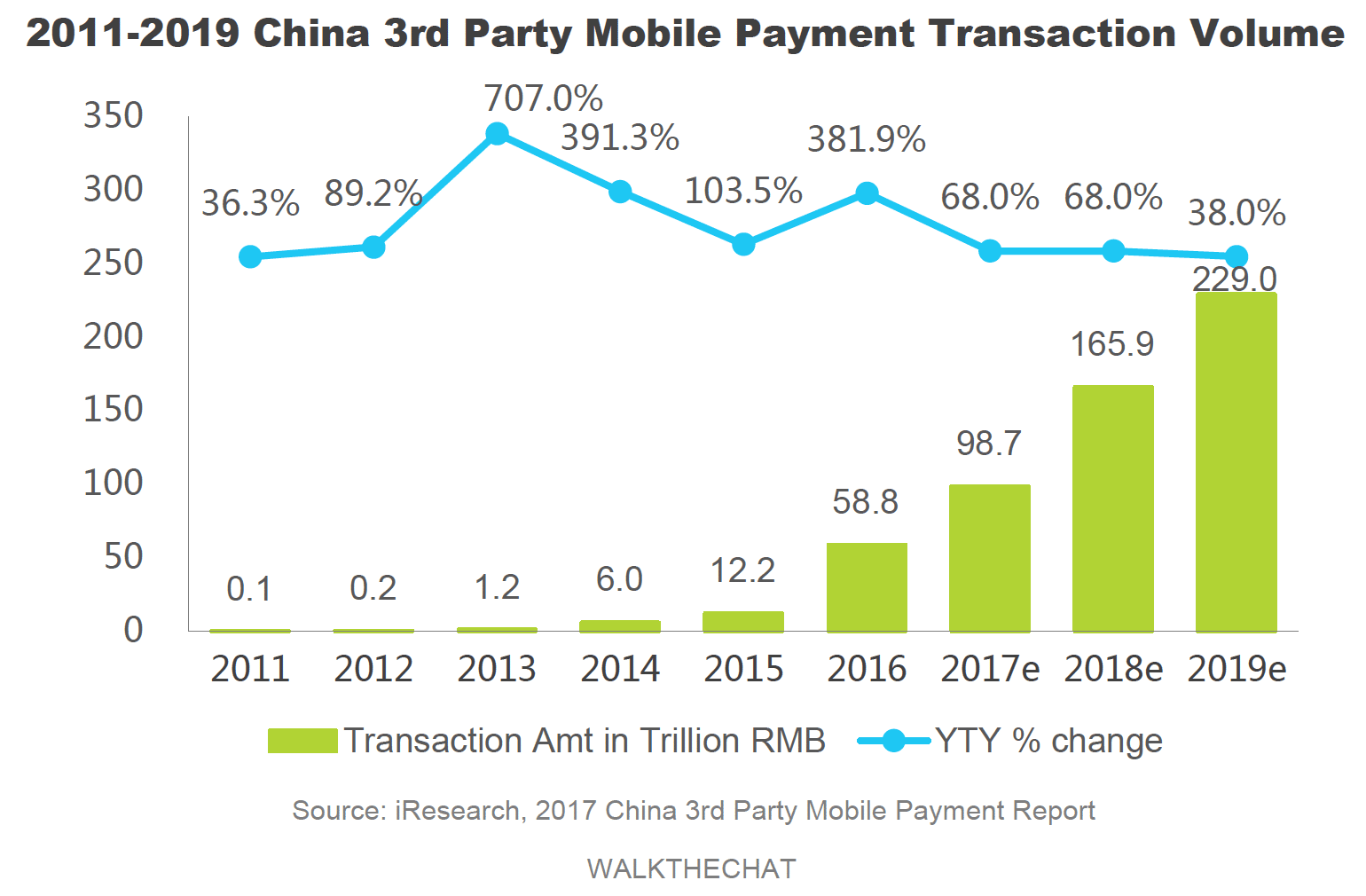

- Mobile payment transaction increased 381% to RMB58.8 trillion in 2016 and are expected to grow at a 68% growth rate in the next 2 years

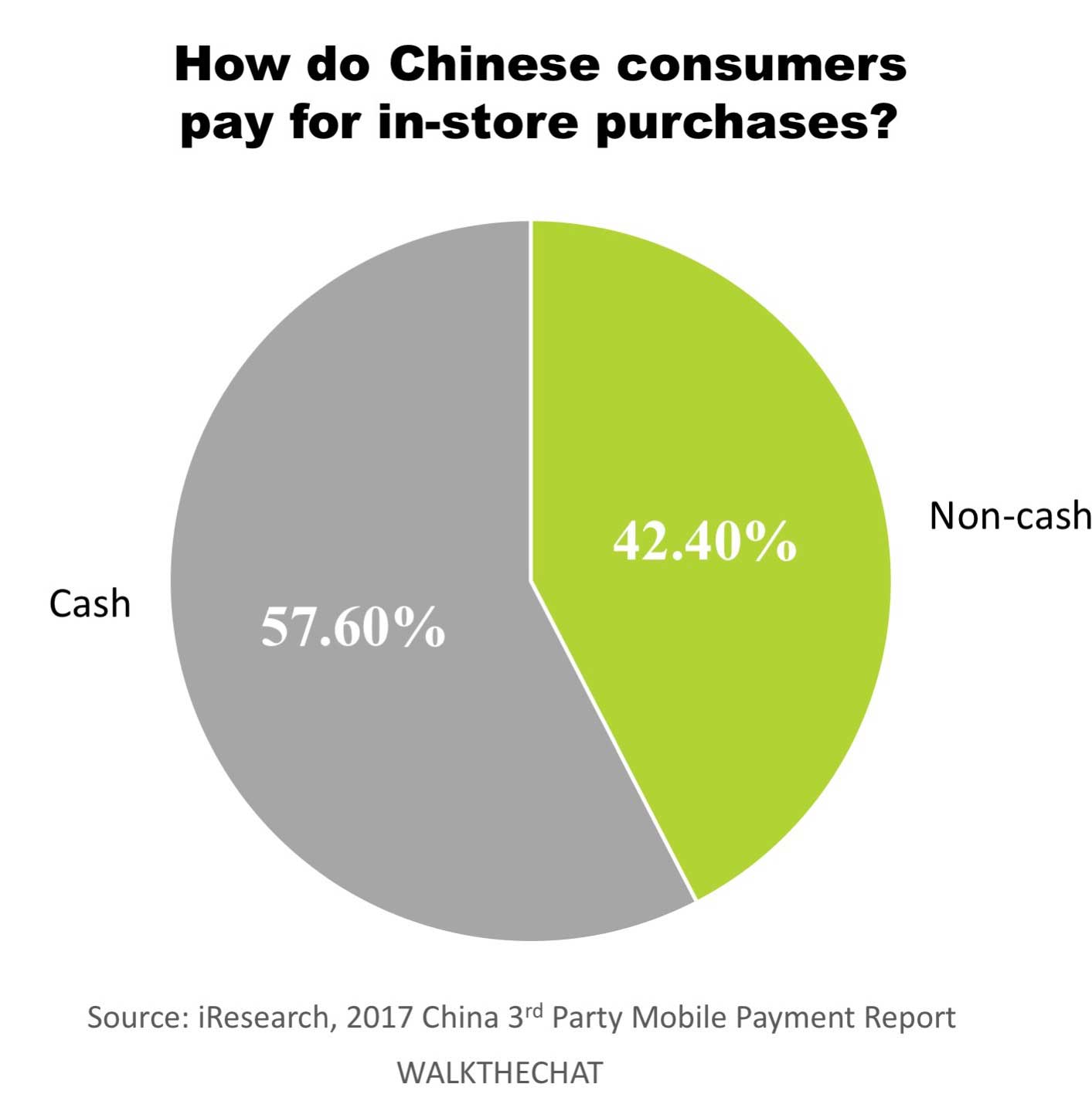

- Mobile payment amount for 74% of all online payments

- 42.4% of in-store purchase is done via non-cash payment

By Q4 2016, WeChat more than doubled its payment market share to 37%. Just a year ago in Q3 2015, WeChat only had a 15.9% market share. Online payments are very concentrated between the two major players, only leaving 8% of the market to the remaining payment competitors.

Of the RMB18.5tn transactions in Q42016, RMB11.9tn or 65% were business related transactions (transactions that can be traced to a product or a service). Alipay amount for an impressive 61.5% of such business transactions. WeChat Payment only takes 26% of the market share, since large portion of its transactions are peer-to-peer.

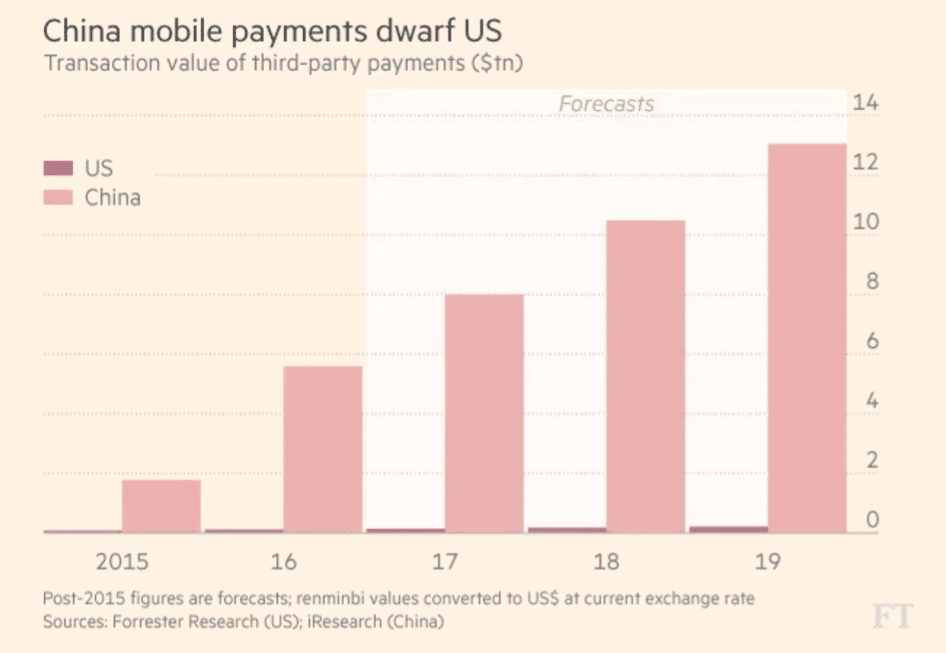

In year 2016, mobile payments reached RMB58.8tn (USD8.6 tn), a 381.9% year-over-year growth. The transaction volume is expected to grow at a 68% rate over the next 2 years.

In comparison, US is expected to see a mere volume of USD62.49 billion in mobile payment value in 2017 according to eMarketer. When comparing the two countries, U.S data is barely visible on the graph…

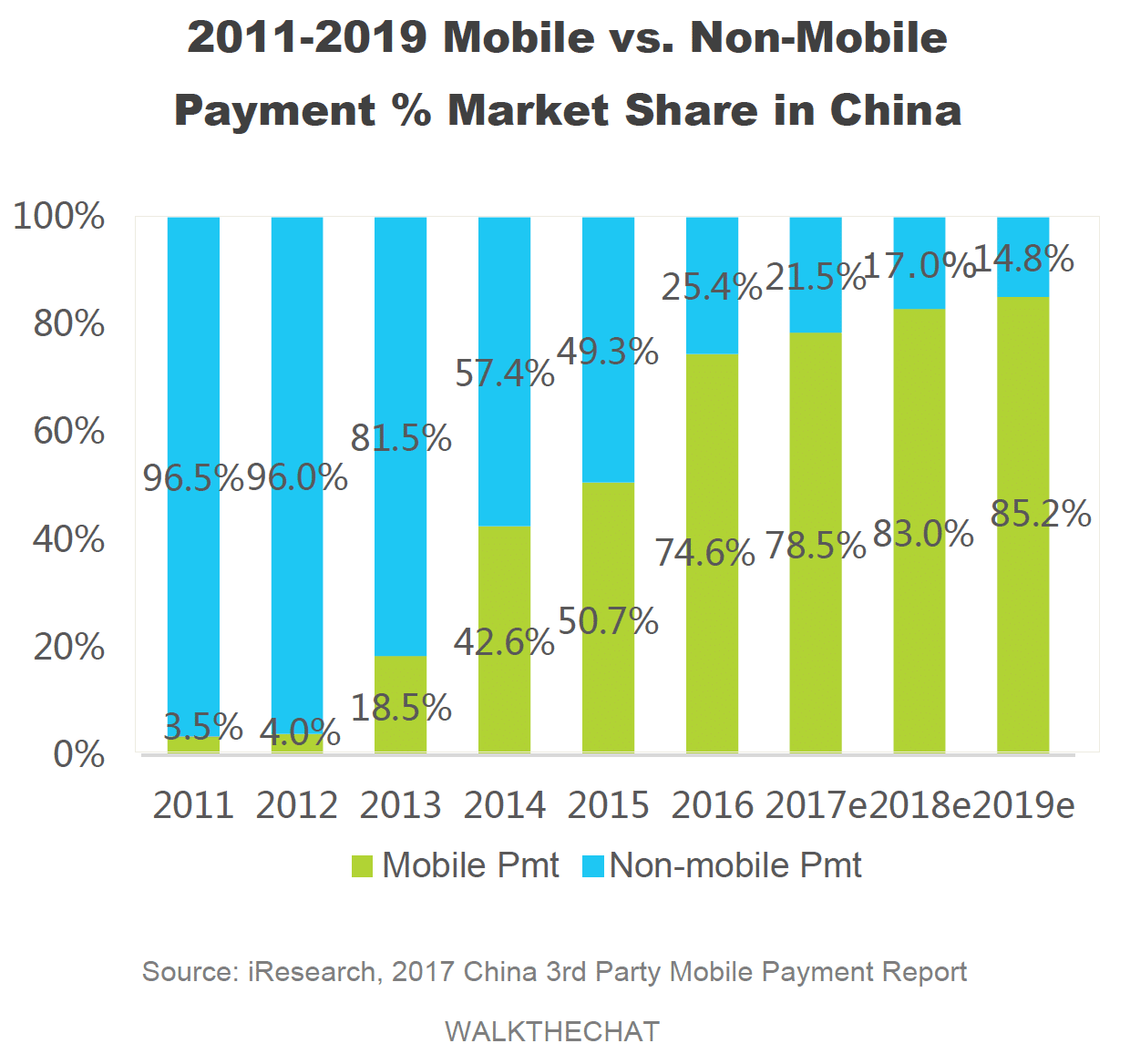

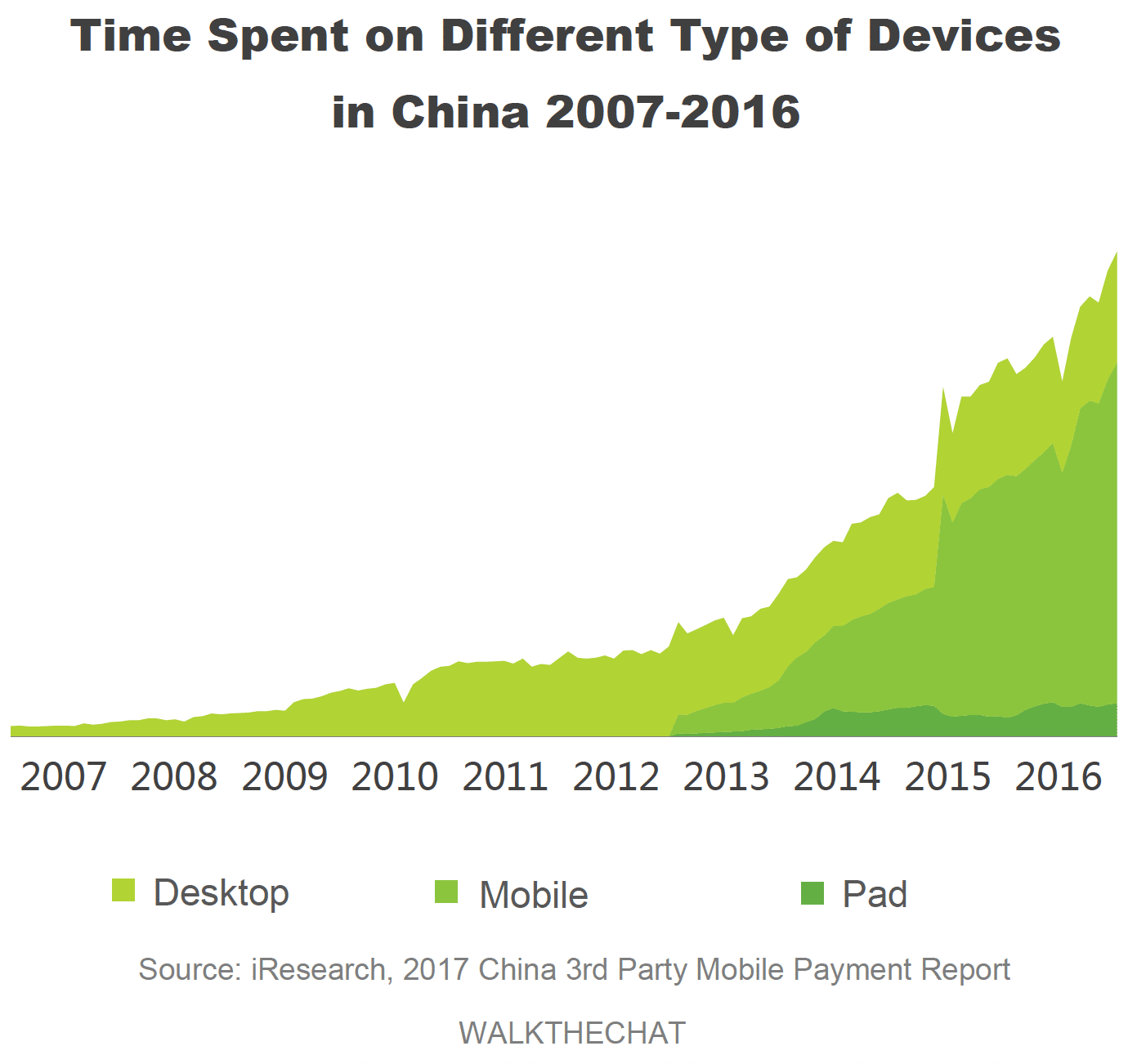

Users are moving away from desktop to mobile devices. Mobile payment amount for 74.6% of total online payments.

The trend correlates with the increasing amount of time users are spending on mobile devices.

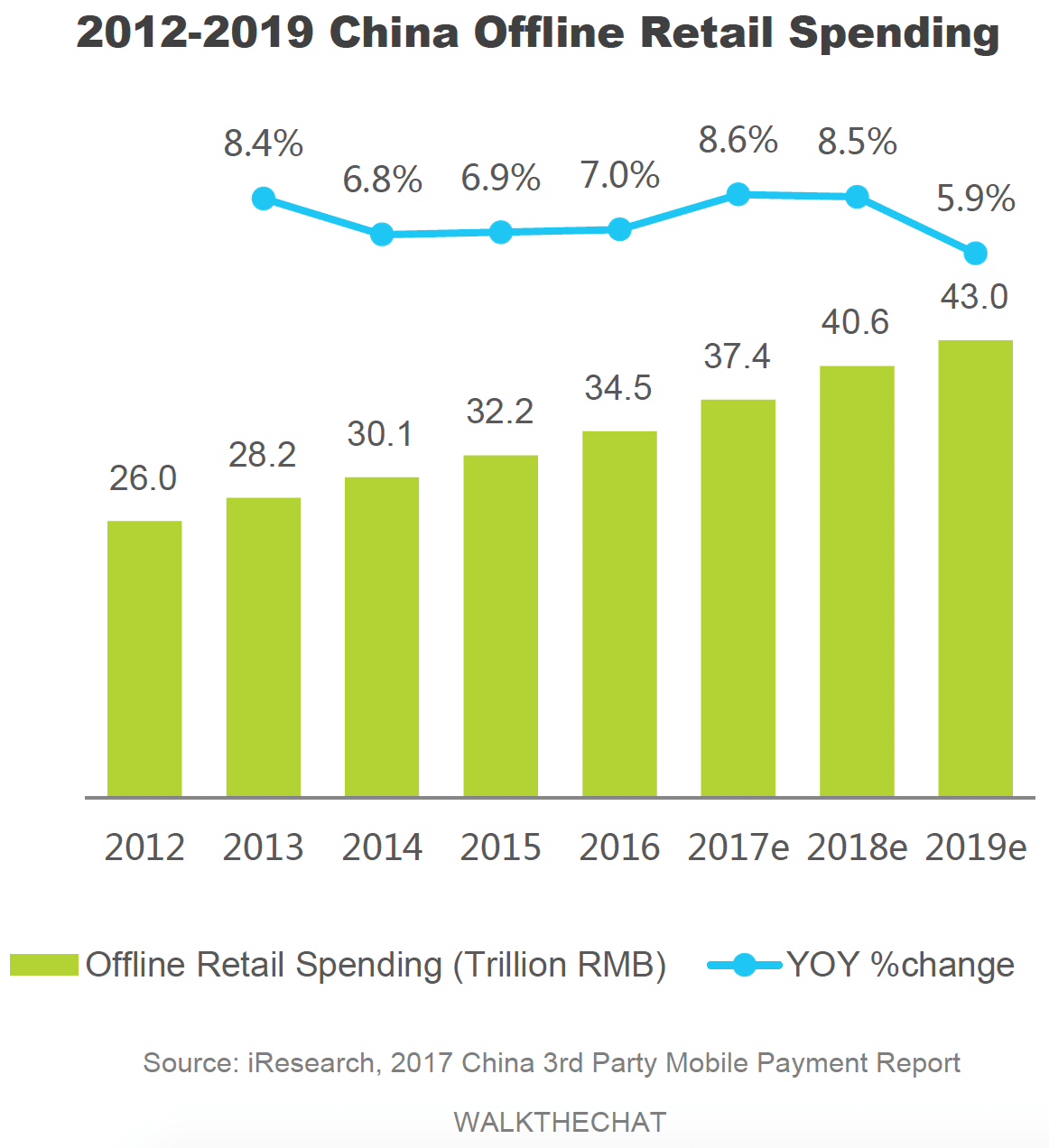

In comparison, the offline retail transaction value for consumer products is only RMB43tn. Offline spending is also expected to grow at a much slower pace in the next 3 years (bear in mind that there is overlap between offline retail and mobile payments.

It’s worth noting that non-cash payment amount for 42.40% of in-store transactions.

Conclusion

It’s no doubt that China is leading the mobile payment revolution. It’s a simpler life not to deal with cash and credit cards. But it also gives an incredible amount of data to a few companies which are handling many other parts of our social life. So far, the choice is clear: users have chosen convenience over privacy.