Alibaba and Tencent just released their earnings for the period of January to March 2020. A good opportunity to assess the extent to which COVID-19 impacted Chinese online platforms.

Alibaba’s Q1 2020 results

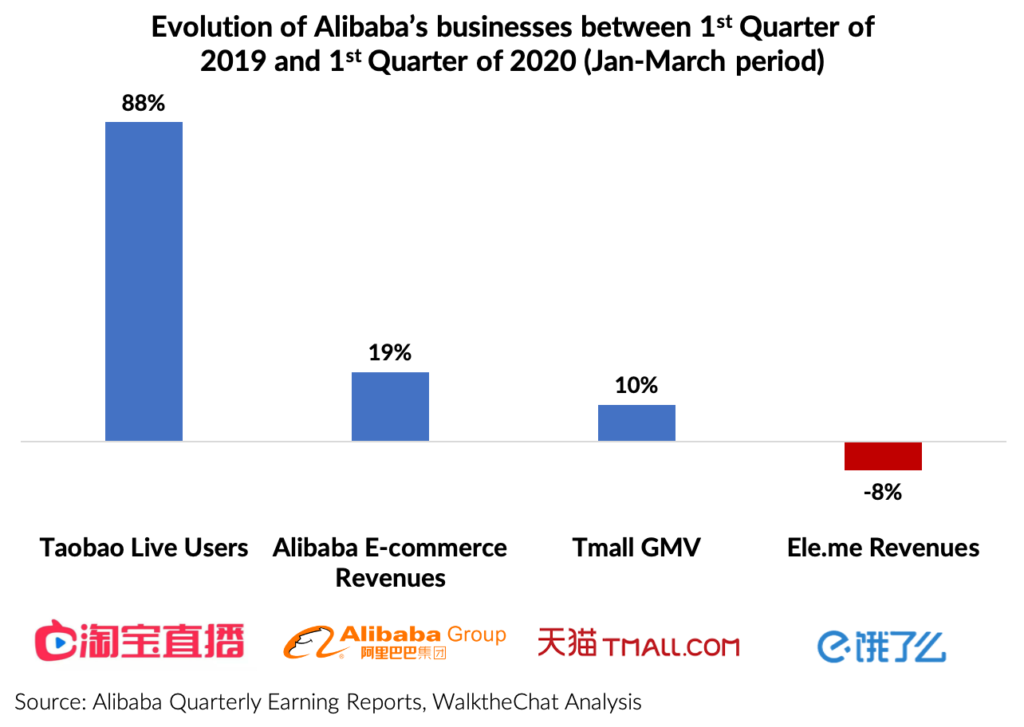

Alibaba saw overall very good performance YOY, due to the strong resilience of the e-commerce sector. Alibaba E-commerce revenues grew 19% YOY, while Tmall Online Physical Goods GMV grew 10% YOY.

Different segments of the Alibaba business got impacted in different ways.

Tmall FMCG and Consumer Electronics combined GMV grew at +25% YOY as customers stockpiled on essential items. But some other segments, however, saw negative growth (we can assume fashion was one of the segments with low or negative growth during the peak of the epidemic).

As users looked for at-home entertainment options, they flocked to Taobao Live, which saw a +88% increase in users YOY. On the other hand, the food delivery business Ele.me saw an 8% decrease in revenue as users preferred to cook at home during the peak of the pandemic.

The earnings report from Alibaba also states that “Tmall online physical goods paid GMV saw a strong recovery in April and continues to improve in May.” We can, therefore, expect a very strong quarter for Alibaba for April-June 2020, given the boost to e-commerce caused by the pandemic.

Other e-commerce platforms: Pinduoduo, JD.com

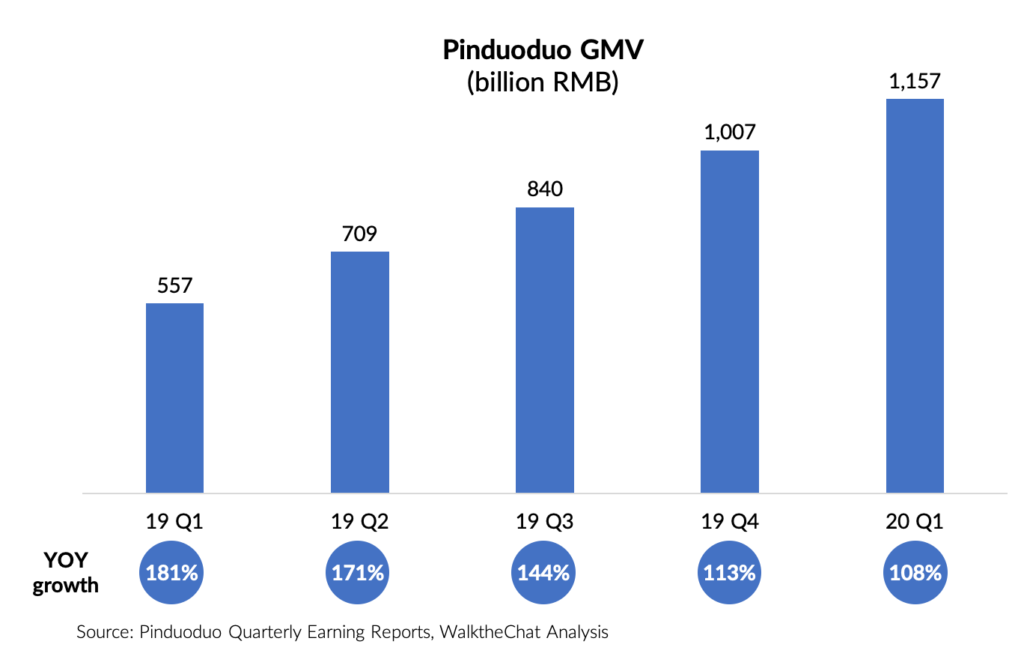

Competitors Pinduoduo and JD.com also maintained steady performance during the COVID-19 epidemic.

Pinduoduo GMV growth rate was steady at 108% YOY. This number represents a slow-down of Pinduoduo’s growth rate, but remains a strong figure given the macroeconomic context.

JD.com reported similar performance, with a 20.7% increase of revenues YOY. This figure represents a strong steady figure, although it is still lower than in previous quarters.

Tencent’s performance

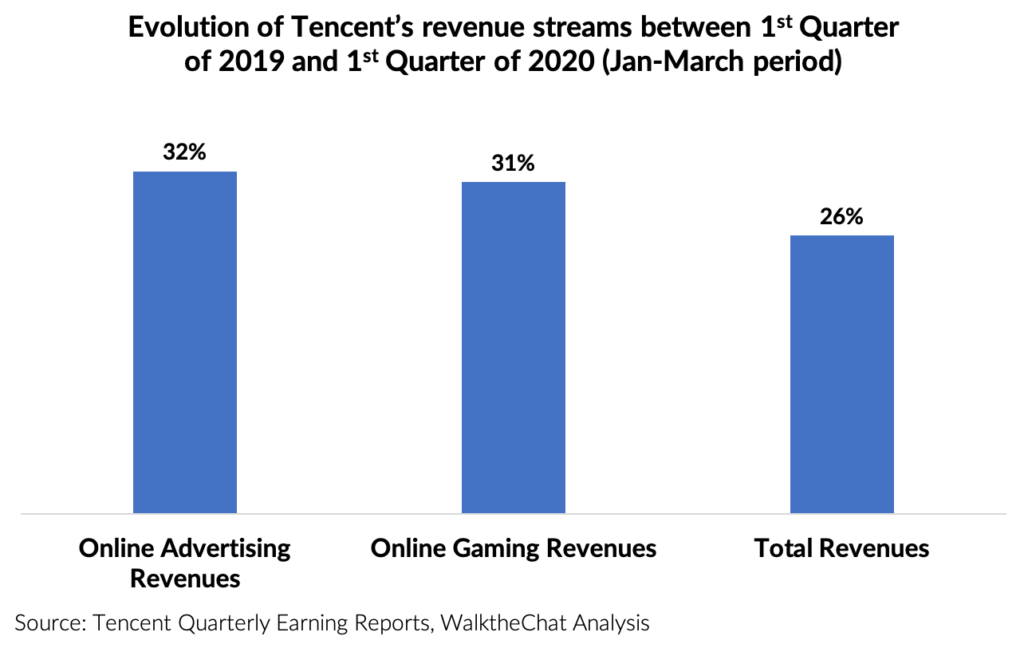

Alibaba wasn’t the only company impacted by the COVID-19 pandemic.

As users were stuck at home, online gaming boomed. Tencent’s revenues from advertising and online gaming grew respectively by 32% and 31% YOY.

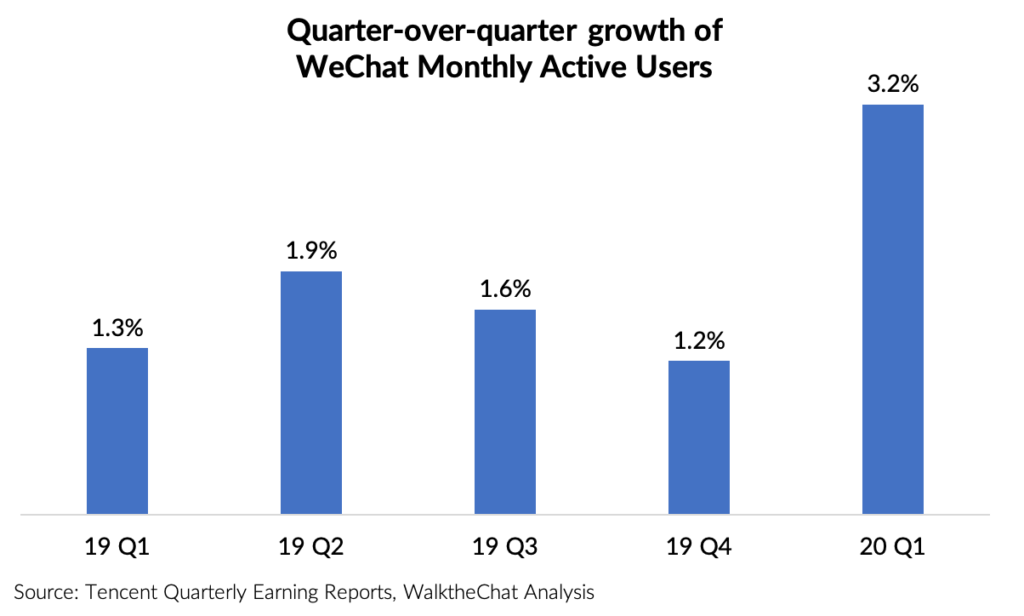

Even mature Apps such as WeChat got boosted by users staying at home. WeChat saw its biggest quarter-over-quarter growth in years with a 3.2% increase in Monthly Active Users.

It is interesting to note that this growth in revenues and users happened despite the increasing competitive pressure from short-video platform such as Douyin and Kuaishou.

Conclusion

As companies are reporting their quarterly earnings, we get a glimpse of the impact of COVID-19 on the Chinese e-commerce space.

Overall, the sector has been extremely resilient. Although it has been hard-hit in January and February, with the rest of the economy, a strong March recovery put most e-commerce and social platforms back on their growth track.

We expect these same companies to achieve exceptional performance on the second quarter of 2020, as more of the Chinese economy has moved online while customers’ confidence improved.