This week, I had a new retail shopping experience at Hema Supermarket, a retail store launched by Alibaba.

What’s special about this supermarket? And does it make sense for Alibaba from a business standpoint?

Data data data

A traditional supermarket gets limited payment data at the check out. But Hema knows everything about their customers: phone number, the product that you are considering to purchase, payment activities, your social media account, Taobao/Alipay account and even your home address.

The data collection process begins at the front door: customers are asked to download the Hema App. You can then use the App to inquire for product information, place an order, and make payments. Alibaba knows every action users take, and can leverage the data to optimize the product offerings.

Converting customers to make online purchases

“The major goal is to drive offline customers to shop online”,says Yi Hou, the founder of Hema.

The supermarket only offers around 3,000 different products in-store, but over 50,000 SKUs on its App.

On the other hand, Hema offers delivery for customers within a 3km radius. And it promises to deliver online orders within only 30 minutes. This is much faster than the other fresh product companies, such as missfresh.cn, that delivers each order within 2 hours for Beijing customers.

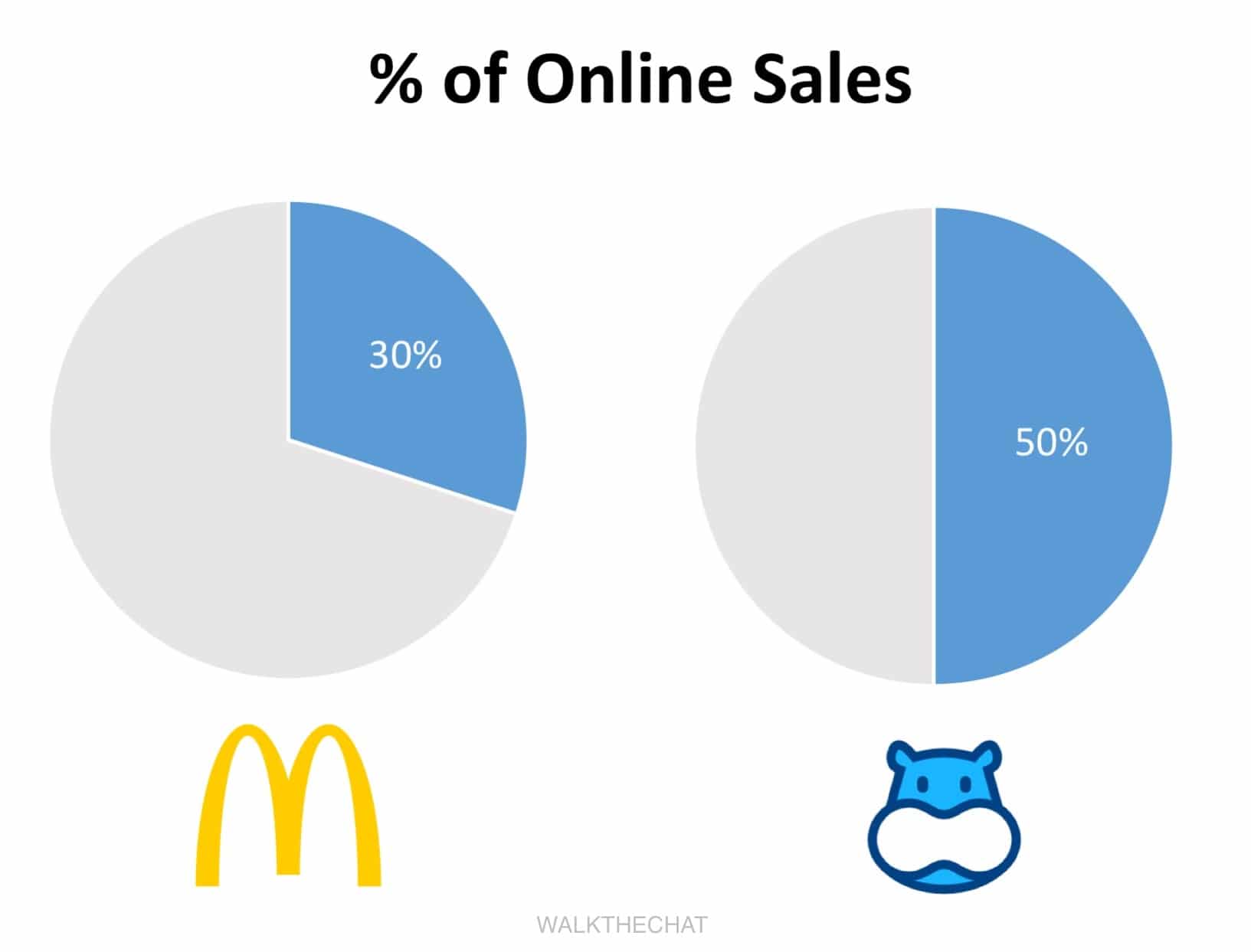

According to Alibaba News, the online delivery order accounts for 50% of the total orders. Older stores (launched for more than half a year) can even reach online orders of 70% or more.

In comparison, the best online conversion restaurant is McDonalds which has only 30% of online order. The revenue per square meter could therefore be 3 to 5 times higher than a traditional supermarket.

According to Hema’s founder, the goal is to reach 80% to 90% of online orders (5 to 10 times more online orders than in-store purchases).

Such high percentage of online order means Alibaba can make more revenue beyond the physical store.

Product offering is focused on providing an on-demand experience

The supermarket is focused on providing an on-demand experience. Buy what you can eat for the moment, in small quantities.

Among the 3,000 in-store products, 80% are food, and 20% are fresh products. But 50% of the store area is dedicated to prepared food and dinning areas.

The first thing you can see is the seafood “aquarium”: huge water tanks, crawfish, Boston lobsters, French oysters, and even giant Russian King crabs. Most of the seafood can be cooked and eaten in-store.

This supermarket also offers products in smaller packages: 750ml milk cartons instead of the traditional 1L package; 350-400g per package of vegetables; 5-banana per package… And most of these fresh products come with a short expiration date.

This is the opposite experience from the Costco approach, which encourages users to buy in bulk and visit the store every several month. Hema instead uses the store as a showcase display for its online products. Users enjoy eating seafood during the store visit, that they can then purchase frequently via its App.

Payment

Of course being an Alibaba owned company, the only payment method accepted is Alipay. The whole supermarket feels like the dream of Alibaba (that they would like to see happen beyond their own properties): every purchase goes through the Alibaba system.

Does it make business sense?

Does this whole approach make sense, from a business standpoint?

The answer is: in theory yes, in practice not really.

Of course, in theory, a supermarket which is also delivering within a short radius could make more money per squarefoot. And offline experience of the products can surely increase online conversion rates.

But in practice, a few problems appear:

- Delivery cost: 30 minutes delivery time within a 3km radius would likely require each delivery to be a single trip by a delivery person. Until delivery happens via drones, this sound like an extremely unscalable and unprofitable model

- Logistics: Alibaba already has an impressive amount of warehouses delivering 55 million packages a day. These supermarkets will likely be much less efficient than Alibaba’s much much larger warehouses

- Business model: There are already hundreds of thousands of brands on Tmall which are willing to help promote their products offline and drive online sales. So far, Alibaba has only 3 offline stores in Beijing. It seems that Alibaba would be much better off relying on their network of brands and merchants to drive online traffic, rather than trying to do it themselves (which would dramatically increase capital expenses)

All in all, the endeavor appears as a smart publicity stunt, but not a game-changer for Alibaba.

What can be the takeaway for small businesses: future of retail

Small businesses can yet learn a lot from this approach. It is a change of mindset in terms of “what is an offline store”. A brick-and-mortar store is not only just the place where you buy things close to your place. It is most importantly an “experience center” where you can test out products that you will later buy online.

The goal is therefore to encourage your customers to buy small portions in-store, and convert them to your online distribution channels: websites, WeChat Official Account, WeChat stores, and Apps. Collect customer data before, during and after their store visit. And provide them with the right payment options such as WeChat Pay and Alipay.

Conclusion

Heman gives us a glance of the future of retail store: focusing on providing in-store experience, converting customers to make online purchases; and make small but frequent on-demand purchases. Although it is mostly a publicity stunt, and it might not make much of a dent in Alibaba’s revenue, it remains a good source of inspiration for small offline retailers.