Let’s face it, you have to master both WeChat and Tmall in order to promote your brand in China. But most brands, even the largest ones, are struggling to perform well on both channels.

Today we’ll dive into how to direct traffic and retain users between WeChat and Tmall.

Why is it so hard to master both Tmall and WeChat?

WeChat and Tmall block each other. On WeChat, users are not able to directly open a Tmall link. Tmall specifically banned merchants to mention anything WeChat related.

Sharing Tmall content on WeChat is also restricted. In order to do so, users will have to copy a code on their clipboard. If another user copies this code and opens the Taobao App, it will automatically open the product page.

These “hacks” enable some interaction between WeChat and Tmall, but they remain a poor user experience.

A last point which makes it difficult for some WeChat brands to move to Tmall is the difference in positioning. While unique brands can stand out on WeChat via influencer marketing, they might find it hard to be visible in Tmall’s search-driven, review-driven and volume-driven ecosystem.

The brand that masters both channels: HomeFacialPro

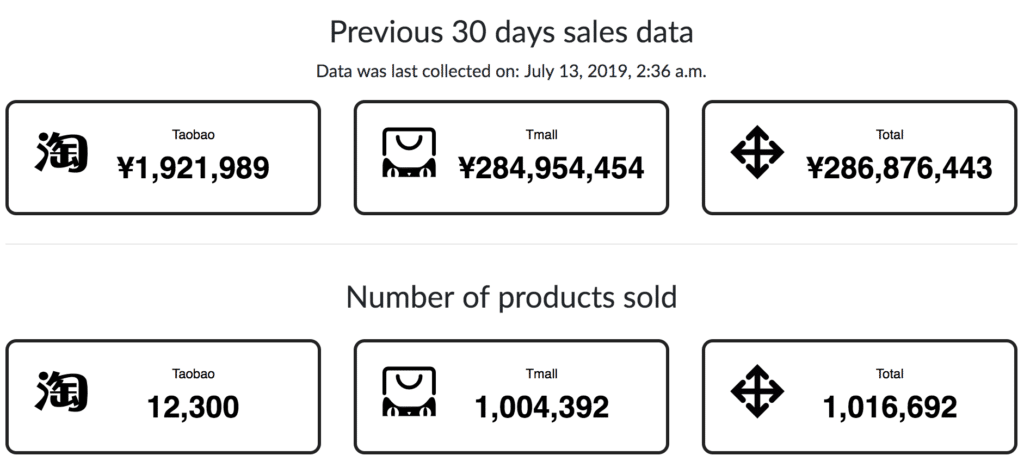

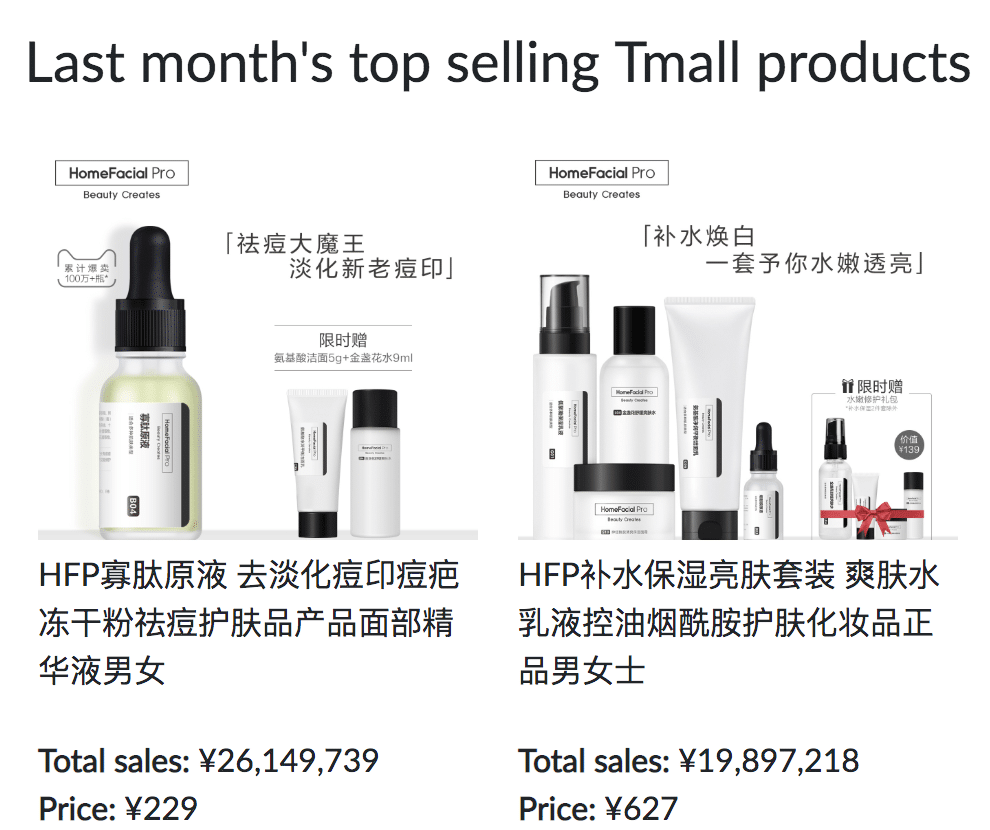

HomeFacialPro (HFP) is ranked as the number 4 skincare brand on Tmall according to 2019 July 18th Tmall sales ranking, right after L’Oréal, Olay, and Lancome. It was only founded in 2014, launched on Taobao in 2016, and later on Tmall in August 2016. Most products are priced between RMB 100 to RMB 200. It had over RMB 280 million monthly sales on Tmall last month according to Daigou Hunter.

The growth of HFP is a textbook case study of how a brand can start on WeChat, drive traffic to Tmall, and retain and up-sell to customers back on WeChat. Here are a few techniques for navigating traffic between Tmall and Tmall.

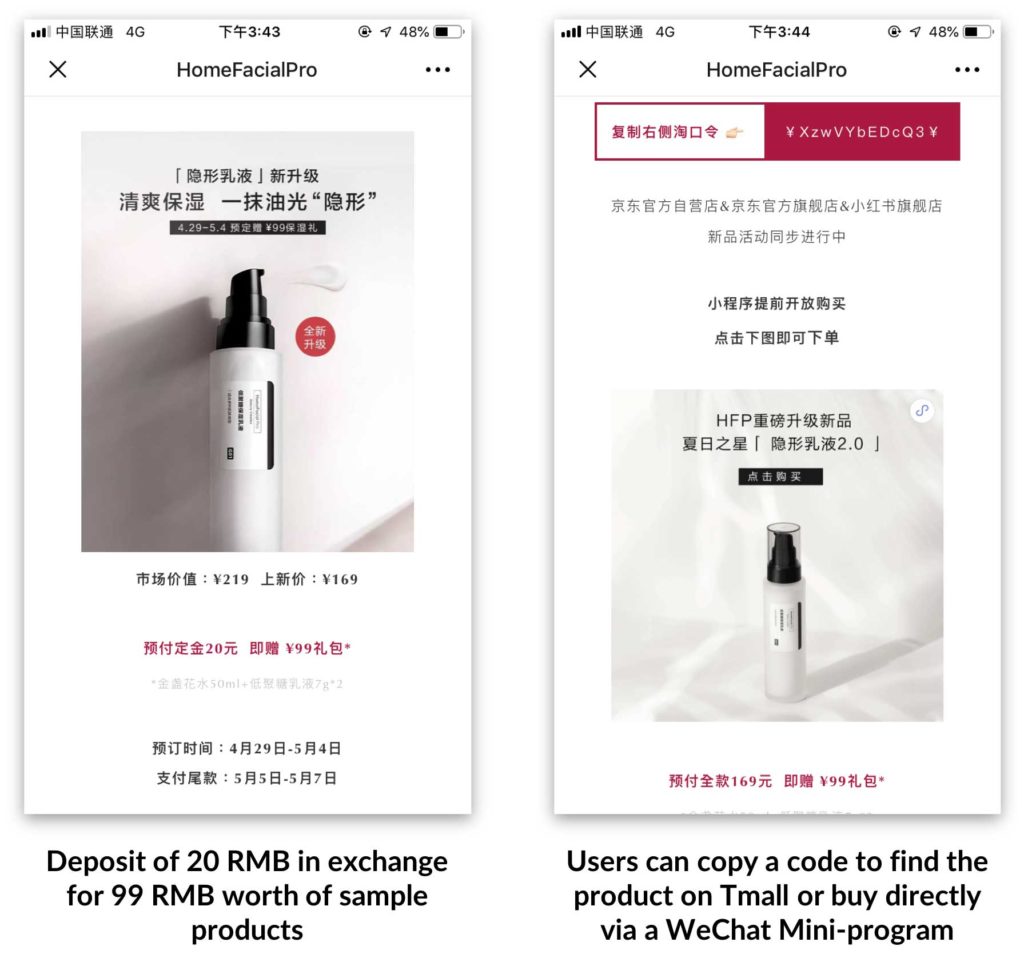

New product launch: launch on WeChat Mini Program first and drive pre-sales traffic to Tmall

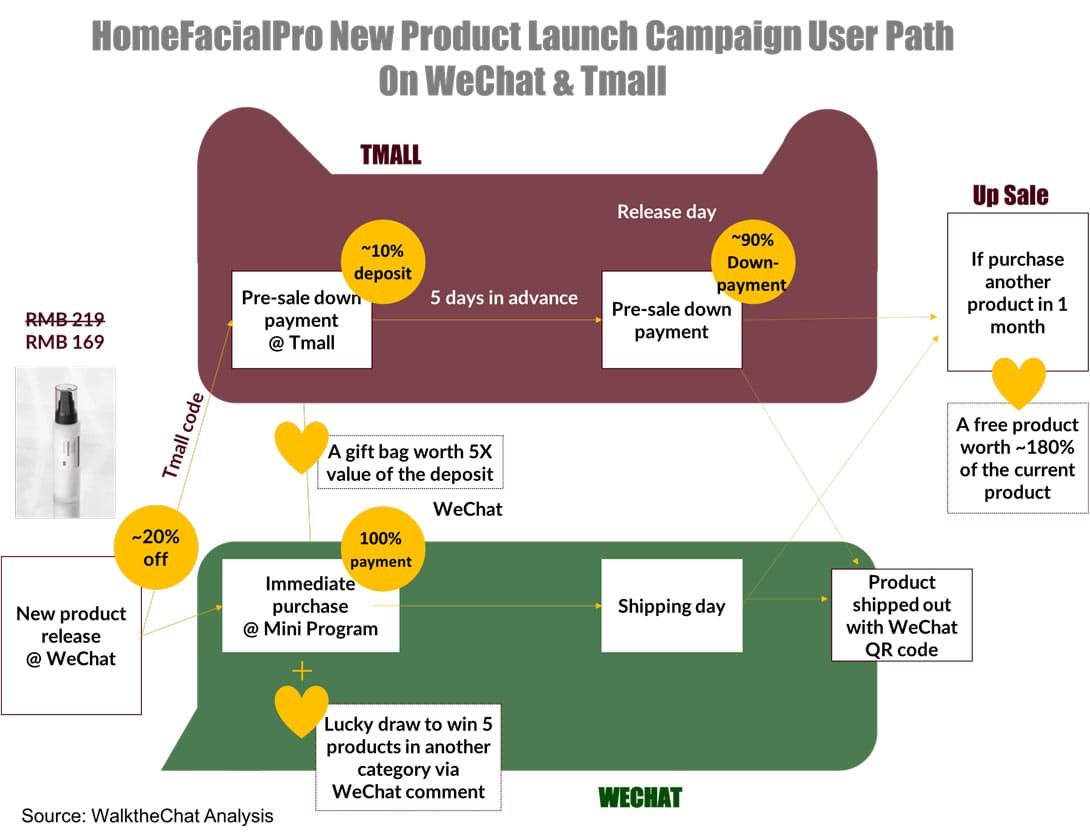

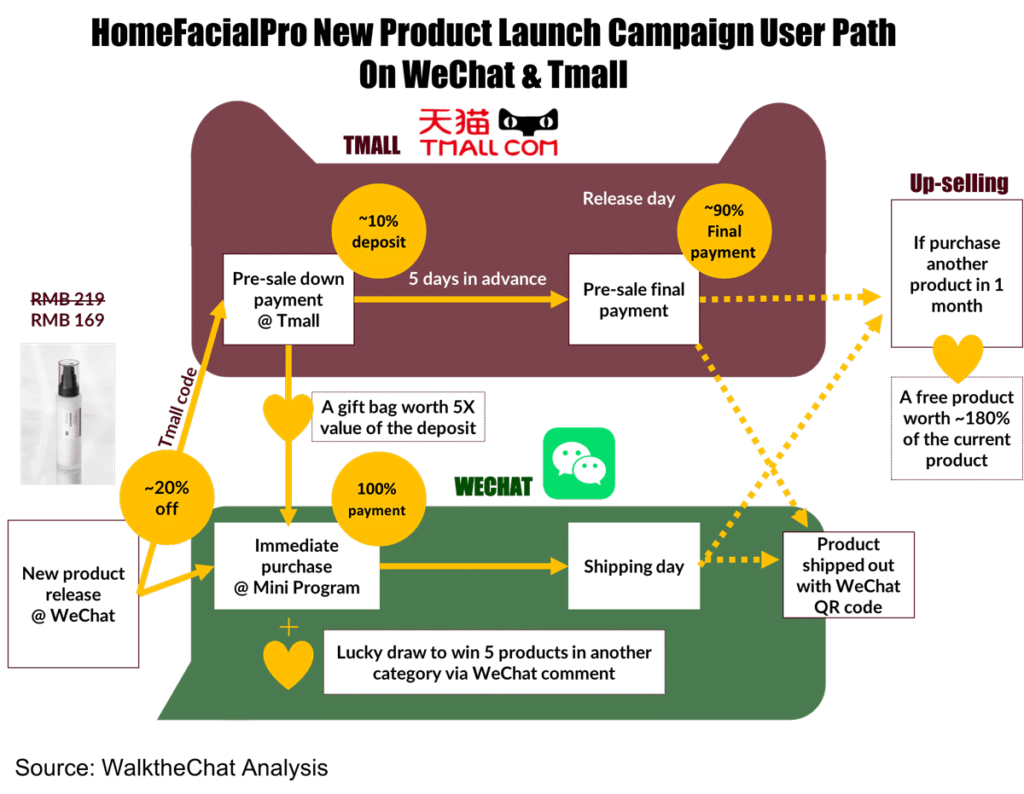

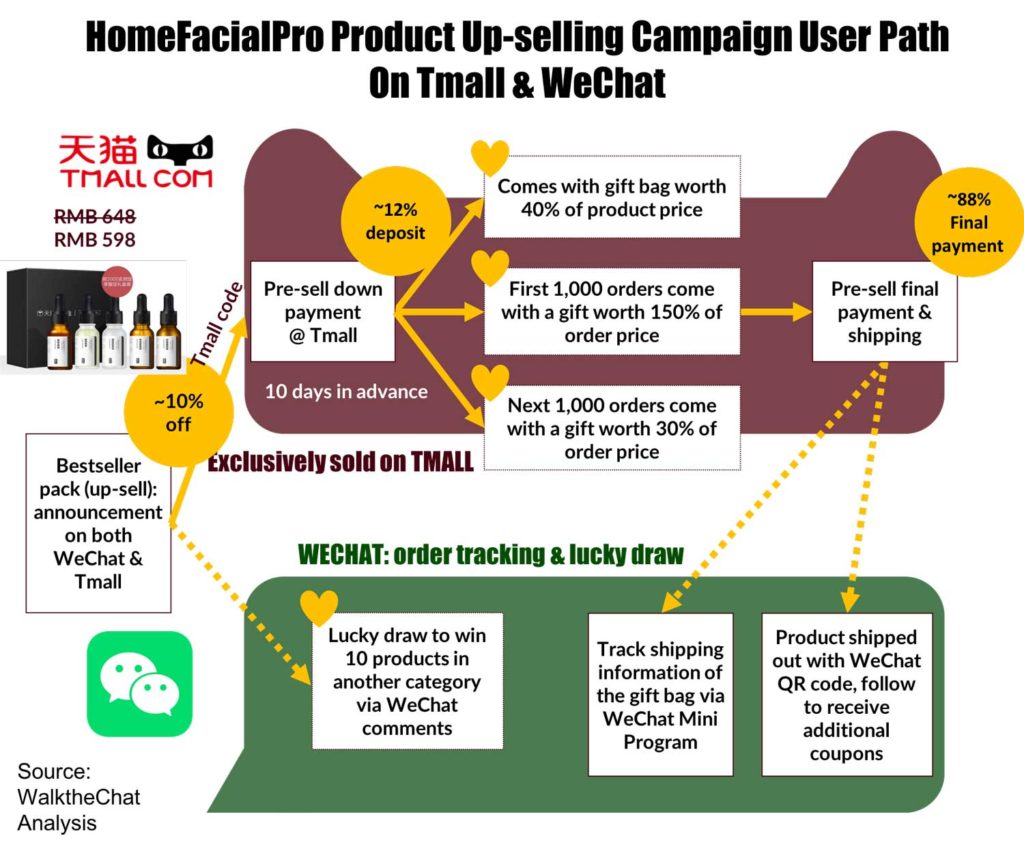

HFP launches a new product every 2-3 months. Each product release has a carefully designed user path that leads users to make purchases while staying in a positive feedback loop between Tmall and WeChat.

Below is a typical new product release campaign workflow.

Product launch is announced on WeChat

The announcement is made on WeChat around 5-10 days ahead of the actual release, together with a pre-sale campaign.

Pre-sale drives users to Tmall

Users can then head to Tmall and make a downpayment that is worth 10% of the product value. In exchange, they are guaranteed to get a gift bag worth 5x the downpayment value. The gift bag contains samples of other HFP products.

For users, purchasing the gift bag already sounds like a good deal. For HFP, as a skincare brand, having users testing out more product is a low-cost way to drive up-sells.

Mini-program leads to direct purchases

Users who can’t wait to get their hands on the product have the option to directly make a purchase on the brand’s WeChat Mini Program. They can then claim all the discounts and gift bags at the time of the product launch. This keeps users within the WeChat ecosystem while collecting 100% of pre-sale payment.

QR code on all shipped products drives users back to WeChat

All the products sold on Tmall will come with a WeChat QR code, that takes users back to the WeChat ecosystem for more promotional information and more up-sells.

Free products are gifted if users buy again on Tmall within a month

After the users complete this sales cycle, if they make another purchase on Tmall within a month, they will get, again, another free product that’s worth even more than the product that they already purchased.

That’s a total of 4 types of discounts and incentives for just one product worth RMB 169. This is the well-thought, carefully crafted and manipulating strategy behind HFP’s new product release.

Driving Tmall traffic to WeChat

HFP masters the conversion from Tmall to WeChat via providing tracking service for gifts exclusively on WeChat.

Here is a typical conversion path for an up-selling campaign. According to Daigou Hunter, the top-selling items are packs of several products priced between RMB 300 and RMB 600.

Users who participate in the pre-sale get gift bags and a chance to win gifts

Again, HFP is giving out up to 200% or the orders worth as gifts during the pre-sale campaign. For an RMB 598 product set, gifts give away include:

These gifts are not only given away as test products, but they also have another equally important role: to drive customers from Tmall to WeChat.

Using gifting campaigns to drive traffic from Tmall back to WeChat using phone number as using identifier

The campaign is set up so that only the first 2,000 orders can get gifts. It gives users the urgency to make an order ASAP. But when users are paying the deposit, they do not know immediately whether they are among the lucky first 2,000 users. The only way for them to check whether they won the gift is to:

- Make the final payment at the product release date

- Go to HFP’s WeChat Mini Program and enter their phone number to check the order status to find out if they have won the product

Using this smart trick, HFP is able to convert a higher percentage of customers into WeChat follower, continuously pushing marketing content to these users and expanding the customer’s life cycle.

This is also a very smart way to synchronize user data between Tmall and WeChat. Once it has the phone number of the users, it can match the user’s Tmall order information with user’s action on the WeChat Mini Program store. With a complete picture of the user’s social and e-commerce behavior, HFP can refine its strategy for more innovative cross-platform campaigns.

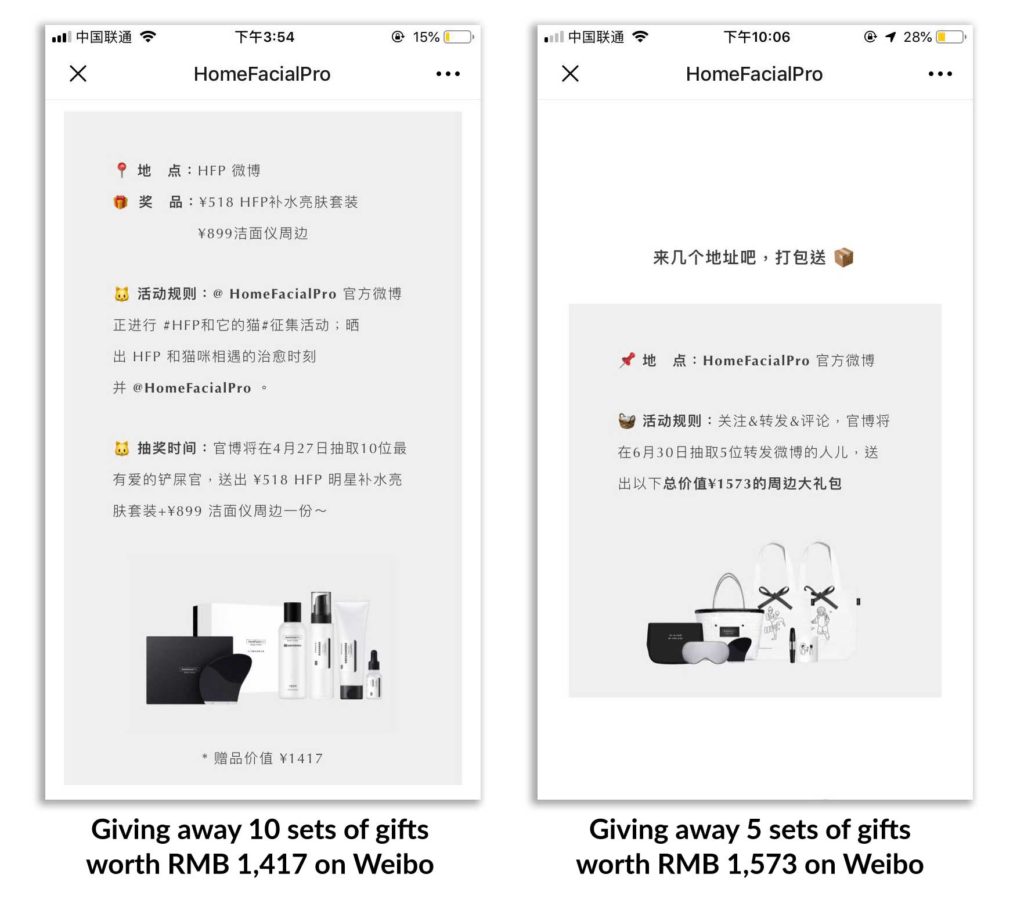

Seasonal traffic flow

HFP focuses on directing traffic from WeChat to Tmall especially during the shopping holidays, such as Double 11, 618. But right after these holidays, it will direct more traffic to its WeChat Mini Program. This makes sense as users are much more likely to make impulse purchases on Tmall during shopping holidays, driven by platform campaigns and coupons.

Since WeChat’s traffic is relatively unaffected by shopping festivals, it is better to focus on user engagement and incentivized sharing campaign during the off-season period.

From time to time, the WeChat account even drives traffic to the brand’s Weibo account. Users need to @ the Weibo Account, # the campaign topic, and share pictures or stories about a specific topic in order to win a prize.

Such multi-platform strategy also enables HFP to diversify its risk by relying on various marketing channels for different use-cases and at different periods of the year.

One more thing…

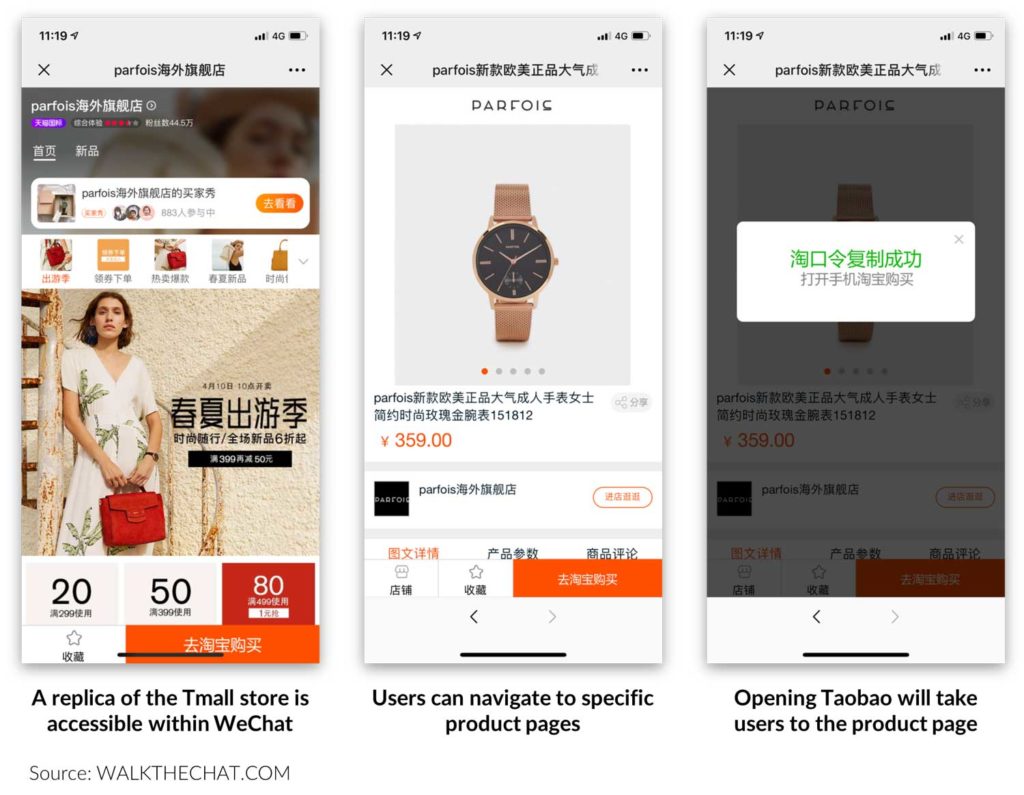

A last trick used by some brands to drive traffic from WeChat to Tmall is to create “fake” versions of their Tmall store on WeChat.

The stores are replicas of their Tmall stores on WeChat, which mimic the design of Tmall. Users can navigate to specific product pages. If they click the “Buy now” button, a code will be copied to their clipboard.

The user is then invited to open the Taobao App which will automatically take them to the right product page.

Although these experiences are often clunky (and a WeChat Mini-program should be prefered), they represent an imaginative approach from brands to overcome the barriers between Tmall and WeChat.

Conclusion

The Chinese internet is segmented between the Tencent or Alibaba ecosystem with invisible walls restricting information sharing. Building brand awareness in both ecosystems is crucial for brands that want a complete re-purchasing loop.

HFP offers a good outlook into a brand that successfully managed to create a virtuous circle of engagement between its Tmall store and WeChat account, using Tmall for sales and pre-sales, while leveraging WeChat as an impulse-buying, product announcement and service platform.