With Douyin, Kuaishou and Red becoming stronger and stronger in the Chinese social media space, it is getting harder for brands to decide which platform to pick.

Here is some data that will help you decide where to run KOL campaigns depending on your brand and positioning.

Social platforms demographic data

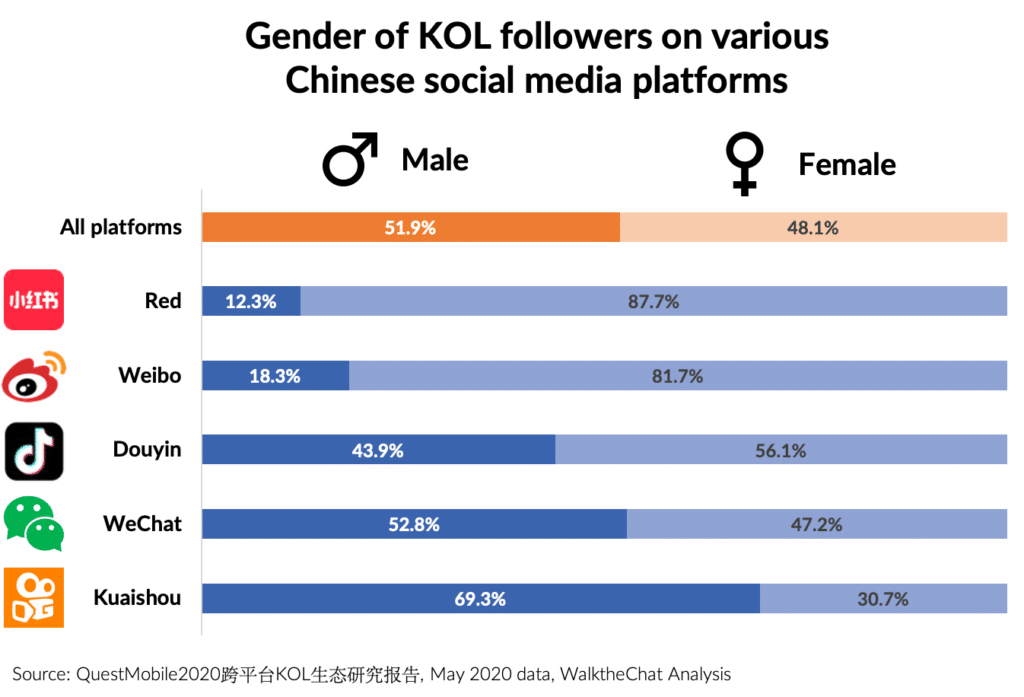

In terms of gender, Red and Weibo are heavily dominated by female users (87.7% and 81.7% of KOL followers are female). This fits the positioning of the platforms focusing on following cosmetics/fashion influencers and stars.

Douyin and WeChat are more balanced, which also reflects that the two platforms are the ones with highest penetration rate. WeChat covers most of the Chinese Internet population, and therefore has a very balanced ratio of male and female users.

Kuaishou, with 69.3% of male KOL followers, is the platform with the highest percentage of male users.

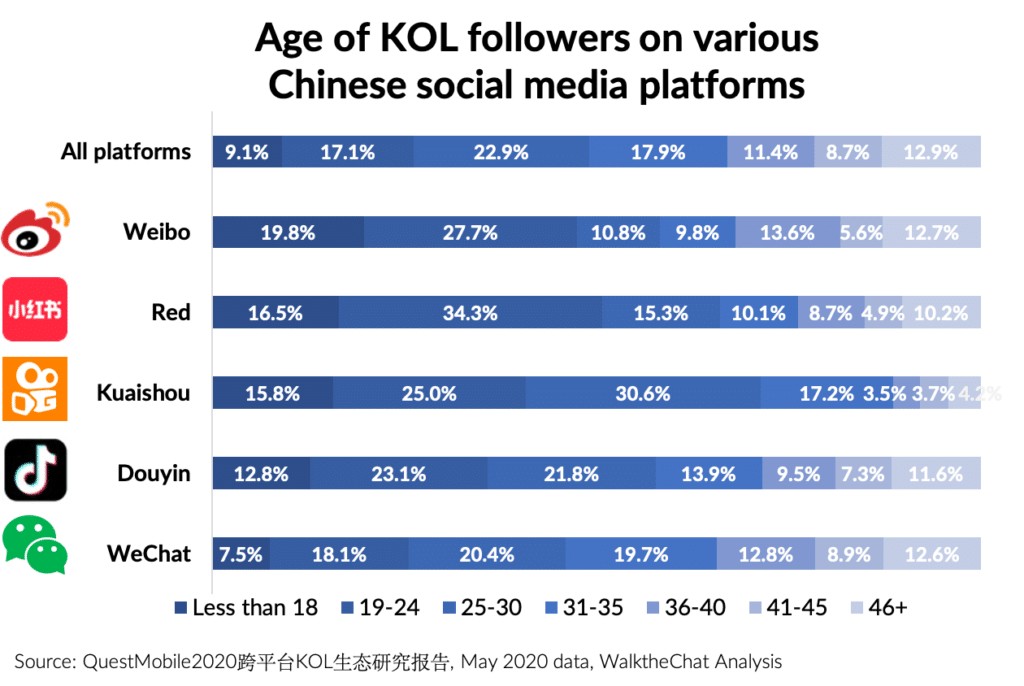

Weibo and Red are the platforms with the youngest KOL followers (respectively 47.5% and 50.8% of them are younger than 30 years old).

WeChat has the oldest user base, with only 25% of KOL followers younger than 30 years old, and 20% of users above 40 years old.

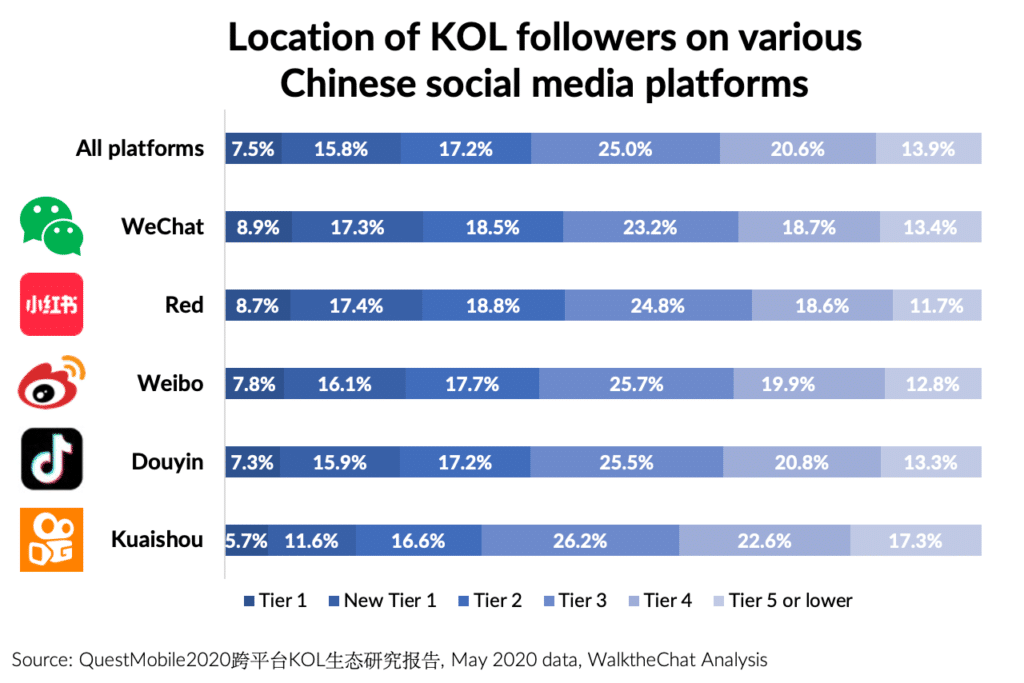

Red has the strongest presence in larger cities, with 44.9% of followers in Tier 1-2 cities, against only 33.9% for Kuaishou.

Kuaishou has the largest presence in small towns, with 39.9% of KOL followers in Tier 4 cities or lower, against only 30.3% for Red.

Conversion rate to e-commerce

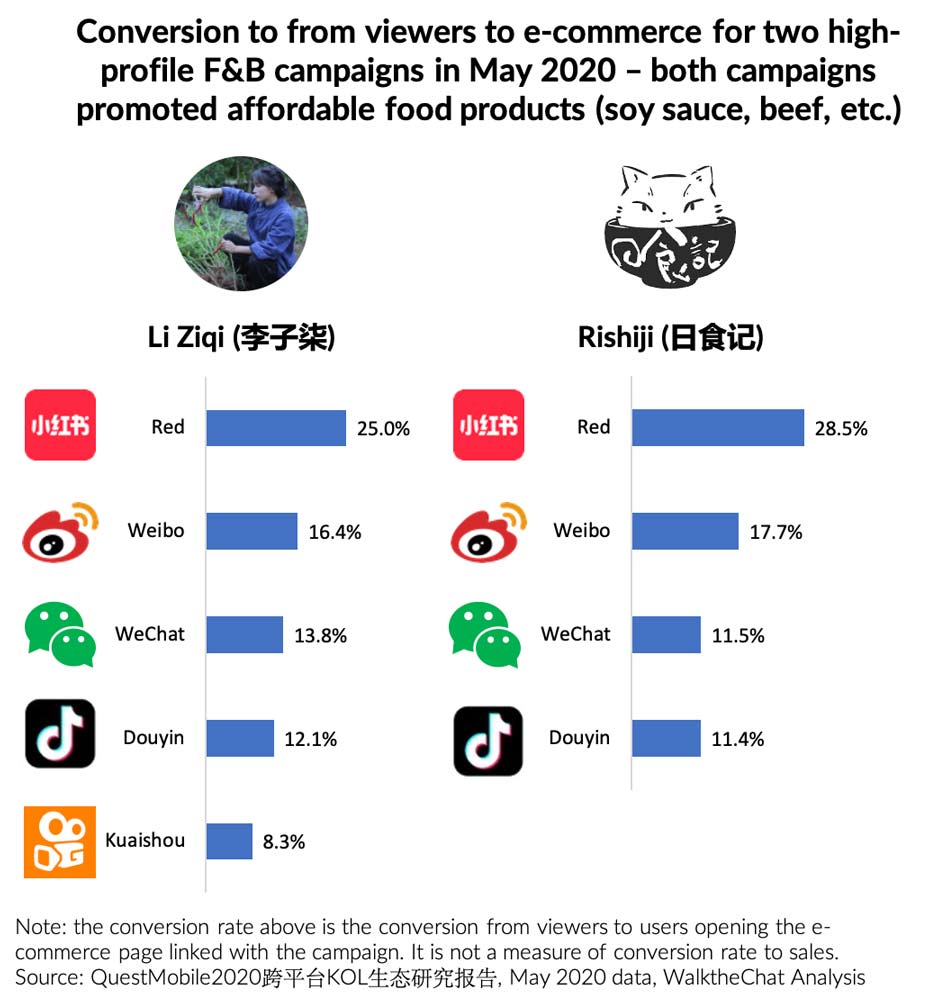

Conversion rates are most challenging to study as they depend heavily of product pricing, category and platform.

High-profile KOLs Li Ziqi and Rishiji both saw their best performing conversion rate to e-commerce (users clicking to check the product, not users purchasing) from Red and Weibo.

Douyin and Kuaishou saw the worse conversion to e-commerce, with WeChat in-between.

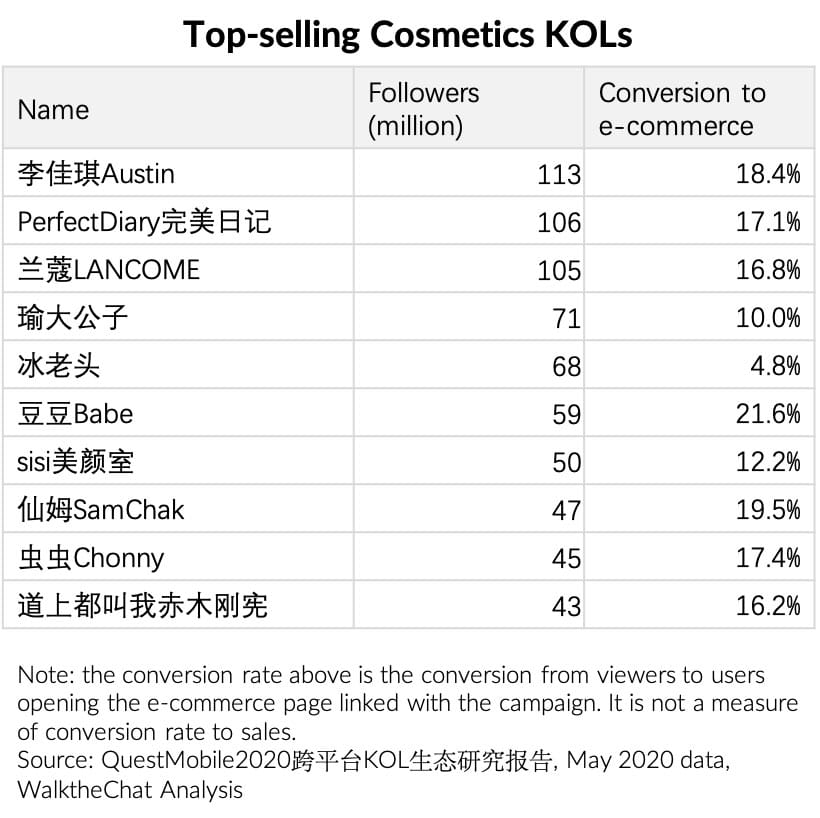

When considering conversion rates across all platforms (WeChat, Weibo, Red, Douyin, and Kuaishou), KOLs in the cosmetics have remarkably high conversion rates (around 15% on average, and as high as 21.6%).

Fashion KOLs have a lower conversion to e-commerce, closer to 10% on average. Highest-profile KOLs such as Li Jiaqi and Wei Ya are focusing on the beauty and cosmetics industry, which explains the higher conversion rate in this category.

Conclusion

Brands must have a good understanding of the demographics of different platforms before running campaigns.

During KOL promotions, influencers send messages to their entire following without the possibility of targeting specific user groups. A good understanding of demographics can impact conversion rates.

The data gives us the following insights:

- Red and Weibo are an excellent choice for brands targeting female users.

- Kuaishou is the only network heavily skewed toward male users.

- WeChat is perfect for reaching older users (30+) with higher purchasing power.

- Red and Weibo are appropriate to reach younger customers.

- Red and WeChat are ideal for reaching users with more purchasing power living in larger cities.

- Red is powerful for promotion to e-commerce. Be careful, though: most users don’t buy directly on Red, so make sure that your products are available on Tmall or a WeChat Mini-program.

- KOL promotion, in general, will be more efficient for brands in the cosmetics and beauty industry rather than fashion (although the conversion rate in both industries remain high, averaging around 10%-15%)

And if you have any questions on KOL selection and campaigns planning, feel free to reach out to info@walkthechat.com