iiMedia Research just released a very exhaustive report about cross-border e-commerce in China in 2017.

Here are the highlights:

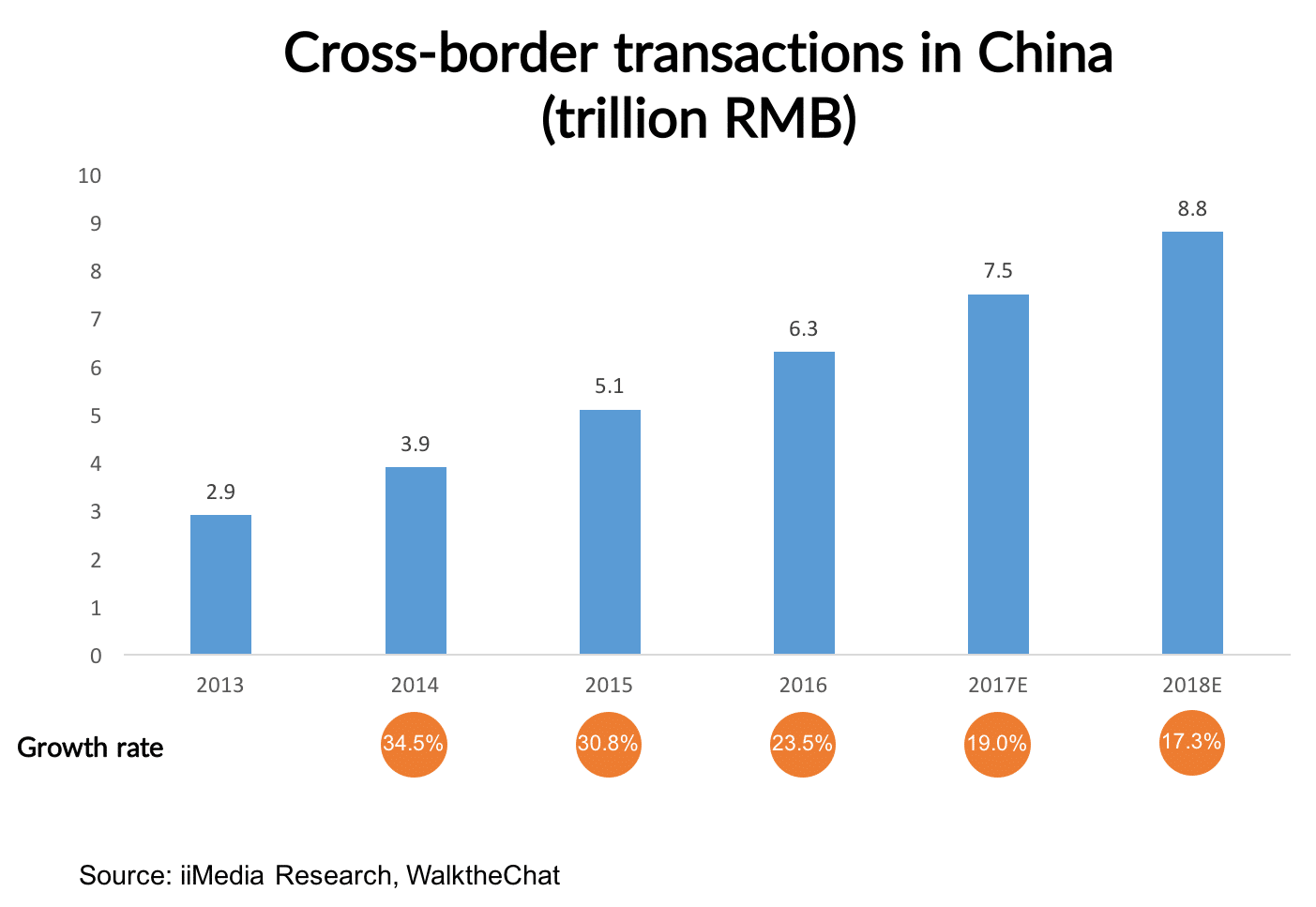

- Cross-border e-commerce keep growing and is expected to reach a 7.5 trillion RMB volume in 2017

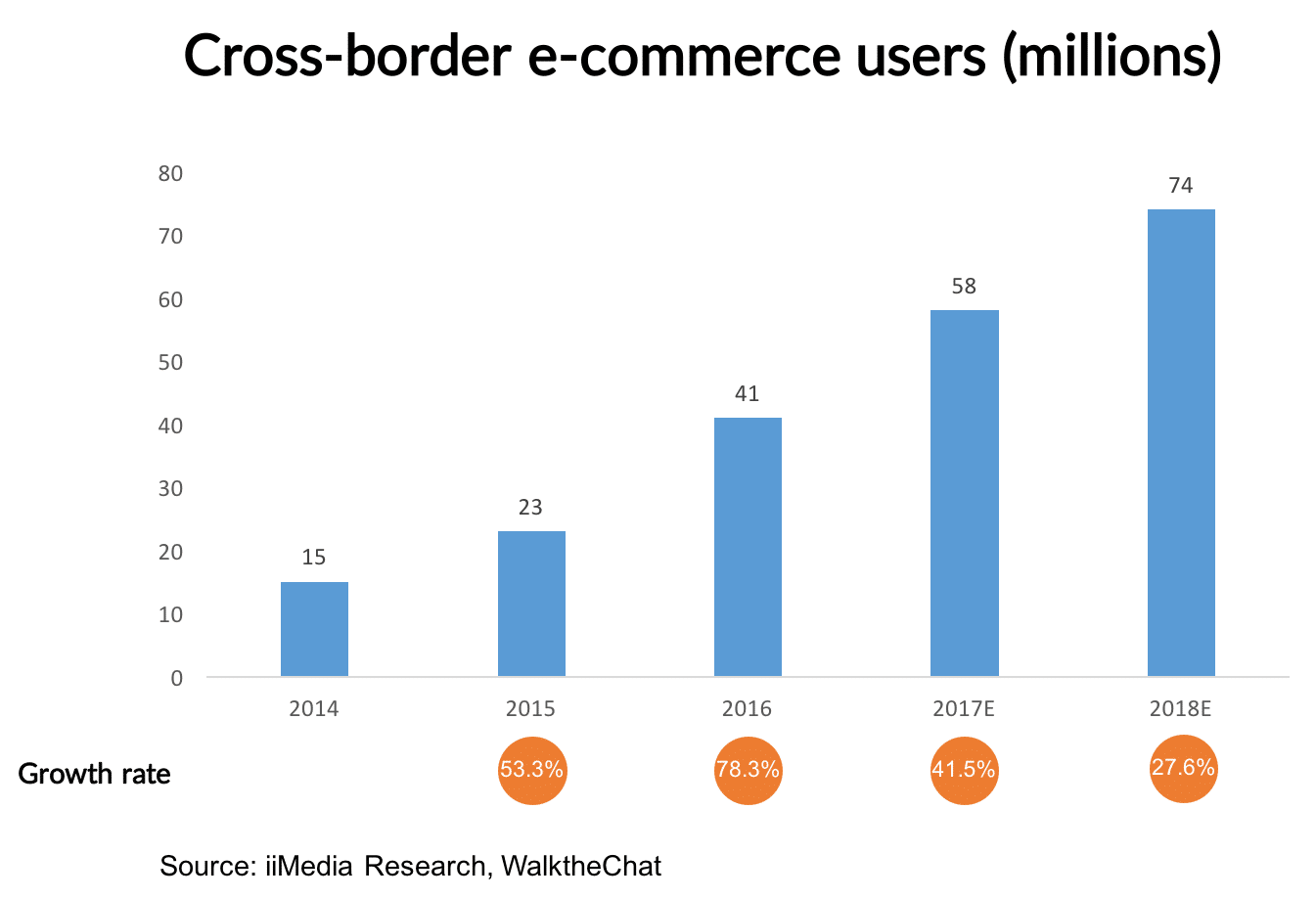

- 58 million users in China are expected to engage in cross-border transactions in 2017

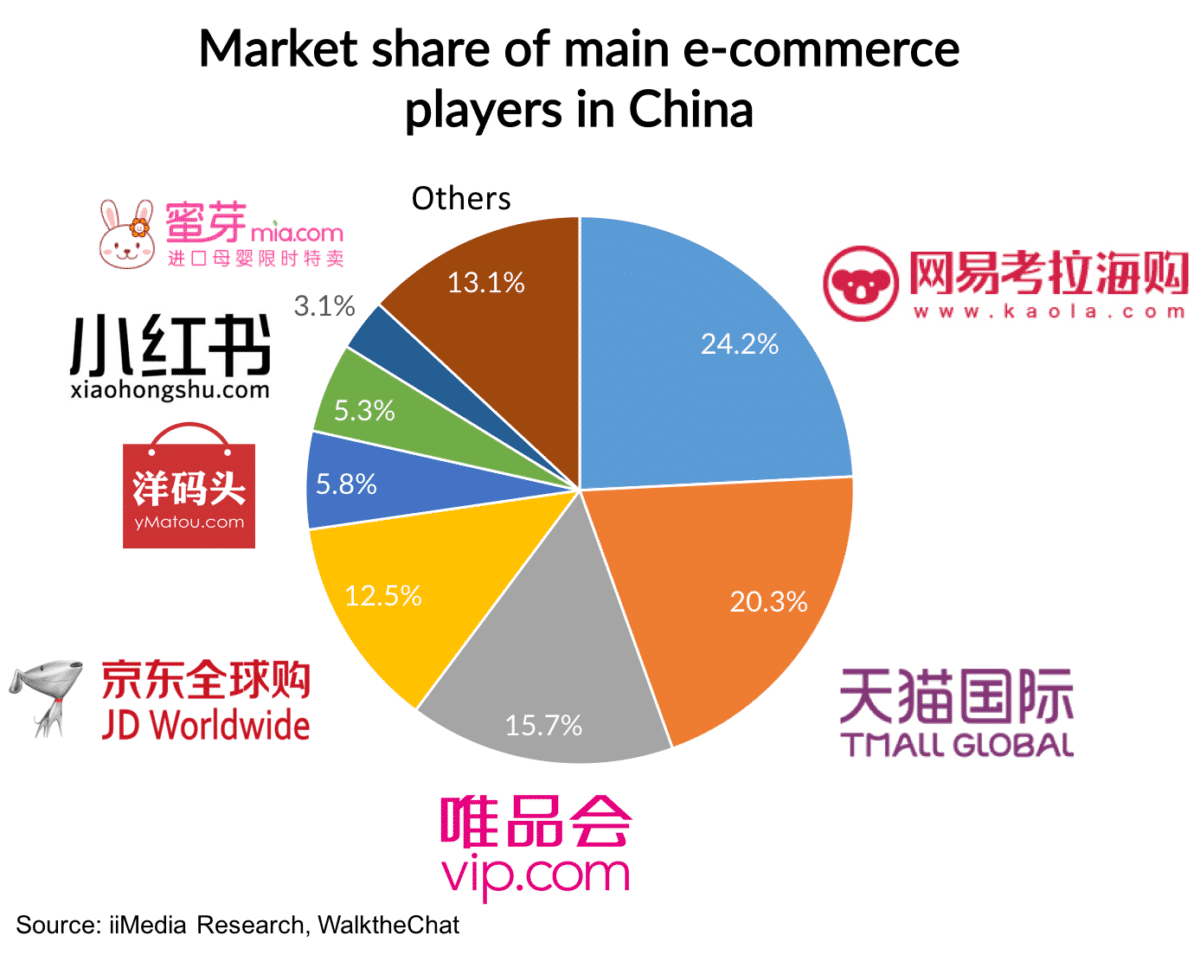

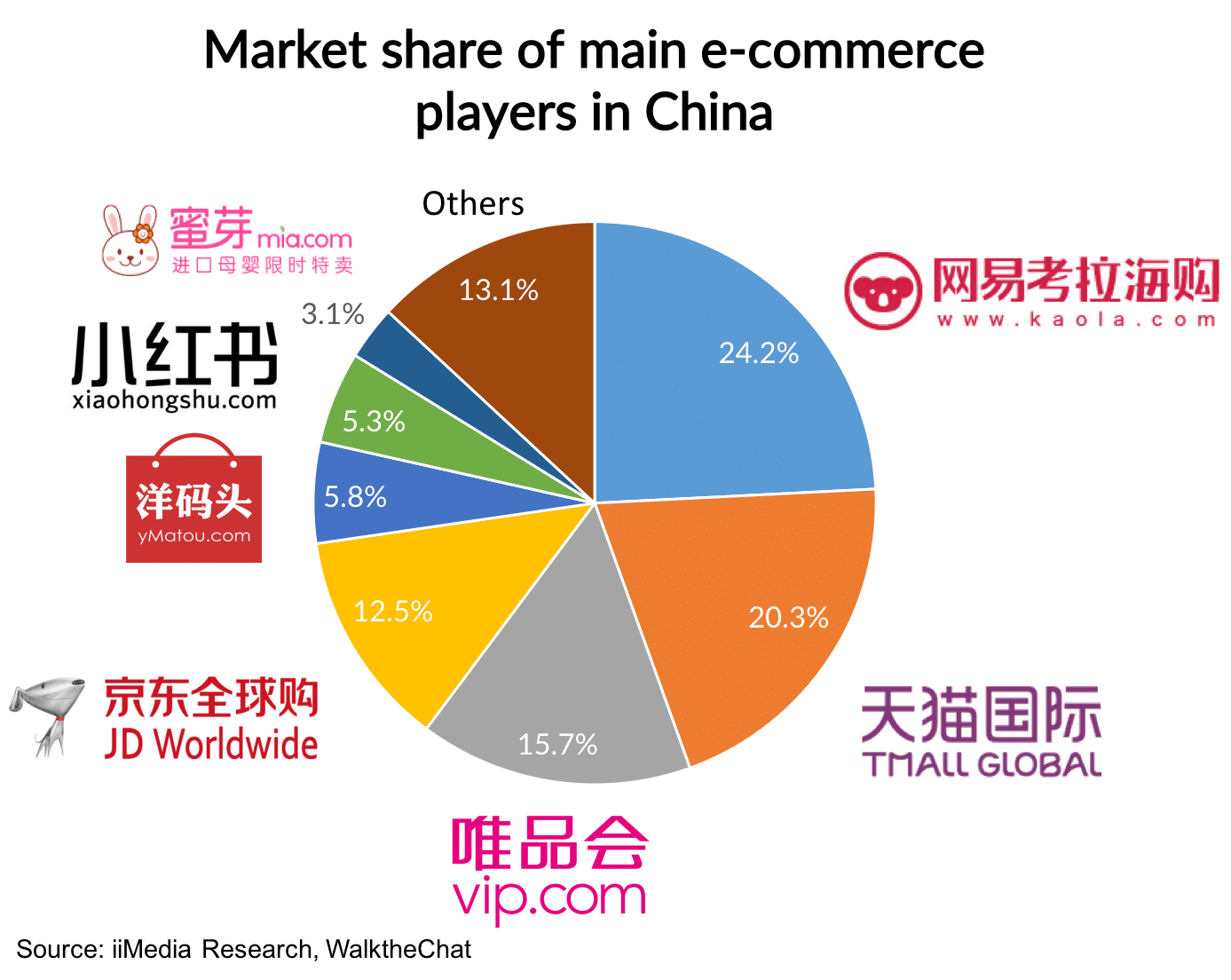

- Cross-border e-commerce market is very fragmented as opposed to local e-commerce market

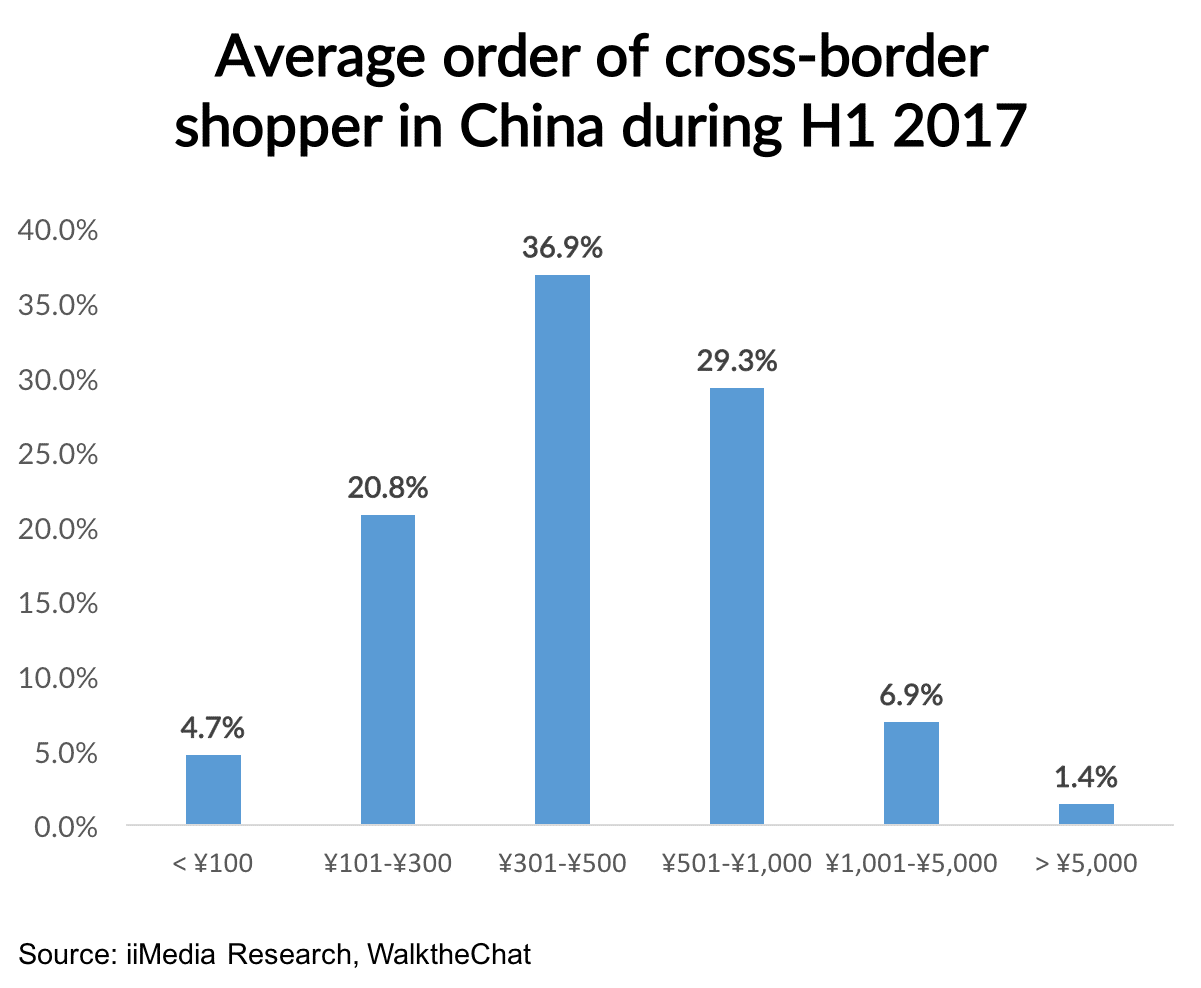

- Cross-border shoppers make frequent purchases between 300 RMB and 1,000 RMB

Booming growth

The cross-border e-commerce market is expected to reach 7.5 trillion RMB in 2017 (this includes both B2C and B2B cross-border e-commerce).

Growth is however starting to plateau around 17% (still quite a healthy growth rate).

Meanwhile, the number of end users in China engaging in cross-border transactions.

B2C users are growing faster than the overall cross-border market, although there is also a slight decrease in growth as the number of cross-border buyers catches up with the overall amount of e-commerce users.

A fragmented market

According to the iiMedia report, the market for cross-border e-commerce is surprisingly fragmented.

While the traditional e-commerce market is heavily dominated by Alibaba (with about 60-70% market share), cross-border e-commerce is much more fragmented with no player getting more than 25% of the total market.

Surprisingly, although Tmall and JD are significant players, they by no mean dominate the cross-border game.

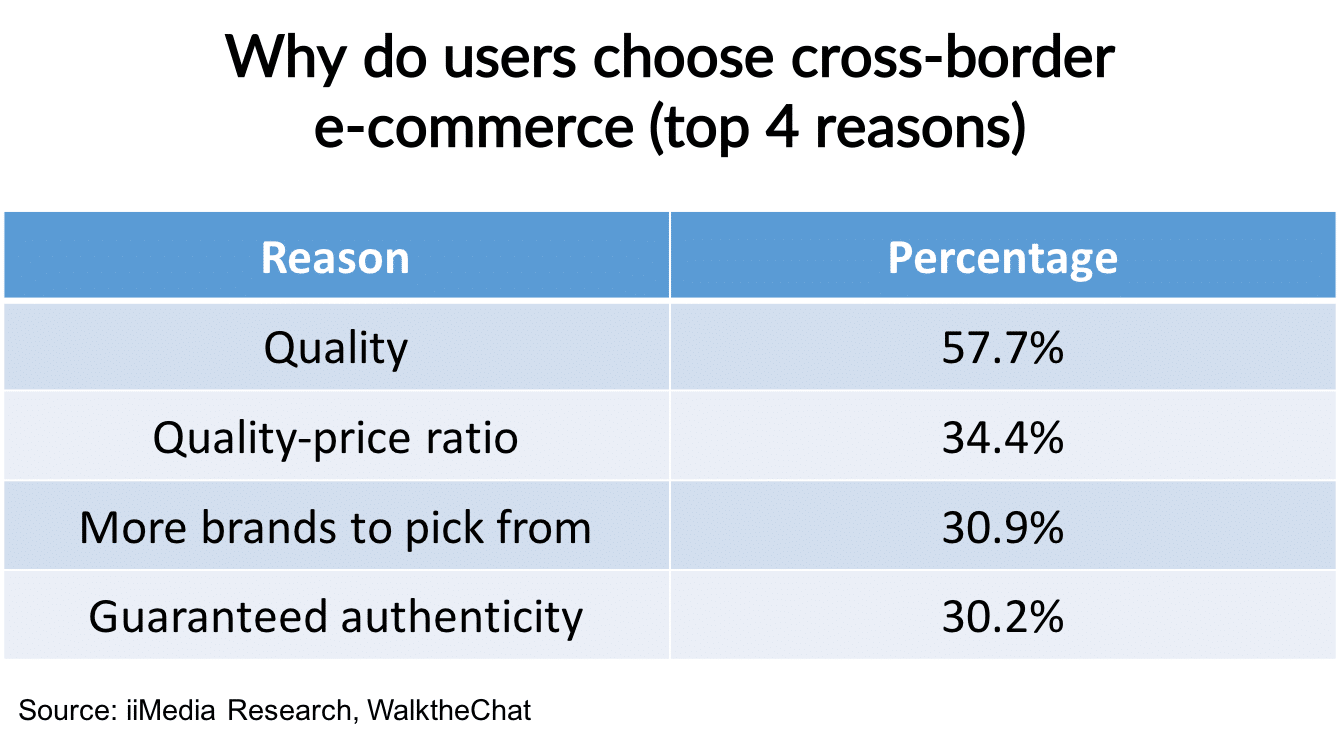

Why do Chinese cross-border buyers purchase?

Better product quality is the main incentive for customers to buy cross-border.

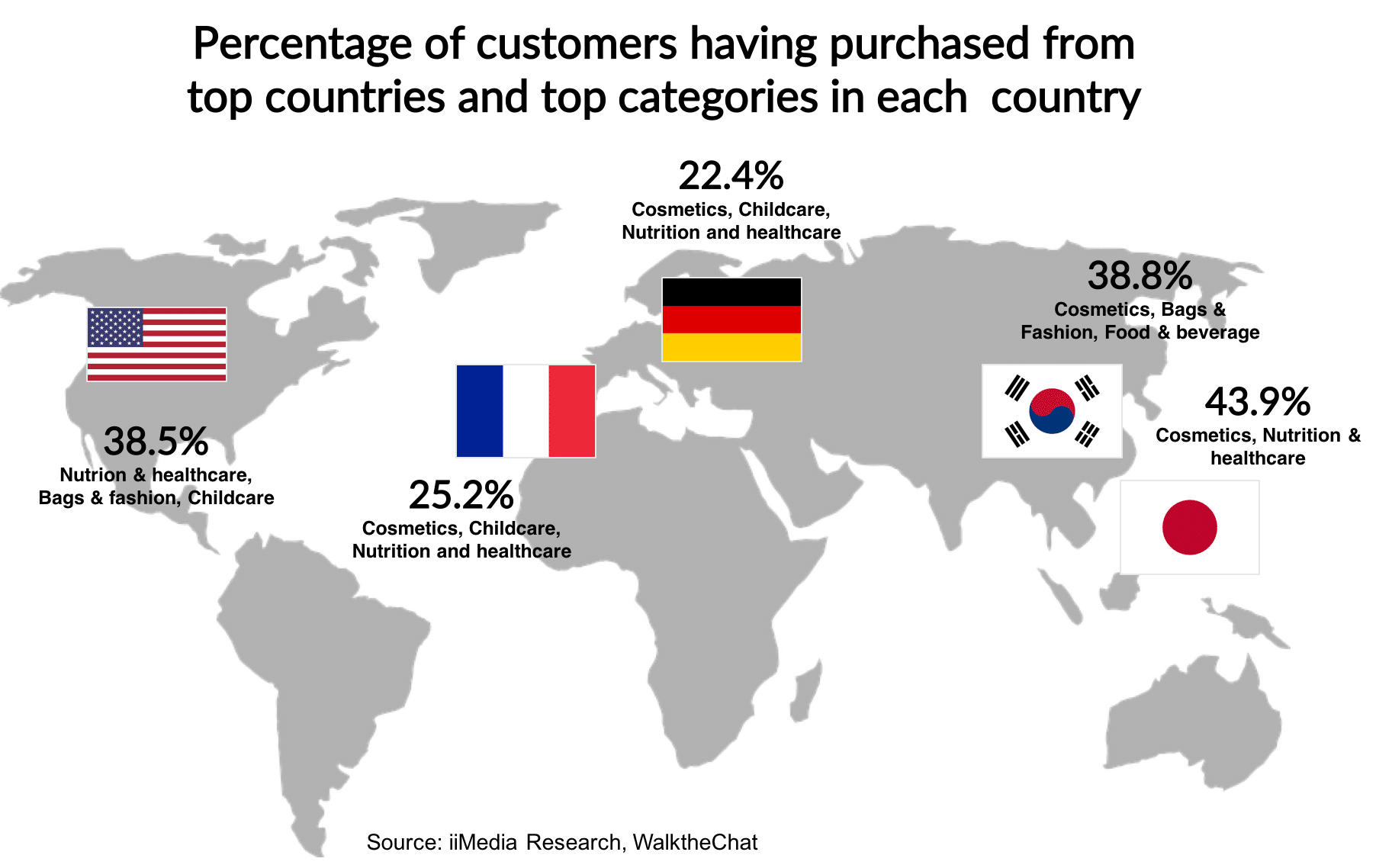

Consequently, Japan, Germany, Korea, France and U.S are top destinations for cross-border purchases, with Japan being a clear leader.

How do Chinese cross-border buyers purchase?

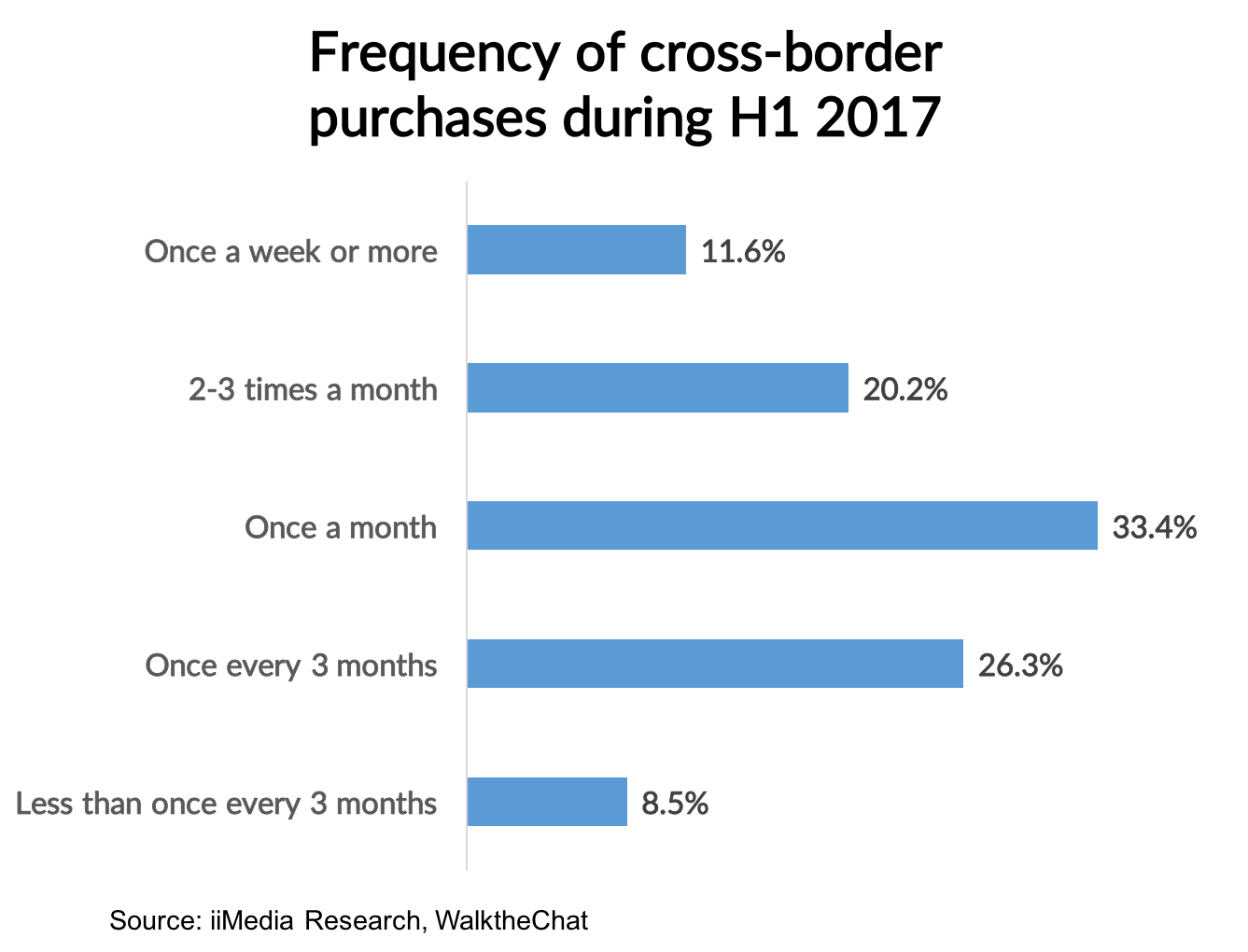

Among cross-border buyers, the frequency of purchase is surprisingly high: 65% of users purchase cross-border at least once a month. 11.6% do so more than once a week.

66.2% of orders ranging from 300 to 1,000 RMB. It is however important to note that these orders are often made on large platforms which focus on promoting cheaper products.

Our personal experience operating hundreds of cross-border e-commerce shops is that customers are very willing to spend more than 1,000 RMB on cross-border purchases, especially in order to make the shipping cost worth it. We find orders between 1,000 to 5,000 RMB to be extremely common via cross-border WeChat stores.

Conclusion

The cross-border e-commerce market in China continues its booming growth. Unlike the local e-commerce market, users are used to shopping in platforms other than Tmal, and sometimes buying directly from overseas merchants

This trend gives a unique opportunity for brands to finally break free from Tmall and JD.com, and start building a direct relationship with their customers.