The social commerce space never lacks innovation. A new type of location-based social model called Community Group Buy is changing how people engage in grocery shopping. Here is the monthly Gross Merchandise Value (GMV) of top community group buy platforms according to eburn.com:

- Xingshen Youxuan 兴盛优选 – 370 million RMB

- Shixianghui 食享会 – 210 million RMB

- Niwonin 你我您 – 200 million RMB

- Shihuituan 十荟团– 150 million RMB

- Songshu Pinpin 松鼠拼拼 – 100 million RMB

…

One of the top ranking platforms Xingshen Youxuan can get 1 million daily orders from over 300 cities.

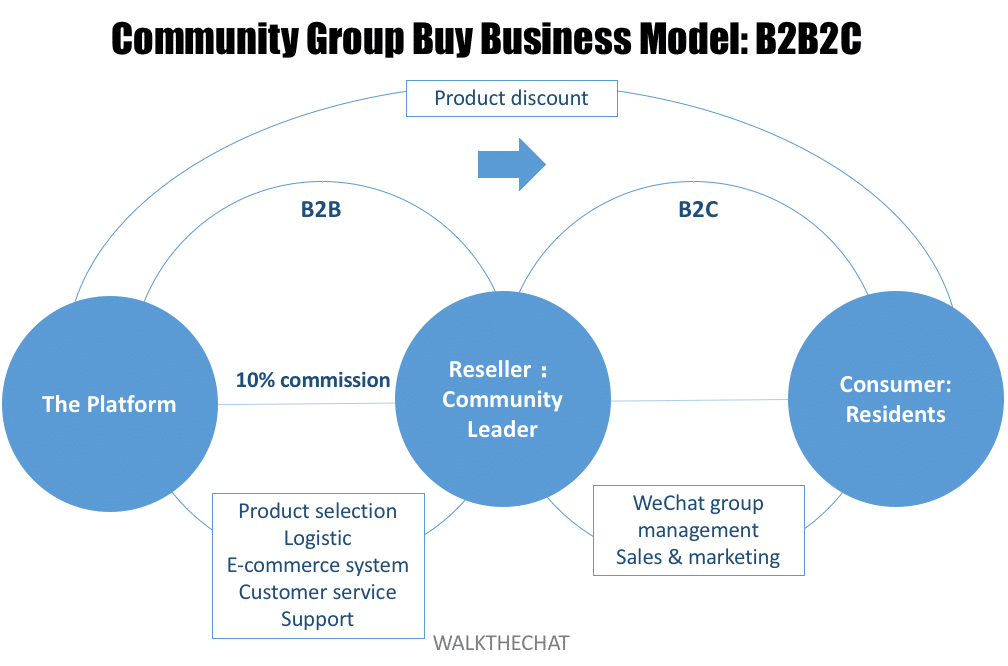

How does it work? B2B2C Model

The purchase is usually initiated by a community leader on a WeChat group. Usually, the community leader gathers residents living in the same compound in a WeChat group. Once members placed the order, the platform would ship the orders to the community leader. Each user then has to pick up their orders from the community leader.

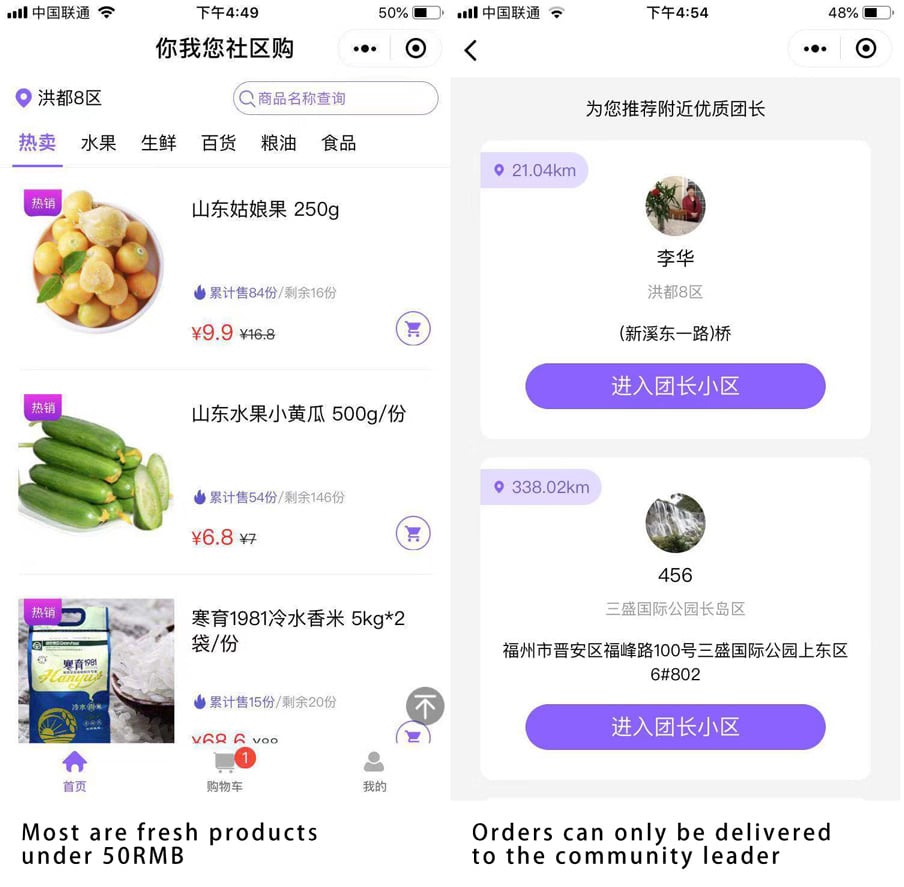

When you first enter the Mini Program, you will be asked to pick a group leader that is closest to you. Then you will be able to see what kind of products the group leader offers.

The community leader

A typical community leader is either a stay-home mum or a community shop owner. According to Liu Kai, founder of Niwoning, 70% of users would prefer to purchase from stay-home mums as they are perceived as more trustworthy. Most of the top 30 community leaders are stay-home mums in Niwonin, one of the top platforms.

Illustration from https://medium.com/thrive-global/the-middle-class-philanthropist-515dbae73922

Although some platforms still prefer to pick the community shop owners as the community leader. The shop owners have a physical store, it makes it easier to store orders. The store owners also tend to be more stable.

The leader is usually in charge of:

- Managing the WeChat group of residents within a compound

- Sending out the group buy information to the group on a daily basis

- Running campaigns to sell more products

- Temporary product storage (after the order is delivered to the compound)

- Sometimes even delivery of the product door to door

According to Liu Kai, founder of Niwoning, the platform’s margin is around 25%-30%. And the group buy owner usually can take 10%-15% cut. Each group leader has to meet a target of 30,000 RMB monthly sales within 3 months, or the platform would name a new leader. This means a group leader would earn at lease 3,000 RMB per month. The average sales are 40,000 RMB according to Liu.

This is a natural selection to filter for the top influencer. It also incentivizes the leaders to go out of their ways to maintain sales revenue.

Centralized distribution system to minimize cost

Since all the orders will be directly shipped to the community leader, this largely minimized the logistic cost. Liu mentioned in an interview with Tencent, Niwonin can limit the cost of shipment to under 0.5 yuan per product. The platform operates like a B2B business.

The community leader does not need to store the inventory for more than 1-2 days as orders are prepared and shipped only after user place orders. The platform works with manufacturers and farmers to prepare the shipment once the order has been received. Usually, an order would take 3-4 days to be delivered to the end consumer. This seamless “farm-to-table” process helps to maintain the freshness of the products.

Once the order is delivered to the group leader, they are properly stored. Most of the group leaders that sells over 50,000 RMB would arrange a freezer to help store the products. For smaller group leader with no freezer, they can choose to only sell fresh products.

Product selection

Most of the items sold are under 50RMB with a high re-purchasing rate. 60% of items are fresh products such as fruits, vegetables, seafood, and meat. Everyday products such as toilet paper, cooking oil, and seasonal clothes and cosmetics are also popular on the platform. Low price and high frequency make these products ideal for the group buy promotion: users can make an impulse purchase and trust the community leader.

Unlike a traditional e-commerce platform where you can find hundreds of brands selling the same product, these platforms only work with one brand for each product. The platform deliberately doesn’t give consumers too much choice, which is an important social commerce tactic. The limited selection means less decision time, thus making it much easier for users to make the impulse purchase. Carrying only one brand for each product category also means the platform is able to negotiate the best price with the brand.

Many of products are from small brands, some products such as fruit and vegetables don’t even have their own brand. Since community group buys is based on consumers’ trust in the community leader, the branding of the product becomes less important. This also allows the platform to choose the vendors with the best rate.

The consumer group

According to Niwonin, 44% of register users are female aged 30 to 39. 85% of daily active users are female. 70% of users are aged between 30 to 49. And the top customers are usually iPhone users.

The Community Group Buy platforms started in Changsha, Huangzhou, Suzhou, and Nanjing. These are tier 2, or new tier 1 cities. These groups buy deal tend to be more popular in mid-tier cities, where people have enough purchasing power, and the community is tight. Users in the tier 1 cities tend to choose more traditional e-commerce platforms such as Taobao and Pinduoduo since it’s more efficient to have the products directly delivered to your door. People in top tier cities often don’t know their neighbors which also makes it hard for the community leader to sell.

The top 4 group leaders of Shixianghui are from Taizhou, Jiangxi, Wuxi, and Yangzhou. These are tier 2 and tier 3 cities.

WeChat group management

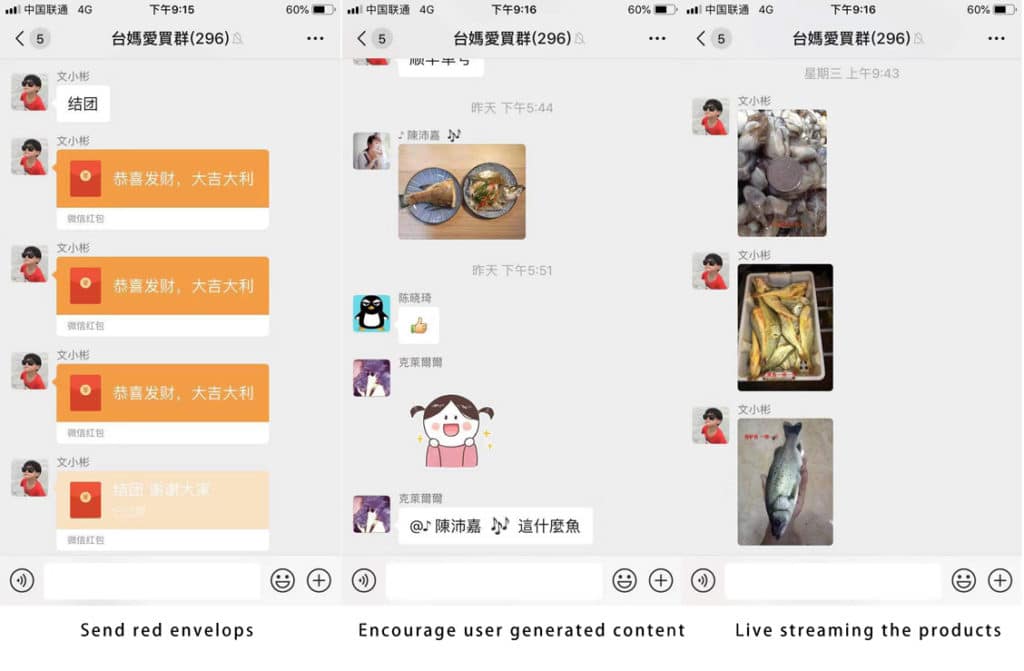

It’s not easy to manage a WeChat group. But most of these platforms have hundreds of groups to manage. For example, Niwonin now has over 10,000 WeChat groups. A couple of methods to makes WeChat group management easier includes:

- Clear group rules

- Using WeChat CRM to detect keywords so that customer service can pro-actively solve issues

- Encourage user-generated content to increase engagement, exposure, and trust (for example, encourage consumers to post pictures of their meals or unpacking videos)

- Share pictures of the origin of the product. Take apple as an example, the group owner would share picture and videos of farmers picking the apple, packaging it, and the transportation. This gives consumers a farm-to-table experience.

- Red envelopes are regularly sent to users in the group in order to push them to pay attention to the group and be aware of the newest promotions

The fast growth

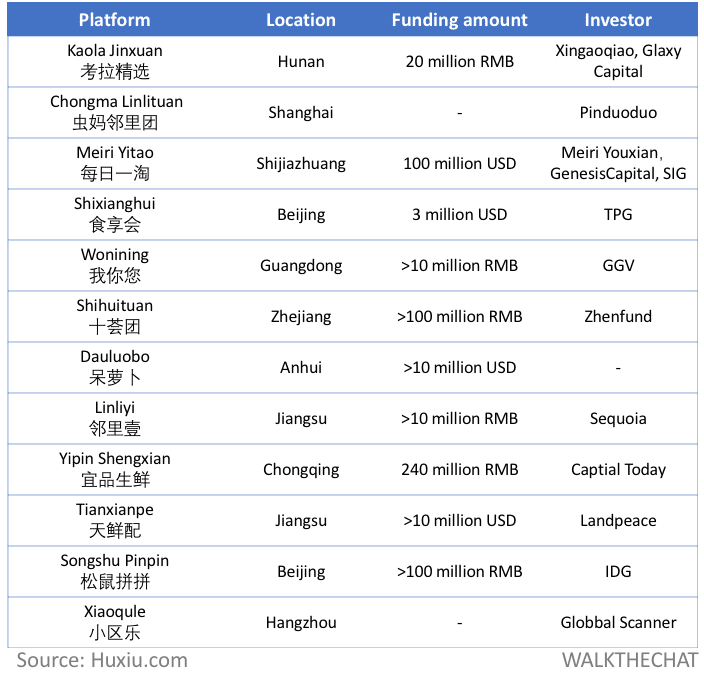

Some of the platforms such as Shixinghui, Shihuituan were founded in just a year. Others have been in the business for several years, but only started to operate under the current model since 2018. Yet top VCs such as IDG, GGV, Sequoia, and ZhenFund are already backing the top players.

Here is a list of the investment pulling into the group buy platforms:

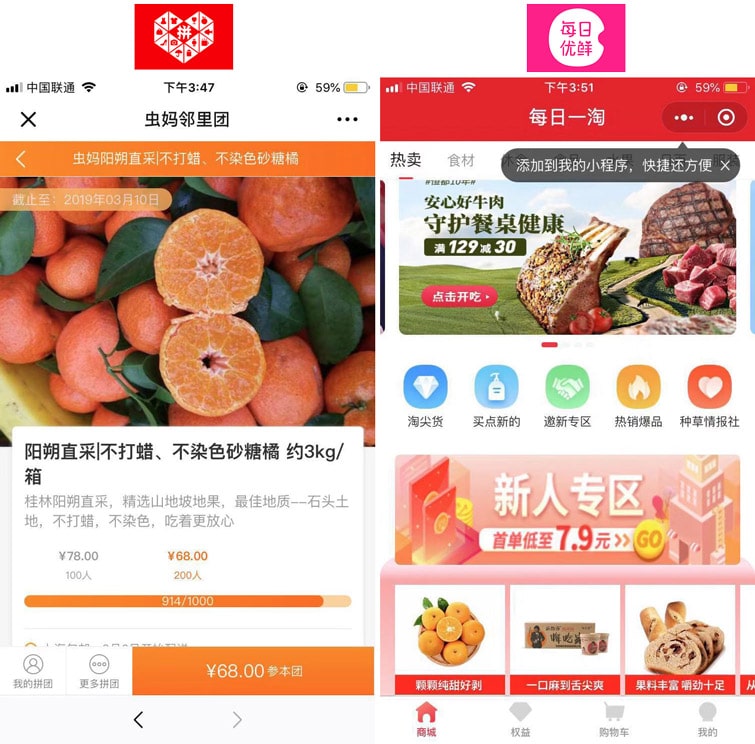

Many are invested by big e-commerce platforms such as Pinduoduo and Meiri Youxian (MissFresh / 每日优鲜). Chongma Linlituan (below left) is a group buy platform focusing on direct sourcing of fruits. And Meiriyitao (right) has a wider focus on food and other lifestyle products.

Investing in these e-commerce newcomers make sense for platforms like Pinduoduo and Meiri Youxian, since it not only helps to minimize the risk of being disrupted, but also is a great way for the startups to leverage the larger player resources in vendor and supply chain.

Conclusion

The Community Group Buys is a new e-commerce model that influences the Chinese consumers living in tier 2 and tier 3 cities. It creatively combines an efficient distribution channel and the influence of a community KOLs.

As the group buy model matures in smaller cities, social commerce expands and WeChat Payment gains a critical advantage against Alipay. After all, the mid-tier cities are where the potential lays.