If one day, a WeChat friend starts to promote “discounted” groceries, “best-price” cosmetics and other products of all sorts, he or she might have joined one of the biggest WeChat based multi-level revenue sharing platforms. Some of the biggest platforms include Yunji (云集), Beidian (贝店) and Global Scanner (环球捕手, AKA 51Bushou).

Everyone is a store operator

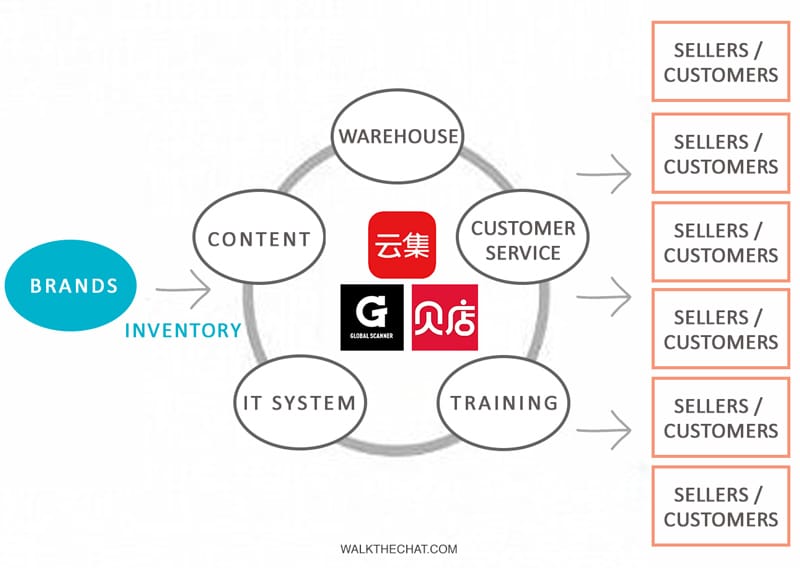

These social based e-commerce platforms operate on the new model called S2B2C. And the marketing part if very much a multi-level marketing scheme.

Platform: the major platform controls the whole supply chain and distribution channel.

- It provides a wide selection of products list.

- Logistic services

- Customer service

- A wide range of product list individuals can pick and add to their own WeChat shop. It sources products directly from the manufacturer/brand thus is able to maintain a heavily discounted price on a wholesale level

- Smoothlessly integration with WeChat to enable social sharing

- Clear instruction for a shop owner to recruit a new user to be the seller

- Clear rewarding system and commission system to reward individuals who had recruited the most sellers and buyers

- Support on marketing content

- IT support

All these efforts are to ensure the individual sellers can get all the support to easily start a personal WeChat shop.

Brands: a wide range of brands collaborate with these platforms. From P&G, L’Oréal, Swisse, to agriculture products and unbranded products produced by local manufacturers.

Store owners (individuals who ran WeChat shop): this is the marketing force behind the platform. It’s hundreds of thousands of individuals who use the platforms to create their own stores and sell these products on their own WeChat Moments/Weibo. If any of seller’s friend purchases the product, the platform will take charge of shipping, customer service, and returns. And the seller will get a commission on the sale.

The sellers don’t hold an inventory or take care of logistics themselves. They enjoy support in content, IT, customer service, logistics services of the revenue-sharing platform. All sellers have to do is promote products on WeChat to their friend circle. There are virtually no barriers to entry or expenses involved for a user to sell.

The recruitment of store owners: multi-level revenue sharing scheme

To become a store owner, the individual will need to first purchase an overpriced Gift bag (福袋) from an existing store owner, usually costs around 400-500 RMB. The gift bag contains cosmetics products that worth just a fraction of its price, and act as an entry ticket for the new seller to open his/her own store.

Existing store owners are offered cash rewards and commission to recruit more users to sell; they are also encouraged by the platform to purchases the products themselves, with all sorts of discounts, allowances, and members-only prices.

Garnering a certain number (typically 60-100) recruits (i.e. paying users that bought a membership) bumps you up to the next “manager” level, with the ability to get a bigger share of the revenue of the whole network. Those who make up the top “director” tier has a group of managers under their supervision, and enjoy a share of everybody’s sales revenue.

Who are the main revenue-sharing players?

Yunji, Beidian, and Global Scanner are the biggest social based revenue sharing platform.

Here is the WeChat mention index of the 3 platforms.

And here is a Qianfan Index of these platforms againest traditional e-commerce paltforms such as Taobao and JD.

Yunji

Based on monthly users and popularity on WeChat, Yunji Weidian (literally micro shops) is clearly in the lead among similar platforms.

Yunji was founded in 2015, and it claimed to have 3 million registered users, reported single-day sales exceeding RMB278 million and a 2017’s turnover exceeding RMB 10 billion, which in turn generated some RMB 150 million in tax revenue. The retail app covers a variety of categories from groceries and cosmetics to electronics and fashions, with logistical support from its 30 self-operated warehouses.

Some milestones of Yunji:

- May 2015 – Yunji Weidian (the seller platform) and Yunji VIP (the buyer platform) went online.

- May 2016 – Reported sales of RMB 583 million in its first year.

- March 2017 – Raised RMB 229 million for Series.

- May 2017 – Reported sales of RMB 3,539 million in its second year, with a record sales of RMB 700 million achieved in a single month.

- May 2017 – Categorized by the authorities as a pyramid scheme for their practice in 2016, Yunji was fined RMB 9.58 million.

- July 2017 – Sold 300,000 oranges in just a few hours with a large-scale campaign. That was more than 2,500 oranges per minute, a record that would have been unimaginable without e-commerce.

- April 2018 – Raised RMB 802 million for Series B.

- May 2018 – Sold 60,000 boxes of milk and 190,000 of yogurt, through its “adopt a cow” campaign, bringing in sales of RMB 8 million.

Beidian

Beidian claimed to cater to an 80-million user base made predominantly of housewives, appealing to their desire to earn income using at-home free time. The majority of sales made on Baidian are fresh groceries in massive volumes, such as the million pounds of potatoes achieved on the last Single’s Day sales.

Global Scanner

Launched in 2016, reported a user base of 30 million, including 2 million paid members. Targeting young urban females in first and second-tier cities, it attracts new users by offering competitive prices on grocery and personal care products that are often cheaper than other e-commerce sites after a user-exclusive commission. Turnover in 2017 reached RMB 200 million, and single-day sales reached 153 million on their second anniversary last April.

Conclusion

User-generated content proves to be highly effective and cost-efficient for boosting traffic and sales.

It is worth noting that on revenue-sharing platforms like Yunji, whose business motto is “buy to save, share to earn”, there is no explicit difference between buyers and sellers. Shopkeepers would purchase the same products they promote, and customers and become a seller on the platform by invitation. This means their distributor network grows hand in hand with the customer base.

Judging by the brutal rate at which these S2b2C platforms are growing (despite multi-level marketing schemes with more than 3 levels are banned in China), one may well anticipate the next giant that challenges “traditional” leaders like Taobao and JD.com will emerge from social e-commerce. That being said, it remains to be seen how these fast-growing networks will manage to toe the line between being profitable growth and being suspected of being multi-level pyramid schemes.