With almost 300 million Monthly Active Users, online reading might be the biggest Chinese digital market that you’ve never heard about. Let’s look into the main players and trends of this slightly nerdy industry.

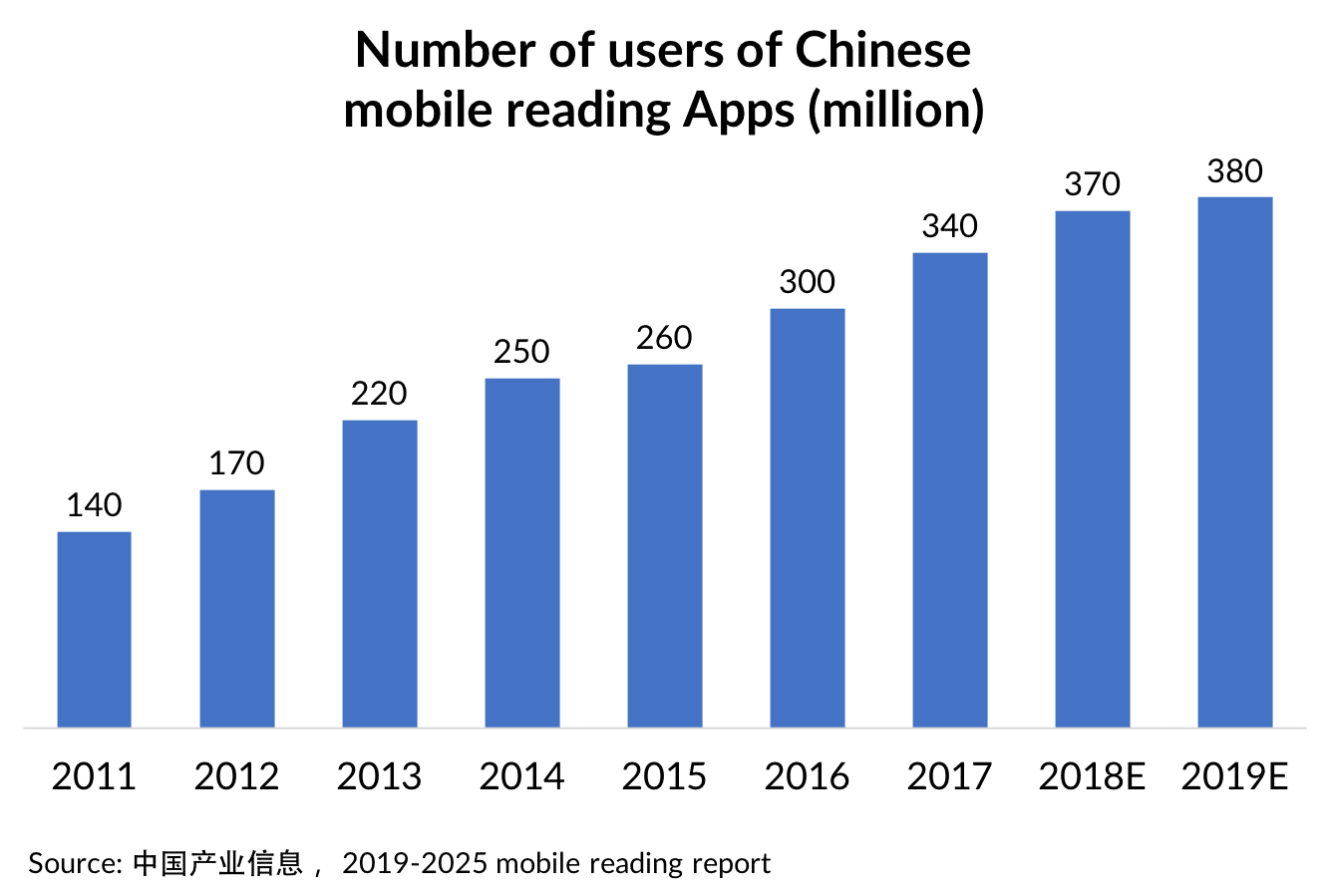

The ever-growing mobile reading market

The mobile reading market has been growing to more than 300 million monthly active users in 2017.

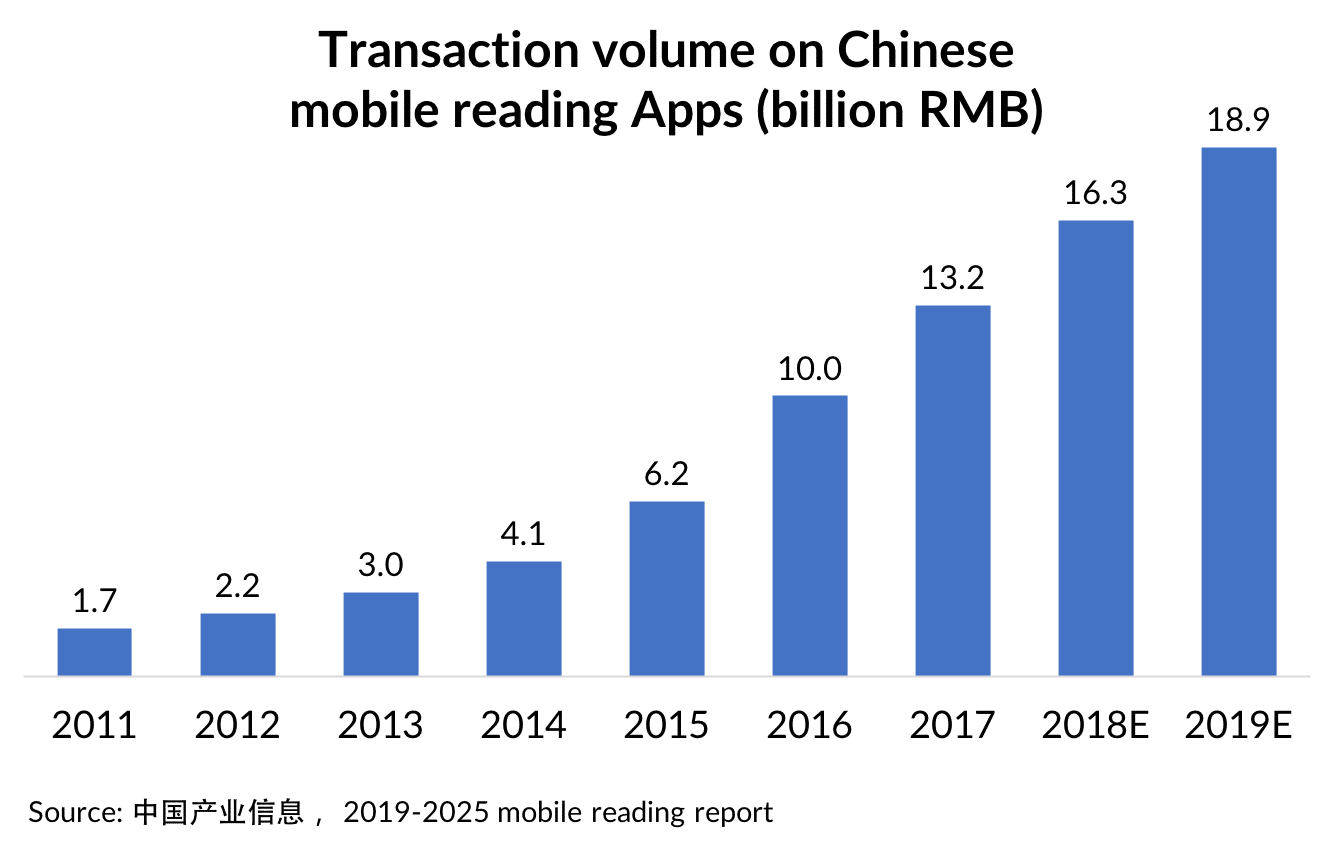

In the meantime, transaction volumes on Chinese mobile reading Apps has been booming with a growth rate of more than 40% every year, reaching 18.9 billion RMB.

Who’s leading the mobile reading market?

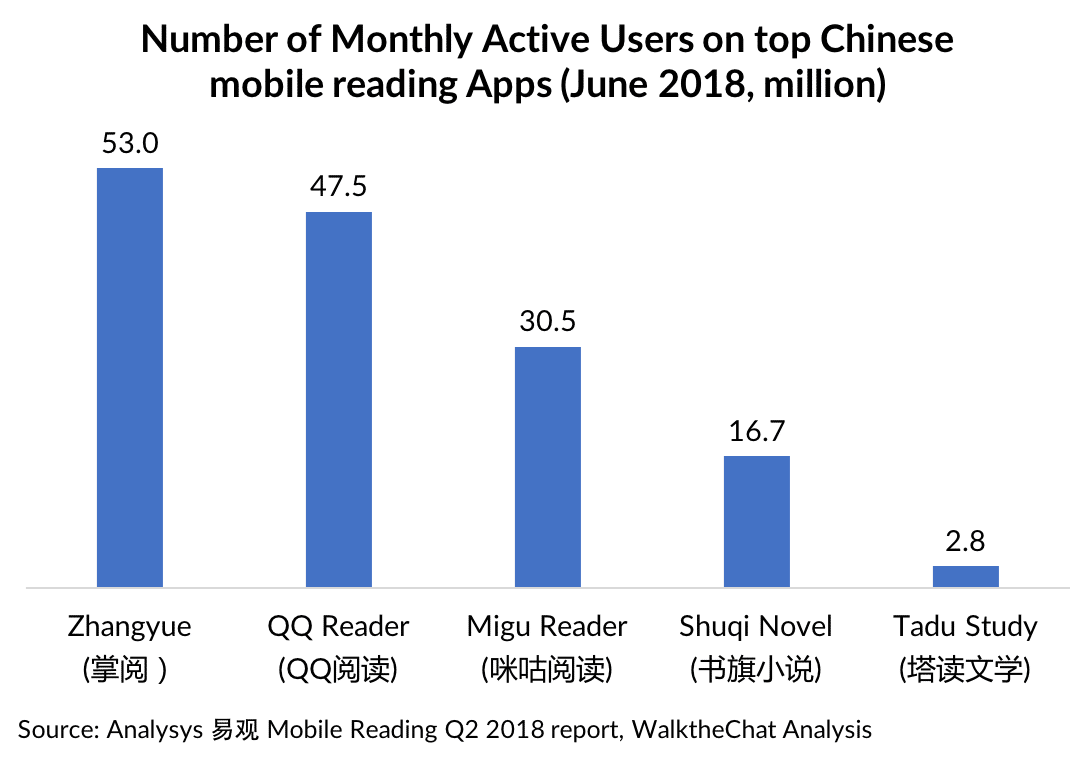

The main actors of the mobile reading market are Zhangyue and QQ Reader with around 50 million Monthly Active Users (MAU’s)

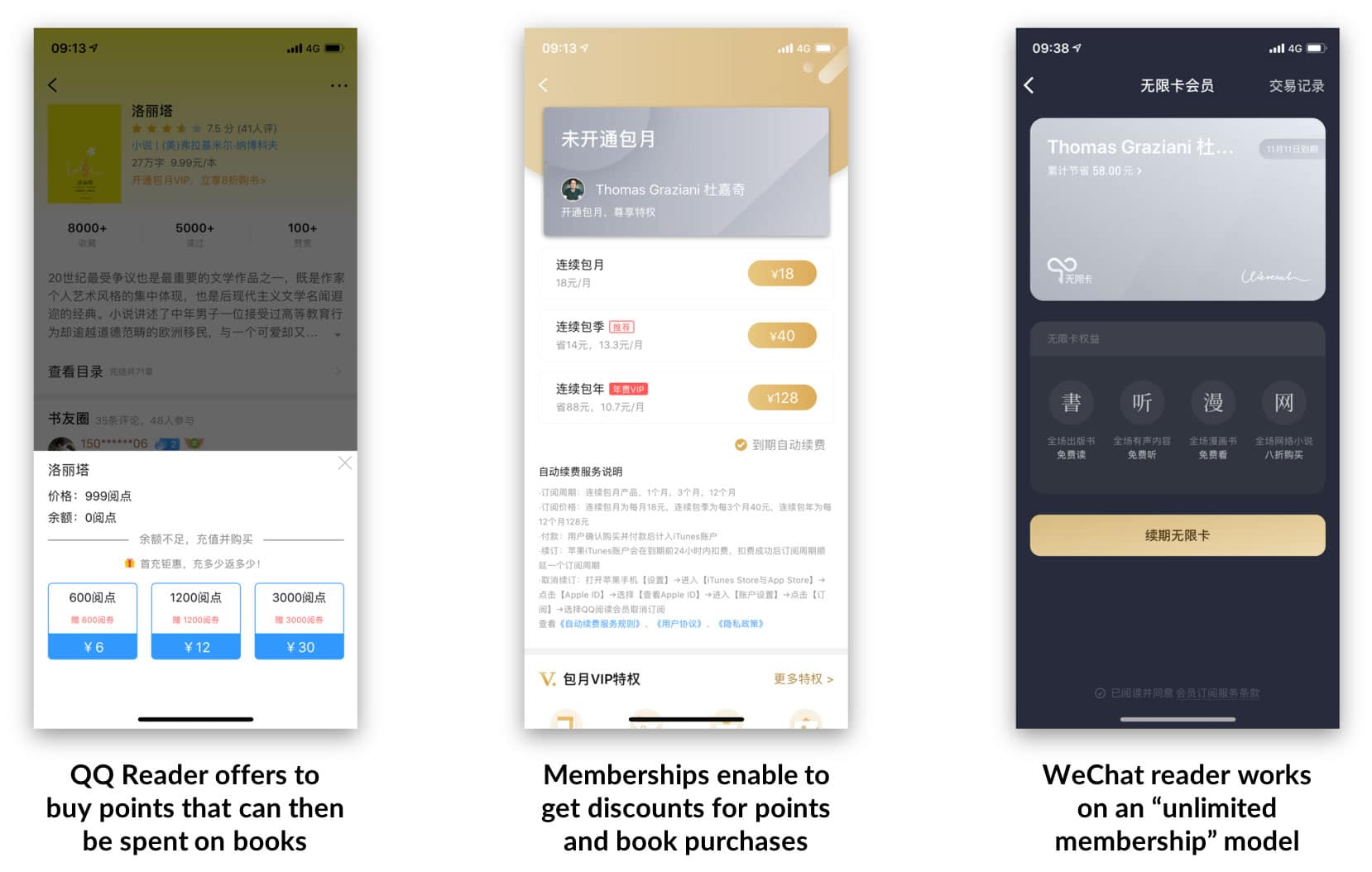

Apps in the Chinese mobile reading market adopt different types of business model:

- QQ Reader uses a point-based system, users can purchase or earn points and use them to buy more books (although a membership is available in order to get access to special discounts)

- WeChat Reader (a growing contender in the space) relies on unlimited reading membership

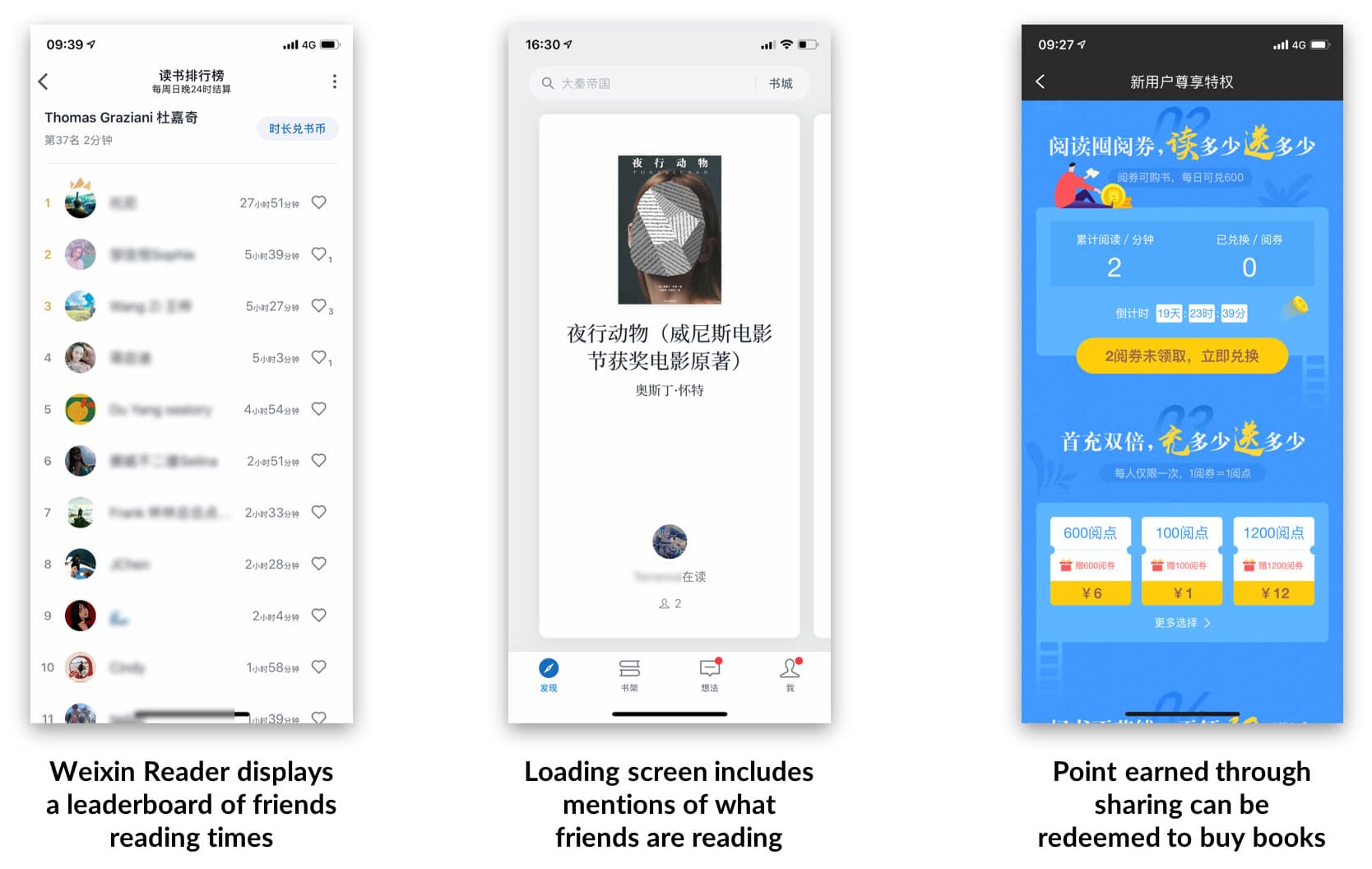

WeChat Reader, thanks to its integration with WeChat, delivers powerful social features aimed at improving engagement and user growth:

- Users are shown a leaderboard of their friend’s reading habits

- Users can share their position and reading time on WeChat Moments

- Their friends will then be invited to join the App to read books with free incentives

- Homepage shows mentions of friends currently reading specific books

- Earning points via sharing or other in-App behavior (consistently reading every day, etc.) enables users to earn points which can then be redeemed in exchange for books

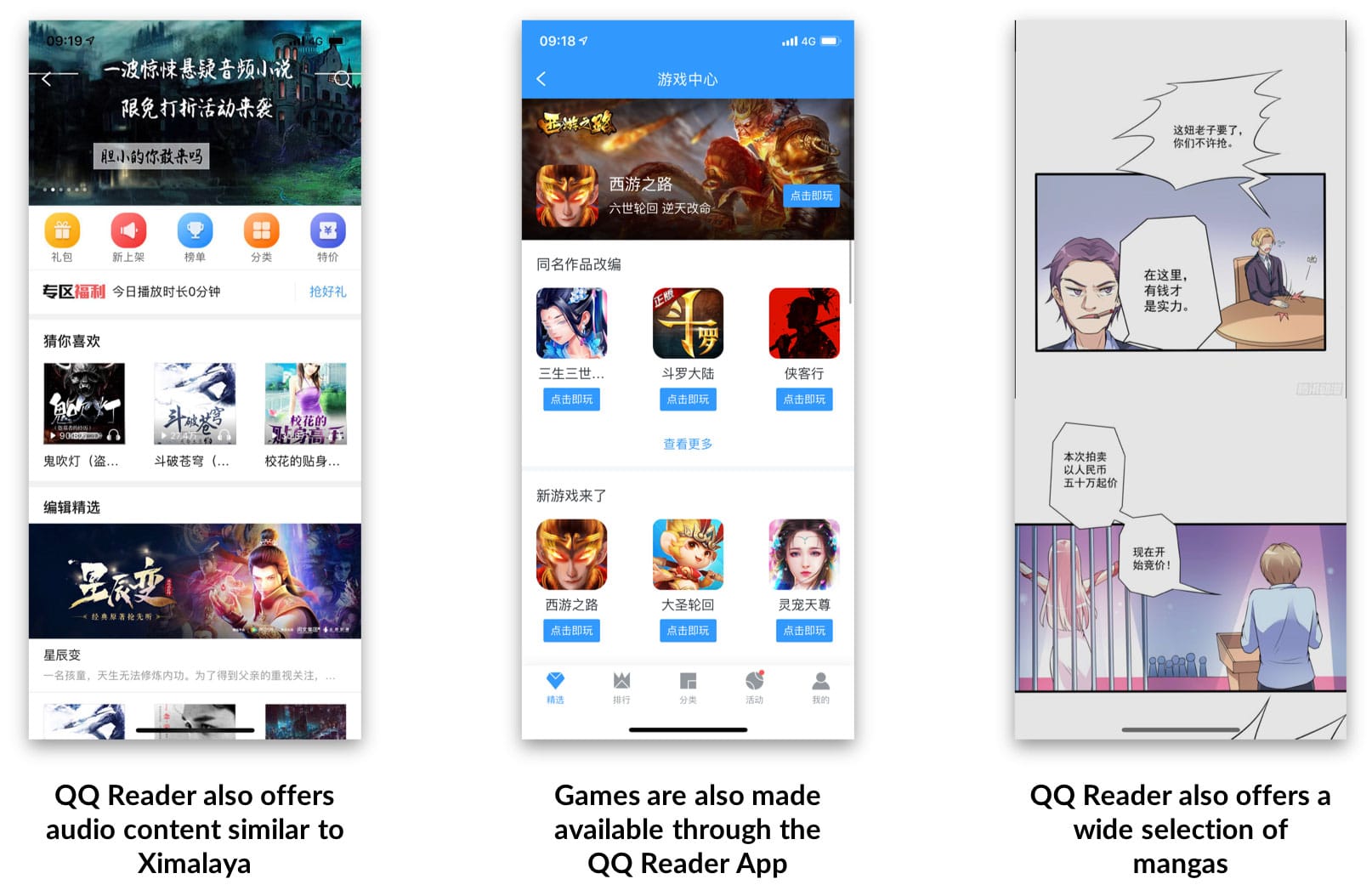

The Apps like QQ Reader that benefit from a broader content ecosystem via their parent company also promote this content through their reading App. For instance, QQ Reader also sells mangas, but also video games and audio content (thus competing against Ximalaya, Dedao and Zhihu)

Who is reading?

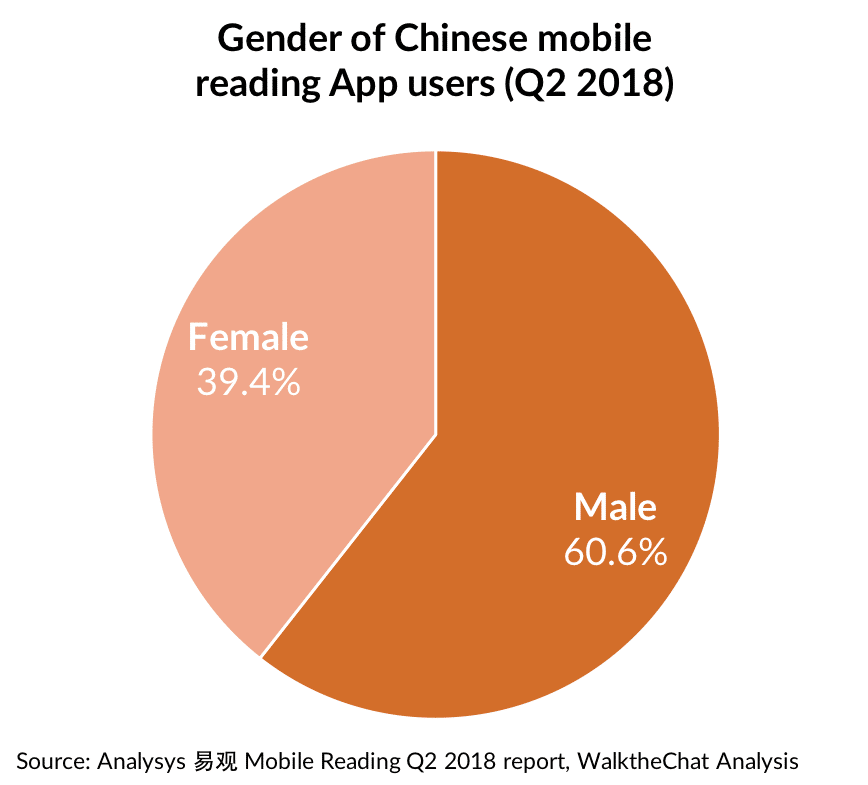

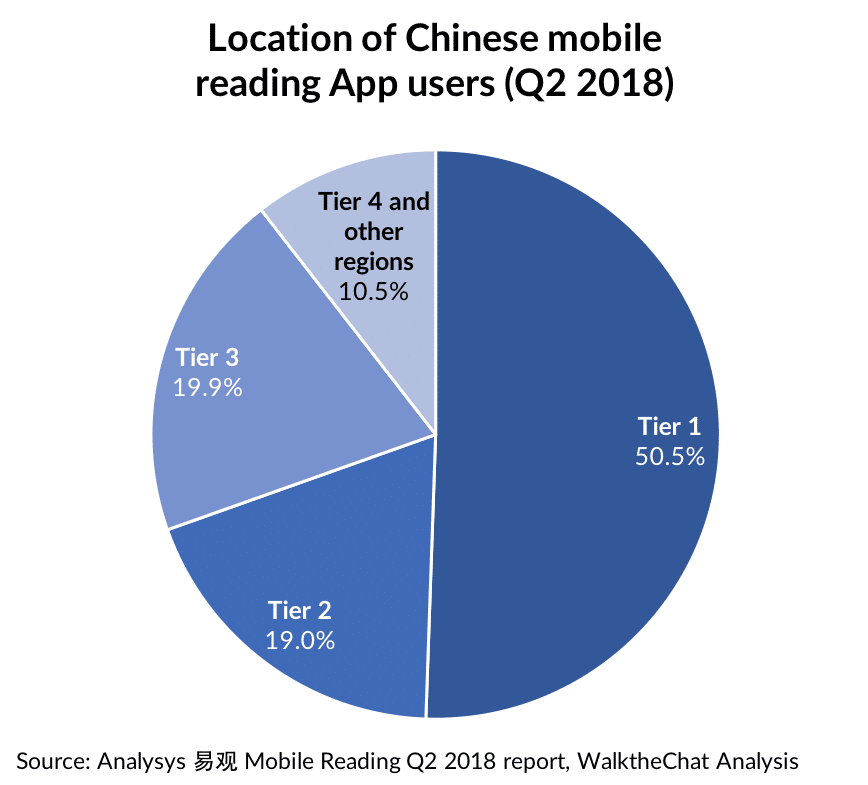

The users of Chinese mobile reading Apps are mostly male (60.6%) and very predominantly located in large cities (more than 50% of them are located in Tier 1 cities!).

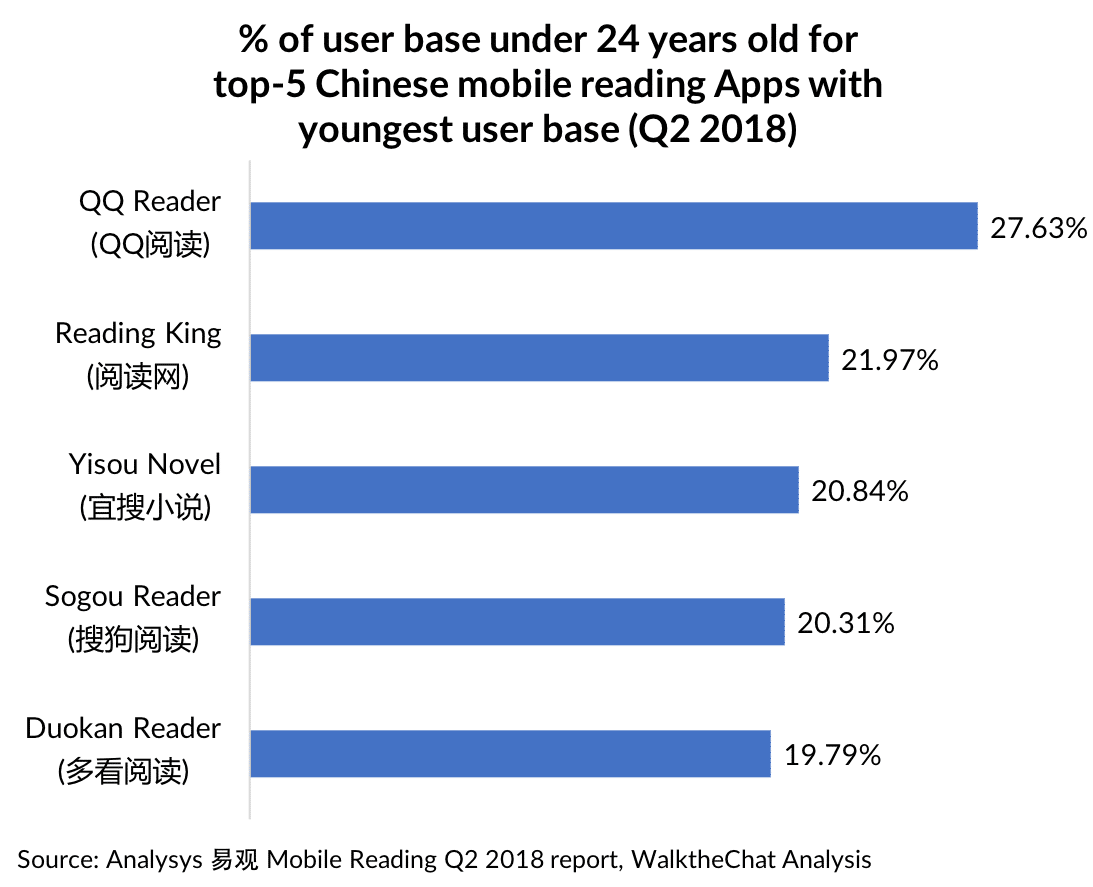

The age of users depends of the App: QQ Reader has the youngest user base with 27.63% of users being under 24 years old (which correlates with the messaging and social App QQ also performing better among younger users)

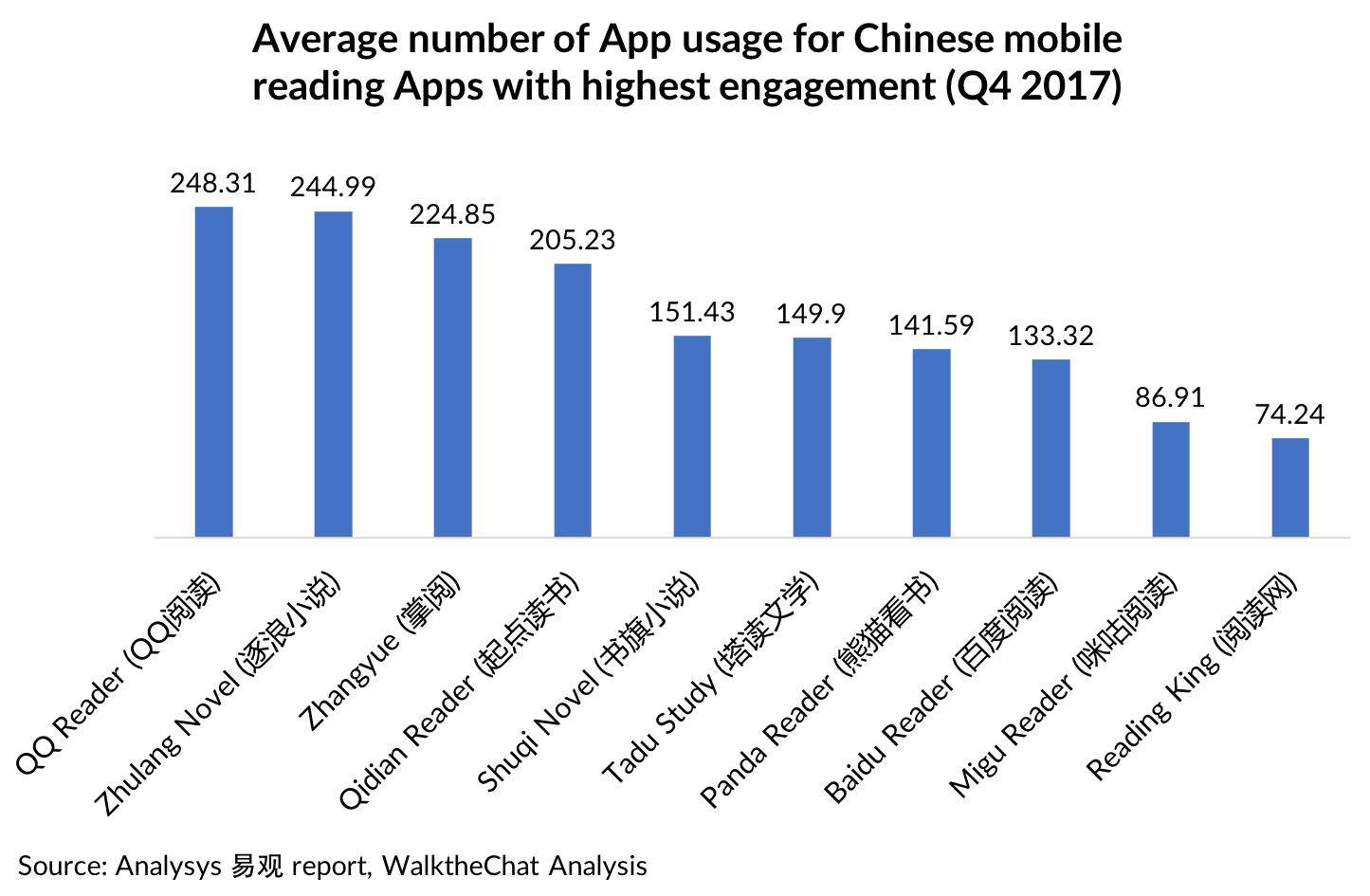

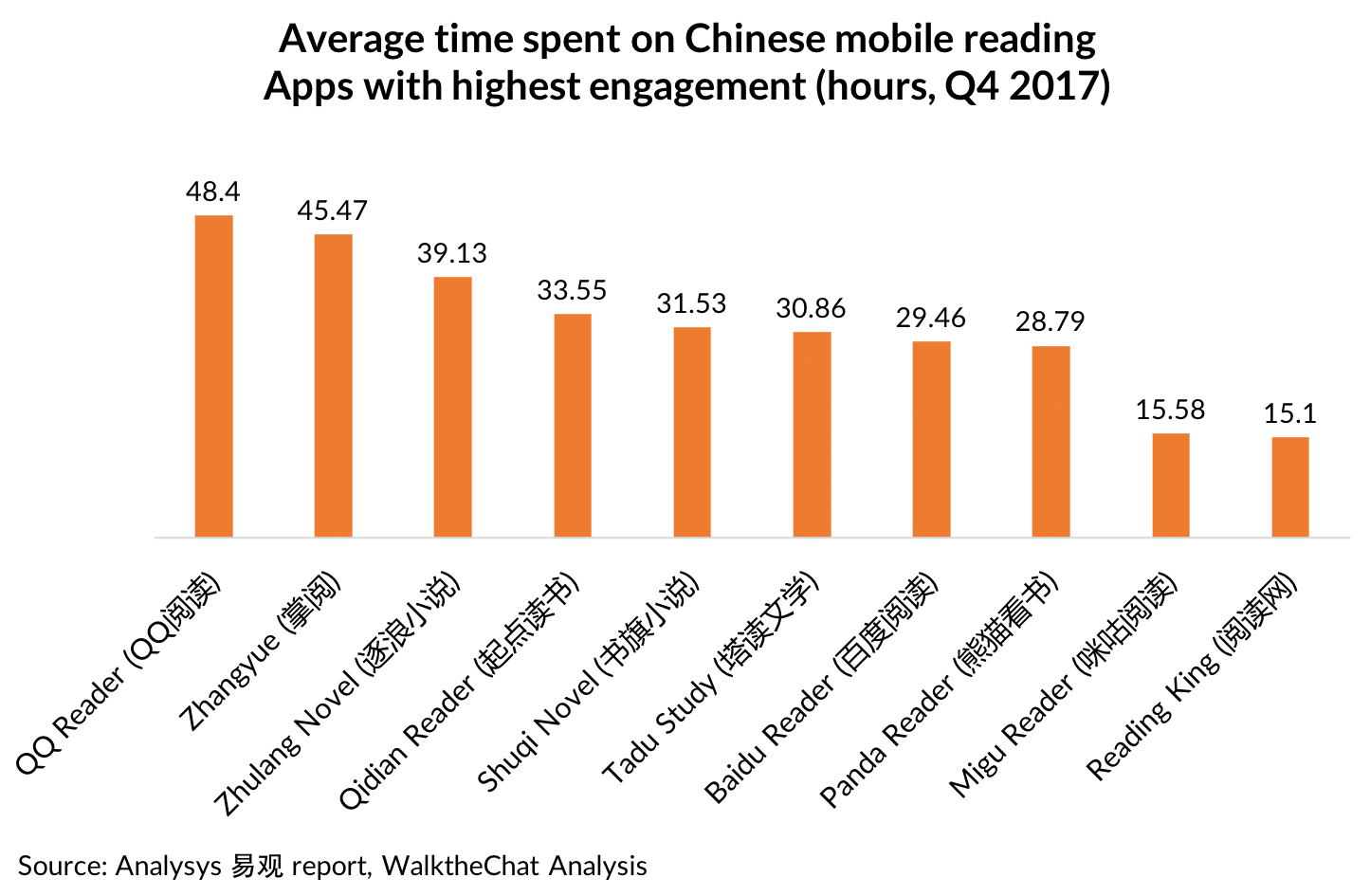

QQ Reader also has the best engagement rate both in terms of number of App usage and time spent on the App.

Thoughts on the future of mobile reading in China

Although Zhangyue still leads the way in terms of mobile active users, App from the Tencent ecosystem such as QQ Reader are likely to steal the show in the near future, leveraging social features, gamification and a young user base.,

WeChat Reader (微信读书) also is likely to have a bright future. The Tencent App leverages the fact that reading time is more than a statistic: it is a status symbol. Users are proud to show-off their latest achievements on their WeChat moments, creating a viral loop bringing in more users and engagement.

Conclusion

Once again, China demonstrates its ability to come up with innovative business models (unlimited subscriptions, point-based systems, gamification) and growth strategies (social sharing, viral loops) compared to Western counterparts (Kindle reading being more of a solitary experience).

By combining social with ebooks, China managed to turn an old industry into an engaging digital experience where users can discover, share… and sometimes show off a little bit.