For any resident of major Chinese cities, it has been hard to avoid the war going on between bike sharing companies Ofo, Mobike, Bluegogo and the like.

Each backed by Chinese Internet giants, they are tearing themselves apart to win China’s new prized market. But this war has consequences beyond China. It spawned the creation of similar startups outside China.

It’s a brand new trend: U.S copycats of Chinese innovation.

The booming U.S bike sharing market

If the latest innovation in terms of bike sharing come from China (TechCrunch talks about “Chinese-style bike sharing” startups), the market has nonetheless been growing in the U.S for quite some time.

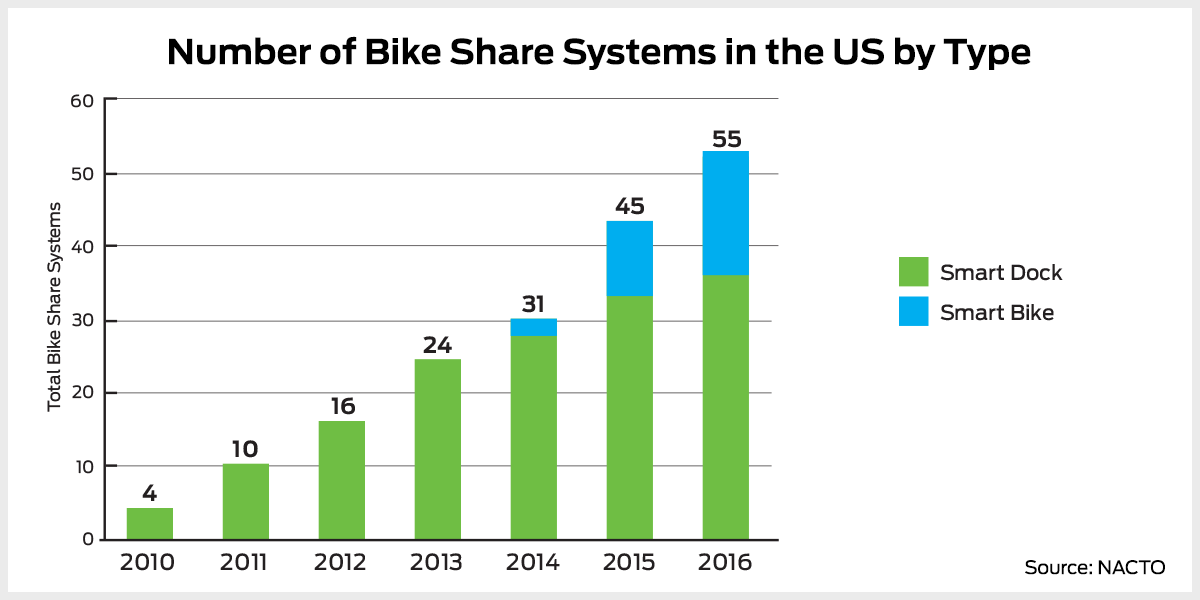

“Smart dock” systems (meaning the bike can’t be left anywhere but has to be taken back to a fixed dock) have been operating since 2010, and “Smart bikes” (more similar to Ofo/Mobike) since 2014.

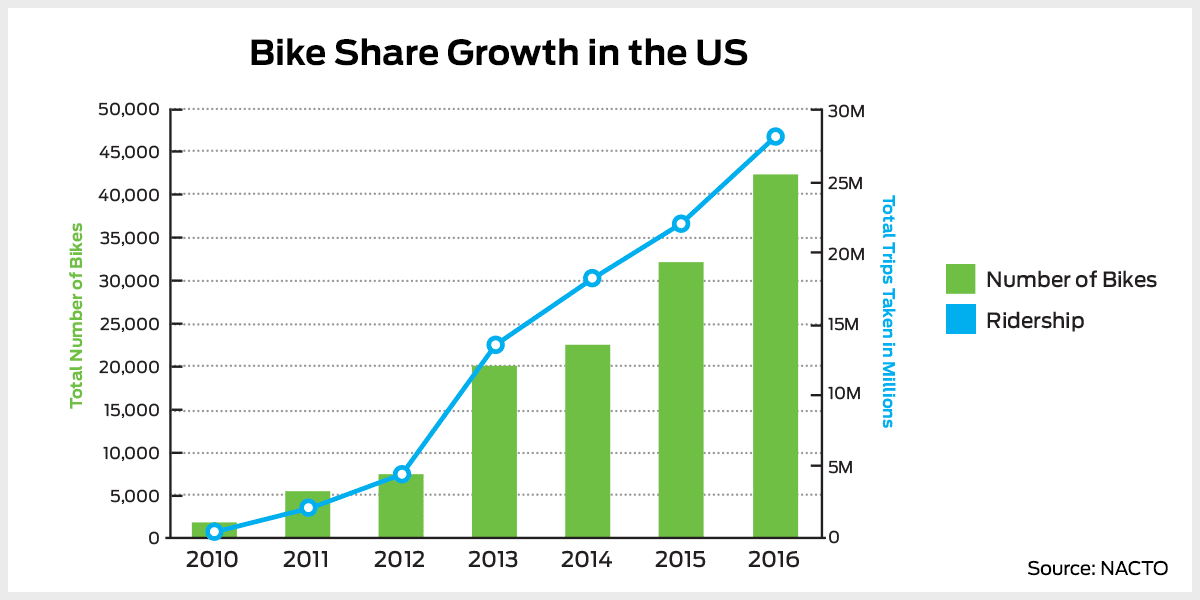

The number of bikes and trips has also been rising exponentially

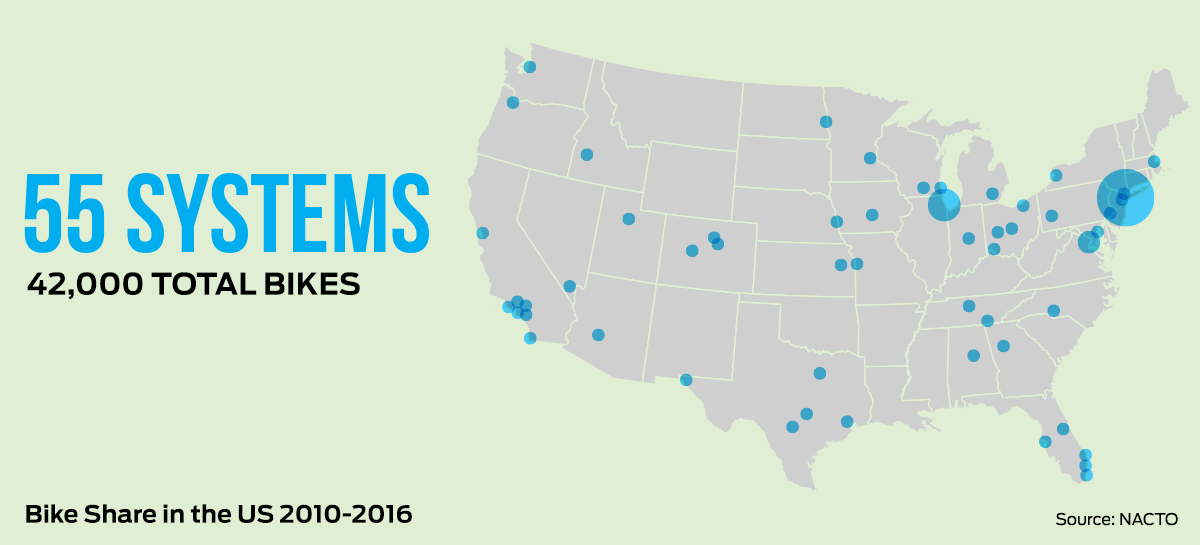

Such systems are widely spread across the U.S

Research from Roland Berger projects that the global market for bike sharing could reach $6.1 billion dollars by 2020. A significant pie, but which might not justify the existence of many well-funded players.

Spin: a Mobike copycat

According to a report by TechCrunch, Spin is a Ofo/Mobike copycat aiming to deploy about 100,000 bikes in the U.S by the end of 2017.

The startup was launched by ex-engineers from the car-sharing APP Lyft and from the comment-management platform Disqus.

Young tech founder from the car-sharing industry: team Spin also has much common grounds with Mobike and Ofo founders

Young tech founder from the car-sharing industry: team Spin also has much common grounds with Mobike and Ofo founders

In terms of technology, Spin seems to take its inspiration from the high-end approach of Mobike: it is using QR codes to unlock the bike via an APP. The bike is using theft-resistant screws and solid foam tires in order to limit the cost of maintenance.

Spin bikes are in many ways similar to their older sister Mobike

Spin bikes are in many ways similar to their older sister Mobike

In terms of pricing, the positioning is also significantly more aggressive than its Chinese equivalents: $1 for every 30 minutes of ride.

And Spin isn’t the only player in this space: it has been preceded by Social Bicycles, another U.S bike sharing startup in operation since 2010.

Spin already has to deal with local competitors such as Limebike

Another player, LimeBike, announced a $12 million funding round just a few days ago, led by the prestigious VC firm Andressen Horrowitz.

Moving the battlefield

With a few notable exceptions (such as Huawei in telecommunication and smartphones), competition between Chinese and U.S brand has mostly constituted of U.S companies trying to enter the Chinese market.

Things are now moving the other way around. Spin and its future siblings will have to do with competition from Chinese companies. Ofo has announced in December plans to expand in London and Silicon Valley, while Mobike is planning to start operations in Singapore.

London “Boris bikes” will now have to face competition from Chinese innovators

London “Boris bikes” will now have to face competition from Chinese innovators

The market in China is arguably more cut-throat than in Europe in the West: abundant capital creates fierce clash between. So far, U.S companies have poor track-records in terms of beating Chinese competitors (ie: eBay, Uber, Amazon, etc.)

We’ll now see whether oversea firms can defend more efficiently on their home turf.

Are the U.S still a good place to innovate?

In terms of market size, the U.S.A remain the crown jewel of the West. But legit concerns have been voiced as to how smoothly such disruption might happen in the U.S.

When Chinese bike sharing company Bluegogo stated its intention to launch bikes in San Francisco as a market test, it suffered a backlash from local city authorities.

San Francisco municipal authorities threatened Bluegogo with launching legal action against Bluegogo, explaining that exclusivity right had been given to U.S mega-corporations such as Ford Motors.

Bluegogo had to withdraw from it’s initial expansion due to local government backlash

The question therefore remains if Spin, LimeBike and other local incubents will manage to thrive in this climate seldom encouraging innovation.

What’s next?

With a projection of a $6.1 billion dollars by 2020, and some players such as Ofo already being values as “Unicorns” (above 1 billion dollars valuation), it is likely that the bike sharing market will soon become more concentrated.

Chinese startups today have a tremendous head start in this space. Will the space remain divided between inside and outside China (like for car-hailing with Uber and Didi) or will a global leader emerge?