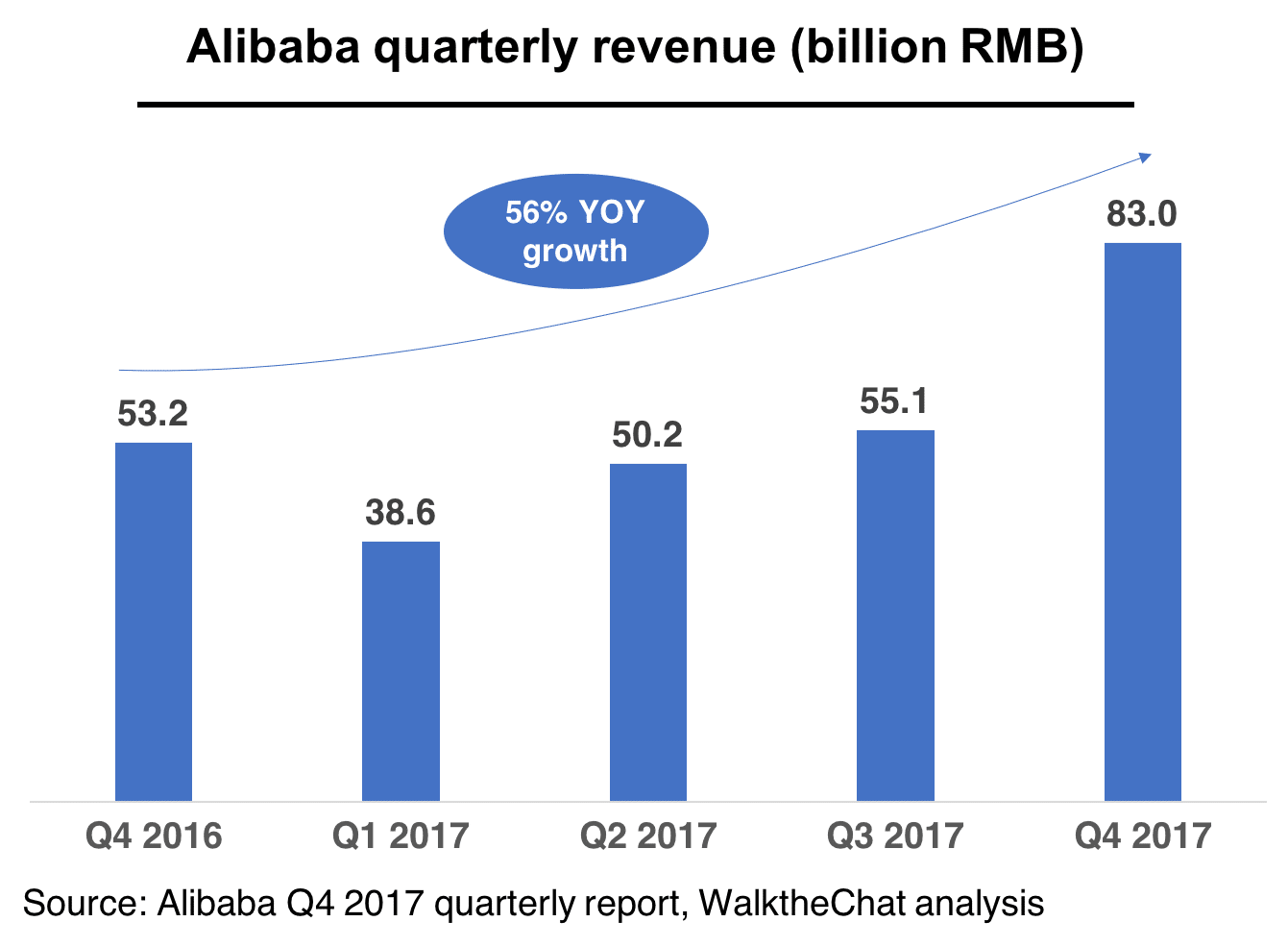

Alibaba just published their December Quarter 2017 results. With 56% YOY revenue growth, we should be impressed. Yet, Alibaba’s stock fell after the publication of the results. Why? Let’s have a closer look.

Impressive 56% YOY growth

Alibaba experienced an impressive 56% YOY growth by Q4 2017. The seasonality of the revenues (with a peak during Q4) is mostly due to the high revenues brought in by the Single’s Day sales.

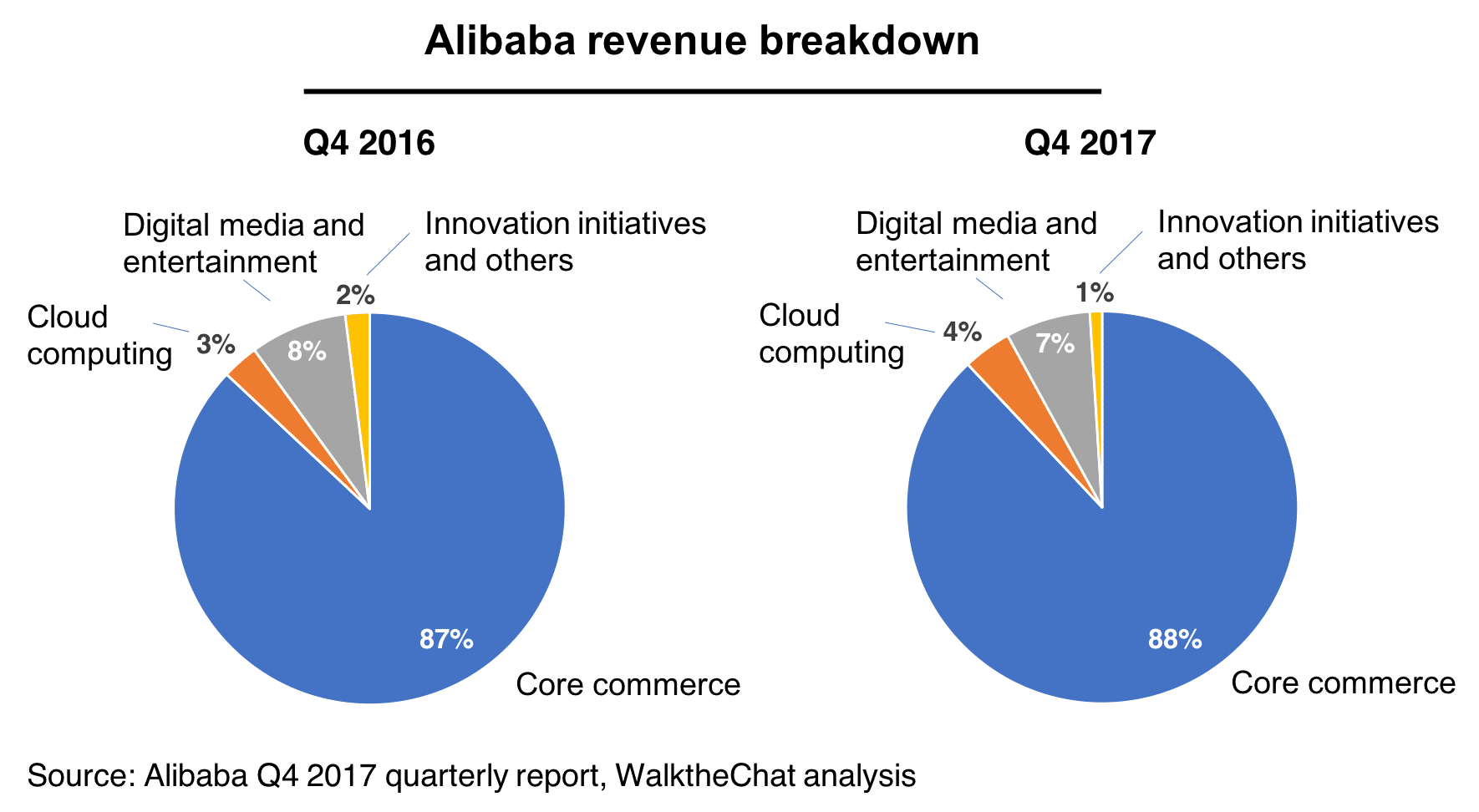

This revenue was mostly contributed to by Alibaba’s core e-commerce business, representing 88% of total revenue. This number has barely changed since Q4 2016.

Alibaba’s revenue depends heavily on the growth of the Chinese e-commerce market, which might become an important risk for the company.

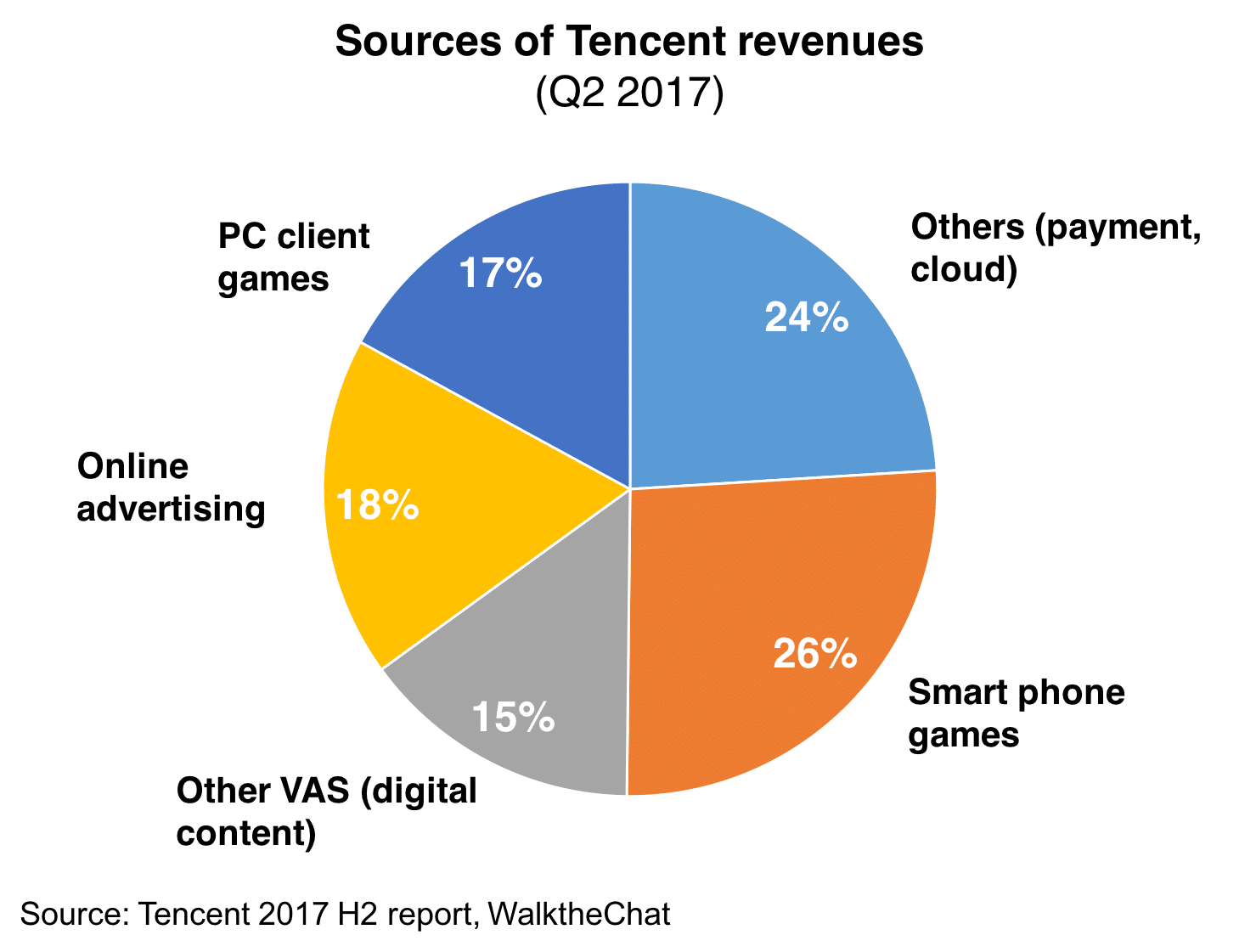

Comparatively, Tencent has a much more diverse revenue distribution. Tencent does not even depend on WeChat, its biggest product with 1 billion users, as its major source of revenue. According Tencent’s Q2 2017 earning report, earnings from WeChat (mostly advertising and WeChat Pay) represent less than 1/3 of Tencent’s total revenue.

Alibaba still has a long way to go for mitigating risk and diversification of its portfolio.

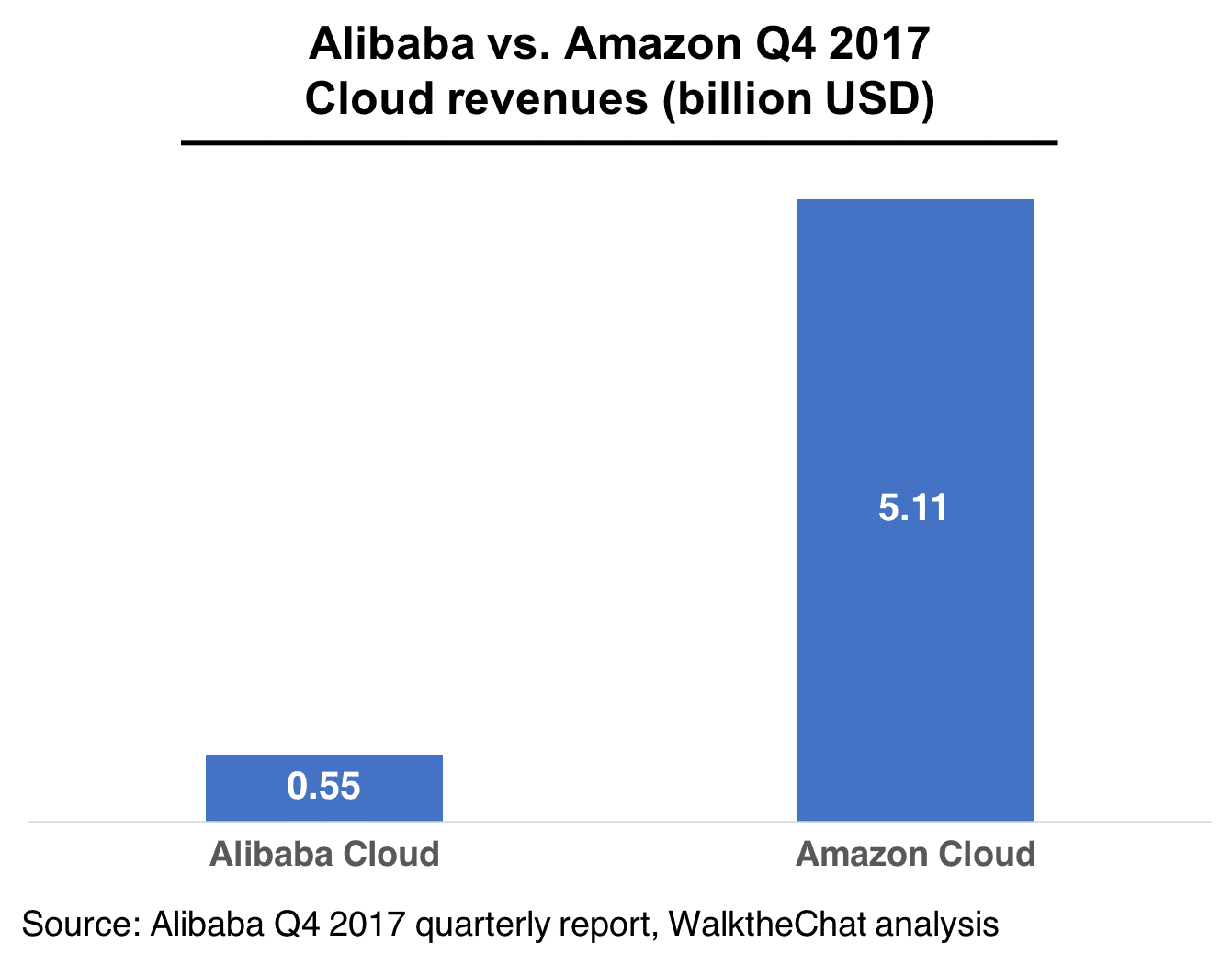

Cloud revenues doubled in 1 year

Alibaba’s Cloud revenues (from its cloud company Aliyun) more than doubled within a year (with a 104% YOY growth rate). This is particularly exciting as many analysts are considering Aliyun to be the Chinese equivalent of Amazon Web Services (AWS), and AWS is already a 100+ billion USD company.

There is, however, a very long way to go for Aliyun to catch up with AWS. As of Q4 2017, AWS revenues are almost 10 times larger than Aliyun’s.

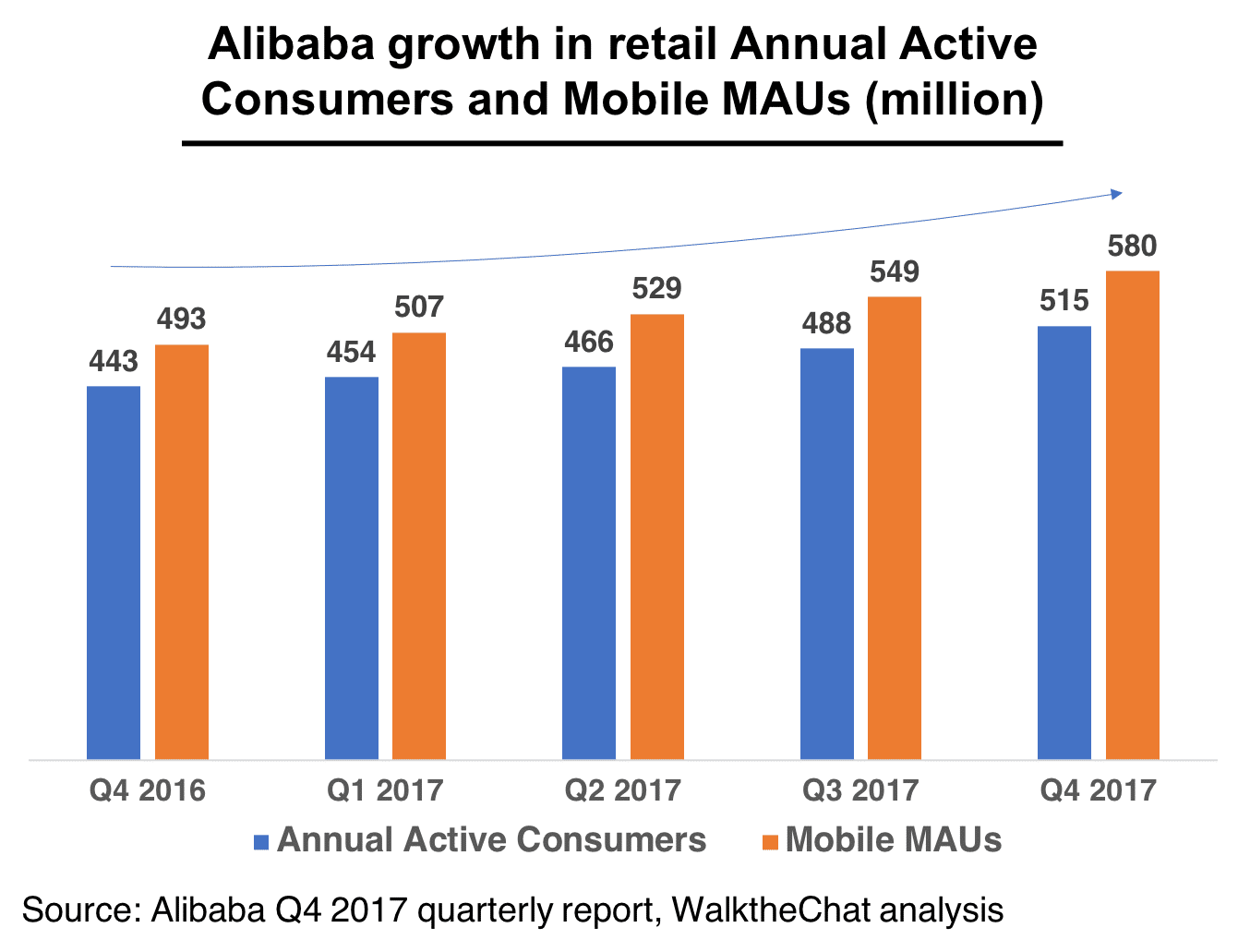

Steady growth of Monthly Active Users

Alibaba has seen a steady growth of Mobile Active Users, to 580 million.

Jack Ma’s company is still lagging behind WeChat, which announced almost 1 billion mobile users last quarter. With a growth rate of 17%, it is also very unlikely to catch up, being too close to WeChat own’s growth rate (16% YOY during the last quarter).

Picking up 33% of Ant Financial

Another announcement was made: Alibaba will “pick up” 33% of its affiliate Ant Financial (the company operating Alipay).

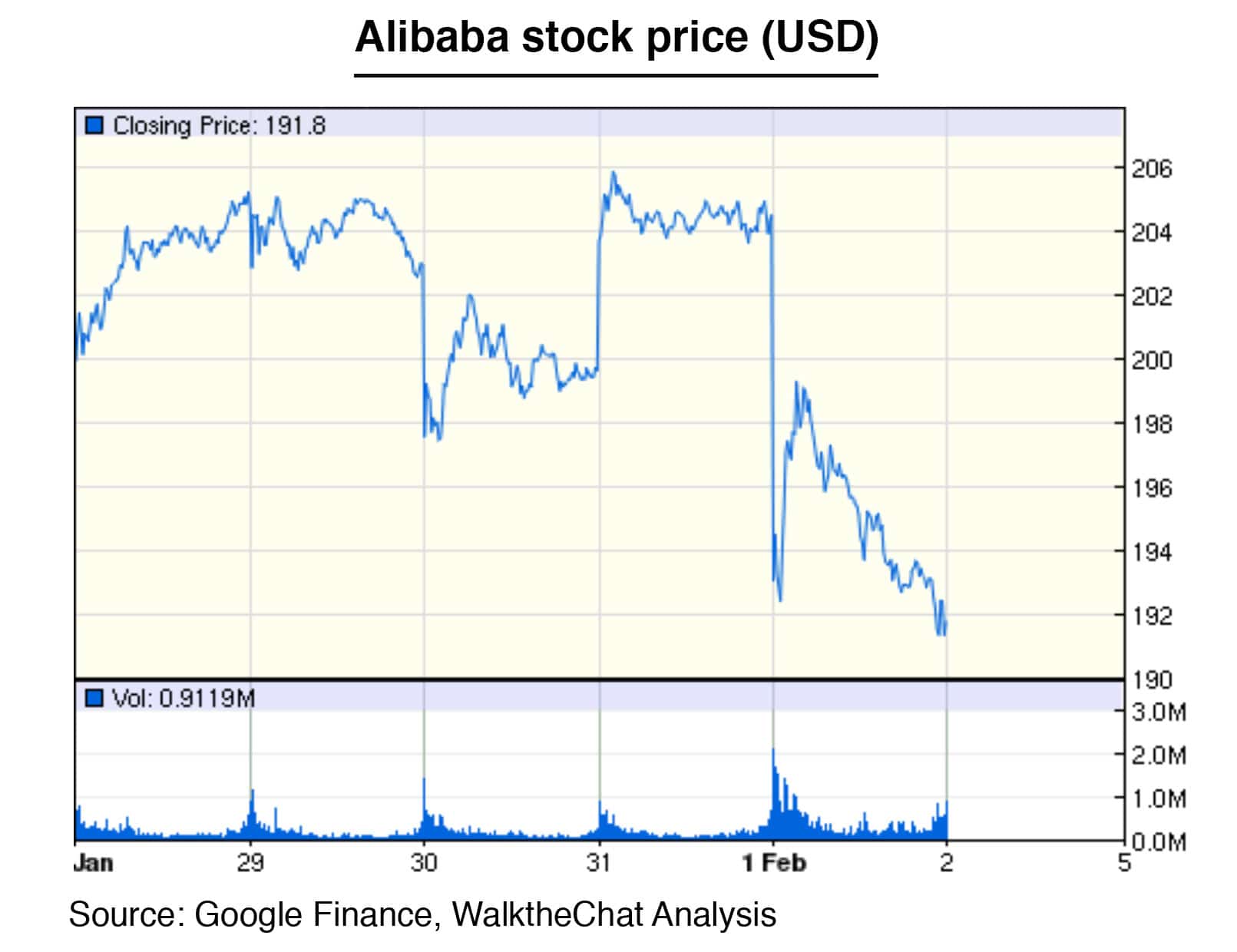

Why “pick up”? Because this stake is replacing a previous agreement according to which Ant Financial had to redistribute 37.5% of its pre-tax profits to Alibaba each quarter. This means a loss of 4.5% of revenue for Alibaba. Alibaba confused analysts saying that the deal would have no cash impact on its business, and by claiming that the deal was “paid with IP” (apparently following a previous agreement with Ant Financial dating from 2014)

Consequently, Alibaba’s stock price dropped right after the announcement.

But this might still be a good move for Alibaba. Indeed, Ant Financial is rumored to go toward its IPO, probably in the next 12 to 15 months (according to MarketWatch). If it does so, this stake in the online finance company might well be a worthwhile investment.

Moreover, the stake in Ant Financial gives Alibaba both a long-term access to Ant Financial’s revenue, and a stronger influence in terms of decision making in the company. On the long run, these are excellent news.

Another reason for this drop in share price might be that earning per share ($1.63 per share) missed some Wall Street estimates of ($1.67 per share). Even though revenues actually exceeded analysts expectations.

Conclusion

Alibaba delivered, by any means, an impressive quarter and strong growth. The explosion of its cloud business is encouraging, although still far off its Western competitor Amazon Web Services.

Yet, analysts decided to dump the stock after the Q4 results announcement. This move was most likely motivated by the uncertainty of the Ant Financial deal. However, it seems unjustified as Alibaba seems to be playing a long-term game by investing in Ant Financial, which might lead to a large payoff at the moment of its IPO.

But the real risk for Alibaba lies elsewhere: the company completely depends on e-commerce, and Tencent is determined to try to steal the show.