The rise of DeepSeek, business-friendly signals from the administration and turmoil in the United States have led many businesses to reconsider China as a key market for 2025.

But what is the best way to enter the Chinese market in 2025 ? Here are five ways.

Part 1 : who can enter the Chinese market in 2025 ?

Gone are the days when a foreign company could wave a French, Italian or Swiss flag and automatically get impressive sales in the Chinese market. Today, entering China requires significant differentiators to ensure success.

We recommend at least 3 of these 5 characteristics to enter the Chinese market, though preferably all of them:

- Product-market-fit outside China: your product should already be successful outside China, generating upwards of $20M USD of yearly revenue, ideally more than $50M.

- Key differentiators: your product should stand out in terms of features compared to local competition. In 2025, Chinese consumers prioritize price (20%) and product functionality (20%) over origin (11%), signaling a shift toward value-driven, practical purchasing (AlixPartners).

- Storytelling potential: your founding/management team must be ready to tell a story and get personally involved in translating that story to the Chinese market

- Adaptability to Local Consumer Preferences: copy-pasting your overseas strategy, packaging and product characteristics is no longer sufficient to succeed in China

- Financial resources: you should be able to involve significant resources and inventory to enter the Chinese market

Although these points might sound obvious, many companies overlook them when entering the market. Once you decided yourself as ready, you can choose between low-risk and high-risk approaches.

Part 2 : low-risk approaches

Low-risk approches involve a smaller financial, inventory and human resources commitment. Although they have limited upside, they can be essential to test the market and draw key learnings.

Low risk strategy #1 : Red stores

- Risk: low

- Requirement: no special requirement

- Cost: $3,500 refundable deposit, 5% commission, and 0.7% payment fee

- Logistics: products can be shipped to a bonded warehouse in Hong Kong or Mainland China (Ningbo and Yiwu)

- Advantages:

- Available to all brands

- Low cost

- Fully owned by the brand

- Downsides:

- Needs marketing to generate sales/growth

- Requires strong local partner for live-stream/influencers operations

Red is the “Instagram of China”. A simple way to set-up shop in China and get your first sales is to establish a presence on Red .

Red stores provide a one-stop experience where customers can discover brands through content, find products and complete purchases without leaving the App.

- In 2024, Red saw an 8.1x surge in new buyers, 3.4x growth in live-stream buyers, and 2.7x more brands partnerships with influencers

- 67% of its top 100 sellers have under 500k followers, proving niche creators drive sales

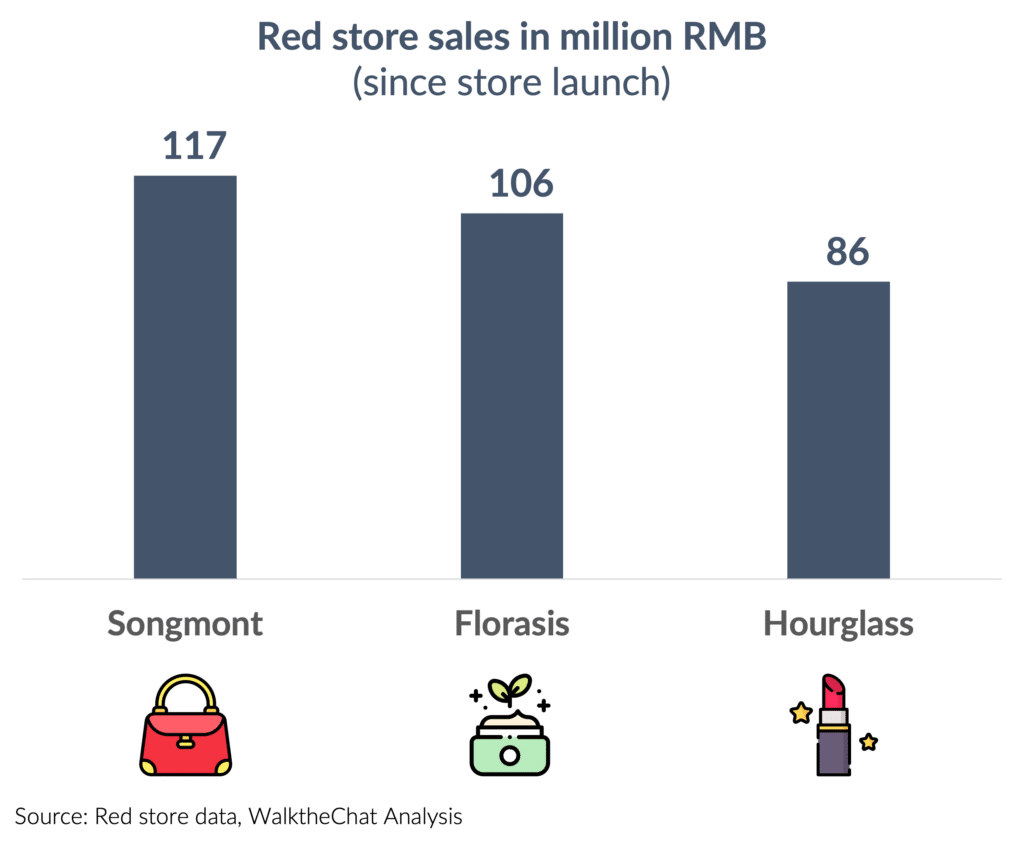

- Local brands such as Songmont (handbags), Florasis (cosmetics) and Hourglass (lipstick) have driven multi-million dollars sales solely on their Red stores

You can contact WalktheChat to create a Red store for your brand.

Low risk strategy #2 : Partner with Showrooms and Buyers Stores

- Risk: very low

- Requirement: brand should have high-enough potential in the market to be selected by Buyer Stores

- Cost: 15% of sales to distributors (note that this doesn’t take into account the markup of distributors)

- Advantages:

- Instant access to established distribution networks (online/offline); reduced operational risks.

- Disadvantages:

- Limited control over brand storytelling; margins diluted by intermediaries.

- Very stringent approval process to be selected

Buyer stores such as FIG, Shatang or 西有 make products available to local distributors in China. Each of these buyer stores averages 600+ wholesale accounts and 100+ seasonal buyers, making products available accross the entire Chinese territory.

They are a great low-risk channel, but selection is tough. Showrooms only have limited display space and will select the brands with highest distribution potential.

Low risk strategy #3 : Listing on 3rd party Apps

- Risk: very low

- Requirement: brand should already be popular and have potential for $150,000 USD of sales during first year with little marketing investment

- Cost: $1,000 USD annual subscription fee + 15% commission

- Advantages:

- Affordable way to access the Apps audience

- Can list on the platform Mini Program

- Disadvantages:

- High commission

- Relies mostly on organic search traffic

3rd party Apps such as Beyond or SENSER enable brand to list their products on multiple Chinese marketplaces and on their own App. In exchange for this service, they charge a relatively steep commission of 15% of sales.

This commission can however be worthwhile for brands that wish to test the Chinese market, evaluate the appeal of different products. But without significant investment or existing interest for the brand, it can be hard to drive meaningful sales through these niche channels.

Part 2 : higher-risk approaches

In 2025, low-risk strategies are unfortunately generally insufficient to “make it big” in China.

Douyin & Tmall stores

- Risk: high

- Requirement: a Tmall or Douyin launch is possible for any brand that believes it can succeed in China, but is very costly

- Cost: $500,000+ investment first year at a minimum, often $1M+

- Advantages:

- Full control over marketing strategy

- Potential for high-volume

- Disadvantages:

- Very heavy cost structure & investment

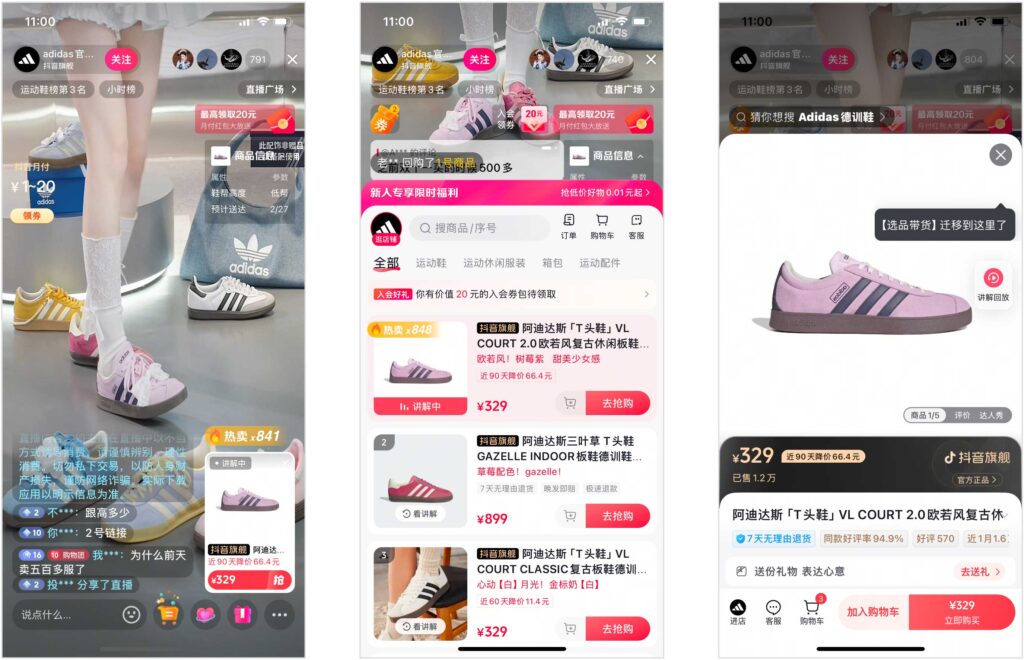

Tmall and Douyin (Chinese version of Tik Tok) stores are a must-have sales channel for any brand serious about reaching scale in China.

They are however quite expensive to launch :

- Live-streaming is required for success, with brands having to launch daily live-streaming activities to maintain visibility (especially on Douyin, where Live-stream will amount to more than 50% of sales)

- Influence is expensive, with a higher cost-per-view than on Red

- Tmall Partners & Douyin Partners are costly, with fees reaching $10,000 / month for established firms such as Baozun

In 2025, breaking-even relying solely on Tmall and Douyin is no easy feat either. Brands will often see a Tmall or Douyin launch as a stepping stone to a profitable multi-channel strategy combining online promotion and offline distribution.

Local distributors

- Risk: very high, not only financially but also in entrusting brand to a local partner

- Requirement: extremely stringent. Brands must have proven exceptionnal success internationally and in China to be picked up by a distributor.

- Cost: although distributors will stomach a lot of the launch costs, working with a distributor means committting a lot of inventory, human resources and marketing investment to succeed in China

- Advantages:

- Great potential in terms of sales

- Part of costs are carried by the distributor

- Disadvantages:

- Extremely hard to get a good distributor deal

- Loss of control over brand image/operations to the distributor

- Potential risk if conflict with distributor over time

A local distributor is one of the last steps of a brand’s deployment in China. It is however risky, costly and must be achieved through a step-by-step approach.

For instance our client PDPAOLA took 5 years between its first sales in China through WeChat and the launch of PDPAOLA’s Shanghai flagship store.

- 2020: launch of WeChat Mini-Program

- 2021: launch of Tmall Global Store

- 2024: partnership with local distributor and opening of first Shanghai flagship store

The launch in China through distributors should therefore be seen as one of the last steps of a long-term, brand development plan in the Chinese market.

Conclusion

Launching a brand in China in 2025 still carries great potential, but it isn’t as simple as it was back in 2005. The Chinese market is bigger than ever, but is now competitive, and customers are careful about their purchasing choices.

Want to learn more ? Contact us.