DT Caijing and Huabei, a personal line of credit product within Alipay app (450 million users), recently released the 2017 Chinese young consumers spending report. The report shows an increase of credit spending by the young Chinese consumers.

This line of credit product was released in April 2015, and grew to over 100 million register user within 2 years.

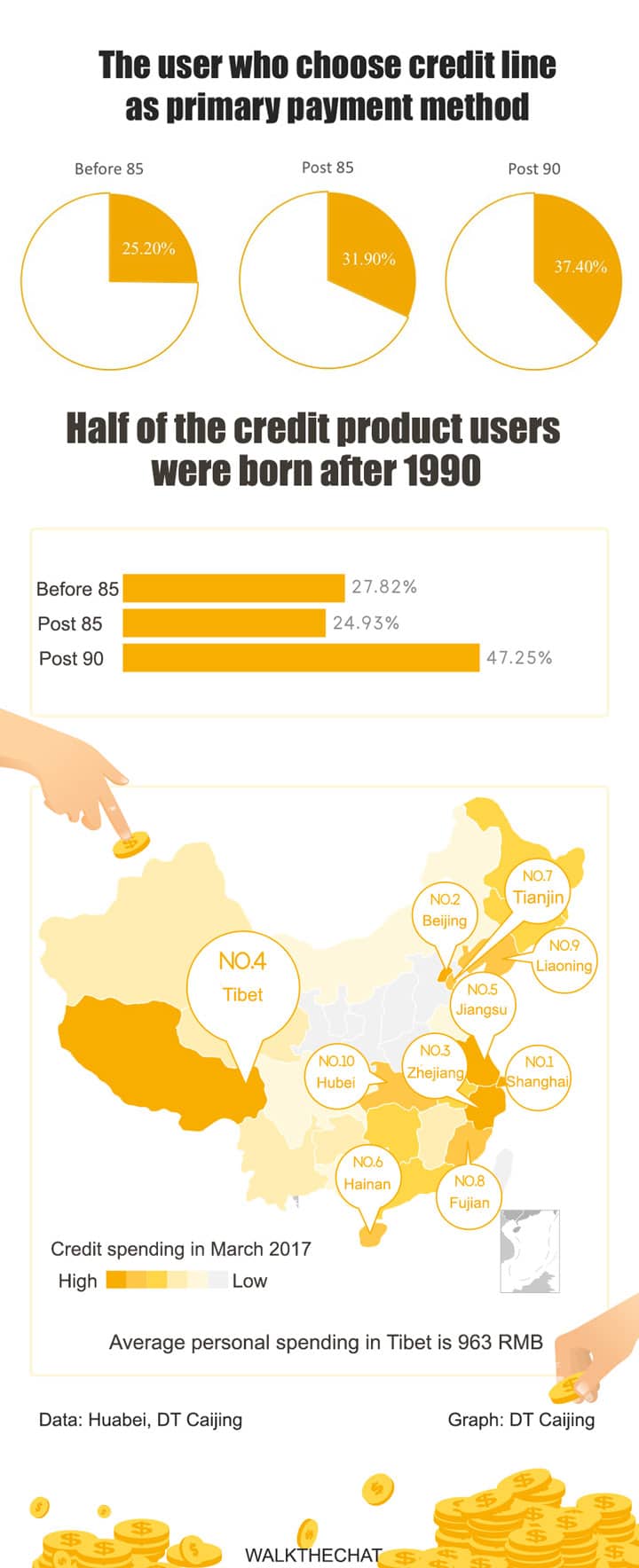

37.4% of 27 years old or younger users setup line of credit as the primary payment method. This rate goes done in the older age brackets.

More than half of personal credit line users are under 27 years old. The younger generation is more used to spending using credit. In contrast, the older generation is more likely to spend via their saving accountc.

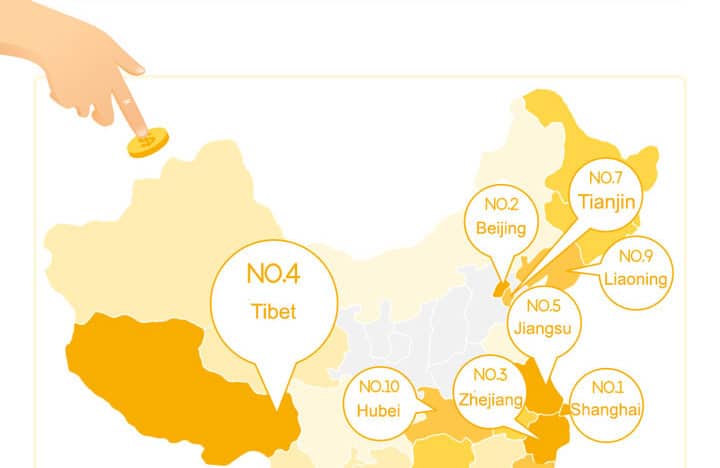

Shanghai, Beijing, and Zhejiang are the top 3 location ranking by average credit spending amount. The 4th region is Tibet with monthly credit spending of 963 RMB.

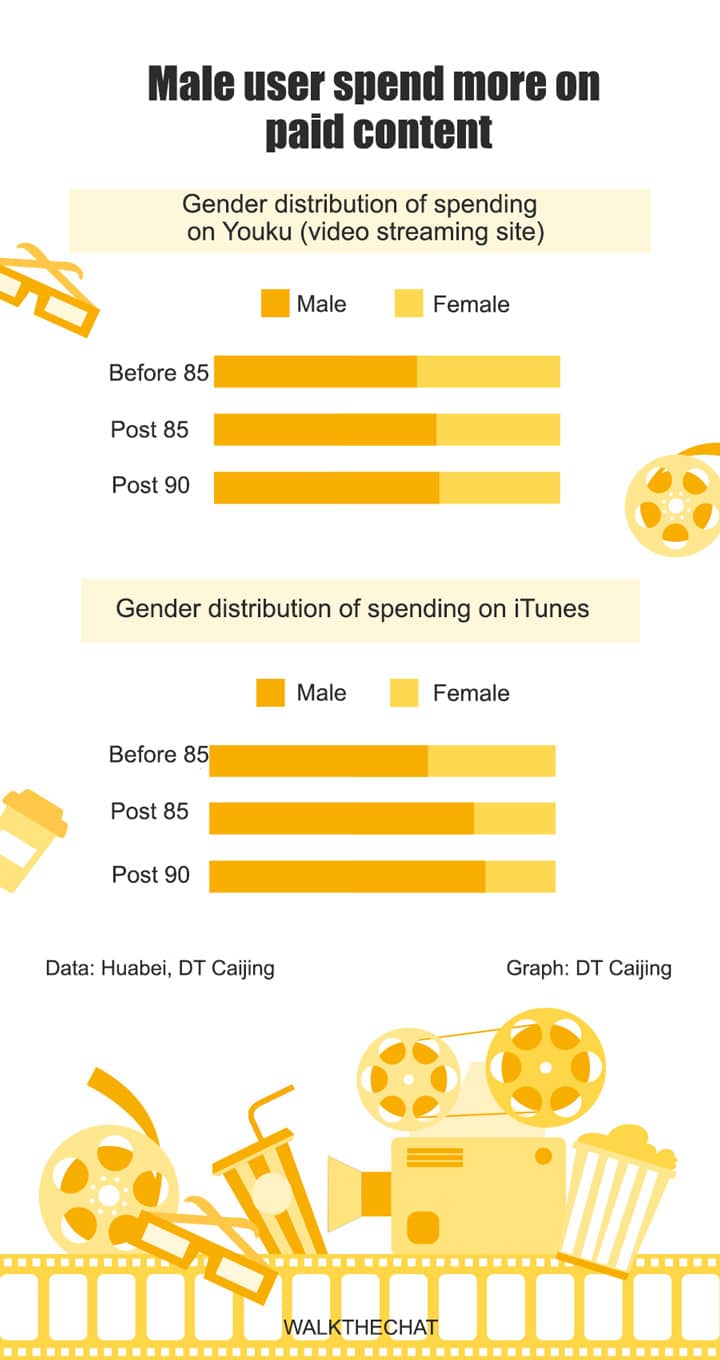

Male tend to spend more than female on digital content, such as video streaming and music/games.

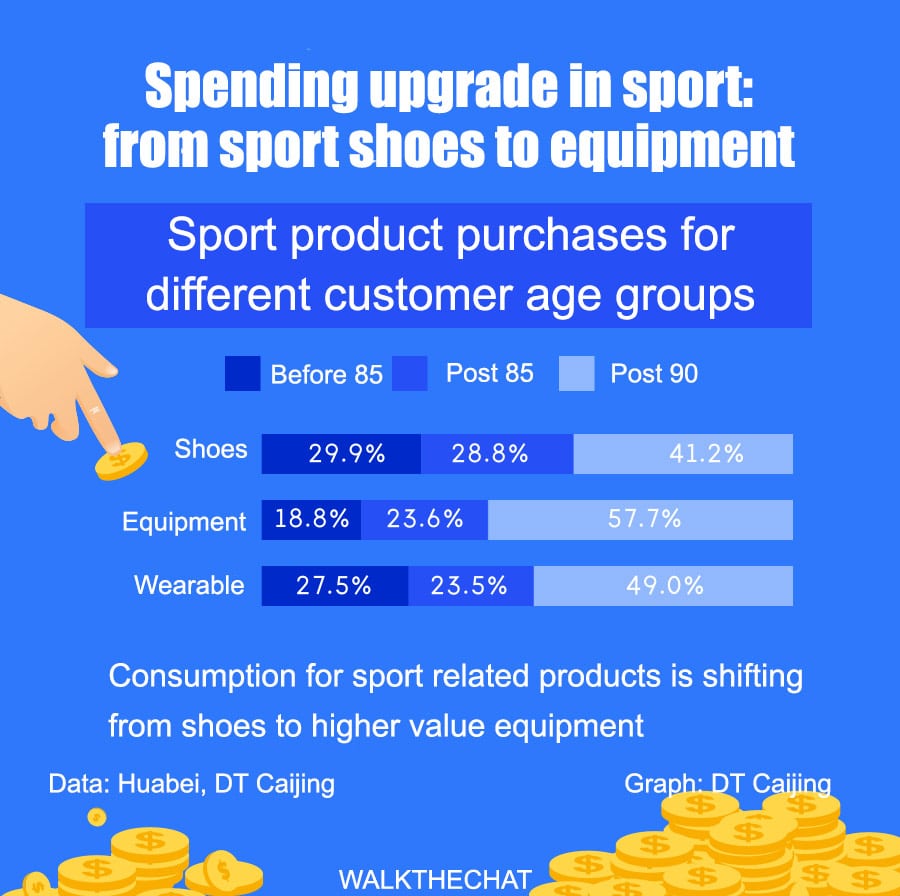

The report also indicates young consumers’s demand within sports equipment is upgrading from spending on sport shoes to spending on higher value equipments.

Conclusion

Why does this matter? There has been a growing concern that Chinese customers were keeping too much savings, and not spending enough to boost the economy and maintain China’s growth rate.

This data from Alipay is extremely encouraging: it suggests that younger users are much more willing to use credit in order to spend, which will in turn boost inner consumption.

And that is great news for the Chinese economy.

Definitions

Before 85- Users born before 1985, or older than 32 years old

Post 85 – Users born between 1985-1989, or 28-32 years old

Post 90 – Users born after 1990, or younger than 27 years old