China’s online video market seems to be dominated by 3 companies: Youku (owned by Alibaba), iQiyi (owned by Baidu) and QQ Video (owned by Tencent).

A third contender is however worth a look, from users and marketers alike: the hype and versatile platform Bilibili.

What is Bilibili?

The popular youth-oriented video streaming and sharing giant Bilibili is considered to be the platform most similar to Youtube. However, Bilibili’s defining features and unique community culture differentiate it from its western counterparts.

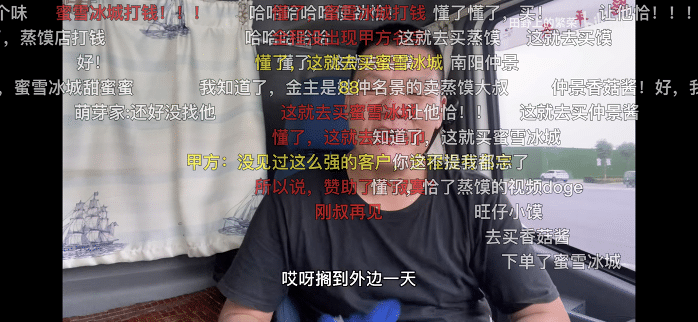

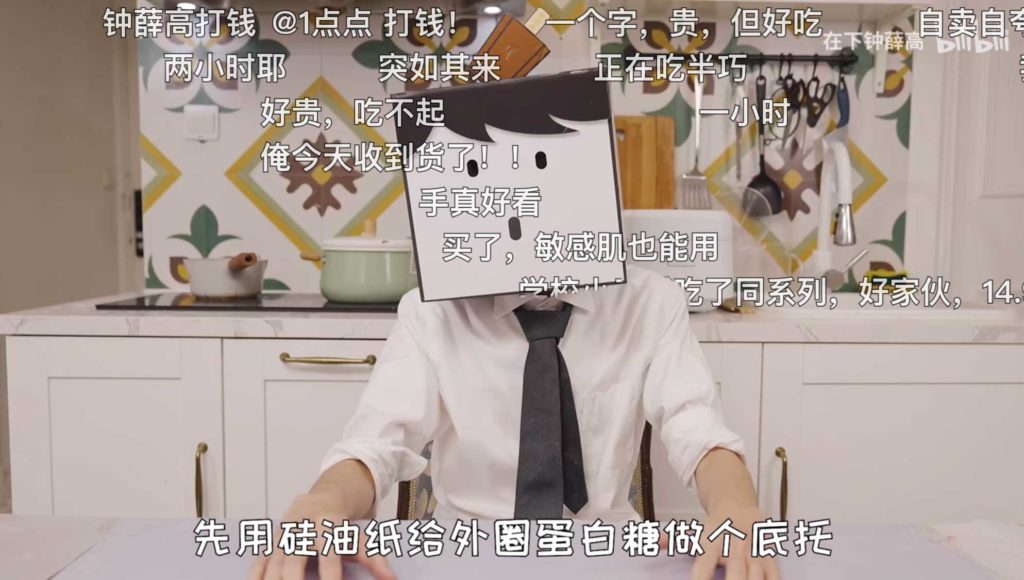

One such feature is “Danmu (弹幕)” or “bullet chat”: a form of video commentary used on online videos. Danmus are comments that appear directly on the video in real-time, sliding from right to left. In China, it was first adopted by Bilibili and AcFu. Nowadays it has become a common practice among mainstream video platforms such as iQiyi and Tencent Video. Danmus are beloved by Millennials and Gen-Zers. As the generation of the one-child policy grew up without siblings, young Chinese people enjoy watching videos with Danmus, which creates a stronger sense of sharing and belonging.

This community feeling helps the platform grow: in China, one out of every two young people is on Bilibili. Young people under 35 years old account for 86% of the platform’s 202 million Monthly Active Users. This audience, with its growing purchasing power, has been a key focus for brands in China.

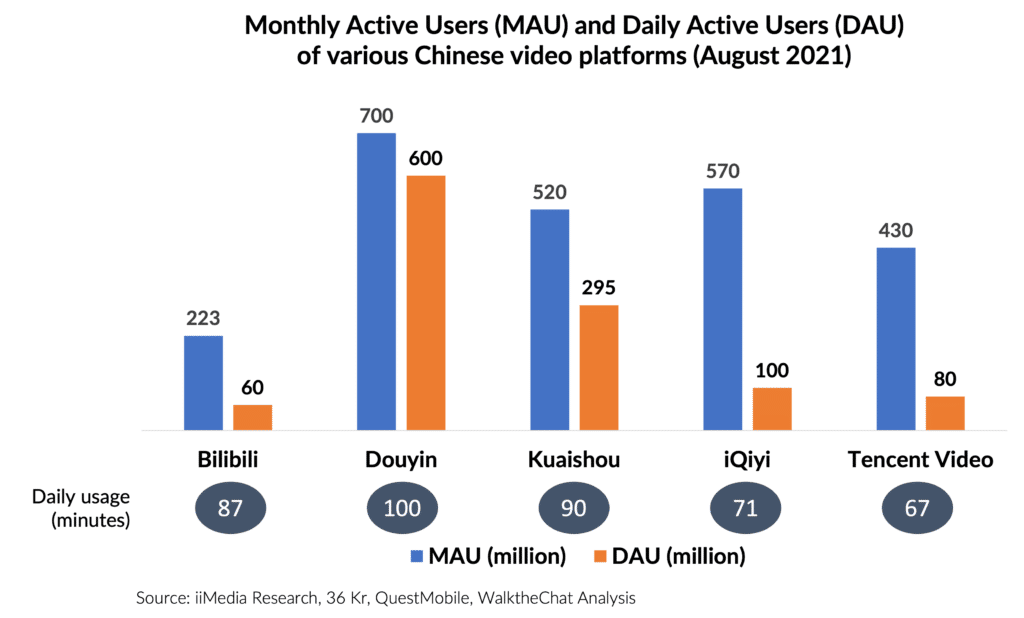

Engagement rates also benefit from this feeling of community: users spend more than 80 min per day on the platform, generating 4.7 billion interactions per month.

Since its creation in 2009, Bilibili has grown from a purely ACG (Anime, Comics, Game) content platform to a pan-entertainment online video community with contents ranging from fashion, lifestyle, technology to gastronomy, knowledge sharing, etc.

The company’s new slogan “All the videos you love are on Bilibili” illustrates this desire of the company to cover all aspects of users’ life. Thus, it has become a not-to-miss platform for brands who want to build a deeper connection with young Chinese audiences.

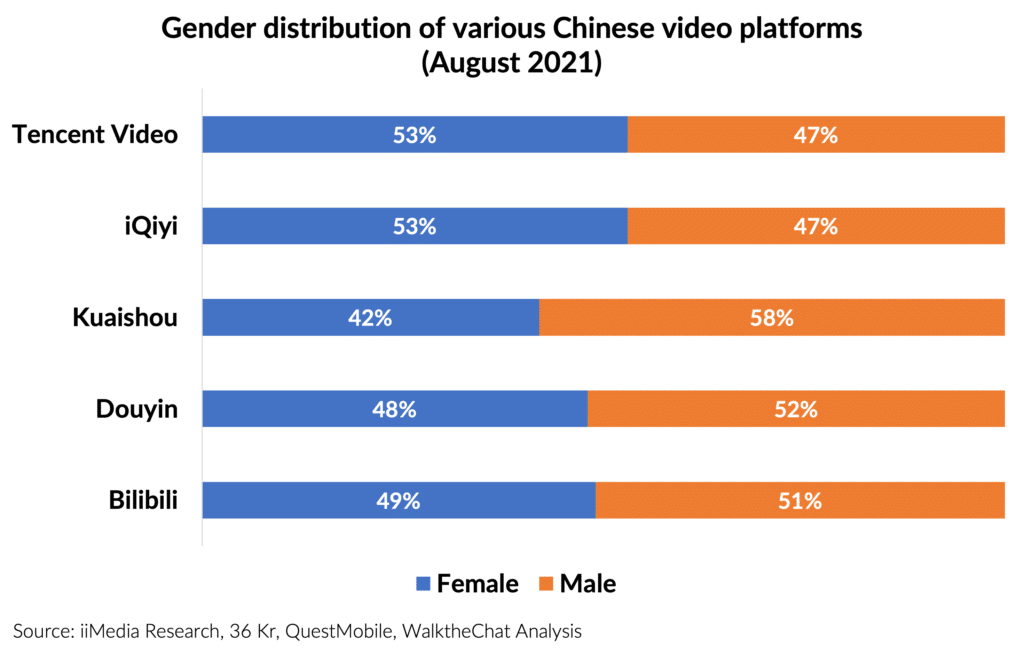

Bilibili also appeals to both male and female users, with an extremely balanced user base of 49% female and 51% male users.

How can brands promote themselves on Bilibili?

E-commerce integration

In order to facilitate the sales-driven collaboration between brands and KOLs, Bilibili published official KOL selection platform Huahuo (花火). Brands are able to measure eCommerce conversion driven by Bilibili KOL if they go through this official channel. There are mainly 2 ways to promote your product and measure performance on Bilibili:

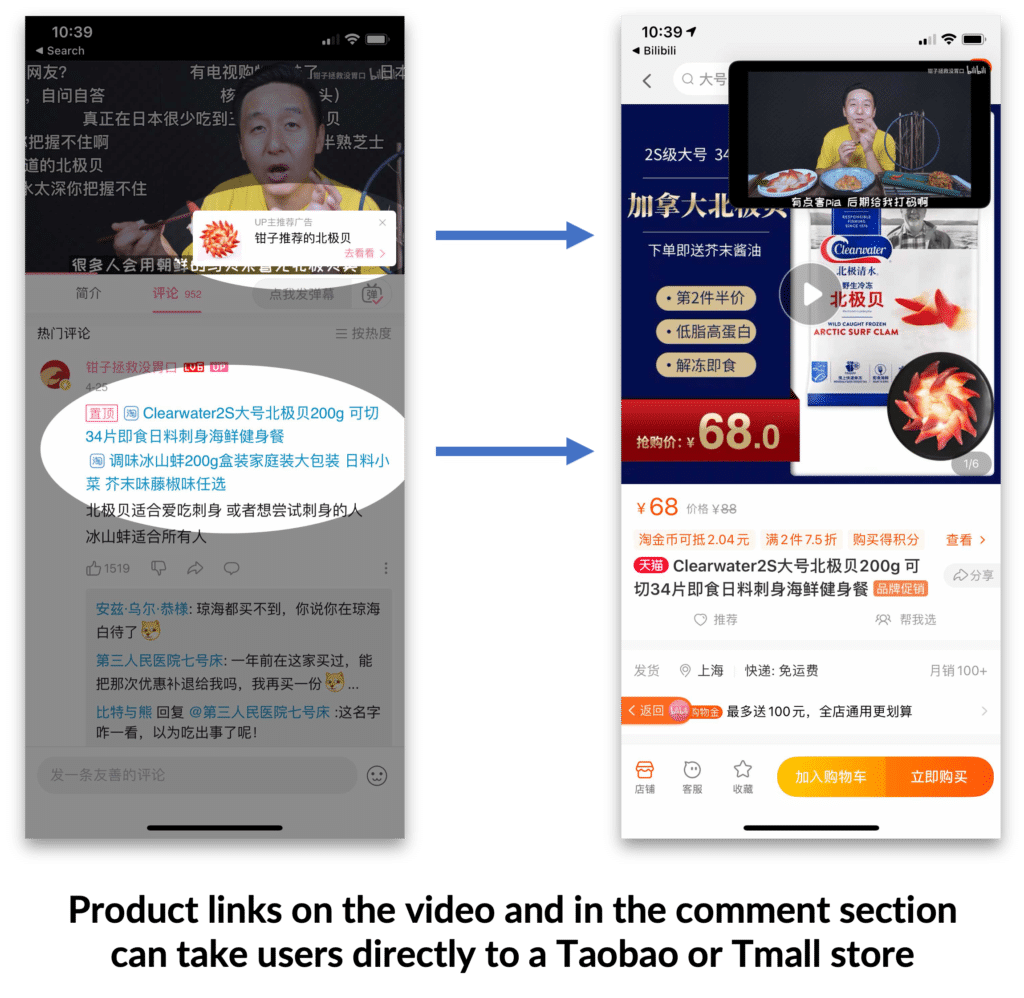

- Yaoyue (邀约), which means “invite” in mandarin. Brands can choose KOLs and confirm the collaboration through Bilibili official KOL platform Huahuo. KOLs can then insert eCommerce links below their video content, easily driving traffic to eCommerce store on Taobao or JD. Brands are able to measure the clicks and sales coming from each campaign. In order to garentee the collaboration quality, Bilibili also designed certain thresholds for KOLs to participate in this program:

- Xuanshang (悬赏), which means “reward”. You can understand it as a multi-brand eCommerce catalog on Bilibili. Brands can upload their products on “xuanshang” program, where Bilibili KOLs can voluntarily choose the products they want to promote and get a commission of 20%-50% (CPS). The product will be shown as a Dammu or icon during the video or live-streaming, or as a link below the video (see examples below). Xuanshang program is still a beta program, and is only open for KOLs with more than 10k fans in Bilibili.

Both Yaoyue and Xuanshang programs can insert product links of Taobao, Tmall, or JD.

Influencers have to meet the following requirements to be eligible for Yaoyue or Xuanshang:

- Completed real-name authentication

- > 18 years old

- ≥ 10.000 fans

- Has original videos released within 30 days

- Creation and influence score* ≥ 70 points (this score relates to the number of videos created and engagement rate over the past yeasr)

- Credit score* ≥ 90 points (this score relates to following Bilibili guidelines)

Although Bilibili is not a conversion-focused short video platform like Douyin or Kuaishou, it is still worth trying if the brand and product match the platform.

Compared to short video platforms and live streaming sales, one clear advantage of Bilibili is the longer time of content retention and long-tail effect. For brands or products that need time and effort to educate customers, the long video format and engaging environment on Bilibili will naturally give users more space to know the product and thus better influence users’ purchasing decisions. The video contents also help to bring continuous brand exposure and help increase the search traffic of eCommerce stores.

Brand accounts on Bilibili

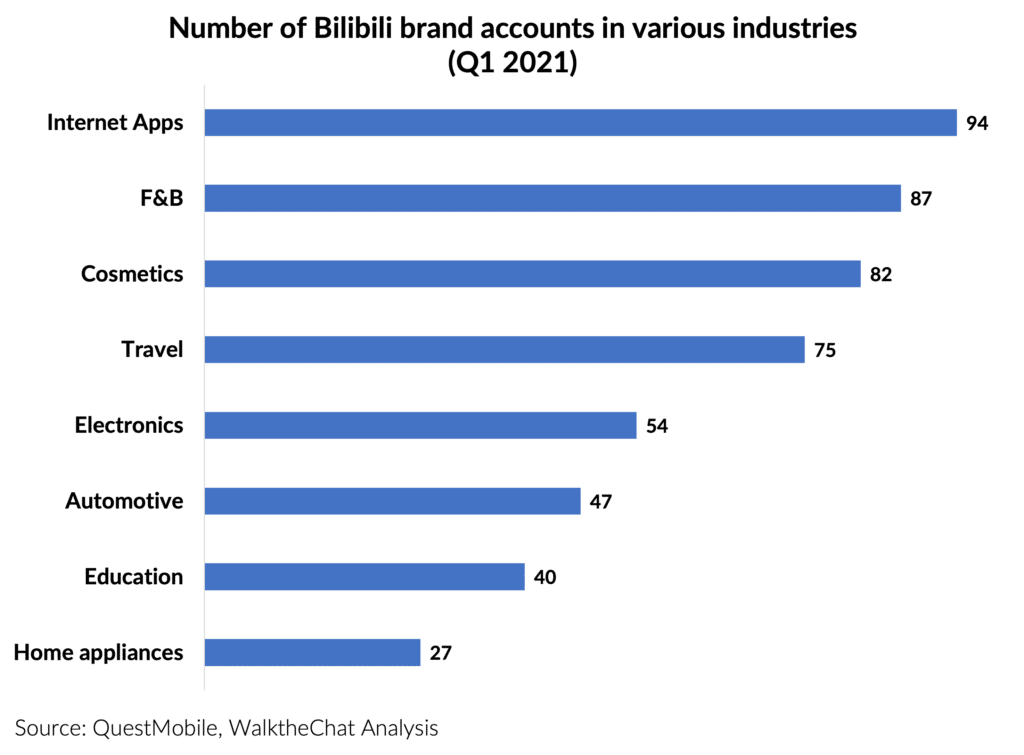

Bilibili is a KOL ecosystem, and few brands got a chance to be directly present on the platform. As of Q1 2021, only 504 brands had an official presence on Bilibili. The top verticals are: internet & Apps, food & beverage, beauty & skincare.

Opening a Bilibili account is not just copy-pasting your global communication materials on this platform. In order to better connect with Bilibili users, it is important to adapt your content strategy to the platform’s DNA.

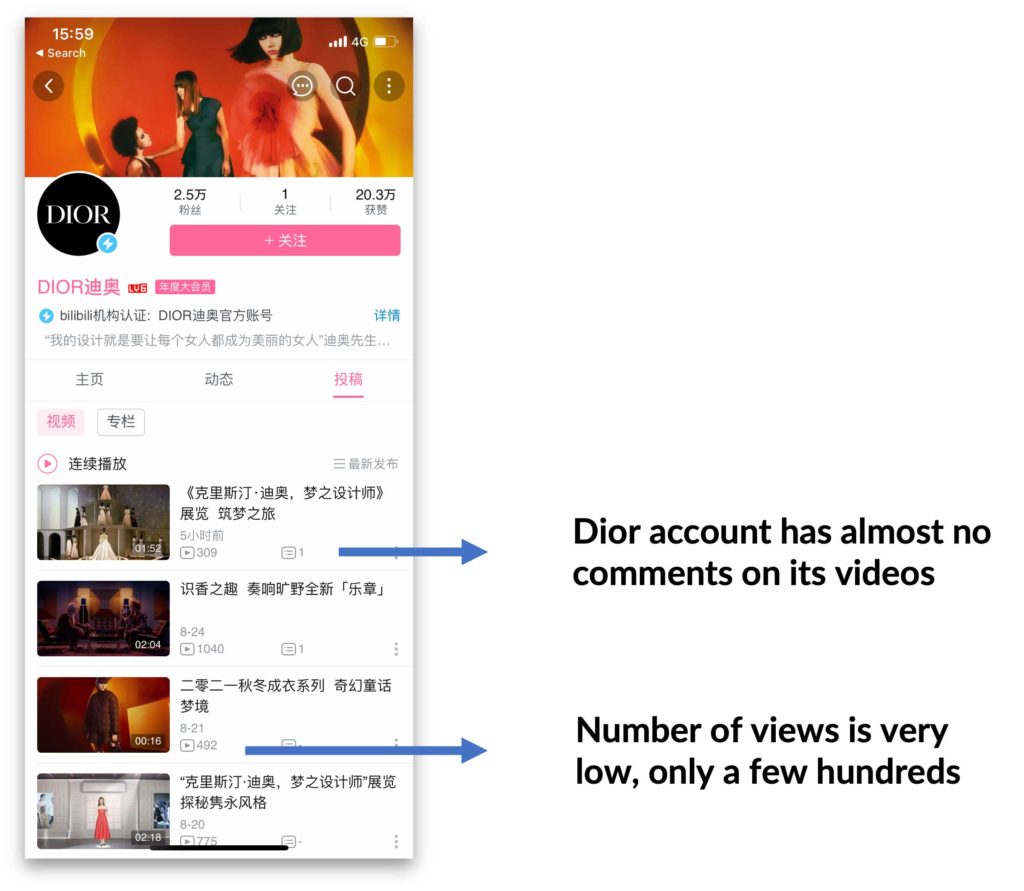

For example, Dior has been on Bilibili since June 2020. However, with standardized videos, each video receives only around 100-200 views and no 0 interactions (danmu or comments).

Another example is China Merchant Bank (CMB) official account. By using a trendy anime dance and adapted lyrics to remind users to guard against fraud, CMB received a great welcome from Bilibili users, achieving organic 6.6 million video views. As the 6th largest commercial bank in China, CMB broke the dull stereotype of banking and made efforts to adapt its content strategy for Bilibili’s young user base.

The best practice is to consider your brand as a Bilibili influencer with a character and personality. Bilibili users love brands that are “real” and fun. By building a branded “persona”, you can connect to Bilibili users as if you were making friends.

For example, as a new and innovative Food & Beverage brand, ice-cream brand Chicecream (钟薛高) created the Bilibili account “I am Chicecream” (“在下钟薛高”), whose life goal is to become a top foodie KOL. Leveraging creative content and easy-to-recall character, “I am Chicecream” already attracted 347k followers on Bilibili, and is generating hundreds of interactions videos, much better than the corporate Dior account!

Treat your audience as if you were a native Bilibili user, be close to them and interact with them using “Gen-Z language”, increase your customer stickiness through constant communication.

For example, despite being the Top 1 e-commerce giant in China, Tmall also makes a great effort to connect with their Gen-Z potential customers. Tmall created an account “我叫猫天天” (”I am Mall T T”). The account uses emoticons and Internet slang to reply to comments and dares to make fun of itself, like a native Gen-Z. This approach received a warm welcome from Bilibili users and brought the Tmall brand closer to them.

In summary, it is not easy for western brands to operate a successful and engaging Bilibili brand account. For premium or luxury brands, it is also complicated to capture the precise balance between premium brand image and local adaptation. Therefore, for brands who are hesitating, we recommend you to be present on other Chinese social media such as WeChat or Red, and start by collaborating with Bilibili KOLs to test if your brand and products are ideal for this very young and fun platform.

Collaboration with Bilibili influencers

There are 2 ways to collaborate with Bilibili KOLS: Interstitial ad and brand creative collab. Interstitial ad means that KOLs will simply mention, show and explain the product in their video. For example, makeup KOL “-谢安然-“ uses Little Ordine cosmetics in her makeup video while explaining the makeup process and product quality.

The other format is brand creative collab. KOL will customize an original video by leveraging his/her identity, skills and creativity, to create a video fully demonstrating the brand value. For example, craftsmanship KOL 雁鸿 / Aimee spent 2 month creating a handmade Miao (an ethnic minority in China) headwear to promote Florasis cosmetic collection Miao Impression. The video got 2.3 million views and many fans commented that they love and respect the hard work of the KOL and already bought the collection.

How to select the right Bilibili influencer?

The crucial KPI is average Video play / Followers, which will measure the engagement rate of the influencer.

The average Bilibili KOL gets 20% of their followers to view at least 1 minute of their videos, while top-performers have engagement rates above 50%.

Other important selection criteria include:

- Performance of the influencer on other networks (Red, WeChat)

- Repeat-collaboration with competitors (if other brands worked with the same influencer twice, they’re likely giving good returns)

- Engagement rate: likes, collect, tips given to the influencer, etc.

How much to pay for a Bilibili influencer campaign?

The cost of a Bilibili campaign in RMB is about 10% of the number of followers.

So a campaign with an influencer with 100k followers should cost you 10,000 RMB, or about 1,500 USD.

Of course, this number can vary depending on the influencer’s positioning, popularity, and engagement rate.

Bilibili advertising

Bilibili has various ad placements available depending on your campaign objective.

For branding, brands can use “Splash Screen Ads”, which usually appear when users first open the App. Such ads were used by brands such as Swaroski to promote themselves among a young Chinese audience.

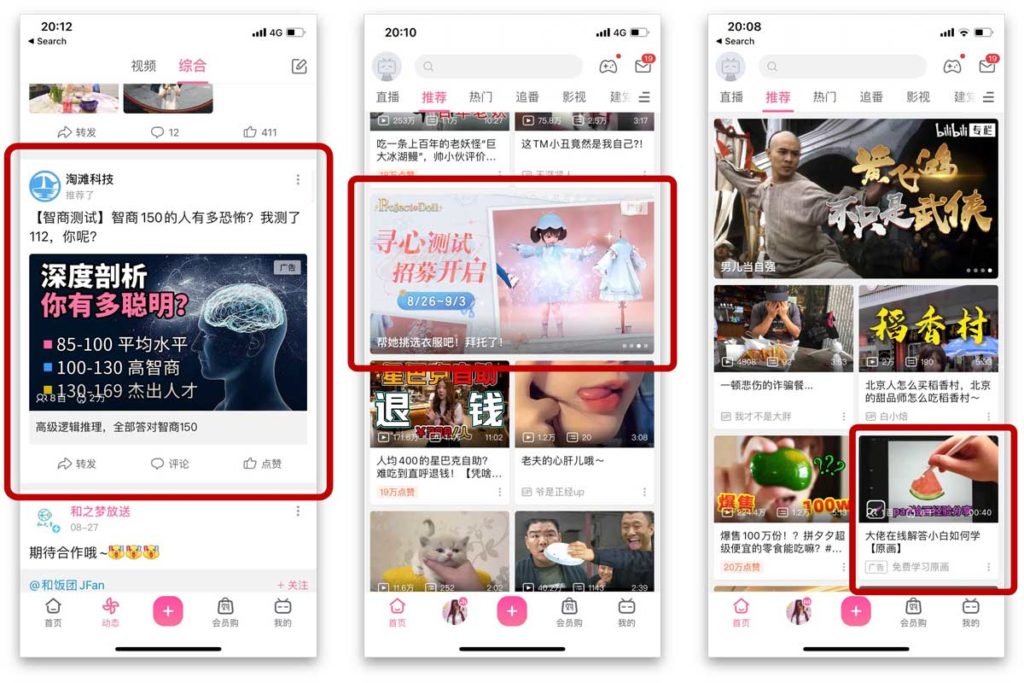

For performance, Bilibili offers Feed Ads which to encourage users to follow brand account, download an App or drive users to a landing page to generate leads. The creative can be an image or video, and it will be shown with an “ad” icon on the top right side of the asset being promoted.

This placement is usually used by advertisers in gaming (mobile game app download), education, and training (Japanese learning, video editing). For fashion, beauty, or retail advertisers, Feed Ads are usually part of a broader campaign marketing mix. Advertisers will combine KOL collab, Yaoyue Program with Feed Ads to guarantee the desired exposure.

Bilibili’s display advertising platform is called Qifei (起飞). It enables to show an existing video to more users on the platform, similar to “Sponsored content” amplification on Facebook. Different from Feed Ads, videos using Qifei will be shown with a “creative promotion” icon on the top-right.

When an influencer collaboration video is performing well in the first few days, brands can use Qifei to further boost the video so that it will reach not only the KOL’s followers but also a wider audience with similar interests.

Conclusion

Bilibili is an extremely trendy social platform in China, attracting a young and engaged user base.

It is however a difficult platform to tackle: even major brands such as Dior have failed to catch Bilibili users’ attention.

To get started, we recommend brands start by working with influencers and amplifying the content through advertising. If the feedback is positive, they can consider launching their own accounts. Such a brand account will however require a completely customized (fun and quirky) content strategy to be successful.