In this article, we will look into:

- What is WeChat Pay – for end users click here

- What is WeChat Pay – for companies click here

- How can foreigners apply for WeChat Pay (for individual) click here

- How can you change the bank card linked with WeChat Pay (for individual) click here

- How to apply for WeChat Pay (for Chinese companies) click here

- How to create WeChat cross-border payment account (for overseas companies) click here

- How to set-up WeChat cross-border payment for Magento, Shopify and WooCommerce click here

- 3 case studies of WeChat cross-border payment click here

- Long-term prospects for WeChat Pay

What is WeChat Pay?

WeChat pay is a payment solution completely integrated inside the social and messaging application of Tencent: WeChat. It appears in the “WeChat Wallet” section of the application.

Through the wallet section and the integrated browser of WeChat, users can perform a variety of transactions using WeChat Pay, including and not limited to:

- Transfer money to friends (especially as “red envelopes” shared during Chinese festivals)

- Perform transactions on e-commerce websites

- Top up their mobile

- Invest in wealth management funds

- Pay for water and electricity bills

- Order and pay for a cab

- Purchase a train or flight ticket

- Book a night in a hotel

- Purchase movie tickets

- And much more…

These transactions are meant to be a future money-maker for Tencent. It is good to keep in mind that Tencent is very different from its Western competitor Facebook: while Facebook makes 95% of its revenue from advertising, the figure was only 17% for Tencent in 2017.

Tencent actually makes most of its money through value-added services. And WeChat Pay will pay a central role in this service strategy.

How do foreigners create WeChat Pay account (for the individual)?

Living in China without WeChat Pay or Alipay is like living without cash or credit card. Survey shows only 10% of users prefer to pay via credit card or cash over WeChat Pay or Alipay. So how can foreigners open WeChat Pay account?

Requirement

- WeChat account

- Passport

- A Chinese bank card

- A phone that linked with your bank card

Steps 1: find the WeChat Wallet “Cards” section

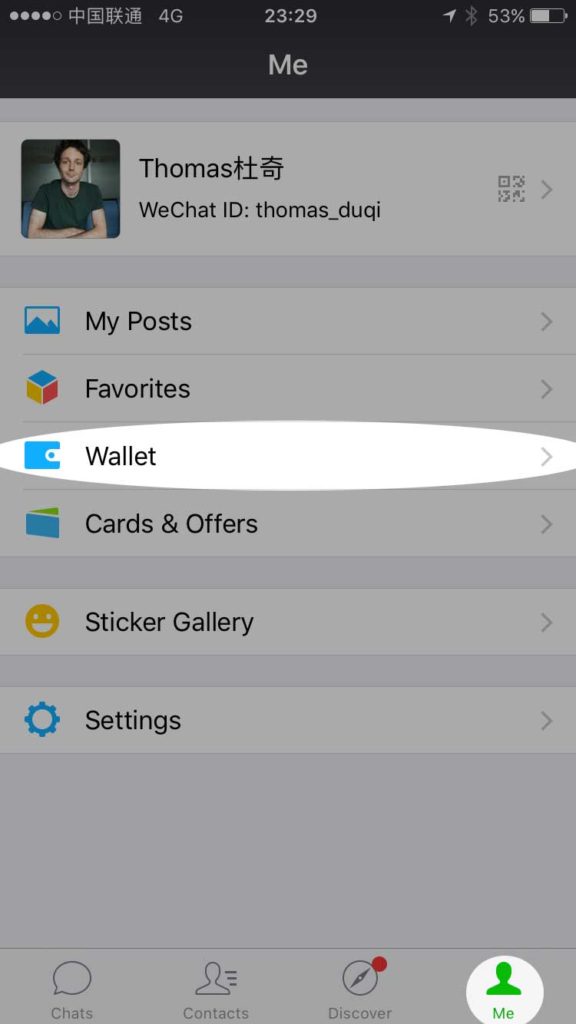

Go to your WeChat and click on Me/Wallet/Cards. This will take you to a section to add a Chinese bank card.

Note if you don’t see Wallet in your WeChat, it is because you downloaded the international version of WeChat. Here is a trick to see the WeChat Wallet on the international version of WeChat.

You can click on Setting/General/Language to change the WeChat language to Chinese.

This will activate your WeChat Wallet. You can then change your language back to English and WeChat Wallet should stay visible.

Step 2: Add a bank card

Now you can add a credit or debit card to link with your WeChat Wallet.

You will need a Chinese bank card.

*Important: make sure you use the exact name you use that matches with the name linked with your bank card. The name field is also case sensitive.

Step 3: done!

Now you have successfully linked your bank card with WeChat!

Now enjoy shopping 🙂

How do I change the bank that’s linked with the WeChat Wallet (for individuals)?

Some people might link a friend’s bank card with WeChat Wallet and later wants to change it, you may bump into a lot of error messages if the two bank cards have different names. Here is how you can change your bank card:

- You can get to Wallet/Card to delete the previous card

- In the add a card page, click on the green information sign to change your name

- Before you click on change names, make sure your WeChat Wallet has a balance of 0

- Make sure your WeChat Pay account is not linked with a third party company for automatic payment (such as Uber, Didi).

- If you see an error message and are not sure what it means, it could possibly be the WeChat mess up the English translation. In this case, you should switch the language back to Chinese and see what it says.

- Then you can proceed to the adding a bank card section (see the section above)

What is WeChat Pay for companies?

Personal WeChat payment is only used for peer-to-peer transactions. It cannot be connected with a company.

Company WeChat Pay account will settle the payment in a company’s bank account. The most common way you can use a company’s payment account is to connect it with your website, Apps or your WeChat shop.

Today, you can use the company’s WeChat Pay in the following 4 settings:

-

In-App web-based payment

This is the most common way to use WeChat payment. You can embed it into your WeChat shop. When users make a payment, they will just need to enter the 6-digit pin code or scan of a fingerprint. Below is an example of how users usually pay on a WeChat/mobile shop.

2. QR code payment

QR code payment is usually used when your customers are shopping on a desktop website. The QR code will be automatically generated by the WeChat payment system. Your customers just need to scan the QR code with WeChat or Alipay to make the payment.

3. In-App Payment

You can integrate WeChat Pay or Alipay on your Apps. Having this popular payment option available for your users will increase the conversion on your Apps.

4. Quick Pay

WeChat Quick Pay is the most common way to accept payment in a physical store. The WeChat payment solution can be connected with your POS system. This way you can scan the WeChat payment QR code of the use. It’s a much faster payment solution than cash or credit card. In this case, users don’t even need to enter the 6-digital pin code to approve the payment.

5. Mini-program payments

Mini-program Payments are triggered if users try to purchase items or services online via a WeChat Mini-program (an App built within the WeChat ecosystem). They are similar to WeChat Web-based payment, although they necessitate a specific technical integration.

How to apply for WeChat Payment (as a company)?

There are two main cases when it comes to applying for WeChat Payment:

- Local WeChat Payment: you already have a company registered in mainland China and can accept payments in RMB

- Cross-border WeChat Payment: Create a WeChat cross-border payment account that connects with your overseas bank account and can settle in your local currency (Chinese customers will still pay transactions in RMB)

If you don’t have a company registered anywhere, then you won’t be eligible.

Option 1: Create a WeChat payment account that connects with your Chinese company’s bank account

If you already have a company registered in mainland China, you will first have to register a local WeChat Official Account (Service account – 服务号). You can do so on the official WeChat Official account page:

In order to create and verify your account, you will need the following documents and information:

- Company registration number (企业注册号)

- A scanned of your business license, with company stamp (执照扫描盖章)

- Account operator name (must be a Chinese national with a WeChat Payment account)

- Account operator’s phone number:

- Account operator’s ID number and ID type

- Official Account name (can only contain Chinese characters, numbers, letters with no space)

- Official Account short description

- WeChat Official account ID (users can use this id to search for the account, the ID can’t contain spaces)

- Last three months of telephone bill of the account operator

- Front and back photocopy of the account operator’s photo ID

- Office landline phone number

- Company banking account

- Bank name

- Bank address

When you apply, make sure to pick Service Account (服务号) as the type of account.

Once your official account is scanned and verified, you will be able to apply to WeChat Payment using the menu on the left-hand side of the account.

You will then have to follow a process similar to the account creation process in order to get WeChat Payment enabled.

Tencent charges a commission of about 0.6% on transactions made through WeChat payment in China.

Option 2: WeChat cross-border payment account (connects to an overseas bank account)

For overseas business, you can setup WeChat cross-border payment account. This account will let your customers to pay in RMB using WeChat Pay, and the payment will be able to settle in your overseas bank account.

Supported currencies

Currently, WeChat cross-border payment solution supports the following currencies: USD, HKD, THB, JPY, KRW, AUD, NZD, SGD, EUR, GBP, CAD, RUB, DKK, SEK, CHF, NOK (updated on December 2019, Tencent will continue to add other currencies). If the currency of your country is not on this list, you can open a multi-currency bank account to accept payment.

How to apply for WeChat cross-border payment account?

You will have two options to create a WeChat Cross-border Payment account.

Option 1: setup via payment agent

You can apply through Tencent (parent company of WeChat) certified payment agencies and local financial institutions. These agencies will help you to transfer the payment overseas and settle in your home countries.

This is the most popular way to apply for payment as oversea businesses. Around 90% of our clients choose this method.

Pros:

- Faster to setup: usually, it takes 1-2 weeks to set up the payment account

- More flexible refund option: usually you will be able to refund the order made within the past month

- More payment options: most of the payment agencies also integrate with other payment solutions, such as Alipay, Union Pay, Visa, Mastercard and etc. They will be a one-stop solution for you to receive payment via all popular payment methods from Chinese customers

- Agency usually have lower settlement amount (usually between 0-$5,000)

- WalktheChat’s WeChat shop platform is integrated with most of the agencies’ API. It means you won’t need an IT team to integrate your shop with the agency’s payment API

Cons:

- Agencies will charge a small premium on top of the WeChat Pay rate. Although the rate of agencies gets is also much lower. So overall, the rate might even be cheaper in some countries.

What are the transaction rate agencies’ charges?

For Australian merchants, the rate is usually between 1.5-2%. For most countries, the rate is usually between 2-3%. You can write to info@walkthechat.com and ask to be introduced to one of the payment agencies for a better rate.

Which agency should I work with?

Depending on the country, you will have different agencies to choose from. Here is a list of certified agency dictionary.

Below is a list of agencies WalktheChat integrated.

- WeChat Pay US: NihaoPay, Citcon

- WeChat Pay Canada: OTT Pay

- WeChat Pay Australia: RoyalPay

- WeChat Pay New Zealand: LatiPay, ePayment

- WeChat Pay Singapore: FomoPay

- WeChat Pay Thailand: Ksher

- WeChat Pay Europe: Adyen (partially integrated with WeChat), Swift Pass

- WeChat Pay Hongkong: AllPay

- Other: some agencies will be able to set up accounts for companies in other countries.

Contact info@walkthechat.com if you need further advice on picking the right WeChat Payment partner.

Note: When you create a payment account via an agency, the payment will go through the agency’s account. Make sure the agency is Tencent certified. If you are not sure, you can contact WalktheChat (info@walkthechat.com) to understand your options.

Option 2: setup via payment directly with WeChat

Here are the pros and cons of setting up a direct WeChat Pay account:

Pros:

- You will be able to negotiate a better rate if your transaction volume is above $50,000 USD per month.

- The payment will settle directly from Tencent’s bank account to your company’s account

Cons:

- Only available for companies with large transactions

- The setup time is usually around 2-4 months.

- Refund feature is limited, you will only be able to refund the user if the incoming transaction on the day is above the refund amount

- The minimal settlement amount is 5,000 USD

How to apply?

You can handle your application for WeChat cross-border payment on TenPay’s website:

Click on the self-application menu.

There are several types of WeChat payment applications:

- App Payment is meant for Android / iOS APP wanting to include WeChat as a payment option

- WeChat Offline Payment is meant for brick-and-mortar stores wanting to add WeChat payment via QR codes

- Official Account Payment is used in order to embed WeChat payment within your mobile website (this is the most common use-case)

Note that the application requests your “Official Account APPID” which is a unique identifier for a WeChat Official Account. If you are unsure how to create an Official Account for your oversea business, feel free to reach out to us.

In terms of fees being charges, there are two main constraints set by Tencent:

- A 1-2% commission on all transactions

- $5,000 USD settlement amount (which means the money will be transferred to your bank account each time you reach $5,000 USD of sales

These are very similar to the terms from Alipay vs. WeChat Payment (cross-border payment). You can see a detailed comparison in the table below.

Cross-border payment and WeChat Mini-Programs

Cross-border payments are possible with WeChat Mini-programs. However, they can be limited to certain countries and currencies.

Each payment partner has different geographical and currency coverage. For more information, please write to info@walkthechat.com

How to set-up WeChat Cross-border Payment on other e-commerce platforms

-

Setting up WeChat cross-border payments on a Magento website

There are several APP’s on Magento Connect enabling you to set-up WeChat payment on your website:

- WeChat Payment Method

- WeChat Payment (高级微信支付)

- Wechat Payment / 微信支付

- WeChat Cross-border Online Payment

However, these extensions have a few drawbacks:

- Low popularity, most of them with 0 reviews

- Most of them integrate the native version of WeChat cross-border payments, which is difficult to apply for (about 3 months) and has some practical limitations (such as the inability to proceed with refunds after the day of the transaction)

There are local representatives of Tencent in various regions (Asia, Europe, U.S, Australia, New Zealand, etc.) who can help you set up accounts faster and with more advanced features. Reach out to us (info@walkthechat.com) for advice on finding the appropriate supplier in your case

-

Setting up WeChat cross-border payment with Shopify

It is unfortunately impossible to set-up WeChat cross-border payment directly with Shopify. Shopify limits the number of payment methods that can be used, and as of March 2017, Shopify isn’t on the list (although Alipay Global is).

The best solution, if you have a Shopify store, is to use a third-party WeChat shop solution with an ability to import your store to WeChat, and host your WeChat store on a separate sub-domain (you can do that with WalktheChat cross-border shop builder)

-

Setting up WeChat cross-border payment with WooCommerce

There is as of now no plug-in for the integration of WeChat Cross-border Payment into WooCommerce. There is however a plugin enabling a local implementation of WeChat Payment (requires a local Chinese company registered in mainland China)

For a cross-border implementation, feel free to reach out for advice.

-

Setting up WeChat cross-border payment for custom websites

Custom implementations are more complex as WeChat Cross-border Payment requires more effort as the WeChat payment API is complex and documentation exists only in Chinese (you can find it here)

WalktheChat provides an SDK to simplify the integration of WeChat cross-border payment. If you think that could be useful, reach out via info@walkthechat.com

How well is WeChat Pay doing?

WeChat Pay is doing, in a couple of words: pretty good.

The function has been popularized by Tencent masterful marketing coup: enabling Chinese users to exchange money via digital red envelopes, a tradition during the Chinese New Year festival. As a consequence of this strategy, as of today, the most popular use of WeChat Pay is still to send red envelopes and exchange money with friends.

Compared to its competitor Alipay, WeChat Pay is however more focused on smaller transaction amounts: only about 20% of WeChat Pay transactions exceed RMB 1,000

Most importantly, WeChat Pay is seeing an explosive growth: according to a report by the consulting agency McKinsey percentage of users having used the feature doubled between 2015 and Q1 2016.

The report also showed that the sources of traffic driving to e-commerce purchase via WeChat Pay were diverse: more or less evenly split between traffic coming from friends, from WeChat Public Accounts, from JingDong (Tencent has a 15% stake in JD) and from other applications.

Another key factor which influences adoption of WeChat Pay is the support from online merchants. Many WeChat Official Accounts (the equivalent of Facebook Pages for Wechat) started linking their “blogs” with WeChat stores in order to generate sales from e-commerce.

The current average of WeChat accounts being linked with a WeChat store (among top accounts is around 25%). Of course these statistics vary depending on the industry. Accounts in the childcare, beauty and travel industries tend to have a higher penetration of WeChat shops (around 30%) while accounts discussing relationship-related topics have a much smaller number of e-commerce implementations.

Because WeChat e-commerce is often related with endorsement from Key Opinion Leaders (due to the social nature of the application), these WeChat store are a heavy driver for the widespread adoption of WeChat Pay.

These WeChat shops are, for the most part, created using third party SaaS platforms (such as Weidian, Youzan or WalktheChat). Such platforms are local equivalents of Shopify which enable to easily set up a store and create a link between social and e-commerce.

The number of accounts having developed their own website is comparatively small, with only 24% of them having developed their own customized WeChat shop.

Why mobile payments like WeChat Pay and Alipay are a terrific market

First thing to understand is: payments are important. And “who will win the payment fight” might very well be a life-or-death question for Alibaba and Tencent.

To take a point of comparison: PayPal represents as of today about 44% of Ebay’s revenues. Moreover, this proportion keeps growing over time since 2002 (PayPal is now going to be taken out off eBay in 2015, but that’s another story)

The reason is simple: e-commerce markets fight for lower and lower margins. In such a commoditised market, payment is the one part of the business where margins get (less) compressed.

Compared with Alipay: Alipay’s revenues reached RMB 13.8 billion in 2013, accounting for 29% of Alibaba’s revenue. Moreover, Alipay’s margin was about 30%, higher than PayPal’s 24%.

The situation is therefore clear: payment is a major path for growth and there is still much room for expansion.

Conclusion:

Both for Tencent and for Alibaba, online payments will be a key source of revenue for the years to come. Online payments are however a market where monopolies tend to appear as users don’t like multiplying the number of services they use. For at least one of the players involved, getting online payments right might be a matter of life and death.