Douyin, the Chinese version of Tiktok, has become the 2nd biggest social media platform with 680 million Daily Active Users (DAU). We used to consider it as a platform to buy cheap products, but the game is changing.

In 2021, Douyin generated 800 billion CNY (~$112 billion) of GMV. Over the years, international luxury houses like Louis Vuitton, GUCCI, Dior, Chanel, Cartier, etc, have established their official presence on this No.1 short video platform. How to balance the entertaining vibe of the platform while maintaining an adequate positioning of your brand?

In today’s article, we will look at:

- Douyin eCommerce size

- Douyin TOP 500 best-seller analysis

- Distribution of products sold on Douyin by price range

- Best-selling product category by price range

- Summary

Note: All data comes from Newrank’s Xindou platform.

Douyin eCommerce Size

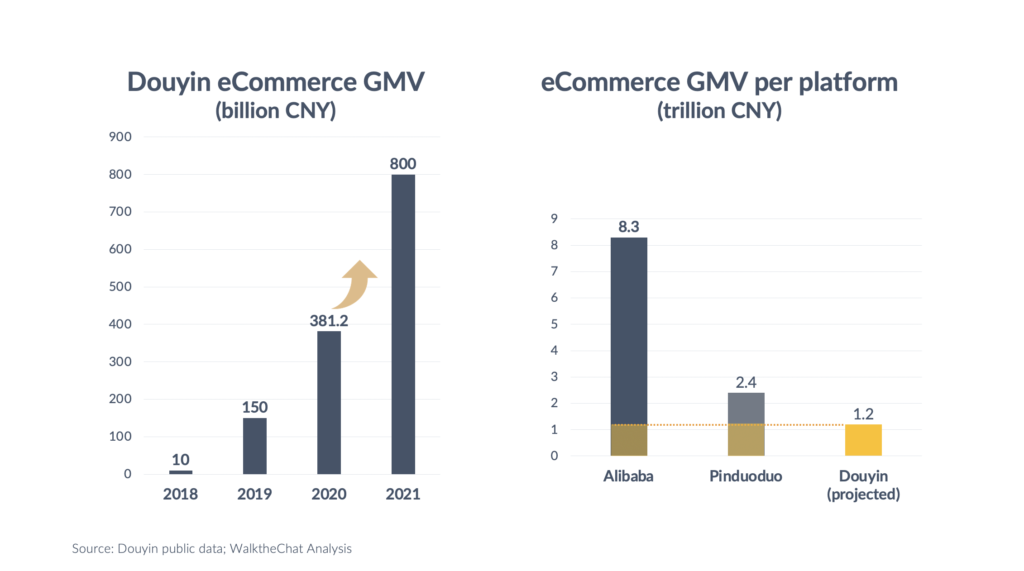

Douyin eCommerce has been growing at 430% per year and is projected to reach 1.2 trillion CNY in 2022. For comparison, Alibaba (Tmall and Taobao) GMV is 8.3 trillion CNY, and Pinduoduo is 2.4 trillion CNY. Douyin eCommerce will reach half the size of Pinduoduo with only 4 years of development. Considering the massive active users and eCommerce growth rate, Douyin is already a juggernaut in the Chinese eCommerce space.

Need help with your Douyin Strategy? Tell us your story, and we are ready to help.

Best-seller Analysis

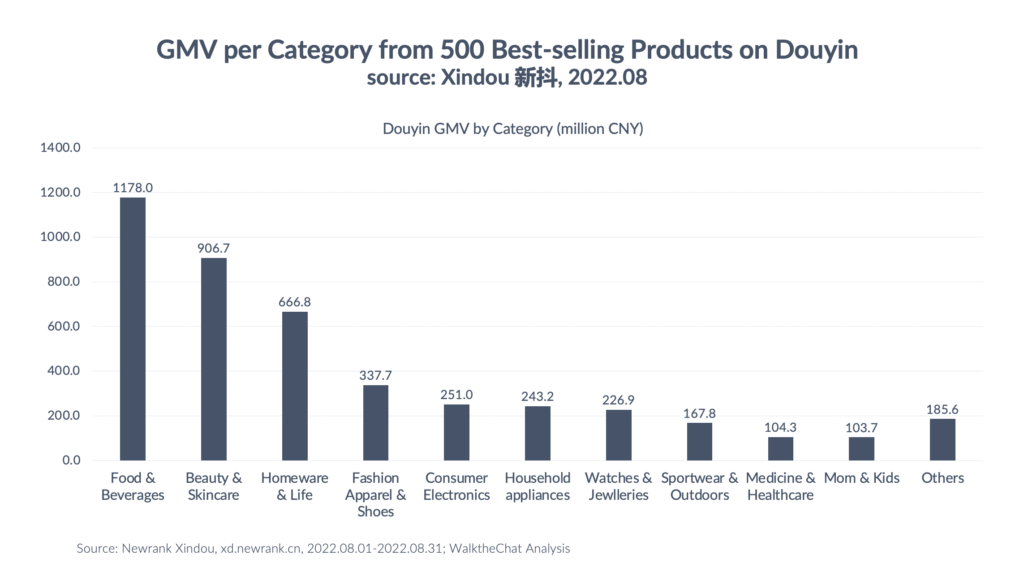

During August, the top 500 best-selling products generated a combined Gross Merchandizing Value (GMV) of 4,372 million RMB (~614 million USD). All these sales are generated directly on the Douyin platform, through Douyin Store.

F&B and beauty are the top-selling categories

Food & beverages and Beauty & skincare are still the TOP 2 best-selling categories on Douyin, contributing 48% of the total GMV combined.

There’s considerable growth in the Fashion category: 8% of the GMV comes from general fashion, shoes, and hats, making it the No.4 best-performing category. Two years ago, clothing comprised only 0.4% of the total GMV.

More diverse product categories

According to a similar analysis we did 2 years ago about the TOP 100 best-selling Douyin campaign, back then, almost 70% of the TOP 100 GMV came from the TOP 2 categories combined (Food & beverages and Beauty & skincare).

Over the years, Douyin has become a more “democratic” platform where you can find all kinds of products, not just F&B and beauty.

Average selling price per category

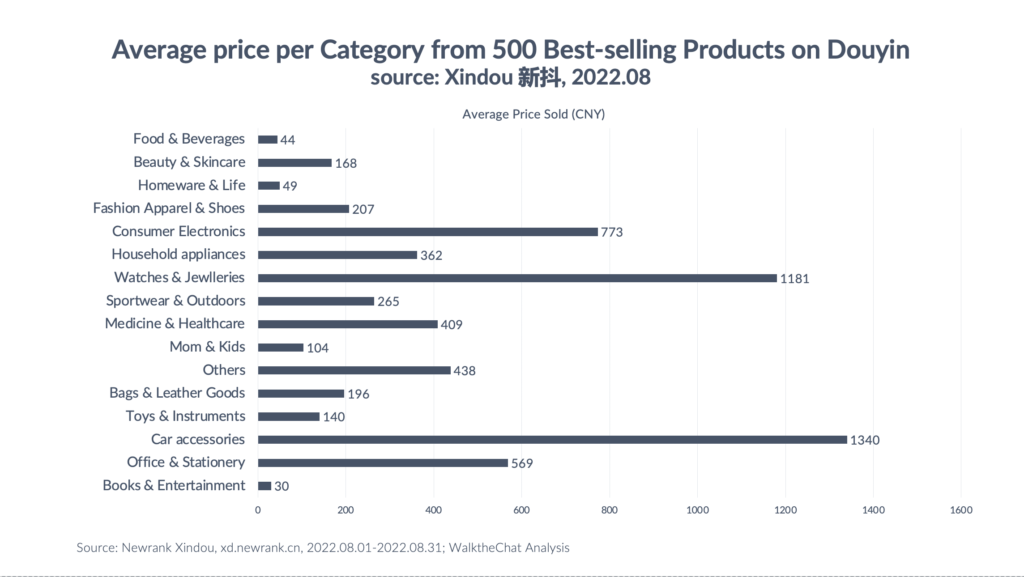

The average price in Beauty & Skincare is 168 CNY (~23.6 USD). Fashion and Bags are a bit higher, around 200 CNY (~28 USD). People still buy more affordable items on Douyin.

The average price in the sportswear & outdoors category is 265 CNY (~37 USD), higher than bags and leather goods (196 CNY, ~27 USD). Chinese consumers are increasingly willing to spend on sportswear in pursuit of a healthier lifestyle and work-life balance.

Douyin is not only for cheap products

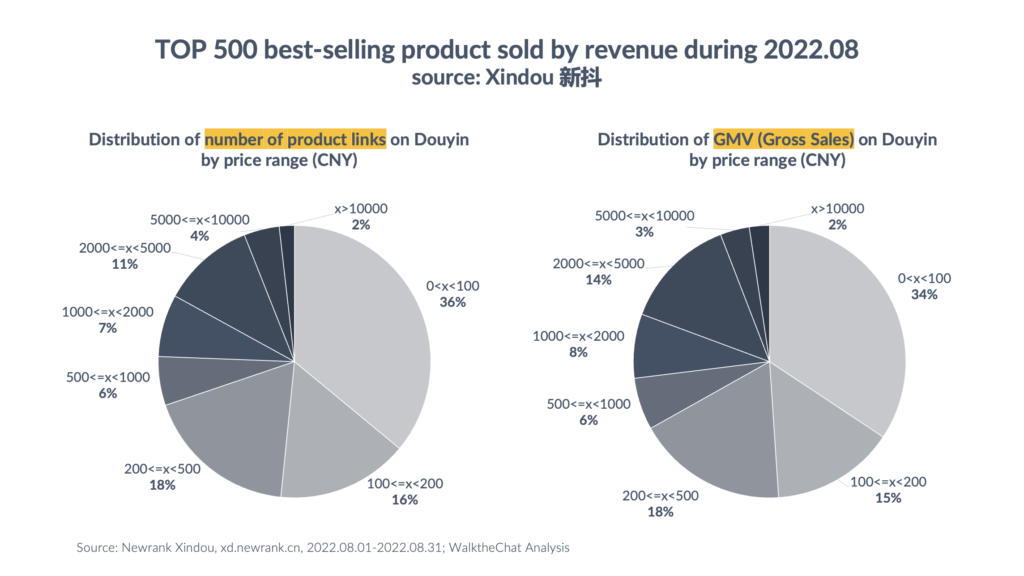

We studied the GMV from TOP 500 Douyin best sellers. In August 2022, 64% of the products sold cost more than 100 CNY (~14 USD), a significant increase from 19% in 2020.

27% of GMV of best-selling products come from products of above 1,000 CNY (~140 USD). Two years ago, this number was only 1%. Considering that young people who spend more than 1,000 CNY online are considered New Middle Class, that is a signficant amount to spend on one single social platform.

To give a comparison, Red users spend an average of 4,100 CNY per month. Although they don’t necessarily purchase on Red, they will more likely research on Red and purchase on Tmall or Taobao. Compared to Douyin, which has a rather even gender distribution, Red attracts more female users (70% active users) living in the higher tier (tier-1 and tier-2) cities with higher purchasing power.

As Douyin continues to attract bigger brands to sell directly In-App, Douyin eCommerce is getting more diversified, where you can buy either cheap or expensive products.

What kind of “expensive” products are people buying on Douyin?

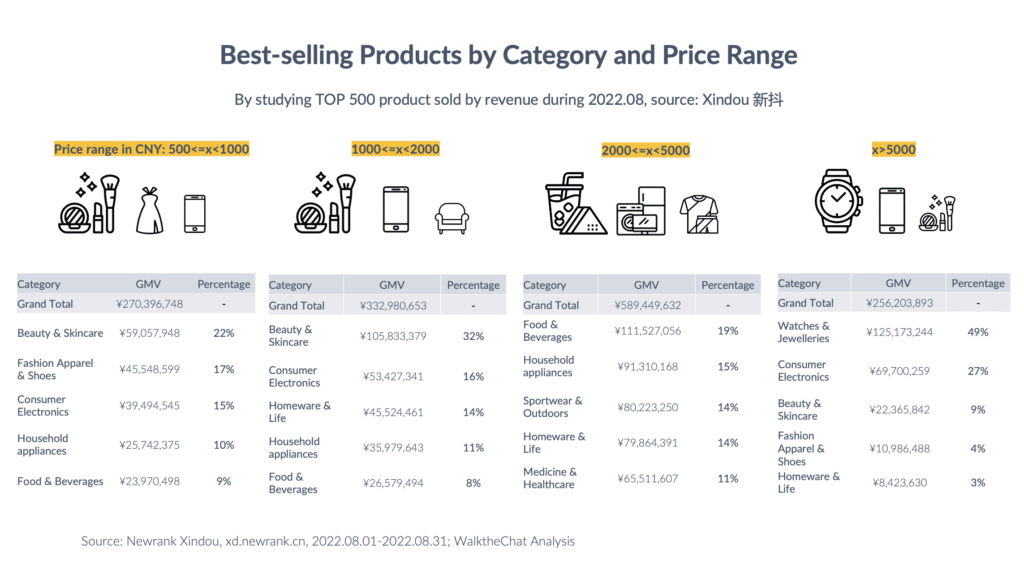

We analyzed the TOP 500 best-selling products by category and price range, and came to the following conclusions:

Beauty & Skincare

For products ranging from 500 to 2000 CNY (~70 – 280 USD), the beauty & skincare industry contributed the highest percentage of GMV, contributing 27% of the total GMV of this price range.

Douyin has been a strong platform for cheap cosmetics brands. However, beauty products with higher price ranges are also picking up. Among these higher price ranges, you will find many international names such as La Mer, Estée Lauder, SK-II, etc. Regarding premium beauty, Chinese customers will still likely go for big international brands, trusting their R&D and functionality. So premium beauty brands don’t need to exclude Douyin from your China eCommerce options.

Food & beverages

Food & beverages, as a rigid demand, appear to be selling in all price ranges.

It’s common to buy cheap snacks, instant food, milk, bread, etc on Douyin. Surprisingly, among high price products of 2000 to 5000 CNY (~280 – 702 USD), 19% of the GMV comes from food & beverages. This is because premium Chinese liquors like Maotai (~3,000 CNY each bottle) are also counted in this category, contributing to the most revenue here.

Regarding prices above 5000 CNY (~702 USD), almost half of the sales come from watches and jewelry.

Fashion apparel & shoes

The general fashion category contributes 17% of the GMV among products ranging from 500 to 1,000 CNY (around 70 – 140 USD), ranking as the No.2 top category. Although most of the sales come from Chinese fashion brands. “Guochao” (国潮, proudly made in China) has become a trend on social media, and Chinese brands can produce more native content around it and thus easier to resonate with the customers.

However, Chinese consumers are less likely to buy more expensive apparel brands on Douyin: the fashion category only represents less than 5% of the GMV with a price range above 1,000 CNY (~140 USD). Most of the sales come from functional clothing such as down coats.

For fashion brands with premium positioning, it’s better to set up a Tmall Flagship Store than try to sell directly on Douyin eCommerce.

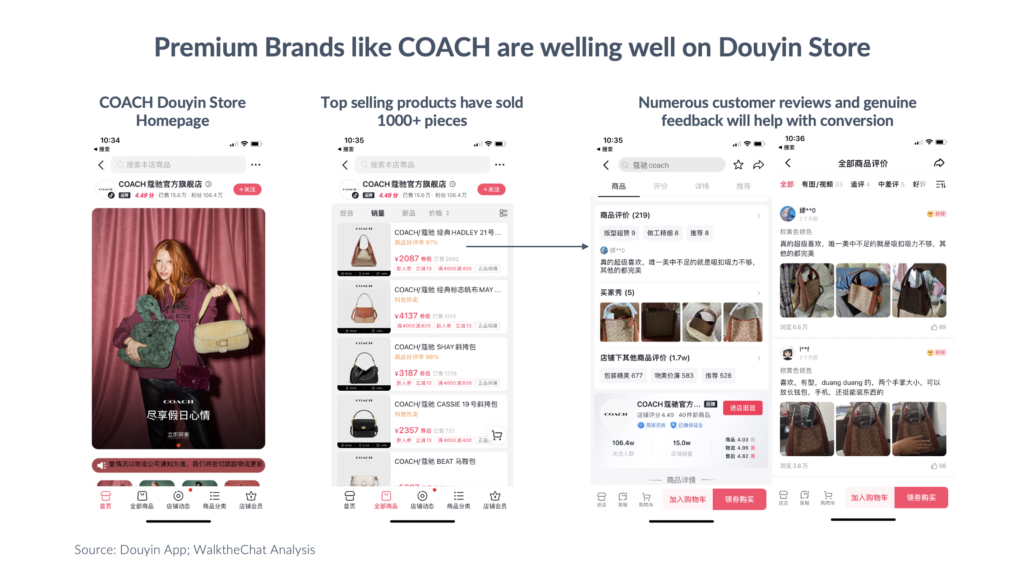

However, at a granular level, premium brands like COACH also sell well on Douyin.

Classical styles like COACH HADLEY sold 2000+ pieces on Douyin and accumulated 200+ real customer comments. On COACH’s Tmall Store, the same product has 1,000+ comments, five times more than Douyin Store. However, 200+ real comments can already give consumers enough information and confidence. It is striking that Douyin Store can already generate one-fifth of Tmall Store’s performance within only four years (Tmall launched in 2010, so 12 years till now).

Summary

Douyin is an interesting platform to look at, even for premium brands. Between Tmall and Douyin, Tmall can provide more established and experienced services, especially for the fashion or luxury category. If you already have a Tmall Store and are struggling to find new growth opportunities, it’s wise to consider Douyin because of the massive audience and rapid growth. It can be a perfect platform for exposure and sales if well-leveraged.