The Chinese internet service market has boomed during the last 2 years, especially with the rising popularity on O2O business model last year. A recent Tencent market research report shows that internet service model has just as much impact on the 2nd and 3rd tier cities as it does for the 1st tier cities (Beijing, Shanghai, Guangzhou and Shenzheng).

So which industry is the next gold mine of the Chinese tech industry in 2015?

Main highlights of Internet market in 2nd and 3rd tier cities

- 45% of people in 2nd and 3rd tier cities had ordered food online, which is the industry with biggest difference of penetration rate with the 1st tier cities, by 5 points.

- 30% of people in 2nd tier cities are in favour of online education, which is 25 points lower than the percentage in 1st tier cities.

- Average spending per person on online travel agent and websites is 70,000 RMB in 2nd tier cities, which is 20,000 RMB lower than 1st tier cities.

Following is some data citing from the Tencent research paper.

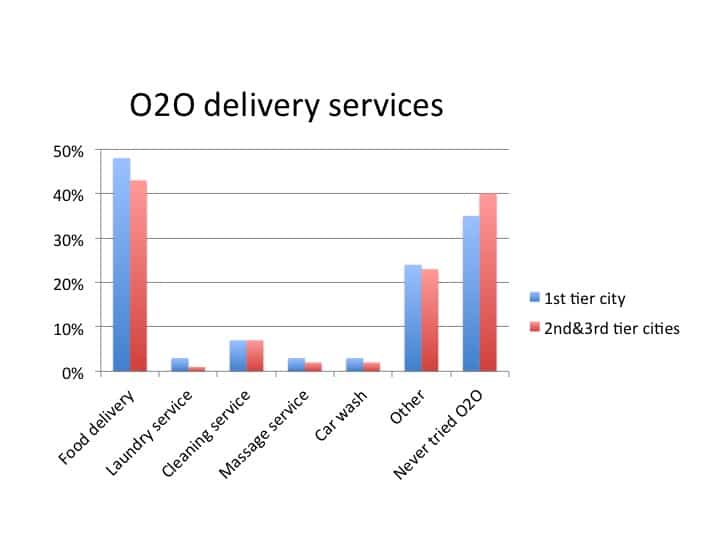

O2O services

Online food delivery industry has surpassed all other industries with over 40% penetration in 2nd and 3rd tier cities. Unlike the traditional approach where delivery service is another line of service to a restaurant, the new food delivery companies do not have a physical location and only focus on O2O model. Other service market like massage, cleaning and car wash are developing but only gaining less than 10% penetration.

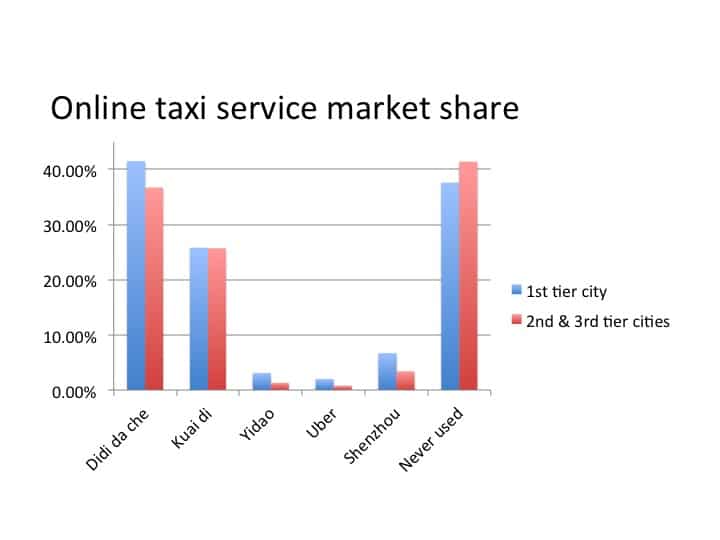

Car rental & taxi industry

Didi and Kuaidi own majority market share. The two companies merged during last valentine’s day and is now dominating the market in all tiers of cities. However, this research shows that most 2nd and 3rd tier users still have concern over the convenience, success booking rate, and payment safety.

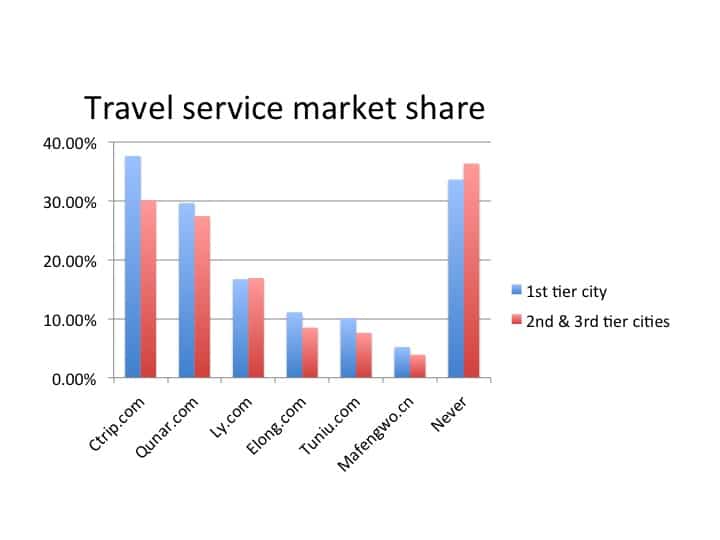

Travel

Compared with the car service industry, online travel services are more fragmented. Key players are Ctrip, Qunar and Ly but with some rapidly growing new competitors like Tuniu and Mafengwo. Overall hotels and flight ticket represent the widest usage of online travel services, higher use of traditional agency in 2nd and 3rd tier cities.

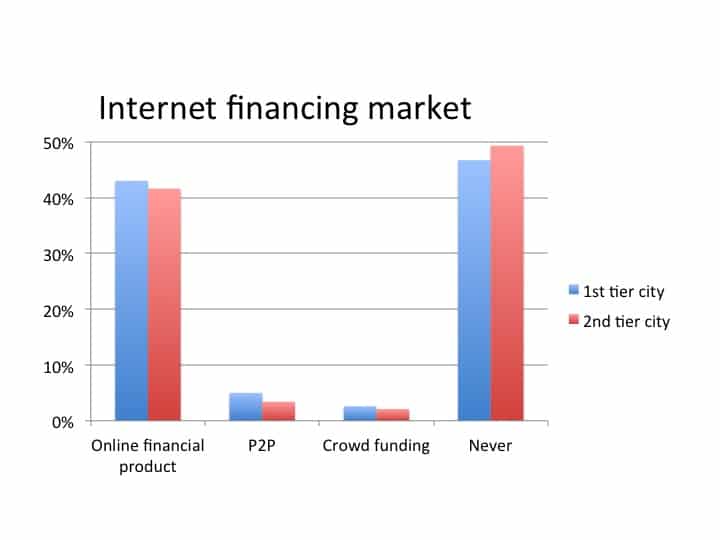

Internet Financing

Internet Financing

Most people focusing on lower value financial product, fewer people use more innovative financial product like P2P or crowd funding.

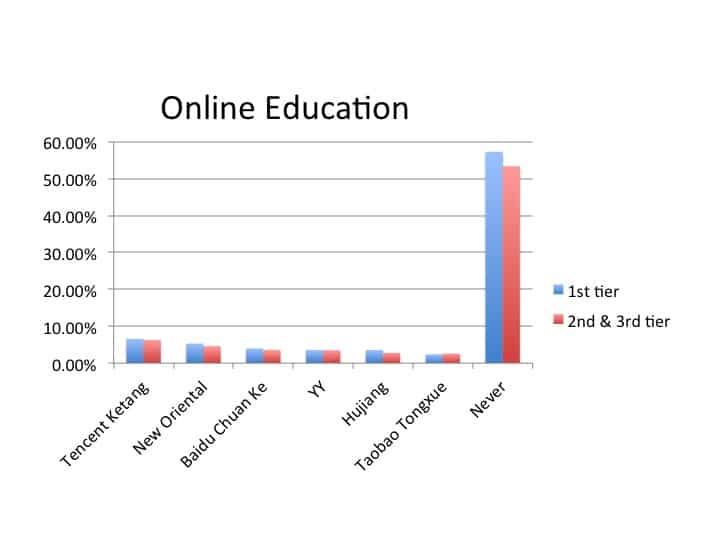

Education

Online education services are still in their very early stage. It’s a very fragmented market with a clear lack of industry leader. Second tier cities have better penetration rate of online education while having fewer offline resources. This disparity indicates a clear market opportunity for online education outside first tier cities.

Conclusion

Overall, the second tier cities online service penetration is lower than 1st tier cities, but the difference is less than 10 percent for most markets. However the number of competitors in each on-line service industry is much lower in 2nd and 3rd tier cities, sometimes with one APP taking most market share. These disparities still create tremendous opportunities in terms of market development in these cities.

Source

Tencent market report: http://tech.qq.com/original/archives/a072.html

*Over 43,000 people participated in the survey.

**Among which 86.7% between age of 16 to 45.