618, happening on June 18th, is the second biggest shopping festival in China after Single’s Day. First launched by JD.com, the festival has broken new records this year, amid the COVID-19 pandemic.

Record-breaking year for JD.com

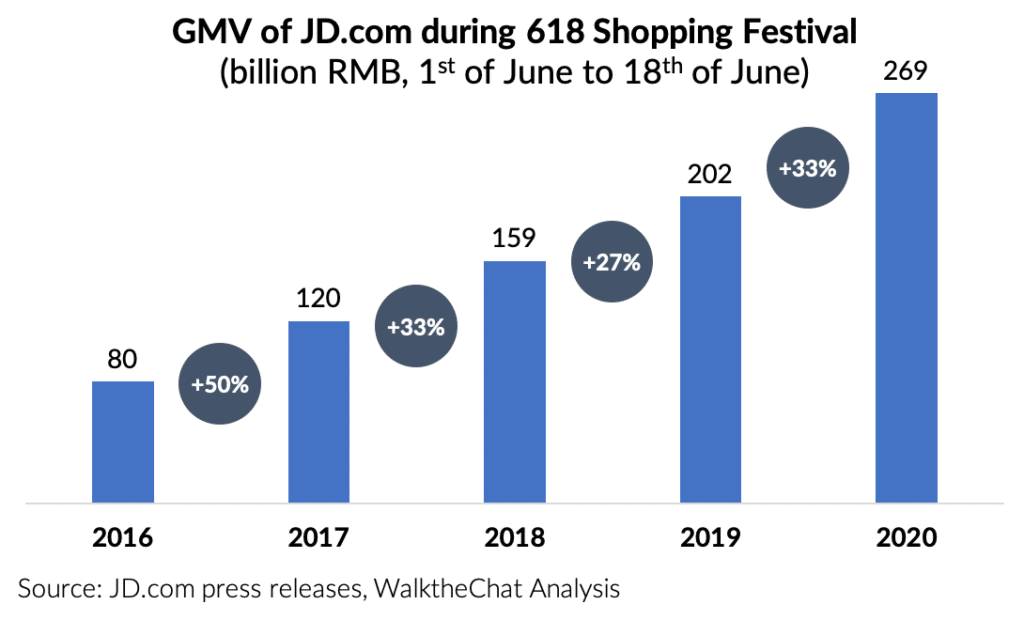

JD.com broke new records this year, with 269.2 billion RMB of orders during the shopping festival (from June 1st to June 18th). The total GMV (Gross Merchandise Volume) grew 33% YOY, an acceleration of growth compared to last year’s festival.

JD.com benefitted from its extensive delivery system, which helped JD.com gain prominence during the COVID-19 epidemic. The first 618 order was delivered in 8 minutes and 21 seconds.

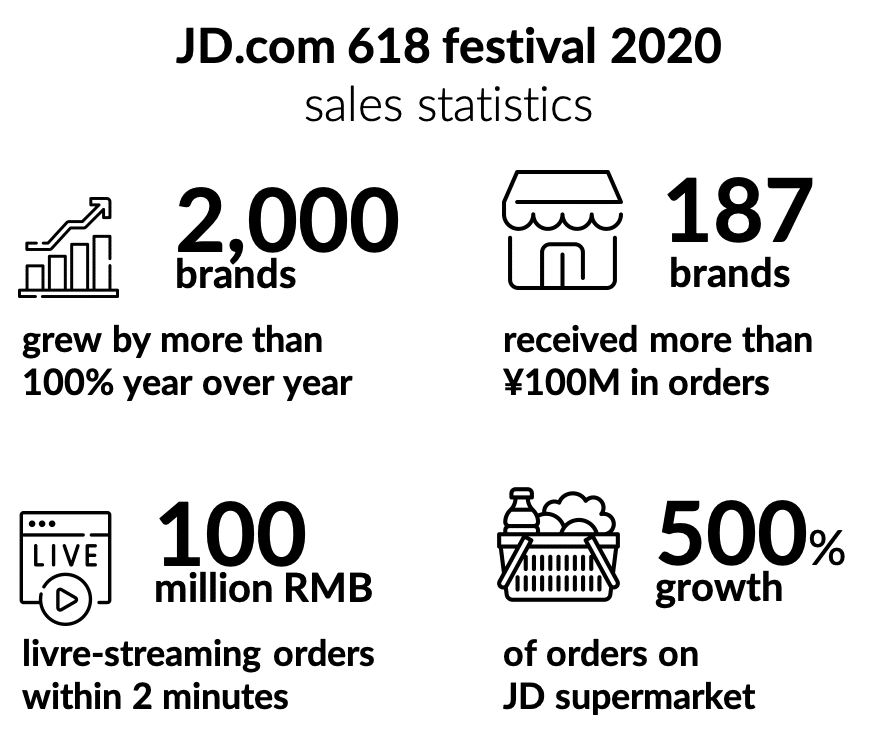

Some sectors, such as JD Supermarket, grew by 500% YOY, boosted by the growth in online groceries during the pandemic.

To achieve this record-breaking result, JD provided over 10 billion RMB subsidy in collaboration with merchants and Kuaishou.

Earlier in May, JD formed a strategic partnership with Kuaishou to drive traffic from short-video platforms. Users no longer need to leave Kuaishou to complete a JD purchase.

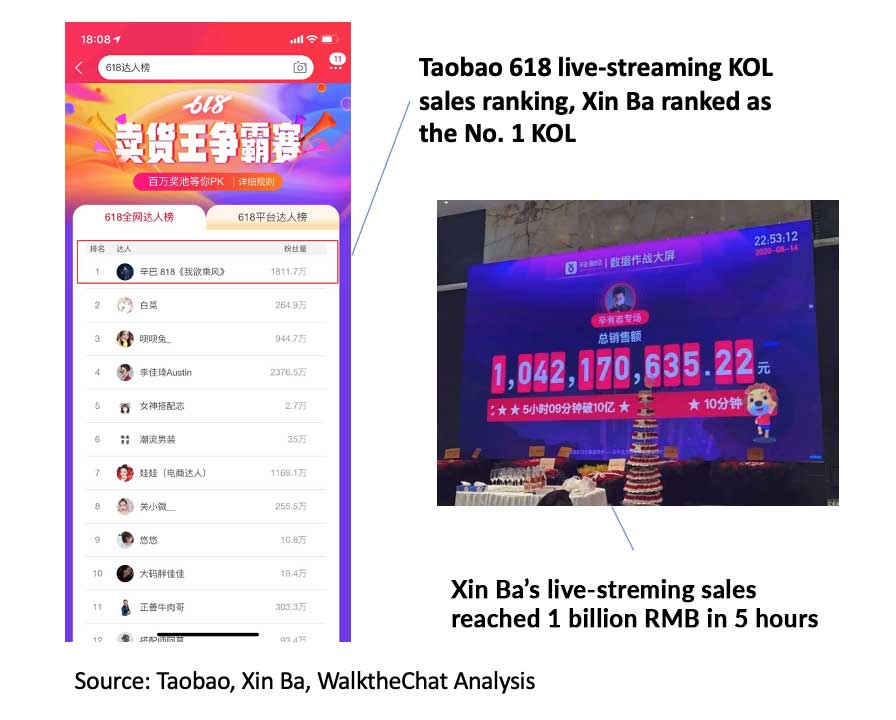

On June 14th, Kuaishou’s top live-streaming KOL Xin Youzhi sold 1.25 billion RMB products during a 10-hour live-streaming. The viewer amount reached 2 million during the peak.

On the same day, June 18th, JD.COM completed a secondary listing in the Hong Kong stock exchange. The stock price jumped 3.5%, following the positive 618 results.

These results show the resilience of the Chinese e-commerce sector, which maintained and accelerated its growth during this quarter.

Tmall performance

Tmall recorded 698.2 billion RMB of GMV during the festival period, more than twice the amount of JD.com.

This is the first year that Tmall reports it 618 GMV, which most likely reflects a significant increase in sales. The company reported that the GMV during the first hour of the festival increased by more than 100% YOY.

30,000 stores saw their sales at least double compared to 2019. 10,000 stores grew by more than 1000% YOY.

Tmall also worked with 300 celebrities to join live-streaming with brands during the 618 campaign. JD worked with 100 stars, competing for users’ attention. Celebrity traffic, along with huge discounts or gifts, are very effective to drive impulse purchases.

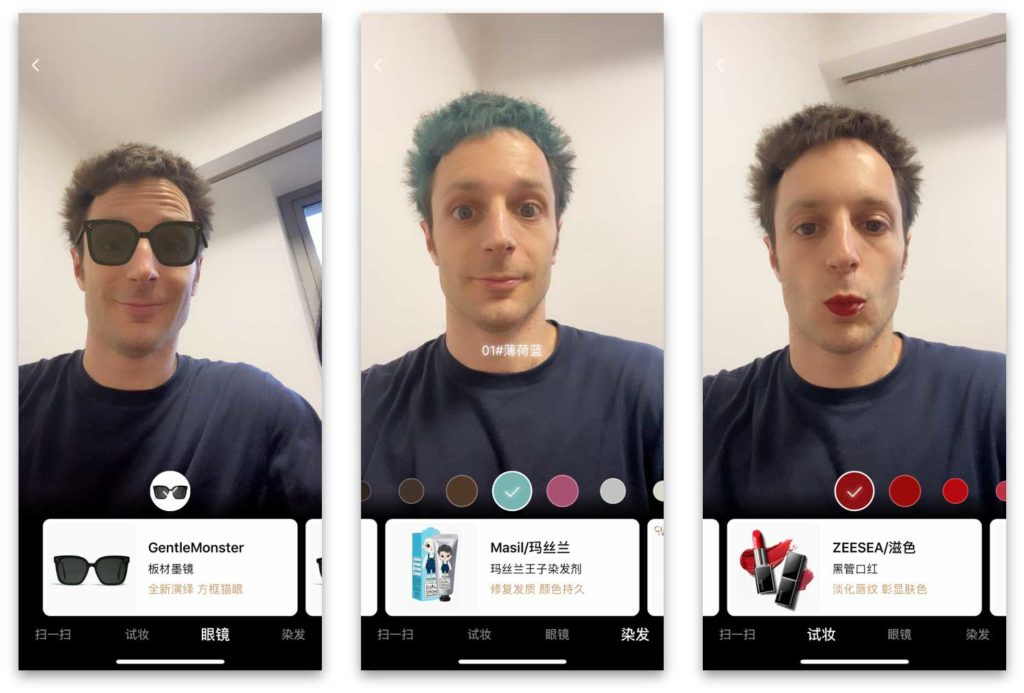

The sales were supported by the launch of many cutting-edge features, such as “AR try-on” enabling users to try makeup, glasses, or hair-dye before buying it.

Other now mainstream Tmall features such as live-streaming helped to boost sales even further.

Other platforms

Most other e-commerce platforms experienced significant growth during this 618 festival:

- Pinduoduo reported that their “Mother & Child” category sales boomed by 510% YOY.

- Suning reports that their omnichannel sales increased by 129% YOY, FMCG sales by 230% YOY.

E-commerce resilience

According to data from the Ministry of Commerce, from January to April this year, China’s total retail sales of consumer goods reached 10.68 trillion yuan, a year-on-year decrease of 16.2%.

However, it is worth noting that online retail sales have continued to grow. The online retail sales of physical goods nationwide were 2.56 trillion yuan, an increase of 8.6% year-on-year.

These 618 data are another data-point showing the resilience of the Chinese e-commerce sector. Amid a global pandemic, the growth of Chinese online sales is actually accelerating.

In 2022, JD and Shopify formed a strategic collaboration to help overseas merchants sell via cross-border eCommerce more easily. Check out this article if you are interested: