Douyin is pushing Douyin stores and starts to softly break ties with Taobao

Douyin recently started to block a Taobao order management system, Qianniu 千牛, from accessing its Douyin store e-commerce data.

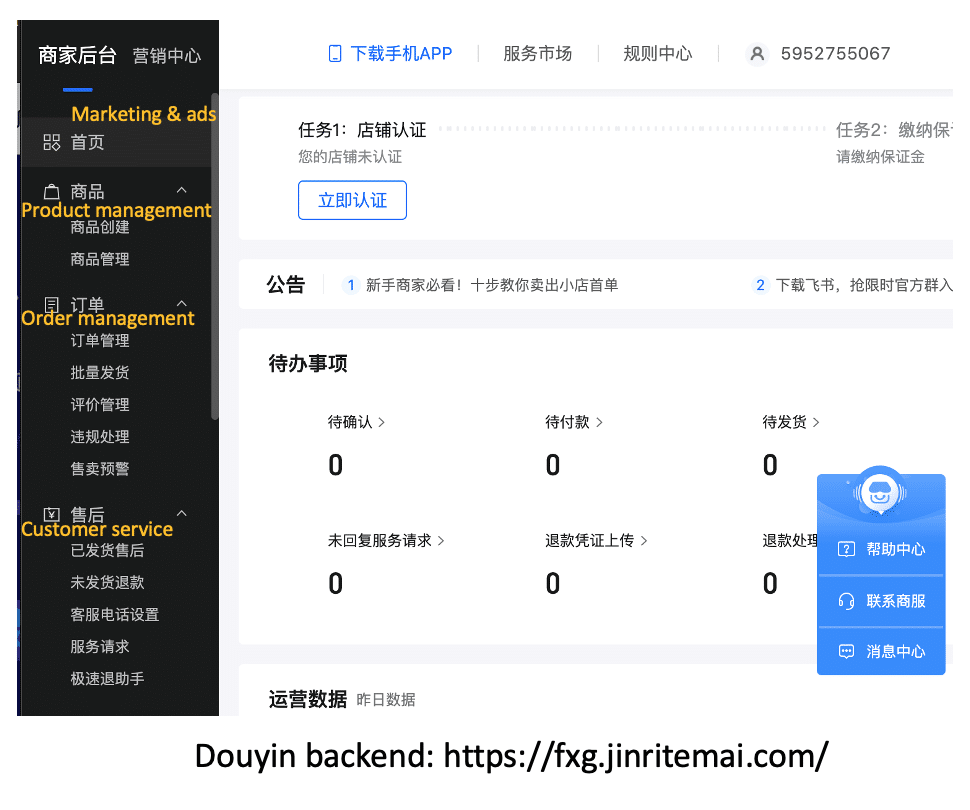

Douyin launched Doudian 抖店, an order management system, similar to Taobao’s Qianniu at the end of 2019. It’s a comprehensive e-commerce system for merchants to create products, manage orders, logistics, customer service, data management, follower status, and ads. Douyin store data used to be available via Taobao’s Qianniu platform but can now only be accessed via Doudian.

This marks the start of a Douyin e-commerce war against Taobao. Although Alimama, Taobao’s affiliate platform, is not affected. Before this, Douyin had already taken small steps that revealed its e-commerce ambitions.

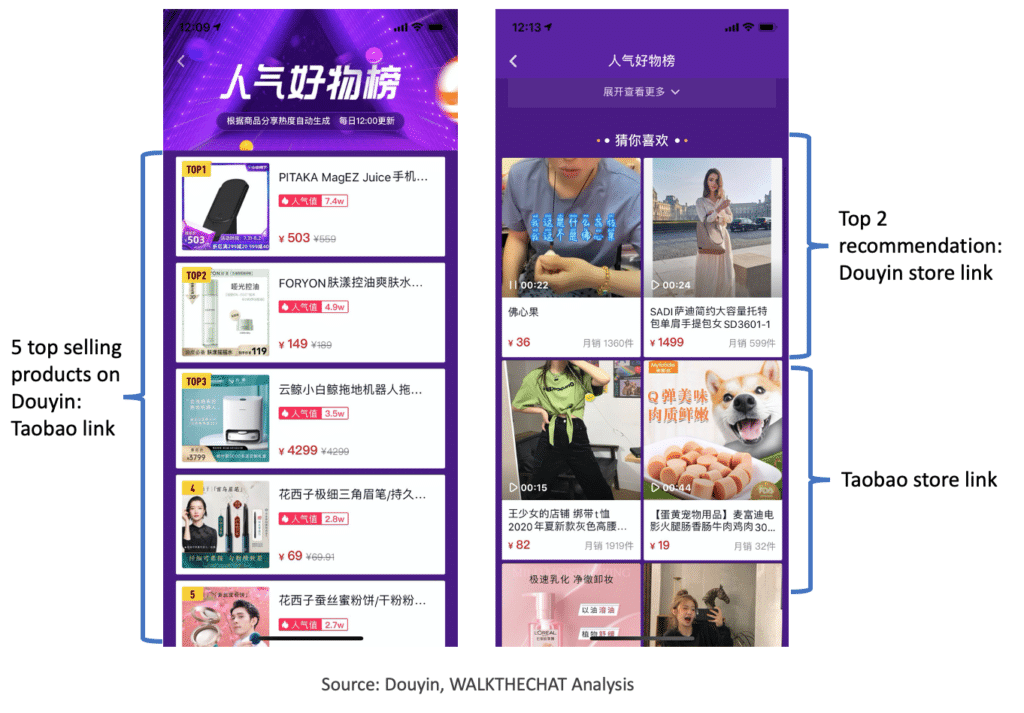

The top 5 best selling products on Douyin are all product links to Taobao. But Douyin is tweaking its algorithm in favor of Douyin stores. The top 2 recommended products for individual users are both from Douyin stores.

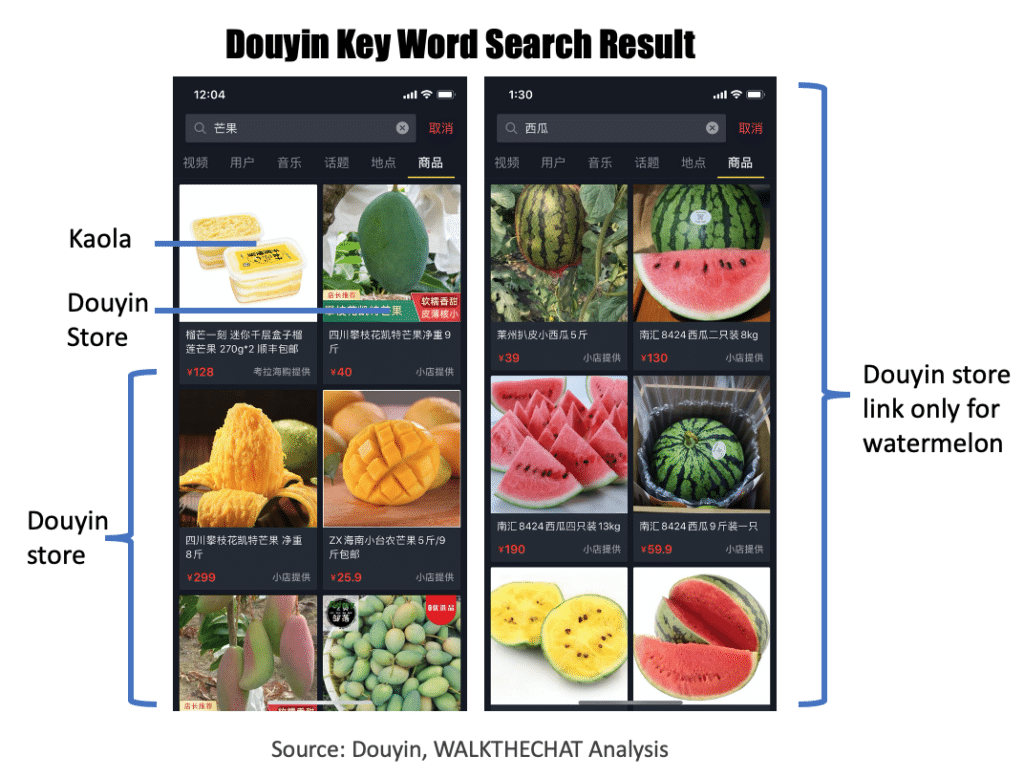

For fruits, Douyin even completely blocked Taobao links. For example, watermelons are only sold via Douyin stores.

For mangos, six of the top-10 ranking results are from Douyin stores, two go to JD.COM, and two go to Kaola.

According to 36kr, Douyin set its e-commerce GMV goal at 200 billion RMB for 2020. To reach this goal, Douyin has been pushing for live-streaming in collaboration with celebrities such as Luo Yonghao.

Starting in April 2020, Douyin canceled the requirement of 300K-Douyin followers for opening a Douyin store. It also allows account with 0 followers to add product links to a video. Compare to Taobao and JD.COM, Douyin only charges 2k-20k deposit to open a Douyin store. Detail deposit list clicks here.

Most Chinese tech companies love to build enclosed ecosystems. Now that Bytedance is strong enough to stand against Tencent or Alibaba, it’s just a matter of time before it builds its own enclosed empire.

Meituan-Dianping blocks Alipay

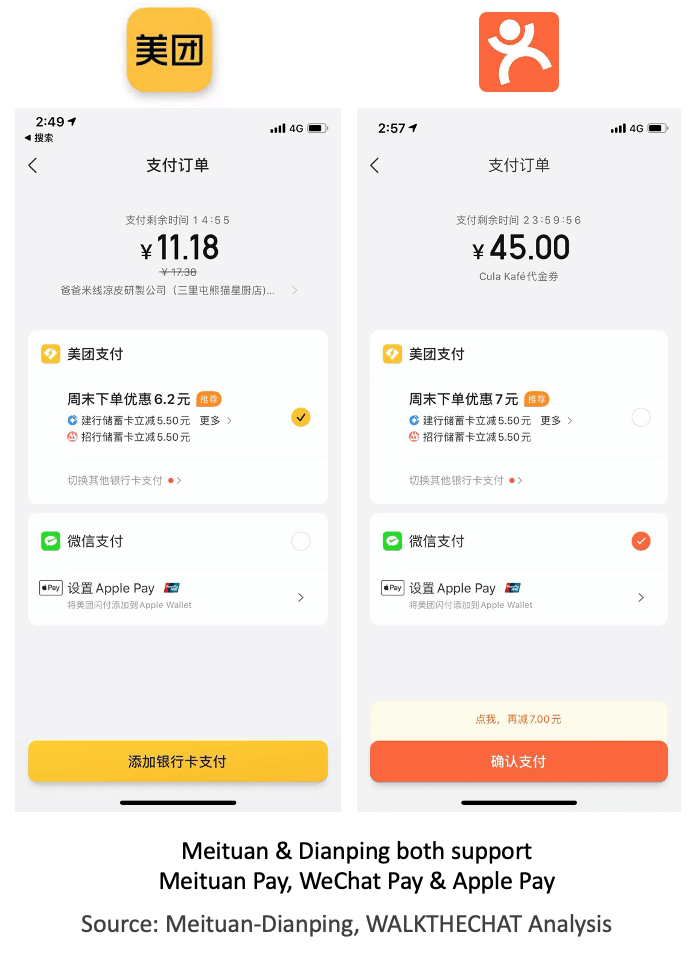

Meituan-Dianping, the food delivery, and life service App, started to block Alipay for some of its users.

This created heated debates online, and Meituan’s CEO Wang Xing responded by tweeting: “Why doesn’t Taobao support WeChat Pay? WeChat Pay has more active users than Alipay, and takes lower service fee than Alipay”.

Both Meituan App and Dianping App do not support Alipay.

Both Alibaba and Tencent have participated in Meituan’s past funding rounds. Alibaba is one of the earlier investors that participated in both B-round and C-round back in 2011 and 2014. Tencent only started to fund Meituan-Dianping in 2017 before Meituan’s IPO.

This block of Alipay is a clear indication that Meituan is siding with Tencent.

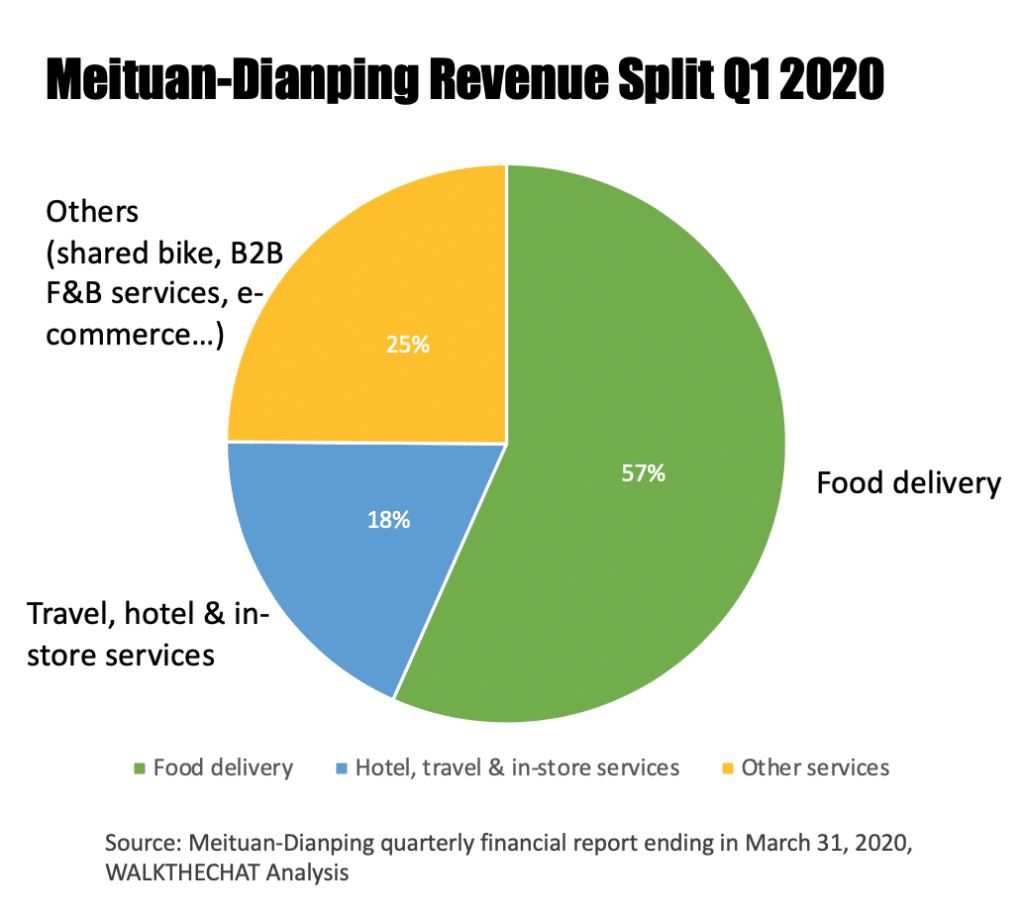

Meituan’s choice of Tencent could be a defensive move as Alibaba backed ele.me. Ele.me is directly competing with Meituan’s main food delivery service, and 57% of Meituan’s revenues are coming from food delivery as of Q1 2020.

COVID-19 had a substantial impact on Meituan. Revenue decreased by 12.6% YoY to 16.8 billion RMB, according to the Q1 2020 financial report. The hardest-hit sectors are Meituan’s travel, hotel booking, and in-store services. This segment made up 33% of Meituan’s total revenues in 2019 and now decreased to only 18%.

According to the tech news cyzone.cn, Ant Financial’s IPO puts enormous pressure on Tencent and thus pressured Meituan to take action to create a closer collaboration with Tencent against Alipay. Ant Financial is the parent company of Alipay, with an estimated value of 200 billion USD.

WeChat Losing Content Creators to Bilibili

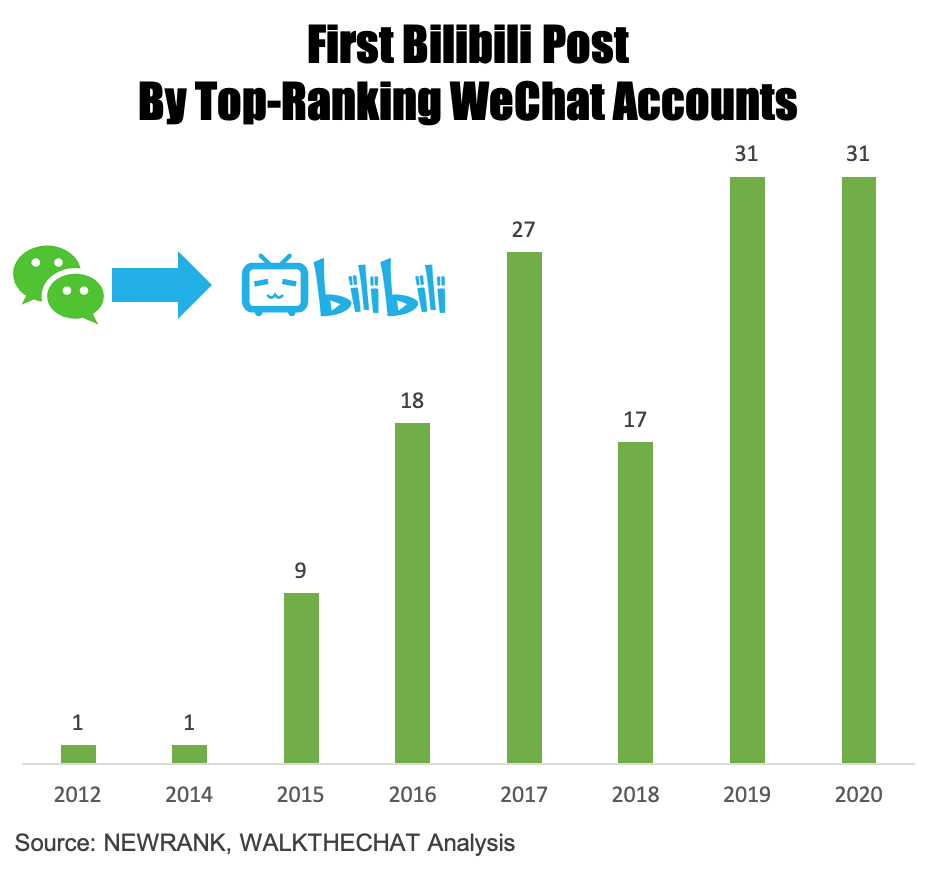

Many top-ranking WeChat Official Accounts are actively publishing content on Bilibili. Here is the amount of the WeChat’s top 500 accounts are entering Bilibili.

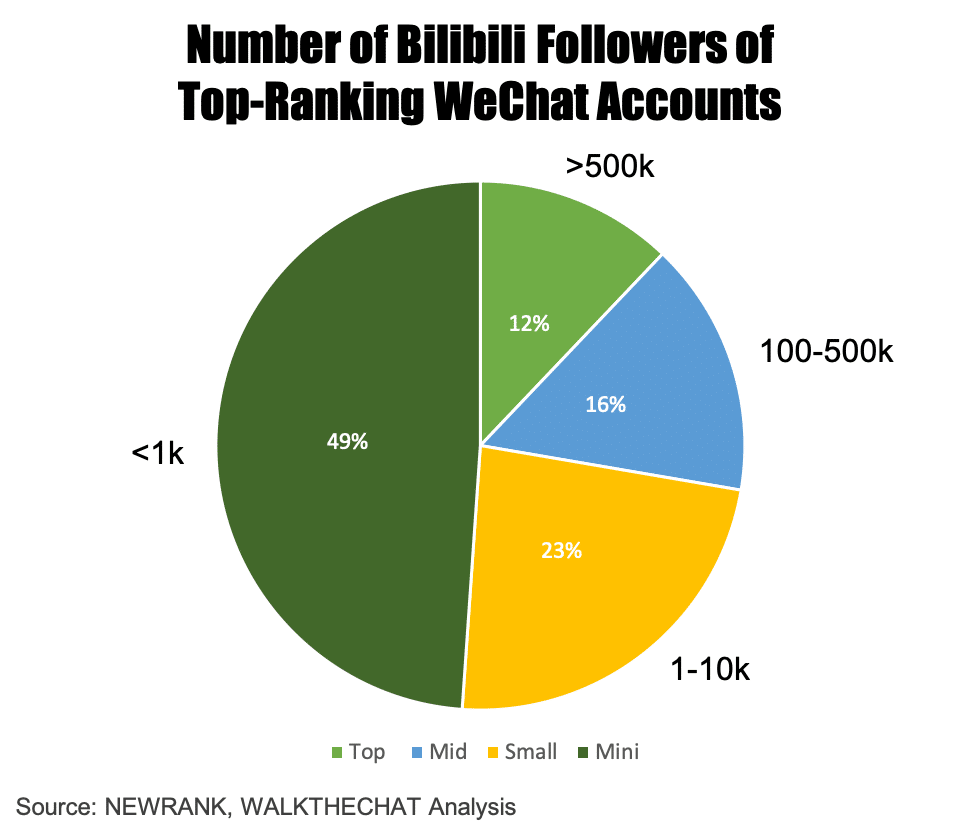

However, most of these top-ranking WeChat accounts struggle to acquire Bilibili followers. Only 12% of these large WeChat accounts have more than 500k Bilibili followers, and 72% of them didn’t reach 10k followers on the video platform! Comparatively, these accounts all have more than 1 million WeChat followers.

Driving traffic from WeChat to Bilibili is not challenging: Bilibili videos can be embedded within a WeChat article. However, attracting followers on Bilibili is extremely hard. Most top-ranking accounts have been operating for at least two years, and growing on Bilibili requires a long term investment.

As user preference shifts toward live-streaming and short-videos, the top WeChat accounts are scrambling to diversify toward new platforms. As the data shows, however, this shift is difficult, and many top WeChat influencers might end up being left behind.