China is a $1.94 trillion e-commerce market, the largest in the world, and more than three times bigger than the U.S. e-commerce market (source: eMarketer).

But it is also a difficult market to enter. What is the potential of YOUR brand in the Chinese market?

Depending on your current digital footprint on Chinese social platforms, your launch might be an almost-certain success or an uphill battle. In this article, we will look into the tools you can use to conduct your brand’s “China Digital Audit”.

What is a China Digital Audit?

A China digital audit is the process of assessing a brand’s potential on the Chinese market based on online data.

The digital audit usually covers three main steps:

- Digital footprint analysis: a measure of the brand’s mentions, sales, comments and other online data found on social media and marketplaces

- Competitor analysis: comparison of the brand digital footprint with similar brands in its industry

- Preliminary conclusions: insights on recommended strategies, marketing approaches, sales or promotion channels based on the results of the previous two steps

Marketplaces digital audit

Sales are the most relevant marker of a brands success in China. They measure the objective appeal of the brand for customers, and are harder to fake compared to views or mentions.

Moreover, because of the vibrant C2C resellers market in China (mostly on Taobao), brands might be able to obtain sales data even if they have never promoted their product on the Chinese market.

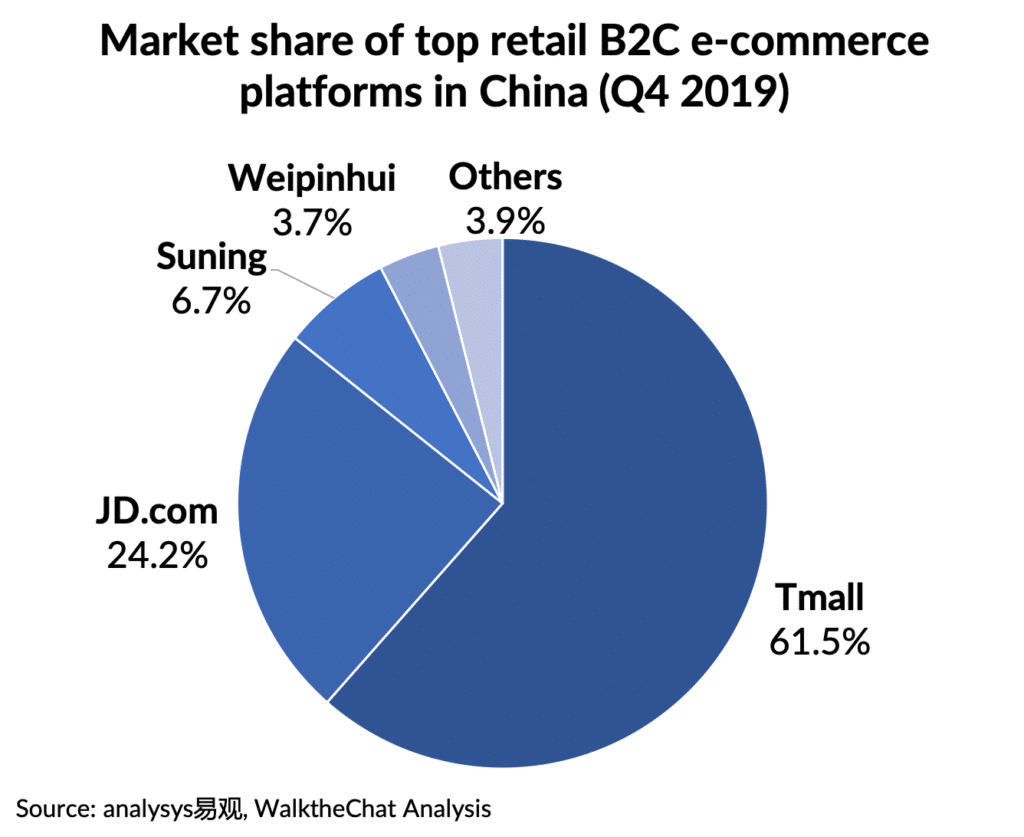

The B2C e-commerce market in China is mostly dominated by Taobao/Tmall. We will therefore focus on these platforms during our analysis.

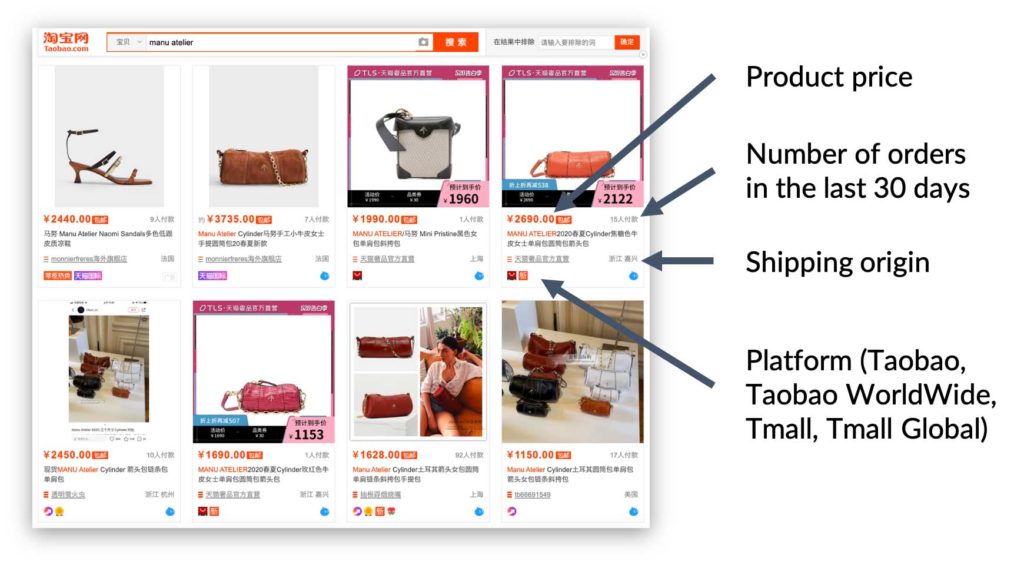

Another advantage of Taobao and Tmall is that they transparently disclose the amount of sales over the last 30 days for each listed product.

A quick search on the Taobao homepage enables to get a sense of the popularity of any brand in China.

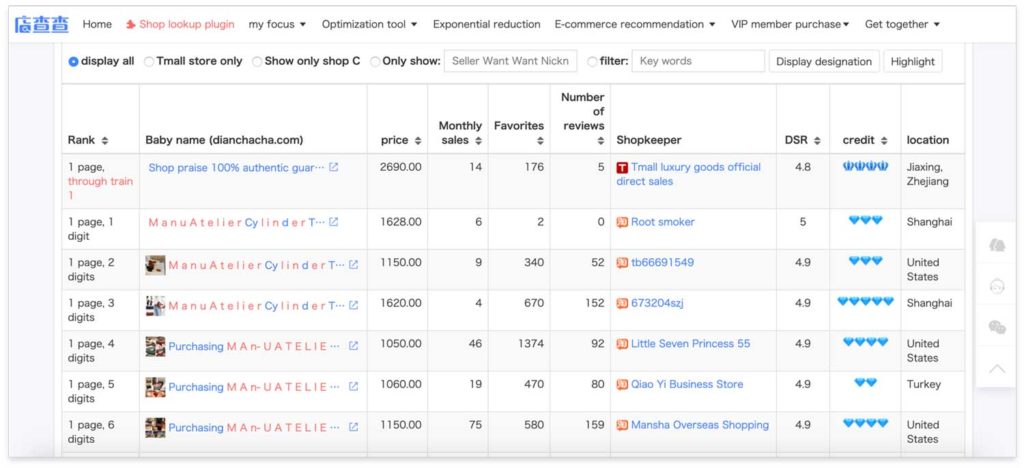

If this preliminary search brings positive results, you might want to deep-dive and calculate the amount of sales during the last 30 days. The platform dianchacha.com offers free keyword search for the past 30 days of data.

The data can’t be exported from the free version of the platform, but can easily be copy-pasted to excel for analysis.

Although Dianchacha is free, it only provides the last 30 days of data. Some platforms archive data from the Taobao platform and re-sell it. We usually use services from https://www.kanda-data.com/ in order to access historical Taobao/Tmall sales data.

The service pricing is roughly the following (can vary based on stores, keywords, the volume of data requested, etc.):

- Pricing: ~1 USD / store / month of data

- Accuracy: ~90%

- Timeline: 3-5 days to collect data

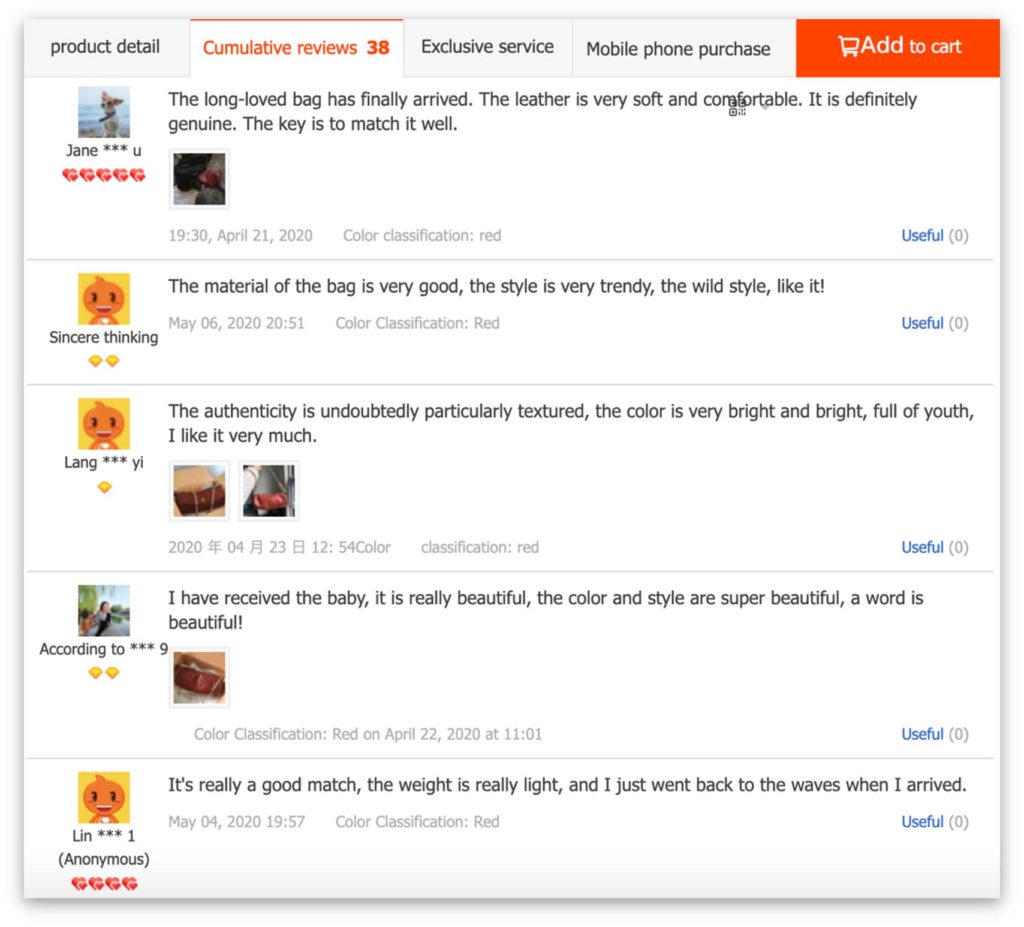

Another method to improve the qualitative audit of your Taobao performance is to look into user comments. If you don’t speak Chinese, these can easily be translated via Google Translate in order to get a sense of their general meaning and user sentiment.

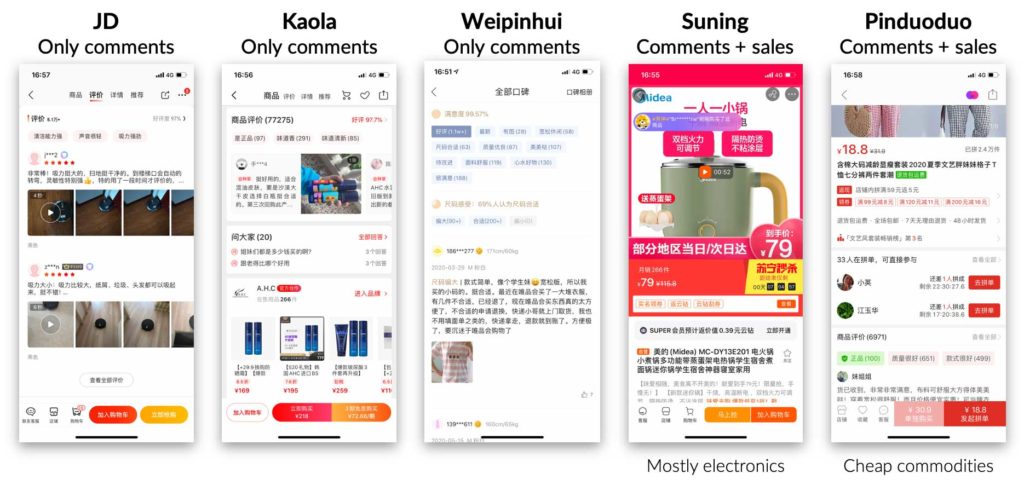

Other platforms will unfortunately not provide much additional data for several reasons:

- Only B2C: other marketplaces only focus on B2C sales. They miss the C2C component of Taobao which makes it particularly interesting to observe the volume of resellers.

- No access to sales volume: large platforms such as JD, Kaola or Weipinhui only give access to the number of comments on each product, but don’t display the sales volume. And comments amount could be easily manipulated.

- Niche platforms: a lot of the smaller e-commerce platforms are focused on niche markets. For instance, Suning focuses on electronics, while Pinduoduo focuses on cheap commodities.

WeChat audit

Once you successfully checked the sales of your brand and competitors on Chinese marketplaces, you will want to look into your social presence.

With 1.2 billion Monthly Active Users, the first place you will look into is of course WeChat.

WeChat in-App search

The simplest way to search for WeChat mentions is to use the in-App search feature.

Pros:

- Exhaustive list

- Can be sorted by overall rank, date or number of views

- Completely free

Cons:

- Not easy to count mentions

- Mobile-only

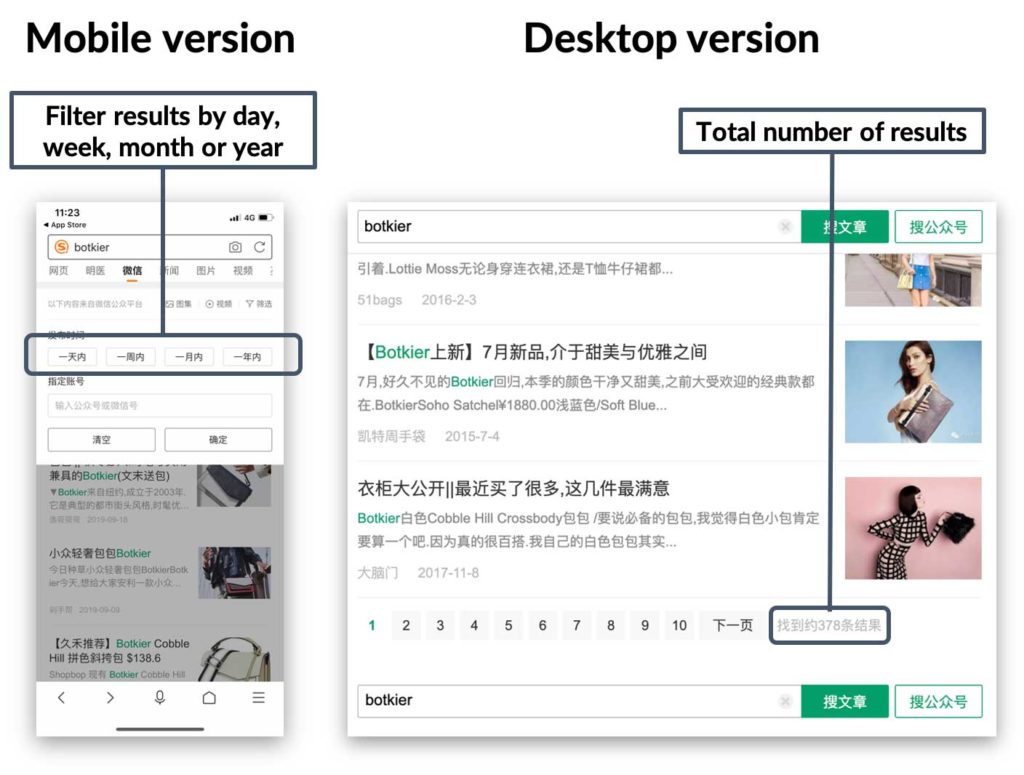

WeChat search via Sogou

Because Tencent invested in the search engine Sogou starting in 2013, Sogou enables searching through WeChat articles and WeChat Official Accounts.

Sogou is a powerful and free way to easily count WeChat mentions.

Pros:

- Exhaustive list

- Can be filtered by last day/week/month/year

- Completely free

- Easy to count

Cons:

- Lacks more advanced filters

Advanced WeChat data service: newrank.cn

If you want more fine-grained data about WeChat mentions, you might want to look into the leader of the market: newrank.cn.

The main downside of newrank.cn is the price of the platform

Pros:

- Exhaustive list

- Multiple filter levels such as time posted / number of likes / number of views

- Enables filter via custom dates

- Easy to count

Cons:

- Quite expensive for data beyond 30 days (5,000 RMB, or $750 per month subscription)

WeChat Index

A last tool which is interesting to assess your WeChat presence is the WeChat Index. It is accessed via a WeChat Mini-program, and can give you the relative popularity of your brand on WeChat.

Pros:

- Takes into account mentions on the entire WeChat ecosystem (not just article mentions)

- Enables easy side-by-side comparison

Cons:

- Doesn’t give objective data, just the “WeChat Index” without the context of how it is calculated

- Only can access the last 90 days of data

Little Red Book Audit

Little Red Book is another ideal platform for digital audit. The network has 85 million Monthly Active Users, 88% of them female.

Most interestingly: it is a common platform to review products from overseas brands. Little Red Book mentions might be the first sign of nascent interest for a brand in China.

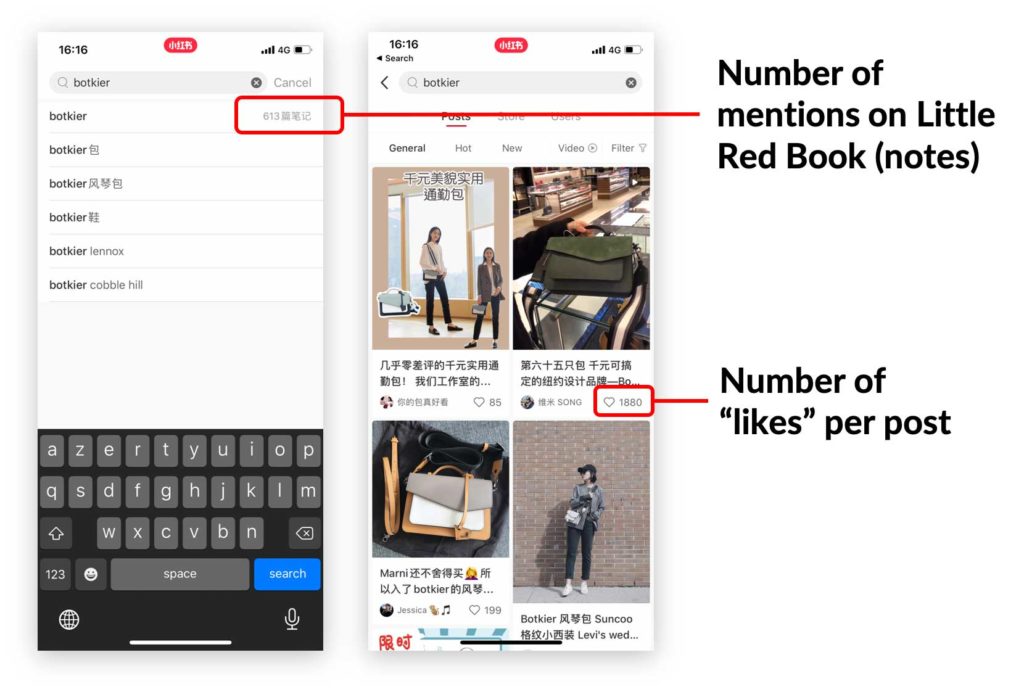

In-App Search

By entering the name of a brand on the Little Red Book App, you can easily access the total number of mentions (called “Notes” on the platform) and likes per post. This is a quick way to get a sense of the general interest for a brand.

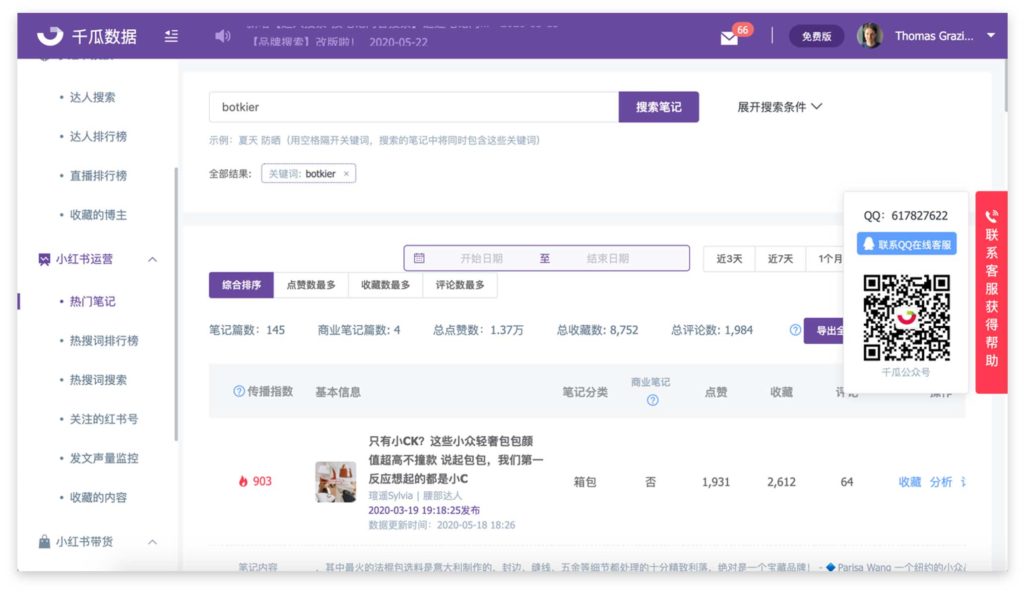

More detailed data via Qiangua

The downside of the in-App search of Little Red Book is that it makes it hard to count the number of mentions and likes. Qiangua (http://app.qian-gua.com/#/material/note) is an online platform which, under its free plan, gives access to a large amount of Little Red Book data.

The platform provides:

- Total number of notes mentioning a brand

- Number of likes on these notes

- Number of notes from other business accounts

- Number of “favorites” for a brand

- Total number of comments about a brand

- 1 year of data

Beyond 1 year of data, you will however have to purchase one of Qiangua’s paid memberships.

Douyin Audit

Douyin, the Chinese version of Tik Tok, has been in the limelight for the last few months, quickly growing to 400 million Daily Active Users in China.

The short-video platform is still booming, and will increasingly be a necessary part of your China Digital Audit.

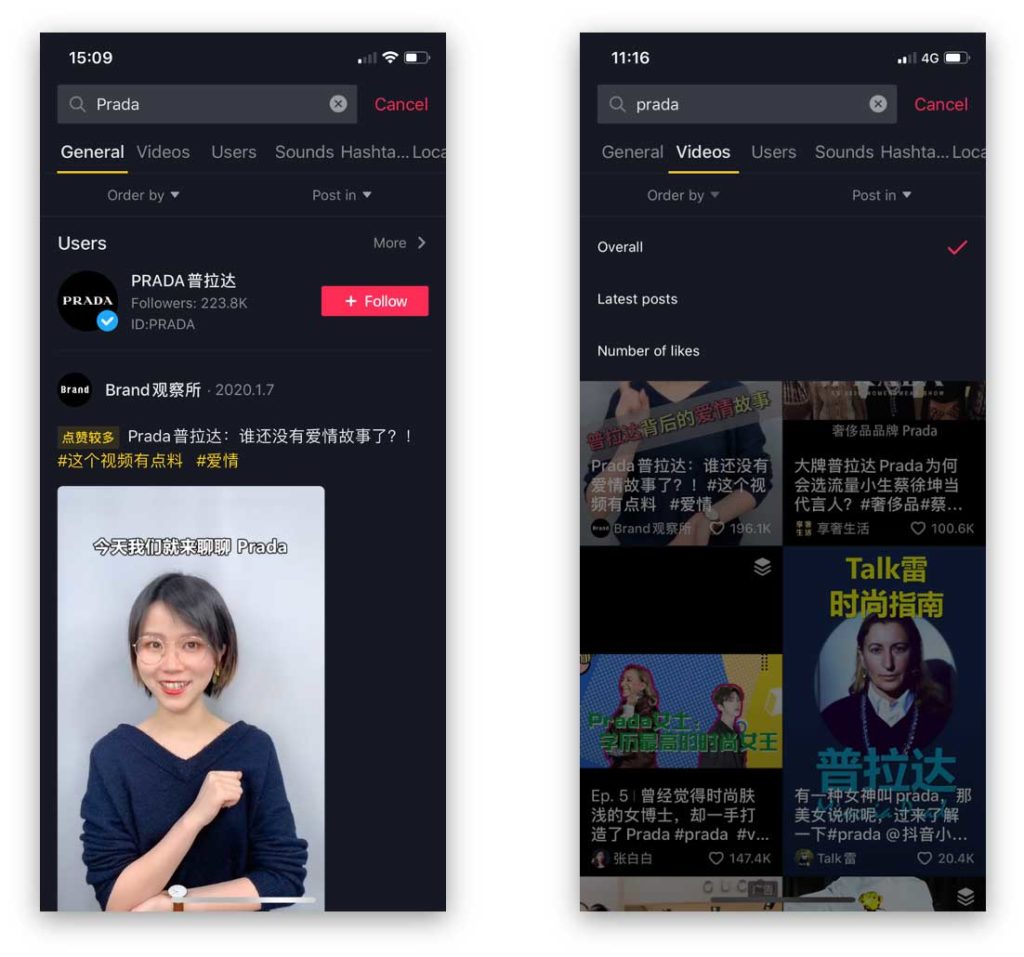

In-App Search

The simplest way to get a first sense of popularity on Douyin is, as for other Apps, an in-App search.

Pros:

- Easy access to full list of mentions

- Can sort based on latest posts or likes

Cons:

- Hard to get the aggregate number of mentions or likes

- Overall, the number of mentions on Douyin is usually low, only relevant for large brands

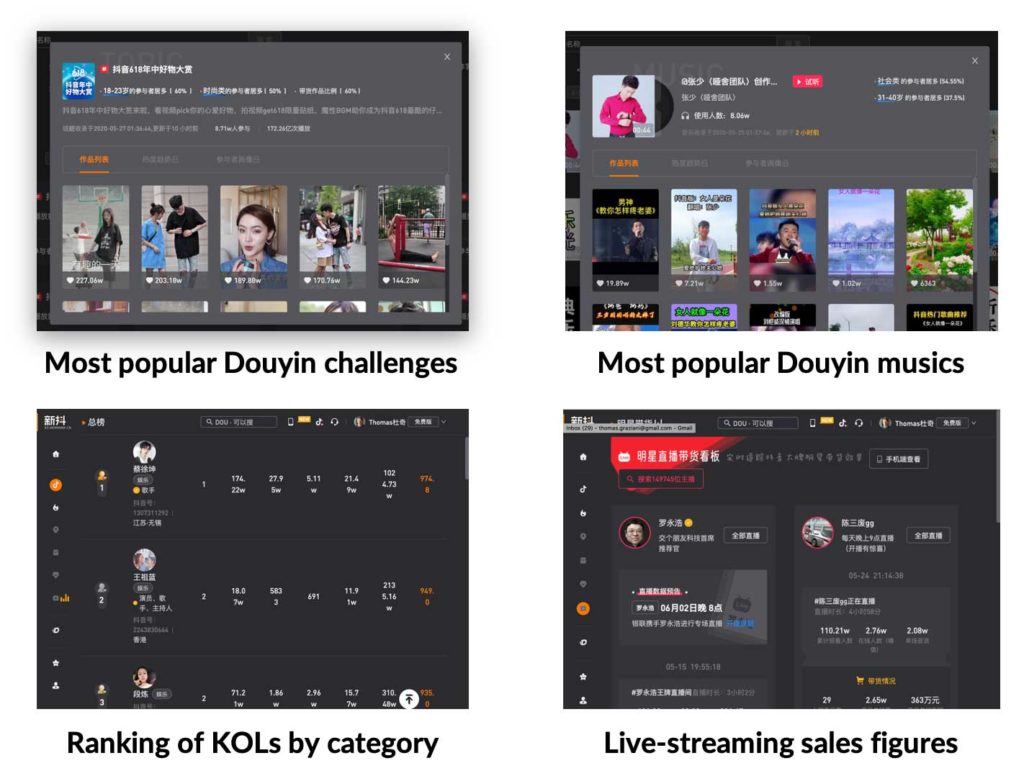

In-depth data via Xindou

The company Newrank, which is leading the market for WeChat data, created a new product for Douyin data: Xindou (https://xd.newrank.cn/data/material/search). This new platform aggregates data about Douyin accounts and mentions.

Pros:

- Easy count of mention

- Can sort based on likes, shares, comments

Cons:

- Can only get 30 days of data without the premium version

- Hard to get the aggregate number of mentions or likes

- Overall, the number of mentions on Douyin is usually low, only relevant for large brands

Xindou is however a good platform to get data beyond the number of mentions. The platform provides insights into most popular hashtags, musics, influencers, and even live-streaming sales data.

However, only the most recent data is available with a free account. A premium account with live-streaming data costs 899 RMB / month (125 USD / month)

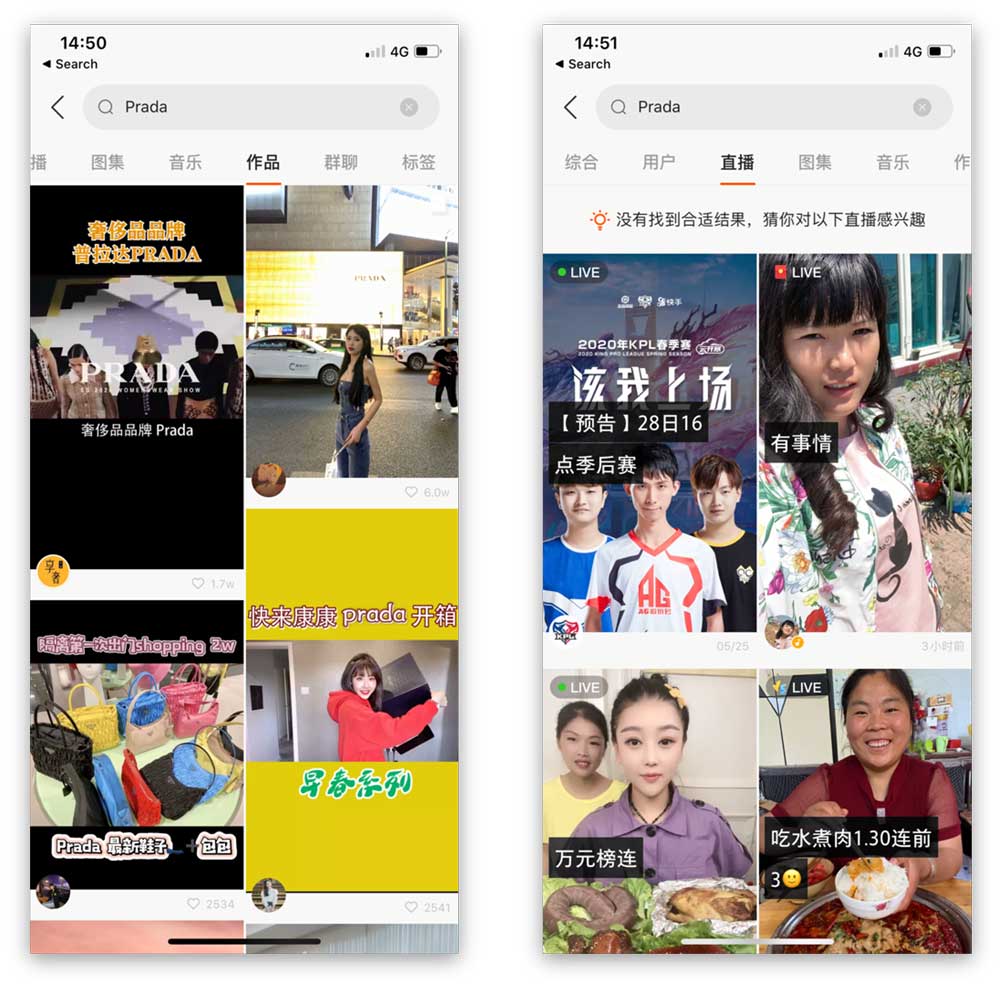

Kuaishou audit

The main contender of Douyin in the short-video space is Kuaishou. With 300 million Daily Active Users, it is well worth a look.

In-App search

Once again, a quick in-App search is the best way to get the first estimate of a brand’s footprint on Kuaishou.

Pros:

- Easy access to full list of mentions

Cons:

- No filters for sorting

- Hard to get the aggregate number of mentions or likes

- Overall, the number of mentions on Kuaishou is usually low, only relevant for large brands

In-depth data via Feigua

Feigua (https://ks.feigua.cn/Member#/Video) is a specialized platform offering some more detailed data about Kuaishou activity. The software only offers 15 days of data under its freemium version.

Pros:

- Can sort videos based on likes, comments or views

- Access to top-performing influencers for benchmarking

Cons:

- Only 15 days of data without the premium version

- Hard to get the aggregate number of mentions or likes

- Overall, the number of mentions on Kuaishou is usually low, only relevant for large brands

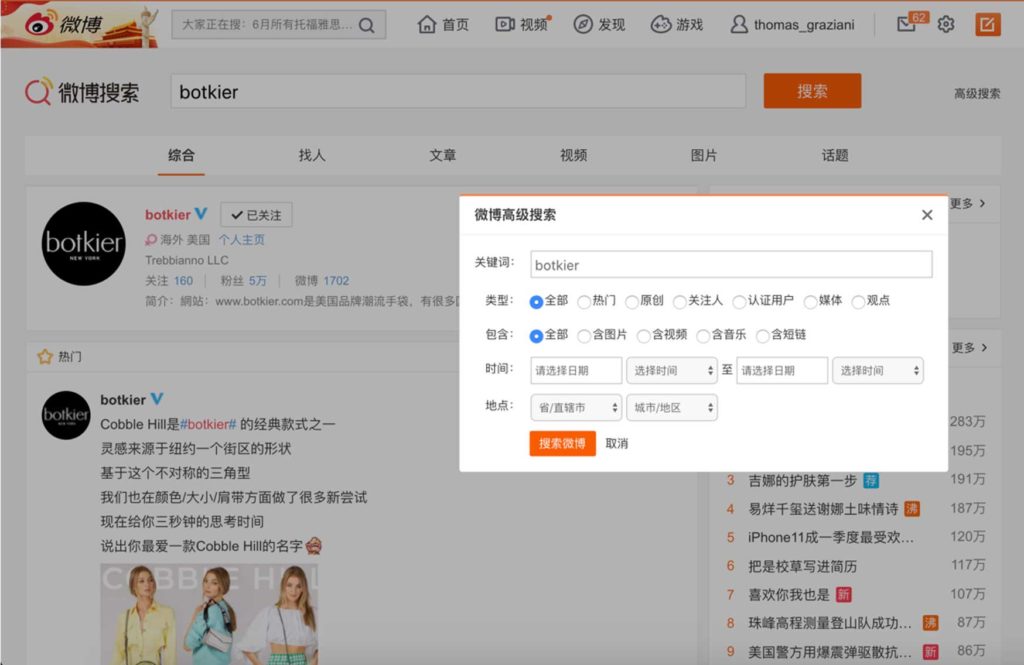

Weibo audit

Weibo audit is relatively straightforward as the native search from Weibo is a good and free solution (using the desktop version of Weibo):

- Easy access

- Exhaustive data

- Filter for time and location

- Can easily count mentions by checking the # of page results

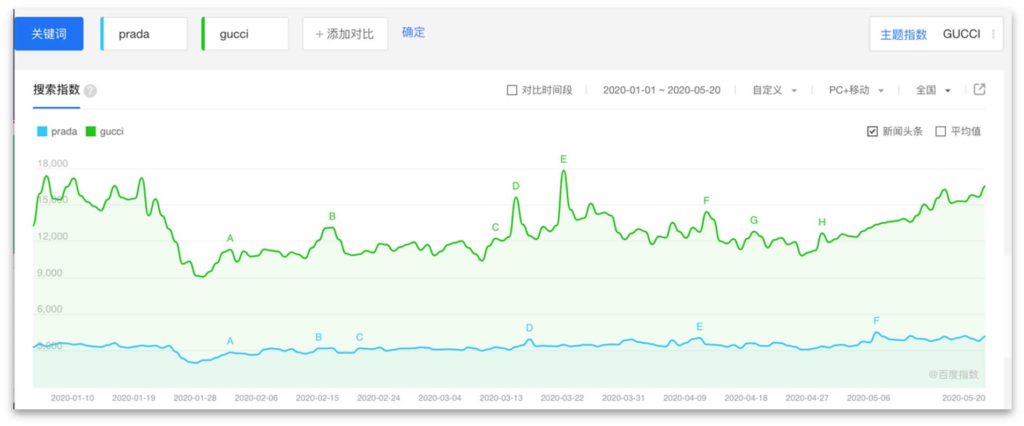

Search Engine Audit

Search habits in China are different from other countries. Most customers would look for products directly on Tmall, JD or WeChat rather than using search engines.

Yet, Baidu Index (http://index.baidu.com/v2/index.html#/) can give indications on the popularity of the brand over time in China. With more than 60% market share, Baidu is still the leading search engine in China.

Pro:

- Can see the trend over a long period of time

- Easy to compare the popularity of different brands

Cons:

- Only give a relative measure of popularity (Baidu Index)

- Baidu is losing in popularity over time

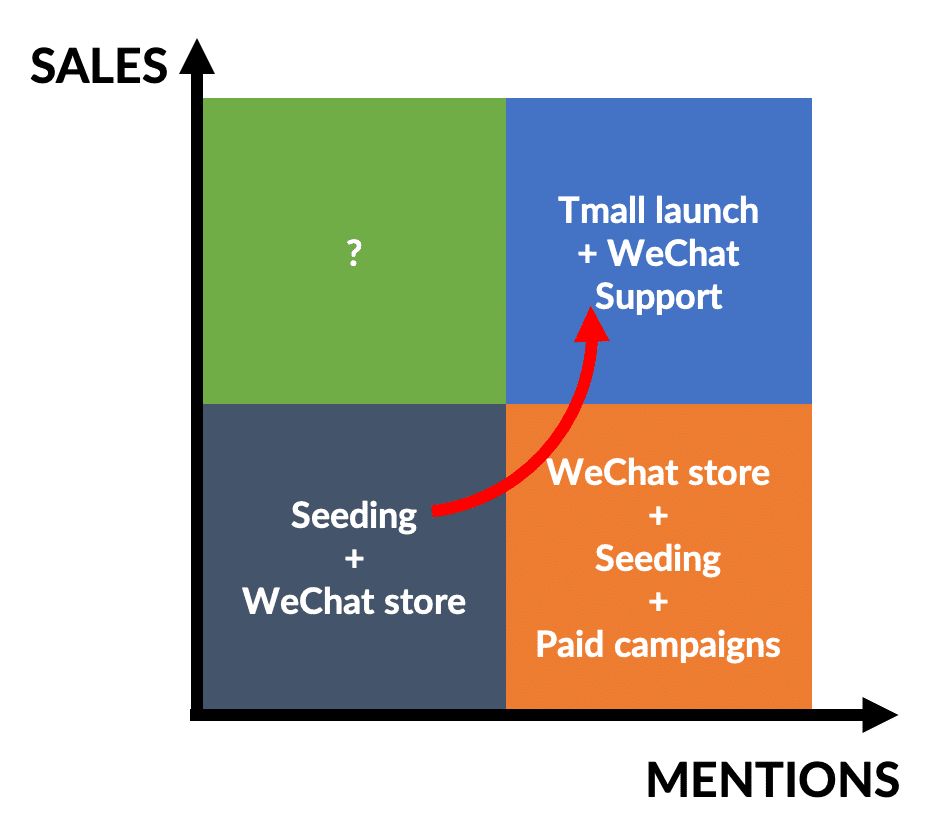

How to draw conclusions from the audit?

There are three main possibilities at the outset of the digital audit:

- High sales, many mentions: if your brand is selling more than 50,000 USD of product per month via C2C Taobao resellers and has a high number of mentions, you can consider a direct launch on Tmall and WeChat. The organic search traffic on Tmall might make this investment worthwhile

- Low sales, many mentions: in this situation, the brand has high-potential in China. However, the search traffic on Taobao makes a direct Tmall launch challenging. In this situation, we would recommend setting up a WeChat store and setting-up paid campaigns with influencers in order to generate the first sales.

- Low sales, few mentions: if the brand doesn’t have many mentions in China, the best of course of action will be setting up a WeChat store and gifting products to influencers in order to create initial momentum and first mentions for the brand.

Conclusion

Before launching in China, a careful digital audit is a necessary step.

Having a clear vision of your brand’s footprint and your competitor’s results will enable you to assess your chances for success. It will also enable you to size your initial investment and pick the right channels to get started.

If you’re looking for advice on how to fine-tune your digital audit, feel free to reach out at info@walkthechat.com. We’re here to help.