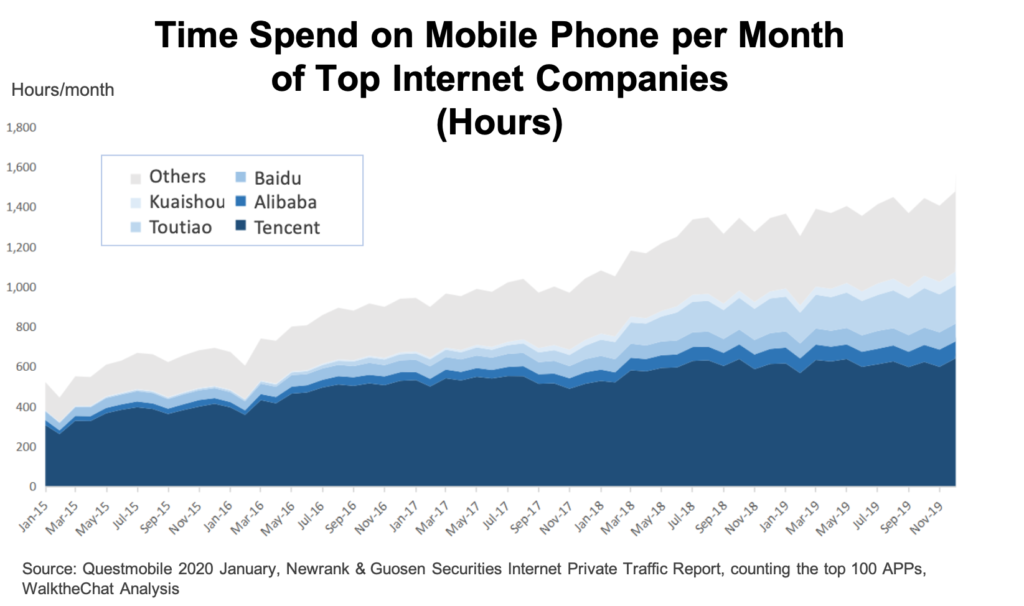

Tencent continues to lose market share in mobile time usage to Toutiao

Back in the good old 2016, the Tencent ecosystem used to represent over 50% of the time Chinese users spent on mobile devices (source: Mary Meeker’s report). Now Tencent only takes up 42.9% of user’s time.

This lost market share goes to Toutiao, the parent company of Douyin, now owning 14.5% of mobile usage time.

The Chinese Tech landscape has become more diverse in the past 5 years. Back in 2016, Baidu, Alibaba, and Tencent (BAT) used to own 71% of mobile time spent. Now the top 70% of users’ time goes to 5 companies: Baidu, Alibaba, Tencent, Toutiao and Kuaishou (BATTK).

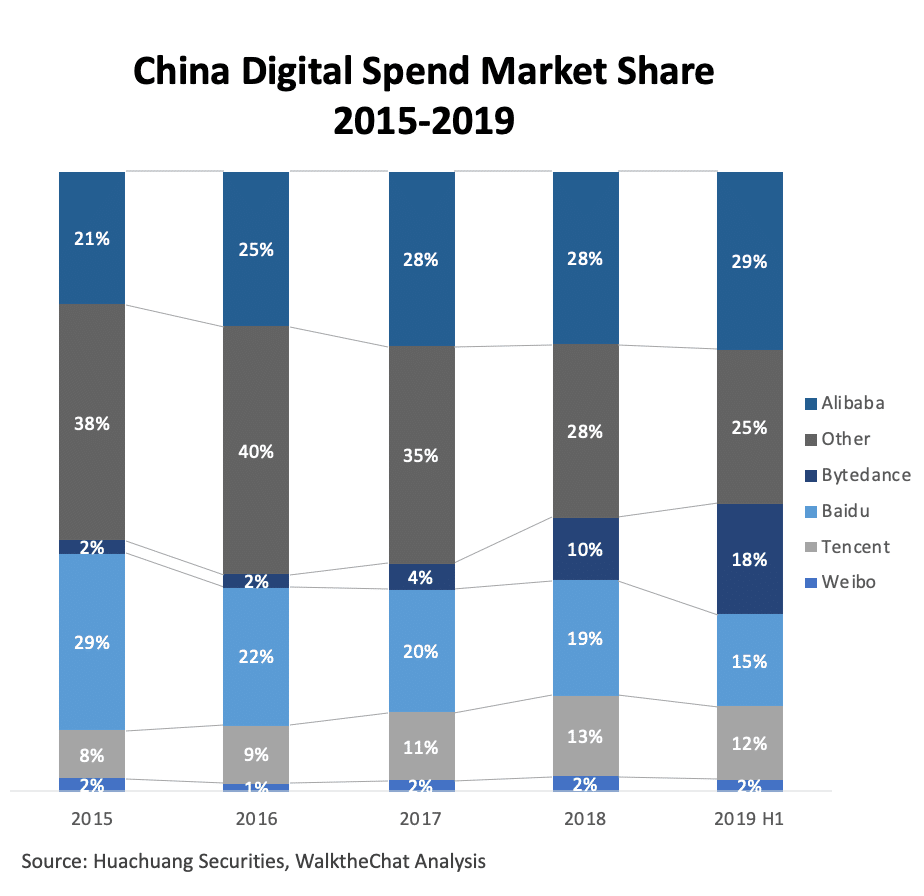

Bytedance Emerged as the 2nd Larget Platform for Advertising Spending

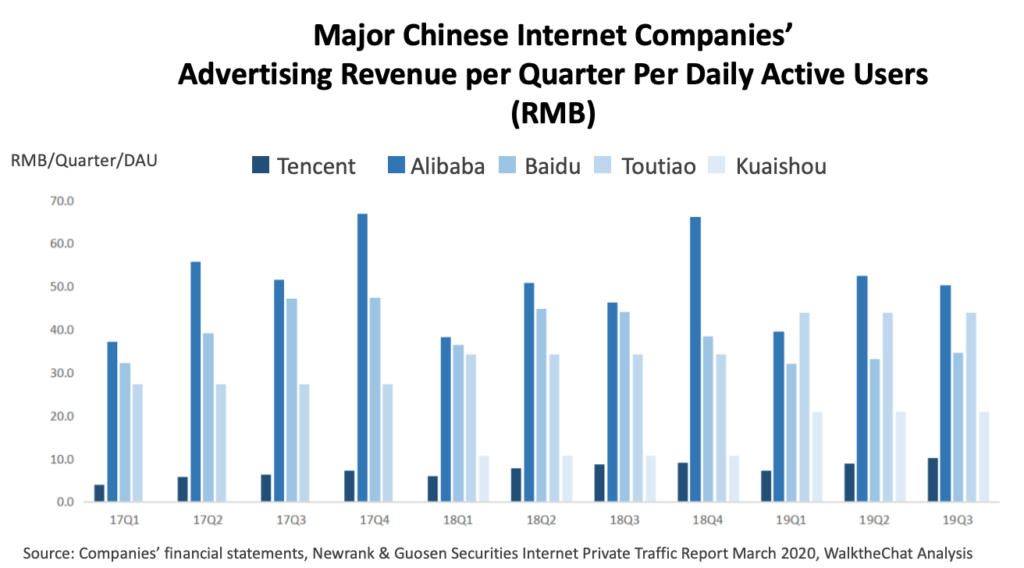

Alibaba is the most efficient in generating advertising revenue, around 50 RMB/quarter/DAU. Bytedance (Toutiao) follows closely making around 43 RMB/quarter/DAU.

Both companies take strict control over advertising and KOL marketing. Bytedance’s KOL platform charges a 5% commission on all campaigns. Any promotional content that didn’t go through the official platform will risk traffic restriction.

Comparatively, Tencent can only generate 10 RMB/quarter/DAU. Tencent seems determined not to monetize via ads. Especially since it has almost no control over the Key Opinion Leader (KOL) spending on its platforms.

Instead, according to its 2019 Q4 financial report, Tencent is increasingly focusing on value-added services such as fintech, gaming and cloud service.

The digital spend market share graph tells another story: Bytedance emerged as the 2nd largest advertising platform in China.

Baidu’s media buying position continues to drop as users spend more time elsewhere, dropping from No.1 in 2015 to 4th place in 2019. Alibaba maintained its No.1 position in the past 4 years, far ahead of ByteDance.

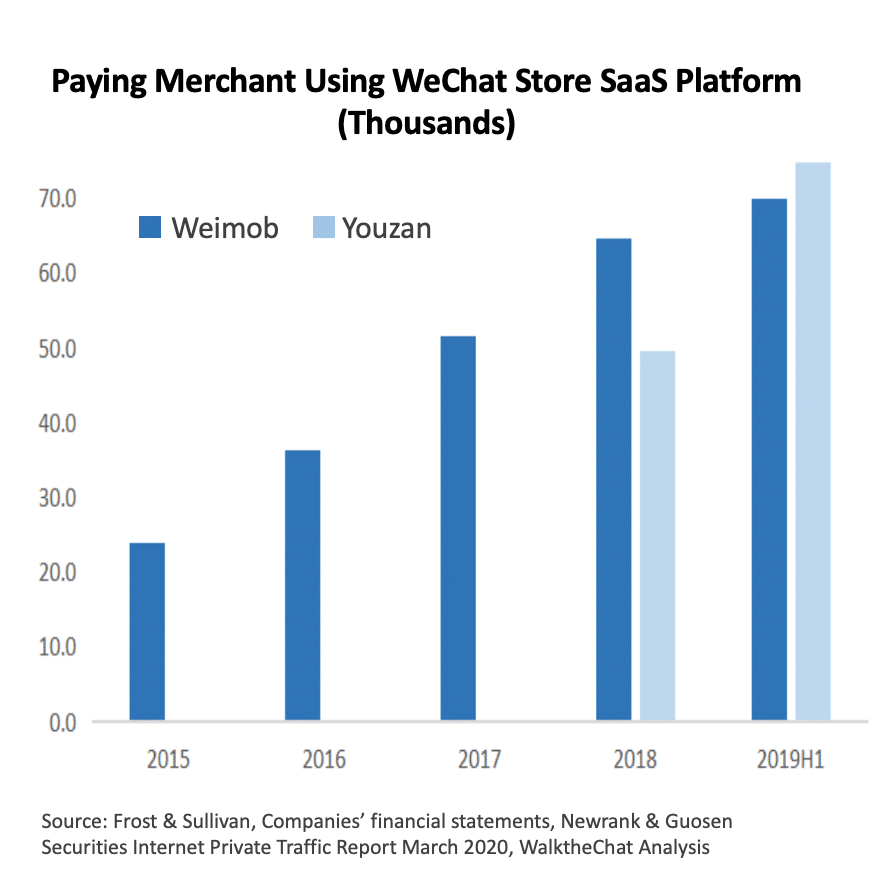

Youzan Becomes the Largest Social-commerce SaaS platform

Youzan surpassed Weimob to be the largest SaaS platform to create WeChat stores, with over 70,000 paying clients.

But as the WeChat store market matures, growth for SaaS social stores will likely slow down. Short video platform such as Kuaishou and Douyin all have their own e-commerce system. Kuaishou heavily promotes its native store while Douyin formed a strategic partnership with Taobao to drive e-commerce traffic there (WalktheChat is still the major platform supporting store creation for overseas companies)

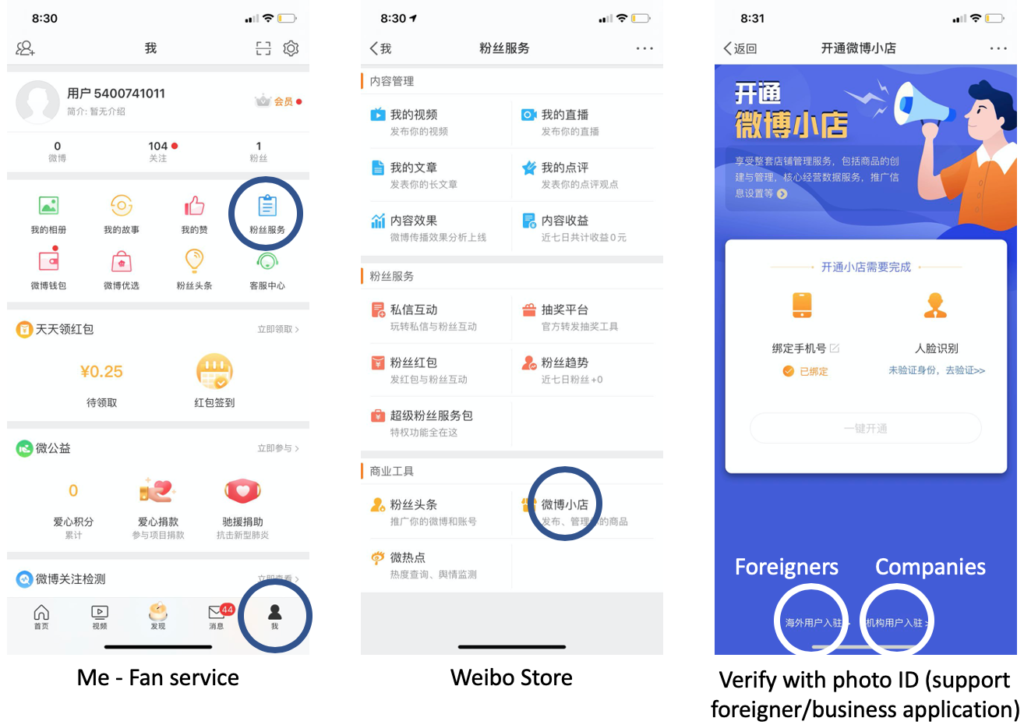

Even Weibo launched its own official Weibo Store last week, enabling individuals (Chinese and foreigners), and Chinese companies to create Weibo Stores. Below is how you can create a Weibo Store. Although most of the products will take users to a Taobao store.

Given Weibo’s low e-commerce conversion rate, and a high concentration of fake data, the Weibo store feature is unlikely to affect the current social commerce ecosystem.

Users spend more time on Bilibili and Douyin than on WeChat

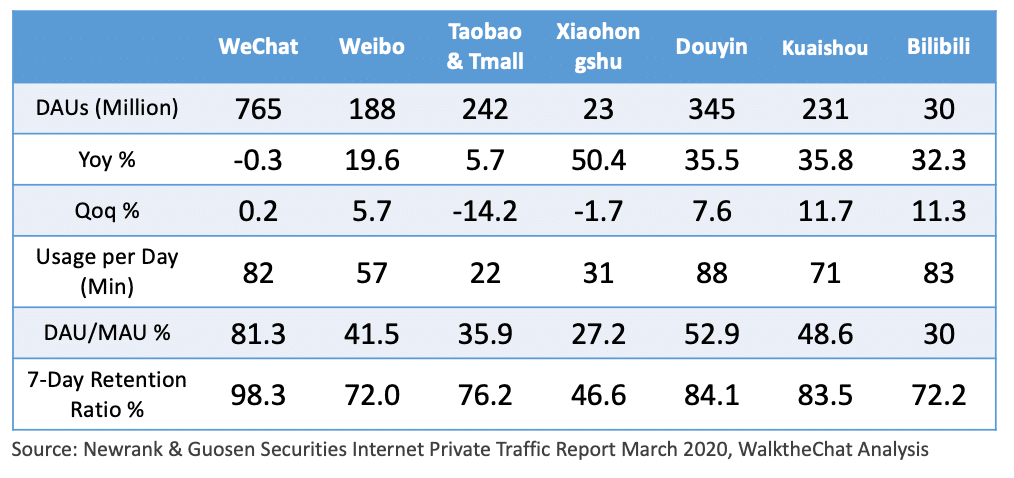

Douyin users spend 88 minutes per day on the App, 6 minutes more compared to WeChat. Bilibili users are also extremely loyal, spending 83 minutes per day on the App.

WeChat, with the highest DAUs (Daily Active Users) stats, is also the only platform with a decreasing number of DAU YoY. It’s also the platform with the highest user retention rate, the 7-day retention ratio reached an almost perfect score of 98.3%.

Conclusion

The Chinese Internet space is more vibrant today than it ever was. The rise of short-video platforms such as Douyin and Kuaishou has shaken the dominance of Tencent over Chinese social medias.

This more diverse ecosystem is more challenging to understand for brands. But it also means opportunities for marketing and sales: brands can leverage the newest trends & platforms in order to gain visibility in the Chinese market.

Click here to download the full Newrank Private Traffic Report (in Chinese).