5 news from this week:

- Alibaba attempts to acquire Ele.me

- Momo acquires Tantan

- Tiao-yi-tiao mini-program starts monetizing

- iQiyi files for IPO in the U.S at $US 10 billion valuation

- Mini-program analytics App Alading raises 60 million RMB funding

#1. Alibaba attempts to acquire Ele.me

Alibaba made a move to purchase food-delivery leader Ele.me for $9.5 billion USD, according to ifeng.com.

The Chinese e-commerce giant already owned a 23% stake in the company after investing almost US$1.2 billion in it, a bargain compared with the current acquisition pricetag.

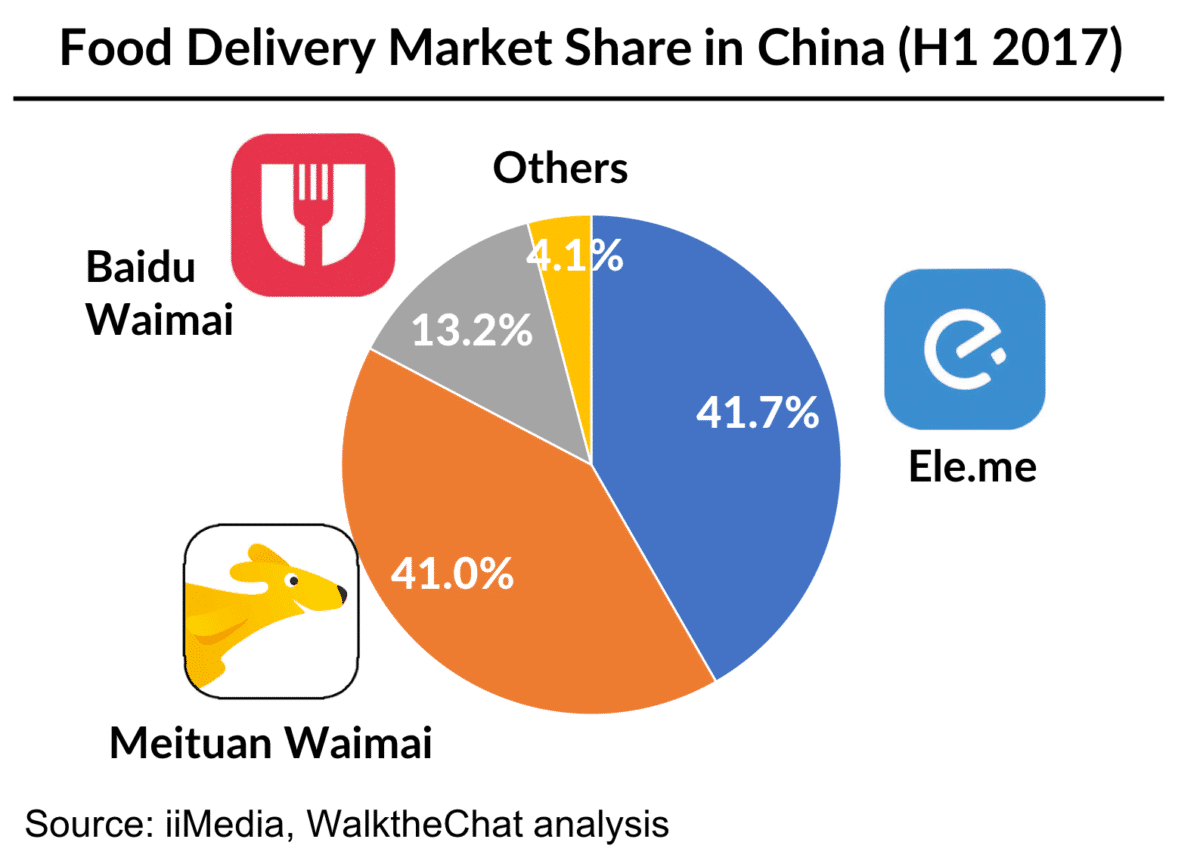

Baidu Waimai had previously sold its business to Ele.me for a reported US $800 million. This leaves two giants in the Chinese food delivery business: Alibaba’s Ele.me and Tencent’s Meituan.

This move would leave Alibaba in a dominant position with about 55% of the total food delivery market in China.

#2. Momo acquires Tantan

The online-dating leader Momo has expanded its reach by acquiring competitor Tantan for an impressive 800 million USD.

After launching its live streaming feature in 2015, Momo saw an explosion of its revenues: they skyrocketed from 50.9 million USD in Q1 2016 to 354.5 million USD in Q3 2017: an astounding growth of 38% per quarter.

Momo has also grown way beyond its initial scope as a dating website: it provides games and live streaming features, along with features copied from Tantan.

Tantan has a simpler set of features (very similar to Tinder – to the point of copying the interface), but was successful at attracting the very sought for post-90’s and post-95 users. Tantan figures speak for themselves (as of early 2017):

- 110 million registered users

- 72 million verified users

- 20 million monthly active users

- 7 million daily active users

- 75% of daily active users were born after 1990

Momo had seen its growth slow down (monthly active users grew from 74.8 million to 94.40 million between Q2 2016 and Q3 2017)

#3. Tiao-yi-tiao mini-program starts monetizing

You’re likely to have heard of the Tiao-yi-tiao mini-program. Actually, you are likely to have spent a few hours of your life playing with it.

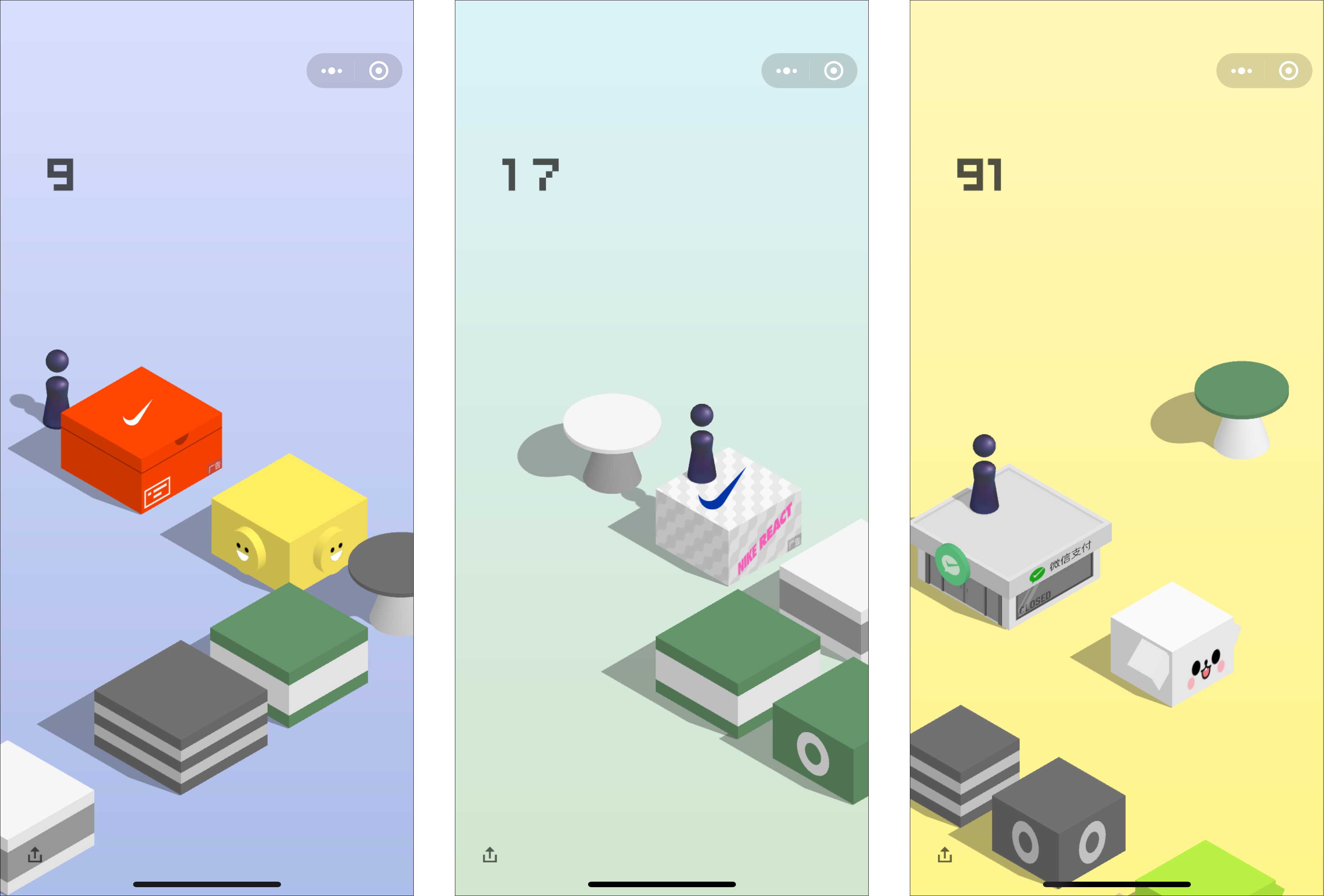

The mini-program recently launched an interesting monetization strategy: it started releasing “branded blocks” that it sold to various large brands such as Nike and McDonalds.

However, these ads are not for everyone: the price tag is 20 million RMB, and the brand are personally handpicked by Zhang Xiaolong, WeChat’s founder. Users can see the logo but cannot engage with the brand, leaving it impossible to measure the ROI of the ads.

#4. iQiyi files for IPO in the U.S

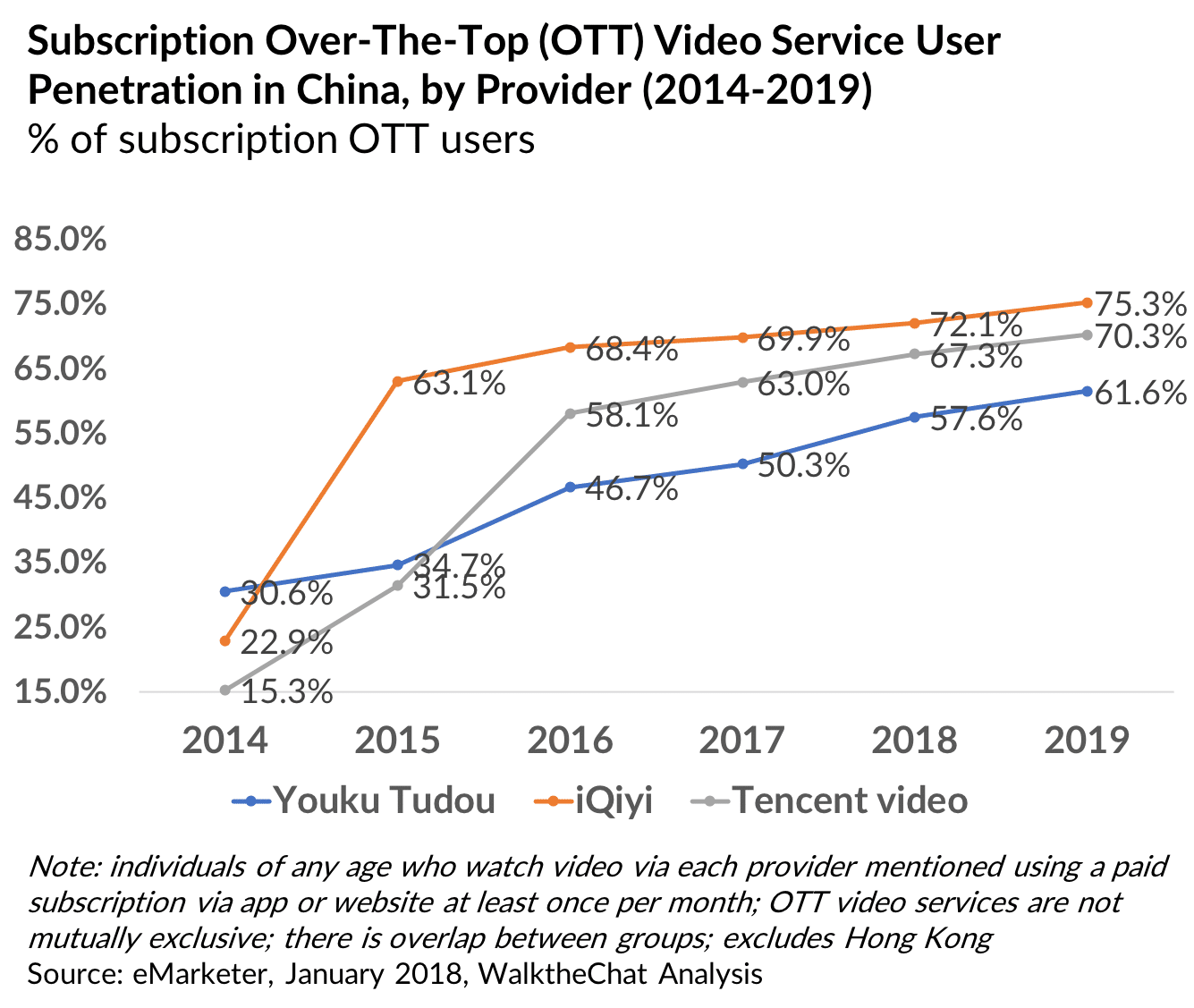

Baidu’s video service iQiyi files for IPO in the U.S. It is expected to raise 1.5 billion USD with a total valuation of about 10 billion USD.

iQiyi has been seizing the majority of the video streaming market in China, with about 70% of video streaming users subscribing to their service as of 2017.

#5. Mini-program analytics App Alading raises 60 million RMB funding

The mini-program analytics App Alading raised 60 million RMB in funding.

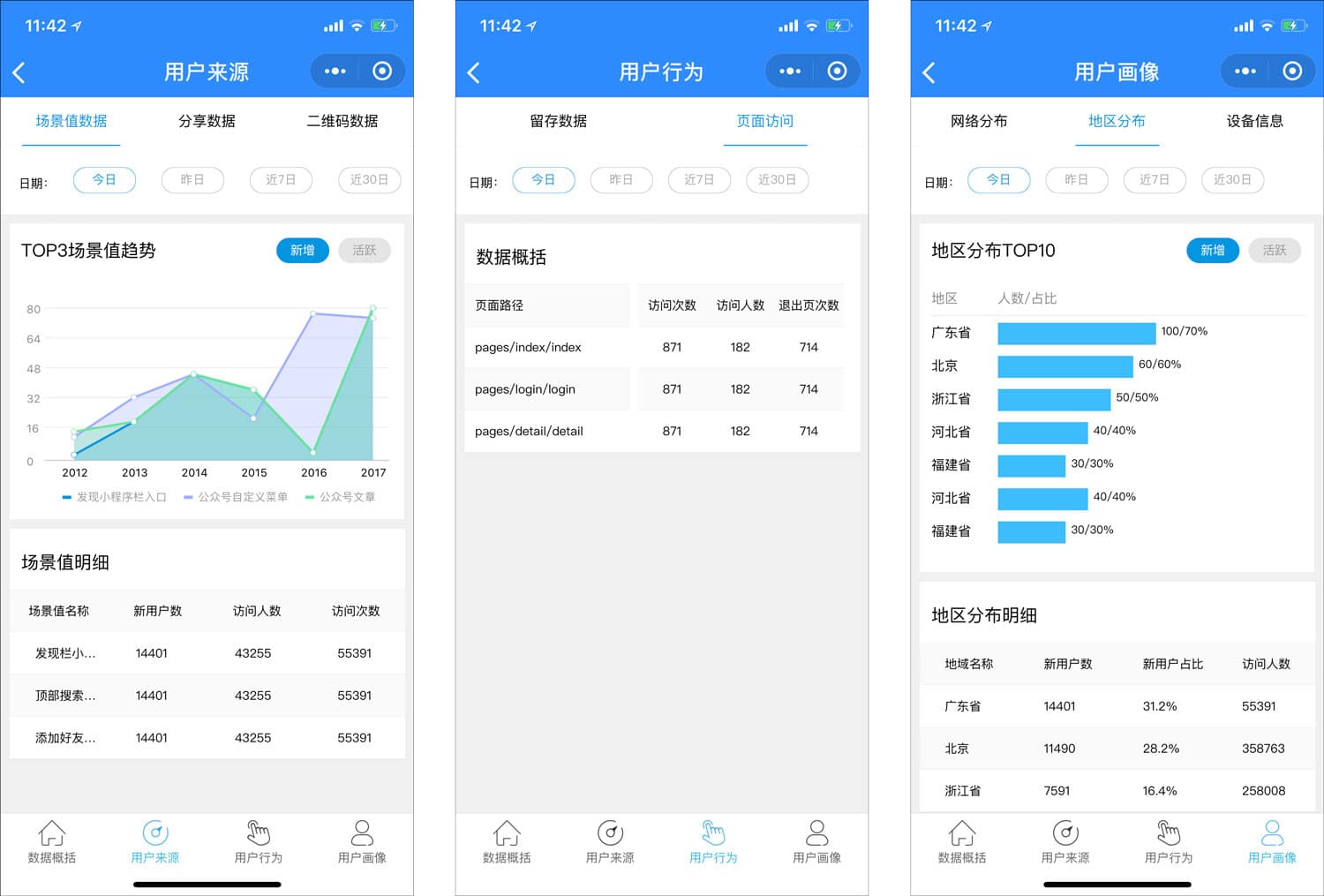

Alading enables mini-programs to gain insights about their mini-program’s engagement: user data, sharing behavior and most popular pages/bounce rates.

This round of funding is proof of the fact that, after a slow start, mini-programs are definitely picking up steam.

Beyond individual applications, a real ecosystem of services is being born under the concept of mini-programs, which will push the limits of what they can provide for end users and brands.