- Dec 15, 2017 – 4.2 billion yuan ($636 million) investment for a 5% stake in Yonghui Superstore Co Ltd, a superstore with 600 locations in China

- Jan 23, 2018- potentially acquiring 1.7% stake in Carrefour

- Jan 29, 2018 – 14% stake of Wanda for 34 billion yuan ($5.4 billion)

- Jan 31, 2018 – 2.5 billion yuan ($396.91 million) investment for 5.31% share in HLA, a Chinese menswear firm with 5,000 stores

- Feb 2, 2018 – 3 billion yuan investment in Shengda, a gaming company

And the list goes on…

Tencent is running one of the largest and most active investment funds in Asia. Today we look at the Tencent investment deals and try to predict what’s coming next.

Overview

According to IT Juzi, Tencent has invested over 422 billion yuan in over 350 companies since 2012. Considering the undisclosed deals, the actual investment amount is much higher.

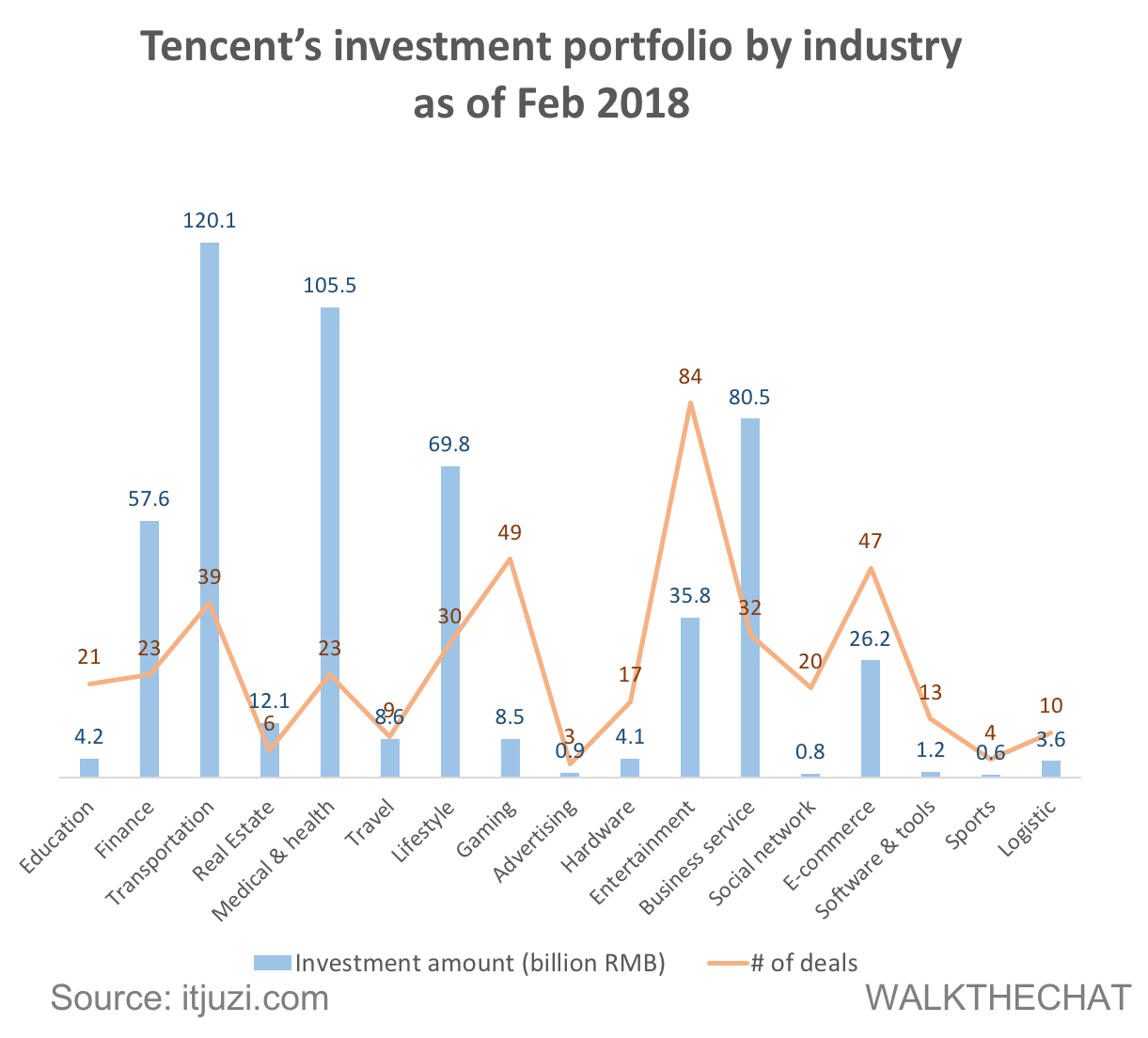

According to the graph below, its fund portfolio spans various industries, including transportation, medical & health, business service, lifestyle, and finance.

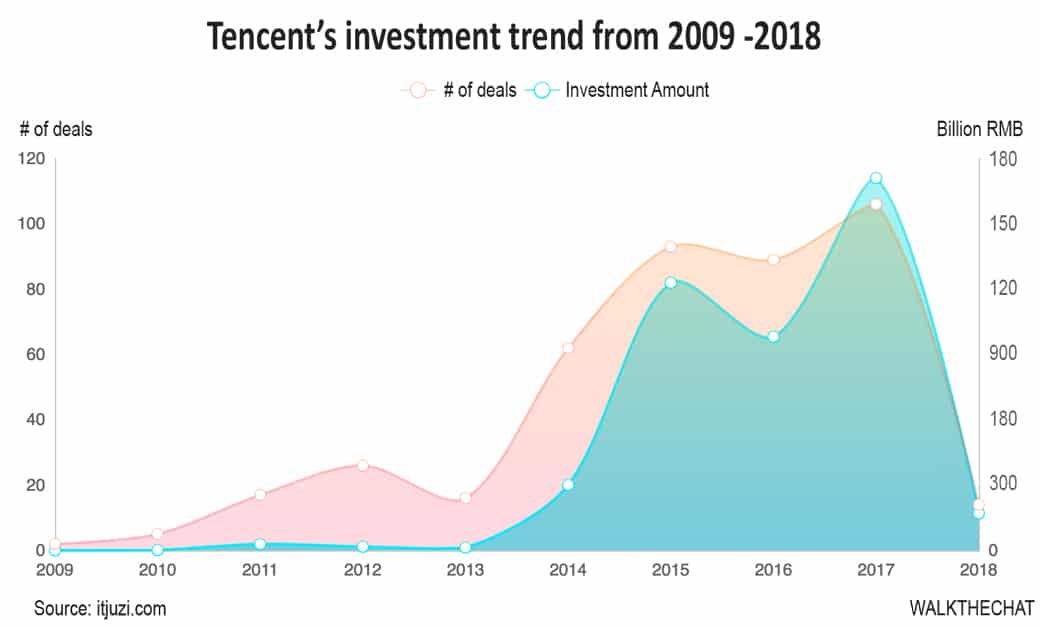

The investment frequency has surged last year. In 2017 alone, Tencent has made 105 investment deals for 171 billion yuan.

Tencent Investment Trend

The number of Tencent’s investment deals is 60% larger than Alibaba’s. 40% of the investments are into startups in their early funding stage; 28% in the development stage; and 17% are strategic level investments. The focus of 2017 was entertainment, business services, and hardware.

A shift in investment strategy since 2011

Tencent’s investment department was only founded in 2011. Tencent experienced a huge shift in strategy that year.

In November 2010, Tencent had a huge conflict with Qihoo, the producer of 360 Safeguard. The dispute soon escalated to a war during which Tencent stopped providing services to QQ users whose computers had Qihoo 360’s software installed. This unfair action from Tencent caused users’ anger in online forums and microblogs. The Ministry of Industry and Information Technology finally had to step in to stop this Internet war.

This was the famous 3Q war of 2010. After this crisis, Tencent has shifted its strategy to become a more open platform. It slowly shifted from building everything internally to collaboration with other industry leaders in areas other than gaming and social media. This involved a much more active investment strategy.

The Tencent investment activity significantly increased starting in 2014. That year, Tencent invested 15% into JD.COM.

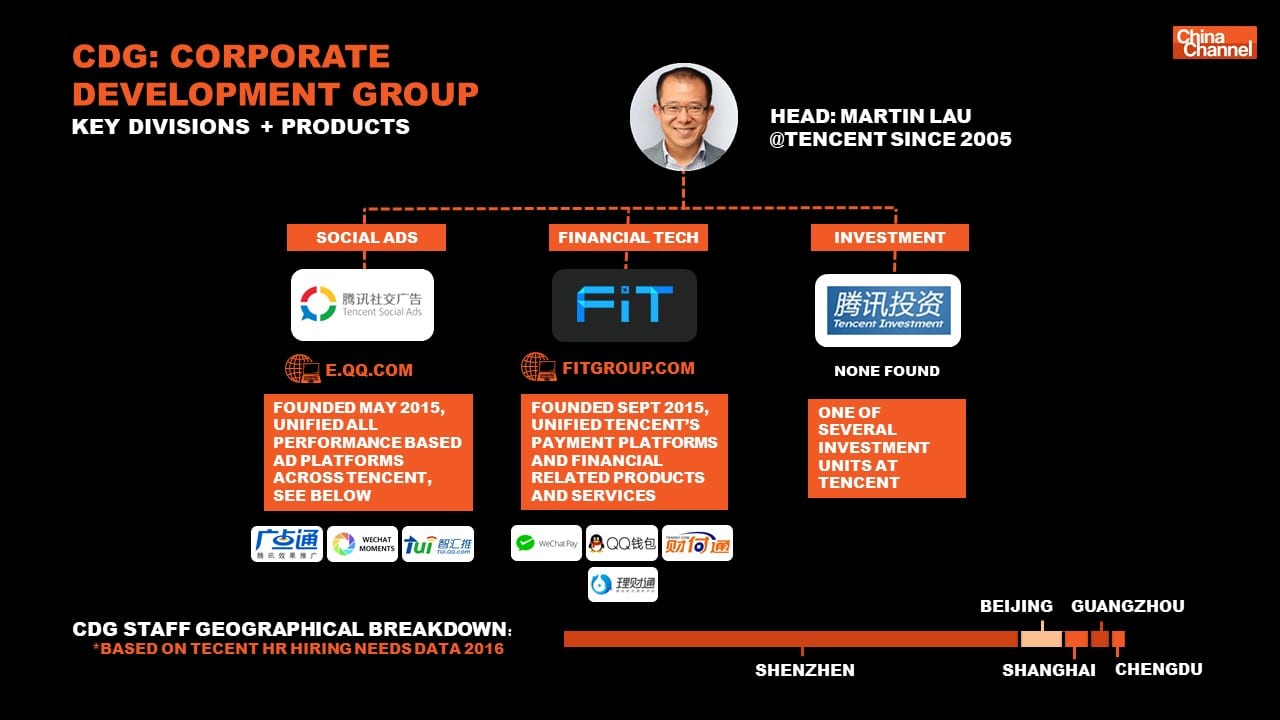

Martin Lau

The leader of this mysterious department is Martin Lau, the president of Tencent. Below is a chart of Martin’s management portfolio made by ChinaChannel.

In an internal conference, Martin disclosed that Tencent investment fund portfolio (of 600 companies in total) grew 113% in 2017, a speed that surpassed the growth of Tencent. Some of the successful IPO cases Tencent invested in include Sogou, Yuewen.com, ZhongAn Online, and Yinxin Group Limited.

Strong focus on retail in 2018

In 2018, the speed of acquisition is only increasing, especially in the retail area.

The 4 biggest areas Tencent investment team focused on are:

- High-quality content

- Advanced technology

- Business services

- New retail

“New Retail” means the combination of retail experience and digital solutions. This is the new strategic focus that Tencent added to its investment plan. According to a reliable source from AI Caijing, the focus of the first half of 2018 is on offline retail stores such as department stores and convenient stores.

“In the next 30 years, China’s economic growth will mostly depend on consumer spending upgrade. Internet will be the key to push retail brands and retail industry forward, thus having tremendous investment potential.” says Haifeng Lin, Tencent investment fund partner.

Haifeng points out that the current digital solutions for retail businesses are still not mature. For example, many membership programs only track the purchasing behavior of users, but do not track the channel of purchase or the motive behind that purchase. The future will depend on aggregating consumer data from all possible channels, and providing a customized digital service. This will be the biggest competitive advantage for tech giants such as Tencent.

According to the Department of Commerce, China’s consumer retail sales were up 10.2% to reach 36.600 trillion Yuan. E-commerce was up 28% to 5.5 trillion yuan. 85% of retail sales still happen in offline retail.

It’s clear that offline retail will be the next battleground between Tencent and Alibaba. And one in which Tencent definitely stands a chance, as most offline users have one App opened as they enter the store: WeChat.

Here is a graph showing the investment structure “war map” of Tencent and Alibaba in the supermarket industry as of Feb 2018.

Alibaba has been investing in retail stores for 3 years. It has invested in some of the best retail brands such as Intime Retail 银泰, Suning 苏宁, Sanjiang Shopping三江购物, Bailian Co百联集团, Lianhua Supermarket联华超市, Xinhuadu新华都, and Sun Art Retail Group高鑫零售.

Tencent only started investment in retail since last year, but it has already seized stakes in Yonghui Superstores 永辉超市, Carrefour China 家乐福中国, Wanda万达商业, BBK Electronics步步高, and HLA 海澜之家. JD, a strategic partner of Tencent has also invested in Walmart.

Some retail stores still remain independent, or have not chosen a team yet.

In the supermarket space, these players are still independent: Baihuo Wangfujing Department store百货王府井, Dashang Group大商集团, Ewushang鄂武商, Hualian Supermarket商超华联, Wumart物美, CSF Market超市发.

These convenience store giants have not picked a side either: 7-11, Lawson 罗森, Taiwan FamilyMart 全家, Quik快客, Meiyijia美宜佳.

Investment style in retail stores

The investment style of both Tencent and Alibaba are different.

Tencent is focusing on strategic investments. Most of its retail investments end up with Tencent controlling about 5% of the company. Investment is a tool for Tencent to build its ecosystem of allies. Even after Tencent’s investment, most of the companies stay independent on the operational level.

Alibaba’s investments usually end up with a much stronger restructuring model. The focus of the restructuring is decentralization. Alibaba reorganizes the structure of the acquired company to integrate the retail business with its marketplace platforms, bringing a more efficient logistic solution, and shared data. For example, when investing in Sun Art Retail Group, Alibaba spent 22.4 billion HKD in order to gain a 36.16% controlling stake.

The difference in investment style is caused by the difference in core businesses between Tencent and Alibaba

Alibaba’s core is e-commerce which has a strong correlation with retail business. Thus it brings more synergies to the deals, and is willing to take more risks in order to completely restructure companies.

Tencent is a gaming and social media company, e-commerce has been its weak point. “Usually the companies that choose Tencent are lacking either cash or technology. If the company is under larger operational pressure, they choose Alibaba so that it would bring a much larger change to their business” says Liayang, VP of Beijing Commerce Economy Academy.

Conclusion

As Tencent’s influence keeps expanding via investment deals, users can expect a more integrated ecosystem linking the online and offline world.

Most offline businesses might have to choose a side: Tencent and its ever-growing WeChat, or Alibaba and its e-commerce empire? This is a life-or-death decision that most retail groups will soon be forced to make.