Although the global personal luxury market is stuck in a holding pattern for the foreseeable future, China is likely to continue to make up for weaker demand elsewhere.

China’s Domestic Luxury Market Expands

Data published by global management consulting company Bain & Company in 2016 shows that China’s domestic luxury spending has been on the rise from 2014 to 2016, taking its market capitalization to nearly 170 billion. Compared with luxury goods spending overseas, local consumption increased 5%, resulting in the first reversal since 2001. All the data indicates Chinese consumers are doing more of their shopping in-country.

Shopping sprees are no longer the main reason for Chinese people to travel abroad. The narrower gap between domestic and international prices has led to a decline in overseas purchases. Since 2015, Chanel proactively took the lead in adjusting its pricing strategy by initiating a 20% drop in the price of the luxury goods in Mainland China and a 20% increase in their prices in Europe. The price difference between the two regions now runs at less than 5%. Subsequently, brands including Cartier also enacted price adjustments.

Changes in tariffs also helped expand China’s luxury market. At the beginning of 2016, the government reduced import and export taxes for more products in a bid to stimulate domestic consumption. Similar measures were also taken in June when tariffs were cut on various goods including clothes, shoes and cosmetics. The smaller the cost difference between domestic and overseas luxury markets, the more Chinese consumers buy luxury goods at home.

Changes on the Ground

According to data from Tencent and Secoo’s “White Paper on Online Retail for Luxury Goods”, young middle class consumers are the biggest online spenders. This group spends more time on mobile client apps and they have high expectations for interactive online services. Strong demand from this sector has prompted luxury brands to develop their digital marketing strategies.

Upon entry into the China market, luxury brands set up their own official retail websites to target Chinese consumers. However, these weren’t their primary sales channels and are now seen as display platforms.

The Early Years: T-mall

T-mall, owned by Alibaba, is one of the biggest B2C online retail websites in China and was the first Chinese e-commerce platform that most luxury brands cooperated with in China.

On April 24, 2014, Burberry was the first high-end brand to join T-mall with the lofty ideal of increasing its visibility among Chinese consumers. Following in Burberry’s footsteps, brands like Coach, Calvin Klein and Hugo Boss also began to sell on T-mall. Even though T-mall delivered lots of traffic in the beginning, only 2% of it produced purchases. For example, in its first 18 days on T-mall, Burberry only sold 132 items, 32 of which were later returned for a refund. And in the case of Coach, two years after launching on T-mall, they closed their flagship shop and look for other ways to interact with customers online.

So what happened?

- Fake Products

Although Alibaba Group chairman Jack Ma set up a program that effectively cracked down on US$ 1.7 trillion worth of trade in fake goods and promised that fakes had no place on his e-commerce platforms, it was still hard for Alibaba to change its image as China’s biggest counterfeit warehouse and pirated goods still appeared. Luxury brands didn’t want their products shown on the same page with counterfeits and off-brand products.

Fake Chole Drew Bag on T-mall. (left) • Real Chole Drew Bag on Chole website. (right)

- Image Mismatch

T-mall couldn’t offer luxury brands a trading platform with an atmosphere of rarity and exclusivity. T-mall is more of a hypermarket where people buy because of crazy promotions and lower prices. Luxury brands have fixed prices, crafted goods and curated images. It was impossible for them to flood the market by cutting prices or selling unwanted goods. A luxury brand sale on T-mall would result in brand dilution.

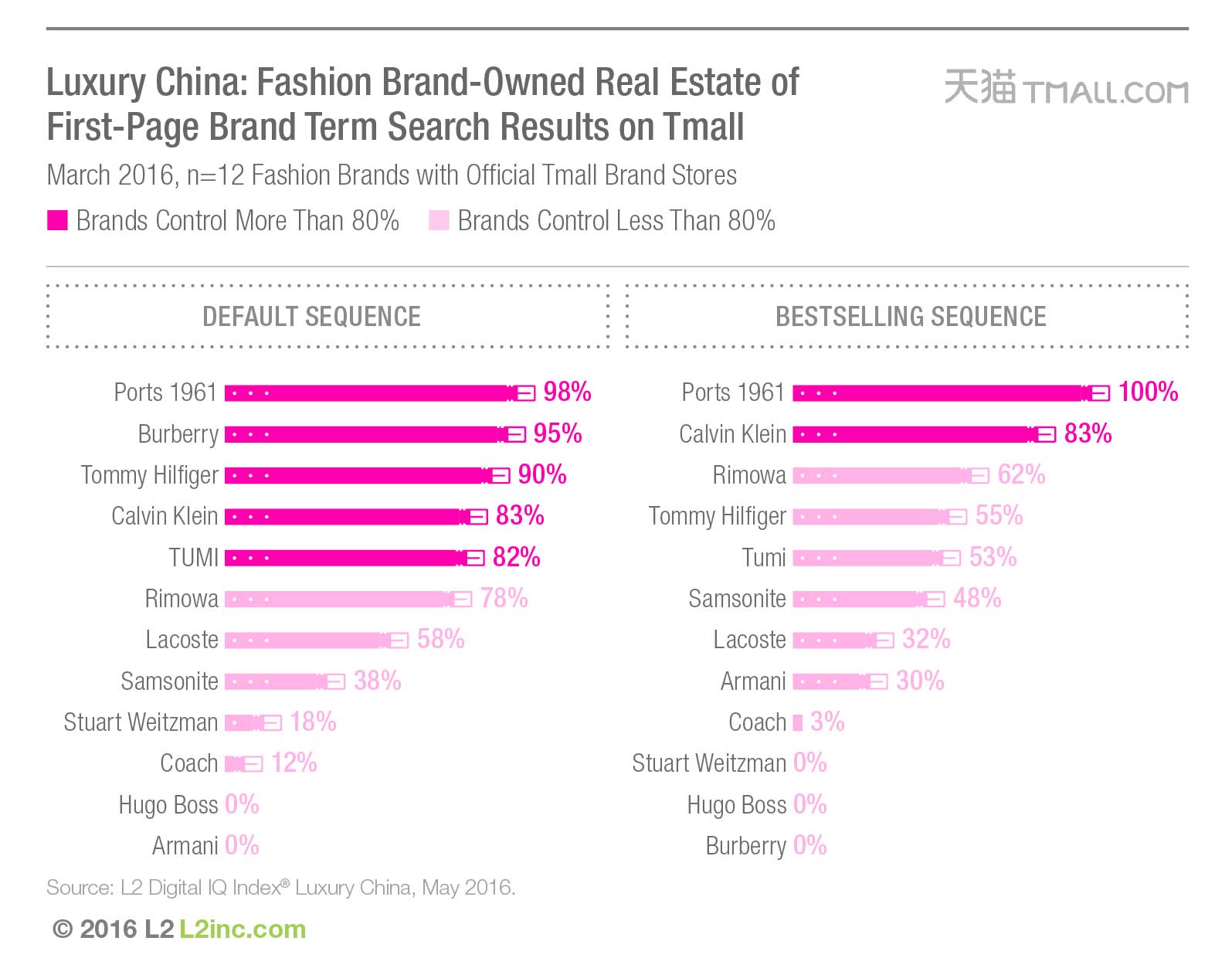

- Hard to Control and Drive Traffic

Luxury brands’ lack of control in terms of customer traffic and audience targeting was also a problem. Surveys from l2inc.com show official T-mall flagship stores receive no priority when an online shopper searches for a brand online. Just a few of the luxury brand T-mall stores, such as Burberry and Tommy Hilfiger, receive more than 90% of the search results for their brand name. Most brands, such as Coach, Hugo Boss and Armani have really low search engine priority.

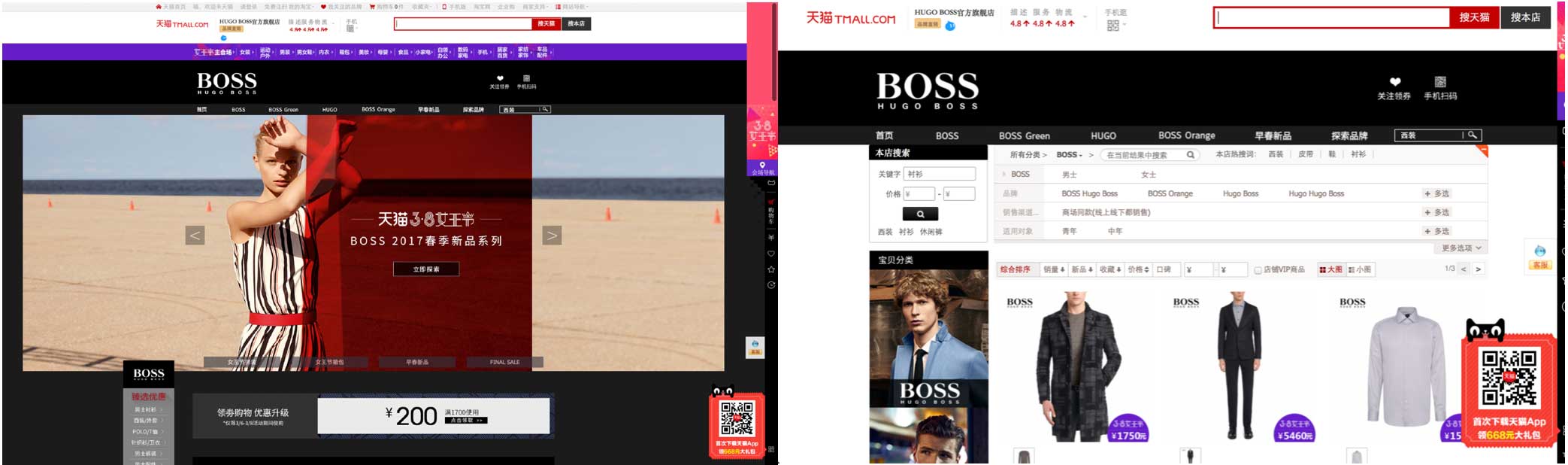

- Lack of Customizable Design Elements

Although T-mall provided interfaces for brands, the page designs were similar. The stiff, formal design and lack of interesting functions didn’t give customers a positive or meaningful visual experience and weren’t suited to high-end goods.

↑Hugo Boss’s T-mall flagship store.

↑Hugo Boss’s T-mall flagship store.

- Lack of Interaction

T-mall is a straightforward website for business-to-consumer online retail. It doesn’t provide ways for brands to connect with a community of their customers. AliWangwang, an embedded instant messaging program, is the most popular tool that brands use to interact with their customers. However, it’s mainly used to inquire about products, engage in bargaining and other basic interactions between brands and customers. It’s difficult to engage in any higher level communication, such as giving consumers clothing coordination tips, inspiration for industrial design, etc.

These failures on T-mall prompted luxury brands to look for more suitable platforms.

Along Comes WeChat

WeChat, by contrast, supports various interactive functions that brands can use to contact current and potential customers and engage in marketing and sales. Brands can post content, launch innovative giveaway campaigns, conduct online polls and even send private messages to customers.

Here are some examples of how luxury brands use WeChat to drive sales.

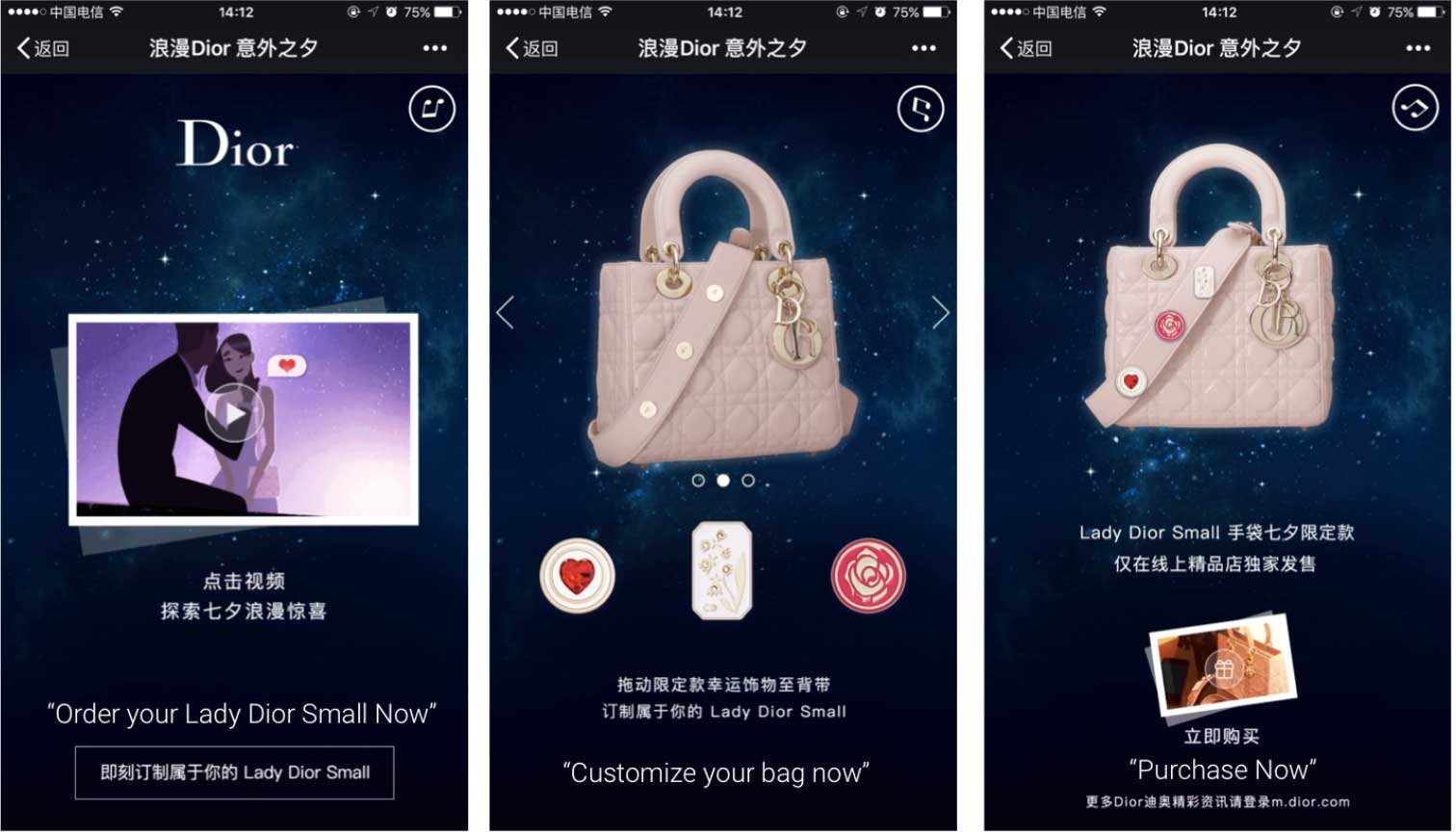

- Online Customization Campaigns

Many luxury brands have conducted sales-driven campaigns on WeChat. On Chinese Valentine’s Day 2016, Dior launched an online customization campaign for its Lady Dior handbag. Users could choose the accessories for a small Lady Dior bag and directly purchase it using WeChat’s payment system or Alipay. The limited-edition bags, which cost 28,000 RMB each, were sold out within a day.

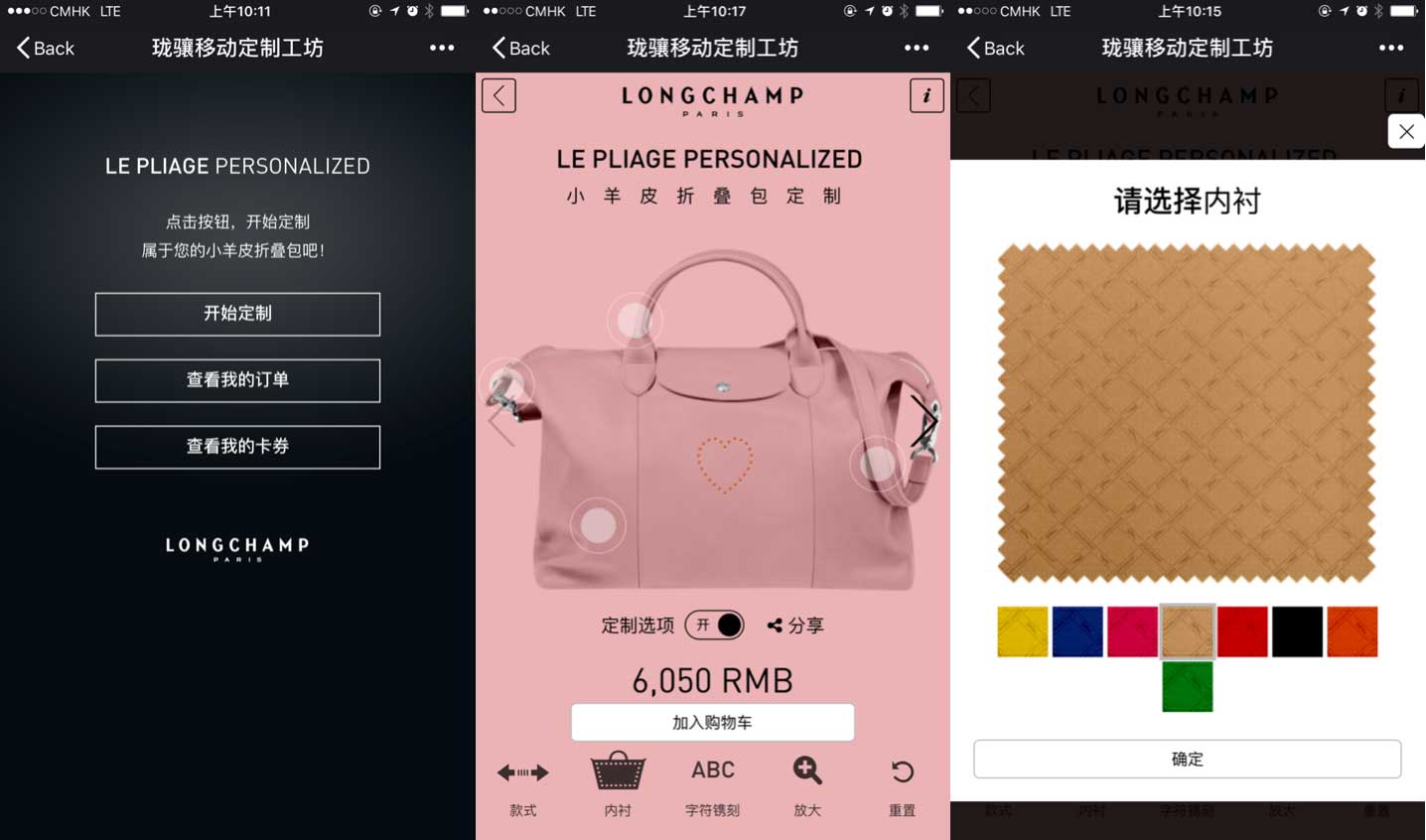

The success of Dior’s WeChat e-commerce strategy has encouraged more luxury brands to follow their lead. For example, Longchamp started a personalization service for its Le Pliage line through their WeChat account. Users can select the color combination of the handbag and choose words to be embossed on the bag. After personalizing it, consumers can, with a few more clicks, purchase it and pick it up in a nearby store or have it delivered to their home.

- Quality Linked Content

Luxury brands update their WeChat content frequently. Most of them post one article per day. They combine their sales links with articles that have catchy titles, interesting text and high-quality pictures, GIFs, and videos. This leads to a seamless and convenient shopping experience connected to a brand image controlled and curated by the brand.

- Exclusive Deals

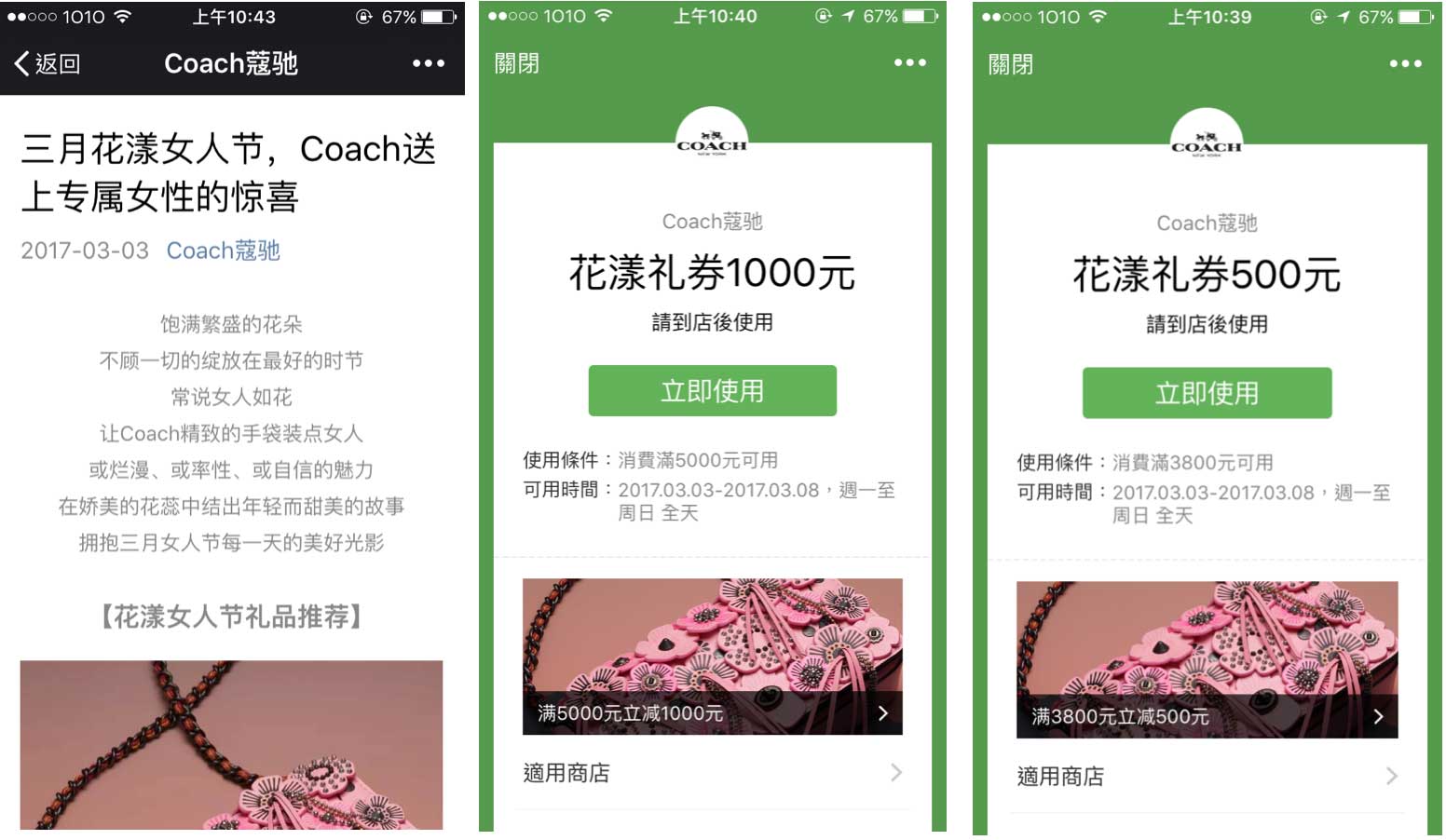

Some brands also excel at distributing WeChat coupons to engage fans and drive sales. In honour of International Women’s Day on March 8th, Coach invited their followers to celebrate in-store. Coach offered a 500 RMB cash coupon and a 1000 RMB cash coupon that people could use or share with a friend.

- Online Consultations and Reservations

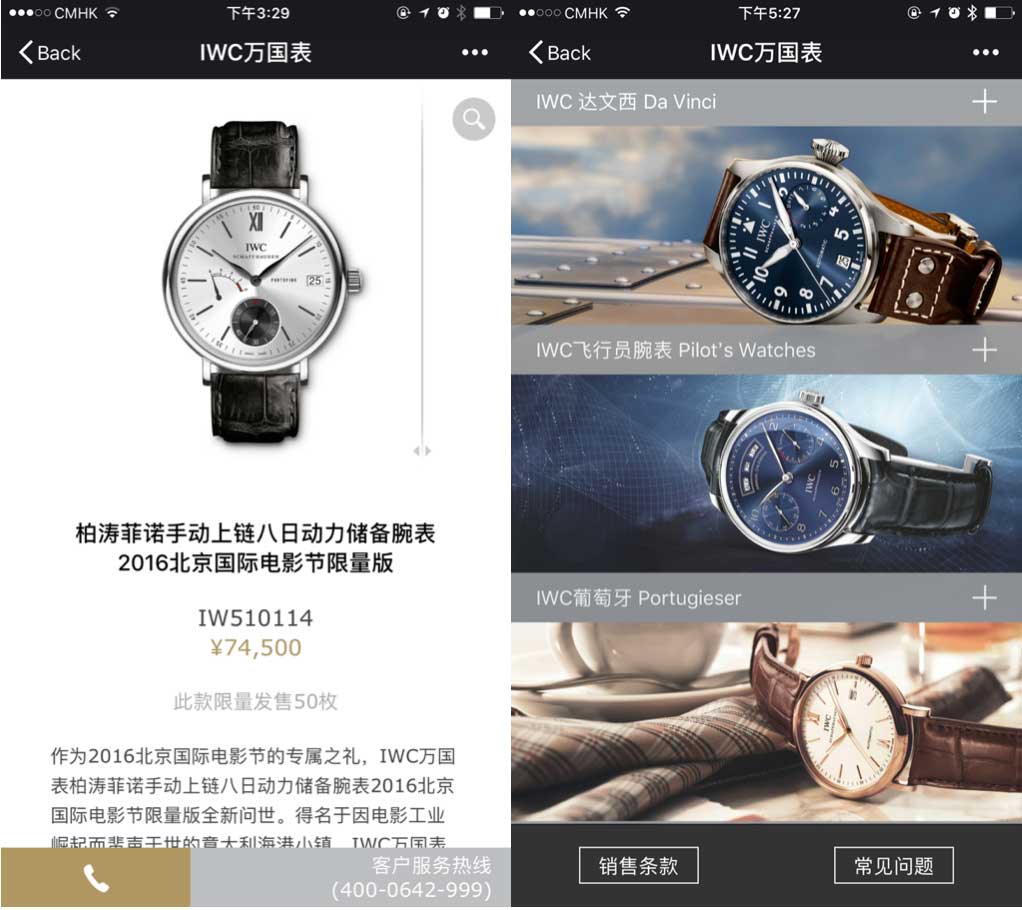

Some brands have responded to the needs and feedback of their Chinese online customers with unique solutions. International Watch Company offers detailed information about its limited editions and customers can contact the sales team to reserve one if they’d like to buy it. Similarly, Cartier has a reservation system that allows consumers to book an in-store consultation.

- Intelligent Positioning Systems

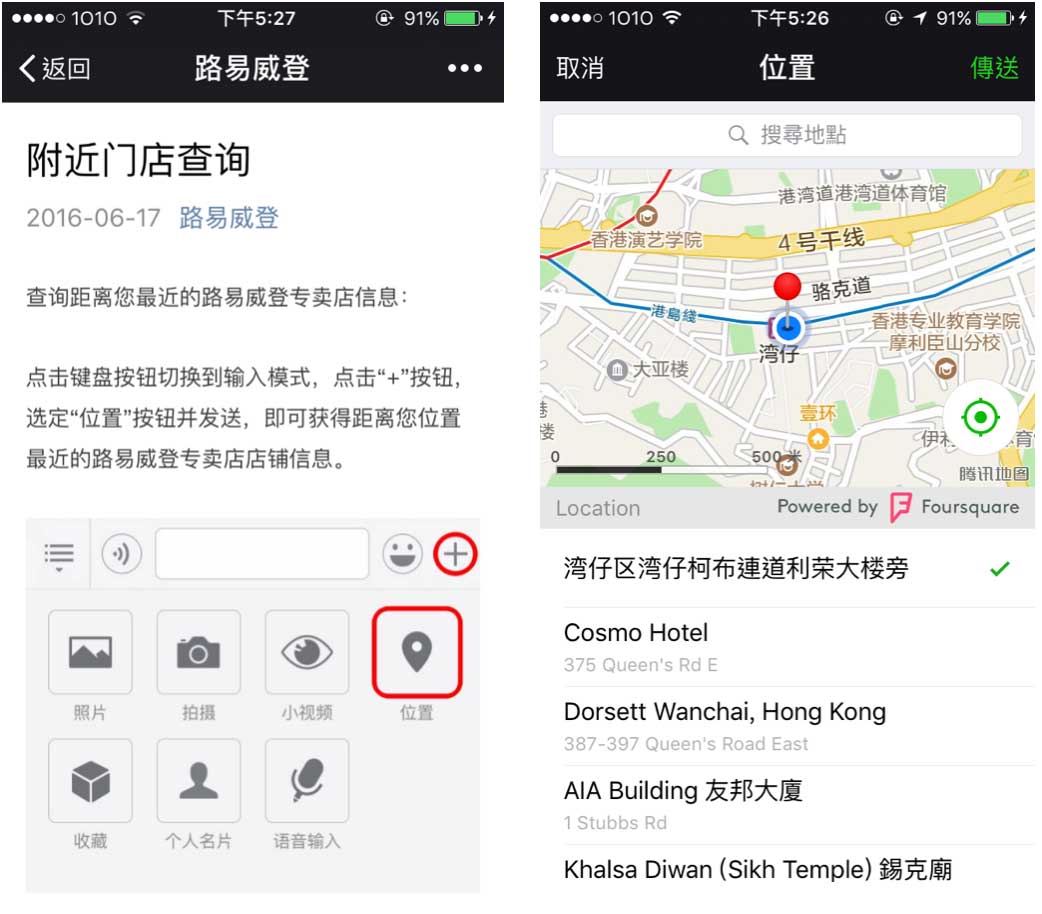

According to L2’s Digital IQ Index® Luxury China: WeChat report, 53% of luxury brands in China have activated the location identification function in their official WeChat accounts, compared with 15% doing so for their stores outside of China. This service helps users find the nearest retail store. In the case of Louis Vuitton, users can receive the store location by sharing their own location with WeChat.

Conclusion

WeChat’s platform provides a personalized and functional platform for consumers and a more communicative and customizable platform for sales. By enhancing interactions and building a lively brand image, luxury brands aim to attract more potential consumers and strengthen brand loyalty, interactions and sales.

Given the reduction in luxury purchases in many markets, WeChat has become a key opportunity for brands to revive their growth. The platform however comes with some drawbacks: it doesn’t benefit from the organic search volume of Tmall and Jingdong. It is therefore a useful complement to drive impulse purchases, or for new brands entering the market without an existing search volume in China.

This article was provided by ChoZan

ChoZan is a resources platform for marketers who work with Chinese social media, such as WeChat and Weibo. ChoZan provides marketing teams the step-by step navigators, consumer trends, case studies, KOL lists, Helpdesk support and more. Please book your demo here.