Tencent, Alibaba and Baidu are very different companies with one common denominator: diversification. The 3 China tech-leaders are launching forays in many industries, and often end-up in fierce competitions.

In which sectors are BAT (Baidu Alibaba Tencent) investing, how, and how much?

Financial services and micro-loans

Tencent teamed up with China Rapid Finance

China Rapid Finance, allegedly the largest online consumer lending marketplace (and which recently raised a $35 million round) teamed up with Tencent in order to benefit from the huge amount of data from China’s number 1 mobile ecosystem.

The company already operated 2.5 million loans, and hopes to market to 50 million more potential customers which were identified via the data provided by Tencent.

Tencent considering investment in student-loan start-up Fenqile

Tencent is considering an investment in student loan start-up Fenqile. The start-up provides very small loans to students, and uses peer-pressure to ensure a high-repay rate (Fenqile declared its default rate is bellow 1%). It is valued at about $1 billion.

Tencent invested in Fenqile, which means “happy installments” in Chinese, runs a shopping site where college students borrow money to buy goods and pay back the loans in monthly installments.

Alibaba led a $200-million investment round for Qufenqi, Fenqile’s main competitor

Last August, Alibaba led a $200-million investment round Qufenqi, Fenqile’s main competitor (bringing the total amount raised by the company to more than $400 million). Qufenqi operates on a similar business model than Fenqile, providing young students or workers with smalll loans and monthly re-payments.

Alibaba’s financial arm Ant financial received investment from China Post Group

Earlier this year, Ant Financial (Alibaba’s spin-off for financial services, including Alipay and Yu’e Bao) received investment from China Post Capital, which hence became Ant Financial’s largest stakeholder.

The partnership will enable Alibaba to benefit from China Post 40,000 branches, giving unprecedented opportunities for O2O integration.

Alibaba’s Ant Financial invested 1.2 billion yuan into Taiwan’s Cathay Financial Holdings

Following the deal, Ant Financial owns 60% of the company, thus enabling Alibaba to enter the fast-growing online insurance business.

Albeit being a very concentrated market (with gigantic players such as Ping’an) the market has seen a large number of smaller and rapidly-growing players appear via digitisation.

Tencent-backed fully-online bank WeBank rolled-out last August

WeBank, a Tencent-backed (and therefore tightly WeChat-integrated) online banking service rolled out last August.

The service remains very simple in its features (as security concerns remain, for instance regarding account creation) but represents an interesting experiment in what is likely to become a soon-to-become fully-digital banking industry.

Healthcare sector

Tencent backed online medical service provider Guahao

Last year, Tencent invested $100 million USD in online medical service provider Guahao.

Initially focusing on appointments with doctors, the APP is now expanding its services to online diagnosis and ratings, trying to improve the experience of patients visiting Chinese hospitals.

Guahao announced last September a $394 Series C funding, to which Tencent also participated along with various other investors.

Tencent invested $70M in Health Service Community DXY

September last year, Tencent invested $70M in online healthcare service community DXY (which is claiming 4 million registered members)

The services, along with Guahao, are being integrated in Tencent services cloud: WeChat City Services (which already enables doctors appointmetns in some trial cities)

Tencent led $40 million Series B for “Doctors social network” Medlinker

Last September, Tencent invested $40 million Series B in a fast-growing start-up enabling communication between Healthcare professionals.

The platform which enables doctors to communicate and exchange information, already claims more than 200,000 active users.

Alibaba acquired controlling stake in CITIC 21cn for US$172.23 million

Alibaba acquired a controlling stake in the pharmaceutical data company, and integrated its database of drugs into its e-commerce and cloud-computing platform.

Baidu invests US$40 million in healthcare service Quyi

Tencent and Alibaba are not the only tech players eying the healthcare sector: Baidu also invested $40 million in healthcare service provider Quyi.

Quyi’s main APP, Quyiyuan, is providing very similar services to their Tencent & Alibaba equivalents: doctor appointments, online diagnosis and payments

Food delivery and restaurant booking

Tencent backed food delivery App Ele.me got $630 million in Series F funding

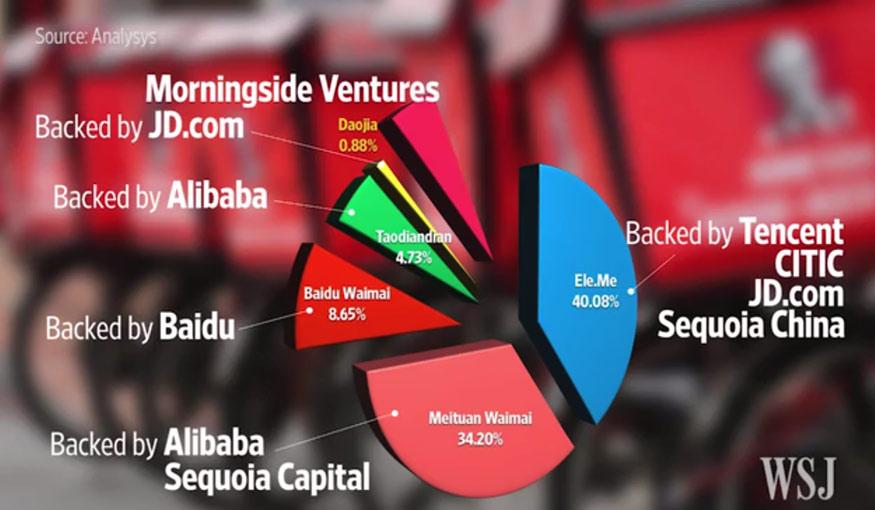

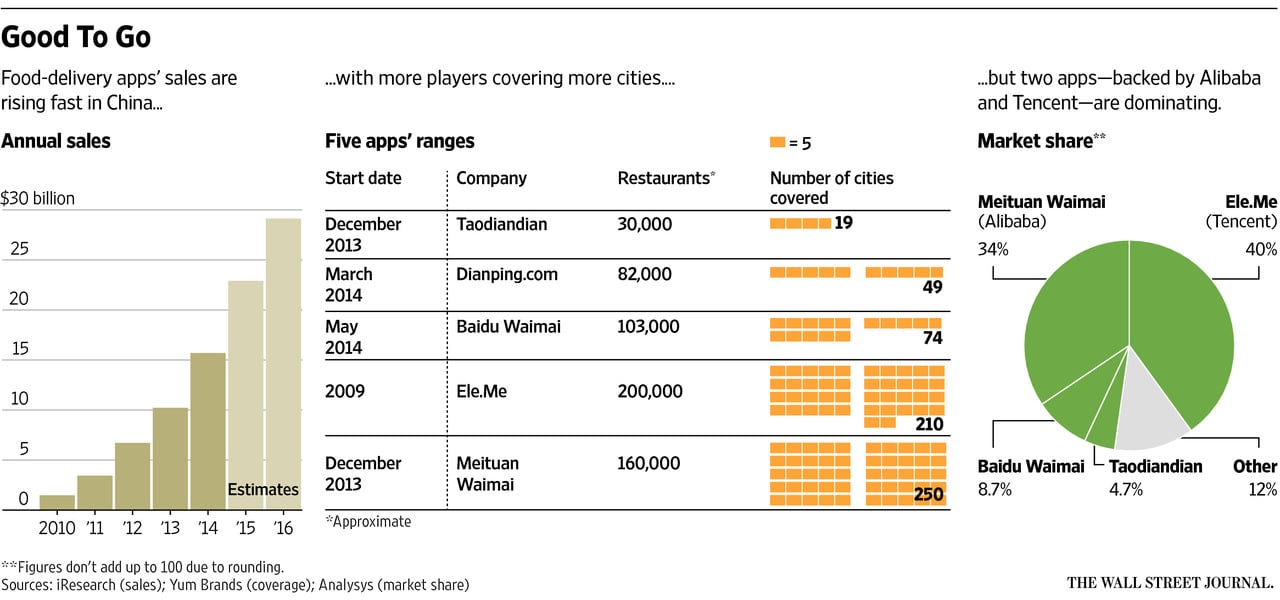

Uniformed food deliverymen on their electric scooters are fast becoming a fixture of major Chinese cities. Online-to-offline (O2O) food delivery model allows Tencent to leverage the growing trend of mobile phone owners, combining e-commerce with the traditional restaurant industry. And Ele.me leads the country’s food ordering market with 40 percent market share, according to Beijing-based research firm Analysys International.

Source: Wall Street Journal, Analysys International

Alibaba backed Meituan Waimai seeking for the next funding round

Meituan comes in second to Ele.me taking 34% market share. However O2O food delivery is not a cheap industry to be in. Chinese consumers are so sensitive to price that the choice of where to order dinner can be solely based on which platform gives out more coupons. In the pricing war again Ele.me, Meituan seems to used up its $700 million funding from Series D early in January this year and is now seeking for the next funding round, aiming at 100 million.

Tencent backed Dianping values at $4 billion

Dianping the largest restaurant review and group-buying App in China. Since April this year, it raised $850 million from a group of investors including smartphone maker Xiaomi Corp. making it the second-largest on record for a Chinese startup. Dianping is also integrated with WeChat makes it easier for users to review restaurant and buy restaurant coupons without leaving WeChat.

Baidu invested $3.2 billion in its group-buying service Nuomi

First it’s group buying, then it’s daily deal, and now it’s called O2O. What every you want to call it, Nuomi started out as a group buying site, and it’s fair to say that the service has grown beyond that description. Nuomi is an e-commerce platform for selling products, restaurant coupons, movie tickets and experiences. And by taking majority share in Nuomi, Baidu is in position to fight an uphill battle against e-commerce giant Alibaba.

Oversea expansion

Alibaba invested $500 million in Indian e-commerce firm PayTM

For many Chinese tech companies (first of which being Xiaomi) India is the next frontier for their international expansion.

Alibaba thus invested $500 million USD in India’s e-commerce company PayTM, thus acquiring a 25% stake in the company, via its financial arm Ant Financial.

Alibaba invests US$ 1 billion in building a global cloud computing network

Alibaba Group announced a planned $1 billion investment in developing its oversea cloud computing business.

The investment plan will support the establishment of new centers in Middle East, Singapore, Japon and Europe.

The company also entered a strategic partnership with the enterprise management software Yongyou Software, which might help Alibaba extend its reach in the Asia Pacific region.

Alibaba acquired translation company 360 Fanyi to support cross-border business

Alibaba recently announced the complete acquisition of 360 Fanyi, a translation company with which Alibaba Group had already partnered with since last April.

The acquisition will help support the Tmall Global and AliExpress expansion, enabling Chinese companies to reach oversea markets and oversea vendors to tap into the much sought-after Chinese upper-middle-class market.

Tencent invested $50 million USD in WeChat-copycat in Canada: Kik

Kik has always proudly claimed being inspired by China’s most popular messaging APP. It might therefore be encouraging that they got last August funding from none other than Tencent.

The $50 million USD investment will help Tencent build assets outside China, while WeChat is struggling to gain traction outside Chinese-speaking countries, and especially so in America and Europe.

Other O2O investments

Baidu invests USD $85 million in used-car saes APP Renrenche

Founded by former Baidu employees, the company enabling selling used cars for a small commission fee (3%) was already valued over $500 million USD after 1 year of operation.

Tencent and Jingdong had also jointly invested $1.55 billion in the network Easy Car (which also includes second-hand car selling) while Alibaba integrated its own second-hand car market to its platform.

Baidu led $100 million series B in e-washing APP Edaixi

E-daixu enables its users to have their dirty laundry picked up, and delivered back clean to their doors within 72 hours.

The company had received its angel funding from Tencent, and claims 5 million users with over 100,000 orders per day.