Niche brands, such as Nanushka, Rouje, Jil Sander, Stussy, have been extremely popular in China for the past few years, and many niche brands have their eyes on China.

This article will analyze Chinese niche brand Songmont went from 0 to 10 million RMB of sales in their local market.

👜 Brand overview

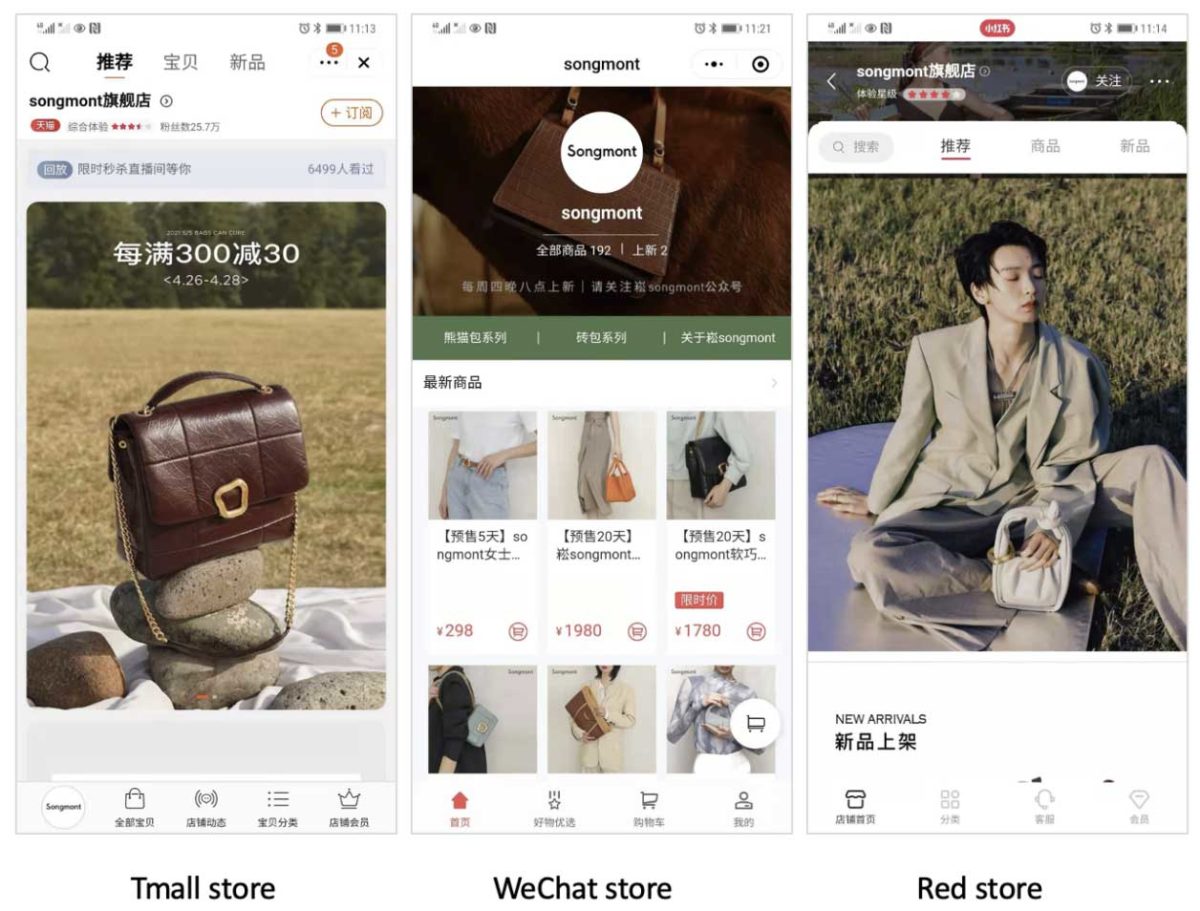

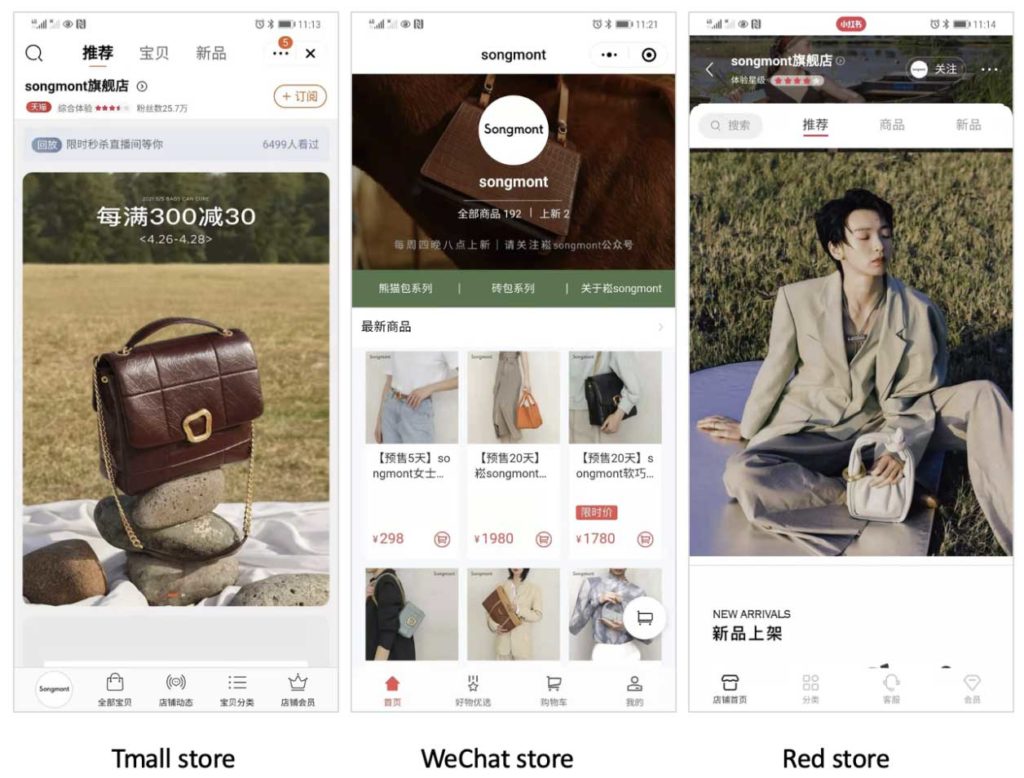

Songmont is a premium local Chinese handbag brand with an average handbag price range from 1,000 RMB – 2,500 RMB.

Starting from 2019, Songmont began to invest massively in influencer campaigns on WeChat & Red (including sales-focused campaigns on WeChat, sales-focused live-streaming campaigns on Red, branding-focused KOL & KOC campaigns on Red) in order to boost sales. In the same year, their annual revenue reached 10 million RMB.

WeChat strategy: start small for exposure, then go big for sales

Like many other niche brands, Songmont first started working with the smaller-size WeChat KOLs in order to test the market with a limited budget. Smaller-size WeChat KOLs are more affordable, which makes them a better testing ground for an early-stage brand.

Songmont has a total of 359 mentions from WeChat official accounts, and only 18.6% of the mentions are coming from the Tier 1 KOLs. The majority of mentions come from middle-size KOLs with less than 30k article view.

Source: WalktheChat Analysis, WeChat

Once the brand improved its social presence, it started focusing on bigger WeChat KOLs to boost sales.

Songmont has launched 21 WeChat KOL campaigns since 2021, much more focused on larger influencers.

Source: WalktheChat Analysis, WeChat

Almost half of Songmont’s promotional campaigns are collaborations with Tier 1 KOLs and middle-size KOLs.

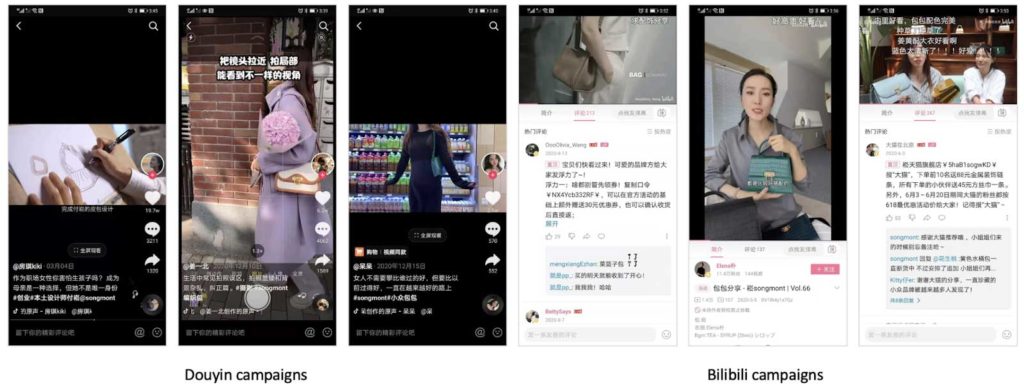

Apart from adjusting the KOL strategy for WeChat & Red, Songmont also started to leverage KOLs from popular video-content platforms including Bilibili & Douyin. These platforms offer access to a broader user base, as they rely more on customizing each user’s feeds through powerful algorithms.

Bilibili strategy: a mix of exposure and sales-driven campaigns

Bilibili started as a platform focused on animation, comics, and games. It is therefore the perfect platform to target the younger Gen Z. Fashion is still a niche category on the platform, enabling brands to stand out.

Songmont repeated their WeChat strategy: being a relative upstart on the platform, they started by targeting smaller KOLs to gain initial momentum.

Source: WalktheChat Analysis, Bilibili

Here again, Songmont favors smaller-size KOLs with followers around 10,000 to 50,000 for branding campaigns and relatively bigger KOLs with 100,000+ followers for sales-focused campaigns (with direct link to their Tmall store).

Songmont also favors investing in spot promotion among other products/brands for branding campaigns: this is an efficient way to receive a proper mention on Bilibili without paying the price of a whole video content.

Douyin: branding campaigns to get customers familiar with the brand

As the most trending video APP, Douyin now has an DAU of 600+ million. However, most users use the APP to kill time: the sales conversion for expensive products is low. Songmont, hence, favors branding campaigns on Douyin to get as many potential customers familiar with the brand as possible, focusing on branding rather than sales.

The brand’s approach for Douyin is straightforward: focus on the middle-size KOLs and Tier 1 KOLs with 100,000 to 1,000,000+ followers who have large groups of young female followers from smaller cities in China.

Source: WalktheChat Analysis, Douyin

Songmont launched 10 KOL campaigns since December, 2020 to April, 2021, all the campaigns are collaborations with Tier 1 KOLs and middle-size KOLs.

The branding campaign between Fu Song, the founder of Songmont, and Tier 1 KOL Kiki with 10+ million followers, reached 197,000+ likes, 3,211 comments, and 1,325 reposts.

Conclusion

Songmont, as a local upstart who quickly went from 0 to 10 million RMB revenues, presents a good footprint of success in the Chinese market:

- Working with plenty of small-size KOLs on WeChat & Red in the initial stage for exposure and sales

- After getting initial momentum, switching investment to middle-size & Tier 1 KOLs on WeChat & Red to boost sales

- Leverage video platforms to reach a broad audience for branding purpose

- Bilibili: working with smaller KOLs for both branding & sales

- Douyin: working with middle-size KOLs and Tier 1 KOLs for branding

- Once the brand gains significant momentum, launch collaboration campaigns with Top Tmall live-streaming KOLs to take the brand to the next level. Songmont worked with influencers including Viya (2020 Sep) & Li Jiaqi (2021 Apr & 2021 June).