A short history of Douyin

Dou Yin is an impressive product: it was developed in 200 days, and within a year got 100 million users, with more than 1 billion videos viewed every day.

How did a team of 8 achieved such as result in just 500 days? Let’s look into it.

What is Douyin?

Douyin is a short-video App with powerful editing capabilities. It enables users to add music and effects to their videos in order to make them more interesting/creative.

Here’s a reel of some Douyin videos. Have a look, but don’t forget to go back to reading the article once you’re done 😉

Why do all of these effects matter? Creating interesting video or audio content is remarkably difficult (much more so than writing interesting articles – and even that is tough, I can tell you) – providing tools to make the content richer and funnier is incredibly valuable

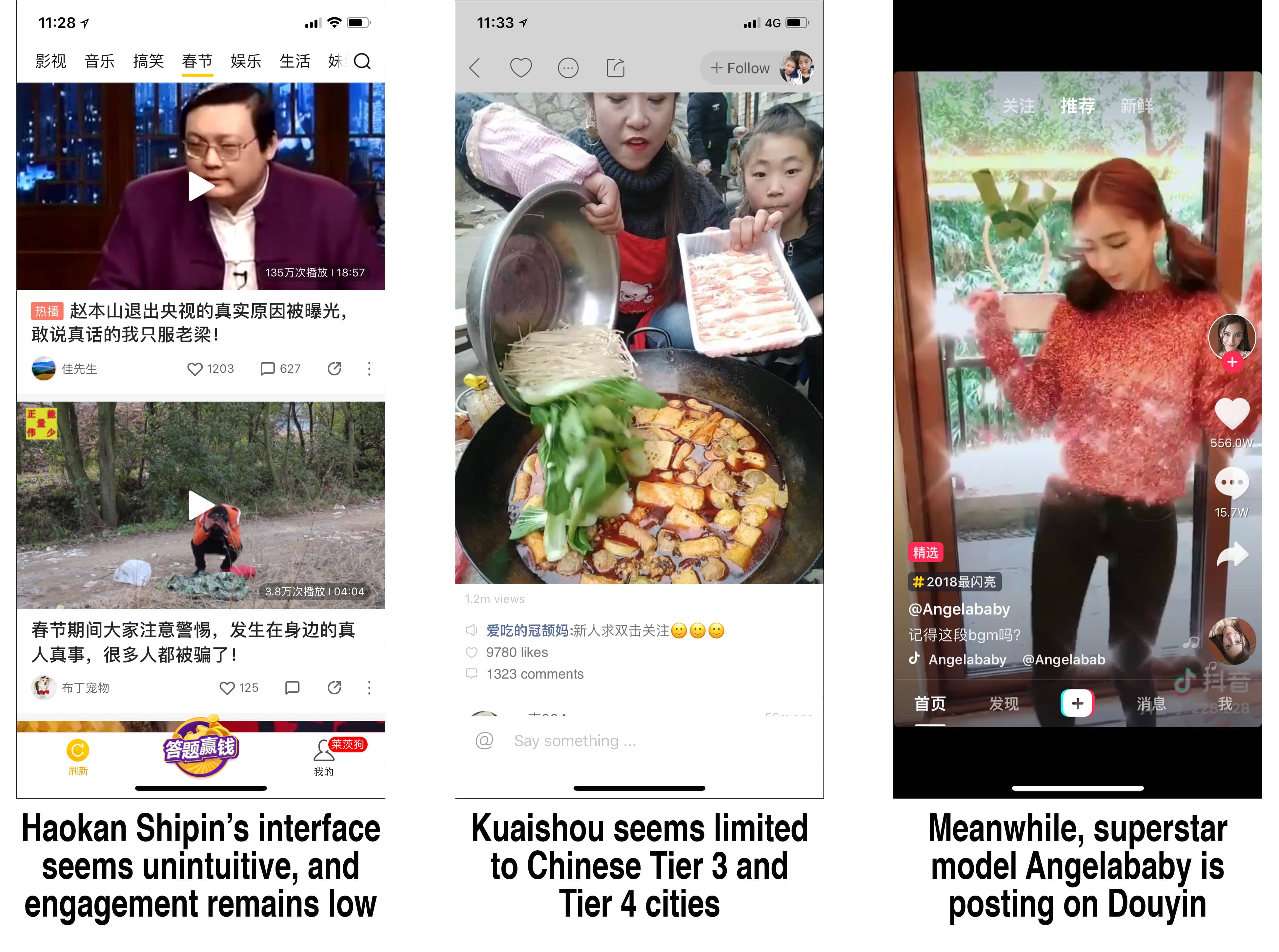

Another game changing aspect of Douyin is its interface: while competitors like Kuaishou are asking users to click on videos, Douyin has a more convenient and addictive “swipe” interface (similar to Musical.ly and… Tinder)

Competitive landscape

The market of short videos in China is not anything new: some of the entrants started as early as 2011.

Who did Douyin have to beat in order to make its way to the top?

- Kuaishou (快手): launched in 2011. In March 2017, it received a 350 million USD investment from Tencent. In November 2017, Daily Activer Users had already exceeded 100 million

- Miaopai (秒拍): launched by Weibo in 2012, Miaopai benefited from the traffic generated by its parent company. However, its core product remained mediocre and performance has been disappointing. Miaopai still managed to raise a 500 million USD E round of funding in November 2016

- Haokan Shepin (好看视频): a project of Baidu, “Haokan Shepin” relies on Baidu’s technological resources and know-how. Launched in November 2017, it already ranks #27 among the free Apps on App stores.

Kaishou is mostly present in Tier 3 and Tier 4 cities in China. Its content consists mostly of users showing off wealth or flirty behavior.

This is quite different from Douyin’s positioning: most of its users are in Tier 1 or Tier 2 cities, and are young people, often below 24 years old. Douyin’s content is often fun and quirky, appealing to a more educated audience.

Of course, this is a curse for Kuaishou who would like to appeal to these younger and wealthier users (who are more valued by advertisers and investors alike), but Douyin seems to only be getting stronger.

Miaopai appears as a weaker contender due to it mostly relying on Weibo’s support. Haokan Shepin is a new entrant which still has to prove its capability to make a dent in this crowded market.

A story of Douyin

Douyin experienced a meteoric rise in the span of less than 2 years.

- 2016-09-26 A.me official launch

- 2016-12-22 A.me changed its name to Douyin

- 2017-01-09 Receives several million RMB of seed investment from Toutiao

- 2017-03-13 Yue Yunpeng forwards a short video with a Douyin watermark, which is forwarded 5,083 times, and receives 83,175 likes.

- 2017-08-11 Video views exceed 1 billion

- 2017-11-10 Toutiao purchases Musical.ly for 1 billion USD and merges it to Douyin

- 2018-01-23 The App starts getting international success, ranking #1 among free App downloads on App stores in Thailand

The phases of Douyin’s growth

Phase 1: September 2016 – April 2017

The early phase of September 2016 was mostly about refining the product and finding a core group of early adopters.

It was also the opportunity for Douyin to improve their branding by changing their name and logo in order to get ready to scale.

In order to kickstart growth, Douyin integrated social sharing with QQ, Weibo and WeChat, knowing full-well that users would be thrilled to share their well-edited videos, taking users back to the App.

Comments on the App Stores were overwhelmingly positive. Two main criticisms were directed toward Douyin at the time:

- Being a Chinese version “copycat” of Musical.ly

- Some technical issues (login glitches, etc.) which ended up being quickly solved

Phase 2: May 2017 – December 2017

This second phase marked the explosive growth of Douyin. This growth was partly fueled by sponsoring some major Chinese variety shows in order to gain exposure, such as “Hip-Hop in China” (中国有嘻哈), “Happy Camp” (快乐大本营) and “Everyday Upward” (天天向上).

Douyin also perfected its App by including a wider choice of filters, stickers and effects which could be added to the videos to make them more engaging.

The App also started exploring opportunities for monetization. In September 2017, it ran a first advertising campaign with sponsored videos from Airbnb, Harbin Beer and Chevrolet.

The campaigns were a success, and Douyin stated that this model was the future of its monetization. As we discussed, the upscale audience of Douyin makes it an interesting platform for such campaigns.

Finally, this second phase of development also saw the entry of Douyin in live streaming. The live streaming capability was restricted to users with substantial audiences (above 50,000 or so).

Live streaming provided Douyin with another opportunity for growth and monetization, and its strong foothold in short-videos enabled it to enter a promising but extremely competitive space.

Comments on the App store during this growth phase were overwhelmingly positive, insisting on the addictive nature of the App. The few negative comments were largely linked with the performance issues linked with the surge of users, which put some stress on Douyin’s infrastructure.

Phase 3: December 2017 to today

At this stage, Douyin had made this way all the way to the #2 rank of the Apple Chinese App store, and first in the video/photo category.

Douyin however still managed to move forward and extend its scope by introducing a “Live Q&A” function which spawned a new wave of growth. By pricing the cost of having a question answered much lower than other platforms (users have to pay to get an answer, but they pay only about 3 RMB against hundreds of RMB on other platforms) Douyin managed to further fuel its growth.

This current phase is also the one in which Douyin has to deal with the drawbacks of growth: with an user base of more than 100 million, avoiding nefarious behavior is a challenge. The App has to keep getting better at monitoring videos and comments in order to maintain a healthy environment for its users.

It is also the opportunity for Douyin to go abroad. Under the name Tik Tok, the App has so far shown impressive results, making it all the way to the top of the Apple store “Free apps” ranking in Japan and Thailand.

Conclusion

Douyin has doubtlessly been one of the most successful Apps of 2017. It showed impressive skills in product development, and perfectly paced its investment in growth in order to take over long-established and well-funded incumbents.

The App now has the opportunity of becoming a truly global leader in its space, becoming one of the first Chinese apps to successfully gain worldwide reach. International expansion will be the main opportunity and challenge for Douyin in 2018.

Douyin most successful campaigns

A cute puppy on Douyin grabbed your attention, bringing a burst of happiness so brief it’s addictive. Conveniently you swiped up to a bottomless feed of 15-second videos, from people (often attractive young females) eating/making food, doing passionate lip-syncs and comical dances, shopping, to holding some more puppies.

The Chinese mini-music-video social network combine funny and interesting short clips, an immersive full-screen interface and powerful AI for its sticky magic.

Who is watching?

Having grown to about 154 million monthly active users, Douyin was the 6th most downloaded app in the world in the first quarter of 2018, combining iOS and Android app downloads. It was also the most downloaded non-game iOS app in the world, beating such big names as YouTube, Instagram, Facebook and WhatsApp in download charts.

Considering that Android users in China have to download the app from third-party stores (as Play is banned), Douyin (named Tik Tok overseas, where the platform has also expanded rapidly) has successfully established a strong international presence, especially in Asian countries like Thailand, Japan, Indonesia and Vietnam.

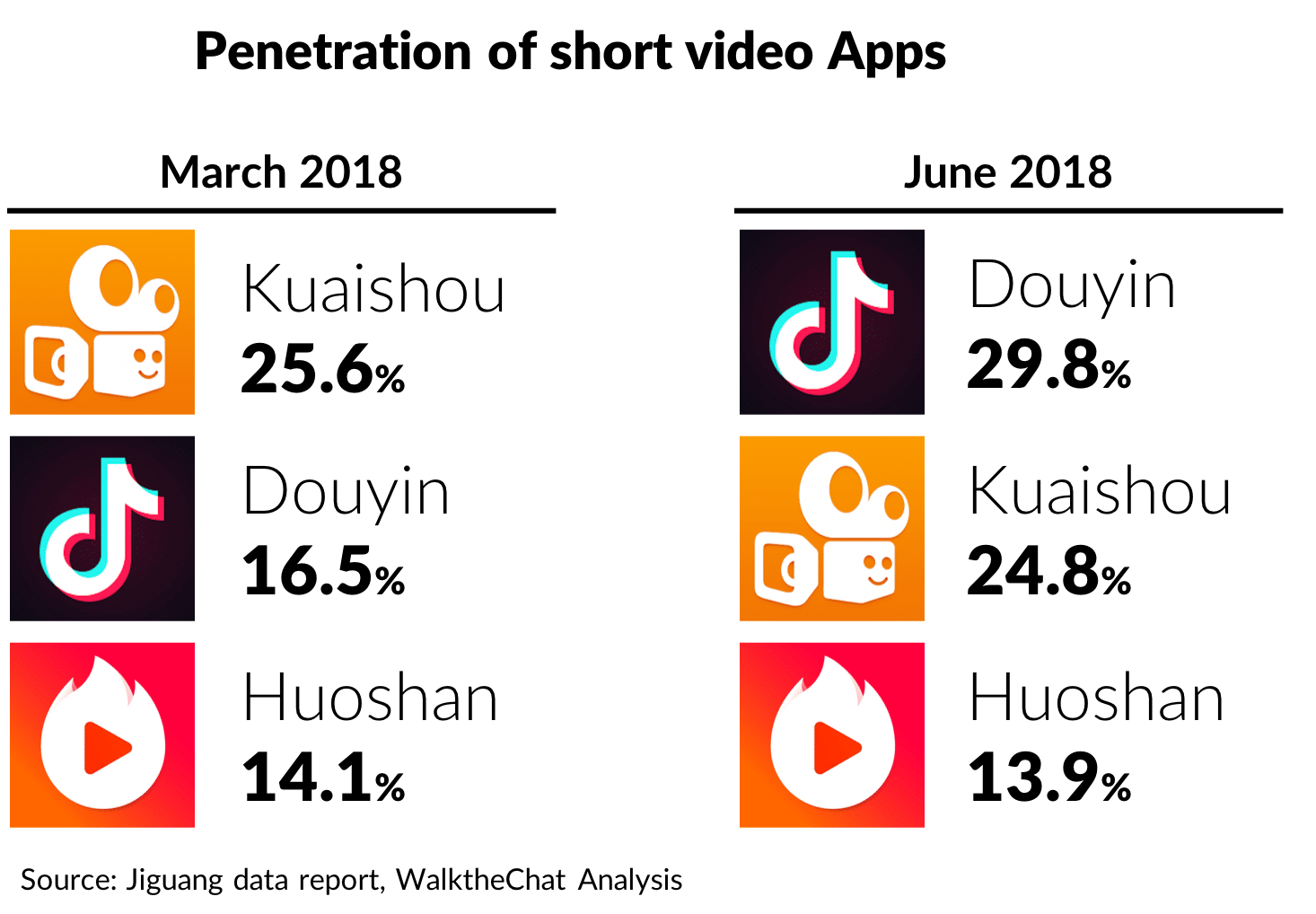

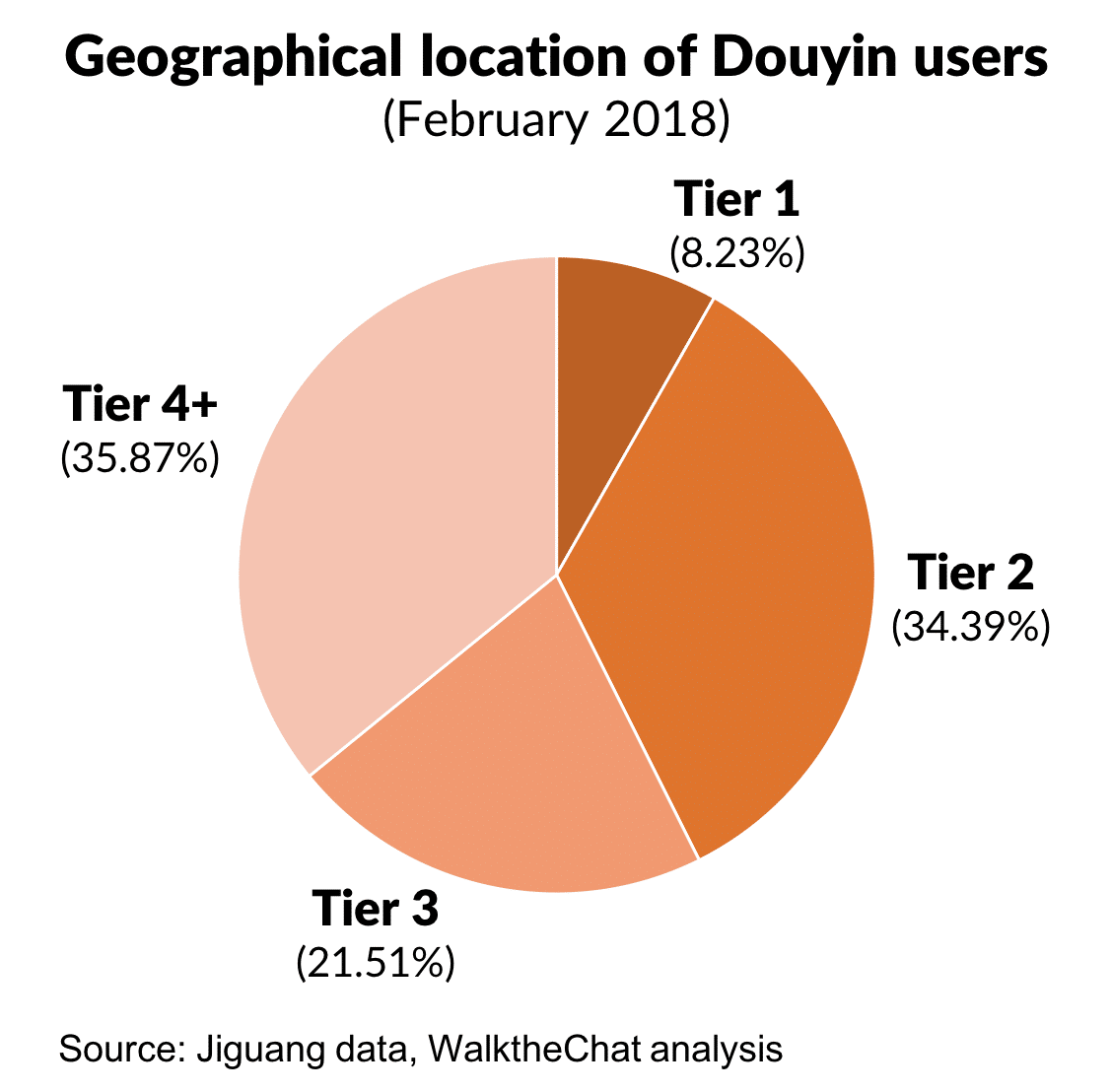

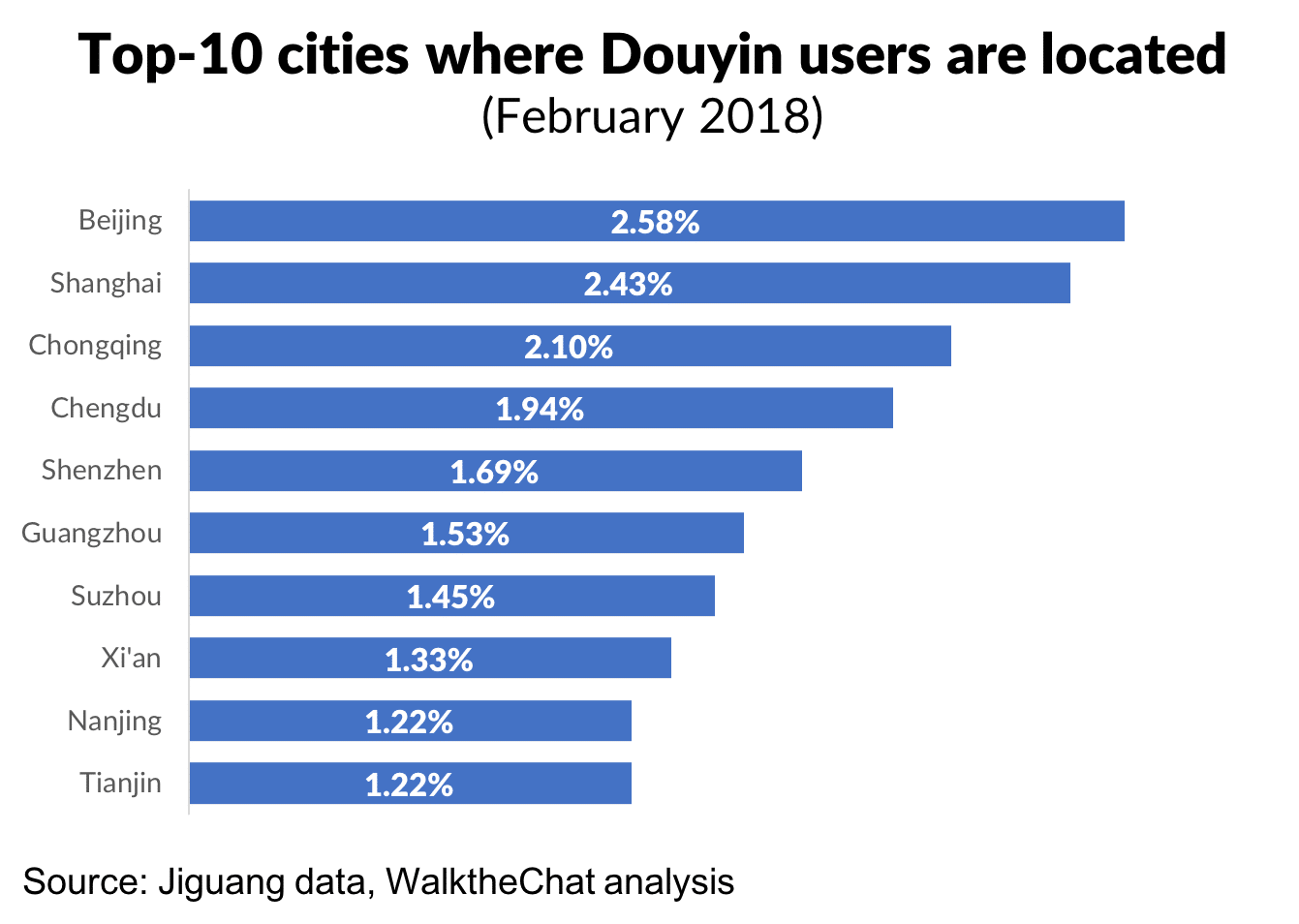

At home, Chinese youth love the fun and quirky content. Jiguang data shows that 43% of Douyin users live in first- and second-tier cities, the developed metropolitan areas.

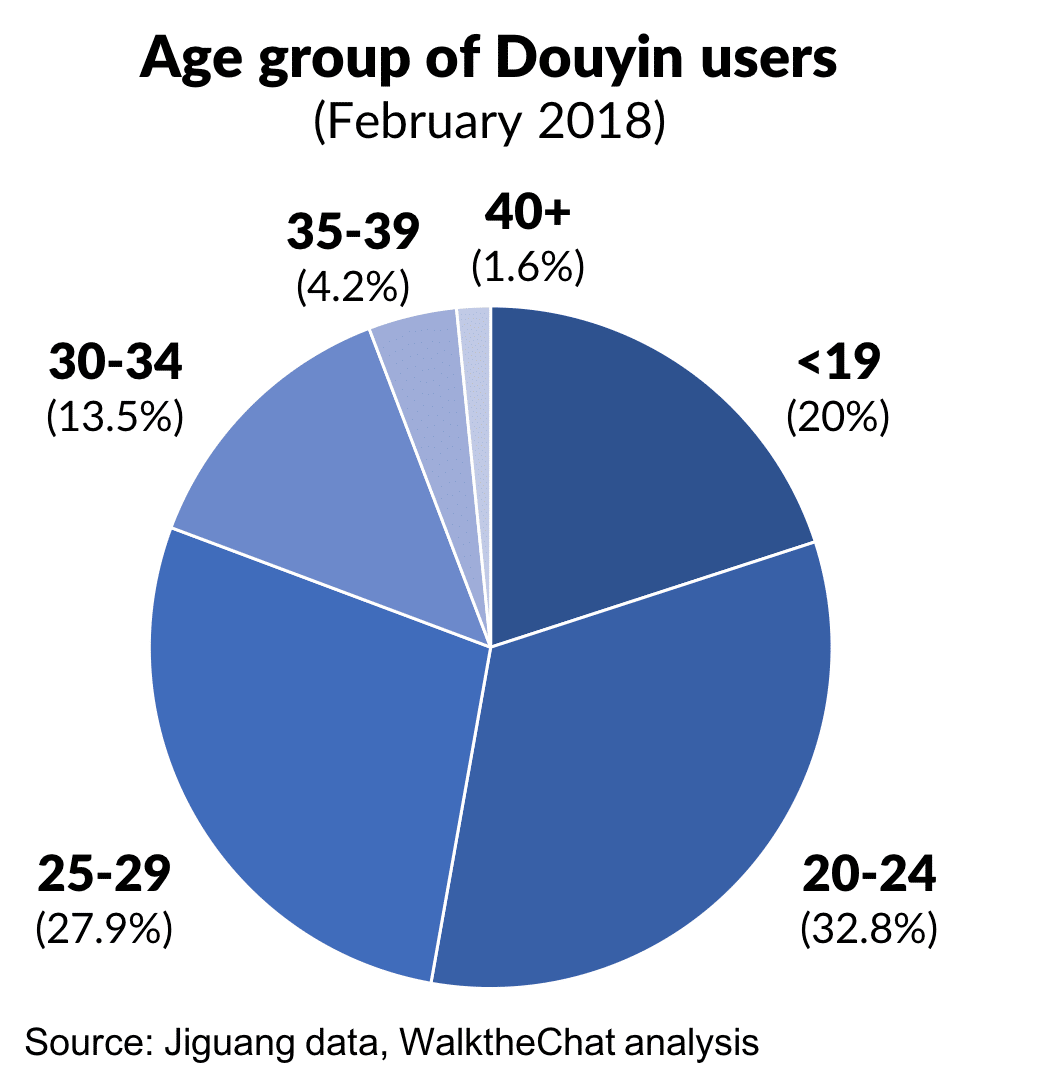

Douyin users are also remarkably young: often below 24 years old. The predominantly young and upscale audience makes Douyin an interesting platform for brands who are curious to tap into China’s Gen Z shopper set.

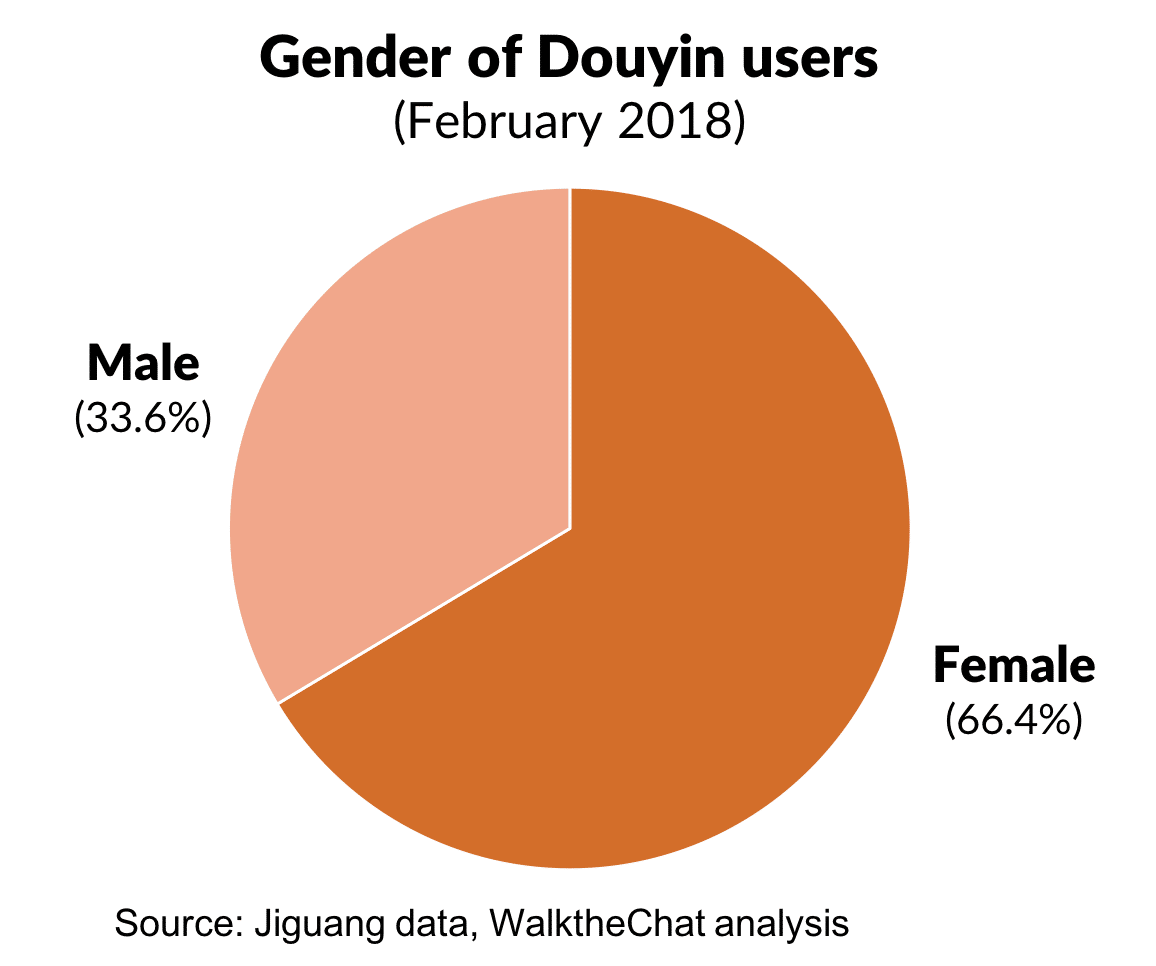

The predominantly female audience of Douyin is another appeal of the App for advertisers, eager to reach out to young and affluant female users.

2018: spreading to the entire Chinese population

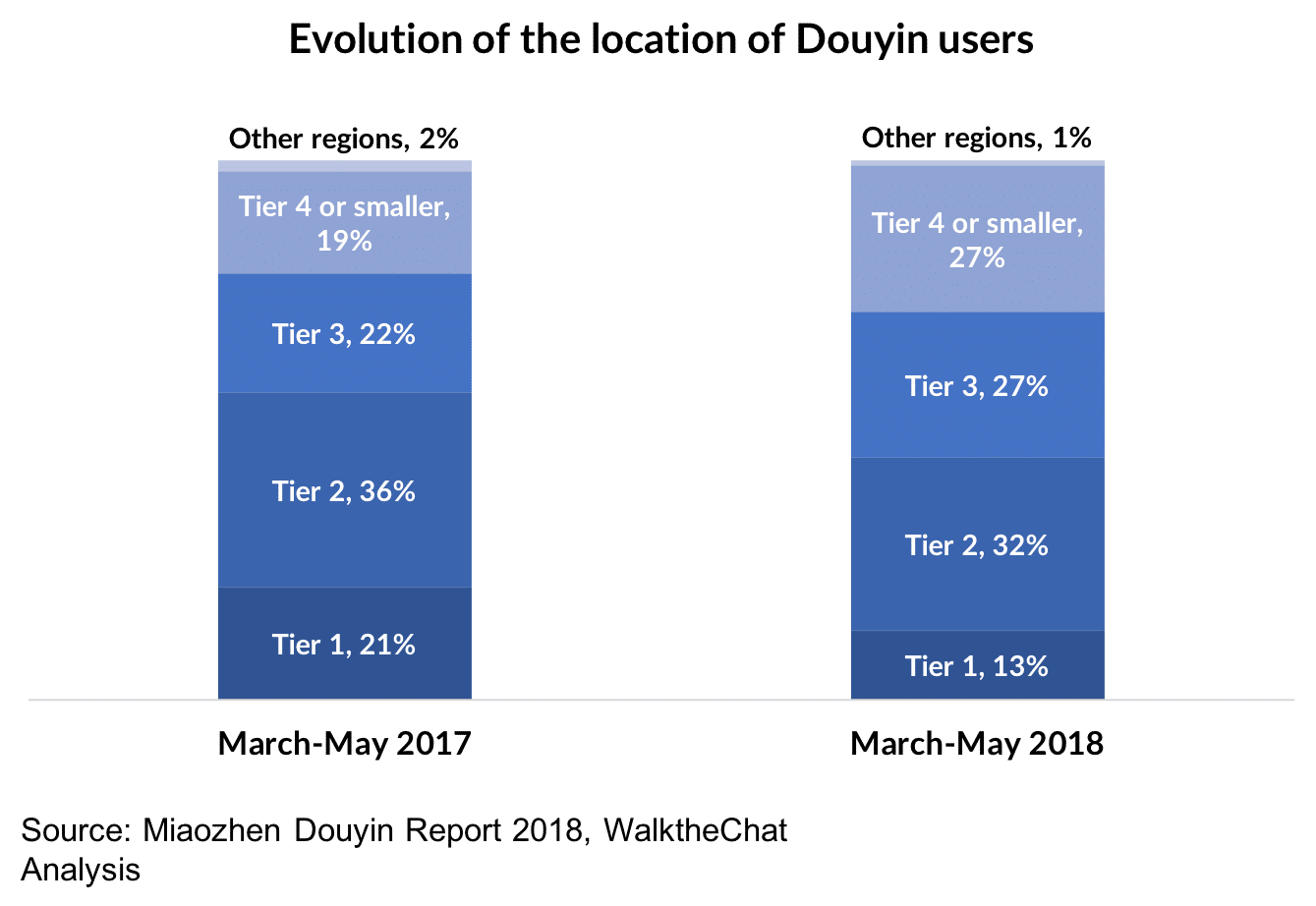

During its first few months of existence, Douyin was perceived as mostly targeting very young users in Tier 1 cities. Data is however showing that this trend is shifting.

Recent growth of Douyin

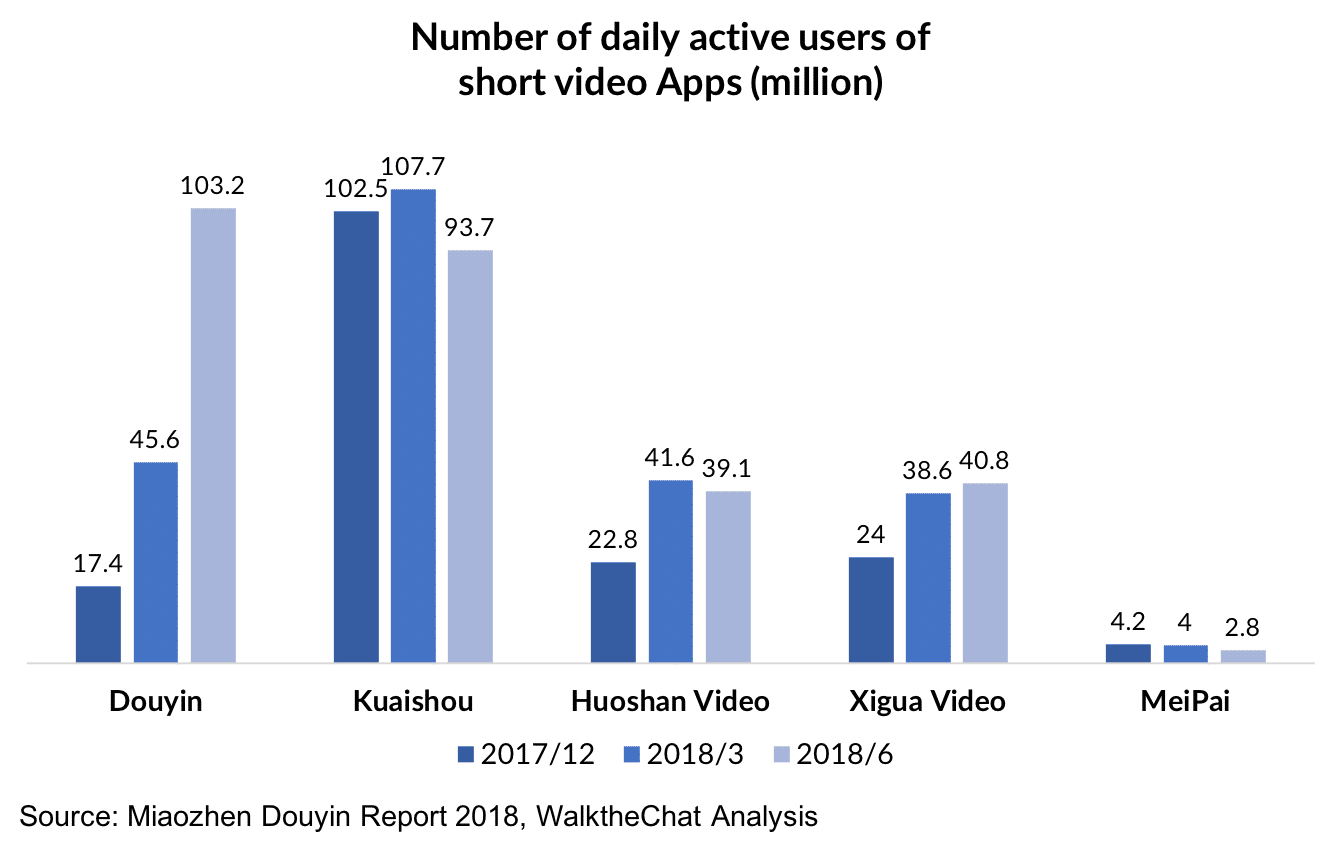

Over the first months of 2018, Douyin continued its explosive growth trajectory, taking over the leading short-video Apps of China such as Kuaishou.

Douyin now has the largest market penetration of all Chinese short-video Apps with 29.8% of market penetration and 103.2 million daily active users.

Where has this additional growth been coming from?

Evolution of Douyin users age

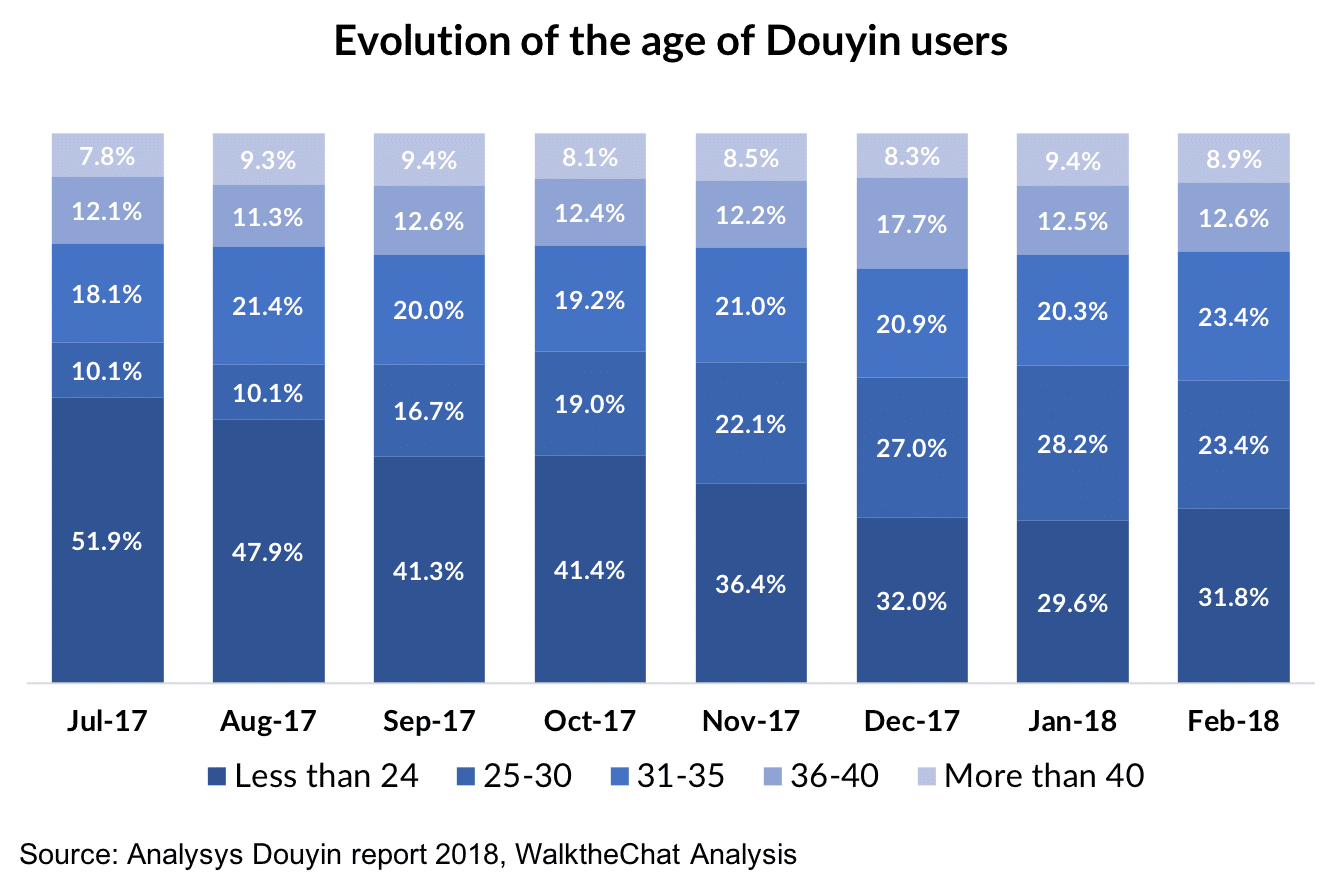

In July 2017, Douyin was still mostly driven by its young user population, with 51.9% of its users being less than 24 years old.

In the span of just 8 months, this situation has however seen a strong shift. By February 2018, users below 24 years old represented only 31.8% of the Douyin monthly user base.

In the meantime, the proportion of users between 25 to 35 grew from 28.2% in July 2017 to 46.8% in February 2018.

Evolution of Douyin users location

Another characteristic of Douyin during its early days was its strong footprint in Tier 1 cities.

This trend has also shifted: Tier 1 city users have shrinked from 21% to 13% between March-May 2017 and March-May 2018. In the meantime, users in Tier 4 or smaller citier grew from 19% to 27% of the Douyin user base.

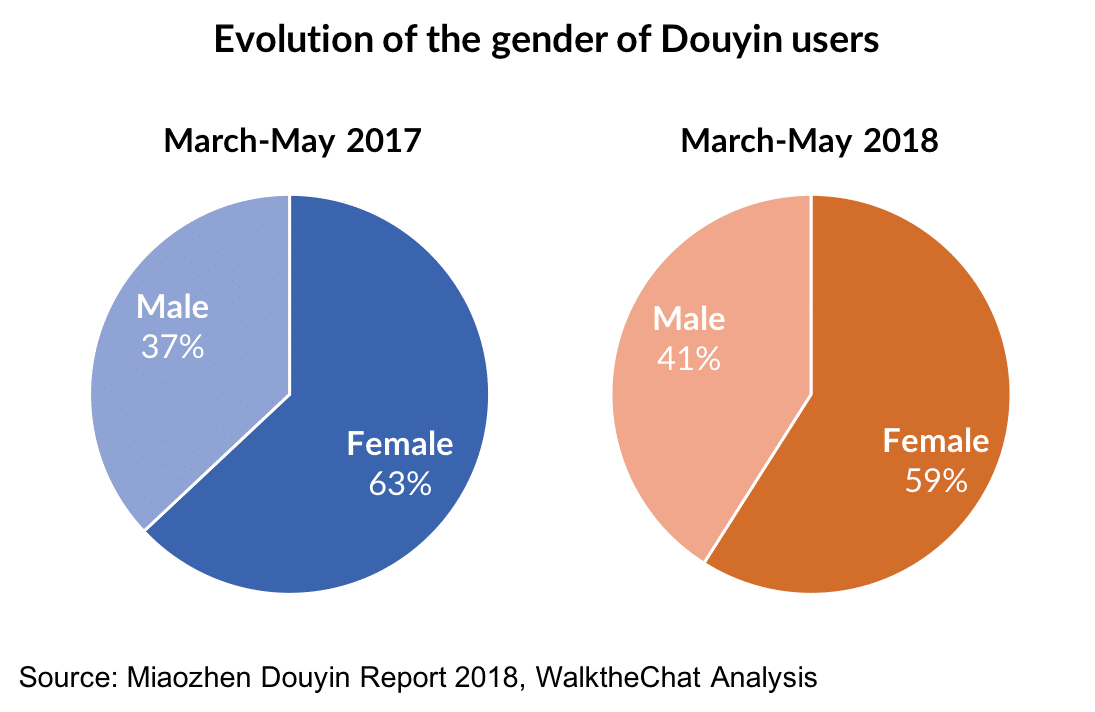

Gender of Douyin user

Gender is another demographic characteristic of Douyin user base which became more balanced over time. Male population on Douyin grew from 37% to 41% between March-May 2017 and March-May 2018.

Why is Douyin user base changing?

The evolution of the Douyin user demographics is due to two factors.

First a natural maturing of the App which is growing from a base of early adopters into the broader market. As an App become more mainstream, it is natural that is starts reaching a broader and broader segment of the population.

The second reason is an intentional change of positioning for Douyin. Even the slogan of Douyin went from “专注新生代的音乐短视频社区” (The music video platform of the new generation) to “记录美好生活” (Record your beautiful life). This change clearly translates an intention to include a broader population within the target market of the App.

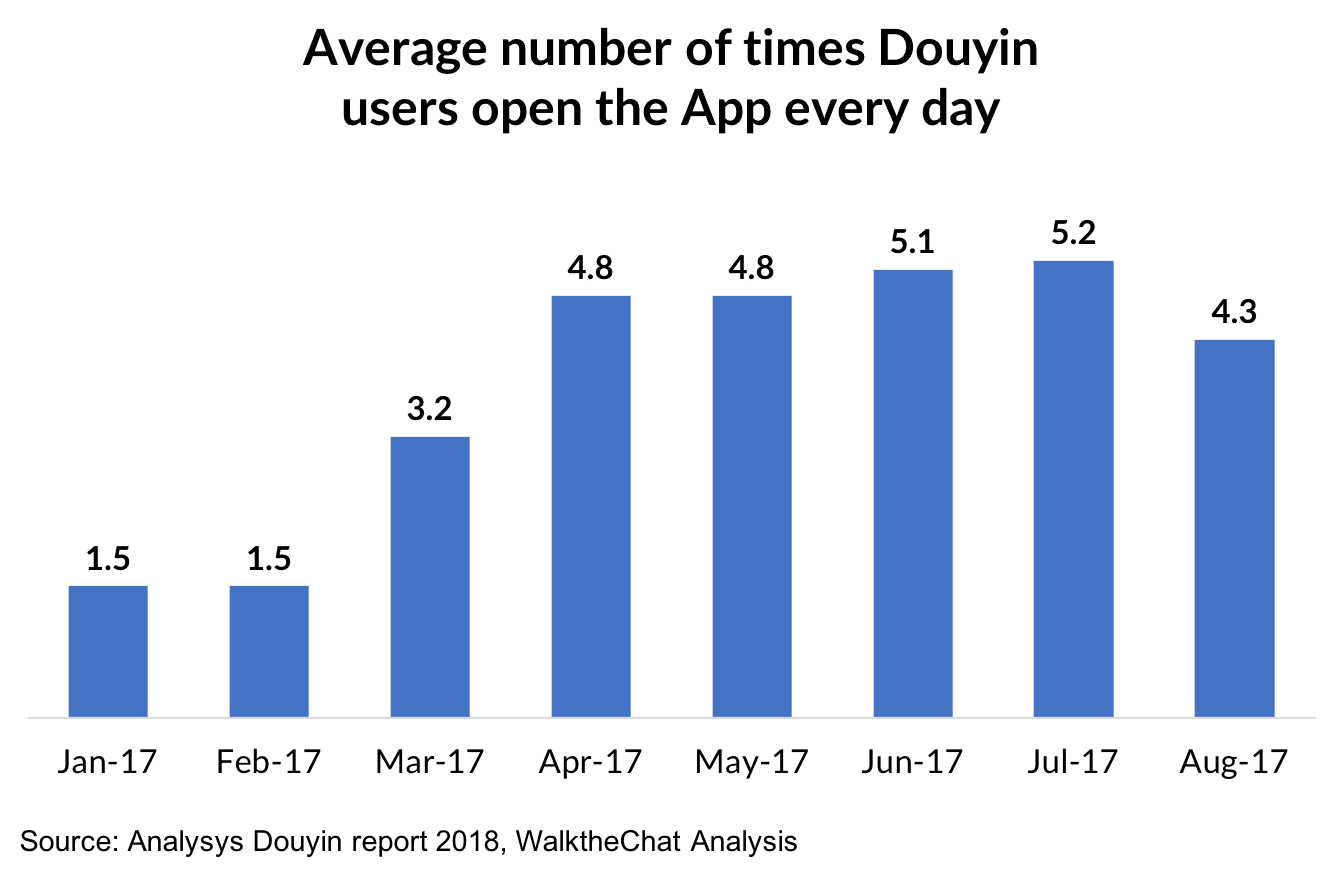

Increasing engagement

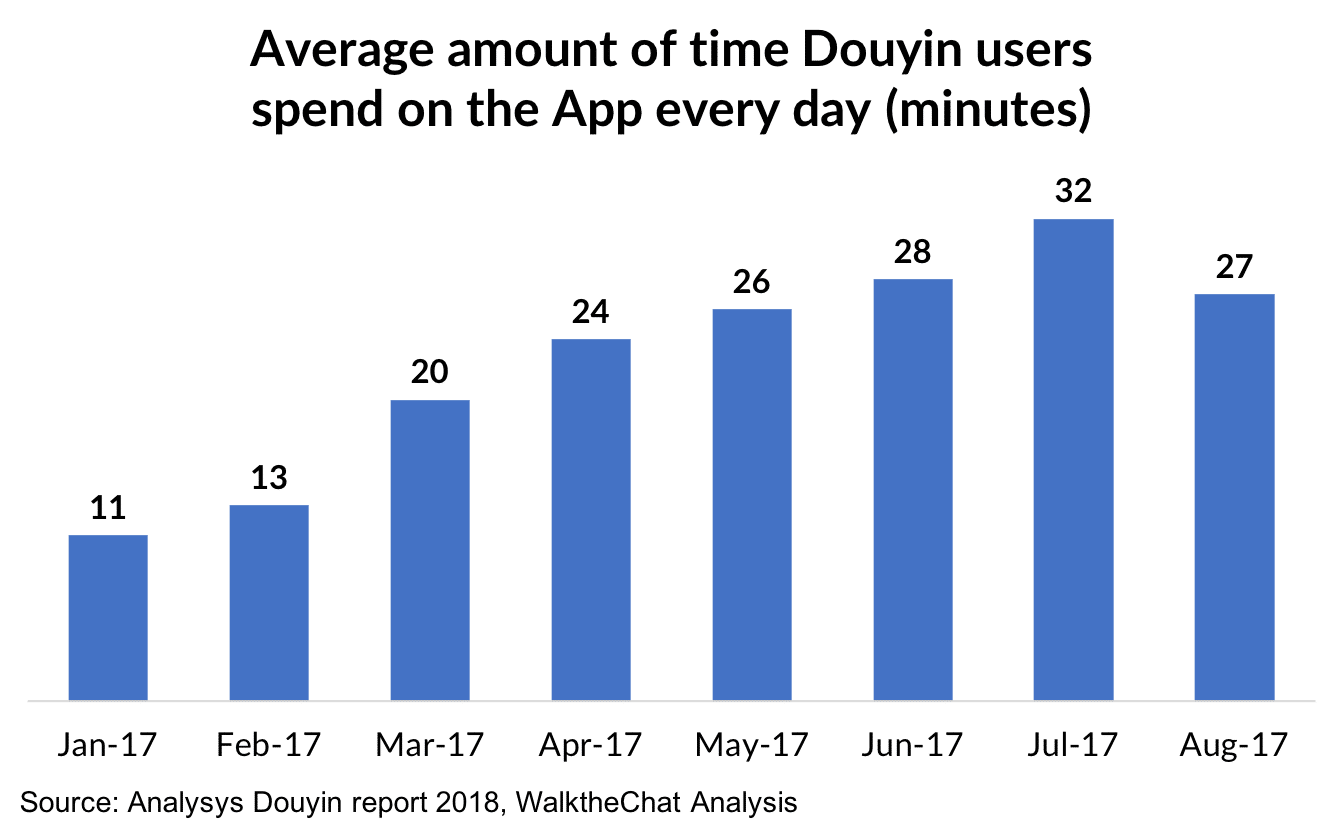

The engagement on the App has been overall high and increased fast. It is however interesting to notice that Douyin seems to have reached a peak of engagement around July 2017.

This slight decrease of engagement highlights potential risks for Douyin on the long run.

What are the risks for Douyin?

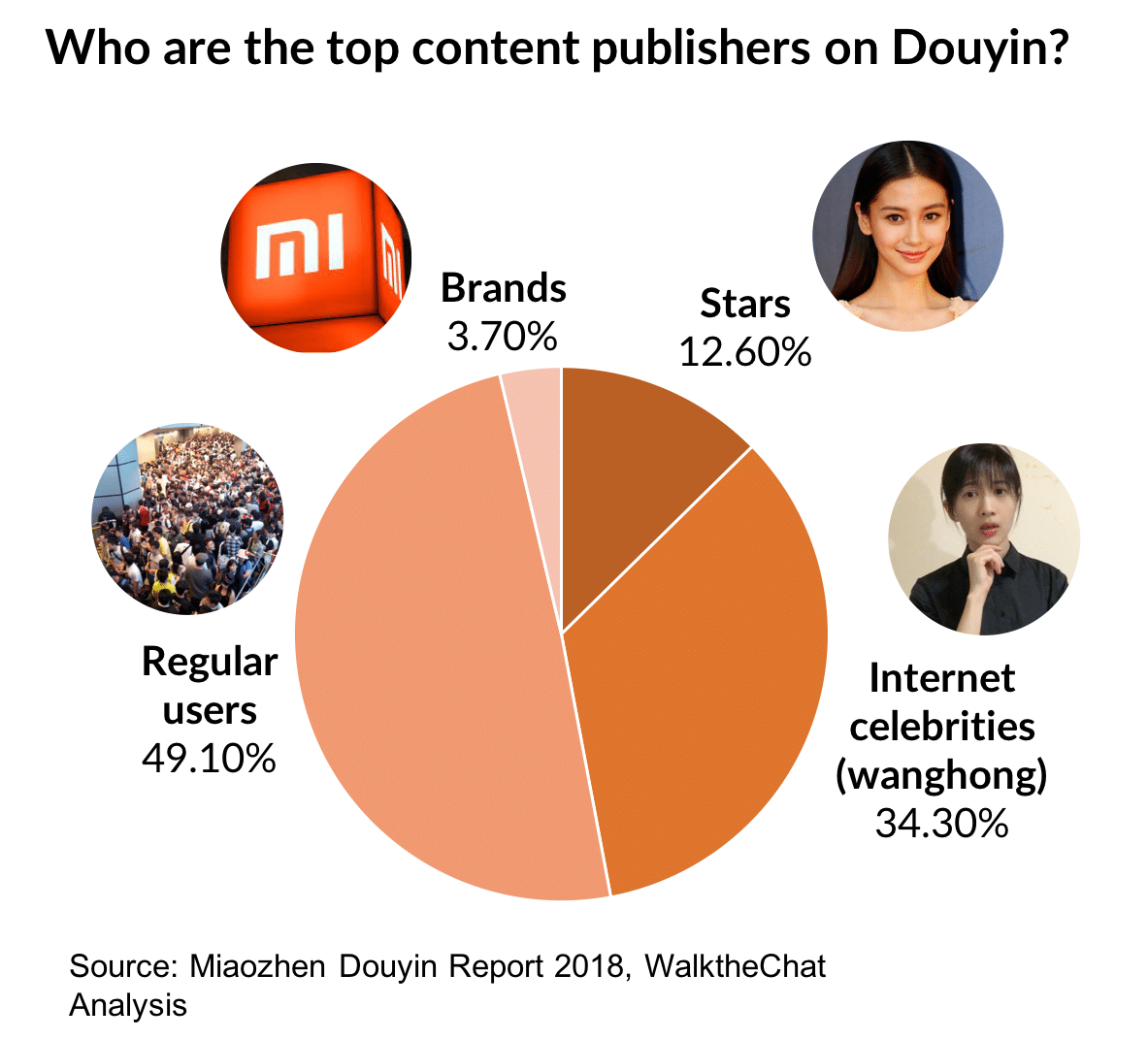

One of the risks that Douyin is exposed related to content creation. Only about half of the content on Douyin is created by grass-root users, the remaining half being created by superstars, Internet celebrities or brands.

This situation is leaving Douyin quite exposed: Internet celebrities and superstars can easily switch from one platform to another as fads change. It is an important challenge for Douyin to incentivize more users to become content creators instead of simply swiping through the App when they get bored.

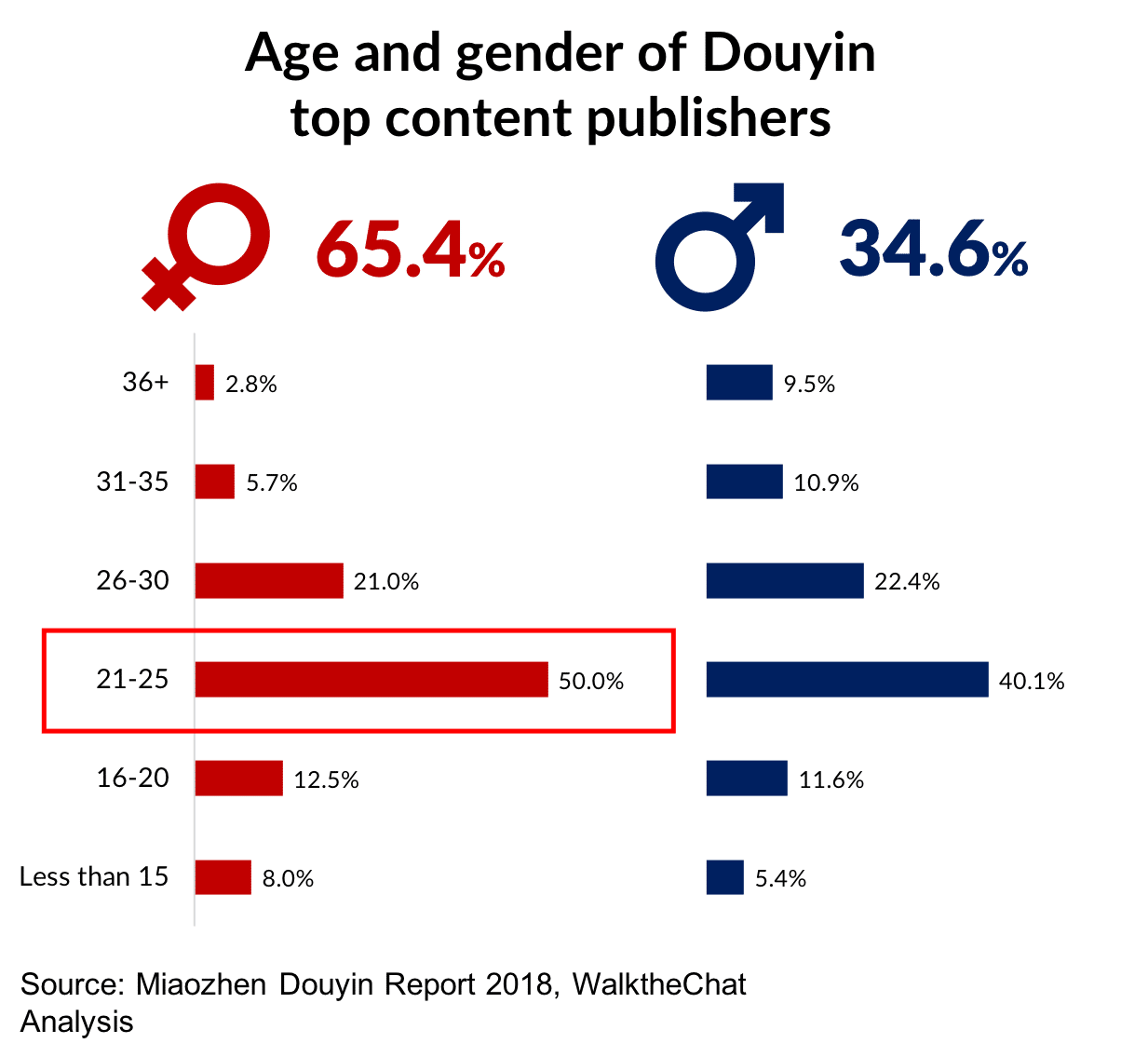

As of now, content creators on Douyin are mostly young female users. The App will likely try to empower users to publish content beyond this niche early adopters group.

How can brands use Douyin for marketing?

Close ties with KOLs (key opinion leaders) contribute hugely to the exponential growth of Douyin’s popularity. In fact, Douyin has contracts with hundreds of KOLs to ensure that their promotional content goes through the official channels with required fees.

Although direct partnerships are much more expensive, it is a way to ensure visibility of the campaign, which would stand a better chance to go viral. Without working with the platform, sponsored content that bypass this official “agency” can get taken down or find it challenging to achieve viral success.

There are several ways to run a campaign on Douyin. Let’s take a look at some examples:

1. Michael Khors – Hashtag challenge

The American fashion label is Douyin’s first partnership with a luxury brand. In addition to hiring 3 fashion influencers (抖音达人) to appear at an event with the brand’s ambassadors, which include Yang Mi and Mark Chao, the Douyin “in-house” KOLs, who have a collective follower base of 4 million, promoted a “City catwalk” hashtag challenge by sharing videos of them doing a catwalk with Michael Khors products.

A challenge, as it suggests, invites users to complete for the most popular video. It is estimated that the trio’s clips were streamed for over 5 million times, with 30,000 users posting their own 15-second catwalk videos using the hashtag.

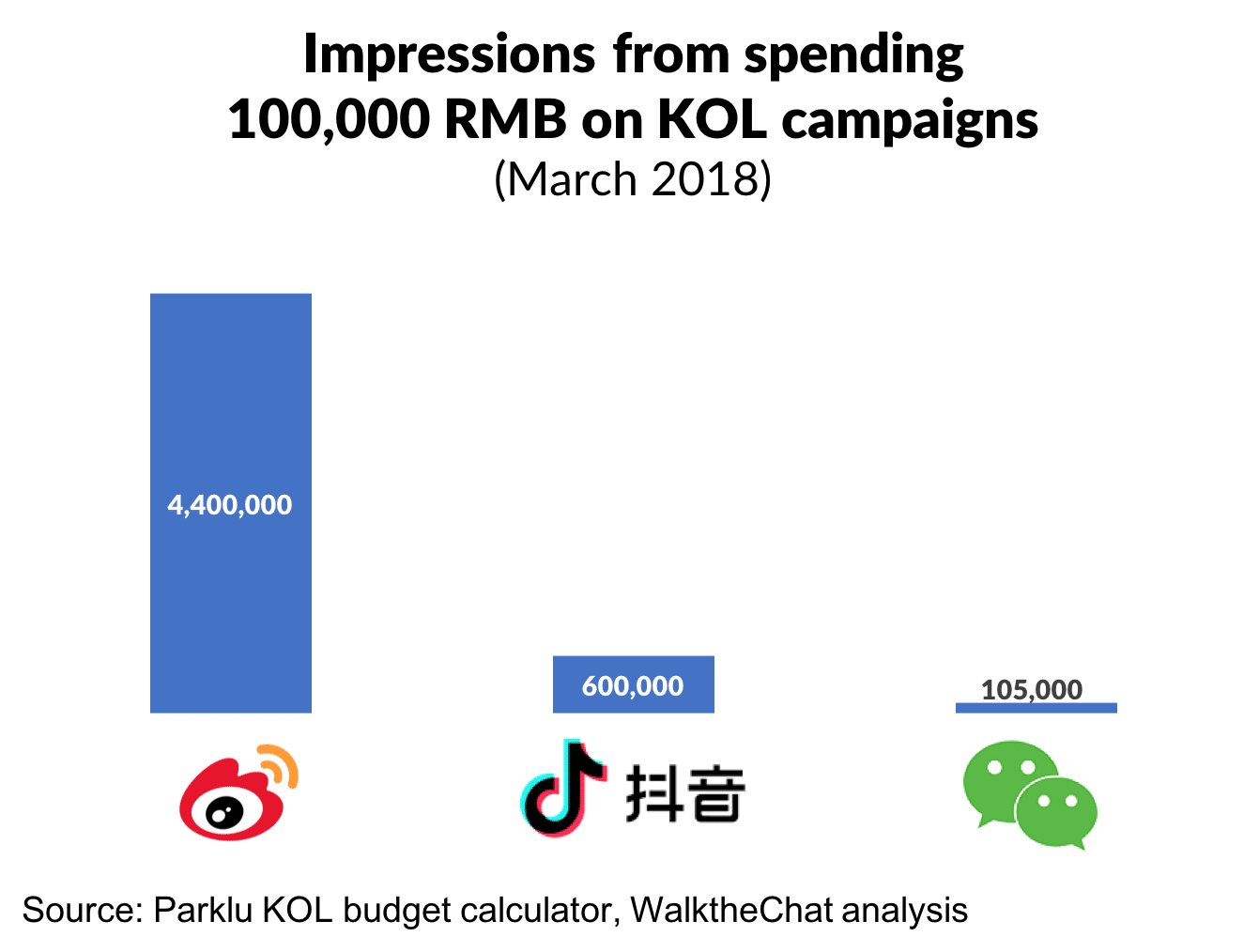

Buying these campaigns directly from the platform is not strictly necessary. Going directly to the influencers is significantly cheaper, although growth would then rely purely on organic reach.

Douyin campaigns end up costing somewhere in-between a WeChat and Weibo campaign. Spending 100,000 RMB on a WeChat campaign will get you 105,000 impressions on WeChat, 4,400,000 on Weibo and 600,000 on Douyin according to Parklu’s KOL budget calculator.

2. Haidilao Hot Pot Customer-broadcasted in-store activities

One of the most innovative F&B challenges on Douyin, which features innovative call-to-actions.

At a Haidilao restaurant, users can request a DIY Douyin recipe , and the staff would know to let you “style” your hot pot yourselves. allowing users to show off their individual dining shows.

As of April, about 15,000 Douyin users participated and about 2,000 short videos have been posted, some by food and lifestyle KOLs who took a keen interest, with some 50 million video views.

As more users come in to request their Douyin recipe, the campaign turns online engagements into offline customers.

3. Answer Tea: more offline engagement

Answer Tea’s campaign involves a special packaging design. Users can send their orders along with a question. Ask anything (Will I get rich this year? Do you think I am beautiful?) and the answer will be revealed as they open the lid of their cup. It is kind of like a fortune-telling exercise.

“Shopfront -> Question -> Receipt -> Answer” is typically how a post in this campaign goes. Their Douyin channel has accumulated 345,000 followers, and their 30+ clips have garnered 1.1 million likes. Booming sales aside, the Douyin campaign has driven Answer Tea to sign with 250 franchise partners. Mind you, their first shopfront only opened in January this year.

4. Oreo – In-app ads combined with KOL content

Oreo is one of the mass market brands that went the more “traditional” route, combining in-app banner ads and native in-feed ads with KOL-generated posts. The in-feed ads fit seamlessly inside the video feed, capturing attention without breaking the user’s flow. KOLs are featured participating in the brand’s campaign by sending Oreo-branded New Year greetings to friends.

Oreo’s presence on Douyin remains long after the campaign ended. It is worth noting that a user-uploaded video of the making of a strawberry yogurt using Oreo cookie went viral, and has prompted many to post their own dessert making moments, and even to explore more Oreo dessert recipes.

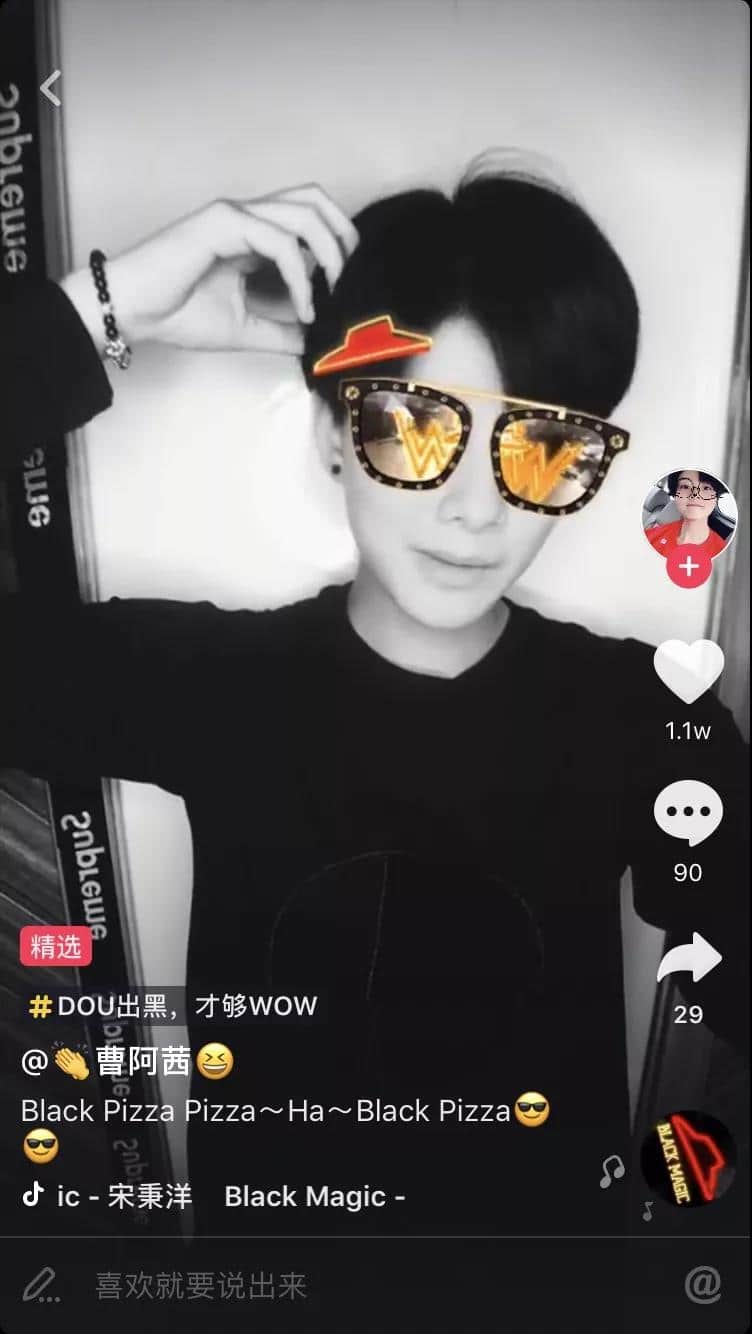

5. Pizza Hut – Custom stickers

Brand-sponsored animated stickers are a great way to engage millions of content-creating users daily. Pizza Hut’s recent campaign features such on-brand motifs as the iconic red hat, sunglasses and their shopfront as stickers for user to accessorise their clips with.

According to Shichangbu, the videos featuring Pizza Hut’s stickers were streamed for over 1 million times.

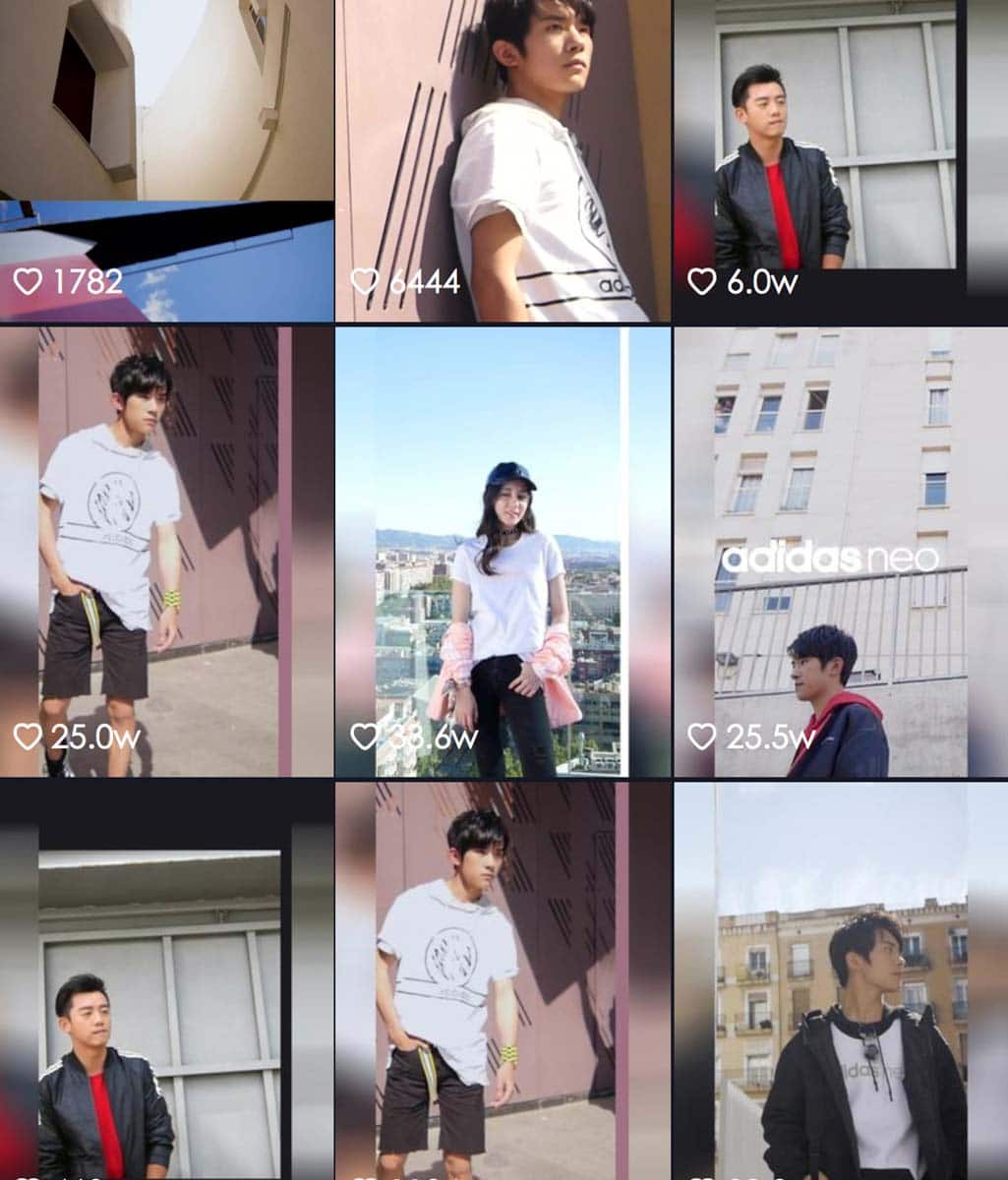

6. Adidas Neo – Authentic content crafted specifically for the platform

It’s been clear that Douyin isn’t just a social network for musical selfies, but it is also a unique opportunity for a brand to visually present its personality.

Douyin works well for Adidas, who it mainly for its sub-brand AdidasNeo that targets a younger audience.

Its Douyin account localizes the brand through generating original content specifically for the platform with local celebrities that embody their target buyer persona. Most of the fashion brand’s posts feature their products in some way, but more as an accessory in the context of the active, stylish lifestyle.

Compared to more mature platforms such as Weibo and WeChat, Douyin’s short-video formats allows more room for playful creativity to condense a brand’s essence.

Conclusion

Douyin has been quite creative in opening ways for monetization through marketing. The platform is already past the beginning of its hype cycle, so it is not cheap anymore.

But for brands who are targeting young affluents Chinese users, the return on investment might still be high for the months to come. Don’t miss the trend!