The transition from offline to online is usually gradual. But the coronavirus epidemic has pushed lots of retail businesses to the edge of bankruptcy, and many of them have to choose between going online or die.

A retail business shifting sales to its WeChat Mini-Program

BESTSELLER Fashion Group China is one of the biggest fashion retailers in China, with more than 7,000 retail stores. It’s also the parent company of Jack & Jones, Only, Vero Moda, and 20 other brands.

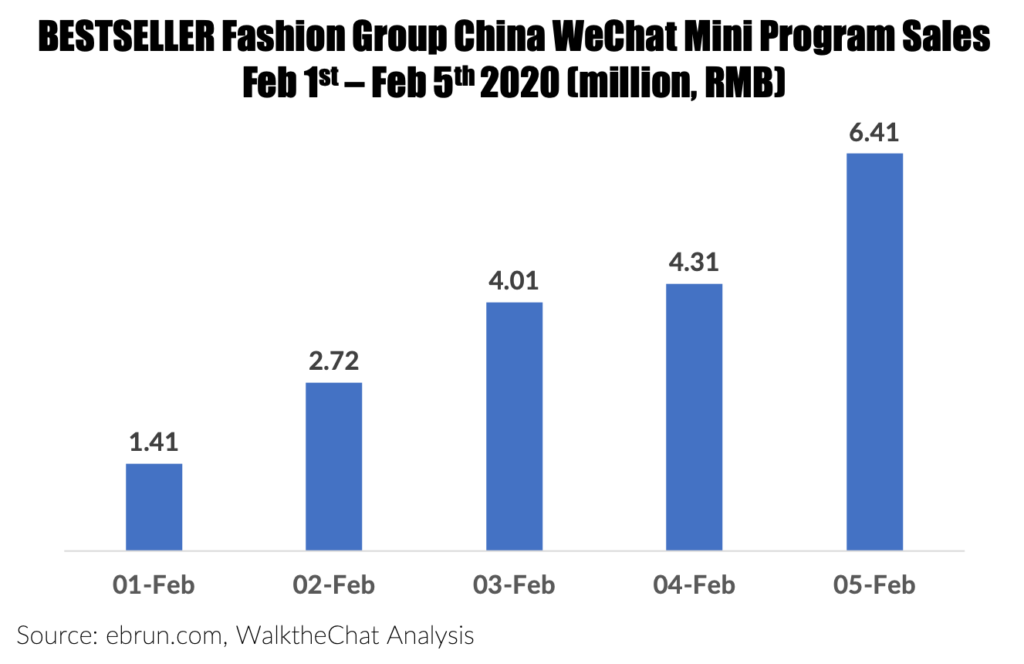

Liu Dongyue, retail manager of BESTSELLER, told ebrun.com that the company’s WeChat Mini Program sales (18.9 million RMB) were 3 times larger compared to its retail sales (6.2 million RMB) from Feb 1st to 5th.

Although this is still a fraction amount of revenue compared to the same time last year, the Mini Program channel gives the company a growth opportunity and advantage over other retailers.

Revenue sharing is the engine driving Mini Program sales

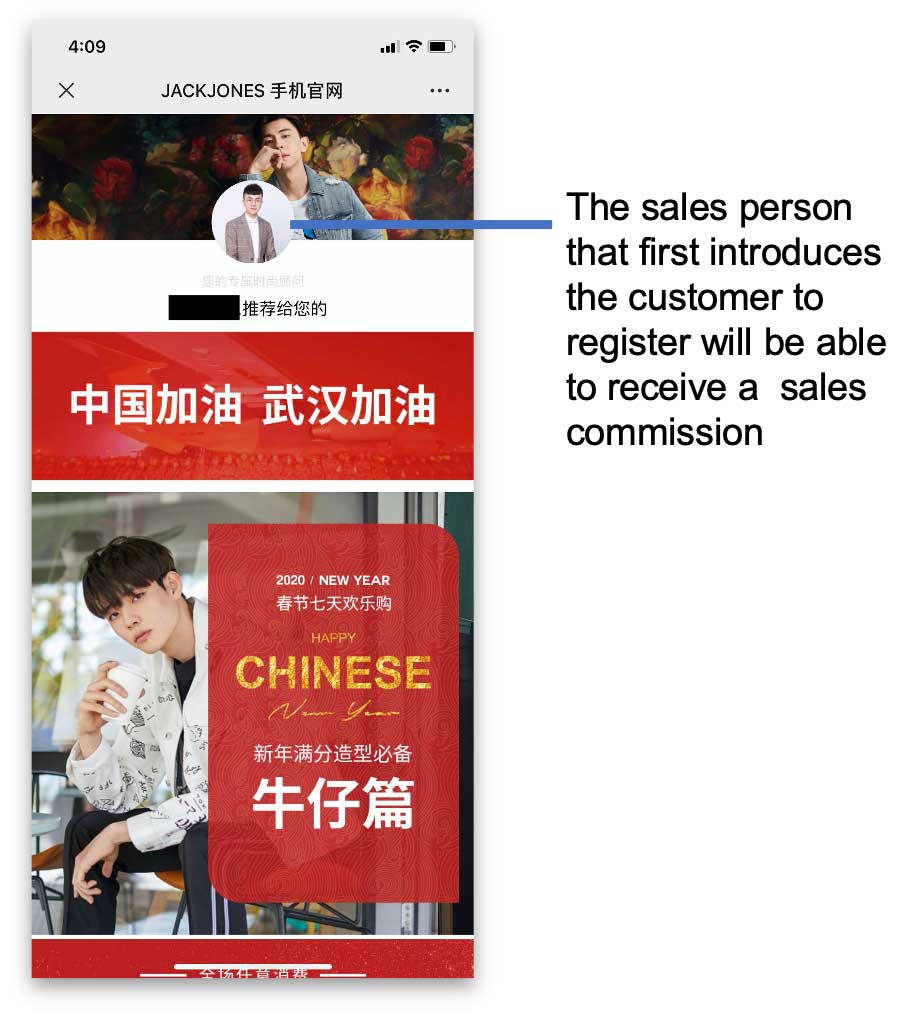

The engine behind the sales growth on Mini Program is revenue sharing. BESTSELLER encourages all of its store employees to become an online salesperson and will reward the top 40% of salespeople with a 10% commission during the virus period. Driven by the high commission, it only took 2 days for the Mini Program sales to exceed offline sales.

Tracking system

BESTSELLER’s salespeople have a great incentive to recruit as many new customers as possible to earn more commission.

According to the interview with ebrun.com, some store managers also implemented rigorous KPIs focusing on both the sharing rate and sales performance. This also encouraged the traditional offline salesmen to step out of their comfort zone to communicate with WeChat contacts online. This customer relationship will likely continue benefiting the company even after the virus period.

The salesmen are also encouraged to share trackable QR codes to drive followers to Jack & Jones’ Official Account.

Centralized marketing support

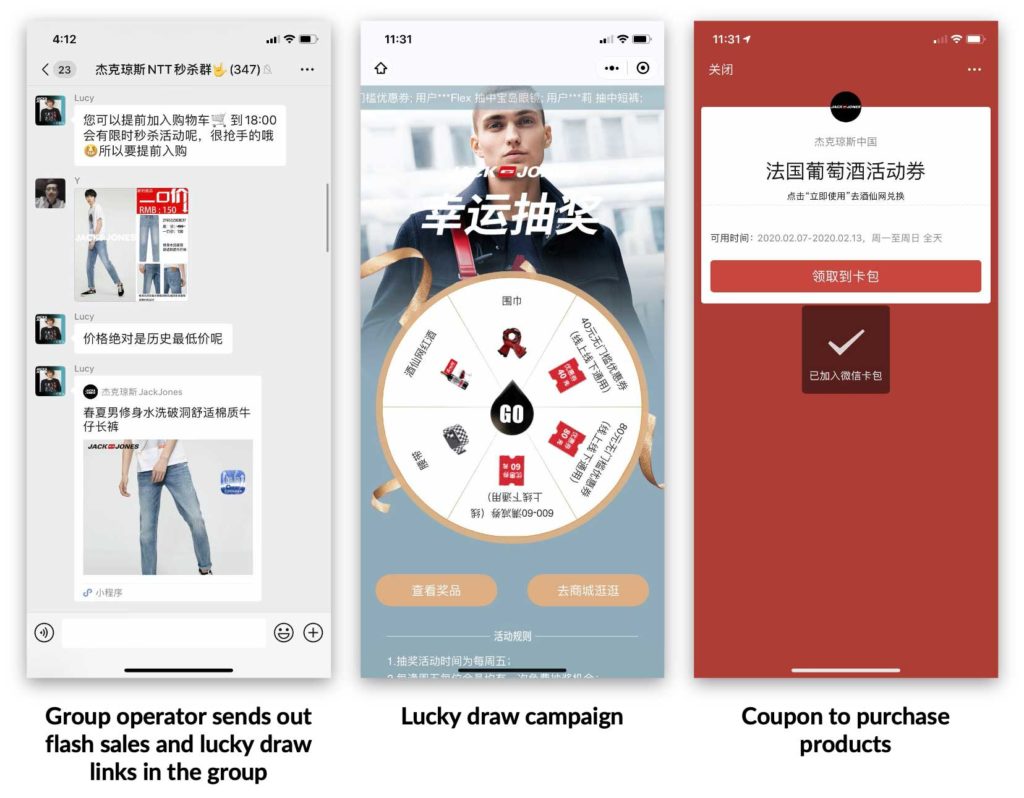

BESTSELLER Fashion Group created marketing tools such as lucky draws and flash sales that can be shared in groups or on moments. These tools are used to support the work of salespeople.

Salespeople usually create groups to engage with their prospective customers. Each group has around 400 members. The group manager will send out flash sales deals, lucky draws, and instructions on how to use coupons to get the best deal in the group. Group members are also encouraged to make pre-sales inquiries.

The balance between WeChat store and retail store

Mini Programs will not be able to make up for the loss of retail sales, but they are a good risk mitigation strategy during these special times.

According to ebrun.com, 75% of the product sold on Bestseller’s WeChat store are available online-only, thus won’t cannibalize its offline sales. It also offers support for in-store customers to buy some of the rare size products.

20% of the sales happen when offline stores are closed.

Although companies such as BESTSELLER are suffering from short-term losses, they might emerge stronger from the crisis through the expansion of their online following and operations.

Expansion of vegetable delivery

As the coronavirus made many consumers feel reluctant to go out, orders on fresh food e-commerce Apps surged:

- Meituan Maicai (the fresh product e-commerce App of Meituan) receives 2 to 3 times more orders than before the Chinese New Year.

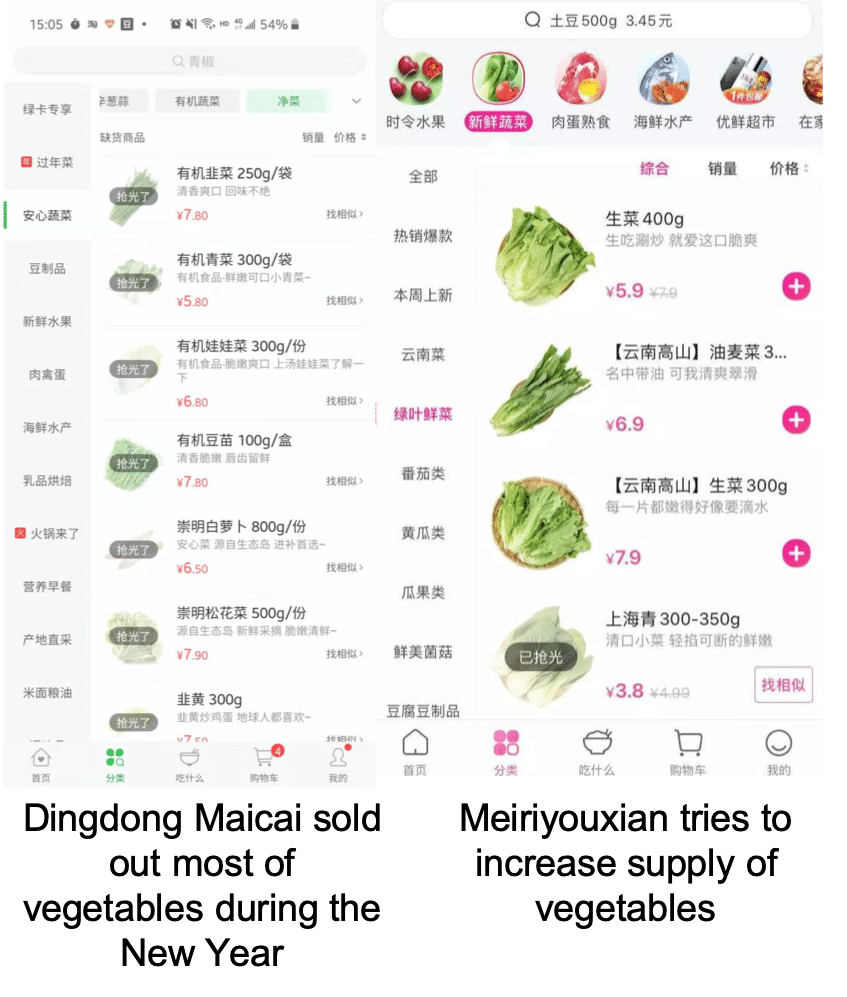

- Dingdong Maicai, a startup App backed by Sequoia Capital, claimed its order increased by 300% on the Chinese New Year’s eve compared to last year, and order value increased by 70%. According to Dingdong’s official announcement in July 2019, the daily number of orders was 400,000.

- Meiriyouxian is one of the largest fresh delivery Apps. Their order volume increased by 350% YoY during the first 8 days after the New Year. According to Wang Juncheng, CFO of Meiriyouxian, the average order value increased from 30 RMB to 120 RMB. Meiriyouxian also increased its daily vegetable supply from 500 tons to 1,000 tons.

In order to purchase vegetables before they run out, some users set up an alarm clock at midnight to place orders on Hema, and 6 am to place orders on Dingdong. The peak will drop after the virus, but top players such as Dingdong and Meiriyouxian will likely have acquired a lot of new users in the process.

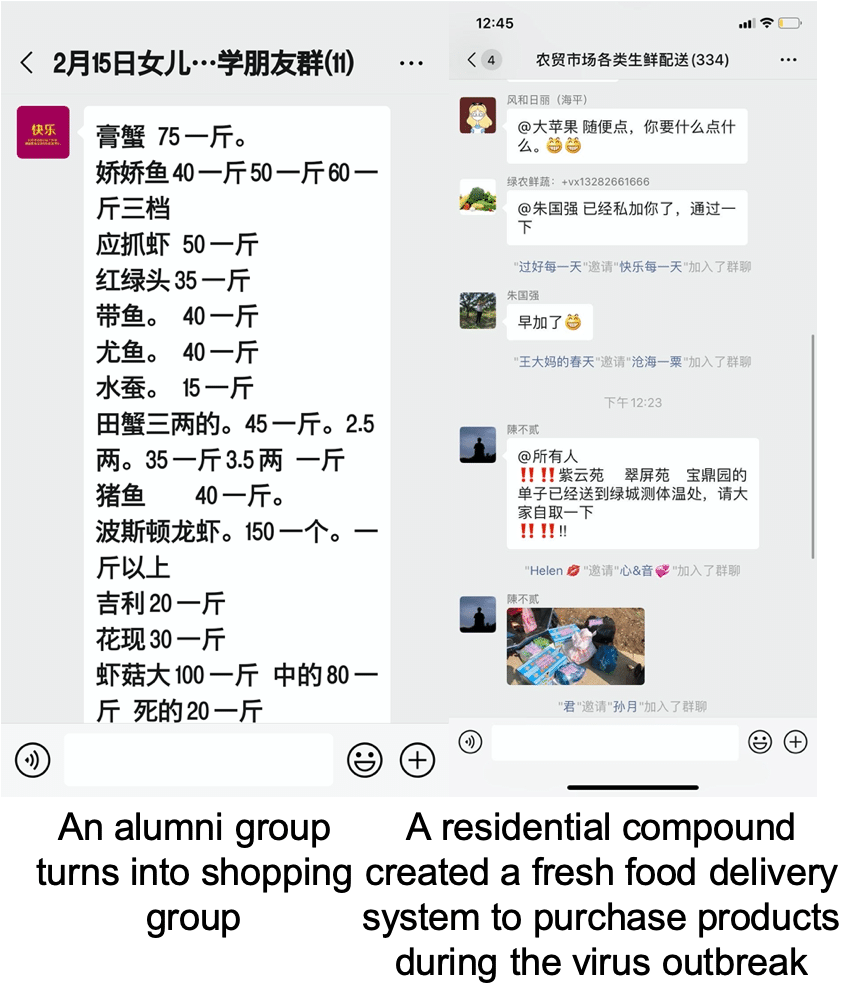

Other than existing fresh food delivery Apps, residential compound, friends group, or even inactive alumni groups turned into daigou groups for food and vegetables.

Mom & pop clothing stores create WeChat sells via groups

E-commerce transition doesn’t always have to be as radical as a complicated revenue-sharing system.

Wei Xulin is the owner of a small coat store in An’hui. He invited friends and customers to join his flash sale group. Xulin will send around 20 products with a specific size and price into the group.

The group has only been operating for 3 days, the owner made around 2-3 orders per day. During a typical operating day, the store gets 10 orders. Although the WeChat group only recovers 20-30% of the usual sales revenue, the owner also uses the group to encourage people to visit his store after it opens to select the products in person. Thus the group keeps people engaged and could also be used for future marketing.

Conclusion

Retail businesses are among the industries that were hit the hardest by the virus situation. Businesses that already have an e-commerce system are suffering less from the epidemic. For those that don’t have an online strategy, finding one could become a matter of life and death.